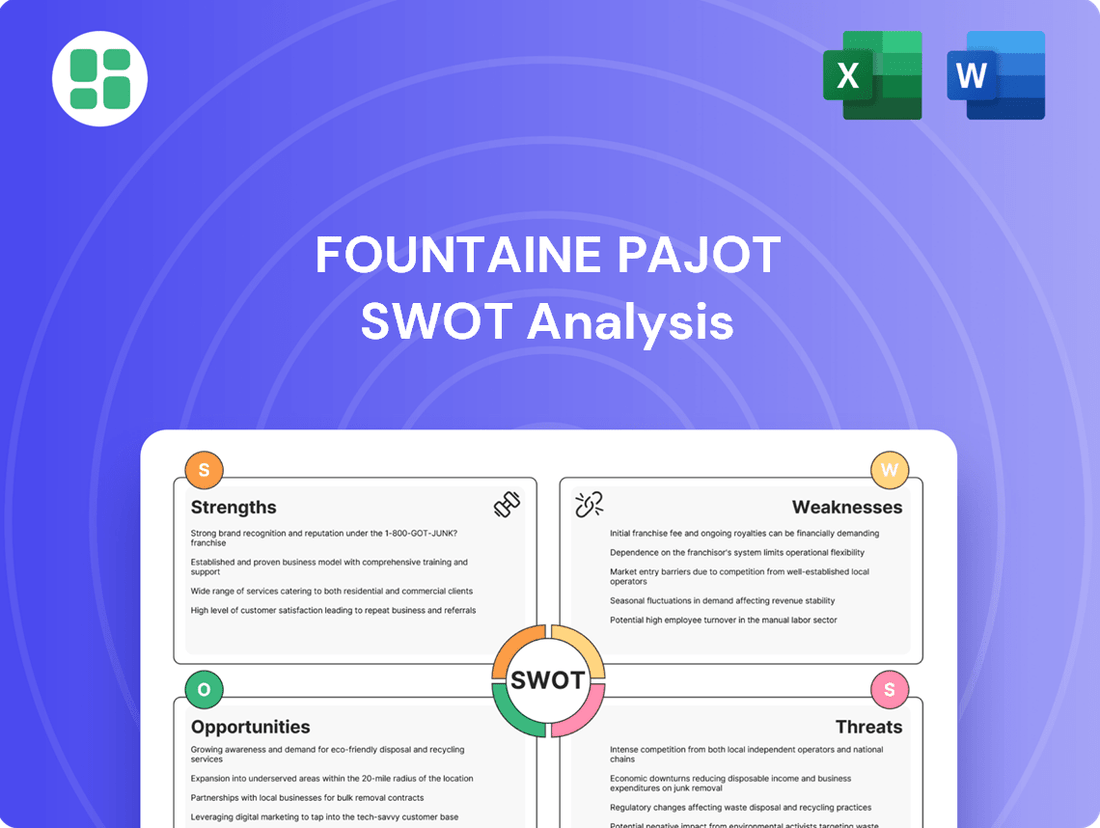

Fountaine Pajot SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fountaine Pajot Bundle

Fountaine Pajot, a leader in the sailing and motor yacht market, boasts strong brand recognition and a diverse product portfolio. However, they face challenges from increasing competition and evolving market demands. Understanding these dynamics is crucial for any stakeholder.

Want the full story behind Fountaine Pajot’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Fountaine Pajot boasts over five decades of dedicated experience in crafting luxury cruising catamarans, establishing a formidable global brand. This extensive history underpins a reputation for exceptional quality, continuous innovation, and robust performance within the competitive multihull market.

Fountaine Pajot demonstrates a strong commitment to innovation and sustainability, a critical differentiator in today's market. Their 'Odyssea 2024' plan, targeting carbon neutrality by 2030, underscores this dedication. This proactive approach includes significant investments in developing electric and hydrogen propulsion systems for their yachts, alongside research into bio-sourced and recycled materials.

Fountaine Pajot boasts a diverse product line, encompassing both sailing and power catamarans, which appeals to a wide array of customers. This breadth allows them to capture market share across private ownership, bareboat charter, and professional charter operations. Their commitment to creating comfortable, spacious, and robust yachts designed for global exploration further solidifies their broad market appeal and reach.

Robust Financial Performance and Growth

Fountaine Pajot has showcased impressive financial health, significantly boosting its turnover. By August 31, 2024, the company achieved a turnover of €351 million, effectively doubling its previous figures. This robust growth underscores its strong market position and operational efficiency.

The company's financial performance is further highlighted by substantial net income growth, reflecting effective cost management and strong sales. This financial strength has cemented Fountaine Pajot's status as the second-largest European yacht manufacturer, a testament to its market penetration and brand appeal.

- Doubled Turnover: Reached €351 million by August 31, 2024.

- Significant Net Income Growth: Indicating improved profitability.

- Market Leadership: Established as the second-largest European yachting player.

Operational Excellence and Production Capacity

Fountaine Pajot's operational excellence is a key strength, driven by its integrated industrial model. This approach allows them to consolidate essential functions and bring crucial processes, such as electric motor production, back in-house, thereby optimizing overall performance and control.

The company is actively bolstering its production capabilities through substantial investments in expanding industrial capacity and modernizing its facilities. This strategic move is designed to ensure they can effectively meet growing market demand while upholding rigorous quality standards across their product lines.

Fountaine Pajot's commitment to operational efficiency is evident in their continuous efforts to refine their manufacturing processes. This focus not only enhances their ability to deliver high-quality yachts but also positions them to capitalize on market opportunities by scaling production effectively.

- Integrated Industrial Model: Fountaine Pajot benefits from an in-house approach to key functions, including electric motor production, enhancing efficiency and quality control.

- Capacity Expansion: Significant investments are being made to increase industrial capacity and modernize facilities, aiming to meet rising demand.

- Quality Enhancement: The modernization efforts are focused on maintaining and improving the high-quality standards expected of Fountaine Pajot yachts.

Fountaine Pajot's brand is synonymous with luxury and performance in the cruising catamaran market, built on over 50 years of expertise. Their dedication to innovation, particularly in sustainability with plans for carbon neutrality by 2030 and investments in electric/hydrogen propulsion, sets them apart. The company's diverse product range, catering to both sailing and power enthusiasts, ensures broad market appeal.

Financially, Fountaine Pajot is performing exceptionally well, doubling its turnover to €351 million by August 2024 and showing significant net income growth. This strong financial footing solidifies their position as the second-largest European yacht manufacturer.

Their operational strengths lie in an integrated industrial model, allowing for in-house production of key components like electric motors, which enhances control and efficiency. Substantial investments in expanding and modernizing production facilities are underway to meet increasing demand while maintaining high-quality standards.

| Strength Area | Key Aspect | Supporting Fact/Data |

|---|---|---|

| Brand Reputation & Experience | Global leader in luxury cruising catamarans | Over 50 years of experience |

| Innovation & Sustainability | Commitment to carbon neutrality by 2030 | Investments in electric/hydrogen propulsion |

| Financial Performance | Rapid turnover growth | €351 million turnover by August 2024 (doubled) |

| Market Position | Second-largest European yacht manufacturer | Strong net income growth |

| Operational Efficiency | Integrated industrial model | In-house electric motor production |

What is included in the product

Delivers a strategic overview of Fountaine Pajot’s internal and external business factors, highlighting its market strengths, operational gaps, and potential risks.

Provides a clear, actionable framework to identify and address Fountaine Pajot's strategic challenges and opportunities.

Weaknesses

Fountaine Pajot's position as a maker of luxury leisure products inherently ties its performance to the broader economic climate. When economies falter, discretionary spending, particularly on high-ticket items like yachts, tends to decrease significantly. This sensitivity was underscored in 2024, with reports suggesting a somewhat uneven performance in the European yacht charter sector, a key market indicator.

The sophisticated construction of luxury catamarans, like those produced by Fountaine Pajot, necessitates the use of advanced materials and cutting-edge manufacturing techniques. This inherently drives up production costs significantly. For instance, the integration of lightweight yet durable composites and complex electrical and plumbing systems adds to the expense of each vessel.

Consequently, these elevated production expenses translate directly into a high total cost of ownership for Fountaine Pajot's catamarans. This can restrict the potential customer base to a more affluent and exclusive segment of the market. For 2024, the starting price for a new Fountaine Pajot Astrea 42 catamaran was often in the range of €400,000 to €500,000, before options and customization, illustrating this point.

Fountaine Pajot's reliance on a complex global supply chain for specialized yacht components presents a significant vulnerability. Disruptions, whether from geopolitical events or logistical challenges, can directly impact production schedules and increase costs. For instance, a 2023 report highlighted a 15% average increase in raw material costs for marine manufacturing due to supply chain bottlenecks.

Intense Competition in a Fragmented Market

The catamaran market, though expanding, presents a considerable challenge due to its fragmentation, with many companies vying for position. Fountaine Pajot faces rivals not only from other catamaran builders but also from monohull manufacturers, particularly in the premium and luxury segments. This intense competition demands constant investment in research and development to ensure product uniqueness and desirability.

Maintaining market share and pricing power in this environment requires Fountaine Pajot to consistently innovate and differentiate its offerings. For example, by the end of 2024, the global catamaran market size was estimated to be around USD 2.5 billion, with projections indicating growth to over USD 3.5 billion by 2029, underscoring the competitive intensity.

- Market Fragmentation: Numerous competitors exist, from large established builders to smaller, niche players.

- Product Differentiation: Continuous innovation is key to standing out and commanding premium pricing.

- Rivalry Intensity: Competition extends beyond catamarans to include high-end monohull yachts.

- Investment Needs: Significant R&D spending is necessary to maintain a competitive edge.

Exposure to Geopolitical and Regulatory Risks

Fountaine Pajot faces significant headwinds from global geopolitical shifts and evolving regulatory landscapes. For instance, escalating trade disputes, like those seen between major economic powers in 2024, can lead to unpredictable increases in the cost of imported components and raw materials, directly impacting manufacturing expenses and potentially squeezing profit margins. This exposure means that the company's financial performance can be indirectly affected by international political developments.

Furthermore, the marine industry is increasingly subject to stricter environmental regulations. Fountaine Pajot must continually invest in research and development to ensure its yacht designs and production methods comply with these evolving standards, such as those related to emissions and sustainable materials. Failure to adapt could result in penalties or a loss of market competitiveness, as seen with the growing demand for eco-friendly vessels in the 2024-2025 period.

- Tariff Impact: Potential increases in import duties on key materials like fiberglass and marine-grade metals could raise production costs by an estimated 3-5% in 2024-2025, depending on specific trade agreements.

- Environmental Compliance: Investments in new hull designs and propulsion systems to meet stricter emissions standards (e.g., IMO 2025 regulations) may require capital expenditures of several million Euros over the next two fiscal years.

- Supply Chain Volatility: Geopolitical instability can disrupt the sourcing of specialized components, leading to production delays and increased logistics costs.

Fountaine Pajot's reliance on discretionary spending makes it vulnerable to economic downturns, impacting sales of high-value leisure products. The company also faces high production costs due to advanced materials and complex manufacturing, which translate into a premium price point that limits its customer base. Furthermore, a fragmented market with intense competition from both catamaran and monohull builders necessitates substantial ongoing investment in research and development to maintain a competitive edge.

Full Version Awaits

Fountaine Pajot SWOT Analysis

This is the actual Fountaine Pajot SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's strategic positioning. You'll gain valuable insights into their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The global luxury yacht market is experiencing robust expansion, with projections indicating continued growth. This trend is fueled by a rising number of high-net-worth individuals worldwide and an uptick in global tourism, creating a favorable environment for companies like Fountaine Pajot.

By 2027, the luxury yacht market is anticipated to reach approximately $10.1 billion, up from an estimated $7.7 billion in 2022, representing a compound annual growth rate (CAGR) of around 5.7%. This significant market expansion offers Fountaine Pajot a prime opportunity to boost its sales volume and capture a larger share of the market.

The marine industry is witnessing a significant surge in demand for eco-conscious and low-emission boating experiences. Fountaine Pajot's commitment to electric, hybrid, and hydrogen propulsion systems, alongside the use of bio-sourced materials, positions them favorably to capitalize on this growing market preference.

Ongoing advancements in marine technology, such as the integration of fuel cell technology and sophisticated AI-driven navigation systems, offer significant opportunities for Fountaine Pajot to elevate its yacht performance and owner experience. These innovations promise increased efficiency and enhanced onboard capabilities, aligning with a growing demand for more sustainable and technologically advanced vessels.

Fountaine Pajot is strategically capitalizing on these technological shifts by actively incorporating cutting-edge innovations into its new model development pipeline. This proactive approach ensures the company remains at the forefront of the industry, offering clients state-of-the-art sailing and motor yachts that meet evolving market expectations for performance and environmental consciousness.

Expansion into Emerging Markets and Distribution Networks

Fountaine Pajot's strategic expansion into high-growth regions, particularly the United States and the Asia-Pacific, presents a significant opportunity. The US market, a key driver in the global leisure boating industry, offers substantial potential for increased sales. In 2023, the US recreational boating market was valued at approximately $40 billion, with projections indicating continued growth through 2025.

Strengthening its distribution networks and forging collaborations for region-specific boat models will be crucial for capitalizing on these emerging markets. This approach allows Fountaine Pajot to better cater to local preferences and regulatory environments, thereby tapping into new customer segments and solidifying its global footprint. For instance, developing models tailored to the specific cruising needs in Southeast Asian waters could unlock considerable market share.

Key opportunities include:

- US Market Penetration: Leveraging the robust US boating market, which saw a significant increase in new boat sales in 2024, to boost overall revenue.

- Asia-Pacific Growth: Targeting the rapidly expanding middle class and increasing interest in marine leisure activities across countries like China, Australia, and South Korea.

- Distribution Enhancement: Establishing new dealerships and partnerships in underserved territories to improve market access and customer service.

- Product Customization: Developing and marketing boat models specifically designed for the unique conditions and customer demands in emerging markets.

Growth in Charter and Experiential Tourism Markets

The burgeoning demand for yacht chartering and experiential tourism, particularly for catamarans favored for their stability and spaciousness, represents a significant growth avenue. Fountaine Pajot is well-positioned to leverage this trend by enhancing its product lines tailored for both bareboat and crewed charter segments.

The global yacht charter market was valued at approximately USD 10.5 billion in 2023 and is projected to reach USD 18.2 billion by 2030, exhibiting a compound annual growth rate of 8.2%. This expansion is driven by increasing disposable incomes and a desire for unique travel experiences.

- Expanding Charter Fleet Offerings: Fountaine Pajot can introduce new catamaran models specifically designed for charter operations, focusing on durability, comfort, and ease of management for charter companies.

- Partnerships with Charter Companies: Collaborating with established charter operators globally can provide Fountaine Pajot with direct access to a large customer base and valuable market insights.

- Developing Experiential Packages: Creating bundled offerings that combine catamaran charters with curated experiences, such as gourmet dining, water sports, or cultural excursions, can attract a premium segment of the experiential tourism market.

Fountaine Pajot can capitalize on the growing demand for sustainable marine solutions by further developing its electric and hybrid propulsion systems. The increasing preference for eco-friendly boating, evidenced by a projected 5.7% CAGR in the luxury yacht market through 2027, presents a significant opportunity for the company.

Expansion into high-growth regions, particularly the United States and Asia-Pacific, offers substantial revenue potential. The US recreational boating market alone was valued at approximately $40 billion in 2023, indicating strong market penetration opportunities.

The company is also well-positioned to benefit from the expanding yacht charter market, which was valued at $10.5 billion in 2023 and is projected to grow at an 8.2% CAGR. By enhancing its catamaran offerings for charter operations and partnering with charter companies, Fountaine Pajot can tap into this lucrative segment.

Threats

Persistent economic uncertainties, including elevated inflation rates and the looming possibility of recessions in key markets, present a substantial threat to Fountaine Pajot. These conditions directly dampen luxury consumer spending, a critical driver for high-value recreational products like yachts.

A tangible impact of these economic headwinds is already being observed in the marine industry. For instance, reports from late 2023 and early 2024 indicate a slowdown in new boat sales and a softening of demand in the yacht charter sector across certain European and North American regions, directly affecting revenue streams and overall profitability for manufacturers like Fountaine Pajot.

The luxury catamaran sector is a crowded space, with many brands competing for customer attention and sales. Fountaine Pajot faces the challenge of maintaining its standing against rivals who might introduce compelling new designs or offer more attractive pricing, potentially impacting its market share if the company doesn't keep pace with innovation and market demands.

Fountaine Pajot faces a significant threat from fluctuating raw material costs, particularly for fiberglass, resins, and engines, which are crucial for yacht construction. For instance, the price of key petrochemicals, the base for many resins, saw considerable volatility in 2023 and early 2024 due to global supply chain disruptions and energy price swings.

Furthermore, the imposition or adjustment of international tariffs on imported components, such as specialized marine electronics or engines from specific regions, can directly inflate production expenses. For example, a hypothetical 10% tariff on a key engine component could add tens of thousands to the cost of a single yacht, impacting Fountaine Pajot's ability to maintain competitive pricing.

These combined pressures of rising material expenses and tariffs could compress Fountaine Pajot's profit margins. Alternatively, passing these increased costs onto consumers through higher yacht prices might dampen demand in an already sensitive luxury market, especially as economic growth forecasts for 2024 and 2025 indicate potential slowdowns in some key markets.

Evolving Environmental Regulations and Compliance Costs

The marine industry faces escalating environmental regulations, impacting manufacturers like Fountaine Pajot. These evolving standards for emissions, waste management, and sustainable production necessitate significant capital outlay for research and development and operational overhauls. For instance, the European Union's ongoing efforts to decarbonize maritime transport, including potential mandates for alternative fuels and stricter emission controls, could translate to substantial compliance costs for boat builders.

Failure to proactively address these regulatory shifts poses a dual threat: incurring penalties for non-compliance and diminishing market competitiveness. Companies that lag in adopting greener technologies or sustainable manufacturing processes risk alienating environmentally conscious consumers and facing a competitive disadvantage against more agile peers. The increasing focus on the circular economy and lifecycle assessments for marine products further complicates compliance, demanding a comprehensive approach to design and production.

- Increased R&D Investment: Fountaine Pajot must allocate more resources to developing eco-friendly materials and propulsion systems to meet upcoming environmental standards.

- Production Process Overhaul: Adapting manufacturing to reduce waste and emissions, potentially requiring new equipment or facility upgrades, adds to operational expenses.

- Risk of Penalties: Non-compliance with stricter environmental laws, such as those concerning waste disposal or emissions, could lead to significant fines, impacting profitability.

- Competitive Disadvantage: Competitors who invest early in sustainable practices may gain a market edge by appealing to a growing segment of environmentally aware buyers.

Volatility in Fuel Prices

Fluctuating global fuel prices pose a significant threat to Fountaine Pajot, especially impacting its motor yacht segment and charter business. For instance, crude oil prices saw considerable volatility throughout 2023 and into early 2024, with Brent crude trading in a range that often exceeded $80 per barrel. This directly translates to higher operating costs for yacht owners and charter companies, potentially discouraging new yacht purchases or reducing demand for charter services.

The economic sensitivity of discretionary spending on luxury items like yachts means that sustained high fuel costs can dampen consumer confidence and purchasing power. As of mid-2024, forecasts suggest continued energy market uncertainty, which could further pressure Fountaine Pajot's sales volumes in its motor yacht lines.

- Increased Operating Expenses: Higher fuel prices directly inflate the cost of running a motor yacht, making ownership less attractive.

- Reduced Charter Demand: Charter companies facing elevated fuel bills may pass costs to consumers or reduce fleet availability, impacting bookings.

- Market Uncertainty: Persistent volatility in energy markets creates an unpredictable environment for potential buyers and charterers.

Intensifying competition from established and emerging players in the luxury catamaran market presents a significant threat. For example, brands like Sunsail and Moorings are actively expanding their fleets and marketing efforts, potentially diverting customers. Furthermore, new entrants with innovative designs or competitive pricing strategies could erode Fountaine Pajot's market share if it fails to differentiate effectively.

Geopolitical instability and global trade tensions can disrupt supply chains and impact export markets. For instance, trade disputes or sudden shifts in import/export regulations could lead to increased costs for components or hinder access to key customer regions. The company's reliance on a global supply network means it is susceptible to these external shocks, potentially affecting production timelines and product availability.

The increasing prevalence of cybersecurity threats poses a risk to Fountaine Pajot's operational integrity and customer data. A successful cyberattack could disrupt manufacturing processes, compromise sensitive design information, or lead to data breaches, resulting in significant financial losses and reputational damage. Protecting intellectual property and customer information requires ongoing investment in robust security measures.

SWOT Analysis Data Sources

This Fountaine Pajot SWOT analysis is built upon comprehensive data from financial reports, detailed market research, and expert industry commentary to provide a robust and insightful strategic overview.