Eurowag Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurowag Bundle

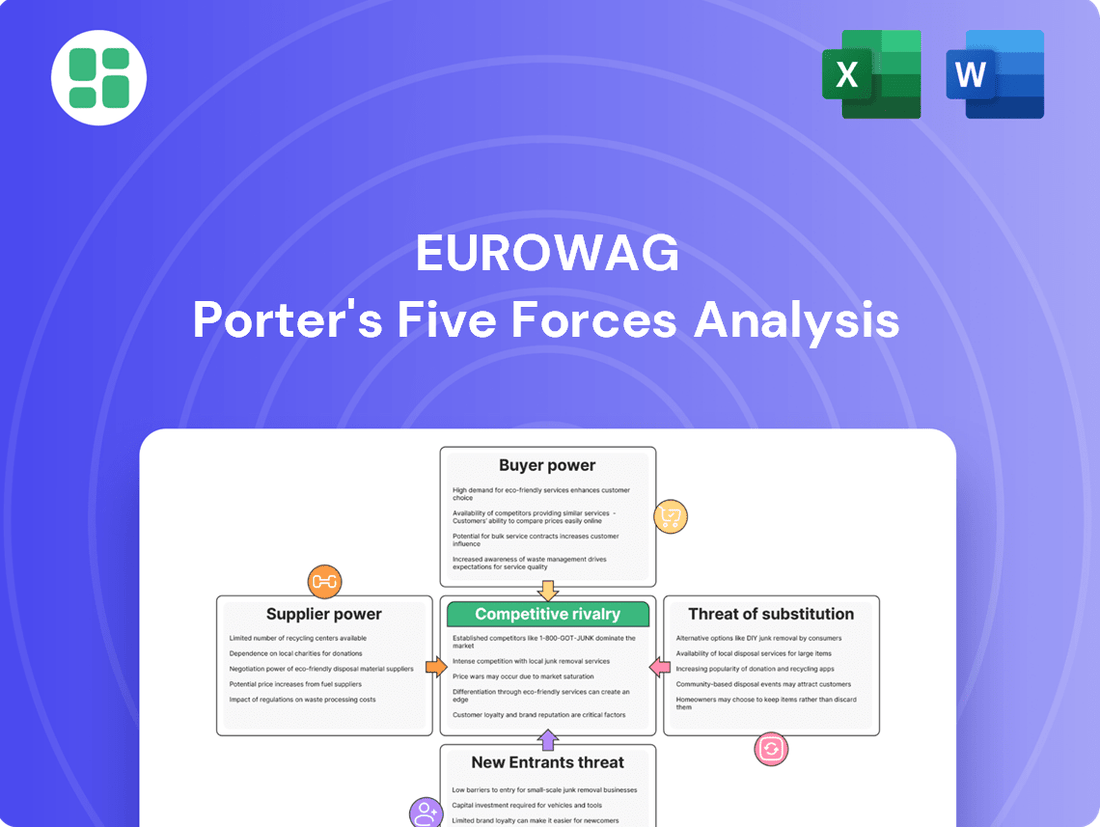

Eurowag operates within a dynamic European road transport sector, where understanding the competitive landscape is crucial. Our analysis reveals how buyer power, supplier leverage, and the threat of new entrants significantly shape Eurowag's strategic environment.

The complete report reveals the real forces shaping Eurowag’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Eurowag's reliance on a diverse supplier base, including fuel networks, toll operators, telematics providers, and financial institutions, means supplier power isn't uniform. For example, major toll system operators in key European markets, where alternatives are scarce, can exert considerable influence due to their essential infrastructure.

The concentration and specialization within these supplier groups significantly impact their bargaining leverage. When a particular fuel brand or toll service provider dominates a region, Eurowag has fewer options, potentially leading to less favorable terms. This was evident in 2024 with reports indicating increased pricing power for specialized telematics hardware manufacturers due to ongoing supply chain constraints in the semiconductor industry.

The bargaining power of suppliers for Eurowag is significantly influenced by switching costs. For instance, if Eurowag relies on specialized software for its fleet management or payment processing, the expense and effort involved in migrating to a new provider can be substantial. This often includes data migration, system reconfigurations, and employee retraining, making a switch economically unviable for minor gains.

These high switching costs empower suppliers, as Eurowag faces considerable financial and operational hurdles if it decides to change providers for critical services like toll payment solutions. For example, integrating new telematics hardware requires not just purchasing the hardware but also ensuring compatibility with existing fleet management systems and potentially updating driver training protocols. This complexity discourages frequent supplier changes, thereby strengthening the supplier's position.

While many of Eurowag's core offerings like fuel and toll payments are becoming increasingly commoditized, the uniqueness of certain supplier services significantly impacts their bargaining power. For instance, if a supplier provides proprietary telematics hardware essential for Eurowag's fleet management solutions, or offers advanced data analytics crucial for optimizing client operations, their leverage increases substantially. In 2023, the global telematics market was valued at approximately $29.5 billion, with specialized solutions commanding premium pricing.

Threat of Forward Integration by Suppliers

Large fuel suppliers, a key component of Eurowag's network, possess the potential to integrate forward. This means they could directly offer their own comprehensive payment and technology solutions to commercial road transport companies, bypassing intermediaries like Eurowag.

This forward integration by major fuel providers, for instance, would directly challenge Eurowag's established market position. In 2024, the global fuel card market was valued at an estimated $100 billion, highlighting the significant scale and resources these potential competitors command.

- Potential for direct competition from major fuel companies.

- Threat of integrated payment and technology solutions offered by suppliers.

- Impact on Eurowag's market share and pricing power.

Importance of Eurowag to Suppliers

Eurowag's extensive network and substantial transaction volumes can position it as a vital customer for numerous suppliers, especially smaller or geographically focused ones. This dependency can serve to temper the bargaining power of these suppliers, as they may be motivated to offer competitive pricing and favorable terms to secure and maintain Eurowag's business, thereby ensuring a consistent revenue flow.

For instance, in 2024, Eurowag reported processing millions of transactions for fuel and toll services across Europe. This scale means that a significant portion of a smaller fuel station's or toll operator's revenue might be directly attributable to Eurowag customers. Consequently, these suppliers have a vested interest in maintaining a positive relationship and potentially offering better rates to retain this substantial business.

- Large Customer Base: Eurowag's millions of end-users create a significant demand for fuel and toll services, making its affiliated suppliers crucial partners.

- Transaction Volume: The sheer volume of transactions processed by Eurowag in 2024 translates to substantial revenue for its network of fuel stations and toll operators.

- Supplier Incentive: Suppliers are incentivized to offer favorable terms to Eurowag to secure their share of this high-volume business and ensure predictable income.

- Mitigation of Power: This reliance on Eurowag's customer base can reduce the suppliers' ability to dictate terms, as they value the consistent business provided by Eurowag's platform.

The bargaining power of suppliers for Eurowag is a nuanced factor, influenced by supplier concentration, switching costs, and the threat of forward integration. While a diverse supplier base can mitigate individual supplier power, concentrated markets for essential services like toll operations or specialized telematics can shift leverage towards suppliers, especially when supply chain issues, as seen in the semiconductor industry in 2024, limit alternatives.

High switching costs associated with integrating new systems or data migration further solidify supplier positions, making it economically challenging for Eurowag to change providers for critical functions. For example, the global telematics market, valued around $29.5 billion in 2023, demonstrates the premium placed on specialized, integrated solutions.

Conversely, Eurowag's substantial transaction volumes, processing millions of transactions in 2024, can reduce the power of smaller or regional suppliers who rely on this business for a significant portion of their revenue. This creates an incentive for these suppliers to offer competitive terms to maintain their relationship with Eurowag.

| Factor | Impact on Eurowag | Example/Data Point |

| Supplier Concentration (e.g., Toll Operators) | Increased bargaining power for dominant suppliers | Essential infrastructure in key European markets with few alternatives |

| Switching Costs (e.g., Telematics Integration) | Strengthens supplier position due to high migration expenses | System reconfigurations, data migration, and retraining costs |

| Supplier Specialization (e.g., Proprietary Hardware) | Enhanced leverage for unique service providers | Global telematics market valued at $29.5 billion in 2023 |

| Eurowag's Transaction Volume | Reduced bargaining power for suppliers dependent on Eurowag | Millions of transactions processed in 2024, significant revenue for smaller partners |

| Threat of Forward Integration (e.g., Fuel Companies) | Potential for direct competition, impacting Eurowag's market share | Global fuel card market valued at $100 billion in 2024 |

What is included in the product

This analysis unpacks the competitive intensity facing Eurowag by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players in the European mobility and payment solutions market.

Effortlessly assess competitive pressures with a pre-built Porter's Five Forces framework, allowing for rapid identification of market threats and opportunities.

Customers Bargaining Power

Eurowag’s customer base is quite diverse, spanning from single-truck owner-operators to substantial fleet businesses. This fragmentation means that while individual small customers have very little sway, larger entities can exert more influence. For instance, a large transport group making significant use of Eurowag's services might be in a position to negotiate better pricing or specialized service packages due to their substantial business volume.

Eurowag's strategy to be a comprehensive 'one-stop shop' significantly raises switching costs for its clients. When customers integrate multiple Eurowag services, such as fuel cards, toll management, and telematics, the effort and expense to move to a competitor become substantial.

The administrative burden of changing these integrated systems, coupled with potential operational downtime and the need for staff retraining, acts as a powerful deterrent. This complexity effectively locks customers into Eurowag's ecosystem, diminishing their bargaining power.

Customers can choose from a wide array of alternatives, including utilizing separate providers for fuel, tolls, and telematics, or even managing these functions internally using conventional methods. This broad availability of substitutes, even if they lack the seamless integration Eurowag offers, empowers customers by giving them choices. This directly influences Eurowag's ability to set prices and define its service packages, as customers can always look elsewhere if they feel the terms are unfavorable.

Price Sensitivity of Customers

Commercial road transport is a sector acutely aware of costs, with fuel and tolls being major components of operational expenditure. This means customers are always on the lookout for the most economical options, giving them significant leverage over service providers like Eurowag.

This high price sensitivity directly translates into increased bargaining power for customers. They can readily switch to competitors offering better rates, compelling Eurowag to maintain competitive pricing structures to retain its customer base.

- Fuel Costs: In 2024, fuel prices remained a dominant factor, with average diesel prices in Europe fluctuating significantly, impacting transport operators' budgets.

- Toll Charges: Tolls across major European routes represent a substantial and often unavoidable cost for hauliers, further amplifying their focus on overall price efficiency.

- Price Comparison: The ease with which transport companies can compare fuel card and toll management services online empowers them to negotiate more aggressively.

- Market Competition: A competitive landscape with multiple fuel card providers means customers have viable alternatives, strengthening their position to demand lower prices.

Information Availability and Transparency

The increasing availability of information significantly boosts customer bargaining power. Digital comparison tools and readily accessible industry benchmarks allow customers to easily evaluate Eurowag's services and pricing against competitors. This transparency means customers are well-informed, leading them to expect and demand better value and superior service.

For example, in the European fuel card market, where Eurowag operates, online platforms frequently publish comparative data on fuel prices and service fees across various providers. This readily available information empowers fleet managers to negotiate more favorable terms, as they can quickly identify and leverage more competitive offers. In 2024, the average fuel price across Europe saw fluctuations, making price transparency a critical factor for businesses managing large fleets. Eurowag's ability to offer competitive and transparent pricing becomes paramount in retaining customers who can easily switch to alternatives based on this readily available data.

- Information Accessibility: Digital platforms and industry reports provide customers with easy access to comparative pricing and service quality data for fuel card providers.

- Price Sensitivity: Increased transparency allows customers to identify cost savings, putting pressure on providers like Eurowag to offer competitive rates.

- Demand for Value: Informed customers are more likely to demand better service and added benefits, leveraging their knowledge to negotiate improved terms.

Eurowag's customers, particularly larger fleet operators, possess considerable bargaining power due to their significant purchasing volume. This allows them to negotiate favorable pricing and tailored service packages. The company's strategy of offering integrated services, like fuel cards and toll management, increases switching costs, which in turn reduces customer leverage by making it complex and expensive to move to a competitor.

Customers are highly price-sensitive, especially concerning fuel and toll costs, which are major operational expenses. This sensitivity drives them to seek out the most economical options, empowering them to demand competitive pricing from Eurowag. The availability of numerous alternatives, including specialized providers or in-house management, further strengthens their position by providing viable choices.

In 2024, the average diesel price across Europe remained a critical factor for transport businesses, directly influencing their negotiating stance with service providers. For instance, a 10% fluctuation in fuel costs could significantly impact a large fleet's budget, making price comparison tools and competitive offers from providers like Eurowag essential for cost management.

| Factor | Impact on Bargaining Power | 2024 Data/Context |

|---|---|---|

| Customer Volume | High volume customers have greater negotiation power. | Large fleet operators, managing hundreds of vehicles, represent a significant portion of Eurowag's revenue. |

| Switching Costs | High switching costs reduce customer bargaining power. | Integration of Eurowag's fuel, toll, and telematics services creates substantial administrative and operational hurdles for customers to switch. |

| Price Sensitivity | High price sensitivity increases customer bargaining power. | Fuel and toll costs can represent up to 40% of a haulier's operating expenses, making customers highly focused on price efficiency. |

| Availability of Substitutes | More substitutes increase customer bargaining power. | The market offers numerous alternative fuel card and toll management providers, allowing customers to compare and switch easily. |

Preview the Actual Deliverable

Eurowag Porter's Five Forces Analysis

This preview showcases the complete Eurowag Porter's Five Forces Analysis, detailing the competitive landscape of the fuel and mobility services sector. You'll gain insights into the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ready for your strategic decision-making.

Rivalry Among Competitors

The commercial road transport solutions market is quite crowded, featuring a blend of direct rivals offering similar integrated payment and mobility platforms. Eurowag also contends with specialized companies focusing on fuel cards, toll management, telematics, and financial services, creating a diverse competitive landscape across Europe.

Eurowag encounters competition from both large, well-established companies with significant market share and smaller, more nimble niche players that can quickly adapt to specific market needs. This dynamic means Eurowag must constantly innovate to stay ahead. For instance, in 2024, the European fuel card market alone was valued at billions of Euros, with numerous providers vying for a share.

While the commercial road transport sector is generally mature, Eurowag is capitalizing on the digital transformation and the increasing demand for integrated fleet management solutions. This focus on innovation creates avenues for growth even within a stable industry.

Eurowag's impressive double-digit net revenue growth, as reported in their 2023 financials, underscores a dynamic market for their comprehensive service offerings. This expansion suggests that companies can achieve significant growth by meeting evolving customer needs rather than solely by outmaneuvering rivals for existing market share, thereby moderating intense competitive rivalry.

Eurowag positions itself as a 'one-stop shop' for integrated payment and technology solutions, a strategy designed to stand out from competitors offering only single services. This approach aims to create stickiness with customers by providing a comprehensive suite of tools, thereby reducing the likelihood of them switching to a rival for a specific need.

The successful adoption and functionality of its newly launched integrated platform, Eurowag Office, which debuted in late 2024, is critical to solidifying this product differentiation. By offering a seamless and efficient user experience across multiple services, Eurowag seeks to move the competitive landscape away from pure price wars and towards a focus on value-added services and integrated solutions.

Exit Barriers and Fixed Costs

Eurowag's competitive rivalry is intensified by high fixed costs, particularly in maintaining its sophisticated technology platforms and extensive payment networks. These substantial investments, estimated to be in the hundreds of millions of euros for similar large-scale fintech operations, act as significant barriers to exiting the market.

This creates a dynamic where established players are compelled to remain and compete fiercely, even when market conditions are less favorable. For instance, the ongoing development and integration of new payment technologies and compliance with evolving regulations demand continuous capital expenditure, discouraging new entrants and locking in incumbents.

- High Fixed Costs: Significant investment in technology, networks, and customer support infrastructure.

- Exit Barriers: These costs make it difficult and expensive for companies to leave the market.

- Aggressive Competition: Competitors are incentivized to stay and fight for market share, even in downturns.

- Example: Continuous investment in payment technology and regulatory compliance is a key cost driver.

Strategic Commitments and Acquisitions

Eurowag’s strategic commitments, including substantial investments in platform development and key acquisitions like Inelo, directly impact competitive rivalry. These moves aim to bolster scale and product offerings, forcing rivals to respond with similar investments to maintain market position.

The acquisition of Inelo, for instance, significantly expanded Eurowag's European footprint and service portfolio, particularly in telematics and fleet management solutions. This strategic consolidation pressures other players in the road toll and fleet services sector to either seek their own acquisitions or intensify organic growth efforts to compete effectively.

- Strategic Investments: Eurowag’s commitment to platform enhancement and acquisitions, like Inelo, signals a proactive strategy to gain market share and technological advantage.

- Rivalry Intensification: These actions compel competitors to increase their own investments in technology and market expansion, leading to a more dynamic and potentially consolidated industry landscape.

- Market Consolidation Pressure: Acquisitions by major players like Eurowag create a ripple effect, encouraging smaller or less aggressive competitors to consider mergers or strategic partnerships to survive.

The competitive landscape for Eurowag is characterized by numerous players, from large, established firms to specialized niche providers, all vying for market share in the commercial road transport solutions sector. Eurowag's strategy of offering integrated, one-stop-shop solutions, exemplified by its late 2024 launch of Eurowag Office, aims to differentiate itself from competitors focusing on single services and shift the competitive focus from price to value-added offerings.

High fixed costs associated with maintaining sophisticated technology platforms and extensive payment networks create significant barriers to market exit for existing players, fostering intense rivalry. For example, continuous investment in payment technology and regulatory compliance is a key cost driver, encouraging incumbents to compete aggressively to recoup these substantial investments.

Eurowag's strategic investments, including acquisitions like Inelo, intensify competitive rivalry by forcing other market participants to either increase their own investments or risk losing market position. This consolidation pressure encourages a more dynamic, and potentially consolidated, industry landscape as rivals respond to Eurowag's expanded service portfolio and European footprint.

SSubstitutes Threaten

The primary substitute for Eurowag's integrated platform is the reliance on traditional, non-integrated methods for managing fleet operations. This involves using separate providers for fuel cards, manual toll payments, standalone telematics systems, and in-house financial management.

These fragmented approaches, while less efficient, are readily available and widely understood by transporters, posing a significant threat. Many smaller operators may continue to utilize these methods due to familiarity and perceived lower upfront costs, even with the operational inefficiencies.

Transport companies, particularly smaller ones, might choose to handle their expenses and fleet management internally using manual methods or simple accounting software. This approach, though less efficient, bypasses subscription costs and the risk of vendor dependency, presenting a substitute threat to integrated digital solutions.

For businesses hesitant about adopting advanced digital platforms, these in-house or manual systems serve as a viable alternative. The perceived cost savings and control offered by manual processes can be a significant draw, especially for those not yet fully appreciating the long-term benefits of specialized fleet management software.

Customers can opt for single-service specialized providers instead of an integrated platform like Eurowag. This means sourcing fuel, tolls, telematics, and VAT refunds from separate companies. While this might increase administrative work and limit data integration, it provides flexibility and can offer cost savings on individual services, directly substituting parts of Eurowag’s bundled solution.

Emerging Technologies and DIY Digital Tools

The increasing availability of advanced digital tools, including open-source software and AI-powered solutions, presents a growing threat of substitution for traditional integrated fleet management systems. Transport companies with the necessary in-house technical skills could potentially develop their own semi-integrated systems, bypassing the need for external providers like Eurowag.

This trend is amplified by the continuous improvement in user-friendliness and capability of these DIY digital solutions. For instance, by 2024, the global market for AI in transportation was projected to reach significant figures, indicating a substantial investment and development in this area, which could fuel the creation of more accessible and powerful internal tools.

- DIY Integration: Companies can leverage readily available software components to build custom solutions.

- Cost Efficiency: Developing in-house systems might offer long-term cost savings compared to subscription-based services.

- Customization: Tailoring solutions to specific operational needs provides a competitive edge.

- AI Advancement: The rapid progress in AI makes sophisticated automation and data analysis more attainable for internal development.

Alternative Transport Methods

Shifts towards alternative transport methods like rail or intermodal freight could gradually reduce the overall demand for commercial road transport, indirectly impacting Eurowag's core business. For instance, the European Union has ambitious goals to shift more freight from road to rail, aiming for a significant increase in rail freight volume by 2030. This macro trend, while not a direct substitute for Eurowag's fuel cards and toll services, represents a long-term challenge to road-centric logistics.

While not immediate substitutes, the growing adoption of localized supply chains, driven by resilience and efficiency concerns, could also diminish the need for long-haul road transport. This trend is gaining traction, with many businesses re-evaluating their global supply networks. For example, a 2024 report indicated a growing preference among manufacturers for regional sourcing, potentially impacting the volume of cross-border trucking Eurowag serves.

Eurowag's services are deeply integrated into the operational efficiency of commercial road transport. Therefore, any significant, sustained decline in road freight volume due to modal shifts would indirectly affect the demand for Eurowag's fuel and toll management solutions. The European Commission's multimodal freight initiatives, supported by substantial funding, are designed to facilitate this transition over the coming years.

The threat of substitutes for Eurowag's integrated platform primarily stems from fragmented, non-digital approaches to fleet management. Companies can opt for separate providers for fuel cards, toll payments, and telematics, or manage these functions internally using manual processes or basic accounting software. This offers flexibility and potential cost savings on individual services, even if it increases administrative burden.

DIY integration using open-source software and AI presents a growing substitute threat. By 2024, the global AI in transportation market was projected to reach substantial figures, enabling companies to develop custom, semi-integrated systems. This allows for tailored solutions and potential long-term cost efficiencies compared to subscription-based services.

Shifts towards alternative transport modes like rail, supported by EU initiatives aiming for increased rail freight volume by 2030, indirectly impact Eurowag. Similarly, the trend towards localized supply chains, with a growing preference for regional sourcing noted in 2024 reports, could reduce demand for long-haul road transport services.

| Substitute Method | Key Features | Potential Impact on Eurowag | Example Data/Trend |

|---|---|---|---|

| Fragmented Providers | Separate fuel, toll, telematics services | Reduced demand for integrated solutions, potential loss of bundled revenue | Customers can choose best-of-breed for each service |

| In-house/Manual Management | Internal processes, basic accounting software | Bypasses subscription fees, perceived control, but less efficient | Smaller operators may prefer familiarity and lower upfront costs |

| DIY Digital Solutions (AI/Open Source) | Customizable, potentially cost-efficient, AI-driven automation | Direct competition for integrated platforms, especially with in-house tech capabilities | Global AI in transportation market projected significant growth by 2024 |

| Modal Shift (e.g., Rail) | Reduced reliance on road freight | Indirectly lowers overall demand for road transport-centric services | EU aims to significantly increase rail freight volume by 2030 |

Entrants Threaten

Entering the integrated commercial road transport solutions market demands significant capital. New players need to invest heavily in technology, building out extensive fuel and toll networks, and acquiring customers. For instance, Eurowag’s own substantial investments in research and development highlight the financial commitment necessary, creating a formidable barrier for potential new competitors.

The commercial road transport sector in Europe is a minefield of regulations, especially concerning fuel, tolls, and cross-border movements. For any new company looking to enter, navigating these intricate rules, obtaining necessary licenses, and meeting compliance standards presents a substantial challenge. These significant entry barriers are particularly pronounced for businesses aiming for pan-European reach, requiring substantial investment and expertise to overcome.

Eurowag thrives on network effects; its platform becomes more valuable as more drivers, fleet managers, and fuel stations join, creating a self-reinforcing cycle. For instance, in 2024, Eurowag reported a significant increase in transaction volumes across its network, directly correlating with user growth.

The company's deeply entrenched relationships with a vast array of fuel suppliers and toll operators, built over years, act as formidable barriers. New entrants would face immense difficulty in replicating this extensive and trusted network, which is crucial for seamless operations in the road transport sector.

Technology Complexity and Data Infrastructure

The technological complexity and the need for substantial data infrastructure present a significant barrier to entry for new companies looking to compete with Eurowag. Building a platform that seamlessly integrates fuel card management, toll payments, telematics, VAT refund processing, and financial services demands advanced technical expertise and considerable upfront investment.

Eurowag's strategic focus on developing and continuously enhancing its integrated platform, supported by a sophisticated data lake, underscores this challenge. This commitment to a robust technological backbone makes it exceedingly difficult for potential new entrants to replicate Eurowag's comprehensive offering and achieve competitive parity quickly.

- Technological Hurdles: Developing a unified platform for diverse fleet management services requires specialized software engineering and integration capabilities.

- Data Infrastructure Demands: Managing vast amounts of real-time data from telematics, transactions, and customer interactions necessitates significant investment in secure and scalable data storage and processing.

- Investment in Innovation: Eurowag's ongoing R&D, exemplified by its data lake initiatives, creates a moving target for competitors, requiring them to match or exceed similar technological advancements.

- Barriers to Scale: The capital expenditure and technical know-how needed to build a comparable infrastructure limit the number of viable new entrants capable of achieving meaningful scale.

Brand Recognition and Customer Loyalty

Building strong brand recognition and fostering customer loyalty in the commercial road transport sector is a significant hurdle for newcomers. Eurowag, established in 1995, has cultivated a well-recognized brand and a loyal customer base over decades of consistent service. This established presence acts as a considerable barrier, requiring new entrants to make substantial investments in marketing and offer demonstrably superior value to even begin attracting customers away from Eurowag.

New entrants face the challenge of overcoming Eurowag's established reputation, which is built on years of reliable service and customer relationships. For instance, in 2023, Eurowag reported a significant increase in its customer base, underscoring its strong market position. This loyalty means that new competitors must not only match existing service levels but exceed them, a difficult and costly undertaking.

- Brand Equity: Eurowag's long operational history, dating back to 1995, has allowed it to build substantial brand equity.

- Customer Loyalty Programs: The company likely employs loyalty programs and tailored services that further entrench existing customers.

- Marketing Investment: New entrants would need to allocate considerable resources to marketing campaigns to build awareness and trust comparable to Eurowag's standing.

- Service Differentiation: To attract customers, new entrants must offer a clear and compelling differentiation in service, pricing, or technology.

The substantial capital required for infrastructure, technology, and regulatory compliance in integrated road transport solutions presents a significant barrier. Eurowag's ongoing investments in its platform and network, as seen in its 2024 transaction volume growth, demonstrate the scale of investment needed to compete effectively.

Navigating complex European regulations and establishing strong supplier and toll operator relationships are major hurdles for new entrants. Eurowag's established network, built over decades, provides a competitive advantage that is difficult and costly to replicate.

The threat of new entrants is mitigated by the high switching costs for customers due to integrated services and loyalty programs. Eurowag's brand recognition, cultivated since 1995, and its reported customer base growth in 2023, highlight the difficulty new players face in gaining market traction.

Porter's Five Forces Analysis Data Sources

Our Eurowag Porter's Five Forces analysis is built upon a robust foundation of data, integrating insights from Eurowag's annual reports, investor presentations, and public filings. We also leverage industry-specific research from reputable market intelligence firms and macroeconomic data from sources like Eurostat and national statistical offices to provide a comprehensive view of the competitive landscape.