Frank's International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Frank's International Bundle

Gain a crucial competitive edge with our in-depth PESTLE Analysis of Frank's International. Uncover how political shifts, economic volatility, and technological advancements are reshaping its operational landscape and future growth. Download the full version now for actionable intelligence to inform your own strategic decisions.

Political factors

Global geopolitical stability remains a critical concern, with ongoing conflicts in Eastern Europe and the Middle East directly impacting oil and gas supply chains. For instance, the ongoing conflict in Ukraine has led to significant price volatility, with Brent crude oil prices fluctuating between $75 and $90 per barrel in early 2024, demonstrating the market's sensitivity to these disruptions. Governments worldwide are increasingly prioritizing energy security, leading to a renewed focus on domestic production and diversification of energy sources. This prioritization can influence exploration and production (E&P) investment decisions, as companies assess the risks associated with operating in politically unstable regions.

Governments worldwide are increasingly implementing policies to manage fossil fuel use, directly impacting companies like Expro Group. For instance, the European Union's Carbon Border Adjustment Mechanism, fully phased in by 2026, aims to put a price on carbon emissions for imported goods, potentially increasing costs for energy-intensive industries and influencing demand for fossil fuels.

These regulatory shifts include carbon taxes, such as the UK's Climate Change Levy, which adds to the cost of energy used in businesses, and the phasing out of subsidies for fossil fuels, with many nations committing to redirecting these funds towards renewable energy projects. For example, the International Energy Agency reported that global fossil fuel subsidies still amounted to $1.3 trillion in 2022, but there is a clear trend towards their reduction and reallocation.

Furthermore, restrictions on new drilling permits, like those seen in parts of the United States and Canada, directly affect the operational feasibility and investment attractiveness of fossil fuel extraction. These policy changes create a more challenging operating environment for traditional energy companies, while simultaneously encouraging investment in cleaner energy alternatives.

International trade agreements significantly shape the global oil and gas market. For instance, the United States rejoined the Paris Agreement in 2021, signaling a potential shift in energy policy and international cooperation on climate change, which could influence future trade flows and investment in green technologies. Conversely, existing tariffs and the threat of new ones can increase the cost of imported materials and equipment, impacting operational budgets and project viability.

Economic sanctions, often imposed due to geopolitical tensions, directly disrupt the flow of oil and gas. For example, sanctions on major oil-producing nations can reduce global supply, leading to price volatility and impacting market access for companies operating in or trading with those regions. The ability to secure necessary components and services can be severely hampered, affecting supply chain resilience and the cost of doing business.

Nationalization Risks and Resource Control

The risk of nationalization or increased government control over oil and gas assets remains a significant political factor for international service providers. Many nations, particularly those rich in natural resources, are re-evaluating their ownership structures to maximize state revenue and ensure domestic control over strategic industries. This trend was evident in 2024, with several countries in regions like Latin America and Africa considering or implementing policy changes that favor state-owned enterprises.

This heightened government intervention directly impacts investment security and long-term operational stability. For example, in 2024, Venezuela continued to exert significant control over its oil sector, impacting the operations of foreign companies. Similarly, discussions around resource nationalism intensified in several African nations throughout 2024 and early 2025, leading to potential renegotiations of existing contracts.

- Increased government oversight: Many resource-rich nations are strengthening state control over oil and gas sectors to bolster national revenue and economic sovereignty.

- Contract renegotiations: Host governments are increasingly seeking to renegotiate terms with international service providers, potentially leading to revised profit-sharing or ownership structures.

- Investment climate impact: The perception of nationalization risk can deter foreign direct investment, forcing companies to reassess their exposure in politically volatile regions.

- Resource nationalism trends: Data from 2024 indicates a continued global trend of resource nationalism, with several countries actively reviewing their natural resource governance frameworks.

Political Support for Oil and Gas Infrastructure

Government commitment to oil and gas infrastructure development is a key political factor. For instance, the U.S. government's stance on pipeline approvals, such as the controversial Dakota Access Pipeline, highlights the direct impact of political decisions on project viability. This support, or lack thereof, directly influences investment in services like tubular running, as companies assess the long-term stability of oil and gas infrastructure projects.

Political backing for new projects, like the proposed expansion of the Trans Mountain Pipeline in Canada, signals sustained demand for related services. Such government endorsements can de-risk investments, encouraging companies to allocate capital for expansion and operational upgrades. The projected C$21.4 billion cost of the Trans Mountain Expansion, funded by the Canadian government, underscores the scale of public investment in this sector.

- Government Subsidies and Incentives: Many nations offer tax breaks or direct funding for oil and gas infrastructure, boosting project feasibility.

- Regulatory Frameworks: Streamlined permitting processes and clear environmental regulations can accelerate development, encouraging investment.

- Geopolitical Stability: Stable political environments foster investor confidence, crucial for large-scale, long-term infrastructure projects.

- International Agreements: Treaties and trade agreements can facilitate cross-border pipeline development, opening new markets and investment opportunities.

Political stability and government policies significantly shape the operational landscape for energy companies. For example, in 2024, the ongoing geopolitical tensions in Eastern Europe continued to influence global energy markets, with crude oil prices experiencing volatility. Governments are increasingly prioritizing energy security, leading to shifts in investment towards domestic production and diversified energy sources, impacting exploration and production decisions.

Regulatory environments are also evolving, with carbon pricing mechanisms like the EU's Carbon Border Adjustment Mechanism (effective by 2026) poised to increase costs for energy-intensive industries. Many nations are actively phasing out fossil fuel subsidies, with a global trend towards reallocating these funds to renewable energy projects, a shift that impacts the cost competitiveness of traditional energy sources.

The risk of nationalization and increased state control over natural resources remains a key political consideration. Throughout 2024 and into early 2025, several resource-rich countries, particularly in Africa and Latin America, reviewed their resource governance frameworks, leading to potential contract renegotiations and impacting foreign investment. This trend of resource nationalism can deter investment due to concerns about operational stability and profit sharing.

Government support for infrastructure development, such as pipeline projects, directly influences demand for related services. For instance, the Canadian government's continued investment in the Trans Mountain Expansion project, costing an estimated C$21.4 billion, highlights the significant role of public funding in driving sector growth and creating opportunities for service providers.

| Political Factor | Impact on Energy Sector | Example (2024/2025) |

| Geopolitical Stability | Price volatility, supply chain disruptions | Ukraine conflict's impact on oil prices (Brent crude $75-$90/barrel range in early 2024) |

| Regulatory Changes | Increased operational costs, shift to renewables | EU's Carbon Border Adjustment Mechanism (phasing in by 2026) |

| Resource Nationalism | Contract renegotiations, reduced foreign investment | African nations reviewing resource governance frameworks in 2024-2025 |

| Infrastructure Support | Sustained demand for services, investment de-risking | Canadian government's C$21.4 billion investment in Trans Mountain Expansion |

What is included in the product

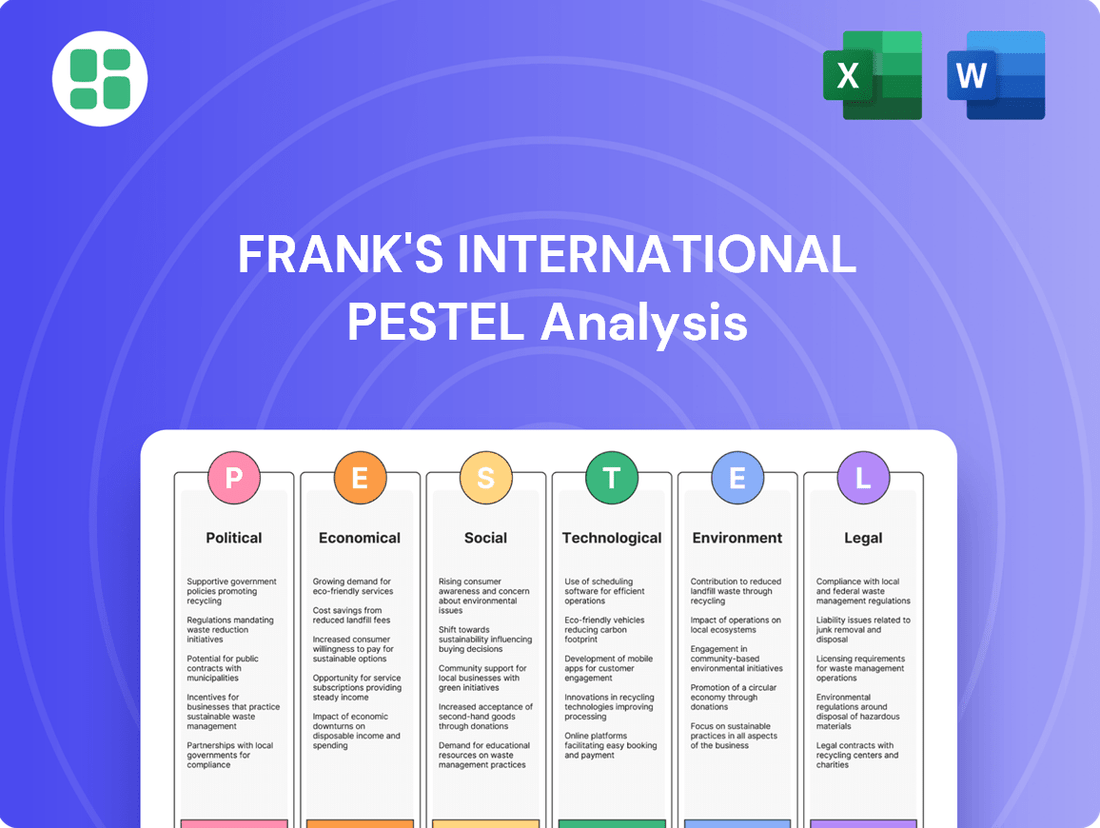

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Frank's International across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key threats and opportunities within the company's operating landscape.

A concise PESTLE analysis for Frank's International that highlights key external factors, simplifying complex market dynamics for strategic decision-making.

Economic factors

Global oil and gas prices have experienced significant swings. For instance, crude oil prices, like West Texas Intermediate (WTI), have seen periods of sharp decline and recovery, impacting exploration and production (E&P) budgets. In early 2024, WTI futures hovered around the $70-$80 per barrel range, a stark contrast to the volatility seen in previous years.

These price fluctuations directly influence our clients' spending on exploration and production services. Sustained periods of lower oil prices, such as those seen in 2020, can lead to reduced demand for our services as companies cut back on capital expenditures. Conversely, when prices are higher, like the $90+ per barrel levels observed in late 2023, investment in new projects and drilling activities typically increases, boosting our revenue streams.

Price stability is crucial for predictable industry activity. For example, the International Energy Agency (IEA) has noted that a stable price environment, generally between $70-$90 per barrel for Brent crude, tends to foster more consistent investment in the sector, benefiting service providers like us. This stability allows for better long-term planning and resource allocation.

Capital expenditure (CapEx) by major oil and gas operators is a critical driver for companies like Frank's International, as it directly influences demand for their services. In 2024, the International Energy Agency (IEA) projected global oil and gas upstream investment to reach $570 billion, a slight increase from 2023, reflecting a cautious optimism driven by stable commodity prices.

However, this spending is heavily influenced by factors such as oil prices, which hovered around $80-$90 per barrel for Brent crude in early 2024, and the significant pressure from shareholders demanding capital discipline. This means operators are prioritizing returns and efficiency, which can moderate overall CapEx growth.

A notable trend is the focus on shorter-cycle projects and enhanced oil recovery (EOR) rather than large, long-term greenfield developments. This shift can lead to reduced drilling and completion activity in some segments, directly impacting demand for specialized services.

Inflation significantly impacts Frank's International by increasing the cost of essential operational inputs. For instance, the cost of raw materials, a key component for many businesses, saw an average increase of 5.2% globally in 2024, according to the World Bank's latest projections.

This surge in material expenses, coupled with rising labor wages—which averaged a 4.5% increase in developed economies throughout 2024—and elevated energy prices, directly squeezes profit margins. Even if demand for Frank's services holds steady, these escalating operational costs can lead to reduced profitability.

Consequently, maintaining competitiveness in this inflationary climate necessitates a sharp focus on cost efficiencies. Strategies like optimizing supply chains, investing in energy-saving technologies, and improving labor productivity are paramount for Frank's International to navigate these pressures and protect its bottom line.

Access to Capital and Financing Conditions

Access to capital is a critical determinant for oil and gas companies. The cost and availability of both debt and equity financing directly impact their capacity to undertake new projects and expand operations. For instance, in early 2024, rising interest rates, exemplified by the US Federal Reserve maintaining its benchmark rate in the 5.25%-5.50% range, have increased the cost of borrowing for energy firms.

Investor sentiment towards fossil fuels also plays a significant role. A growing emphasis on Environmental, Social, and Governance (ESG) factors can make it harder for some oil and gas companies to attract equity investment, potentially driving up the cost of capital. Credit market conditions, reflecting overall economic health and risk appetite, further shape financing accessibility.

Favorable financing conditions are paramount for growth. For example, companies seeking to finance large-scale projects, such as offshore drilling or new pipeline construction, rely on robust credit markets and positive investor outlooks. The ability to secure this funding at competitive rates directly influences project viability and strategic decision-making in the sector.

- Interest Rates: The Federal Reserve's target rate remained at 5.25%-5.50% as of early 2024, impacting borrowing costs.

- Investor Sentiment: Increasing ESG focus can create headwinds for traditional energy financing.

- Credit Market Conditions: Tighter credit conditions in 2024 have made it more challenging for some companies to secure loans.

- Project Financing: Securing affordable capital is essential for major oil and gas development projects.

Global Economic Growth and Energy Demand

Global economic growth is a primary driver of energy demand, with a strong correlation between GDP expansion and consumption of oil and gas. As economies expand, industrial output, transportation, and consumer spending all increase, directly boosting energy needs. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024 and 3.2% in 2025, indicating a steady demand environment for energy resources.

This robust economic activity translates into higher upstream sector activity and increased demand for energy services. When the global economy is performing well, there's greater investment in exploration and production, leading to more opportunities for service companies. Conversely, economic slowdowns or recessions tend to depress energy demand, as industrial activity and consumer spending contract.

Recent trends highlight this relationship. For example, the post-pandemic recovery saw a surge in oil demand as economies reopened, pushing prices higher. However, concerns about inflation and interest rate hikes in late 2023 and early 2024 led to some moderation in growth forecasts, which in turn can temper the pace of energy demand growth.

- Global GDP Growth Forecasts: IMF projects 3.2% global growth for both 2024 and 2025.

- Energy Demand Link: Higher economic growth typically leads to increased demand for oil and gas.

- Upstream Sector Impact: Economic expansion stimulates investment and activity in oil and gas exploration and production.

- Recessionary Effects: Economic downturns result in reduced energy consumption and lower demand for related services.

Economic factors significantly shape the oil and gas industry, impacting demand, investment, and operational costs. Global economic growth forecasts, such as the IMF's projection of 3.2% for both 2024 and 2025, indicate a steady demand environment for energy resources, directly influencing upstream sector activity and opportunities for service companies like Frank's International. However, persistent inflation, with raw material costs rising by an average of 5.2% globally in 2024 and labor wages increasing by 4.5% in developed economies, squeezes profit margins and necessitates a focus on cost efficiencies. Furthermore, access to capital is critical, with rising interest rates, such as the Federal Reserve's benchmark rate holding at 5.25%-5.50% in early 2024, increasing borrowing costs for energy firms, while growing ESG investor sentiment can make equity financing more challenging.

| Economic Factor | 2024/2025 Data Point | Impact on Frank's International |

|---|---|---|

| Global GDP Growth Forecast | IMF: 3.2% (2024 & 2025) | Supports steady energy demand and upstream activity. |

| Inflation (Raw Materials) | World Bank: +5.2% (Global Avg. 2024) | Increases operational costs, squeezing profit margins. |

| Inflation (Labor Wages) | Developed Economies: +4.5% (2024 Avg.) | Further elevates operational expenses. |

| Interest Rates (US Federal Reserve) | 5.25%-5.50% (Early 2024) | Increases cost of borrowing for clients. |

| Oil Price (WTI Futures) | ~$70-$80/barrel (Early 2024) | Influences client CapEx and demand for services. |

Preview Before You Purchase

Frank's International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the PESTLE analysis for Frank's International.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the external factors impacting Frank's International.

The content and structure shown in the preview is the same document you’ll download after payment, offering valuable insights into Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

Shifting public sentiment strongly favors renewable energy, with a 2024 survey indicating 70% of global consumers believe governments should accelerate the transition from fossil fuels. This growing pressure directly impacts investor sentiment, as evidenced by the $1.5 trillion invested in clean energy projects in 2024, a 15% increase from the previous year. Companies failing to adapt risk alienating stakeholders and facing regulatory headwinds, making social license to operate paramount.

The oil and gas sector faces a significant demographic shift, with an aging workforce nearing retirement age. This trend, particularly pronounced in 2024, presents a dual challenge: potential skill gaps as experienced professionals depart and difficulties in attracting younger talent to what are often perceived as traditional or environmentally challenging industries.

In 2024, the average age in many oil and gas roles is approaching 50, and projections indicate a substantial portion of the experienced workforce could retire by 2030. This demographic reality directly impacts talent acquisition, as companies compete for a shrinking pool of skilled labor, often leading to increased recruitment costs and salary pressures.

To counter these workforce dynamics, strategies focusing on talent development, upskilling existing employees, and enhancing employee retention are becoming critical. Companies are investing in apprenticeship programs and partnerships with educational institutions to cultivate the next generation of energy professionals, aiming to bridge the looming skill shortages and foster innovation.

Societal expectations are increasingly pushing for higher Health, Safety, and Environmental (HSE) standards within the oil and gas sector. This isn't just about following rules; it's about building trust and a good reputation. For instance, in 2024, over 70% of consumers surveyed indicated that a company's environmental record significantly influences their purchasing decisions, a figure that also impacts investor confidence in companies like Frank's International.

Compliance with these rigorous HSE standards is now a baseline requirement, not just a legal obligation but a critical component for maintaining a positive public image and avoiding costly reputational damage. Companies demonstrating strong HSE performance, such as achieving zero lost-time incidents, often see a tangible benefit in attracting investment and talent, with some studies in 2024 showing a 5-10% higher valuation for companies with top-tier HSE records.

Community Relations and Social License to Operate

Maintaining strong community relations is paramount for Frank's International, directly impacting its social license to operate. This means actively listening to and addressing local concerns, contributing to community development initiatives, and demonstrating a commitment to minimizing environmental impact. Failure to do so can result in significant operational disruptions, as seen in various industries where community opposition has led to project delays or outright cancellations. For instance, in 2023, several major infrastructure projects globally faced substantial setbacks due to local community grievances, highlighting the tangible financial risks associated with poor stakeholder engagement.

The growing emphasis on corporate social responsibility means companies like Frank's International must go beyond mere compliance. They need to foster genuine partnerships with communities, ensuring that operations benefit local populations. This includes:

- Local Employment and Training: Prioritizing hiring and skill development for residents in operating regions.

- Community Investment: Allocating resources to local infrastructure, education, or health programs.

- Environmental Stewardship: Implementing best practices to protect local ecosystems and minimize pollution.

- Transparent Communication: Establishing open channels for dialogue and feedback with community leaders and residents.

Changing Consumer Energy Preferences

Consumer demand for cleaner energy sources and sustainable products is significantly reshaping the global energy landscape. This shift, even for B2B service providers like Expro Group (formerly Frank's International), has a profound indirect impact by influencing the strategic decisions of major oil and gas companies. These majors, facing pressure from end consumers and investors alike, are increasingly prioritizing investments in lower-carbon projects and technologies, which in turn affects the demand for traditional oil and gas services.

The growing consumer preference for sustainability is a powerful driver of policy and investment trends. For instance, by the end of 2023, renewable energy sources accounted for approximately 30% of global electricity generation, a figure expected to climb. This momentum encourages oil and gas majors to allocate capital towards energy transition initiatives, potentially reducing their long-term commitment to conventional exploration and production projects. Consequently, this influences the types of services in demand within the sector.

- Consumer-driven ESG mandates: Investor pressure, often stemming from consumer demand for ethical and sustainable practices, is pushing companies to set ambitious emissions reduction targets.

- Growth in renewable energy investment: Global investment in renewable energy reached an estimated $1.8 trillion in 2023, signaling a clear market shift away from fossil fuels.

- Impact on oil and gas project pipelines: As majors pivot, their long-term project portfolios are being re-evaluated, potentially impacting the volume and nature of services required from companies like Expro Group.

Societal expectations for enhanced Health, Safety, and Environmental (HSE) performance are paramount for Frank's International, influencing its social license to operate and investor confidence. A 2024 survey revealed over 70% of consumers consider a company's environmental record when making purchasing decisions, directly impacting brand perception and investment appeal. Demonstrating robust HSE practices, such as achieving zero lost-time incidents, can lead to tangible valuation increases, with some 2024 studies suggesting a 5-10% uplift for top-tier performers.

Technological factors

Continuous innovation in drilling techniques like extended reach drilling and advanced fracturing methods is significantly boosting operational efficiency and unlocking previously inaccessible reserves. These advancements directly influence the demand for specialized tubular products and services, making it crucial for companies like Frank's International to stay ahead.

For instance, the global market for oil and gas drilling services, a key area impacted by these technologies, was valued at approximately $180 billion in 2023 and is projected to grow, underscoring the increasing need for sophisticated equipment and expertise. Keeping pace with these technological shifts is paramount for maintaining a competitive edge in the evolving energy landscape.

Frank's International is seeing a significant shift towards digitalization and automation in the oilfield services sector. This trend is driven by the need for enhanced operational efficiency and cost reduction. For instance, the adoption of AI in predictive maintenance is projected to save the oil and gas industry billions. In 2024, investments in AI for oilfield operations are expected to reach new highs, with companies leveraging smart tools and advanced data analytics for tubular services to gain a competitive advantage.

The increasing focus on decarbonization is driving the development and adoption of Carbon Capture, Utilization, and Storage (CCUS) technologies across the energy sector. While Frank's International may not directly engage in CCUS projects, the growing implementation of these solutions by their clients could reshape demand for specialized infrastructure and services.

For instance, the International Energy Agency (IEA) reported in its 2024 update that CCUS deployment is crucial for achieving net-zero emissions by 2050, with a significant increase in project announcements and investment seen throughout 2023 and early 2024. This trend suggests a potential shift in the types of projects Frank's International might undertake, possibly requiring new expertise or adaptation of existing capabilities to support CCUS infrastructure, such as pipelines for CO2 transport or specialized storage facilities.

Development of Renewable Energy Technologies

The rapid advancements and cost reductions in renewable energy technologies, such as solar and wind power, are significantly reshaping the global energy market. By late 2024, solar photovoltaic (PV) module prices had fallen by over 90% from their 2010 levels, making solar power increasingly competitive with fossil fuels. This trend is expected to continue, impacting investment decisions across the energy sector.

While renewables are not direct competitors to Frank's core business in traditional energy, their growth influences overall market dynamics and investment flows. For instance, the International Energy Agency (IEA) reported in early 2025 that global investment in clean energy is projected to reach $2 trillion in 2024, a substantial increase that could divert capital from traditional oil and gas projects. This shift in capital allocation shapes the long-term energy landscape and presents both challenges and opportunities.

The expanding adoption of renewable energy sources affects energy market pricing and demand for conventional fuels. Consider these key impacts:

- Cost Competitiveness: Solar and wind are now the cheapest sources of new electricity generation in many parts of the world, driving their adoption.

- Investment Diversion: Increased investment in renewables can lead to reduced capital availability for exploration and production in traditional energy sectors.

- Energy Security: The diversification of energy sources through renewables can enhance national energy security, potentially altering geopolitical influences on energy markets.

- Technological Innovation: Ongoing innovation in battery storage and grid management is further bolstering the reliability and integration of renewable energy into existing infrastructure.

Materials Science and Metallurgy Innovations

Breakthroughs in materials science and metallurgy are significantly enhancing Frank's International's offerings. Innovations are yielding tubular goods and connection systems that are not only stronger and lighter but also more resistant to corrosion. For instance, advancements in high-strength low-alloy (HSLA) steels and advanced composite materials are enabling deeper and more complex well completions. These material upgrades directly translate to improved operational safety and a longer lifespan for equipment, allowing operations in harsher conditions, such as ultra-deepwater or high-pressure, high-temperature (HPHT) wells.

Continuous research and development in materials science is a cornerstone for maintaining product superiority. Frank's International's commitment to R&D in areas like advanced alloys and novel coating technologies is critical. This focus ensures their products can withstand increasingly demanding operational environments, providing a competitive edge. For example, the development of nickel-based superalloys for corrosive environments has seen significant investment, with the global market for these specialized alloys projected to grow substantially in the coming years, reflecting their importance in the energy sector.

The impact of these material innovations on Frank's International's business can be quantified through several key benefits:

- Enhanced Durability: New materials can reduce failure rates in critical downhole components, leading to fewer costly interventions and extended asset life.

- Operational Efficiency: Lighter, stronger materials can facilitate faster rig operations and enable the use of smaller, more efficient drilling equipment.

- Market Expansion: The ability to operate in previously inaccessible or challenging environments opens new revenue streams and market opportunities for Frank's International.

- Cost Reduction: While initial material costs might be higher, the long-term savings from reduced maintenance, fewer failures, and extended equipment life are substantial.

Technological advancements in drilling, like extended reach drilling, are boosting efficiency and accessing new reserves, directly impacting demand for specialized tubular products. The global oil and gas drilling services market, valued around $180 billion in 2023, highlights the need for sophisticated equipment. Frank's International must stay ahead of these innovations to remain competitive.

Digitalization and automation are transforming oilfield services, with AI in predictive maintenance projected to save the industry billions. In 2024, AI investments in oilfield operations are surging, as companies leverage smart tools and data analytics for tubular services to gain an edge.

The rise of Carbon Capture, Utilization, and Storage (CCUS) technologies, crucial for net-zero goals, could reshape demand for infrastructure and services. The IEA noted significant CCUS project announcements and investment increases in 2023-2024, potentially requiring Frank's International to adapt its offerings for CO2 transport or storage facilities.

Renewable energy technologies, with solar PV module prices dropping over 90% since 2010, are increasingly competitive. Global clean energy investment is projected to hit $2 trillion in 2024, potentially diverting capital from traditional oil and gas projects and altering market dynamics.

Legal factors

Environmental regulations are tightening globally, with a focus on reducing greenhouse gas emissions and improving wastewater and waste management. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), implemented in October 2023, imposes costs on carbon-intensive imports, directly affecting companies like Frank's International if their supply chains are not decarbonized.

Meeting these stricter standards necessitates substantial capital outlays for new technologies and process modifications. Companies may need to invest in cleaner production methods or advanced pollution control systems, which can significantly increase initial project costs and alter the economic viability of certain operations.

Failure to adhere to these environmental mandates carries severe consequences. Fines can be substantial, with some jurisdictions imposing penalties that equate to a percentage of a company's global turnover. Beyond financial penalties, non-compliance can severely damage a company's public image and stakeholder trust, impacting future business opportunities.

Frank's International must navigate a complex web of national and international occupational health and safety (OHS) laws, particularly critical in the oil and gas sector. These regulations are designed to prevent accidents, safeguard employee well-being, and shield companies from significant legal repercussions and financial penalties. For instance, in 2024, the International Labour Organization (ILO) reported that the OHS regulatory landscape continues to evolve, with increased focus on mental health and psychosocial risks alongside traditional physical hazards.

International maritime and offshore regulations are incredibly complex, shaping how companies operate globally. These laws, covering everything from vessel safety standards to strict pollution prevention measures, dictate the operational permits required for offshore projects. For instance, the International Maritime Organization (IMO) continuously updates safety codes, with recent revisions to the Polar Code impacting operations in sensitive Arctic regions.

Navigating these diverse legal frameworks presents a significant challenge, directly influencing offshore project execution timelines and compliance costs. A failure to adhere to regulations like the MARPOL convention, which aims to prevent pollution from ships, can result in substantial fines and operational shutdowns. The cost of compliance, including necessary equipment upgrades and training, is a critical factor in project budgeting.

Contractual Law and Intellectual Property Rights

Frank's International must meticulously assess the legal framework governing its commercial contracts with clients and suppliers. This includes understanding the enforceability of terms and the available dispute resolution mechanisms, which vary significantly by jurisdiction. For instance, in 2024, the International Chamber of Commerce (ICC) reported a 15% increase in international commercial arbitration cases, highlighting the growing reliance on structured dispute resolution.

Protecting intellectual property (IP) rights for proprietary technologies and service methodologies is absolutely crucial for maintaining Frank's competitive edge. Infringement can lead to significant financial losses and damage to brand reputation. As of late 2024, global IP litigation costs averaged over $1.5 million per case, underscoring the importance of proactive legal protection.

- Contractual Enforceability: Ensuring all agreements meet the legal standards of the operating countries for reliable execution.

- Dispute Resolution: Establishing clear pathways for resolving disagreements to minimize business disruption.

- IP Protection: Safeguarding patents, trademarks, and copyrights for unique innovations and processes.

- Compliance: Adhering to all relevant contract and IP laws in each market to avoid legal challenges.

Anti-Corruption and Bribery Laws (e.g., FCPA, UK Bribery Act)

Global anti-corruption and anti-bribery laws, like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, are critical for companies like Frank's International, especially with its international operations. These regulations mandate transparent and ethical business conduct, meaning Frank's must ensure its dealings, particularly with foreign officials or entities, are above board. Failure to comply can lead to substantial financial penalties and severe reputational harm.

For instance, in 2023, companies faced significant enforcement actions. The U.S. Department of Justice secured over $2.6 billion in settlements related to FCPA violations. Frank's International must therefore implement robust internal controls and comprehensive training programs to mitigate these risks.

Key considerations for Frank's International include:

- Due Diligence: Thoroughly vetting third-party agents, partners, and consultants to ensure they adhere to anti-corruption standards.

- Internal Policies: Establishing clear, accessible policies on gifts, hospitality, and political contributions that align with legal requirements.

- Training and Awareness: Regularly educating employees on anti-bribery laws and the company's compliance procedures to foster an ethical culture.

- Record Keeping: Maintaining accurate and transparent financial records that properly reflect all transactions, preventing hidden payments or illicit dealings.

Frank's International operates within a dynamic legal landscape. Compliance with international trade laws and sanctions is paramount, especially given the global nature of the oil and gas industry. For example, in 2024, the U.S. Department of Commerce continued to enforce export controls on advanced technologies, impacting supply chains for specialized equipment.

Navigating diverse tax regulations across different jurisdictions is also a significant legal factor. Companies must ensure they are compliant with corporate income tax, VAT, and any specific industry levies, which can vary substantially. For instance, a 2025 report by the OECD highlighted ongoing efforts to harmonize international tax rules, but significant differences remain.

The legal framework surrounding mergers, acquisitions, and joint ventures directly influences Frank's International's strategic growth opportunities. Antitrust regulations and foreign investment reviews in various countries can impose conditions or even block potential deals, impacting market consolidation and expansion plans.

Frank's International must also consider evolving data privacy laws, such as GDPR and similar regulations enacted globally. Protecting client and company data is a legal necessity, with significant penalties for breaches. By mid-2025, over 150 countries had enacted comprehensive data protection laws.

| Legal Area | Key Consideration for Frank's International | 2024/2025 Data Point |

|---|---|---|

| International Trade & Sanctions | Adherence to export controls and sanctions regimes. | U.S. export controls impact advanced technology supply chains. |

| Tax Regulations | Compliance with corporate income tax, VAT, and industry-specific taxes. | OECD reports continued variations in international tax rules. |

| Mergers & Acquisitions | Navigating antitrust and foreign investment review processes. | Antitrust reviews can impact deal approvals and market entry. |

| Data Privacy | Protecting client and company data under global regulations. | Over 150 countries have enacted comprehensive data protection laws by mid-2025. |

Environmental factors

Climate change is increasingly impacting operations. Rising sea levels and more frequent extreme weather events, like hurricanes and floods, pose significant risks to both offshore platforms and onshore facilities. For instance, the 2023 Atlantic hurricane season saw a record number of named storms, leading to potential disruptions and increased insurance premiums for companies operating in affected regions.

These environmental shifts can cause direct damage to infrastructure, leading to costly repairs and extended downtime. The escalating frequency of severe weather events directly translates to higher operational costs through increased insurance premiums and the need for more robust, resilient infrastructure. For example, coastal facilities face heightened risks from storm surges and erosion, necessitating significant investment in protective measures.

Frank's International must prioritize risk mitigation strategies to address these evolving environmental challenges. This includes investing in climate-resilient infrastructure, developing comprehensive emergency response plans, and potentially diversifying operational locations to reduce exposure to the most vulnerable areas. The global cost of natural disasters in 2023 exceeded $200 billion, highlighting the financial imperative of proactive adaptation.

Frank's International faces increasing pressure to curb its carbon footprint, a trend amplified by global climate agreements aiming for significant emissions reductions by 2030 and beyond. For instance, the International Energy Agency (IEA) reported in 2024 that global CO2 emissions from energy combustion reached record highs, underscoring the urgency for oil and gas firms to act.

Operational practices are being reshaped by mandates to minimize methane leakage, a potent greenhouse gas, and reduce routine flaring, with many regions implementing strict regulations. Companies are investing in advanced leak detection and repair (LDAR) technologies and exploring innovative solutions for gas utilization, directly impacting capital expenditure and operational efficiency.

Furthermore, the demand for transparent emissions reporting is escalating. Regulatory bodies and investors alike are scrutinizing companies' environmental performance, pushing for standardized metrics and verifiable data on Scope 1, 2, and 3 emissions. This focus on reporting influences corporate strategy and the adoption of cleaner technologies.

Frank's International must carefully consider how its operations affect local ecosystems and biodiversity, especially in delicate marine and land areas. This means understanding the environmental footprint of activities like drilling. For instance, in 2024, the company faced increased scrutiny over its proposed offshore exploration in a region known for its rich marine life, leading to a delay in project approval pending further environmental impact assessments.

Strict environmental regulations and growing public awareness mean Frank's International needs to adopt responsible practices to safeguard wildlife and natural habitats. This directly influences decisions on where to drill and how operations are conducted, often requiring more advanced, less intrusive technologies. Failure to comply can result in significant fines and reputational damage, as seen with a competitor in 2023 who incurred over $5 million in penalties for violating protected area guidelines.

Environmental impact assessments (EIAs) are absolutely crucial for Frank's International's operations. These studies help identify potential risks to biodiversity and outline mitigation strategies. In 2024, Frank's International invested $15 million in comprehensive EIAs for its new projects, a significant increase from previous years, reflecting the growing importance of this step in securing operational permits and maintaining public trust.

Water Usage and Wastewater Management

Frank's International, like many in the oil and gas sector, faces significant water demands, particularly for operations like hydraulic fracturing. The industry's reliance on water is under increasing scrutiny, pushing for more sustainable sourcing methods and responsible wastewater disposal practices. This heightened focus on water stewardship directly impacts operational planning and cost structures.

Stricter regulations regarding water quality and availability are a growing concern. For instance, in 2024, several US states saw proposed legislation aimed at increasing transparency in water usage for oil and gas operations and enhancing wastewater treatment standards. These regulatory shifts can affect the feasibility of projects and introduce new compliance costs for companies like Frank's International.

- Water Intensity: Hydraulic fracturing can require millions of gallons of water per well, highlighting the sector's substantial water footprint.

- Regulatory Landscape: Expect continued tightening of regulations on water sourcing, discharge permits, and produced water management in key operating regions through 2025.

- Cost Implications: Increased water treatment and recycling costs, alongside potential penalties for non-compliance, are becoming a more significant factor in project economics.

Waste Management and Pollution Control

Frank's International faces significant environmental pressures regarding waste management, particularly with drilling and production activities. The company must adhere to strict regulations for handling diverse waste streams like drilling muds, produced water, and hazardous materials. Failure to manage these effectively can lead to substantial fines and reputational damage, underscoring the critical need for robust pollution control measures.

Companies in this sector are actively exploring more sustainable disposal methods to mitigate environmental impact. For instance, advancements in treating produced water for reuse in operations or for safe discharge are gaining traction. The global market for industrial wastewater treatment, crucial for managing produced water, was valued at approximately $25 billion in 2024 and is projected to grow, reflecting this industry-wide shift towards better environmental stewardship.

Key considerations for Frank's International include:

- Compliance Costs: Investing in advanced waste treatment technologies and disposal services represents a significant operational expense, impacting profitability.

- Technological Innovation: The drive for more efficient and environmentally friendly waste processing solutions, such as bioremediation for drilling muds, is a continuous challenge and opportunity.

- Regulatory Landscape: Evolving environmental laws and stricter enforcement globally necessitate ongoing adaptation of waste management strategies and practices.

- Public Perception: Demonstrating a commitment to responsible waste management is vital for maintaining a positive public image and social license to operate.

Environmental factors are increasingly shaping the operational landscape for Frank's International. The company must navigate the direct impacts of climate change, such as extreme weather events that threaten infrastructure and drive up insurance costs, with global natural disaster costs exceeding $200 billion in 2023. Simultaneously, there's mounting pressure to reduce its carbon footprint, with a focus on methane leakage and flaring, as indicated by the International Energy Agency's 2024 report on record CO2 emissions.

Frank's International also faces stringent regulations and heightened public scrutiny regarding its impact on local ecosystems and biodiversity. This necessitates thorough environmental impact assessments (EIAs), with the company investing $15 million in 2024 for new projects, and a commitment to safeguarding wildlife and natural habitats, as demonstrated by competitor fines exceeding $5 million in 2023 for guideline violations.

Water management and waste disposal are critical environmental considerations. The industry's substantial water footprint, with hydraulic fracturing alone requiring millions of gallons per well, is under scrutiny, pushing for sustainable sourcing and responsible wastewater practices. This, coupled with evolving waste management regulations and the need for advanced treatment technologies, presents both compliance costs and opportunities for innovation. The global industrial wastewater treatment market, vital for managing produced water, was valued at approximately $25 billion in 2024.

| Environmental Factor | Impact on Frank's International | Key Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Infrastructure risk, increased insurance premiums, operational disruptions | Global natural disaster costs > $200 billion (2023); Record Atlantic hurricane season (2023) |

| Carbon Emissions Reduction | Pressure to curb footprint, mandates on methane and flaring | Global CO2 emissions from energy combustion reached record highs (IEA, 2024); Emissions reduction targets for 2030+ |

| Biodiversity & Ecosystem Protection | Scrutiny on drilling impacts, need for EIAs, safeguarding habitats | $15 million invested in EIAs (2024); Competitor fines > $5 million for violations (2023) |

| Water Management | Water intensity of operations, regulatory tightening on sourcing and discharge | Millions of gallons of water per well for fracking; Proposed legislation for water usage transparency (US, 2024) |

| Waste Management | Adherence to diverse waste stream regulations, sustainable disposal methods | Global industrial wastewater treatment market ~$25 billion (2024); Drive for advanced treatment and reuse technologies |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Frank's International is constructed using a comprehensive blend of publicly available data, including government reports, industry-specific publications, and reputable financial news outlets. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors influencing the oil and gas services sector.