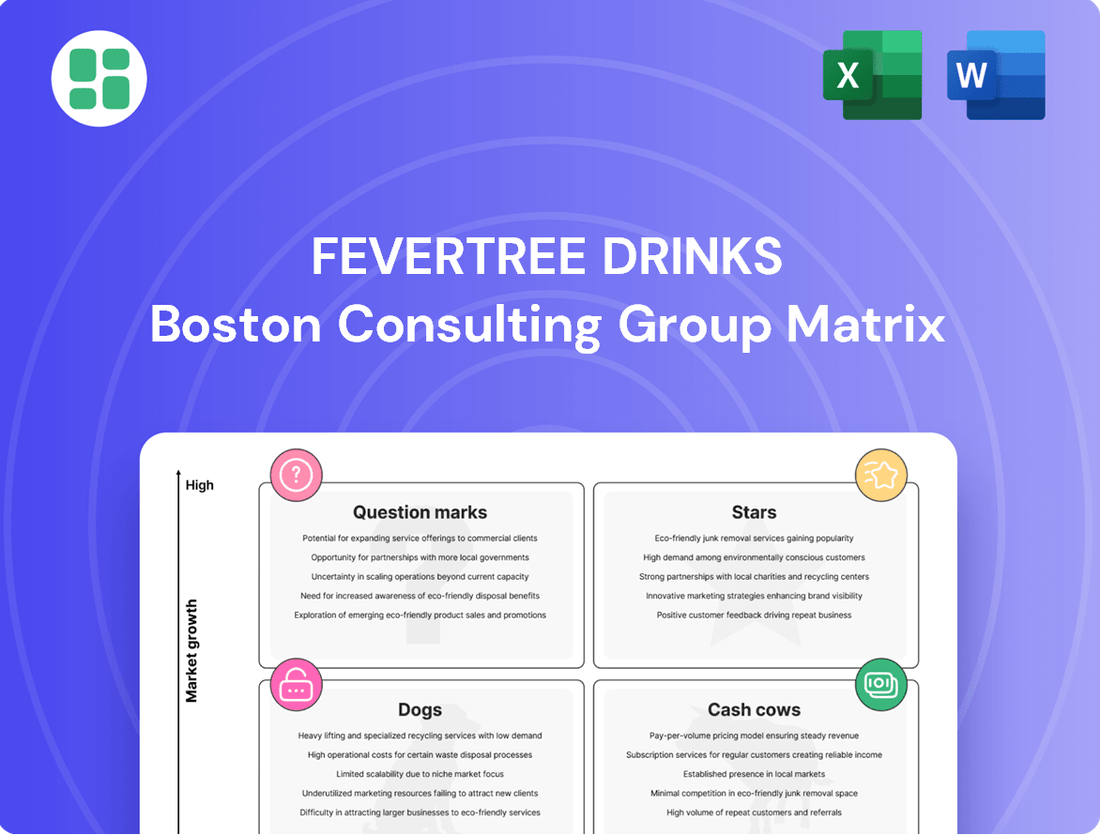

Fevertree Drinks Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fevertree Drinks Bundle

Curious about Fevertree Drinks' product portfolio? This preview offers a glimpse into their potential position within the BCG Matrix, hinting at which brands might be driving growth and which require careful consideration.

To truly understand Fevertree's strategic landscape, unlock the full BCG Matrix report. It reveals the definitive placement of each product as Stars, Cash Cows, Dogs, or Question Marks, providing the clarity needed for informed investment decisions and a robust growth strategy.

Stars

Fevertree's US premium mixer market is indeed a star performer. In fiscal year 2024, the company saw a robust 12% revenue increase in the US, significantly outperforming the broader market's expansion.

This growth is underpinned by Fevertree's dominant market share in crucial segments. They command 32% of the US Ginger Beer market and 27% of the Tonic Water segment, solidifying their leadership.

The combination of strong revenue growth and substantial market share in a burgeoning premium mixer category firmly establishes the US as a star market for Fevertree Drinks.

Fevertree's Ginger Beer range is a clear star in their portfolio, driving substantial growth. This line now accounts for a significant portion of their non-tonic revenue, which represents about 45% of all sales.

The brand is particularly dominant in the US market, a region experiencing rapid expansion for ginger-based beverages. Fevertree's leading position here highlights the product's strong appeal and market penetration.

Continued investment is crucial for maintaining this momentum. The versatility of ginger beer and the increasing consumer preference for these flavors solidify its status as a high-growth, high-market-share product that needs ongoing support.

The January 2025 announcement of a strategic US partnership with Molson Coors marks a pivotal moment for Fevertree Drinks, aiming to turbocharge its presence in the massive American premium beverage market.

While fiscal year 2025 is anticipated as a transitional period, this collaboration is poised to harness Molson Coors' formidable distribution infrastructure and marketing prowess. This synergy is projected to fuel sustained revenue and EBITDA expansion for Fevertree in the United States.

Under the BCG matrix framework, Fevertree's US operations, revitalized by this partnership, are classified as a Star. This designation reflects the substantial investment required to capitalize on the market's potential, with the expectation of significant future returns on that investment.

Growth in Rest of World (ROW) Markets

Fevertree's Rest of World (ROW) markets demonstrated impressive momentum in FY24, with sales climbing 19% overall, or 22% when currency fluctuations are ignored. This strong performance was significantly boosted by the strategic implementation of new subsidiary models, particularly in Australia.

These ROW markets, though potentially smaller in initial scale compared to established regions, are proving to be significant growth engines for Fevertree. The company is actively capturing market share by investing in local production and distribution networks to meet the escalating consumer demand for premium mixers in these areas.

- FY24 ROW Growth: 19% (22% constant currency)

- Key Market Example: Australia, benefiting from new subsidiary models

- Strategy: Investment in local production and distribution

- Market Position: Rapidly gaining market share in high-growth opportunities

Emerging Cocktail Mixer Portfolio

Fevertree's emerging cocktail mixers, including Margarita, Mojito, and Espresso Martini variants, are strategically placed within a rapidly expanding global market. This segment is projected to grow at a CAGR of 6.8% to 8.2% between 2024 and 2030/2033, indicating strong consumer demand for convenient, high-quality cocktail solutions. Fevertree's investment in these new product lines aims to capture a significant share of this burgeoning market.

The company's focus on these specific mixer types reflects a deliberate effort to capitalize on popular cocktail trends. Significant upfront investment in marketing and distribution is essential to build brand awareness and drive trial, thereby paving the way for these products to transition into Stars and eventually Cash Cows within Fevertree's portfolio.

- Market Growth: Global cocktail mixers market expected to grow at 6.8%-8.2% CAGR from 2024-2033.

- Product Strategy: Fevertree's new Margarita, Mojito, and Espresso Martini mixers target high-demand segments.

- Investment Focus: Initial marketing and distribution are key to establishing market presence and future success.

- Portfolio Positioning: These mixers are positioned as potential Stars, requiring investment to become Cash Cows.

Fevertree's US premium mixer market is indeed a star performer, with the company seeing a robust 12% revenue increase in the US in fiscal year 2024. This growth is underpinned by their dominant market share, commanding 32% of the US Ginger Beer market and 27% of the Tonic Water segment. The January 2025 strategic US partnership with Molson Coors is expected to further fuel this star performance by leveraging extensive distribution and marketing capabilities.

| Market Segment | FY24 Growth (US) | Market Share (US) | BCG Classification |

|---|---|---|---|

| Premium Mixers (Overall US) | 12% | Leading | Star |

| Ginger Beer (US) | Strong | 32% | Star |

| Tonic Water (US) | Strong | 27% | Star |

What is included in the product

The Fever-Tree Drinks BCG Matrix analyzes its portfolio, identifying potential Stars in emerging markets, Cash Cows in established tonic lines, Question Marks in new flavor launches, and Dogs in declining premium soda segments.

The Fevertree Drinks BCG Matrix offers a clear, one-page overview, relieving the pain of understanding complex portfolio performance.

Cash Cows

Fevertree's position in the UK premium tonic water market is a classic example of a cash cow. Despite a 3% revenue dip in FY24 for the UK market, which is a mature segment with lower growth, Fevertree continues to lead. This dominance is underpinned by its strong brand equity and extensive distribution network, allowing it to generate consistent cash with minimal need for aggressive promotional spending.

Fevertree's established core tonic range in Europe functions as a Cash Cow within its BCG Matrix. The company maintains a dominant position as the largest premium mixer brand across the continent, consistently increasing its value share in the overall mixer market.

While FY24 saw some regional fluctuations and flat brand revenue in constant currency, the mature European markets benefit from the enduring strength of its core tonics. These products, bolstered by strong brand loyalty and well-entrenched distribution, generate predictable and substantial cash flow with minimal incremental investment needed for maintenance.

Fevertree Indian Tonic Water, the company's original and flagship product, remains a cornerstone of its premium mixer offerings. In 2024, it continues to hold a significant market share in mature regions, consistently generating robust and predictable cash flows.

This established product benefits from strong brand recognition and widespread consumer loyalty, requiring minimal further investment in marketing. The substantial cash generated by Indian Tonic Water is strategically deployed to fuel growth in other segments of Fevertree's portfolio.

On-Trade Channel Dominance

Fevertree's strong foothold in the on-trade channel, encompassing hotels, restaurants, bars, and cafes, is a cornerstone of its success. This established presence in key markets ensures a consistent revenue stream.

The premium positioning of Fevertree's products makes them highly desirable for both mixologists and discerning consumers. This preference translates into high margins and a stable income base, characteristic of a cash cow.

- On-Trade Revenue Contribution: In 2024, the on-trade channel continued to represent a significant portion of Fevertree's global revenue, demonstrating its enduring strength.

- Premium Product Appeal: Despite market fluctuations, the demand for high-quality mixers in premium establishments remained robust, supporting Fevertree's pricing power.

- Profitability Driver: The on-trade segment consistently delivers strong profit margins, reinforcing its status as a cash cow for the company.

Optimized Supply Chain & Production Efficiencies

Fevertree's strategic focus on optimizing its supply chain and production has yielded tangible results, directly impacting its cash cow products. By localizing production, the company has not only shortened lead times but also significantly improved its cost structure.

This operational enhancement is clearly reflected in its financial performance. For instance, Fevertree reported an improvement in gross margins by 540 basis points in fiscal year 2024. Such gains are crucial for established products with high market share, as they translate directly into increased cash generation.

- Increased Profitability: Higher gross margins mean more profit from each unit sold, boosting the cash flow from mature product lines.

- Cost Reduction: Localized production and supply chain efficiencies directly lower operational expenses, further enhancing cash generation.

- Enhanced Competitiveness: Improved cost-efficiency allows Fevertree to maintain competitive pricing for its established products while still generating strong cash flows.

- Foundation for Growth: The robust cash generated by these optimized operations provides the financial flexibility to invest in new product development or market expansion.

Fevertree's core tonic water range in established markets like the UK and Europe functions as a cash cow. These products, characterized by high market share and low growth, generate substantial and consistent cash flow with minimal investment needed for maintenance or expansion. The company's strong brand equity, particularly for its Indian Tonic Water, ensures continued consumer preference and pricing power in these mature segments.

The on-trade channel, a significant contributor to Fevertree's revenue, consistently delivers strong profit margins for its premium mixers. This segment's resilience, even amidst some market fluctuations in 2024, reinforces the cash cow status of its core offerings. The company's focus on operational efficiencies, such as localized production, has further boosted gross margins, with a notable 540 basis point improvement reported in FY24, directly enhancing cash generation from these established products.

| Product/Segment | Market Position | Growth Rate | Cash Flow Generation | Investment Need |

| UK Premium Tonic Water | Market Leader | Low (Mature) | High & Consistent | Low |

| European Core Tonics | Market Leader (Value Share) | Low (Mature) | High & Consistent | Low |

| On-Trade Channel (Global) | Strong Presence | Stable | High Profit Margins | Low |

Full Transparency, Always

Fevertree Drinks BCG Matrix

The Fevertree Drinks BCG Matrix preview you see is the exact, fully formatted report you will receive upon purchase, containing no watermarks or demo content. This comprehensive analysis is designed for immediate strategic application and professional presentation. You can confidently expect the same in-depth market insights and clear visualization in the downloadable version. This document is ready for your business planning, offering actionable intelligence for optimizing Fevertree's product portfolio.

Dogs

Certain niche or limited-edition flavor extensions in Fevertree's portfolio, especially in developed markets, might not capture substantial market share or sustain consumer engagement. These items could yield little revenue while demanding significant marketing investment, often resulting in break-even or small losses.

For instance, while Fevertree's core tonic water and ginger ale lines are strong performers, some experimental flavors launched in 2023, like the Elderflower & Raspberry tonic, saw limited uptake in the UK according to industry reports, indicating potential underperformance in specific segments.

These underperforming niche flavors are prime candidates for discontinuation or a significant reduction in resource allocation. This strategic move would free up capital and focus resources on more profitable and high-growth product lines within the company's portfolio.

Fevertree's strategic decision to refocus its non-Fevertree brand portfolio in Germany resulted in a significant £7 million revenue reduction in 2024. This move indicates that these legacy brands were likely experiencing low growth and holding a small market share within the German beverage landscape.

Such a reduction in revenue from these specific brands points towards them being classified as 'dogs' within the BCG matrix framework. This means they are not generating substantial profits and are likely consuming resources without delivering commensurate returns, prompting a strategic de-prioritization or divestment.

While Fevertree generally sees strong performance across Europe, certain specific sub-markets have encountered headwinds. Germany, for instance, has experienced softer sales, a trend attributed to subdued consumer sentiment in the region. This economic environment has impacted purchasing decisions for premium mixers.

Should these challenging conditions in sub-markets like Germany persist without any indication of recovery or an improvement in Fevertree's market share within those areas, specific product lines or distribution strategies could be categorized as dogs within the BCG matrix. This classification would necessitate a thorough evaluation of their future viability and the allocation of resources.

Products Affected by Declining Spirit Categories

Fevertree's UK revenue experienced a downturn due to the declining popularity of the gin category. This segment was a significant driver for their mixer sales historically.

Products heavily reliant on spirit categories that are shrinking in mature markets, even if premium, may struggle with growth. These could become 'dogs' in the BCG matrix if they don't adapt.

- Declining Gin Category Impact: In 2024, the UK gin market, a key driver for Fevertree's mixer sales, saw a slowdown, directly affecting revenue streams tied to this spirit.

- Market Share Stagnation: Products predominantly linked to these mature, declining spirit categories risk market share stagnation, even with premium positioning, as consumer preferences shift.

- Diversification Need: To avoid becoming a 'dog' in the BCG matrix, Fevertree needs to diversify its product portfolio or find new applications for existing products beyond these specific spirit pairings.

Inefficient Distribution Channels in Less Developed Markets

In certain emerging or challenging international markets, Fevertree's distribution channels might be classified as dogs if they exhibit low sales volumes and high operational costs without achieving meaningful market penetration. These segments tie up capital and resources without delivering proportionate returns, prompting a critical evaluation of their future strategy or potential divestment.

For instance, if a market like Vietnam, which is still developing its premium beverage infrastructure, shows minimal uptake for Fevertree's mixers despite significant investment in distribution networks, these channels could be deemed dogs. Such a scenario would highlight inefficient market entry or a mismatch between product offering and local consumer preferences.

- Low Sales Volume: In 2024, some less developed markets might have seen Fevertree's mixer sales volumes below 5,000 units per quarter, a stark contrast to higher-performing regions.

- High Maintenance Costs: Distribution in these areas could incur upwards of 20% of gross revenue in logistics and operational expenses, significantly eroding profitability.

- Limited Market Penetration: Brand awareness and market share in these specific segments might remain below 2% by the end of 2024, indicating a lack of consumer adoption.

- Resource Drain: Continued investment in these underperforming channels diverts resources from more promising growth opportunities, impacting overall company efficiency.

Certain niche or limited-edition flavor extensions in Fevertree's portfolio, especially in developed markets, might not capture substantial market share or sustain consumer engagement. These items could yield little revenue while demanding significant marketing investment, often resulting in break-even or small losses.

For instance, while Fevertree's core tonic water and ginger ale lines are strong performers, some experimental flavors launched in 2023, like the Elderflower & Raspberry tonic, saw limited uptake in the UK according to industry reports, indicating potential underperformance in specific segments.

Fevertree's UK revenue experienced a downturn due to the declining popularity of the gin category. This segment was a significant driver for their mixer sales historically. Products heavily reliant on spirit categories that are shrinking in mature markets, even if premium, may struggle with growth, potentially becoming 'dogs' if they don't adapt.

In 2024, the UK gin market, a key driver for Fevertree's mixer sales, saw a slowdown, directly affecting revenue streams tied to this spirit. Products predominantly linked to these mature, declining spirit categories risk market share stagnation, even with premium positioning, as consumer preferences shift.

Question Marks

Fevertree's new cocktail mixer variants, launched in 2023, are positioned in a high-growth market. While the overall cocktail mixer category is expanding, these specific products are still building their presence, holding a relatively small market share as they gain traction. For instance, the global ready-to-drink cocktail market, which includes mixers, was valued at approximately USD 1.3 billion in 2023 and is projected to grow significantly.

These new offerings require substantial investment in marketing and distribution to climb the BCG matrix. The aim is to elevate them from question marks to stars by aggressively driving consumer awareness and sales, thereby capturing a larger portion of this burgeoning market. This strategic push is crucial for securing future growth and market leadership in the premium mixer segment.

Fevertree's expansion into new geographic territories, such as untapped regions in Africa and Asia, aligns with the characteristics of a question mark in the BCG Matrix. These markets offer significant long-term growth potential, but Fevertree currently holds a low market share within them.

The company's ambition to unlock global potential means these new ventures demand considerable investment in establishing distribution networks, marketing, and brand awareness. For instance, in 2023, Fevertree continued its global expansion, aiming to build its presence in over 90 countries worldwide, with a particular focus on emerging markets where its brand recognition is still developing.

Fevertree's expansion into dedicated non-alcoholic premium beverages, beyond their established mixer role, aligns with a significant wellness trend. This move leverages their strong brand recognition in both alcoholic and non-alcoholic settings, with non-tonic products already representing a substantial 45% of their global revenue.

Launching standalone premium non-alcoholic drinks would target a rapidly expanding market, but it would also mean entering a new product category with an initially low market share. This strategic pivot necessitates considerable investment to establish a foothold and carve out a distinct market segment.

Innovation in Sparkling Drink Category

Fever-Tree's Sparkling Collection, featuring low-calorie spritzes, is positioned as an innovator within the sparkling drink category. These products cater to a growing consumer preference for lighter, more sophisticated beverage options.

While the core tonic water and ginger beer lines likely hold a dominant market share, the Sparkling Collection represents a burgeoning segment with high growth potential. For instance, the global low-calorie beverage market was valued at approximately USD 100 billion in 2023 and is projected to grow significantly, indicating a favorable environment for such innovations.

- Innovation Focus: Fever-Tree's Sparkling Collection targets the premium, low-calorie spritz market, a segment experiencing increasing demand.

- Market Position: These newer offerings likely have a smaller market share compared to Fever-Tree's established tonic and ginger beer products, placing them in the 'Question Mark' category of the BCG matrix.

- Growth Potential: The category benefits from a strong trend towards healthier, refreshing beverage choices, with the low-calorie segment showing robust expansion.

- Strategic Imperative: Continued investment in marketing and consumer education is crucial for increasing market penetration and moving these products towards 'Star' status.

Premiumisation in Less Developed Mixer Sub-Categories

Fevertree's strategy centers on elevating consumer expectations in mixer categories. This involves identifying and entering less developed or more conventional mixer sub-categories, such as niche fruit-flavored sodas designed for specific spirits beyond their current offerings, where the premium segment is still emerging. These markets present significant growth opportunities if premiumization trends take hold, though Fevertree would likely begin with a modest market share, requiring strategic investment to foster market development.

This approach positions these sub-categories as potential question marks within the BCG matrix. The company's focus on sophisticated flavor profiles and superior alternatives directly supports this strategy. For instance, while Fevertree has seen substantial success with its tonic water range, expanding into less explored segments like premium ginger beer for dark rum or artisanal cola for aged whiskies could represent these question mark opportunities.

- Market Entry Strategy: Targeting nascent premium segments in less developed mixer sub-categories requires careful market research and potentially higher initial marketing spend.

- Growth Potential: Successful premiumization in these areas could unlock substantial revenue streams, mirroring Fevertree's success in the premium tonic water market.

- Investment Needs: Building brand awareness and consumer preference in these new segments will necessitate dedicated resources for product development and marketing.

- Competitive Landscape: While the premium segment may be nascent, existing conventional players will still present a competitive backdrop.

Fevertree's foray into new and emerging mixer categories, like specialized fruit-flavored sodas for specific spirits, represents classic question marks. These segments offer high growth potential driven by premiumization trends, but Fevertree's market share is currently low, necessitating significant investment to build awareness and preference. For example, the global specialty beverage market, which includes these niche segments, is expected to see robust growth in the coming years.

These ventures require substantial marketing and distribution investment to transition from question marks to stars. The company's aim is to capture a larger share of these developing premium markets, mirroring its success in the core tonic water segment. In 2024, Fevertree continued to explore such opportunities, aiming to expand its product portfolio into less saturated yet high-potential areas.

The company's strategic expansion into new geographic markets, particularly in Asia and Africa, also fits the question mark profile. These regions present considerable long-term growth prospects, but Fevertree's brand recognition and market penetration are still developing, requiring significant capital for establishing distribution and marketing infrastructure. Fevertree's global reach extended to over 90 countries by the end of 2023, with a strategic focus on building its presence in these emerging economies.

Fevertree's move into standalone premium non-alcoholic beverages, beyond their established mixer role, positions these as question marks. This taps into the growing wellness trend and a rapidly expanding market, but it means entering a new product category with an initially low market share. The non-alcoholic beverage market is projected for substantial growth, with Fevertree's existing non-tonic products already contributing significantly to their revenue.

BCG Matrix Data Sources

Our Fevertree Drinks BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable insights.