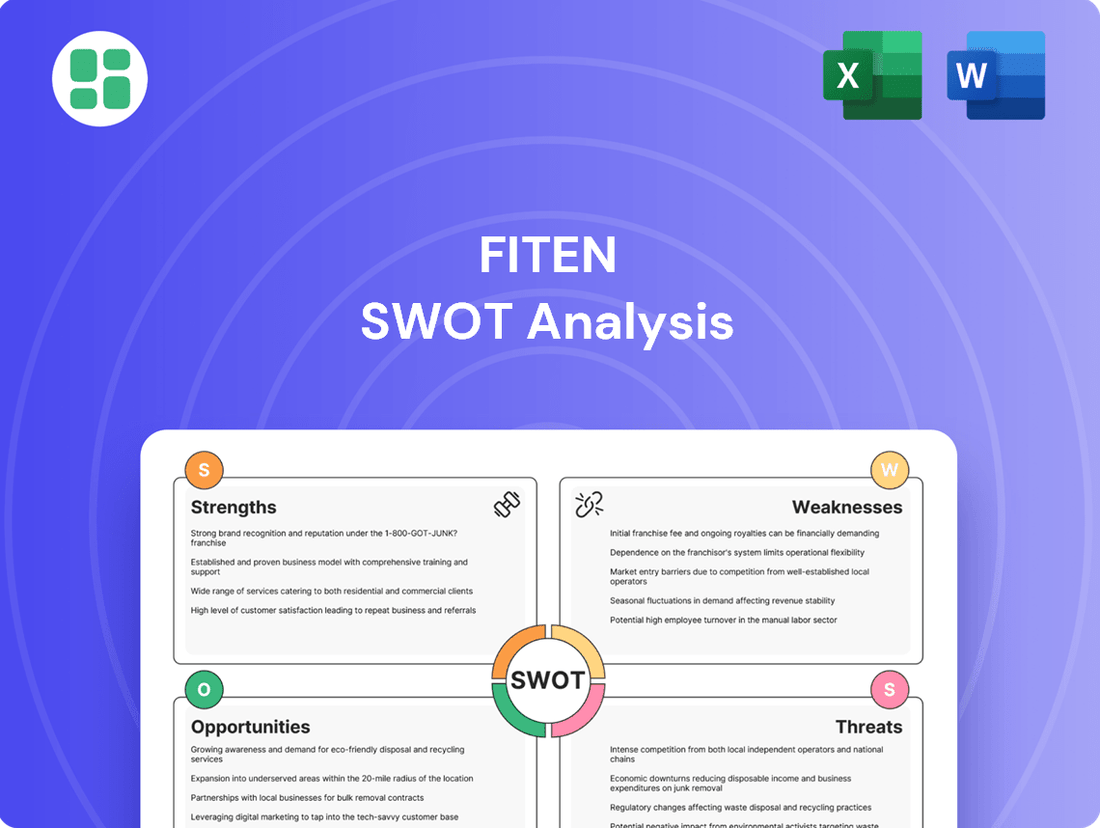

Fiten SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fiten Bundle

Fiten's strengths lie in its innovative product development and strong brand loyalty, but it faces challenges with increasing competition and evolving consumer preferences. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want to truly grasp Fiten's market position and future potential? Purchase the complete SWOT analysis to unlock expert commentary, detailed financial context, and actionable strategic takeaways, empowering your decision-making.

Strengths

Fiten Sp. z o.o. distinguishes itself with a complete service package, encompassing the design, installation, and ongoing maintenance of photovoltaic systems. This end-to-end capability ensures consistent quality control throughout every project phase and delivers a streamlined client experience, setting Fiten apart from competitors who may focus on isolated services.

Fiten's ability to serve both businesses and individual clients significantly broadens its market reach. This dual focus diversifies revenue streams, helping to mitigate risks tied to reliance on a single market segment. For instance, in 2024, the commercial solar sector saw an estimated 15% growth, while residential installations grew by approximately 12%, showcasing Fiten's potential to capitalize on both trends.

Fiten's dedication to sustainable energy is a significant strength. This focus directly supports global decarbonization efforts and aligns with the European Union's ambitious climate goals. For instance, the EU aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, a target Fiten's mission actively contributes to.

This mission-driven approach resonates strongly with a growing segment of environmentally aware consumers and businesses. Furthermore, it positions Fiten favorably for attracting investments from ESG-focused funds, which are increasingly influential in capital markets. In 2024, sustainable investments are projected to continue their upward trajectory, making this a key differentiator.

Expertise in Photovoltaic Technology

Fiten's deep specialization in photovoltaic technology is a significant strength, allowing them to cultivate profound expertise in designing and implementing solar power solutions. This focused knowledge translates into high-quality, efficient systems, giving them a competitive advantage in a dynamic market. For instance, by concentrating on PV, Fiten can optimize system performance, leading to greater energy yields for their clients.

This concentrated expertise enables Fiten to excel in problem-solving and adapt quickly to advancements in solar technology. Their understanding of the nuances of photovoltaic installations means they can offer tailored solutions that maximize efficiency and reliability. In 2024, the global solar PV market saw continued growth, with installations reaching new heights, underscoring the value of specialized knowledge in this sector.

- Specialization: Deep knowledge in photovoltaic installations.

- Efficiency: Ability to develop high-quality, efficient solar power solutions.

- Market Edge: Optimized system performance and better problem-solving capabilities.

Leveraging Market Growth

Fiten is poised to benefit from the robust expansion of the renewable energy market. The global push towards decarbonization, amplified by stringent climate targets, is fueling unprecedented investment in green technologies.

Specifically, the solar energy sector is a standout performer. In the European Union, solar power is the fastest-growing energy source, a trend expected to continue through 2025 and beyond. This rapid expansion presents a significant opportunity for Fiten to increase its market share and revenue streams.

- Global renewable energy capacity is projected to reach over 7,000 GW by 2028.

- Solar power is expected to account for more than half of all new renewable capacity additions globally in 2024.

- The EU aims to source at least 42.5% of its energy from renewables by 2030.

- Investments in renewable energy in the EU reached €146 billion in 2023, a substantial increase from previous years.

Fiten's comprehensive service offering, from initial design to ongoing maintenance of photovoltaic systems, ensures quality control and a seamless client journey, differentiating them from competitors. Their ability to cater to both business and individual clients diversifies revenue and mitigates risk, capitalizing on the 2024 growth in both commercial (estimated 15%) and residential (approximately 12%) solar sectors.

Fiten's core strength lies in its deep specialization in photovoltaic technology, enabling the development of highly efficient and reliable solar solutions. This focused expertise allows for optimized system performance, leading to greater energy yields for clients and a competitive edge in the rapidly advancing solar market. This specialization is crucial as the global solar PV market continues its strong growth in 2024.

| Strength Aspect | Description | Market Relevance (2024/2025 Data) |

|---|---|---|

| End-to-End Service | Design, installation, and maintenance of PV systems. | Ensures consistent quality and client satisfaction. |

| Dual Market Focus | Serves both businesses and individuals. | Diversifies revenue; commercial solar grew ~15% in 2024, residential ~12%. |

| Renewable Energy Mission | Commitment to sustainable energy solutions. | Aligns with EU climate goals (55% GHG reduction by 2030) and growing ESG investments. |

| Photovoltaic Specialization | Deep expertise in PV technology. | Leads to high-quality, efficient systems and superior problem-solving in a growing market. |

What is included in the product

Examines the opportunities and risks shaping the future of Fiten, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Fiten's SWOT analysis offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities for growth.

Weaknesses

Fiten's expansion into large-scale solar projects faces a significant hurdle in their capital intensity. Developing utility-scale photovoltaic installations demands substantial upfront investment, estimated to be in the hundreds of millions of dollars per gigawatt, for everything from panels and inverters to land acquisition and grid connection. This high capital requirement can strain Fiten's financial capacity, potentially slowing down growth unless substantial external financing is secured.

Fiten's reliance on government policies and subsidies presents a significant weakness. The solar energy sector, while growing, remains highly sensitive to shifts in regulatory frameworks and financial incentives. For instance, a reduction in tax credits or a change in net metering policies, which have been crucial drivers of adoption, could directly dampen consumer demand and impact Fiten's project pipeline and profitability.

The profitability of solar projects is intrinsically linked to these external support systems. A sudden withdrawal or phasing out of subsidies, a scenario that has played out in various markets globally, can create substantial market volatility. This volatility directly affects the viability of new projects and can lead to a slowdown in the expansion Fiten is pursuing, potentially impacting its revenue streams and return on investment in the short to medium term.

The solar installation sector is experiencing a surge in competition, with a growing number of both local and international companies vying for market share. This heightened rivalry is a significant weakness for Fiten, as it directly impacts pricing strategies and profitability.

The intense market competition translates into considerable pricing pressures, potentially squeezing Fiten's profit margins. To counter this, the company must invest heavily in differentiation and cost-efficiency to maintain its competitive edge.

In 2024, the global solar installation market saw an estimated 15% increase in the number of active companies, intensifying the competitive landscape. This trend suggests Fiten will need to continually innovate and optimize its operations to avoid losing ground.

Supply Chain Vulnerabilities

Fiten's reliance on global supply chains, especially for photovoltaic modules, presents significant vulnerabilities. The European Union, for instance, still imports a substantial portion of its solar panels from China, a dependency that can lead to price fluctuations and shipping disruptions. This was evident in early 2024 when geopolitical tensions and trade policy shifts created uncertainty for component sourcing.

These dependencies expose Fiten to risks beyond just cost. Geopolitical events impacting key manufacturing regions can cause unexpected delays, impacting project timelines and revenue generation. For example, a sudden export restriction from a major manufacturing hub in Asia during 2024 could have significantly hampered Fiten's ability to secure necessary components for its planned installations.

- Component Sourcing Risk: Dependence on a limited number of global suppliers for critical components like solar panels and inverters.

- Price Volatility: Exposure to fluctuating raw material costs and shipping rates, impacting project economics.

- Geopolitical Impact: Vulnerability to trade disputes, tariffs, and political instability in key manufacturing countries.

Grid Integration Challenges

As Fiten expands its solar capacity, integrating this intermittent power into existing grids presents significant challenges. Bottlenecks in current infrastructure can hinder the efficient absorption of fluctuating solar output, potentially leading to delays in project approvals and substantial costs for necessary grid upgrades. For instance, in 2024, grid connection queues for renewable projects in the US exceeded 2,000 GW, highlighting the scale of this integration issue.

These integration hurdles can directly impact Fiten’s operational efficiency and profitability. Permitting delays, often exacerbated by grid capacity constraints, can push back revenue generation timelines. Furthermore, the need for costly grid enhancements, such as upgrading transmission lines or installing energy storage solutions, can increase the overall project expenditure, potentially reducing Fiten's return on investment. In some regions, grid congestion has already led to the curtailment of solar power, meaning that generated electricity cannot be delivered to the grid, resulting in lost revenue for developers.

- Grid Congestion: Existing infrastructure struggles to accommodate the influx of variable solar energy.

- Permitting Delays: Grid limitations slow down the approval process for new solar installations.

- Increased Costs: Significant investment is required for grid upgrades to support higher solar penetration.

- Curtailment Risk: Potential for lost revenue due to inability to transmit generated solar power.

Fiten's significant capital requirements for large-scale solar projects pose a substantial weakness, demanding hundreds of millions of dollars per gigawatt for development. This intense capital intensity can strain the company's financial resources, potentially hindering expansion unless substantial external financing is secured.

The company's profitability is closely tied to government policies and subsidies, making it vulnerable to regulatory shifts. Changes in tax credits or net metering policies, crucial for demand, could directly impact Fiten's project pipeline and overall profitability. The global solar installation market saw an estimated 15% increase in active companies in 2024, intensifying competition and putting pressure on Fiten's profit margins.

Fiten's reliance on global supply chains for components like solar panels creates vulnerabilities. Geopolitical events or trade policy shifts, such as those impacting Asian manufacturing hubs in early 2024, can lead to price volatility and shipping disruptions, affecting project timelines and revenue generation.

Integrating intermittent solar power into existing grids presents major challenges, with grid connection queues for renewable projects in the US exceeding 2,000 GW in 2024. These integration issues can cause permitting delays, increase project costs due to necessary grid upgrades, and lead to lost revenue through power curtailment.

Preview the Actual Deliverable

Fiten SWOT Analysis

This is the same Fiten SWOT analysis document included in your download. The full content is unlocked after payment.

You are viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

The file shown below is not a sample—it’s the real Fiten SWOT analysis you'll download post-purchase, in full detail.

Opportunities

The increasing integration of renewable energy sources, particularly solar power, is driving a substantial need for advanced energy storage solutions to maintain grid stability and reliability. This trend presents a significant opportunity for Fiten to broaden its service portfolio.

By expanding into battery storage solutions, Fiten can tap into a market projected for robust growth, with the global energy storage market expected to reach over $300 billion by 2030. This strategic move would undoubtedly enhance Fiten's value proposition for its existing and potential clients.

Ongoing innovations in solar panel technology, such as perovskite, bifacial, and tandem cells, present significant opportunities for higher efficiency and reduced manufacturing costs. These advancements, with perovskite solar cells achieving lab efficiencies exceeding 30% by early 2024, can dramatically improve energy output per square meter.

Fiten can capitalize on these technological leaps by adopting and integrating cutting-edge PV solutions. This strategic move allows Fiten to offer clients more advanced, higher-performing, and ultimately more cost-effective solar energy systems, enhancing its competitive edge in the market.

The European Green Deal and REPowerEU plan are significantly boosting the solar industry by setting ambitious renewable energy targets. These initiatives include supportive policies like mandatory rooftop solar installations and various financial incentives, creating a robust demand and a very attractive investment climate for companies like Fiten.

Expansion into New Market Segments

Fiten can significantly expand its reach by entering new market segments beyond conventional solar panel installations. Emerging areas such as building-integrated photovoltaics (BIPV), which embed solar technology directly into building materials, offer substantial growth potential. For instance, the global BIPV market is projected to reach over $40 billion by 2030, indicating a strong demand for innovative solar solutions.

Further opportunities lie in developing floating solar farms, which are particularly advantageous for regions with limited land availability. These installations can also offer environmental benefits by reducing water evaporation. Another promising avenue is the integration of solar power into electric vehicle (EV) charging infrastructure, aligning with the global shift towards sustainable transportation. The EV charging market is expected to grow exponentially, with solar-powered charging stations representing a key differentiator.

Fiten's strategic entry into these niche markets could unlock new revenue streams and diversify its business portfolio:

- Building-Integrated Photovoltaics (BIPV): Tapping into a market segment valued at over $40 billion by 2030.

- Floating Solar Farms: Addressing land scarcity and water conservation needs in specific geographies.

- Solar EV Charging Infrastructure: Capitalizing on the rapid expansion of the electric vehicle market.

Increased Corporate ESG Adoption

Businesses are increasingly prioritizing Environmental, Social, and Governance (ESG) initiatives, actively seeking to reduce their carbon footprint and demonstrate a commitment to sustainability. This growing focus is a significant tailwind for companies like Fiten, as it directly translates into heightened corporate demand for renewable energy solutions. Fiten is well-positioned to capitalize on this trend, tapping into a expanding market segment dedicated to achieving ambitious environmental targets.

The global ESG investing market reached an estimated $35.3 trillion in assets under management by the end of 2023, with a substantial portion directed towards renewable energy. For instance, corporate power purchase agreements (PPAs) for renewable energy saw a record 30.4 GW of capacity signed globally in 2024, a 15% increase from 2023, highlighting the tangible demand. This presents a clear opportunity for Fiten to offer its services and products to a widening corporate client base aiming to meet their sustainability mandates.

- Growing Corporate Demand: Increased emphasis on ESG by businesses worldwide fuels the need for sustainable energy solutions.

- Market Expansion: The drive for carbon footprint reduction creates a larger addressable market for renewable energy providers.

- Sustainability-Linked Financing: Companies are increasingly tying financing to ESG performance, making renewable energy investments more attractive.

Fiten can leverage the increasing demand for energy storage solutions driven by renewable energy integration, a market projected to exceed $300 billion by 2030. By expanding into battery storage, Fiten can enhance its service offerings and appeal to a broader client base.

The company can also capitalize on advancements in solar technology, such as perovskite cells achieving over 30% efficiency in early 2024, to offer more potent and cost-effective systems. Furthermore, supportive policies from initiatives like the European Green Deal are creating a highly favorable investment climate for solar companies.

Emerging markets like Building-Integrated Photovoltaics (BIPV), expected to reach over $40 billion by 2030, and solar-powered EV charging infrastructure present significant diversification opportunities. These niche areas can unlock new revenue streams and align Fiten with key growth trends.

The strong corporate focus on ESG initiatives is a major opportunity, as businesses actively seek to reduce their carbon footprint. With ESG investing reaching an estimated $35.3 trillion in assets under management by the end of 2023, Fiten can tap into substantial demand for its renewable energy solutions.

| Opportunity Area | Market Projection | Key Driver |

|---|---|---|

| Energy Storage Solutions | >$300 billion by 2030 | Renewable energy integration |

| Advanced Solar Tech Integration | N/A (Continuous innovation) | Higher efficiency, lower costs |

| BIPV Market | >$40 billion by 2030 | Sustainable building materials |

| Solar EV Charging | Rapid EV market growth | Sustainable transportation |

| ESG-Driven Corporate Demand | $35.3 trillion ESG assets (2023) | Corporate sustainability goals |

Threats

Fiten's growth is susceptible to policy reversals or uncertainty, particularly concerning renewable energy incentives. For instance, a sudden reduction in solar panel subsidies, which have been a key driver for market adoption, could significantly dampen demand for Fiten's products and services in 2024-2025. This creates a volatile operating environment, impacting long-term project planning and investment decisions.

The solar industry is experiencing fierce competition, with both established giants and emerging players engaging in aggressive price wars. This intense rivalry puts significant pressure on solar installers like Fiten, potentially squeezing their profit margins. For instance, in 2024, reports indicated that the average cost of solar panel installation saw a decline of up to 10% in certain markets due to competitive pressures, directly impacting installer profitability.

This aggressive pricing environment makes it difficult for Fiten to maintain healthy profit margins without potentially compromising on the quality of materials or services offered. The risk is that to remain competitive on price, Fiten might be forced to cut corners, which could damage its reputation and long-term sustainability in the market.

The solar industry is a hotbed of innovation, meaning Fiten's current solar panel technology and installation methods could become outdated quite rapidly. This pace of change presents a significant threat, as newer, more efficient, or cost-effective solutions could emerge, making Fiten's existing assets less competitive.

For instance, while silicon-based solar panels dominated the market for years, advancements in perovskite solar cells are showing promising efficiency gains, with some research cells achieving over 25% efficiency in laboratory settings as of early 2024. If Fiten's installed base relies on older technology, its operational efficiency and economic viability could be challenged by these emerging technologies.

Economic Downturns and Investment Slowdown

Economic instability can significantly dampen enthusiasm for large solar projects, which demand substantial initial investment. This hesitation from both consumers and businesses could stall Fiten's new project pipeline.

A potential economic downturn in 2024-2025 might see reduced capital expenditure across industries, directly impacting the solar sector. For instance, if interest rates remain elevated, the cost of financing these capital-intensive projects increases, making them less attractive.

- Reduced Consumer Spending: Lower disposable income can decrease demand for residential solar installations.

- Business Investment Hesitation: Companies may postpone or cancel large-scale solar farm developments due to economic uncertainty.

- Financing Challenges: Higher borrowing costs make it more expensive for Fiten and its clients to fund projects.

- Supply Chain Vulnerabilities: Economic shocks can exacerbate existing supply chain issues, leading to project delays and cost overruns.

Grid Capacity and Permitting Bottlenecks

The existing electricity grid infrastructure may struggle to accommodate the rapid increase in renewable energy capacity, leading to grid connection delays and curtailment. In 2024, the US Department of Energy reported that over 1,500 GW of proposed clean energy projects were waiting for grid interconnection, highlighting a significant bottleneck. This can directly impact Fiten's ability to bring new renewable projects online efficiently, potentially delaying revenue generation and increasing project costs.

Lengthy permitting processes can also significantly slow down project deployment, impacting Fiten's operational efficiency and project timelines. For instance, average permitting times for utility-scale solar projects in some regions can extend to over two years, adding considerable uncertainty. This regulatory hurdle means Fiten must factor in extended development phases, potentially impacting its competitive advantage in a fast-moving market.

- Grid Capacity: Over 1,500 GW of clean energy projects awaiting interconnection in the US as of 2024.

- Permitting Delays: Average permitting times for utility-scale solar projects can exceed two years.

- Impact on Fiten: Potential for delayed project commissioning, increased development costs, and reduced operational efficiency.

Fiten faces significant threats from fluctuating government incentives for renewable energy, which could reduce demand, and intense competition leading to price wars that squeeze profit margins. Rapid technological advancements in solar energy also pose a risk, potentially making Fiten's current offerings obsolete quickly, as seen with the rise of perovskite solar cells showing over 25% efficiency in early 2024 research.

Economic downturns in 2024-2025 could curb investment in large solar projects due to reduced capital expenditure and higher financing costs. Furthermore, critical infrastructure challenges, such as grid capacity limitations with over 1,500 GW of clean energy projects awaiting interconnection in the US by 2024, and lengthy permitting processes, averaging over two years for utility-scale projects, can delay Fiten's project deployment and increase costs.

| Threat Category | Specific Threat | Impact on Fiten | Relevant Data (2024-2025) |

| Policy & Regulatory | Changes in Renewable Energy Incentives | Reduced demand, project viability issues | Potential reduction in solar subsidies impacting market adoption. |

| Market & Competition | Intense Price Competition | Squeezed profit margins, potential quality compromise | Average solar installation costs declined up to 10% in some markets due to competition. |

| Technological | Rapid Technological Obsolescence | Reduced competitiveness of existing assets | Perovskite solar cells achieving over 25% efficiency in lab settings (early 2024). |

| Economic | Economic Downturn / High Interest Rates | Decreased investment, financing challenges | Elevated interest rates increasing project financing costs. |

| Infrastructure | Grid Capacity Limitations | Project delays, increased costs | Over 1,500 GW of clean energy projects awaiting interconnection in the US (2024). |

| Infrastructure | Permitting Delays | Extended development timelines, operational inefficiency | Average permitting times for utility-scale solar projects exceeding two years. |

SWOT Analysis Data Sources

This Fiten SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, detailed market research, and expert industry insights to provide a clear and actionable strategic overview.