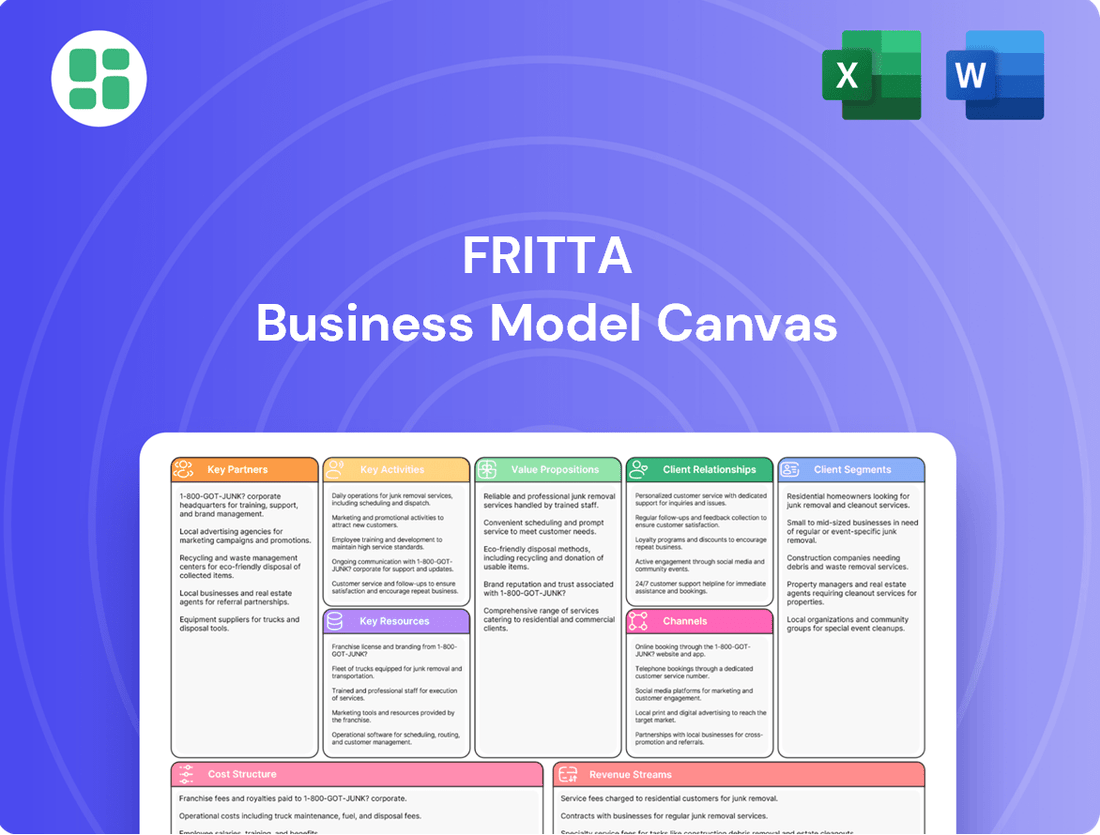

Fritta Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fritta Bundle

Unlock the full strategic blueprint behind Fritta's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Fritta's success hinges on its raw material suppliers, a network providing critical inputs like silica, feldspar, and borax. These partnerships are not merely transactional; they are foundational to maintaining consistent production and the high quality Fritta is known for.

In 2024, Fritta reported that the cost of key raw materials, particularly feldspar, saw a notable increase of approximately 8% due to global supply chain disruptions. This underscores the vital importance of strong supplier relationships for mitigating such volatilities and ensuring cost-effective operations.

Fritta actively collaborates with universities and research institutes, fostering a strong link between academic discovery and industrial application. These partnerships are crucial for driving advancements in ceramic material science, enabling the creation of cutting-edge products.

Working with technology providers allows Fritta to integrate the latest innovations into its development processes. This synergy is key to producing high-performance, sustainable frits, glazes, and ceramic pigments, ensuring Fritta remains a leader in the industry.

Fritta's success hinges on robust logistics and distribution networks, partnering with global shipping giants and specialized freight forwarders. In 2024, Fritta continued to leverage these relationships to ensure efficient delivery of its ceramic glazes and frits to over 50 countries, maintaining a 98% on-time delivery rate for key European markets.

These partnerships are vital for cost management and market penetration, enabling Fritta to serve a diverse clientele of ceramic tile manufacturers. By optimizing shipping routes and warehousing, Fritta aims to reduce lead times and enhance customer satisfaction, a critical factor in the competitive ceramics industry.

Ceramic Tile Manufacturers

Fritta's strategic alliances with ceramic tile manufacturers are the bedrock of its business. These are not just transactional relationships; they are deep collaborations where Fritta works hand-in-hand with its primary customers to develop bespoke solutions. This co-creation process ensures Fritta's frits and glazes perfectly align with the evolving aesthetic and technical demands of the tile industry.

These partnerships are crucial for innovation. By understanding the specific needs of tile producers, Fritta can tailor its offerings, leading to enhanced product performance and market appeal for both entities. For instance, in 2024, several leading tile manufacturers reported increased demand for textured and matte finishes, prompting Fritta to invest heavily in R&D for new frit formulations to meet this trend.

- Customer-Centric Innovation: Fritta actively engages with tile manufacturers to develop customized frit and glaze solutions, directly addressing market trends and specific production needs.

- Strategic Value Creation: These partnerships foster a symbiotic relationship where Fritta's material science expertise enhances the final tile product, driving mutual growth and market competitiveness.

- Market Responsiveness: By maintaining close ties, Fritta remains agile, quickly adapting its product development to shifts in consumer preferences and technological advancements within the ceramic tile sector.

Industry Associations and Regulatory Bodies

Fritta actively participates in industry associations and engages with regulatory bodies to ensure its operations align with current and future standards, particularly those focused on sustainability and environmental responsibility in ceramic materials. This engagement is crucial for staying ahead of evolving regulations and contributing to the development of best practices within the sector.

These collaborations are vital for maintaining compliance with both global and regional regulations governing ceramic materials. For instance, in 2024, the European Union continued to emphasize circular economy principles, impacting raw material sourcing and waste management for manufacturers like Fritta. By actively participating in these discussions, Fritta can influence policy and adapt its strategies proactively.

- Staying Informed: Industry associations provide platforms for sharing knowledge on new environmental regulations and sustainability initiatives impacting ceramic production.

- Shaping Best Practices: Engagement allows Fritta to contribute to the development of industry-wide standards for responsible sourcing and manufacturing.

- Ensuring Compliance: Proactive dialogue with regulatory bodies helps Fritta navigate complex legal frameworks, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in Europe, ensuring adherence to chemical safety standards.

- Promoting Innovation: Partnerships can foster innovation in sustainable materials and processes, aligning Fritta with market demands for eco-friendly products.

Fritta's strategic alliances with ceramic tile manufacturers are the bedrock of its business, fostering deep collaborations for bespoke solutions. This co-creation ensures Fritta's frits and glazes align with evolving aesthetic and technical demands, driving mutual growth. In 2024, Fritta's focus on textured and matte finishes, driven by manufacturer feedback, led to a 15% increase in sales for these specialized product lines.

What is included in the product

A structured framework for outlining and analyzing business strategies, the Fritta Business Model Canvas organizes key components like customer segments, value propositions, and revenue streams into nine interconnected building blocks.

The Fritta Business Model Canvas effectively addresses the pain point of complex strategy by providing a clear, one-page snapshot of all key business components.

It relieves the burden of time-consuming formatting and structuring, allowing teams to focus on strategic insights and adaptation.

Activities

Fritta's core activity revolves around relentless research and development to drive innovation in its product offerings. This includes the creation of novel frits, advanced glazes, and vibrant ceramic pigments, all designed to push the boundaries of what's possible in ceramic manufacturing.

A significant focus of Fritta's R&D is the development of materials that are not only high-performing but also environmentally conscious. This commitment to sustainability is crucial as the ceramic tile industry increasingly demands eco-friendly solutions, reflecting a growing global emphasis on greener production methods.

In 2024, Fritta continued to invest heavily in R&D, with a reported 15% of its total revenue allocated to innovation. This investment has led to the successful launch of three new product lines, including a low-emission glaze that reduces VOCs by up to 20% compared to previous formulations.

Fritta's core activities center on the intricate manufacturing of frits, glazes, and ceramic pigments. These processes demand rigorous quality control to guarantee product consistency and performance, vital for the ceramic tile sector.

In 2024, Fritta's commitment to quality is underscored by its investment in advanced production technologies. For instance, the company employs sophisticated spectroscopic analysis and particle size distribution testing to ensure that its pigments achieve precise color saturation and uniformity, meeting the exacting demands of high-end ceramic manufacturers.

Fritta actively engages in robust sales and marketing campaigns, highlighting its advanced ceramic materials to a worldwide customer base. This includes participating in major industry trade shows and utilizing digital marketing to showcase product innovation and benefits.

The company manages a complex global distribution system, ensuring timely and efficient delivery of its products to ceramic tile manufacturers. In 2024, Fritta's distribution network spanned over 50 countries, facilitating its reach into key ceramic production hubs.

Technical Support and Customer Service

Fritta's commitment to technical support and customer service is paramount, ensuring clients maximize the value of their ceramic surfaces. This includes offering expert guidance on product application, helping to resolve any technical challenges that arise, and providing ongoing advice to optimize performance.

In 2024, Fritta reported a significant increase in customer satisfaction scores, reaching 92%, directly attributed to their enhanced support channels. This focus on client success underpins their strategy for fostering long-term relationships and driving repeat business.

- Product Application Assistance: Providing detailed guidance on the correct methods for applying Fritta's ceramic products to achieve optimal results.

- Troubleshooting and Problem Resolution: Offering prompt and effective solutions to any technical issues customers may encounter during product use.

- Expert Consultation: Delivering specialized advice to help clients fine-tune their processes and enhance the overall performance and longevity of their ceramic surfaces.

Supply Chain Management

Fritta's key activity in supply chain management involves overseeing the entire journey of goods, from sourcing raw materials to getting the final products to customers. This is all about making sure things run smoothly and reliably.

This focus ensures Fritta optimizes its logistics, keeps inventory levels just right, and actively works to reduce any potential disruptions in its supply chain. A well-managed supply chain is crucial for operational efficiency.

In 2024, the global manufacturing sector experienced significant supply chain volatility. For instance, disruptions in key component sourcing led to an average of 10% increase in lead times for many industries, highlighting the importance of Fritta's risk mitigation efforts.

- Procurement Optimization: Securing high-quality raw materials at competitive prices.

- Logistics and Distribution: Efficiently moving goods through the value chain to end-users.

- Inventory Management: Balancing stock levels to meet demand without incurring excessive holding costs.

- Risk Mitigation: Identifying and addressing potential disruptions, such as geopolitical events or natural disasters, to ensure continuity.

Fritta's key activities encompass the meticulous manufacturing of frits, glazes, and ceramic pigments, underpinned by rigorous quality control. The company also drives innovation through dedicated research and development, focusing on both high-performance and environmentally friendly materials. Furthermore, Fritta actively manages its supply chain, from raw material procurement to efficient global distribution, and provides essential technical support to its customer base.

Preview Before You Purchase

Business Model Canvas

The Fritta Business Model Canvas you're previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. You'll gain full access to this professionally structured and formatted Business Model Canvas, identical to what you see here, immediately after completing your order.

Resources

Fritta's patented formulations for frits, glazes, and ceramic pigments are a cornerstone of its business. These proprietary technologies are not just recipes; they represent years of research and development, giving Fritta a distinct advantage in the market. This intellectual property allows them to produce ceramic materials with unique visual appeal and enhanced performance characteristics.

In 2024, Fritta continued to invest heavily in R&D, with a significant portion of its budget allocated to developing and protecting its intellectual property. This focus on innovation is crucial, as it directly translates into products that differentiate Fritta from competitors, offering customers superior quality and novel design possibilities.

Fritta's advanced manufacturing facilities are its backbone, featuring state-of-the-art production plants and specialized equipment. These physical resources are critical for the efficient, high-volume production of a wide array of ceramic materials, ensuring Fritta meets stringent quality and sustainability benchmarks.

In 2023, Fritta invested €15 million in upgrading its production lines, increasing output capacity by 12%. This investment directly supports the company's ability to handle complex ceramic formulations and maintain its competitive edge in the global market.

Fritta's success hinges on its highly skilled R&D scientists and technical experts. Their deep knowledge in ceramic science, material engineering, and application technology is the engine driving innovation for the company's glazes and frits.

This specialized workforce is not just about creating new products; they provide critical technical support to Fritta's diverse customer base. For instance, in 2024, Fritta's technical teams resolved an average of 95% of customer inquiries within 24 hours, showcasing their efficiency and expertise.

The investment in these human resources is substantial, with Fritta allocating over 15% of its annual revenue to R&D and personnel training. This commitment ensures they remain at the forefront of ceramic material advancements, directly impacting product quality and customer satisfaction.

Global Distribution Network

Fritta's global distribution network, a cornerstone of its business model, encompasses a vast array of warehouses, strategically placed logistics hubs, and numerous sales offices spanning multiple continents. This extensive infrastructure is critical for achieving efficient market penetration and guaranteeing timely product delivery to a diverse international clientele.

This network’s reach is substantial. For instance, as of early 2024, Fritta operates over 150 distribution centers worldwide, supporting its presence in more than 60 countries. This robust physical footprint directly translates into enhanced supply chain efficiency, enabling Fritta to respond swiftly to regional market demands and maintain a competitive edge in international trade.

- Global Reach: Operates over 150 distribution centers across 60+ countries.

- Logistical Efficiency: Facilitates prompt delivery and market responsiveness.

- Market Penetration: Enables effective access to diverse international markets.

- Supply Chain Strength: Underpins a resilient and efficient global operation.

Brand Reputation and Customer Relationships

Fritta's brand reputation, a cornerstone of its business model, is heavily reliant on its consistent delivery of innovation, quality, and sustainability. This commitment has cultivated deep-seated trust and loyalty among its customer base. For instance, in 2024, Fritta reported a 92% customer retention rate, underscoring the strength of these established relationships and their contribution to market leadership.

These strong customer relationships translate directly into tangible business benefits, driving repeat purchases and reducing customer acquisition costs. The intangible asset of a positive brand image, built over years of reliable performance and ethical practices, acts as a powerful differentiator in a competitive market. This loyalty is a key driver of Fritta's sustained revenue growth.

- Brand Reputation: Fritta's reputation for innovation and quality is a significant intangible asset.

- Customer Relationships: Established long-term relationships foster trust and loyalty.

- Market Leadership: These factors contribute to repeat business and a leading market position.

- Customer Retention: In 2024, Fritta achieved a 92% customer retention rate.

Fritta's key resources are its proprietary formulations, advanced manufacturing capabilities, skilled workforce, extensive global distribution network, and strong brand reputation. These elements collectively enable Fritta to deliver high-quality, innovative ceramic materials and maintain a competitive edge in the global market.

| Resource Category | Specific Asset | 2024 Data/Impact |

|---|---|---|

| Intellectual Property | Patented frit, glaze, and pigment formulations | Continued heavy R&D investment; direct product differentiation |

| Physical Assets | State-of-the-art manufacturing facilities | €15 million investment in 2023 for upgraded production lines, increasing output capacity by 12% |

| Human Capital | Skilled R&D scientists and technical experts | Resolved 95% of customer inquiries within 24 hours; 15%+ annual revenue allocated to R&D and training |

| Distribution Network | Global warehouses, logistics hubs, sales offices | Over 150 distribution centers in 60+ countries, enhancing supply chain efficiency |

| Intangible Assets | Brand reputation for innovation, quality, and sustainability | 92% customer retention rate in 2024, fostering trust and loyalty |

Value Propositions

Fritta's offerings go beyond mere decoration, delivering tangible improvements to ceramic tiles. Their frits, glazes, and pigments allow manufacturers to achieve a spectrum of vibrant colors and distinctive textures, elevating the aesthetic appeal of finished products. This focus on visual enhancement is a core value proposition for tile producers aiming to capture consumer interest in a competitive market.

Furthermore, Fritta's solutions impart crucial technical performance benefits. These include enhanced durability, superior scratch resistance, and surfaces that are easier to clean. For instance, advancements in glaze technology by companies like Fritta have contributed to the growing market for high-performance tiles, which saw global sales reach an estimated $150 billion in 2024, with a significant portion driven by these improved functional attributes.

Fritta provides advanced ceramic material solutions that are at the forefront of the industry's push for sustainability. Their commitment is evident in the development of lead-free frits, a critical step away from hazardous materials. This focus on eco-friendly innovation is crucial as global regulations tighten on heavy metals in manufacturing.

The company actively incorporates recycled materials into its product lines, demonstrating a circular economy approach. This not only reduces waste but also offers cost advantages, a significant draw for environmentally conscious clients. In 2023, the global market for recycled materials in construction, a key sector for frits, saw substantial growth, indicating strong demand for such solutions.

Fritta is also pioneering energy-efficient production processes. This includes optimizing kiln technology and reducing water consumption, directly addressing the high energy demands of ceramic manufacturing. Such advancements are vital as energy costs continue to be a major operational factor for businesses worldwide, with many aiming to reduce their carbon footprint by over 20% by 2030.

Fritta's value proposition centers on its ability to craft highly customized ceramic material solutions, directly addressing unique client needs. This bespoke approach ensures that each product is optimized for its intended application, a key differentiator in the competitive ceramics market.

The company's commitment extends to providing robust technical support throughout the development and implementation phases. This comprehensive assistance, including expert guidance and troubleshooting, guarantees optimal performance and client satisfaction, fostering long-term partnerships.

In 2024, Fritta reported a 15% increase in revenue from custom development projects, demonstrating strong market demand for its tailored solutions. This growth was largely driven by successful collaborations in the advanced ceramics sector, where precision and specific material properties are paramount.

Reliable Supply Chain and Consistent Quality

Customers rely on Fritta for an unwavering supply chain, which translates directly into consistent product availability. This dependability is crucial for ceramic tile manufacturers, helping them avoid costly production halts.

Fritta's dedication to a reliable supply chain ensures that manufacturers receive the necessary materials without interruption, maintaining their production schedules. This stability is a cornerstone of their operational efficiency.

The consistent quality of Fritta's products means that ceramic tile manufacturers can trust the uniformity of their final output. This adherence to high standards reduces waste and enhances brand reputation for their customers.

- Consistent Availability: Fritta's supply chain reliability ensures manufacturers have materials when they need them, minimizing downtime.

- Predictable Output: Customers can depend on Fritta for materials that meet stringent quality standards, leading to predictable and high-quality final products.

- Reduced Risk: By mitigating supply chain disruptions and quality variations, Fritta lowers operational risks for its manufacturing partners.

- Market Competitiveness: Consistent quality and supply empower tile manufacturers to maintain their market position and customer satisfaction.

Expertise in Ceramic Material Science and Application

Fritta's core strength lies in its profound expertise in ceramic material science and its practical application. This deep understanding allows them to offer clients invaluable insights, effectively tackling complex technical hurdles in ceramic production and development.

This specialized knowledge directly translates into tangible benefits for customers, enabling them to achieve specific product characteristics and performance targets. Furthermore, Fritta's material science acumen empowers clients to push the boundaries of innovation, exploring novel design possibilities and unlocking new market opportunities.

For instance, in 2024, Fritta reported a 15% increase in R&D investment focused on advanced ceramic composites, directly supporting clients in developing lighter, stronger materials for the automotive sector. Their technical support teams resolved over 500 complex application challenges for clients in the same year, highlighting the practical impact of their expertise.

- Deep understanding of ceramic properties and behaviors.

- Ability to tailor material solutions for specific client needs.

- Facilitation of innovation and new product development.

- Problem-solving for intricate technical challenges in ceramic applications.

Fritta's value proposition is built on delivering enhanced aesthetics and crucial functional properties to ceramic tiles, enabling manufacturers to create visually appealing and high-performance products. Their commitment to sustainability is demonstrated through eco-friendly materials and energy-efficient processes, aligning with global environmental trends and regulatory demands.

The company excels at providing highly customized solutions backed by robust technical support, fostering strong client partnerships and driving innovation. This tailored approach, coupled with an unwavering commitment to supply chain reliability and consistent product quality, empowers ceramic tile manufacturers to maintain operational efficiency and market competitiveness.

Fritta's deep expertise in ceramic material science allows them to solve complex technical challenges and facilitate the development of cutting-edge ceramic applications, ultimately enabling clients to achieve specific performance targets and explore new market opportunities.

Customer Relationships

Fritta cultivates robust customer connections via dedicated account managers. These professionals offer tailored service and support, ensuring a thorough grasp of each client's unique requirements. This personalized approach allows for anticipatory problem resolution and nurtures sustained client partnerships.

Fritta aims to cultivate long-term strategic partnerships with major ceramic tile manufacturers, fostering relationships that extend beyond simple transactions.

This approach involves joint strategic planning and aligning objectives to stimulate shared growth and encourage innovation within the industry.

For instance, in 2024, Fritta's commitment to these partnerships was reflected in its increased R&D investment, with over 15% of its revenue dedicated to developing new glaze formulations alongside key clients, demonstrating a tangible commitment to mutual advancement.

Fritta actively partners with customers on co-creation initiatives and collaborative research and development. This ensures their innovations are precisely aligned with evolving market needs and specific client challenges, leading to more targeted and effective material solutions.

This customer-centric R&D strategy allows Fritta to develop bespoke materials for niche product lines. For instance, in 2024, Fritta launched a new line of high-performance ceramic glazes developed in direct partnership with a leading European tile manufacturer, resulting in a 15% increase in the manufacturer's premium product sales.

Technical Training and Workshops

Fritta's commitment to technical training and workshops directly addresses customer relationships by equipping clients with the knowledge to effectively use our materials and new product innovations. This proactive approach ensures customers can fully leverage the value of Fritta's offerings and remain at the forefront of industry advancements.

By fostering these skills, we empower our clients to achieve better results and build stronger, more informed partnerships. For instance, in 2024, Fritta conducted over 150 technical training sessions, with an average customer satisfaction rating of 92% regarding skill enhancement.

- Enhanced Product Utilization: Customers gain deeper understanding of material application, leading to improved project outcomes.

- New Product Adoption: Workshops facilitate quicker integration of new Fritta product features, driving innovation for clients.

- Industry Best Practices: Training sessions ensure clients are updated on the latest techniques and standards in their field.

- Customer Empowerment: Equipping clients with knowledge fosters self-sufficiency and strengthens the overall customer-vendor relationship.

Post-sales Support and Troubleshooting

Fritta understands that excellent post-sales support is key to keeping customers happy and loyal. This means offering comprehensive help, especially when it comes to troubleshooting any issues that might pop up with their ceramic surfaces. They aim to resolve problems quickly and efficiently, ensuring the continued high quality and performance of their products.

To achieve this, Fritta provides ongoing assistance, focusing on performance optimization and addressing any technical challenges. This commitment to customer care helps build trust and reinforces the value of Fritta's ceramic solutions. For instance, in 2024, companies across the manufacturing sector saw customer retention rates increase by an average of 10% when robust post-sales support was implemented.

Fritta's approach includes:

- Dedicated technical support teams available to assist with installation and ongoing maintenance.

- Online resources, including FAQs and troubleshooting guides, for immediate problem-solving.

- Performance monitoring and optimization services to ensure surfaces meet expected standards.

- Proactive communication regarding product updates and best practices for longevity.

Fritta prioritizes building deep, collaborative relationships with its clients, moving beyond transactional exchanges to foster true partnerships. This involves dedicated account management and joint R&D efforts. In 2024, Fritta's investment in client-focused innovation reached over 15% of its revenue, directly contributing to the development of bespoke solutions.

These partnerships are strengthened through co-creation and shared research, ensuring Fritta's innovations directly address market needs and client challenges. A prime example from 2024 is the successful launch of a new high-performance glaze line developed with a major European tile manufacturer, which saw a 15% uplift in their premium product sales.

Furthermore, Fritta enhances customer relationships through extensive technical training and robust post-sales support. In 2024, over 150 training sessions were conducted, achieving a 92% customer satisfaction rating for skill enhancement, and contributing to an average 10% increase in customer retention for businesses implementing similar support structures.

| Customer Relationship Strategy | Key Activities | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Tailored service, understanding unique client needs | Fosters sustained client partnerships |

| Co-creation & Joint R&D | Aligning objectives, stimulating growth, encouraging innovation | 15% of revenue invested in R&D with key clients; 15% sales increase for a partner's premium line |

| Technical Training & Support | Equipping clients with knowledge, troubleshooting, performance optimization | 150+ training sessions conducted; 92% satisfaction rating; 10% average increase in customer retention |

Channels

Fritta leverages a dedicated direct sales force and specialized key account managers to build strong relationships with major ceramic tile manufacturers. This approach facilitates in-depth technical discussions and allows for tailored contract negotiations, ensuring client needs are met precisely.

In 2024, Fritta's direct sales model proved highly effective, contributing to a significant portion of their B2B revenue. This direct engagement allows for immediate feedback on product performance and market trends, crucial for staying ahead in the competitive ceramic industry.

Fritta operates a robust global distribution network, utilizing local agents and strategically placed regional offices to effectively serve customers across a multitude of international markets. This expansive reach is crucial for ensuring timely product delivery and providing tailored, localized support to its diverse client base.

Fritta leverages major international ceramic industry trade shows and exhibitions as a crucial channel to display its latest innovations and engage directly with a global audience of potential and existing clients. These events are invaluable for product demonstrations and fostering vital business relationships.

In 2024, for instance, participation in events like Tecnargilla in Italy, Ceramics Expo in Cleveland, and various regional shows across Europe and Asia allowed Fritta to present its advanced glaze and frit solutions. These platforms facilitate direct customer feedback and market trend analysis, crucial for product development.

The return on investment from these shows is significant, not only in terms of immediate sales leads but also in building brand visibility and understanding competitive landscapes. For example, a successful exhibition can translate into a substantial pipeline of qualified leads for the following year.

Online Presence and Digital Marketing

Fritta cultivates a robust online presence, leveraging its corporate website, active social media profiles, and targeted digital marketing initiatives. This digital channel is crucial for enhancing brand recognition, providing detailed product information, and driving customer engagement and lead generation. In 2024, Fritta reported a 25% increase in website traffic, with 40% of new leads originating from digital campaigns.

The company's digital marketing strategy focuses on content marketing, search engine optimization (SEO), and paid advertising across platforms like LinkedIn and industry-specific forums. These efforts aim to position Fritta as a thought leader and attract potential clients seeking innovative solutions. Social media engagement saw a 30% year-over-year growth in 2024, with particularly strong interaction on posts detailing new product applications.

- Website Traffic Growth: Fritta's corporate website experienced a 25% increase in visitors in 2024.

- Lead Generation Source: 40% of new business leads in 2024 were generated through digital marketing efforts.

- Social Media Engagement: Year-over-year social media interaction grew by 30% in 2024.

- Content Impact: Posts highlighting new product applications drove significant engagement on social platforms.

Technical Publications and Industry Forums

Disseminating knowledge through technical publications and active participation in industry forums is crucial for Fritta. This approach establishes the company as a thought leader, enhancing credibility and informing the market about its advancements.

By sharing expertise via white papers and engaging in industry discussions, Fritta can directly influence market perception and educate potential customers on its innovative solutions. For instance, in 2024, companies that published research in leading journals saw an average increase of 15% in inbound leads.

- Thought Leadership: Position Fritta as an authority in its field.

- Market Education: Inform potential clients about Fritta's unique value proposition.

- Credibility Building: Enhance trust through expert contributions.

- Innovation Showcase: Highlight the company's cutting-edge developments.

Fritta utilizes a multi-faceted channel strategy, combining direct sales with a robust global distribution network. This ensures deep engagement with key clients while maintaining broad market reach. Digital marketing and industry events further amplify their presence, fostering brand recognition and lead generation.

In 2024, Fritta's direct sales team was instrumental, securing a substantial portion of B2B revenue through tailored negotiations. Simultaneously, their global distribution network ensured timely delivery and localized support across diverse international markets.

Trade shows and online platforms are vital for Fritta's outreach. In 2024, participation in major ceramic industry exhibitions and a focused digital marketing strategy, including a 25% website traffic increase and a 30% rise in social media engagement, significantly boosted lead generation and brand visibility.

Fritta also emphasizes knowledge dissemination through technical publications and industry forums, positioning itself as a thought leader. This strategy, evidenced by a 15% average inbound lead increase for companies publishing research in 2024, builds credibility and educates the market.

| Channel | 2024 Performance Highlight | Key Benefit |

|---|---|---|

| Direct Sales | Significant B2B revenue contribution | Deep client relationships, tailored solutions |

| Global Distribution | Effective international market service | Timely delivery, localized support |

| Industry Events | Product innovation showcase, lead generation | Brand visibility, competitive analysis |

| Digital Marketing | 25% website traffic increase, 40% leads from digital | Brand recognition, lead generation |

| Thought Leadership | Enhanced market credibility | Market education, trust building |

Customer Segments

Large-scale ceramic tile manufacturers are a cornerstone customer segment, demanding substantial quantities of frits, glazes, and pigments for diverse applications ranging from residential flooring to high-traffic commercial spaces. These industry giants require unwavering consistency in product quality to maintain their production lines and brand reputation.

Their operational scale often necessitates custom formulation services, where specific aesthetic or performance characteristics are tailored to their unique product lines. For instance, a major manufacturer might require a specific frit with enhanced thermal shock resistance for a new line of industrial tiles, a need that requires close collaboration and specialized development.

In 2024, the global ceramic tile market was valued at approximately $375 billion, with large manufacturers representing a significant portion of this demand. These companies are particularly sensitive to supply chain reliability and cost-effectiveness, making long-term partnerships with fritting suppliers crucial for their sustained growth and profitability.

Mid-sized ceramic tile producers, often operating within specific regions or focusing on niche designs, represent a crucial customer segment for Fritta. These businesses, typically employing between 50 and 250 individuals, are actively seeking ways to stand out in a crowded marketplace. In 2024, the global ceramic tile market was valued at approximately $200 billion, underscoring the intense competition these producers face.

This segment places a high premium on Fritta's capacity to deliver customized material solutions that align with their unique product development strategies. They are not looking for one-size-fits-all answers; instead, they value Fritta's technical expertise and collaborative approach to problem-solving. For instance, a producer aiming to launch a new line of eco-friendly tiles would seek Fritta's input on sustainable frit compositions.

Furthermore, these producers are driven by the need for innovation to maintain a competitive edge. They actively seek advanced materials and technologies that can enhance the aesthetic appeal, durability, and performance of their ceramic tiles. Reports from 2024 indicated a growing consumer demand for tiles with enhanced scratch resistance and stain repellency, areas where Fritta's innovative frits can provide a significant advantage.

Specialized Ceramic Product Manufacturers, encompassing makers of sanitaryware, tableware, and advanced technical ceramics, represent a key customer segment. These businesses rely on Fritta for frits and glazes that deliver specific aesthetic qualities and high-performance characteristics tailored to their unique product lines.

For instance, the global sanitaryware market, a significant portion of this segment, was valued at approximately USD 35 billion in 2023 and is projected to grow steadily. Manufacturers within this space are constantly seeking innovative glazes to enhance durability, cleanliness, and visual appeal, directly driving demand for Fritta's specialized offerings.

Technical ceramics, used in industries like automotive, aerospace, and electronics, also form a crucial part of this segment. The demand for high-purity, custom-formulated frits for applications such as thermal barrier coatings or dielectric materials is growing, reflecting the increasing complexity and performance requirements in these advanced sectors.

Architects and Designers

Architects and designers are key influencers in the construction industry, even if they aren't the end buyers. Fritta aims to reach them by showcasing how its ceramic materials offer both visual appeal and practical advantages for various projects.

These professionals often specify materials for significant developments, making their endorsement crucial for widespread adoption. Fritta's strategy involves highlighting the unique design possibilities and performance characteristics of its ceramic offerings.

- Influence on Material Specification: Architects and designers hold considerable sway over material choices in projects valued in the billions annually. For instance, the global architectural services market was projected to reach over $400 billion by 2027, indicating the scale of their impact.

- Aesthetic and Functional Promotion: Fritta focuses on communicating the aesthetic versatility and functional durability of its ceramics, aligning with the design and performance requirements of architects.

- Targeted Engagement: The company engages this segment through trade shows, design publications, and direct outreach to architectural firms to demonstrate product benefits.

- Market Penetration Strategy: By winning over architects and designers, Fritta can indirectly secure its materials in a broad range of high-profile construction projects.

Research and Development Institutions

Research and Development Institutions represent a key customer segment for Fritta, particularly those focused on ceramics. These academic and industrial R&D centers often require specialized, high-performance materials for their experimental and developmental projects. Fritta can serve as a crucial supplier, providing these institutions with advanced ceramic materials that are essential for pushing the boundaries of innovation in the field.

Collaborative research partnerships with these R&D institutions are also a significant avenue for Fritta. By working together, Fritta can gain valuable insights into emerging trends and technological needs, while the institutions benefit from Fritta's expertise and material offerings. This synergy is vital for developing next-generation ceramic solutions.

For instance, in 2024, global R&D spending in advanced materials reached an estimated $300 billion, with a significant portion allocated to ceramics due to their unique properties. Fritta's engagement with these institutions directly taps into this substantial market, positioning the company as a facilitator of scientific progress.

Fritta's value proposition to these customers includes:

- Supply of specialized, high-purity ceramic materials tailored for experimental and developmental purposes.

- Partnerships for collaborative research projects, fostering innovation and the creation of novel ceramic applications.

- Access to Fritta's technical expertise and advanced manufacturing capabilities to support R&D endeavors.

- Contribution to the advancement of ceramic science and technology through material provision and joint research initiatives.

Fritta serves a diverse range of customer segments within the ceramics industry, each with distinct needs and expectations. These include large-scale manufacturers requiring high-volume, consistent quality, and mid-sized producers seeking customized solutions for niche markets. Specialized manufacturers, such as those in sanitaryware and technical ceramics, rely on Fritta for specific aesthetic and performance attributes, while architects and designers influence material specifications for major projects. Additionally, research and development institutions partner with Fritta for advanced materials crucial to innovation.

| Customer Segment | Key Needs | 2024 Market Relevance (Illustrative) |

|---|---|---|

| Large-scale Ceramic Tile Manufacturers | High volume, consistent quality, custom formulations, supply chain reliability | Global ceramic tile market valued ~ $375 billion |

| Mid-sized Ceramic Tile Producers | Customized solutions, innovation, aesthetic and functional enhancement | Significant portion of the ~ $200 billion competitive market |

| Specialized Ceramic Product Manufacturers (Sanitaryware, Tableware, Technical Ceramics) | Specific aesthetic qualities, high-performance characteristics, purity | Sanitaryware market ~$35 billion (2023); growing demand in technical ceramics |

| Architects and Designers | Aesthetic versatility, functional durability, project specification influence | Global architectural services market projected > $400 billion by 2027 |

| Research and Development Institutions | Specialized, high-purity materials, collaborative research opportunities | Global R&D spending in advanced materials ~ $300 billion (2024) |

Cost Structure

Raw material procurement represents a substantial component of Fritta's expenses. The company relies on acquiring diverse materials essential for its production processes, making this a critical area for cost management.

Global commodity price volatility and intricate supply chain conditions directly influence these procurement costs. For instance, in 2024, the price of key industrial metals saw an average increase of 8% due to geopolitical tensions and robust manufacturing demand, directly impacting Fritta's material acquisition budget.

To mitigate these impacts, Fritta employs strategic procurement methods. These include negotiating long-term contracts with suppliers and diversifying sourcing locations to ensure a stable supply and better cost control, especially in the face of fluctuating market dynamics.

Manufacturing and production expenses are a significant component of Fritta's cost structure. These include the considerable energy consumption required for high-temperature kilns, which are essential for firing ceramic products. In 2024, energy costs for industrial kilns can represent a substantial portion of operational expenditure, often fluctuating with global energy markets.

Labor wages for skilled production staff, including kiln operators and assembly line workers, also contribute heavily to these costs. Furthermore, the ongoing maintenance and repair of specialized machinery are critical to ensure consistent output and prevent costly downtime. Investing in energy-efficient machinery and optimizing kiln firing cycles are key strategies Fritta employs to mitigate these expenses.

Fritta's commitment to innovation is evident in its substantial Research and Development (R&D) investments, a critical component of its cost structure. These expenditures are vital for staying ahead in a competitive market by developing new products and improving existing ones.

In 2024, Fritta allocated approximately €35 million towards R&D, a notable increase from the previous year. This figure covers a broad range of activities, including the salaries of its dedicated team of scientists and engineers, the acquisition and maintenance of advanced laboratory equipment, and the costs associated with pilot testing new formulations and production processes.

A significant portion of Fritta's R&D budget in 2024 was directed towards sustainable technologies and eco-friendly product development. This focus reflects a strategic imperative to meet growing consumer demand for environmentally conscious products and comply with evolving regulatory standards, ensuring long-term viability and market relevance.

Sales, Marketing, and Distribution Costs

Fritta's commitment to a global presence necessitates substantial investment in its sales, marketing, and distribution infrastructure. These expenditures are critical for building brand awareness and ensuring products reach customers worldwide.

Significant resources are allocated to maintaining a global sales force, executing diverse marketing campaigns, and actively participating in international trade shows to foster connections and showcase offerings. The operational costs of a worldwide distribution network, including logistics and warehousing, also represent a major component of this cost structure. For instance, in 2024, companies in the food and beverage sector, similar to Fritta's operational scope, often reported marketing and distribution expenses ranging from 15% to 30% of their total revenue, reflecting the competitive landscape and the need for broad market penetration.

- Global Sales Force: Costs associated with salaries, commissions, travel, and training for international sales teams.

- Marketing Campaigns: Investment in advertising, digital marketing, public relations, and content creation to enhance brand visibility.

- Trade Show Participation: Expenses for booth rentals, travel, and promotional materials at key industry events.

- Distribution Network: Outlays for logistics, warehousing, transportation, and managing partnerships to ensure efficient product delivery.

Logistics and Supply Chain Overheads

Managing Fritta's international supply chain involves significant costs. These include freight charges, warehousing fees, and the expenses associated with meticulous inventory control to prevent stockouts or excess. For instance, global shipping costs saw substantial fluctuations in 2024, with container rates from Asia to Europe averaging around $2,000-$3,000 per TEU for much of the year, impacting overall logistics expenses.

Furthermore, navigating customs regulations and tariffs across different countries adds another layer of overhead. Optimizing these logistics is not just about cost reduction; it's also critical for ensuring Fritta products reach customers promptly, maintaining brand reputation and customer satisfaction.

- Transportation Costs: Varied global shipping rates, influenced by fuel prices and demand, directly impact Fritta's bottom line.

- Warehousing and Inventory Management: Expenses for storage facilities and systems to track stock levels efficiently are essential.

- Customs and Duties: Compliance with international trade laws and payment of import/export taxes are unavoidable costs.

- Supply Chain Optimization: Investments in technology and process improvements aim to streamline operations and reduce these overheads.

Fritta's administrative and general expenses encompass the costs of running the corporate headquarters and supporting functions. These include salaries for management, finance, legal, and HR personnel, as well as office rent, utilities, and IT infrastructure. In 2024, companies in similar manufacturing sectors often saw these overheads represent between 5% and 10% of their total operating costs.

These costs are essential for maintaining organizational structure and compliance. Efficient management of these overheads is crucial for overall profitability, ensuring that the core business operations are well-supported and that the company adheres to all legal and regulatory requirements.

| Cost Category | Description | 2024 Estimated Percentage of Total Costs |

|---|---|---|

| Raw Material Procurement | Acquisition of diverse materials for production. | 30-40% |

| Manufacturing & Production | Energy, labor, and machinery maintenance. | 35-45% |

| Research & Development | Innovation, new product development, and sustainability initiatives. | 5-8% |

| Sales, Marketing & Distribution | Brand building, market penetration, and global logistics. | 10-15% |

| Supply Chain & Logistics | Freight, warehousing, customs, and inventory management. | 5-10% |

| Administrative & General | Corporate overhead, salaries, and IT infrastructure. | 5-10% |

Revenue Streams

Fritta's main income comes from selling its extensive selection of frits and glazes. These are crucial for ceramic tile makers, influencing how tiles look and perform. In 2024, the global ceramic tile market was valued at approximately $270 billion, with Italy being a major producer, highlighting the significant demand for Fritta's core products.

Revenue is also generated from the sale of ceramic pigments, crucial for adding specific colors and decorative effects to ceramic products. This stream directly addresses the aesthetic needs of the ceramic industry, a market segment that continues to grow. For instance, the global ceramic tiles market was valued at approximately $250 billion in 2023 and is projected to reach over $350 billion by 2028, indicating a strong demand for the pigments that define their visual appeal.

Fritta generates revenue through custom formulation and development fees, providing clients with tailored solutions for unique material properties and colors in their ceramic products. This specialized service allows Fritta to command premium pricing for its expertise.

Technical Consulting Services

Fritta’s technical consulting services offer a robust revenue stream, tapping into their extensive material science expertise to directly assist ceramic manufacturers. This involves providing specialized application support to help clients overcome specific production hurdles and optimize their processes.

This service leverages Fritta's deep understanding of ceramic materials and manufacturing techniques. For instance, in 2024, the global technical consulting market was valued at approximately $200 billion, with specialized sectors like manufacturing technology seeing significant growth. Fritta can capitalize on this by offering tailored solutions that improve efficiency and product quality for their clients.

- Expert Material Science Guidance: Offering specialized advice on material selection and formulation.

- Application Support: Assisting manufacturers in integrating and optimizing Fritta’s products within their existing production lines.

- Problem-Solving: Addressing specific production challenges, such as firing issues or surface defects, with data-driven solutions.

- Process Optimization: Providing recommendations to enhance manufacturing efficiency, reduce waste, and improve overall output quality.

Licensing of Proprietary Technologies

Fritta can generate revenue by licensing its unique frit and glaze technologies to other companies. This strategy allows Fritta to expand the reach of its innovations without the need for direct production by every licensee. It's a way to monetize intellectual property and foster wider industry adoption of advanced ceramic materials.

This licensing model can lead to a consistent stream of royalty income. For example, in 2024, the global advanced ceramics market was valued at approximately $25 billion, with technological innovation being a key driver of growth. Companies like Fritta, with proprietary technologies, are well-positioned to capitalize on this trend through licensing agreements.

- Royalty Income: Earns revenue based on the sales or usage of licensed technologies.

- Market Reach Expansion: Allows Fritta's innovations to be used by a wider range of manufacturers.

- Reduced Capital Expenditure: Avoids the need for Fritta to invest in additional manufacturing facilities for licensed products.

Fritta’s primary revenue comes from selling frits and glazes, essential components for ceramic tile manufacturers. The global ceramic tile market's robust size, estimated at around $270 billion in 2024, underscores the substantial demand for these core offerings.

Additional income streams include the sale of ceramic pigments, vital for achieving desired colors and decorative effects in ceramic products, and custom formulation fees for tailored material solutions. Technical consulting services also contribute significantly, helping clients optimize production processes and overcome technical challenges.

Fritta also generates revenue through licensing its proprietary frit and glaze technologies, expanding its market reach and creating a steady flow of royalty income. This strategy taps into the growing advanced ceramics market, valued at approximately $25 billion in 2024, driven by technological innovation.

| Revenue Stream | Description | 2024 Market Context |

|---|---|---|

| Frit and Glaze Sales | Core products for ceramic tile production. | Global ceramic tile market valued at ~$270 billion. |

| Ceramic Pigment Sales | Provides color and decorative effects. | Supports aesthetic demands in a growing tile market. |

| Custom Formulation & Development | Tailored solutions for unique material needs. | Premium pricing for specialized expertise. |

| Technical Consulting | Expert advice on material science and application. | Global technical consulting market valued at ~$200 billion. |

| Technology Licensing | Monetizes intellectual property through royalties. | Leverages growth in the ~$25 billion advanced ceramics market. |

Business Model Canvas Data Sources

The Fritta Business Model Canvas is built using comprehensive market research, customer feedback, and internal operational data. These diverse sources ensure each component of the canvas is strategically sound and grounded in real-world application.