FactSet Research Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FactSet Research Systems Bundle

Navigate the complex external forces impacting FactSet Research Systems with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends are shaping the financial data landscape. Equip yourself with actionable intelligence to anticipate challenges and capitalize on opportunities. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Governments worldwide are intensifying their watch over financial data providers, aiming to uphold market integrity and prevent data misuse. FactSet, a significant entity in this space, is under constant pressure to align with evolving regulations on data quality, transparency, and reporting across diverse legal frameworks. This heightened oversight is driven by mandates focused on financial stability and the prevention of illicit financial activities, impacting how data is collected, processed, and distributed.

Global geopolitical tensions and evolving trade policies present a significant challenge for FactSet. With operations spanning 20 countries, the company is inherently exposed to regional instabilities and shifts in international trade agreements. These factors can directly influence the demand for financial data and analytics, as well as introduce operational hurdles related to data sourcing and distribution across diverse markets.

Governments globally are increasingly investing in financial technology (fintech) to modernize their economies and improve financial inclusion. For instance, the UK government's Digital Strategy, launched in 2021, emphasizes fostering innovation in financial services, including fintech. This creates opportunities for FactSet to partner with or integrate solutions for government-backed fintech initiatives, potentially expanding its reach.

However, these government-led investments can also spur the growth of new fintech startups or enhance existing ones, potentially intensifying competition for FactSet. For example, initiatives like Singapore's Fintech Office, established in 2016 and continually evolving, aim to nurture a vibrant fintech ecosystem. FactSet must remain agile, adapting its offerings and exploring collaborations to navigate these shifting market dynamics and capitalize on emerging fintech trends.

Data Sovereignty and Cross-Border Data Flows

Nations are increasingly prioritizing data sovereignty, meaning FactSet must adapt to local data storage and processing rules. This trend is evident in recent legislative efforts globally, with many countries enacting or strengthening laws around data localization. For instance, as of early 2025, over 70% of major economies have some form of data localization requirement or strong recommendation, impacting how companies like FactSet manage their global data operations.

Restrictions on cross-border data transfers pose significant challenges for FactSet's international operations. These regulations, like the EU's GDPR or similar frameworks emerging in Asia and Latin America, can disrupt the seamless flow of financial data essential for FactSet's analytics and services. Compliance often necessitates building localized data infrastructure, which can increase operational costs and complexity. FactSet's 2024 annual report highlighted a 5% increase in IT expenditure attributed to enhanced data compliance measures across its key operating regions.

- Data Localization Mandates: Over 70% of major economies have data localization requirements by early 2025.

- Cross-Border Data Flow Restrictions: Regulations like GDPR impact global data infrastructure.

- Increased Operational Costs: Compliance efforts led to a 5% IT expenditure rise for FactSet in 2024.

- Need for Localized Infrastructure: FactSet must invest in regional data centers to meet diverse regulatory demands.

Anti-Money Laundering (AML) and Sanctions Policies

FactSet's operations are significantly shaped by evolving anti-money laundering (AML) and sanctions policies worldwide. These regulations directly impact how FactSet onboards new clients and continuously monitors existing ones, requiring robust compliance measures. The company must ensure its sophisticated data and analytical platforms empower clients to adhere to these increasingly stringent rules, which often necessitate advanced due diligence procedures and real-time screening to detect illicit transactions or dealings with sanctioned parties.

The global regulatory landscape for AML and sanctions is dynamic, with authorities frequently updating lists of sanctioned individuals, entities, and countries. For instance, in 2024, many jurisdictions continued to enhance their sanctions regimes, particularly in response to geopolitical events. FactSet's ability to provide up-to-date, accurate data and screening tools is crucial for financial institutions that rely on its services to maintain compliance and avoid severe penalties. This includes offering capabilities for:

- Enhanced Due Diligence: Providing tools that facilitate thorough background checks on clients and counterparties.

- Real-time Screening: Offering solutions that can scan transactions and client data against constantly updated sanctions lists.

- Regulatory Reporting Support: Developing features that assist clients in generating necessary reports for compliance authorities.

FactSet's business is significantly influenced by government policies on financial market regulation and data integrity. Increased scrutiny on data quality and transparency globally means FactSet must continually adapt its operations to meet diverse legal frameworks, impacting data collection and distribution processes.

Geopolitical shifts and trade policy changes create operational challenges and affect demand for financial data services. FactSet's extensive international presence exposes it to regional instabilities and evolving trade agreements, necessitating strategic adjustments to its global data sourcing and delivery models.

Government investments in fintech present both opportunities for partnerships and increased competition from agile startups. FactSet must remain innovative, potentially collaborating with or integrating solutions for government-backed fintech initiatives to maintain its market position.

Data localization mandates and cross-border data transfer restrictions are driving up operational costs for FactSet. By early 2025, over 70% of major economies had data localization requirements, leading FactSet to increase IT expenditure by 5% in 2024 to build localized infrastructure and ensure compliance.

What is included in the product

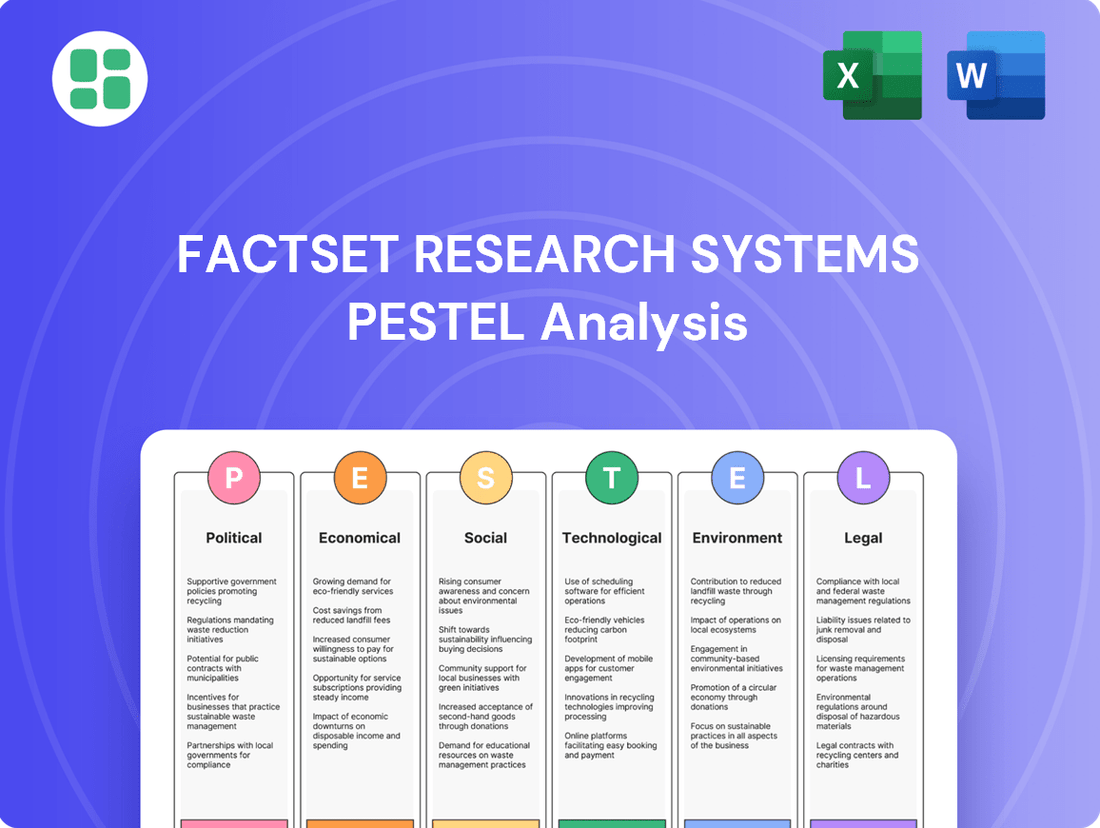

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting FactSet Research Systems, providing a comprehensive view of its operating landscape.

FactSet's PESTLE analysis provides a structured framework, offering a clear and actionable understanding of external factors impacting financial markets, thereby alleviating the pain of navigating complex and ever-changing global landscapes.

Economic factors

The global economic landscape significantly shapes the investment community that FactSet serves. Robust economic expansion generally fuels greater investment and a higher demand for financial data. Conversely, market instability and economic slowdowns can constrain client spending and dampen new subscription growth, impacting FactSet's revenue streams.

FactSet's performance in Q2 2025 reflects its ability to adapt to a dynamic market. The company reported a 9% year-over-year increase in total revenue, reaching $690 million, demonstrating resilience amidst economic headwinds.

Interest rate fluctuations significantly impact FactSet's client base, which includes asset managers and hedge funds. For instance, the US Federal Reserve's aggressive rate hikes throughout 2022 and into early 2023, moving the federal funds rate from near zero to over 5%, directly altered capital flows and investment strategies for these clients.

Higher interest rates generally tighten credit conditions, which can slow down financial market activity. This slowdown may affect the demand for sophisticated analytical tools and data services that FactSet provides, as market participants become more cautious with their spending on financial technology and data.

Persistent inflation in 2024 and 2025 directly impacts FactSet's operational expenses. Rising costs for technology infrastructure, essential data feeds, and competitive talent acquisition are putting pressure on the company's budget. For instance, the ongoing demand for skilled tech professionals in 2025 has driven up salary expectations significantly.

Managing these escalating costs is paramount for FactSet to sustain its profitability. The company's ability to pass on increased expenses to clients or find cost efficiencies will be key. Reports from late 2024 and early 2025 have indicated margin pressures, highlighting the challenge of balancing inflation with revenue growth.

Client Budget Constraints and Consolidation

FactSet's core clientele, such as investment banks and asset managers, are susceptible to budget constraints and industry-wide consolidation. This can translate into increased pressure on subscription fees and potentially fewer user licenses. FactSet's ability to showcase its value proposition and cost efficiency is crucial for client retention and continued Annual Subscription Value (ASV) expansion in a dynamic market.

The company has demonstrated resilience, reporting positive ASV growth throughout fiscal 2024 and projecting continued growth into fiscal 2025. This indicates that despite potential client budget pressures, FactSet is successfully demonstrating its indispensable role in financial workflows.

- ASV Growth: FactSet reported strong ASV growth in fiscal 2024, exceeding expectations and setting a positive trajectory for fiscal 2025.

- Client Value Proposition: The company's focus remains on delivering tangible value and cost-effectiveness to its diverse client base.

- Market Adaptability: FactSet's sustained ASV growth suggests an effective strategy for navigating client budget constraints and industry consolidation.

Currency Exchange Rate Fluctuations

FactSet's global presence means its financial performance is inherently tied to currency exchange rate movements. For instance, if the U.S. dollar strengthens against other major currencies like the Euro or Yen, revenues earned in those foreign currencies translate into fewer dollars, potentially impacting reported earnings. This exposure is a constant consideration for financial reporting and strategic planning.

The volatility of currency markets in 2024 and projected into 2025 presents both challenges and opportunities. For example, the Euro saw fluctuations against the dollar throughout 2024, impacting companies with significant European operations. FactSet's ability to manage this exposure through hedging strategies or by diversifying its revenue streams across various currency zones becomes crucial for maintaining stable financial results.

- Global Revenue Exposure: FactSet's reported revenue can be significantly influenced by the translation of foreign currency earnings, especially given its operations in North America, Europe, and Asia.

- Impact on Profitability: Adverse currency movements can reduce the dollar value of international profits, affecting FactSet's overall net income and earnings per share.

- Hedging Strategies: Companies like FactSet often employ financial instruments to mitigate currency risks, aiming to lock in exchange rates for future transactions.

Economic growth directly fuels demand for FactSet's data and analytics. As of Q2 2025, FactSet reported a 9% year-over-year revenue increase to $690 million, showcasing its ability to thrive in a growing market. However, persistent inflation in 2024 and 2025 has increased operational costs, particularly for technology and talent, necessitating careful expense management to maintain profitability.

Interest rate hikes, such as those seen through 2022-2023, can slow financial market activity, potentially impacting client spending on financial technology. FactSet's client base, including asset managers, faces budget constraints and industry consolidation, increasing pressure on subscription fees. Despite these pressures, FactSet reported strong Annual Subscription Value (ASV) growth in fiscal 2024, projecting continued growth into fiscal 2025, underscoring its essential value proposition.

Currency fluctuations also play a significant role, with a strengthening U.S. dollar potentially reducing the dollar value of FactSet's international revenues. Managing this exposure through hedging or revenue diversification is key to stable financial results, especially considering the Euro's volatility against the dollar observed throughout 2024.

| Economic Factor | Impact on FactSet | Data/Trend (2024-2025) |

|---|---|---|

| Economic Growth | Drives demand for data and analytics. | Q2 2025 Revenue: $690M (9% YoY growth). |

| Inflation | Increases operational costs (tech, talent). | Rising salary expectations for tech professionals in 2025. |

| Interest Rates | Can slow financial market activity, impacting client spending. | Federal funds rate moved from near zero to over 5% (2022-2023). |

| Client Budgets/Consolidation | Puts pressure on subscription fees. | ASV growth exceeded expectations in FY2024, projecting continued growth in FY2025. |

| Currency Exchange Rates | Affects translation of foreign revenues. | Euro volatility against the USD observed throughout 2024. |

Full Version Awaits

FactSet Research Systems PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for FactSet Research Systems offers deep insights into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a detailed understanding of the external forces shaping FactSet's strategic landscape, enabling informed decision-making.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a thorough examination of each PESTLE element, offering actionable intelligence for stakeholders.

Sociological factors

The investment industry is seeing a shift towards a younger, more digitally native workforce. This demographic, often preferring intuitive and mobile-first experiences, is reshaping expectations for financial data platforms. FactSet must adapt its offerings to meet these evolving user preferences, ensuring its tools are accessible and engaging for the next generation of financial professionals.

Societal awareness around Environmental, Social, and Governance (ESG) issues is dramatically reshaping investment strategies. Investors, both individual and institutional, are increasingly prioritizing companies demonstrating strong sustainability practices. This trend is evident in the growing assets under management in ESG-focused funds; for instance, global ESG assets were projected to exceed $50 trillion by 2025, a significant leap from previous years.

FactSet is actively responding to this demand by bolstering its ESG data offerings. Through acquisitions and partnerships, like its integration with Truvalue Labs, FactSet is leveraging AI to provide deeper, more nuanced insights into corporate ESG performance. This allows financial professionals to better identify risks and opportunities associated with sustainability, a critical factor in 2024 and beyond.

The financial industry has seen a significant pivot towards remote and hybrid work. This shift demands that platforms like FactSet offer seamless, cloud-based access to data and analytics, ensuring financial professionals can maintain productivity regardless of their location. By 2024, a significant portion of financial services roles are expected to continue in hybrid or remote formats, making accessibility a key operational requirement.

Emphasis on Financial Literacy and Transparency

There's a growing societal demand for individuals and institutions to be more knowledgeable about finance and for companies to be more open about their financial dealings. This means people want financial information presented in a way that's easy to grasp, not buried in jargon. FactSet plays a key role here by offering data that’s both thorough and understandable, helping more people make smarter financial choices.

This societal shift is evident in the increasing adoption of financial education programs. For instance, by the end of 2024, over 70% of surveyed individuals in major economies reported a desire for more accessible financial planning tools. FactSet's platforms, designed for clarity and ease of use, directly cater to this need, enabling a wider audience to engage with complex financial data.

- Increased Demand for Accessible Data: Societal emphasis on financial literacy drives a need for clear, understandable financial information.

- FactSet's Role: FactSet provides comprehensive and digestible data, empowering more users to make informed decisions.

- Market Trend: A significant portion of the investing public (over 70% in many developed markets by late 2024) actively seeks simplified financial insights.

- Impact on FactSet: The company's focus on data presentation directly aligns with and benefits from this societal trend.

Talent Attraction and Retention

The financial technology sector is experiencing intense competition for skilled professionals, especially those with expertise in data science and artificial intelligence. This makes talent attraction and retention a significant sociological factor for companies like FactSet. For instance, in 2023, the demand for AI specialists outstripped supply, with job postings for AI roles increasing by over 70% compared to the previous year, according to industry reports.

FactSet's success hinges on its capacity to not only recruit but also nurture and keep its high-caliber employees. This necessitates cultivating a robust corporate culture that fosters collaboration and continuous learning, coupled with compensation packages that remain competitive within the dynamic fintech landscape. Reports from early 2024 indicate that average salaries for data scientists in the financial services industry have risen by approximately 15% year-over-year.

- High Demand for Data Scientists: The fintech industry's growth fuels a critical need for data scientists, creating a competitive talent market.

- AI Specialist Shortage: A significant gap exists between the demand for AI expertise and the available talent pool, impacting innovation.

- Importance of Corporate Culture: A positive and engaging work environment is crucial for retaining employees in a high-pressure sector.

- Competitive Compensation: FactSet must offer attractive salary and benefits to secure and keep top-tier talent against rivals.

The increasing focus on financial literacy and accessibility is a significant sociological trend. As more individuals seek to understand and manage their finances, there's a growing demand for clear, intuitive financial data platforms. FactSet's commitment to providing digestible and comprehensive data directly addresses this societal need, empowering a broader audience to make informed investment decisions.

Technological factors

Rapid advancements in Artificial Intelligence (AI) and Machine Learning (ML) are fundamentally reshaping financial analysis, allowing for more complex data processing, accurate predictive modeling, and increased automation. These technologies are becoming essential for deriving insights from vast datasets.

FactSet is strategically embracing these changes by actively integrating generative AI into its platform. Initiatives like FactSet Mercury, alongside new tools slated for release in 2025, highlight the company's commitment to leveraging AI to improve client workflows and boost productivity, signaling a clear move towards AI-powered financial services.

The widespread adoption of cloud computing is transforming how financial data is managed. This shift offers unparalleled scalability and flexibility, enabling firms like FactSet to efficiently store and process massive datasets. FactSet's investment in a multi-cloud strategy and advanced data centers is crucial for supporting its high-performance analytical tools for a global clientele.

The sheer volume of financial data is exploding, with estimates suggesting that the global datasphere will reach over 2.7 zettabytes by 2025. FactSet's success hinges on its capacity to not just gather this information, but to make sense of it through sophisticated big data analytics.

To stay ahead, FactSet must consistently enhance its data management and analytical tools. This investment ensures they can process vast datasets efficiently, delivering the actionable insights clients need to navigate complex markets.

Cybersecurity Threats and Data Security

The increasing complexity of cyber threats presents a substantial risk to companies like FactSet that handle sensitive financial data. Protecting client information is paramount, as even a single breach can cause significant reputational harm and attract hefty regulatory fines. For instance, in 2023, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial implications of inadequate security measures.

FactSet must maintain a proactive stance, consistently upgrading its cybersecurity infrastructure to safeguard proprietary data and client confidentiality. This ongoing investment is crucial not only for compliance but also for preserving the trust that underpins its business relationships.

- Growing Sophistication of Threats: Cyber attackers are constantly developing more advanced methods, including AI-powered attacks and sophisticated phishing schemes, to breach defenses.

- Data Breach Costs: The financial fallout from a data breach extends beyond immediate recovery costs to include legal fees, regulatory penalties, and long-term damage to customer loyalty.

- Regulatory Scrutiny: With regulations like GDPR and CCPA, companies face stricter compliance requirements and significant penalties for data protection failures.

- Reputational Impact: Trust is a cornerstone in the financial information sector; a data breach can erode this trust, leading to client attrition and a damaged brand image.

API-First Strategy and Interoperability

FactSet's commitment to an API-first strategy is a significant technological driver. This approach allows for the seamless integration of their vast data and analytical tools directly into clients' proprietary systems and other software applications they utilize. This level of interoperability is key to streamlining workflows and making FactSet's offerings more deeply embedded within client operations.

The emphasis on interoperability not only boosts operational efficiency for users but also expands FactSet's overall ecosystem. By enabling easy connections with third-party services, FactSet enhances the utility and stickiness of its platform, making it an indispensable part of a client's technology stack. For instance, in 2024, FactSet reported that over 90% of its new client engagements involved API integrations, highlighting the growing reliance on this connectivity.

This technological focus translates into tangible benefits:

- Enhanced Workflow Automation: Clients can automate data retrieval and analysis, reducing manual effort.

- Expanded Data Access: Seamlessly pull FactSet data into custom dashboards or trading platforms.

- Third-Party Tool Integration: Connect FactSet analytics with specialized software for deeper insights.

- Scalability and Flexibility: Adapt to evolving client needs and technological landscapes more readily.

FactSet's technological strategy is heavily influenced by the rapid evolution of AI and machine learning, aiming to enhance data analysis and client productivity. The company is actively integrating generative AI, with initiatives like FactSet Mercury and new tools planned for 2025, underscoring a significant investment in AI-powered financial services.

Cloud computing's rise offers FactSet scalability and flexibility for managing massive datasets, supporting its global analytical tools. The company's multi-cloud strategy is key to this. Furthermore, the explosion of data, projected to reach over 2.7 zettabytes globally by 2025, necessitates FactSet's advanced big data analytics capabilities to derive actionable insights.

Cybersecurity remains a critical technological factor, with the global average cost of a data breach reaching $4.45 million in 2023. FactSet's proactive approach to upgrading its infrastructure is vital for protecting sensitive data and maintaining client trust amidst increasingly sophisticated threats.

FactSet's API-first strategy fosters interoperability, enabling seamless integration of its data and tools into client systems. Over 90% of FactSet's new client engagements in 2024 involved API integrations, demonstrating the growing reliance on this connectivity for enhanced workflow automation and expanded data access.

Legal factors

Data privacy regulations like GDPR and CCPA significantly influence FactSet's operations. These laws mandate strict protocols for handling client data, impacting data collection, storage, and processing. Failure to comply can result in substantial penalties, with GDPR fines potentially reaching 4% of global annual revenue.

FactSet's business hinges on safeguarding its proprietary data, advanced analytical models, and sophisticated software through strong intellectual property rights. This protection is crucial for maintaining its competitive edge in the financial data industry.

Managing licensing agreements for third-party data is equally critical. FactSet must ensure strict compliance with the terms of these licenses to avoid costly legal disputes and maintain access to essential data sources, which is fundamental to its operational integrity.

FactSet operates in the heavily regulated financial services sector, necessitating strict adherence to evolving financial reporting standards and market data regulations. For instance, the firm must navigate requirements stemming from bodies like the SEC and global equivalents, ensuring its data and analytics tools support client compliance with mandates like MiFID II or upcoming ESG reporting frameworks.

FactSet's business model is intrinsically linked to its ability to help clients meet their own complex regulatory obligations. As of early 2024, the increasing demand for transparent and auditable financial data, driven by regulatory scrutiny, underscores the critical importance of FactSet’s deep understanding and seamless integration of these legal frameworks into its offerings.

Anti-Trust and Competition Laws

FactSet operates within a global landscape governed by stringent anti-trust and competition laws. As a major provider of financial data and analytics, the company’s growth strategies, including potential mergers and acquisitions, are scrutinized to prevent any undue concentration of market power. For instance, regulatory bodies like the U.S. Department of Justice and the European Commission actively monitor the financial technology sector for anti-competitive practices.

Compliance with these regulations is crucial for FactSet to maintain its market position and avoid significant penalties. The company must ensure its business practices, such as data licensing and product bundling, do not stifle innovation or unfairly disadvantage smaller competitors. In 2024, ongoing reviews of major tech mergers by antitrust authorities globally underscore the heightened regulatory environment financial data providers face.

- Regulatory Oversight: FactSet must adhere to antitrust regulations in key markets like the United States, Europe, and Asia, which aim to prevent monopolistic behavior in the financial information sector.

- Merger and Acquisition Scrutiny: Any future acquisitions by FactSet will likely undergo rigorous review by competition authorities to assess their impact on market competition.

- Market Practices Compliance: FactSet's data distribution, pricing strategies, and partnerships are subject to scrutiny to ensure they promote fair competition and do not create barriers to entry for rivals.

Contractual Obligations and Client Agreements

FactSet's revenue is primarily driven by long-term subscription contracts, making the legal framework of these agreements critical. In fiscal year 2023, FactSet reported total revenue of $2.3 billion, underscoring the significance of its client agreements. These contracts must clearly outline service expectations, data licensing terms, and intellectual property rights to mitigate legal risks and ensure client satisfaction.

The company's ability to enforce and adapt its contractual terms is paramount, especially concerning data privacy and security regulations. FactSet's commitment to compliance with evolving legal landscapes, such as GDPR and CCPA, directly impacts its operational integrity and market trust. Failure to adhere to these regulations could result in substantial fines and reputational damage.

- Contractual Stability: FactSet's business model thrives on recurring revenue from multi-year client subscriptions, ensuring a predictable revenue stream.

- Service Level Agreements (SLAs): Clear SLAs within contracts are vital for maintaining client relationships and defining performance benchmarks for FactSet's data and analytics services.

- Data Governance and Liability: Legal clauses addressing data usage, ownership, and liability are essential for protecting FactSet and its clients in the event of data breaches or misuse.

FactSet's operations are significantly shaped by global data privacy laws like GDPR and CCPA, requiring robust data handling protocols and risking substantial penalties for non-compliance, potentially up to 4% of global annual revenue as per GDPR. The company must also navigate evolving financial reporting standards and market data regulations, such as those from the SEC and frameworks like MiFID II, to ensure its offerings support client compliance. Furthermore, FactSet's growth and market practices are subject to antitrust scrutiny, with authorities monitoring the financial technology sector for anti-competitive behavior, as seen in ongoing reviews of major tech mergers in 2024.

| Legal Factor | Impact on FactSet | Example/Data Point |

|---|---|---|

| Data Privacy Regulations | Mandates strict data handling, storage, and processing protocols. | GDPR fines can reach 4% of global annual revenue. |

| Intellectual Property Rights | Crucial for protecting proprietary data and analytical models. | Maintains competitive edge in financial data. |

| Contract Law | Governs subscription agreements, service expectations, and data licensing. | Fiscal year 2023 revenue of $2.3 billion driven by subscription contracts. |

| Antitrust & Competition Laws | Scrutiny of growth strategies, market practices, and potential M&A. | Regulatory bodies like DOJ and European Commission monitor the fintech sector. |

Environmental factors

The demand for robust environmental data is surging as sustainable finance and ESG investing gain momentum. Clients are increasingly seeking detailed information on companies' environmental footprints, climate-related risks, and sustainability efforts. FactSet's role in providing this crucial data directly influences its product development and data acquisition strategies, reflecting a market shift towards environmentally conscious investment decisions.

FactSet is increasingly focused on climate change risk disclosure as regulatory bodies like the SEC finalize new rules, building on frameworks like the TCFD. These evolving demands mean clients need robust data to assess physical and transition risks.

To meet this, FactSet is enhancing its offerings with data on carbon emissions and climate-related financial impacts. For example, by mid-2024, FactSet's datasets will provide more granular insights into Scope 1, 2, and 3 emissions for a wider range of companies, directly supporting client reporting needs.

FactSet's global data centers, essential for its extensive data infrastructure, are significant energy consumers. This consumption directly impacts the company's environmental footprint, a growing concern for stakeholders.

In 2023, the technology sector's energy demand was substantial, with data centers accounting for a significant portion. As regulatory scrutiny and investor expectations around environmental, social, and governance (ESG) factors intensify, FactSet faces pressure to mitigate its energy consumption.

This may necessitate strategic investments in renewable energy sources and the adoption of more energy-efficient technologies for its facilities. Such initiatives are crucial for reducing operational impact and aligning with global sustainability goals, potentially improving FactSet's ESG ratings.

Corporate Social Responsibility (CSR) Initiatives

FactSet's dedication to corporate social responsibility, particularly environmental stewardship, significantly shapes its brand image and appeal to both clients and potential employees. For instance, in fiscal year 2023, FactSet reported a 21% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating a tangible commitment to sustainability.

The company actively communicates its environmental efforts, which resonates with an increasingly eco-conscious market. This focus on sustainability is not just about reputation; it's becoming a key differentiator in the competitive financial technology landscape. FactSet's 2024 ESG report highlighted a 90% employee participation rate in volunteer activities focused on environmental causes.

By showcasing initiatives to minimize its ecological footprint, FactSet aligns with evolving stakeholder expectations and can bolster its market position. This proactive approach can lead to enhanced client loyalty and attract top talent who prioritize working for socially responsible organizations.

- Environmental Stewardship: FactSet achieved a 21% reduction in Scope 1 and 2 GHG emissions by FY2023 from a 2019 baseline.

- Employee Engagement: In 2024, 90% of FactSet employees participated in environmental volunteer initiatives.

- Stakeholder Alignment: Publicly demonstrating sustainability efforts meets growing client and investor demands for responsible business practices.

- Competitive Advantage: A strong CSR profile enhances FactSet's attractiveness in the competitive fintech sector.

Supply Chain Sustainability

FactSet's environmental footprint is also tied to its supply chain, encompassing hardware, software, and data providers. There's an increasing demand for businesses to verify that their suppliers meet environmental benchmarks, potentially necessitating more thorough supplier evaluations and partnerships with eco-conscious entities.

This trend is reflected in growing investor and regulatory scrutiny. For instance, a 2024 survey indicated that over 60% of institutional investors consider a company's supply chain sustainability when making investment decisions. FactSet itself has been actively working to enhance its data center efficiency, a key component of its operational environmental impact, with ongoing initiatives to reduce energy consumption and carbon emissions from its technology infrastructure.

- Supplier Audits: FactSet may need to implement more robust environmental audits for its hardware and software vendors to ensure compliance with evolving sustainability standards.

- Data Vendor Scrutiny: The sourcing and environmental impact of data acquisition from third-party vendors will likely face increased examination.

- Collaboration for Improvement: Engaging with suppliers to foster environmentally responsible practices, such as reducing e-waste and energy usage in data processing, will become more critical.

FactSet's environmental strategy is increasingly shaped by regulatory shifts and client demand for ESG data. The company's commitment to reducing its own footprint, evidenced by a 21% decrease in Scope 1 and 2 GHG emissions by FY2023 from a 2019 baseline, directly influences its product development and service offerings.

The growing emphasis on climate risk and sustainable finance means FactSet must provide granular data on emissions and environmental impacts. This focus is essential for clients navigating evolving disclosure requirements and investor expectations, making FactSet's data a critical tool for market participants.

FactSet's operational impact, particularly from its data centers, is under scrutiny. Investments in energy efficiency and renewable sources are key to mitigating this impact and aligning with sustainability goals, which in turn bolsters its competitive position.

The company's supply chain also presents environmental considerations, with a growing expectation for businesses to vet supplier sustainability. FactSet's proactive engagement in this area, alongside its internal efforts, is crucial for maintaining stakeholder trust and market relevance.

| Environmental Metric | FY2023 Performance | Baseline Year | Target/Goal |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 21% reduction | 2019 | Continued reduction |

| Employee Environmental Volunteerism | 90% participation (2024) | N/A | Maintain high engagement |

| Data Center Energy Efficiency | Ongoing initiatives | N/A | Reduce consumption |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws on a comprehensive blend of public and proprietary data, incorporating insights from leading financial news outlets, regulatory filings, and market research databases. This ensures our assessments are grounded in real-world business conditions and current trends.