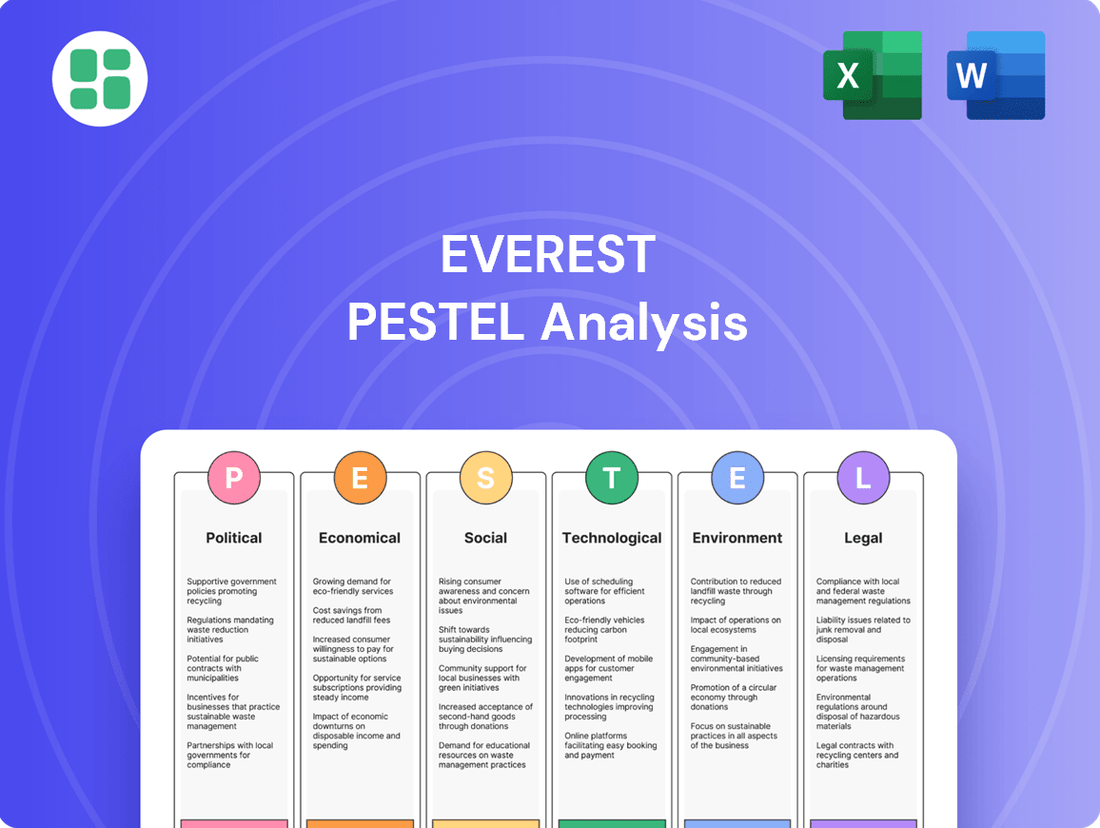

Everest PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Everest Bundle

Unlock the full picture of Everest's external environment with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its path. Gain a strategic advantage by identifying opportunities and mitigating risks. Download the complete analysis now for actionable intelligence.

Political factors

Government housing policies, such as the infrastructure bill announced in July 2024, are designed to speed up the construction of new homes and essential infrastructure. This can boost demand for building materials and home improvement products by creating more construction projects and encouraging existing homeowners to renovate.

Furthermore, specific government funding, like the £1 billion committed to improving home insulation for 300,000 households, directly stimulates the market for energy-efficient building solutions. These programs can lead to increased sales for companies offering insulation, energy-saving windows, and related services.

Brexit continues to cast a long shadow over supply chains, particularly for the construction sector. New customs procedures and evolving trade agreements mean that getting essential materials into the UK is more complex and often more expensive. For instance, reports in late 2024 indicated that lead times for certain imported building components had increased by as much as 20%, directly impacting project timelines and costs.

The labor market within the UK construction industry has also been significantly affected. A noticeable shortage of skilled workers, many of whom previously came from EU nations, is a persistent challenge. This scarcity has driven up recruitment expenses, with some firms reporting a 15% increase in hiring costs for specialized roles. Consequently, there's a growing emphasis on bolstering domestic training programs to fill these critical skill gaps.

Significant updates to UK building regulations, effective April 2024, mandate improved sustainability and energy efficiency. These changes impact product specifications, with updated U-values and renewable energy integration requirements directly affecting demand for items such as windows and doors.

Political Stability and Consumer Confidence

Political stability plays a crucial role in shaping consumer confidence, directly impacting discretionary spending on home improvements. For instance, the ongoing geopolitical tensions in Eastern Europe throughout 2024 and into early 2025 have created an environment of uncertainty, leading many households to postpone significant renovation projects. This caution is reflected in consumer sentiment surveys, which often show a dip in confidence during periods of heightened political risk.

When political landscapes are stable, consumers are more likely to feel secure about their financial future, encouraging them to invest in their homes. Conversely, periods of political uncertainty, such as upcoming elections or significant policy shifts, can make consumers more hesitant to commit to large expenditures like home renovations. This hesitancy can be amplified by concerns about economic stability, which is often intertwined with political developments.

- Consumer confidence indices, such as the Conference Board Consumer Confidence Index, often correlate with political stability, showing dips during periods of heightened uncertainty.

- Geopolitical events in 2024 have demonstrably impacted consumer sentiment globally, leading to a more cautious approach to discretionary spending on items like home improvements.

- Economic policies enacted by stable governments can foster a more predictable environment, encouraging investment in long-term projects like home renovations.

Taxation Policies Affecting Businesses and Consumers

Changes in taxation policies significantly impact both consumers and businesses. For instance, shifts in property transaction taxes can directly affect the affordability of home improvements, a key market for companies like Everest. Similarly, adjustments to corporate tax rates or employment taxes can alter a company's profitability and influence its pricing strategies for bids on projects.

Recent budgets have highlighted potential increases in employment and tax costs for businesses. For example, the UK government's 2024 budget proposals included adjustments to National Insurance contributions, which, while offering some relief to employees, can still represent an increased cost for employers. These kinds of changes directly feed into the cost structures of construction firms, affecting how they price their tender submissions.

- Property Transaction Taxes: Changes in stamp duty or capital gains tax on property sales can influence consumer spending on renovations and new builds.

- Corporate Tax Rates: Fluctuations in corporate tax can impact a company's net profit, affecting investment in new equipment or expansion.

- Employment Taxes: Increases in employer National Insurance contributions or other payroll taxes directly raise operating costs for businesses.

- VAT Adjustments: Changes in Value Added Tax (VAT) rates on building materials or services can affect the final price for consumers and the cost for contractors.

Government initiatives, such as the £1 billion commitment to home insulation upgrades for 300,000 households announced in 2024, directly boost the market for energy-efficient building solutions. New UK building regulations, effective April 2024, mandate higher sustainability standards, influencing product specifications for items like windows and doors.

Political stability is a key driver of consumer confidence, with geopolitical uncertainties in 2024 impacting discretionary spending on home improvements. For example, consumer confidence indices often show dips during periods of heightened political risk, leading to postponed renovation projects.

Changes in taxation policies, including property transaction taxes and corporate tax rates, significantly affect both consumers and businesses. Adjustments to employment taxes, like National Insurance contributions, can alter a company's profitability and influence pricing strategies.

| Policy/Factor | Impact on Everest (Example) | Data/Trend (2024-2025) |

|---|---|---|

| Government Housing Policies (Infrastructure Bill) | Increased demand for building materials and renovation services. | Projects aiming to speed up new home construction and infrastructure development. |

| Energy Efficiency Grants | Stimulates sales of insulation and energy-saving products. | £1 billion allocated for insulating 300,000 homes. |

| Building Regulations (April 2024) | Demand for products meeting higher sustainability and U-value standards. | Mandatory improvements in energy efficiency for new builds and renovations. |

| Brexit Impact on Supply Chains | Increased costs and lead times for imported components. | Reports of up to 20% increase in lead times for certain building components. |

| Skilled Labor Shortages | Higher recruitment costs and potential project delays. | Estimated 15% increase in hiring costs for specialized construction roles. |

| Political Stability & Consumer Confidence | Hesitancy in discretionary spending during uncertain times. | Geopolitical tensions in Eastern Europe affecting consumer sentiment. |

| Taxation Policies (e.g., Employment Tax) | Impact on operating costs and pricing. | Adjustments to National Insurance contributions affecting employer costs. |

What is included in the product

This Everest PESTLE analysis examines the external macro-environmental factors influencing the mountain's unique challenges and opportunities across political, economic, social, technological, environmental, and legal dimensions.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

High inflation continues to be a significant factor impacting the UK economy, directly translating into increased costs for essential raw materials like steel, timber, and cement. These materials are fundamental building blocks for a vast array of home improvement products, making their price fluctuations critical for the sector.

While there have been some indications that certain material prices are beginning to stabilize or even decrease, the overarching inflationary environment means that overall operating expenses for suppliers and manufacturers remain elevated. This sustained pressure on costs directly impacts profit margins throughout the supply chain.

For example, the UK's Consumer Price Index (CPI) remained at 2.3% in April 2024, a slight decrease from 3.2% in March 2024, but still above the Bank of England's 2% target. This persistent inflation means that the cost of goods, including raw materials, continues to be a challenge for businesses in the home improvement sector.

Interest rates, as determined by the Bank of England, have a significant impact on mortgage affordability. When rates rise, so do mortgage payments, making it more expensive for individuals to purchase homes or finance renovations. This can lead to a slowdown in the housing market as potential buyers become more cautious about taking on new debt.

Looking ahead, there's a possibility of interest rate cuts towards the end of 2024 or into 2025. For instance, the Bank of England's base rate was held at 5.25% through much of early 2024, but market expectations have shifted towards potential reductions. Such a move could lower mortgage rates, potentially boosting housing market activity and improving affordability for consumers.

Consumer disposable income is a major factor influencing spending on home improvements, as these projects are often discretionary. In 2024, despite economic headwinds, renovation activity in the UK remained robust, with more than half of homeowners undertaking improvements.

Median spending on home renovations saw a significant increase in 2024, indicating a willingness to invest in property upgrades even with tighter budgets. This trend highlights the resilience of the home improvement sector, driven by homeowners prioritizing their living spaces.

Housing Market Activity and Demand

The UK housing market's health, measured by sales volume and new construction starts, significantly influences the demand for home improvement goods. Despite recent headwinds, there's a positive outlook for 2024, with expectations of increased construction activity fueled by potentially lower mortgage rates and stabilized new home prices.

Data from the Office for National Statistics (ONS) indicated that in the year to March 2024, average UK house prices increased by 1.1%, a slight slowdown from previous periods but still showing resilience. This stability, coupled with anticipated mortgage rate adjustments, could encourage more transactions and subsequent renovation projects.

- Sales Volume: The number of property transactions in the UK for the fiscal year 2023-2024 was estimated to be around 1.1 million, a decrease from the previous year but showing signs of stabilization.

- New Builds: In the final quarter of 2023, there were approximately 35,000 new residential dwellings started in England, a figure that industry bodies hope will see a modest increase in 2024.

- Mortgage Rates: Average fixed mortgage rates for a 75% loan-to-value mortgage have seen fluctuations, with some lenders offering rates below 4.5% in early 2024, potentially boosting buyer confidence.

Economic Growth Forecasts for the UK

The UK's economic growth outlook significantly shapes confidence for both consumers and businesses, directly affecting investment decisions across various sectors, including home improvements. For instance, the Office for Budget Responsibility (OBR) projected in their March 2024 Economic and Fiscal Outlook that the UK economy would grow by 0.8% in 2024, a slight upward revision from their autumn forecast.

The construction industry is facing headwinds, with estimates suggesting a slight contraction in 2024. This is largely attributed to persistent inflation and elevated operating costs. However, looking further ahead, the long-term trajectory for construction remains positive, with forecasts anticipating a return to growth as economic conditions stabilize.

Key economic growth factors impacting the UK include:

- GDP Growth Projections: The OBR forecasts a 1.9% GDP growth for 2025, indicating a strengthening economic environment.

- Inflationary Pressures: While easing, inflation continues to influence construction material costs and consumer spending power.

- Interest Rate Environment: The Bank of England's monetary policy decisions on interest rates will continue to impact borrowing costs for businesses and consumers, affecting investment in new projects.

- Consumer Confidence: Improved economic sentiment, driven by growth forecasts, is expected to boost consumer confidence and discretionary spending, including home improvement projects.

The UK economy is navigating a complex landscape shaped by persistent inflation and fluctuating interest rates. While inflation showed signs of easing in early 2024, remaining above the Bank of England's target, it continues to drive up costs for essential materials in the home improvement sector. The Bank of England's monetary policy, particularly its decisions on interest rates, will be a critical determinant of mortgage affordability and overall consumer spending power.

Despite economic challenges, consumer spending on home improvements has remained resilient, with homeowners prioritizing their living spaces. The housing market, though experiencing a slowdown in transactions compared to previous years, shows signs of stabilization. Projections for modest GDP growth in 2024 and a stronger outlook for 2025 suggest a gradual improvement in the economic environment, which could further stimulate investment in renovations.

| Economic Factor | Data Point | Implication for Home Improvement |

|---|---|---|

| Inflation (CPI) | 2.3% (April 2024) | Elevated costs for raw materials, impacting profit margins. |

| Bank of England Base Rate | 5.25% (Held through early 2024) | Higher borrowing costs, potentially dampening demand for mortgages and renovations. |

| UK GDP Growth Forecast | 0.8% (2024, OBR March 2024) | Suggests a cautious but improving economic environment, supporting consumer confidence. |

| UK GDP Growth Forecast | 1.9% (2025, OBR March 2024) | Indicates a strengthening economy, likely boosting discretionary spending on home improvements. |

| Average UK House Price Growth | 1.1% (Year to March 2024, ONS) | Stability in the housing market can encourage transactions and subsequent renovation activity. |

What You See Is What You Get

Everest PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Everest PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the iconic mountain. Gain valuable insights into the challenges and opportunities surrounding Everest.

Sociological factors

The United Kingdom's population is getting older, with a significant portion of property owners being individuals aged 55 and above. This demographic shift is a key sociological factor influencing the housing market.

This trend is expected to drive increased demand for home modifications that improve accessibility, safety, and overall comfort for older residents. Think about features like easy-access doors, stairlifts, or low-threshold showers.

In 2023, the Office for National Statistics reported that individuals aged 65 and over owned approximately 79% of all residential properties in the UK. This highlights the substantial purchasing power and influence of this age group on housing needs and renovations.

The lingering effects of the pandemic have significantly amplified the importance of home comfort and visual appeal, with consumers increasingly investing in their living spaces. This trend is directly impacting industries like home renovation and construction, as people prioritize functionality and aesthetics. For instance, a 2024 survey indicated that 65% of homeowners planned to undertake home improvement projects, with a substantial portion focusing on enhancing natural light and visual integration with the outdoors.

This heightened focus translates into a growing demand for products that offer both utility and style, such as energy-efficient, customizable windows and doors. These elements not only improve a home's comfort by regulating temperature but also contribute to its overall aesthetic value. The market for high-performance windows saw a 7% growth in 2024, driven by consumer desire for improved living environments and increased property value.

While DIY projects are popular for smaller home improvements, the demand for professional installation services remains strong, especially for complex jobs. For instance, a 2023 survey indicated that 65% of homeowners preferred professional installation for major renovations like window replacements, citing concerns about quality and warranty.

Everest's strategy of emphasizing professional installation aligns with this trend, targeting homeowners who prioritize durability and expert craftsmanship for significant investments such as conservatories and high-performance windows. This approach addresses the need for specialized skills and tools that surpass typical DIY capabilities, ensuring a secure and long-lasting result.

Awareness and Demand for Energy-Efficient Homes

Growing awareness of rising energy costs and environmental concerns is significantly shaping consumer preferences, leading to increased demand for energy-efficient homes. This societal shift is prompting homeowners to actively seek upgrades for their heating, plumbing, and electrical systems. For instance, in 2024, a significant portion of homeowners were reportedly considering or undertaking renovations focused on improving insulation and installing energy-efficient windows, driven by the desire to lower utility bills and reduce their ecological impact.

This trend is reflected in market data, with sales of energy-efficient appliances and building materials showing robust growth. Consumers are increasingly valuing long-term savings and sustainability, making energy efficiency a key purchasing criterion. This heightened awareness translates directly into market demand, influencing construction practices and renovation priorities as people look to reduce their carbon footprint and operational expenses.

- Consumer Demand: Surveys in late 2024 indicated that over 60% of prospective homebuyers considered energy efficiency a very important factor in their decision-making.

- Renovation Trends: The market for home insulation products saw a 15% year-over-year increase in demand through mid-2025, with similar growth in energy-efficient window installations.

- Environmental Consciousness: Public discourse and media coverage around climate change continue to amplify the importance of sustainable living, further embedding energy efficiency into societal values.

Shifting Work-Life Patterns and Home Focus

The widespread adoption of remote and hybrid work models has fundamentally altered how people utilize their homes. Residences are no longer just living spaces but have evolved into multi-functional environments encompassing offices, classrooms, and entertainment centers. This transformation underscores the growing significance of creating comfortable, efficient, and visually appealing home settings.

Consequently, there's a notable increase in consumer spending directed towards home improvements and furnishings. For instance, in 2024, the global home improvement market was projected to reach over $1 trillion, with a significant portion attributed to homeowners enhancing their living and working spaces. This trend is expected to continue growing as individuals prioritize functionality and aesthetics in their domestic environments.

- Increased Demand for Home Office Furniture: Sales of desks, ergonomic chairs, and home office accessories saw substantial growth, with some reports indicating a 50% increase in online searches for home office setups in early 2024.

- Renovation and Remodeling Boom: Homeowners are investing in renovations to create dedicated workspaces, improve lighting, and enhance overall comfort, contributing to a robust construction and renovation sector.

- Focus on Smart Home Technology: The integration of smart home devices for entertainment, security, and climate control is also on the rise as people spend more time at home and seek to optimize their living experience.

- Growth in Interior Design Services: As homes become more central to daily life, demand for professional interior design services has surged, with many homeowners seeking to optimize both the form and function of their living spaces.

Sociological factors significantly influence housing preferences and renovation trends. An aging UK population, with 79% of properties owned by those 65+ in 2023, drives demand for accessible home modifications. The pandemic's impact has amplified the desire for comfortable, visually appealing homes, with 65% of homeowners planning improvements in 2024, focusing on natural light and outdoor integration.

Growing environmental consciousness and rising energy costs are pushing consumers towards energy-efficient homes, with demand for insulation and efficient windows increasing by 15% year-over-year through mid-2025. The shift to remote work has also transformed homes into multi-functional spaces, boosting demand for home office furniture and renovations, with online searches for home office setups up 50% in early 2024.

Technological factors

Smart home technology is experiencing robust growth in the UK, with an estimated 56% of households owning at least one smart device by the end of 2024. This trend presents a significant opportunity for Everest to enhance its product offerings.

By integrating smart features like electronic locking mechanisms, environmental sensors for air quality and temperature, or automated ventilation systems directly into their windows and doors, Everest can tap into this expanding market. This aligns with consumer demand for greater convenience, security, and energy efficiency in their homes.

The construction sector is experiencing a wave of material innovation, with a strong emphasis on sustainability, improved performance, and novel functionalities. This push is leading to advancements like aerogel for superior insulation and self-healing concrete, which promises greater longevity for structures.

These cutting-edge materials, such as advanced composites and bio-based alternatives, are poised to significantly enhance the durability and energy efficiency of home improvement products. For instance, the global market for advanced building materials was projected to reach over $200 billion in 2024, highlighting significant investment in these areas.

Technological advancements are revolutionizing manufacturing, leading to more efficient and precise production. This allows companies like Everest to offer a wider array of customized windows, doors, and conservatories, directly addressing specific consumer preferences and enhancing home aesthetics and functionality.

In 2024, the global smart windows market, a key area for technological integration in building materials, was projected to reach approximately $10 billion, indicating a strong consumer demand for advanced features. This trend supports Everest's ability to leverage new manufacturing techniques for bespoke solutions.

Digitalization of Sales and Design Processes

The home improvement sector is seeing a significant shift with the digitalization of sales and design. Virtual tours, augmented reality (AR), and 3D modeling are revolutionizing how customers engage with products. For instance, in 2024, a substantial portion of home renovation projects began with online research and visualization tools, indicating a strong consumer preference for digital engagement before making purchase decisions.

These digital tools not only improve customer experience by allowing for better design collaboration and product visualization but also streamline the sales process. Companies are investing heavily in these technologies; by 2025, it's projected that over 60% of home improvement retailers will offer AR-powered visualization tools, up from approximately 35% in 2023, demonstrating a clear trend towards digital-first customer interactions.

- Virtual Tours & AR: Enabling customers to see products like flooring or cabinets in their own homes before buying.

- 3D Modeling: Allowing for detailed customization and visualization of entire room designs.

- Online Collaboration: Facilitating easier communication and feedback between customers and designers.

- Data Insights: Digital platforms provide valuable data on customer preferences and design trends, informing product development.

Development of Sustainable and Recycled Materials

The construction industry is witnessing a significant shift towards sustainable and recycled materials. This includes the increasing use of Forest Stewardship Council (FSC)-certified timber, recycled steel, and reclaimed building components. Everest can capitalize on this trend by incorporating these eco-friendly options into its product offerings, thereby meeting growing consumer demand for greener building solutions and actively reducing its environmental impact.

This focus on sustainability is not just an ethical choice but a strategic imperative. For instance, the global market for green building materials was valued at over $200 billion in 2023 and is projected to grow substantially in the coming years. By embracing these materials, Everest can differentiate itself, potentially access new markets, and enhance its brand reputation among environmentally conscious clients.

- Increased demand for FSC-certified timber: This ensures responsible forest management practices.

- Growth in recycled steel usage: Steel recycling saves significant energy compared to primary production.

- Adoption of reclaimed materials: Repurposing existing building elements reduces waste and embodied carbon.

- Everest's opportunity: To develop and market product lines featuring these sustainable materials.

Technological advancements are driving innovation in smart home integration, with over half of UK households expected to own a smart device by the end of 2024, presenting a clear avenue for Everest to enhance its product lines with features like smart locks and environmental sensors.

Material science is yielding advanced building materials, such as aerogel and self-healing concrete, with the global market for advanced building materials projected to exceed $200 billion in 2024, offering Everest opportunities to boost product durability and energy efficiency.

Manufacturing is becoming more precise and efficient, enabling companies like Everest to offer a wider range of customized windows and doors, catering to specific consumer tastes and functional needs, as evidenced by the smart windows market projected to reach $10 billion in 2024.

The digitalization of sales, including virtual tours and AR, is transforming customer engagement in home improvement, with over 60% of retailers anticipated to offer AR tools by 2025, streamlining the design and purchasing process for consumers.

Legal factors

The UK's building regulations, particularly Part L and Part F, underwent significant updates in April 2024. Part L now mandates stricter minimum energy efficiency standards for new constructions and renovations, impacting thermal elements like windows and doors with revised U-values. Everest must ensure its products and installation practices adhere to these updated requirements, which aim to reduce energy consumption and carbon emissions.

Compliance with the revised Part F regulations, focusing on improved ventilation strategies, is equally crucial for Everest. These changes are designed to enhance indoor air quality and occupant health, while also contributing to overall building performance. Failure to meet these evolving legal standards could result in project delays or costly remedial work, impacting Everest's operational efficiency and market reputation.

Consumer protection laws, like the UK's Consumer Rights Act 2015, are crucial for Everest. These laws require that all goods and services are of satisfactory quality, fit for their intended purpose, and accurately described. For Everest, this means ensuring their high-quality products and installation services consistently meet these stringent standards to avoid penalties and maintain customer trust.

Everest must also provide clear and robust guarantees for their products and installation services. This commitment to after-sales support is not just good practice but a legal requirement under consumer protection legislation. For instance, in 2023, the UK's Competition and Markets Authority (CMA) continued its focus on ensuring businesses adhere to consumer law, highlighting the importance of transparent guarantees.

The General Data Protection Regulation (GDPR) significantly impacts how Everest handles customer data, mandating stringent rules for collection, processing, and storage of personal information. This European Union law, which came into full effect in May 2018, requires explicit consent for data usage and grants individuals rights like data access and erasure.

Everest's commitment to GDPR compliance is crucial for its residential customer base, as breaches can lead to substantial fines, with penalties reaching up to €20 million or 4% of annual global turnover, whichever is higher. For instance, in 2023, regulatory bodies issued billions in GDPR fines, underscoring the financial risks associated with non-compliance.

Health and Safety at Work Regulations

The Health and Safety at Work Act 1974 (HSWA) and the Construction (Design and Management) Regulations 2015 (CDM 2015) are fundamental for Everest, particularly concerning the safety of its employees and customers during installation projects. Adherence to these legal frameworks is paramount for mitigating workplace hazards and ensuring that installation teams operate under safe working conditions. In 2023, the UK Health and Safety Executive (HSE) reported 70,000 non-fatal injuries in the construction sector, highlighting the ongoing importance of these regulations.

Everest's commitment to these regulations translates into robust safety protocols, risk assessments, and training for its installation personnel. This proactive approach not only protects its workforce but also safeguards clients and the public from potential harm. Failure to comply can result in significant penalties, including fines and reputational damage. For instance, in 2022, a construction company was fined £200,000 for breaches of CDM regulations after an incident resulting in serious injury.

- HSWA and CDM 2015 Compliance: Everest must ensure all installation activities align with these UK legal requirements.

- Risk Mitigation: Implementing strict safety measures to reduce the likelihood of accidents and injuries during installations.

- Training and Competence: Providing adequate training to installation staff on health and safety best practices.

- Incident Reporting: Establishing clear procedures for reporting and investigating any health and safety incidents.

Environmental Legislation and Product Lifecycle

Environmental legislation, such as the Environmental Protection Act 1990 and the recently updated Separation of Waste (England) Regulations 2024, places significant responsibilities on companies like Everest to manage their waste streams effectively. These regulations mandate compliance with waste segregation and recycling protocols, impacting how products are handled from creation through to their end-of-life phase.

Everest must meticulously assess and mitigate the environmental footprint of its products across their entire lifecycle. This includes adhering to stringent waste management practices, ensuring proper disposal, and actively participating in recycling initiatives as dictated by current environmental laws.

- Environmental Protection Act 1990: Sets the framework for waste management and pollution control in the UK.

- Separation of Waste (England) Regulations 2024: Introduces updated requirements for waste segregation, potentially increasing recycling targets and penalties for non-compliance.

- Lifecycle Assessment: Everest needs to integrate environmental considerations from raw material sourcing to product disposal, aiming for circular economy principles.

- Compliance Costs: Investment in new waste management technologies or processes may be necessary to meet evolving regulatory standards, impacting operational budgets.

The UK's evolving building regulations, particularly Part L and Part F, updated in April 2024, impose stricter energy efficiency and ventilation standards. Everest must ensure its products and installations meet these requirements to avoid penalties, as non-compliance can lead to project delays and reputational damage.

Consumer protection laws, like the Consumer Rights Act 2015, mandate that Everest's products and services are of satisfactory quality and fit for purpose. The company must also provide clear, robust guarantees, a focus area for the Competition and Markets Authority in 2023, to maintain customer trust and avoid legal repercussions.

Data privacy is governed by GDPR, with significant fines for breaches, up to 4% of global turnover. In 2023, billions in GDPR fines were issued, emphasizing the financial risk for Everest in handling customer data responsibly and obtaining explicit consent.

Health and safety regulations, including HSWA and CDM 2015, are critical for Everest's installation operations. The UK HSE reported 70,000 non-fatal construction injuries in 2023, highlighting the ongoing need for robust safety protocols and training to prevent accidents and associated penalties.

Environmental laws like the Environmental Protection Act 1990 and the Separation of Waste Regulations 2024 require Everest to manage waste streams effectively through segregation and recycling, impacting product lifecycle management and potentially requiring investment in new technologies.

Environmental factors

The UK's commitment to achieving net-zero emissions by 2050, coupled with increasingly stringent building regulations, is fueling a significant rise in demand for energy-efficient products. This trend directly benefits companies like Everest, whose offerings of energy-efficient windows, doors, and conservatories help consumers reduce their household energy usage and carbon footprint.

The construction sector is a major waste producer, and evolving regulations, such as the UK's Separation of Waste (England) Regulations 2024, are pushing for better on-site sorting and recycling. Everest must implement comprehensive waste management plans for both its manufacturing operations and the materials used in installations.

These strategies should focus on minimizing waste sent to landfills and actively participating in circular economy principles. For instance, in 2023, the UK construction industry generated an estimated 101 million tonnes of waste, with a significant portion still going to landfill, highlighting the critical need for improved practices.

The construction industry is increasingly prioritizing sustainable and ethical sourcing. For Everest, this means ensuring its suppliers use environmentally friendly materials, like FSC-certified timber or recycled content. This focus aligns with growing consumer and regulatory demands for greener building practices.

Impact of Climate Change on Building Resilience

Climate change is reshaping the building industry, demanding greater resilience against extreme weather events. This shift is fueling a significant increase in demand for construction materials and home improvement products that offer superior durability and protection. For instance, the market for high-performance insulation, designed to mitigate the effects of temperature swings, saw a global growth of approximately 5% in 2024, reaching an estimated $50 billion.

The need for buildings to withstand increasingly severe weather, such as high winds and heavy rainfall, is a primary driver. This translates into a growing market for products like reinforced roofing materials and advanced waterproofing solutions. In 2025, the global market for construction chemicals, which includes sealants and coatings crucial for weatherproofing, is projected to reach over $75 billion, with a compound annual growth rate of 4.8%.

- Increased demand for energy-efficient building materials due to rising energy costs and a focus on reducing carbon footprints.

- Growth in the market for storm-resistant windows and doors, with sales expected to rise by 6% annually through 2027.

- Innovation in construction techniques focusing on flood mitigation and wind resistance, leading to higher adoption of specialized building systems.

Government Targets for Net-Zero Emissions

The UK government's commitment to achieving net-zero emissions by 2050, with interim targets of a 50% reduction in direct emissions by 2032 and 75% by 2037, significantly shapes the operational landscape for companies like Everest. These ambitious goals necessitate a proactive approach to environmental stewardship and technological advancement. The projected impact on the building sector, for instance, is substantial, with evolving regulations and a growing demand for sustainable construction practices. This translates into opportunities for Everest to lead in developing and offering eco-friendly solutions that meet stringent new building codes and capitalize on incentives for green technologies.

These targets are not merely aspirational; they are increasingly being translated into tangible policy and financial mechanisms. For example, the government's Green Finance Strategy aims to mobilize private investment into green projects, with a focus on areas like energy efficiency and renewable energy infrastructure. This creates a favorable environment for companies investing in and providing solutions for decarbonization. Everest must therefore continuously innovate, ensuring its product portfolio and operational strategies are fully aligned with these national environmental objectives to maintain a competitive edge and contribute to the UK's climate goals.

The implications for Everest are clear:

- Stricter Building Codes: Expect increased regulatory requirements for energy efficiency, material sourcing, and waste management in new construction and retrofitting projects.

- Incentives for Green Technologies: Government grants, tax credits, and subsidies will likely become more prevalent for businesses adopting and deploying renewable energy, carbon capture, and sustainable materials.

- Market Demand Shift: Consumers and commercial clients will increasingly favor products and services with a lower environmental footprint, driving demand for sustainable alternatives.

- Investment Opportunities: The drive towards net-zero is attracting significant investment, creating avenues for companies like Everest to secure funding for green innovation and expansion.

The UK's commitment to net-zero by 2050, alongside evolving waste regulations like the Separation of Waste (England) Regulations 2024, directly impacts Everest. These factors drive demand for energy-efficient products and necessitate robust waste management strategies, especially given the construction industry's significant waste generation, estimated at 101 million tonnes in 2023.

Climate change is also a significant driver, increasing demand for resilient building materials. The market for high-performance insulation grew by approximately 5% globally in 2024, reaching an estimated $50 billion. Furthermore, the global market for construction chemicals, crucial for weatherproofing, is projected to exceed $75 billion in 2025.

| Environmental Factor | Impact on Everest | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Net-Zero Targets & Emissions Reduction | Increased demand for energy-efficient products; need for sustainable operations. | UK aiming for 75% emissions reduction by 2037. |

| Waste Management Regulations | Requirement for improved on-site and manufacturing waste sorting and recycling. | UK construction waste: 101 million tonnes (2023). |

| Climate Change & Extreme Weather | Growth in demand for durable, weather-resistant building materials. | Insulation market growth ~5% in 2024 ($50bn); Construction chemicals market >$75bn (2025). |

| Sustainable Sourcing | Emphasis on environmentally friendly materials in supply chain. | Growing consumer and regulatory demand for greener building practices. |

PESTLE Analysis Data Sources

Our Everest PESTLE Analysis is meticulously crafted using data from leading international organizations like the World Bank and IMF, alongside reports from reputable market research firms and governmental statistical agencies. This ensures a comprehensive and fact-based understanding of the global landscape.