FDM Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FDM Group Bundle

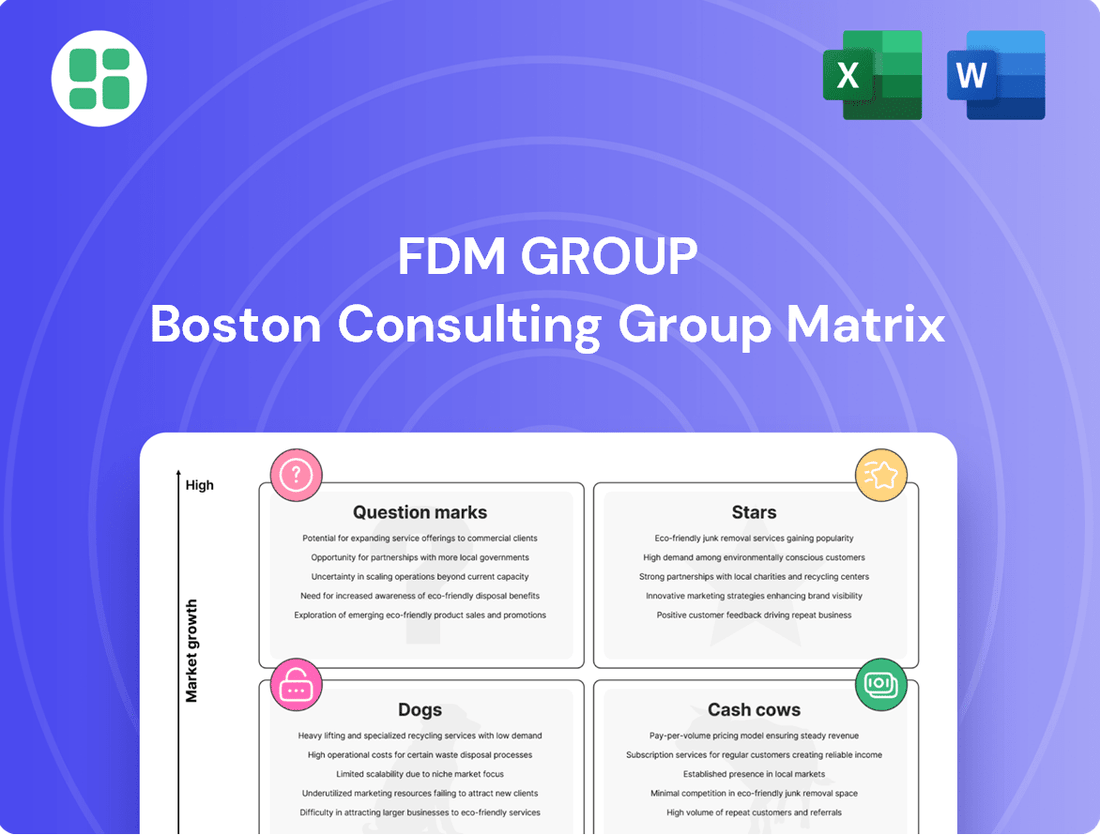

Unlock the strategic power of the FDM Group BCG Matrix. See how their portfolio is divided into Stars, Cash Cows, Dogs, and Question Marks, revealing critical growth and resource allocation opportunities.

This initial glimpse is just the beginning of understanding FDM Group's market position. Purchase the full BCG Matrix to receive detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing their product portfolio and investments.

Don't miss out on the complete strategic picture. Get the full FDM Group BCG Matrix report to uncover data-driven recommendations and gain a competitive edge in today's dynamic market.

Stars

FDM Group's strategic emphasis on AI and Machine Learning consulting places it firmly in the "Star" quadrant of the BCG Matrix. This focus reflects a significant investment in upskilling its workforce in AI technologies, signaling a clear recognition of the sector's high growth potential and a proactive strategy to secure a substantial market share.

By cultivating a talent pool of AI-savvy consultants, FDM Group is positioning itself to be a leader in the rapidly expanding AI market. This move directly addresses the escalating global demand for artificial intelligence expertise across various industries.

In 2024, the global AI market size was estimated to be around $200 billion, with projections showing continued robust growth. FDM Group's investment in AI skills development directly taps into this lucrative and expanding market, aiming to provide essential AI solutions to its clientele.

Cybersecurity Expertise represents a strong star in FDM Group's BCG Matrix. The global cybersecurity market is projected to reach an estimated $376 billion by 2027, showcasing immense growth potential. FDM's model of cultivating in-house talent directly addresses the persistent and widening cybersecurity skills gap, which is a critical concern for businesses worldwide.

The demand for cloud infrastructure expertise is soaring as businesses accelerate their digital transformation journeys. FDM Group is well-positioned to capitalize on this trend by training and deploying skilled consultants in cloud technologies, a critical area for growth.

Despite ongoing market fluctuations, FDM's focus on developing talent in cloud infrastructure allows them to capture significant market share. For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, highlighting the immense opportunity.

Data Analytics and Science

The demand for data analytics and science talent remains exceptionally high, reflecting its critical role in today's business environment. FDM Group is strategically positioning itself to capitalize on this trend, offering comprehensive training programs designed to meet the evolving needs of the market.

FDM's investment in interactive bootcamps and specialized training underscores their commitment to developing skilled professionals in this burgeoning field. This focus is crucial as companies increasingly rely on data-driven insights for competitive advantage.

- Global data analytics market projected to reach $100.1 billion by 2024.

- FDM Group's training programs are designed to address the significant skills gap in data science.

- Companies are investing heavily in data analytics to improve decision-making and operational efficiency.

- The career outlook for data scientists and analysts remains robust, with strong job growth anticipated.

UK Public Sector Engagements

FDM Group's UK public sector engagements demonstrate notable resilience. Despite broader economic headwinds, this segment has shown outperformance, indicating a stable and potentially expanding market for FDM's IT talent solutions. The UK government and associated bodies consistently require skilled IT professionals, a need FDM is well-positioned to meet.

This consistent demand translates into a strong market position for FDM. In 2024, the UK public sector continued to be a significant revenue driver for the company, reflecting the ongoing digital transformation initiatives within government departments. FDM's ability to supply trained IT consultants directly addresses these critical needs.

- Resilience in Challenging Markets: The UK public sector has remained a bedrock of stability for FDM, even amidst wider economic uncertainties.

- Consistent Demand for IT Talent: Government bodies consistently require skilled IT professionals for various projects and operational needs.

- FDM's Strong Market Presence: FDM has cultivated a significant footprint within the UK public sector, serving numerous government agencies.

- Contribution to Digital Transformation: FDM's consultants play a key role in supporting the public sector's ongoing digital modernization efforts.

FDM Group's strategic focus on AI, cloud computing, and data analytics positions these areas as its "Stars" within the BCG Matrix. These sectors exhibit high market growth and FDM's training model is designed to capture significant market share by supplying in-demand skills. The company's investment in these areas reflects a proactive approach to capitalize on the burgeoning demand for specialized IT talent.

The global AI market was valued at approximately $200 billion in 2024, with strong growth projected. Similarly, the cloud computing market was expected to exceed $1.3 trillion in 2024. The data analytics market was also forecast to reach $100.1 billion by 2024. FDM's commitment to upskilling its workforce in these domains directly addresses the escalating need for these capabilities across industries.

| FDM Group's Star Quadrant Areas | Market Growth Potential | FDM's Strategic Approach |

|---|---|---|

| AI and Machine Learning | High, global market size ~ $200 billion (2024) | Invests in workforce upskilling; addresses escalating demand. |

| Cloud Computing | High, global market size > $1.3 trillion (2024) | Trains and deploys skilled consultants; capitalizes on digital transformation. |

| Data Analytics and Science | High, global market size ~ $100.1 billion (2024) | Offers comprehensive training; addresses significant skills gap. |

What is included in the product

Strategic guidance on investing in Stars, maintaining Cash Cows, developing Question Marks, and divesting Dogs.

Quickly identify underperforming units with a clear, visual FDM Group BCG Matrix.

Cash Cows

FDM Group's established core IT operations consulting is a prime example of a Cash Cow within the BCG matrix. This segment, representing their foundational business, operates in a mature market where FDM has secured a significant market share.

These long-standing client engagements ensure consistent and predictable revenue streams for FDM. The stable utilization rates of their consultants in these core IT operations contribute substantially to the company's overall cash flow, even when facing broader economic uncertainties.

For instance, in the first half of 2024, FDM Group reported a revenue of £180.1 million, with their core IT operations continuing to be a robust contributor. This stability is crucial for funding growth initiatives in other business areas.

Traditional software engineering deployments represent a stable, low-growth segment within the broader tech landscape, even amidst challenging market conditions. This stability is a key characteristic of a Cash Cow in the BCG matrix.

FDM Group benefits from its well-established training and placement infrastructure for software engineers. This allows them to consistently secure a significant market share in this area, translating into dependable revenue streams.

For instance, in 2024, the demand for core software engineering skills, while not experiencing explosive growth, remained a foundational requirement for many businesses. FDM Group’s ability to efficiently supply these trained professionals ensures continued, predictable cash flow from these placements.

FDM Group's long-standing client relationships are a cornerstone of its cash cow strategy. The company's business model, which involves placing consultants within client organizations, benefits significantly from the consistent and reliable revenue generated by these established partnerships. In 2023, FDM Group reported a strong cash conversion cycle, partly due to efficient cash collection from its existing client base, which is a testament to the stability these relationships provide.

These mature industry clients offer a predictable revenue stream, minimizing the need for extensive new business development or marketing spend. This allows FDM Group to allocate resources more effectively, further solidifying the cash-generating power of these segments. The company's focus on retaining and deepening these existing relationships ensures a steady inflow of cash, supporting its overall financial health and investment capacity.

UK Market Presence

FDM Group's UK operations, despite a generally tough market in 2024 and the first half of 2025, have demonstrated a notable resilience, especially within the public sector. This segment continues to be a cornerstone for the company’s revenue generation.

The UK market is a mature landscape where FDM Group has cultivated a strong and enduring presence. This established position allows the company to consistently extract significant financial returns, solidifying its status as a cash cow.

- UK Market Resilience: FDM's UK operations exhibited relative stability through 2024 and H1 2025, particularly in public sector contracts.

- Mature Market Dominance: The UK represents a mature segment where FDM holds a substantial market share.

- Consistent Revenue Generation: FDM continues to generate significant revenue from its established UK presence.

Robust Cash Conversion

FDM Group exhibits robust cash conversion, a key indicator of its operational efficiency. In the first half of 2025, the company achieved an impressive cash conversion rate of 155%. This figure highlights FDM Group's adeptness at translating its earnings into actual cash, demonstrating strong financial health.

This high cash conversion rate is further bolstered by a solid balance sheet and a complete absence of debt. Such financial prudence means FDM Group can generate substantial cash from its established, mature business segments without the burden of interest payments or repayment obligations. This financial flexibility is crucial for reinvestment and strategic growth.

- Strong Cash Generation: FDM Group's 155% cash conversion in H1 2025 showcases its ability to efficiently turn profits into cash.

- Debt-Free Status: The company operates without any outstanding debt, enhancing its financial stability.

- Healthy Operations: A strong balance sheet complements its cash-generating capabilities, signaling robust core business activities.

- Financial Flexibility: The combination of high cash conversion and no debt provides FDM Group with significant financial maneuverability.

FDM Group's established IT operations consulting serves as a prime example of a Cash Cow. This segment, representing their foundational business, operates in a mature market where FDM has secured a significant market share, ensuring consistent and predictable revenue streams.

The stable utilization rates of their consultants in these core IT operations contribute substantially to the company's overall cash flow. For instance, in the first half of 2024, FDM Group reported a revenue of £180.1 million, with these core operations remaining a robust contributor, crucial for funding growth initiatives.

Traditional software engineering deployments also represent a stable, low-growth segment. FDM Group benefits from its well-established training and placement infrastructure, allowing them to consistently secure a significant market share and generate dependable revenue streams.

FDM Group's UK operations, despite market challenges in 2024 and H1 2025, have shown resilience, particularly in public sector contracts. This mature market segment, where FDM holds substantial share, allows for consistent financial returns, solidifying its cash cow status.

| Business Segment | BCG Category | Market Growth | Market Share | Cash Flow Contribution |

|---|---|---|---|---|

| Core IT Operations Consulting | Cash Cow | Low | High | Strong Positive |

| Software Engineering Placements | Cash Cow | Low | High | Strong Positive |

| UK Operations (Public Sector) | Cash Cow | Low | High | Strong Positive |

Delivered as Shown

FDM Group BCG Matrix

The FDM Group BCG Matrix preview you're seeing is the identical, fully-formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis. You can confidently use this preview as a direct representation of the high-quality BCG Matrix file that will be yours to download and implement without delay.

Dogs

Supporting outdated legacy systems often places a company in a low-growth market. While FDM Group assists clients in maintaining these systems, a diminishing demand for consultants specializing in very specific or obsolete technologies can signal a low-market-share position. This can lead to minimal cash generation and resource allocation challenges.

For instance, in 2024, the demand for COBOL developers, a classic legacy skill, saw a slight but noticeable dip in certain sectors as companies increasingly migrate to modern platforms. This trend suggests that areas heavily reliant on such niche legacy support might be candidates for strategic review, potentially leading to divestment or a focused effort to minimize resource commitment.

North American market segments are currently facing significant headwinds, as evidenced by a stark 50% revenue decrease in the first half of 2025. This sharp decline is primarily attributed to a major client restructuring event, impacting deployed consultants and overall revenue generation.

The substantial drop in performance within these North American segments points to a diminished market share and considerable challenges in achieving future growth. Consequently, these areas are being classified as Dogs within the FDM Group BCG Matrix framework, signaling a need for careful strategic reassessment.

In today's rapidly evolving market, some skills that FDM Group trains its consultants in might see a sharp decline in client demand. This is particularly true for technologies that are becoming obsolete or are being superseded by newer, more efficient solutions. For instance, if a significant portion of FDM's training portfolio is focused on legacy programming languages that are no longer widely used by clients, these skills would fall into the low demand category.

When FDM's market share in these specific skill areas is also minimal, these training programs become a drain on resources. They consume valuable training time and personnel without yielding proportional returns in terms of consultant placements. This situation is often reflected in a broader decrease in overall consultant deployment rates, indicating that the company is struggling to find client projects for individuals possessing these less sought-after skills.

Internal Headcount Reductions

FDM Group implemented significant internal headcount reductions, approximately 30% in 2024. This strategic move aims to align staffing with prevailing market conditions and optimize operational efficiency.

These reductions can be viewed through the lens of the BCG Matrix, specifically addressing 'Dog' segments. By trimming less profitable internal functions or areas experiencing declining demand, FDM Group is essentially divesting from or minimizing investment in these underperforming units. This cost-saving measure is a direct response to market realities, indicating a focus on streamlining operations and reallocating resources to more promising areas.

- Headcount Reduction: FDM Group reduced its internal workforce by approximately 30% in 2024.

- Market Alignment: Staffing adjustments were made to better match current market demand and economic conditions.

- Cost Optimization: The reductions served as a cost-saving measure, addressing inefficiencies in operations.

- BCG Matrix Implication: This action reflects a strategic trimming of underperforming or 'Dog' segments within the company's internal structure.

Areas Heavily Reliant on Slowed Banking/Finance Sector

The banking and financial services sector has experienced a slowdown, leading to reduced visibility and delayed client decisions. This directly impacts FDM Group's ability to place consultants, as project pipelines shrink and hiring freezes become more common.

For FDM, areas within this sector where it holds a low market share are particularly vulnerable. These segments, characterized by sluggish growth and uncertain immediate recovery, can be classified as Dogs within the BCG Matrix framework. For instance, if FDM's presence in niche areas like specialized fintech lending or certain types of international trade finance is minimal, these could represent significant Dog categories.

- Impact on FDM Placements: Reduced demand for IT services in banking due to economic headwinds.

- Low Market Share Segments: Niche financial services with limited FDM penetration.

- Growth Prospects: These areas exhibit low growth rates and delayed recovery timelines.

- Strategic Consideration: FDM might need to re-evaluate resource allocation in these challenged sub-sectors.

Dogs represent business units or product lines with low market share in low-growth industries. For FDM Group, this translates to areas where demand for specific IT skills is declining and the company's penetration is minimal. These segments generate low revenue and often require significant resources to maintain, making them prime candidates for strategic divestment or consolidation.

In 2024, FDM Group's strategic headcount reduction of approximately 30% directly addresses these underperforming areas. By trimming less profitable internal functions or segments experiencing declining demand, FDM is essentially divesting from or minimizing investment in these 'Dog' categories. This streamlining aims to optimize operational efficiency and reallocate resources towards more promising growth areas.

The banking and financial services sector, particularly niche areas with limited FDM penetration, exemplifies a 'Dog' segment. These areas, characterized by sluggish growth and uncertain recovery, saw a slowdown in 2024, leading to reduced visibility and delayed client decisions, impacting consultant placements.

The North American market segments, experiencing a stark 50% revenue decrease in the first half of 2025 due to client restructuring, are also classified as Dogs. This sharp decline signifies diminished market share and considerable challenges in achieving future growth, necessitating a careful strategic reassessment.

| Segment/Skill Area | Market Growth | FDM Market Share | 2024/2025 Performance Indicator | BCG Classification |

|---|---|---|---|---|

| Legacy System Support (e.g., COBOL) | Low | Minimal | Slight demand dip in 2024 | Dog |

| Niche Fintech Lending | Low | Minimal | Slowdown in banking sector | Dog |

| North American IT Services | Low | Diminished | 50% revenue decrease (H1 2025) | Dog |

| Obsolete Technology Training | Low | Minimal | Low consultant placement rates | Dog |

Question Marks

Emerging niche technology training represents FDM Group's strategic foray into high-potential, nascent markets where their current market share is minimal. These areas, such as advanced AI ethics or quantum computing development, demand substantial upfront investment in specialized training programs to cultivate the necessary talent pool and establish a foothold.

FDM Group's commitment to these areas is underscored by their ongoing investment in curriculum development and instructor recruitment for these cutting-edge fields. For instance, their 2024 training budget allocation for new technology verticals, including areas like generative AI and cybersecurity resilience, saw a significant increase, reflecting a deliberate strategy to build expertise in these emerging niches.

FDM Group's strategic expansion outside financial services is evident in its 2024 client acquisition, with 35 out of 52 new clients originating from non-financial sectors. This diversification highlights a deliberate move to tap into new market segments and reduce reliance on its traditional base.

These new relationships, though promising for future growth, currently represent a nascent market share. Significant investment is anticipated to nurture these accounts and transform them into stable, revenue-generating partnerships.

Expanding into new, high-growth geographic regions where FDM Group currently has a limited presence would place these ventures in the Question Mark category of the BCG Matrix. These initiatives demand substantial investment for market penetration and establishing brand recognition, with their ultimate success and profitability remaining uncertain in the short term. For example, FDM's strategic push into emerging markets in Southeast Asia during 2024, aiming to tap into the burgeoning tech talent pool and digital transformation demands, represents such a Question Mark. While these regions offer significant long-term potential, the initial capital outlay for setting up operations, training local staff, and building client relationships is considerable, and the return on this investment is not guaranteed.

Specialized Digital Transformation Consulting

Within the expansive digital transformation consulting market, FDM Group's highly specialized offerings, particularly in emerging areas, might currently represent a nascent segment with a relatively low market share. This is common for new, innovative services that require significant upfront investment to establish a strong foothold and adapt to rapidly changing client demands. For instance, the global digital transformation market was valued at approximately $767 billion in 2023 and is projected to reach over $1.8 trillion by 2028, showcasing its high growth trajectory.

These specialized services are characterized by the need for substantial investment in research and development, talent acquisition, and the creation of proprietary methodologies to effectively differentiate FDM from competitors. As the digital landscape evolves, FDM's ability to scale these niche capabilities and align them with sophisticated client needs will be crucial for market penetration and future growth.

- High Growth Market: The overall digital transformation market is experiencing robust expansion, with significant projected growth in the coming years.

- Specialized Offerings: FDM's specific consulting services within this broad market may currently hold a smaller market share due to their specialized or nascent nature.

- Investment Requirements: These specialized areas necessitate considerable investment to foster differentiation, build expertise, and scale operations effectively.

- Evolving Client Needs: Continuous adaptation and investment are essential to meet the dynamic and increasingly sophisticated requirements of clients undergoing digital transformation.

Strategic Partnerships for Future Growth

FDM Group might explore new strategic alliances to tap into emerging markets or cutting-edge technologies. These collaborations hold significant growth potential by broadening FDM's operational footprint and enhancing its service offerings.

However, such partnerships often begin with a modest market share. They necessitate substantial investment and diligent oversight to cultivate their full potential, aligning with the characteristics of a question mark in the BCG matrix.

- Access New Markets: Partnerships can unlock entry into geographies where FDM currently has limited presence, potentially mirroring the expansion strategies seen in the tech sector where collaborations have been key to global reach.

- Technology Advancement: Alliances can provide access to proprietary technologies or innovative platforms, accelerating FDM's ability to offer advanced solutions to its clients, much like how software companies partner to integrate new AI capabilities.

- Initial Low Market Share: New ventures typically start with a small customer base or limited market penetration, requiring time and resources to build momentum and market share.

- High Growth Potential & Investment Needs: While the long-term outlook is promising, these initiatives demand considerable upfront investment in integration, marketing, and operational support to achieve significant market traction.

Question Marks represent FDM Group's ventures into high-growth markets where their current market share is minimal. These initiatives, such as expanding into new geographic regions or offering highly specialized digital transformation consulting, require significant upfront investment to build presence and client relationships. The success of these ventures is uncertain, demanding careful management and strategic resource allocation to transform them into profitable endeavors.

| Venture Area | Market Growth Potential | Current Market Share | Investment Required (Est.) | Key Challenges |

|---|---|---|---|---|

| Emerging Geographic Markets (e.g., Southeast Asia) | High | Low | Significant (Operations, Training, Client Acquisition) | Market penetration, Brand recognition, Local regulatory navigation |

| Specialized Digital Transformation Consulting (e.g., Generative AI Ethics) | High | Low | Substantial (R&D, Talent Acquisition, Methodology Development) | Talent scarcity, Rapid technological change, Client adoption rates |

| Strategic Alliances in New Technologies | High | Low | Considerable (Integration, Marketing, Operational Support) | Partnership management, Technology integration, Market acceptance |

BCG Matrix Data Sources

Our FDM Group BCG Matrix is constructed using a blend of internal financial statements, market research reports, and industry growth projections to provide a comprehensive view.