Exact Sciences Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exact Sciences Bundle

Unlock the strategic potential of your product portfolio with a detailed look at the BCG Matrix. Understand the current standing of your offerings as Stars, Cash Cows, Dogs, or Question Marks, and identify opportunities for growth and resource allocation. Purchase the full report for a comprehensive analysis and actionable insights to drive your business forward.

Stars

The Cologuard Plus test, introduced in early 2025, is a prime candidate for the Star category within Exact Sciences' BCG Matrix. Its improved accuracy, targeting a nearly 40% reduction in false positives while preserving high sensitivity for colorectal cancer detection, positions it for significant market growth.

This advanced diagnostic tool is set to reinforce Exact Sciences' dominant presence in the expanding non-invasive colorectal cancer screening sector. This market is anticipated to experience a compound annual growth rate (CAGR) between 6.1% and 7.3% from 2029 to 2032, underscoring the strong demand for innovative solutions like Cologuard Plus.

Benefiting from existing Medicare reimbursement and its inclusion in established clinical guidelines, Cologuard Plus is poised for robust market penetration and widespread adoption. These factors contribute to its strong potential for high revenue generation and market share capture.

The Oncodetect test, a new molecular residual disease (MRD) and recurrence monitoring solution, launched in April 2025, is positioned as a Star within Exact Sciences' portfolio. This classification stems from its strategic targeting of the burgeoning liquid biopsy and precision oncology markets, a sector projected to see significant expansion. The diagnostics segment alone within precision oncology is expected to grow at an impressive 8.6% compound annual growth rate (CAGR).

Clinical data highlights the Oncodetect test's robust performance, demonstrating its ability to detect residual disease up to ten months earlier than traditional imaging methods. This early detection capability is a key differentiator. Furthermore, the test is anticipated to secure Medicare reimbursement in the second quarter of 2025, a crucial step for market penetration and adoption.

By focusing on this nascent but rapidly expanding market, Exact Sciences aims to establish a dominant presence for Oncodetect. The company will be competing with established players such as Natera and Guardant Health, both of whom have a significant footprint in the MRD testing space.

The Cancerguard test, Exact Sciences' multi-cancer early detection (MCED) offering, is positioned as a Star within the BCG matrix. Its planned launch as a laboratory-developed test (LDT) in the latter half of 2025 targets a substantial growth market, aiming to fill critical gaps in current cancer screening protocols.

This MCED test holds significant promise by addressing the majority of cancers that currently lack effective early detection methods. The potential to identify multiple cancers from a single blood draw could revolutionize preventative healthcare.

Early performance data highlights Cancerguard's strong sensitivity, particularly for aggressive cancer types. This capability is crucial for transforming cancer screening, offering a proactive approach to patient health.

Global Expansion of Oncotype DX

The global expansion of the Oncotype DX precision oncology test is a key driver for Exact Sciences' Star quadrant. This continued international adoption fuels growth in the precision oncology diagnostics market, a sector anticipated to expand at an 8.6% compound annual growth rate. The test's increasing reach across various geographies solidifies its position as a leading diagnostic tool.

- Global Reach: Oncotype DX is increasingly available in markets beyond the United States, expanding its revenue base.

- Market Growth: The precision oncology diagnostics market is robust, with projected growth supporting Oncotype DX's trajectory.

- Commercial Strength: Exact Sciences' established sales and marketing infrastructure facilitates this international expansion.

- Clinical Validation: Strong clinical evidence underpins the test's utility, encouraging adoption by healthcare providers worldwide.

Pipeline Innovation in Liquid Biopsy

Exact Sciences' commitment to its broad liquid biopsy pipeline, extending beyond current offerings, firmly places it in the Star category. This includes significant investment in its blood-based colorectal cancer screening test, with anticipated BLUE-C results by mid-2025.

- Pipeline Investment Exact Sciences is channeling substantial resources into developing a comprehensive suite of liquid biopsy tests for various cancers.

- Colorectal Cancer Screening The blood-based colorectal cancer screening test, a key component of this pipeline, is a prime example of a Star initiative.

- Future Growth Potential This strategic focus on non-invasive diagnostics is designed to secure future revenue streams and market dominance as the industry shifts towards less invasive methods.

- Market Leadership Aspiration Through ongoing research and development, alongside strategic acquisitions, Exact Sciences aims to lead the rapidly evolving liquid biopsy market.

Stars represent Exact Sciences' products with high market share in high-growth industries. The Cologuard Plus test, launched in early 2025, targets a nearly 40% reduction in false positives, solidifying its position in the expanding non-invasive colorectal cancer screening sector, which is projected for 6.1%-7.3% CAGR from 2029-2032.

The Oncodetect test, a new MRD and recurrence monitoring solution introduced in April 2025, is poised for significant growth in the precision oncology market, expected to expand at an 8.6% CAGR. Its ability to detect residual disease up to ten months earlier than imaging methods is a key differentiator.

Cancerguard, a planned multi-cancer early detection (MCED) test for late 2025, aims to revolutionize preventative healthcare by identifying multiple cancers from a single blood draw, addressing a critical gap in current screening protocols.

The global expansion of Oncotype DX, already a leader in precision oncology diagnostics, further bolsters Exact Sciences' Star quadrant. The company's robust liquid biopsy pipeline, including a blood-based CRC screening test with anticipated BLUE-C results by mid-2025, underscores its commitment to future market leadership.

| Product | Market Position | Growth Potential | Key Differentiator |

|---|---|---|---|

| Cologuard Plus | Dominant in non-invasive CRC screening | High (6.1%-7.3% CAGR 2029-2032) | Improved accuracy (reduced false positives) |

| Oncodetect | Emerging in MRD and recurrence monitoring | High (8.6% CAGR for precision oncology diagnostics) | Early disease detection (up to 10 months earlier) |

| Cancerguard | Targeting MCED market | High (addressing unmet screening needs) | Multi-cancer detection from single blood draw |

| Oncotype DX (Global) | Leading in precision oncology diagnostics | High (8.6% CAGR) | Established clinical validation and global reach |

| Liquid Biopsy Pipeline | Developing broad non-invasive diagnostics | High (driven by shift to less invasive methods) | Comprehensive suite of tests for various cancers |

What is included in the product

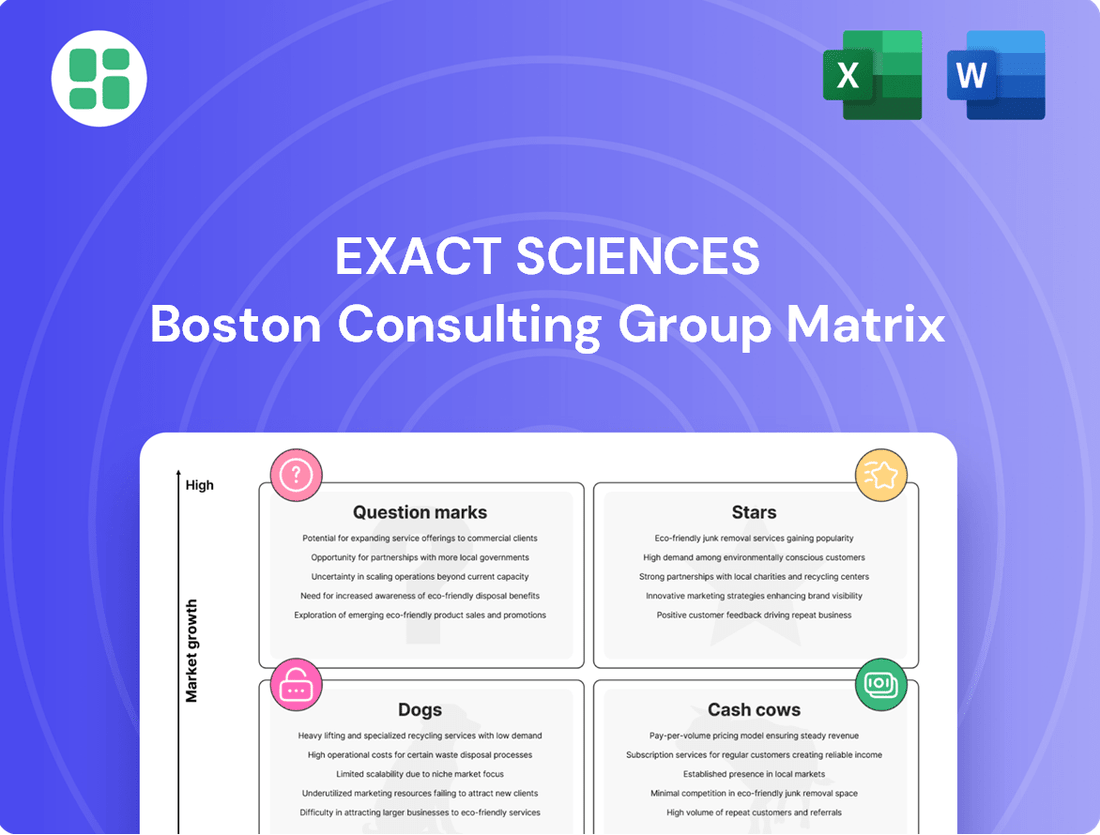

The Exact Sciences BCG Matrix analyzes its product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

It guides investment decisions, highlighting units to grow, maintain, or divest.

A visual snapshot of your portfolio's health, simplifying complex strategic decisions.

Cash Cows

The original Cologuard test stands as a substantial Cash Cow for Exact Sciences. In 2023 alone, it achieved $1.9 billion in sales, with over 3.7 million tests administered. This strong performance contributed significantly to the company's total screening revenue, which reached $2.10 billion in 2024.

Cologuard enjoys a commanding position in the non-invasive colorectal cancer screening market. Its established Medicare coverage and integration into national screening guidelines have solidified its market dominance, reducing the need for heavy promotional spending.

Even with the introduction of newer iterations like Cologuard Plus, the original test remains a primary revenue driver. Its widespread adoption and a consistent base of patients requiring rescreening ensure its continued profitability with minimal ongoing marketing investment.

The Oncotype DX test, especially for its established breast cancer recurrence indications, firmly sits in the Cash Cow quadrant of the BCG Matrix for Exact Sciences. This diagnostic has been a cornerstone in predicting chemotherapy benefit for more than two decades, making it a vital contributor to the company's Precision Oncology segment, which generated $655 million in revenue in 2024.

With a commanding market share in the precision oncology diagnostics space, a sector experiencing an estimated compound annual growth rate of 8.6%, Oncotype DX delivers consistent and reliable cash flow. The ongoing need for its proven predictive capabilities means that while investment is required for market presence and continued clinical validation, these outlays are typically stable and predictable, supporting its Cash Cow status.

Exact Sciences' established commercial infrastructure, encompassing its dedicated sales force and the ExactNexus technology platform, acts as a significant Cash Cow. This well-developed network, honed through years of successfully bringing Cologuard and Oncotype DX to market, efficiently supports current offerings and provides a powerful launchpad for new products.

This existing commercial engine minimizes the requirement for substantial new investments with each product introduction, allowing Exact Sciences to leverage its established channels effectively. The efficiency of this infrastructure directly contributes to healthy gross margins, underscoring its role as a reliable revenue generator for the company.

Recurring Revenue from Rescreening Patients

The recurring revenue from rescreening patients is a significant Cash Cow for Exact Sciences. Cologuard's recommendation for rescreening every three years creates a predictable and stable revenue stream, as seen with the company reporting a 21% increase in revenue to $2.2 billion in 2023, partly driven by repeat testing.

This built-in repeat business minimizes the need for extensive new patient acquisition efforts, which are typically more costly than retaining existing customers. The company's focus on patient compliance and care gap programs further solidifies this recurring revenue model.

- Predictable Revenue: Cologuard's 3-year rescreening interval ensures a consistent demand for the test.

- Cost Efficiency: Retaining existing patients for rescreening is generally more cost-effective than acquiring new ones.

- Revenue Growth: In 2023, Exact Sciences saw a 21% revenue increase, demonstrating the strength of its recurring revenue streams.

Strong Financial Health and Cash Flow Generation

Exact Sciences demonstrates robust financial health, a key characteristic of a Cash Cow. The company's substantial cash reserves and a growing adjusted EBITDA margin, reaching 14% in the third quarter of 2024, underscore this strength.

This strong financial foundation translates into significant operating and free cash flow generation. This consistent cash flow enables Exact Sciences to self-fund its research and development efforts and pursue strategic growth opportunities, highlighting a mature and self-sustaining core business.

- Strong Financial Health: Supported by significant cash reserves.

- Increasing Profitability: Achieved a 14% adjusted EBITDA margin in Q3 2024.

- Robust Cash Flow: Generates substantial operating and free cash flow.

- Self-Sustaining Operations: Funds R&D and strategic initiatives internally.

The established commercial infrastructure of Exact Sciences, including its sales force and ExactNexus platform, functions as a significant Cash Cow. This network, refined through years of marketing Cologuard and Oncotype DX, efficiently supports existing products and new launches, minimizing the need for substantial new investments.

The recurring revenue from rescreening patients, particularly with Cologuard's recommended three-year interval, creates a predictable and stable income stream. This built-in repeat business is more cost-effective than acquiring new customers, as evidenced by Exact Sciences' 21% revenue increase in 2023, partly due to repeat testing.

| Product/Asset | BCG Category | Key Financial Metric | Supporting Data |

| Cologuard | Cash Cow | Sales Revenue | $1.9 billion in 2023 |

| Oncotype DX | Cash Cow | Segment Revenue | $655 million in 2024 (Precision Oncology) |

| Commercial Infrastructure | Cash Cow | Gross Margins | Efficiently supports existing offerings |

| Recurring Rescreening Revenue | Cash Cow | Revenue Growth | 21% increase in 2023 |

What You’re Viewing Is Included

Exact Sciences BCG Matrix

The BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This ensures you get exactly what you see, with no watermarks, demo content, or hidden surprises, ready for your strategic planning needs.

Dogs

Older or less-adopted legacy tests at Exact Sciences, even if still offered, would likely reside in the Dogs quadrant of the BCG Matrix. These are products that have seen minimal market traction or are being superseded by more advanced diagnostic solutions.

Products in this category typically contribute very little to the company's overall revenue and hold a negligible market share. Operating in niche markets that are either stagnant or in decline, these legacy tests consume valuable resources without offering significant growth potential or profitability.

For instance, if Exact Sciences still offers an older, less sensitive genetic screening test that has been largely replaced by their newer, more accurate Cologuard or Guardant Health offerings, it would fit this description. Such tests, while perhaps still functional, do not align with the company's strategic growth objectives and represent a drain on R&D and marketing efforts.

Acquired in-process research and development assets that haven't met expectations or have faced significant impairment charges, like those potentially linked to the Thrive acquisition, can be categorized here if they aren't generating anticipated returns. These assets can consume capital and resources without bolstering market share or driving growth.

Exact Sciences reported impairment charges in 2024, possibly indicating situations where acquired assets are underperforming and not yielding the expected returns, thus tying up valuable company resources.

Products with low specificity and high false positives, like older generations of diagnostic tests, fall into the question mark category of the BCG matrix. These products, while potentially still generating some revenue, are less competitive due to their lower accuracy. For instance, early iterations of certain genetic screening tests might have exhibited higher false positive rates, leading to unnecessary follow-up procedures and patient anxiety.

While Exact Sciences has improved its offerings with products like Cologuard Plus, addressing specificity concerns for colorectal cancer, other legacy tests within their portfolio might still carry these drawbacks. Such products could be candidates for divestiture or discontinuation if their market share is declining and the cost of improvement outweighs potential returns. In 2023, Exact Sciences reported that its Cologuard test achieved a specificity of 86.6%, a significant improvement over earlier versions, but older, less specific tests would be categorized here.

Niche Products with Limited Market Potential

Niche products with limited market potential, often found in the Dogs category of the BCG Matrix, represent highly specialized diagnostic tests. These cater to very small patient populations or have restricted avenues for market expansion. For instance, a rare genetic disorder test might only have a few thousand potential patients globally, making significant market share acquisition challenging.

These specialized offerings may struggle with scalability, potentially becoming resource drains if they fail to capture a substantial portion of their narrow market. Their growth prospects in a wider sense are inherently minimal. For example, a diagnostic test for a condition affecting fewer than 1 in 50,000 people, even if it achieves 80% market penetration, will still represent a small overall revenue stream.

- Limited Patient Population: Products targeting rare diseases or very specific demographic groups inherently face restricted demand.

- Scalability Challenges: The specialized nature of production or distribution can hinder cost-effective scaling, even with high penetration.

- Resource Drain Potential: Without significant market share within their niche, these products can consume R&D and marketing resources without commensurate returns.

- Low Growth Prospects: The inherent limitations of the target market restrict the potential for substantial revenue growth over time.

Divested or Discontinued Products

Divested or discontinued products, like the Oncotype prostate test Exact Sciences previously sold, are historical footnotes in the company's strategic evolution. These ventures were identified as having limited market traction and subdued growth potential, prompting their removal to free up capital and focus for more strategic investments. For instance, the prostate test was part of a broader strategy to refine Exact Sciences' focus on its core oncology diagnostics.

- Divestiture Rationale: Products like the Oncotype prostate test were divested due to low market share and growth prospects.

- Resource Reallocation: Exits allow Exact Sciences to redirect financial and operational resources to more promising business areas.

- Portfolio Optimization: This strategy is crucial for maintaining a lean and focused product portfolio aligned with long-term growth objectives.

Dogs in Exact Sciences' portfolio represent legacy or underperforming products with low market share and minimal growth potential. These are typically older diagnostic tests that have been surpassed by newer, more advanced solutions, or acquired assets that have not met initial revenue expectations. For example, if Exact Sciences maintains an older genetic screening test with lower accuracy, it would likely fall into this category, consuming resources without contributing significantly to overall revenue. In 2024, Exact Sciences reported impairment charges, which could indicate underperforming acquired assets that are not generating expected returns, thus fitting the description of Dogs.

These products operate in stagnant or declining markets, offering little prospect of future profitability. Their low specificity, as seen in earlier diagnostic iterations, further limits their competitiveness. For instance, while Cologuard Plus has improved specificity, older tests might still exhibit higher false positive rates, making them less attractive. Products targeting very niche patient populations also fall into this category, facing inherent scalability challenges and limited growth prospects, even with high penetration within their narrow market.

| Product Category | Market Share | Growth Potential | Profitability | Example |

|---|---|---|---|---|

| Dogs | Low | Low | Low/Negative | Older, less sensitive genetic screening tests; Divested products like Oncotype prostate test |

Question Marks

Exact Sciences' blood-based colorectal cancer screening test is currently positioned as a Question Mark in its BCG matrix. The pivotal BLUE-C study results, anticipated mid-2025, are crucial for its future trajectory in the high-growth non-invasive screening market.

The test faces significant competition, notably from Guardant Health's Shield test, which gained FDA approval in July 2024. This competitive landscape means Exact Sciences must demonstrate clear advantages to capture market share.

While the convenience of a blood test offers potential for it to become a Star product, its current market share is minimal. Success hinges on robust clinical data, securing favorable reimbursement policies, and establishing a distinct competitive edge over existing and emerging alternatives.

Exact Sciences' future Multi-Cancer Early Detection (MCED) pipeline, beyond its Cancerguard EX efforts, is positioned as a Question Mark within the BCG Matrix. This segment is characterized by its innovative nature and potential for high growth, but it's also in its early stages and faces intense competition. Significant research and development investment is necessary, alongside navigating uncertain regulatory approvals and reimbursement landscapes.

The success of these developing MCED tests hinges on their capability to consistently prove superior sensitivity and specificity across a broad range of cancer types. For instance, by mid-2025, Exact Sciences aims to have data supporting the analytical validation of new MCED assays, a crucial step in demonstrating their potential efficacy and paving the way for clinical utility studies.

While Exact Sciences' Oncodetect is set to launch for colorectal cancer (CRC), its potential expansion into other areas like breast cancer places these future indications in the question mark category of the BCG Matrix. This signifies a high-growth market with promising future potential, but also considerable competition.

The molecular residual disease (MRD) market is indeed experiencing rapid growth, with projections indicating it could reach tens of billions of dollars by the end of the decade. However, Exact Sciences faces established players already operating within this space, meaning significant investment will be crucial.

To successfully penetrate these new cancer indications, Exact Sciences will need to demonstrate robust clinical data and execute a strong commercialization strategy. Gaining market share against competitors who have a head start will require substantial resources and a clear value proposition.

Early-Stage Research and Development Projects

Exact Sciences' early-stage research and development projects, including the exploration of novel biomarkers and advanced platforms like MAESTRO for minimal residual disease (MRD) detection, represent significant potential in the rapidly expanding cancer diagnostics market. These initiatives are characterized by high growth prospects but currently hold minimal market share, with considerable uncertainty surrounding their commercial success and market penetration. Significant investment in research and development is essential for these ventures to mature into future market leaders, or Stars.

These early-stage R&D efforts are crucial for Exact Sciences' long-term growth strategy, aiming to capture emerging opportunities in precision oncology. For instance, the MAESTRO platform is designed to address the critical need for early detection of cancer recurrence, a segment projected to grow substantially. The company's commitment to innovation in this space is underscored by its ongoing investment in exploring new diagnostic modalities that could redefine cancer care pathways.

- High Growth Potential: Exact Sciences is investing in areas like MRD detection, which is a rapidly expanding segment within cancer diagnostics, driven by advancements in personalized medicine.

- Low Market Share: Currently, these early-stage projects have a negligible market share, reflecting their developmental status and the significant hurdles to commercialization.

- Significant R&D Investment: The company allocates substantial resources to these initiatives, recognizing the need for extensive research, clinical validation, and regulatory approval processes.

- Commercial Viability Uncertainty: The ultimate market adoption and revenue generation from these R&D projects remain uncertain, typical of early-stage ventures in the biotech sector.

International Expansion into Untapped Markets

Exact Sciences might classify aggressive expansion into untapped international markets as a Question Mark in its BCG Matrix. This strategy involves significant investment in regions with low current market share but high potential for growth in cancer screening and precision oncology. For instance, entering a market like India, which has a rapidly growing population and increasing awareness of healthcare, could represent such a move. The company would need to navigate diverse regulatory landscapes and build commercial infrastructure, similar to its efforts in expanding its Cologuard test globally.

These ventures are characterized by substantial upfront capital requirements for market entry, securing regulatory approvals, and establishing commercial operations. The potential returns are high but inherently uncertain, mirroring the typical profile of Question Marks. For example, the global oncology market is projected to reach $475 billion by 2027, according to some industry analyses, highlighting the vast opportunity but also the competitive intensity Exact Sciences would face in new territories.

- High Investment, Uncertain Returns: Aggressive international expansion requires significant capital for market penetration and regulatory hurdles, with potential for substantial but unassured gains.

- Untapped Market Potential: Targeting regions with low Exact Sciences market share but high growth prospects in cancer screening and precision oncology aligns with the Question Mark strategy.

- Global Oncology Growth: The expanding global oncology market, with projections suggesting significant future value, underscores the potential rewards of successful international ventures.

Exact Sciences' foray into the multi-cancer early detection (MCED) market, beyond its established colorectal cancer screening, is a prime example of a Question Mark. While the potential for detecting multiple cancers from a single blood draw is immense, with the global MCED market anticipated to grow significantly, the company is still in the early stages of development and validation.

The company's pipeline includes tests for various cancers, each requiring extensive clinical trials and regulatory approvals. For instance, by mid-2025, Exact Sciences aims to have data supporting the analytical validation of new MCED assays, a crucial step in demonstrating their potential efficacy and paving the way for clinical utility studies.

Competition is fierce, with other biotech firms also developing MCED technologies. Exact Sciences must prove its tests offer superior sensitivity, specificity, and cost-effectiveness to gain traction and secure reimbursement, particularly in a market where established screening methods already exist for some cancers.

| Product/Initiative | Market Growth | Market Share | Potential | Current Strategy |

|---|---|---|---|---|

| MCED Pipeline (Non-CRC) | High | Low | High | Invest and Develop |

| Molecular Residual Disease (MRD) | High (projected tens of billions by 2030) | Low | High | R&D Investment, Platform Development (e.g., MAESTRO) |

| International Market Expansion | Variable (High in emerging markets) | Low | High | Strategic Entry, Regulatory Navigation |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, industry growth forecasts, and competitor analysis to provide a clear strategic overview.