F45 Training Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F45 Training Bundle

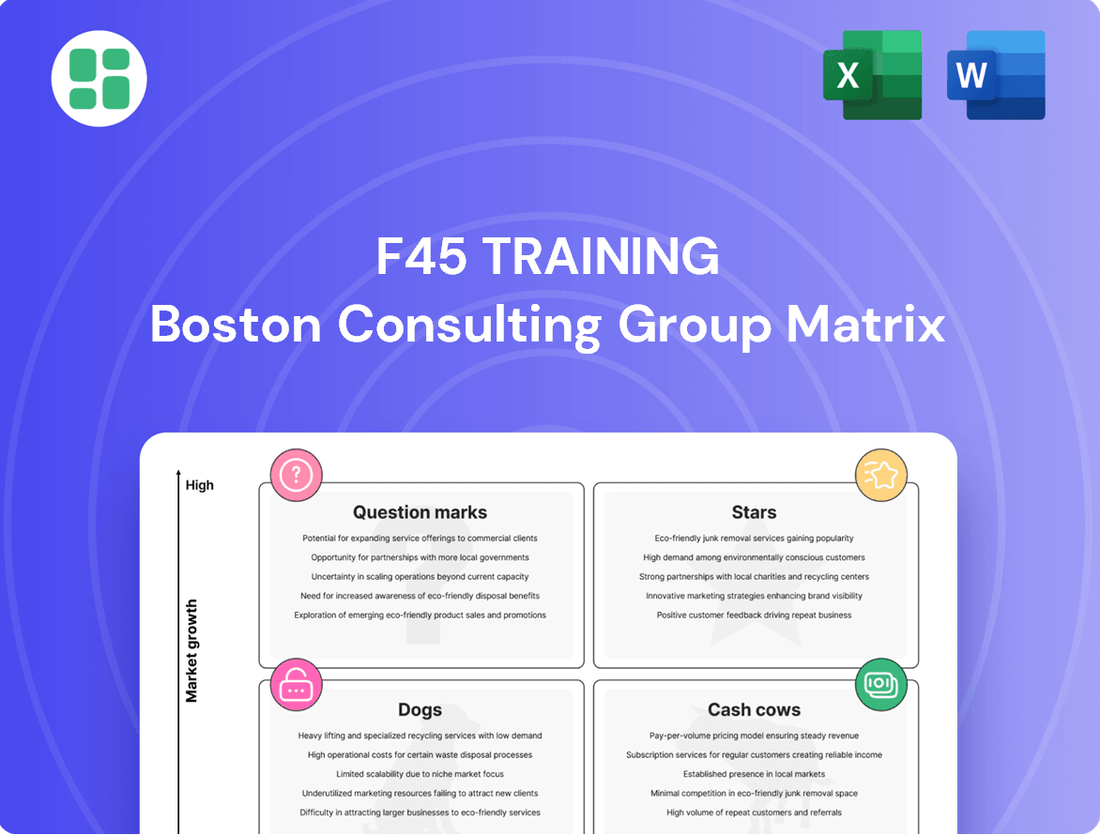

Understand F45 Training's strategic positioning with our BCG Matrix analysis, revealing which offerings are market leaders (Stars), consistent revenue generators (Cash Cows), resource drains (Dogs), or potential growth areas (Question Marks).

This preview offers a glimpse into F45's product portfolio. For a comprehensive understanding of their market share and growth potential, and to unlock actionable strategies for optimizing their fitness offerings, purchase the full BCG Matrix report.

Gain a competitive edge by understanding F45's strategic product placement. The complete BCG Matrix provides the detailed quadrant analysis and expert insights needed to make informed decisions about investment and resource allocation within their fitness empire.

Stars

F45 Training's ambitious global expansion in 2024 saw the opening of 75 new studios and the sale of 87 franchises, underscoring its robust growth and leadership in the boutique fitness sector. This aggressive rollout into markets such as South Africa, South Korea, and various European countries highlights significant market penetration and an expanding international presence.

The company's increasing Average Unit Volumes (AUVs) and a steady stream of franchise inquiries further validate its strong market share in both established and developing territories, positioning it as a star performer in the global fitness franchise landscape.

VAURA Pilates stands out as a significant Star within F45 Training's portfolio. Its Average Unit Volumes (AUVs) experienced a remarkable surge of 51.1% in 2024, positioning it as F45's top-performing brand by this metric.

This athletic reformer Pilates concept is tapping into the robust growth of the global Pilates and yoga market, which is anticipated to reach $417 billion by 2033. The successful launch of its flagship studio in New York City, coupled with substantial franchisee interest, underscores its high growth trajectory and expanding market share in this niche fitness segment.

FS8, F45's unique Pilates-Yoga fusion, demonstrated significant momentum in 2024 with a 23.9% increase in average unit volume (AUV). This growth highlights its strong appeal and expanding presence across international markets.

The brand is capitalizing on the growing consumer preference for low-impact, wellness-focused fitness routines. This strategic positioning has allowed FS8 to emerge as a key player in a burgeoning segment of the fitness industry.

With a standout performance at its Austin flagship studio and a surge in franchisee inquiries, FS8 is solidifying its market position and signaling substantial potential for further expansion and increased market share.

North American & US Core Studios

North American and US core studios at F45 Training have demonstrated exceptional strength, reaching all-time highs in Average Unit Volumes and Same Store Sales during 2024. This sustained record performance in these more mature markets underscores F45's significant market share within the consistently expanding boutique fitness industry.

These established regions are pivotal growth engines for the company, reflecting F45's enduring leadership and robust brand recognition. The consistent upward trend in key financial metrics highlights the resilience and appeal of F45's fitness model.

- 2024 saw record Average Unit Volumes in North America and the US.

- Same Store Sales also reached all-time highs in these core markets for 2024.

- This performance indicates strong market share in the growing boutique fitness sector.

- These mature regions serve as key drivers of F45's overall growth.

Proprietary Workout Programs & Technology

F45 Training's proprietary workout programs and technology are central to its success, positioning it strongly within the fitness industry. Their standardized, tech-integrated functional group workouts, including the F45 Challenge and Lionheart heart rate monitoring, have secured a significant market share. This is driven by the programs' demonstrated effectiveness and continuous innovation.

The company's ability to offer more than 5,000 unique movements, coupled with the integration of wearable technology, significantly boosts member engagement and retention. This core intellectual property acts as a crucial differentiator, fueling demand and reinforcing F45's leading status in the High-Intensity Interval Training (HIIT) market.

- Market Share Dominance: F45's innovative approach to group fitness, leveraging technology and a standardized workout model, has allowed it to capture a substantial portion of the functional training market.

- Member Engagement: The integration of the F45 Challenge and Lionheart technology enhances member commitment, providing data-driven feedback and fostering a sense of community and progress.

- Intellectual Property Strength: The vast library of over 5,000 unique movements and the seamless integration of wearable tech are key differentiators, creating a strong competitive moat.

- HIIT Leadership: These proprietary elements solidify F45's position as a leader in the booming HIIT sector, attracting new members and retaining existing ones through a consistently evolving and effective fitness experience.

VAURA Pilates and FS8 are key Stars in F45 Training's portfolio, showing exceptional growth and market penetration. VAURA Pilates, in particular, saw a 51.1% increase in AUV in 2024, positioning it as the top performer. FS8 also experienced a 23.9% AUV increase, driven by consumer interest in wellness-focused fitness.

F45's core North American and US studios are also Stars, achieving record-breaking Average Unit Volumes and Same Store Sales in 2024. This sustained high performance in established markets highlights F45's strong market share and leadership in the boutique fitness industry.

The company's proprietary workout programs and technology are foundational to its success, securing significant market share in the functional training and HIIT sectors. The F45 Challenge and Lionheart heart rate monitoring enhance member engagement and retention, creating a strong competitive advantage.

| Brand/Segment | 2024 Performance Highlight | Market Position |

|---|---|---|

| VAURA Pilates | 51.1% AUV Growth | Top performer, capitalizing on Pilates market growth |

| FS8 | 23.9% AUV Growth | Key player in wellness-focused fitness, strong international presence |

| North America/US Core Studios | Record AUV & Same Store Sales | Established leadership in mature markets, driving overall growth |

| Proprietary Programs & Tech | High member engagement & retention | Dominant in functional training and HIIT, strong competitive moat |

What is included in the product

Strategic assessment of F45's fitness studios as Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

F45 Training's BCG Matrix provides a clear, actionable roadmap for optimizing franchise portfolio performance.

This visual tool helps identify underperforming studios, allowing for targeted support and resource allocation.

Cash Cows

The established F45 franchise network, especially in mature markets where growth has naturally slowed, is a prime example of a cash cow for F45 Training. These locations benefit from deep brand loyalty and a consistent customer base, leading to predictable and robust profit margins.

These mature studios are vital for generating the reliable cash flow needed to support other areas of the business. For instance, as of the first quarter of 2024, F45 reported that its established studios continued to be a significant contributor to overall revenue, demonstrating the stability of these operations even as the company explores new growth avenues.

F45 Training's standardized franchise model is a cornerstone of its cash cow status. This proven system provides franchisees with consistent workout programs, essential equipment, and comprehensive marketing support, ensuring operational uniformity across locations.

This standardization directly translates into reliable recurring revenue streams through franchise fees and ongoing royalties. For instance, in 2023, F45 reported system-wide revenue of $130.5 million, with a significant portion derived from these franchise-based income sources.

Once a franchise is established and operational, the ongoing investment required from F45's corporate side is relatively low. This stable financial foundation is crucial, allowing the company to allocate capital towards other strategic growth areas and investments.

F45 Training's high-retention membership base acts as a significant cash cow, generating consistent revenue through subscriptions and class packs. This loyalty is fueled by F45's unique community-focused, team-training atmosphere, which fosters strong member engagement.

Established studios benefit from predictable cash flow due to high member retention, significantly reducing the need for costly new customer acquisition. Initiatives like the F45 Challenge and Passport Program further solidify this member stickiness, bolstering the cash cow status.

Equipment & Merchandise Sales

Sales of F45 branded equipment and merchandise to studios and directly to members are likely a consistent revenue source. These sales capitalize on the brand's established market presence, contributing to cash flow with minimal additional marketing spend.

While not the main profit driver, this segment offers a stable income stream. For instance, in 2024, F45 reported that equipment sales to franchisees remained a key component of their revenue model, supporting studio launches and ongoing operations.

- Stable Revenue: Equipment and merchandise sales provide a predictable income.

- Brand Leverage: Capitalizes on F45's existing market share.

- Low Marketing Cost: Generates cash flow with reduced promotional investment.

- Franchisee Support: Essential for new studio setups and ongoing operational needs.

Licensing of Workout Content

F45 Training's extensive library of functional training movements and daily changing workout programs, licensed to its global franchisee network, is a prime example of a cash cow. This high-margin revenue stream is generated from proprietary content that requires relatively low ongoing investment for distribution across its established studios. In 2023, F45 reported that its franchise revenue, largely driven by these content licenses, contributed significantly to its overall financial performance, demonstrating the sustained profitability of this offering.

The licensing of this workout content is a core asset for F45, ensuring a consistent and high-quality brand experience for members worldwide. This strategic advantage allows the company to maintain its market share and reinforces its unique value proposition without substantial incremental costs. The predictable nature of these licensing fees provides a stable income base, characteristic of a cash cow in the BCG matrix.

- High-Margin Revenue: The licensing of workout content generates substantial profit due to low distribution costs.

- Proprietary Asset: F45's unique program library is a key differentiator and a consistent revenue source.

- Brand Consistency: Content licensing ensures a uniform quality and experience across all global franchises.

- Low Investment: Minimal additional capital is needed to distribute this content to existing studios.

Established F45 studios in mature markets represent significant cash cows, offering predictable revenue streams and robust profit margins due to strong brand loyalty and consistent customer bases. These locations are crucial for generating the stable cash flow needed to support other business initiatives, as evidenced by their continued substantial contribution to overall revenue in early 2024.

The standardized franchise model, including consistent workout programs and marketing support, underpins the reliable recurring revenue from franchise fees and royalties. In 2023, F45's system-wide revenue of $130.5 million was heavily influenced by these franchise-based income sources, highlighting the stability of this model.

High member retention, driven by F45's community atmosphere and programs like the F45 Challenge, further solidifies these studios as cash cows by reducing the need for costly new customer acquisition and ensuring consistent subscription revenue. The licensing of F45's proprietary workout content also contributes significantly, providing a high-margin, low-investment revenue stream that ensures brand consistency globally.

| Category | Description | Financial Impact | 2023 Data Point |

|---|---|---|---|

| Mature Franchises | Established studios in saturated markets | Stable, predictable cash flow; high profit margins | Significant contributor to overall revenue |

| Workout Content Licensing | Proprietary training programs and daily workouts | High-margin revenue, low ongoing investment | Key driver of franchise revenue |

| Member Retention | Loyal customer base with recurring subscriptions | Consistent revenue, reduced acquisition costs | Fueled by community and challenge programs |

Preview = Final Product

F45 Training BCG Matrix

The preview you see is the identical F45 Training BCG Matrix document you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, will be delivered to you in its complete, unwatermarked form, ready for immediate strategic application.

Dogs

Underperforming or closed F45 studio locations are considered the Dogs in the BCG Matrix. These are studios with low member engagement, high customer churn, or ineffective management, leading to minimal revenue generation and potential financial losses.

While F45 announced robust growth in 2024, it's important to note that historical data from 2022 indicated a 15.6% franchise closure rate. This suggests that some individual studios faced challenges in achieving sustained profitability, particularly in markets that were either highly competitive or already saturated with fitness options.

These struggling locations can become a drain on company resources, consuming capital and management attention without delivering substantial returns. Addressing these underperforming units is crucial for optimizing the overall portfolio and ensuring efficient resource allocation.

Markets with stagnant growth or intense competition represent F45 Training's Dogs in the BCG Matrix. These are often mature geographical areas where the boutique fitness boom has slowed, or where established competitors already hold significant market share, leaving F45 with a low percentage of customers. For instance, in some established North American or European urban centers, the saturation of fitness studios means F45 struggles to gain traction, potentially leading to low revenue generation.

In these "Dog" markets, F45 may find that the cost of acquiring new members or expanding its presence outweighs the potential returns. This can turn these regions into cash traps, draining resources without delivering substantial growth. Historically, F45 has faced challenges in certain international markets where local fitness preferences or economic conditions did not align with its model, illustrating the characteristics of these "Dog" segments.

Some older F45 workout programs, perhaps those that haven't been updated in years, might be falling out of favor. Think of fitness trends; what was popular five years ago might not be today. If F45 doesn't refresh these legacy formats, they could struggle to attract new members and see existing ones move on. This means less revenue from these specific offerings.

Ineffective Digital Engagement Tools

Ineffective digital engagement tools, such as an underutilized F45 app feature or a poorly adopted online community platform, would fall into the Dogs category of the BCG Matrix. These digital assets, despite F45's significant investment in technology, demonstrate low member adoption and a lack of seamless user experience. Consequently, they possess a low market share within the broader digital fitness engagement space and yield minimal return on the capital invested in their development and maintenance.

The underperformance of these tools can be attributed to several factors:

- Low User Adoption Rates: For instance, if a new F45 workout tracking feature is only used by less than 10% of the active member base, it signifies a failure to capture market interest.

- Poor User Experience: A clunky interface or frequent technical glitches can deter members, leading to low engagement metrics. In 2023, customer satisfaction scores for poorly designed fitness apps often dipped below 50%.

- Limited Competitive Advantage: If these tools do not offer a unique or superior experience compared to competitors' offerings, they will struggle to gain traction.

- Negligible ROI: The cost associated with developing and maintaining these digital assets outweighs any tangible benefits or revenue generated, reflecting their status as Dogs.

Unsuccessful Pilot Programs

F45 Training's unsuccessful pilot programs would be categorized as Dogs in the BCG Matrix. These are ventures that showed little promise from the start or failed to gain momentum after initial testing. For instance, any experimental class formats or localized partnership initiatives that didn't attract members or prove profitable would fit here. These programs, if not managed efficiently, can drain capital without contributing to overall growth.

By mid-2024, F45 has been actively streamlining its operations, which often involves cutting ties with underperforming initiatives. While specific details on failed pilots aren't publicly disclosed, the company's strategic shifts suggest a focus on optimizing its core offerings. For example, if a pilot program involving a niche fitness trend, like a specific type of functional training, saw less than 5% membership uptake in its test markets, it would likely be flagged for divestment.

- Underperforming Pilot Programs: Ventures like experimental class types or localized, unscalable partnerships that failed to gain traction.

- Resource Drain: These initiatives tie up capital and management attention with low potential for return.

- Strategic Divestment: F45's focus on efficiency means quickly cutting or re-evaluating pilots with minimal market adoption.

- Low Growth Prospects: Programs that don't demonstrate significant member acquisition or revenue generation are prime candidates for the Dog quadrant.

F45's "Dogs" represent underperforming studio locations or initiatives with low market share and minimal growth potential. These are often studios in saturated markets or those with declining member engagement, such as older workout formats that haven't been updated to reflect current fitness trends. For example, a studio in a highly competitive urban area that consistently struggles to meet membership targets would be classified as a Dog.

These segments consume resources without generating substantial returns, impacting overall profitability. F45's strategic reviews in 2024 likely identify these underperformers for potential closure or restructuring to optimize capital allocation. Historically, a 15.6% franchise closure rate noted in 2022 highlights the challenges some individual studios faced, illustrating the "Dog" scenario.

Ineffective digital tools, like an underutilized F45 app feature with low user adoption, also fall into this category. If such a feature sees less than 10% usage among active members, it signifies a low market share within digital fitness engagement and a poor return on investment.

Unsuccessful pilot programs, such as experimental class formats that fail to attract members, are also considered Dogs. These ventures, if they show minimal market adoption, are prime candidates for divestment as part of F45's efficiency drive in 2024.

Question Marks

F45's foray into recovery services, such as infrared saunas and cold plunges under the 'Recovery by F45 Training' banner, positions them as a Question Mark in the BCG matrix. This segment is experiencing rapid growth within the broader wellness industry, a trend that continued strongly in 2024 as consumers increasingly prioritized holistic health. While F45 has a strong brand in functional fitness, its market share in specialized recovery is still developing.

The recovery market is highly competitive, with dedicated studios and specialized equipment providers already established. For F45 to succeed, substantial investment will be necessary to build brand recognition and capture market share in this nascent area. This strategic move reflects a broader industry trend of fitness companies expanding their service portfolios to capture more of the consumer's wellness spending, a trend that analysts project will continue through 2025.

F45's partnership with telehealth provider Dr. B for GLP-1 medications represents a strategic move into the burgeoning health tech and wellness sector, a market poised for significant expansion. This collaboration taps into a high-growth area, aligning with the increasing consumer demand for integrated health solutions.

Despite the promising nature of this niche, F45's current market share within this specific medical-fitness integration is notably small. This suggests that while the opportunity exists, F45 is an early entrant, facing the challenge of establishing a strong foothold.

These types of telehealth initiatives demand considerable investment in technology, regulatory compliance, and marketing to achieve successful integration. The ability to effectively execute these elements will be crucial in transforming the potential of this partnership into tangible market share and revenue growth for F45.

F45 Training's introduction of a comprehensive strength training program with functional racks for its flagship brand is a strategic move to capitalize on the rapidly expanding strength training market. This initiative aims to secure a more substantial slice of a sector experiencing significant growth.

While the broader strength training market is a high-growth area, F45's specific enhanced offering is still in its nascent stages, meaning its market share within this particular niche is currently under development. This suggests a need for continued investment to drive widespread adoption and build momentum.

The global strength training equipment market was valued at approximately $15.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 5.8% through 2030, indicating substantial opportunity for F45's new program.

New Uncharted International Markets

Entering entirely new, uncharted international markets places F45 Training squarely in the Question Mark category of the BCG Matrix. These regions, where F45 currently has minimal to no brand recognition, represent significant growth opportunities but also carry substantial risk. The potential for high future revenue exists if F45 can effectively penetrate these nascent markets.

These markets demand considerable initial investment in brand building, operational setup, and tailored marketing strategies to resonate with local consumer preferences. While the long-term growth prospects are attractive, the current low market share necessitates careful planning and execution. For instance, entering a country like Vietnam, with a rapidly growing middle class and increasing interest in fitness, would be a prime example of an uncharted market.

- High Growth Potential: Emerging economies often exhibit higher GDP growth rates, translating to increased disposable income for fitness services.

- Low Market Share: F45's brand awareness and existing customer base in these new territories are negligible, requiring significant effort to establish a foothold.

- Substantial Investment Required: Capital will be needed for market research, localization of training programs, marketing campaigns, and establishing initial franchise locations.

- Strategic Localization: Success hinges on adapting the F45 model, including class formats and pricing, to suit local cultural norms and economic conditions.

B2B Wellness and Corporate Partnerships

Exploring B2B wellness programs and corporate partnerships is a significant growth avenue for F45, aligning with broader fitness franchise trends. This segment offers substantial revenue potential through bulk memberships and dedicated corporate packages. For instance, the global corporate wellness market was valued at approximately $53 billion in 2023 and is projected to grow substantially in the coming years.

However, if F45's current penetration and market share within the corporate wellness sector are low, these initiatives are considered Question Marks. They demand focused sales and marketing investment to secure large contracts and establish a foothold. In 2023, F45 reported a strategic focus on expanding its B2B offerings, though specific market share data in this niche is not yet widely publicized.

- B2B Growth Potential: Corporate wellness programs represent a high-potential market for fitness franchises.

- Investment Required: Securing corporate partnerships necessitates dedicated sales and marketing resources.

- Market Penetration: Low current market share in this sector classifies B2B initiatives as Question Marks.

- Strategic Focus: F45 is actively pursuing B2B expansion, aiming to capture a larger share of this growing market.

F45's ventures into specialized recovery services, telehealth integrations like GLP-1 medication partnerships, and new strength training programs all represent potential growth areas. These initiatives are characterized by high market growth potential but currently hold a low market share for F45, making them classic Question Marks in the BCG matrix. Significant investment is required to build brand recognition and capture market share in these developing segments.

The success of these Question Marks hinges on strategic execution, including substantial investment in marketing, technology, and localization for international markets. For example, the corporate wellness market, valued at $53 billion in 2023, presents a significant opportunity, but F45's low penetration necessitates focused B2B sales efforts. Similarly, the expanding strength training equipment market, projected for robust growth, requires F45 to effectively promote its enhanced offerings.

The company's expansion into uncharted international markets also falls under the Question Mark category. These regions offer high growth potential due to increasing disposable income but demand considerable upfront investment for brand building and market adaptation. F45's ability to navigate these challenges and effectively execute its strategies will determine whether these Question Marks can evolve into Stars or Cash Cows.

The strategic positioning of these new F45 initiatives as Question Marks highlights the company's proactive approach to capturing emerging market trends and expanding its service portfolio. The critical factor for success will be the allocation of resources and the effectiveness of their market penetration strategies in these high-growth, low-share segments.

BCG Matrix Data Sources

Our F45 Training BCG Matrix leverages comprehensive data from franchisee performance reports, market expansion data, and industry growth forecasts. This ensures accurate representation of studio performance and market potential.