Estia Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estia Health Bundle

Estia Health navigates a complex landscape shaped by powerful forces, from the bargaining power of its residents and their families to the intense competition within the aged care sector. Understanding these dynamics is crucial for strategic planning and identifying areas of opportunity and vulnerability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Estia Health’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Workforce shortages are a major concern for Estia Health and the broader Australian aged care industry. The scarcity of skilled nurses and personal care workers significantly boosts their bargaining power. This means providers like Estia Health often face increased wage demands and a greater reliance on expensive agency staff to ensure adequate care levels are met.

The situation is projected to worsen, with significant nurse shortages anticipated by 2025 and continuing into the future. This ongoing challenge forces aged care providers to compete fiercely for qualified staff, often leading to higher recruitment and retention costs, directly impacting operational expenses and profitability.

Suppliers of specialized medical equipment and pharmaceuticals can hold significant bargaining power over aged care providers like Estia Health. This is because these inputs are often critical for resident care, and the proprietary nature of some equipment or drugs can limit readily available alternatives. In 2024, the increasing complexity of resident care, particularly with conditions like advanced dementia, means that specialized and often patented medical provisions are essential, further strengthening supplier leverage.

The bargaining power of technology and digital solutions providers for Estia Health is on the rise. As the aged care industry embraces digital transformation, Estia's reliance on specialized vendors for integrated systems, telehealth, and AI solutions increases. This growing dependency means these tech suppliers hold significant sway.

In 2024, the digital transformation in aged care is accelerating, making technology providers essential for operational efficiency and regulatory compliance. For instance, the global digital health market was projected to reach over $660 billion in 2023 and is expected to continue its robust growth, highlighting the critical nature of these partnerships for companies like Estia Health.

Property and Facility Maintenance Services

The bargaining power of suppliers for property and facility maintenance services for Estia Health is moderate. While many routine services like cleaning and landscaping have numerous providers, specialized technical maintenance for critical infrastructure such as HVAC systems or complex building management systems can concentrate power with a few key suppliers. For instance, in 2024, Estia Health's operational expenditures, which include facility maintenance, represented a significant portion of their overall costs, highlighting the importance of managing these supplier relationships effectively.

The ability of suppliers to exert influence is amplified when Estia Health requires specialized equipment or expertise that is not readily available from multiple sources. This can lead to higher costs for essential upgrades or repairs, impacting the quality and upkeep of their aged care facilities. In 2023, Estia Health reported capital expenditure on property and equipment, underscoring the need for reliable and cost-effective maintenance partners to preserve asset value.

- Specialized services: Suppliers offering unique technical skills or proprietary maintenance solutions can command higher prices.

- Infrastructure dependency: Reliance on specific suppliers for critical building systems can increase their leverage.

- Cost impact: Maintenance costs directly influence Estia Health's operational efficiency and profitability.

Food and Catering Services

The bargaining power of suppliers in the food and catering services sector for aged care providers like Estia Health is moderate. While there are numerous food suppliers, those offering specialized dietary options or adhering to high-quality standards can exert more influence. For instance, suppliers capable of meeting specific nutritional requirements for residents with conditions like diabetes or dysphagia are valuable. In 2023, the Australian aged care sector faced ongoing challenges with food costs, with reports indicating significant increases in grocery prices impacting operational budgets.

Estia Health, like other providers, must navigate the need for cost-effective sourcing while ensuring food quality and nutritional value, which are paramount for resident satisfaction and regulatory compliance. Sector reports consistently highlight food quality as a key resident concern, making reliable and high-standard suppliers crucial. The ability to secure consistent, nutritious, and appealing meals is directly linked to resident well-being.

- Supplier Specialization: Suppliers offering niche dietary solutions (e.g., gluten-free, low-sodium, pureed meals) can command higher prices due to specialized production and expertise.

- Quality Standards: Suppliers meeting stringent food safety certifications and demonstrating a commitment to fresh, high-quality ingredients have greater leverage.

- Cost Pressures: Rising food commodity prices, as seen in 2023 and continuing into 2024, increase the bargaining power of suppliers who can absorb or pass on these costs.

- Contractual Agreements: Long-term contracts can reduce supplier bargaining power by locking in prices and terms, but the ability to negotiate favorable terms depends on the volume and commitment of the provider.

The bargaining power of suppliers for Estia Health is significantly influenced by workforce shortages, particularly for skilled nurses and personal care workers. This scarcity drives up wages and reliance on costly agency staff, empowering suppliers in the labor market. The Australian aged care sector anticipates a worsening nurse shortage by 2025, intensifying competition for staff and increasing recruitment costs.

Suppliers of specialized medical equipment and pharmaceuticals also hold considerable power due to the critical nature and often proprietary status of their products. As resident care complexity increases in 2024, particularly for conditions like advanced dementia, Estia Health's dependence on these specialized, often patented, provisions strengthens supplier leverage.

Technology and digital solutions providers are gaining influence as Estia Health invests in digital transformation. The global digital health market's projected growth to over $660 billion in 2023 underscores the essential role and increasing power of these tech vendors.

Suppliers of property and facility maintenance services have moderate bargaining power, with specialization in critical infrastructure increasing their leverage. Estia Health's operational expenditures in 2024 included significant facility maintenance costs, highlighting the importance of managing these relationships.

In the food and catering sector, suppliers of specialized dietary options or those meeting high-quality standards have greater influence. Rising food commodity prices in 2023 and 2024 have further bolstered supplier power, impacting Estia Health's operational budgets.

| Supplier Category | Bargaining Power Level | Key Influencing Factors | 2024/2023 Data/Projections |

|---|---|---|---|

| Labor (Skilled Nurses, Care Workers) | High | Workforce shortages, competition for staff | Projected worsening nurse shortages by 2025 |

| Medical Equipment & Pharmaceuticals | High | Specialized/proprietary nature, critical for care | Increasing care complexity, reliance on patented provisions |

| Technology & Digital Solutions | Rising | Digital transformation, reliance on integrated systems | Global digital health market projected >$660B in 2023 |

| Property & Facility Maintenance | Moderate | Specialization in critical infrastructure | Significant portion of operational expenditures |

| Food & Catering Services | Moderate | Specialized dietary needs, quality standards | Rising food commodity prices impacting budgets |

What is included in the product

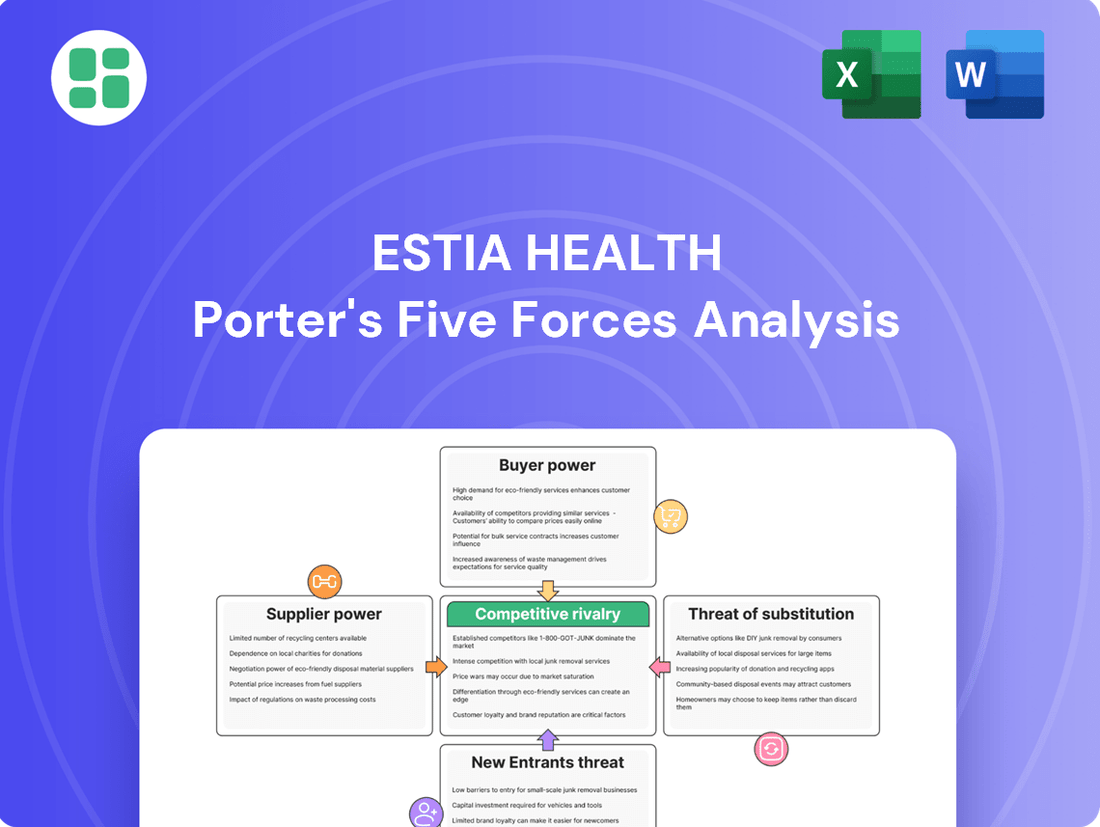

Estia Health's Porter's Five Forces analysis delves into the competitive intensity of the aged care sector, examining threats from new entrants, the bargaining power of suppliers and buyers, the threat of substitutes, and the rivalry among existing providers.

Instantly identify and mitigate competitive threats with a clear, actionable overview of Estia Health's Porter's Five Forces.

Effortlessly visualize the impact of supplier power and buyer bargaining on Estia Health's profitability.

Customers Bargaining Power

The bargaining power of customers in the aged care sector, particularly for providers like Estia Health, is on the rise. Recent aged care reforms in Australia, culminating in the new Aged Care Act 2024 set to take effect in November 2025, are central to this shift. This legislation places a strong emphasis on consumer choice and control, allowing residents and their families to have a more significant say in selecting their care providers and the specific services they receive.

This increased consumer agency directly translates to greater bargaining power for customers. They can now more readily compare offerings, negotiate terms, and switch providers if their needs aren't met. For Estia Health, this necessitates a strategic pivot towards a more personalized and transparent approach to care delivery, ensuring services are tailored to individual preferences to retain and attract residents in this evolving landscape.

Estia Health's reliance on government funding, particularly the Aged Care Funding Instrument (ACFI) and its successor, the Australian National Aged Care Classification (AN-ACC), means that changes in government policy directly influence the bargaining power of its customers. For instance, the introduction of means-tested contributions for non-clinical care from November 2025 shifts some of the cost burden to residents, potentially increasing their sensitivity to pricing and service quality. This dynamic, coupled with government-set pricing and subsidies, means customers' ability to negotiate or switch providers is heavily influenced by the regulatory environment.

The growing accessibility of information from sources like government agencies, the Aged Care Quality and Safety Commission, and providers themselves significantly bolsters customer bargaining power. This increased transparency means consumers and their advocates are better informed about available choices, the quality of care, and crucial safety benchmarks, leading to more discerning selections.

For providers such as Estia Health, this heightened awareness necessitates a commitment to superior standards and clear communication of their services. In 2023, for instance, the Aged Care Quality and Safety Commission reported an increase in publicly available performance data for aged care providers, directly impacting consumer choice and provider accountability.

Influence of Families and Advocates

Families and advocates are significant influencers in the aged care sector, frequently making decisions for residents. Their ability to scrutinize and compare different aged care providers, coupled with their capacity to voice concerns and utilize advocacy services, significantly enhances the bargaining power of the customer. This means Estia Health needs to proactively address the expectations of both the residents and their influential family members.

In 2024, the influence of families is a critical factor for aged care providers like Estia Health. Families often hold the ultimate decision-making power and can impact a provider's reputation through word-of-mouth and online reviews. For instance, resident satisfaction surveys, which heavily involve family input, directly influence occupancy rates and the perceived quality of care. Estia Health's performance in meeting family expectations is therefore paramount to its market standing.

- Family Influence: Families act as key decision-makers and influencers for aged care residents.

- Advocacy Power: The collective voice of families and advocacy groups can pressure providers to improve services.

- Reputation Management: Positive family experiences are vital for Estia Health's reputation and customer acquisition.

- Service Expectations: Providers must meet the evolving needs and expectations of both residents and their families.

High Switching Costs and Emotional Factors

While customers in the residential aged care sector have a growing number of options, the actual costs associated with switching providers can be substantial. These costs extend beyond mere financial considerations, encompassing significant emotional distress for residents and their families, as well as complex logistical challenges in relocating. This creates a degree of inertia that can temper the immediate bargaining power of current residents.

Despite these switching hurdles for existing residents, the initial decision-making process and the potential for future residents to choose elsewhere still exert considerable influence. Providers are thus motivated to maintain high service standards and competitive pricing to attract and retain new admissions. For instance, in 2024, the average occupancy rate across Australian aged care facilities hovered around 85%, indicating that providers who fail to meet resident expectations may struggle to fill beds.

- High Switching Costs: Emotional, logistical, and financial burdens often deter current residents from switching.

- Incentive for Providers: The threat of losing new admissions compels aged care facilities to offer competitive services.

- Market Dynamics: In 2024, an 85% average occupancy rate suggests that quality and service are key differentiators.

The bargaining power of customers for Estia Health is increasing due to greater transparency and consumer choice, driven by reforms like the Aged Care Act 2024. Families are significant influencers, with their satisfaction directly impacting providers. In 2024, resident satisfaction surveys, heavily involving family input, played a crucial role in occupancy rates and perceived quality.

While switching providers involves emotional and logistical challenges, the ability of prospective residents to choose elsewhere pressures Estia Health to maintain high standards. In 2024, the average occupancy rate of around 85% across Australian aged care facilities highlights the importance of service quality in attracting and retaining residents.

| Factor | Impact on Estia Health | 2024 Data/Context |

|---|---|---|

| Consumer Choice & Transparency | Increases ability to compare and switch providers. | Aged Care Act 2024 emphasizes consumer control. |

| Family Influence | Key decision-makers impacting reputation and occupancy. | Satisfaction surveys involving families are critical. |

| Switching Costs | Tempered immediate power for current residents. | Emotional and logistical hurdles remain significant. |

| Market Competition | Drives need for competitive pricing and service. | Average 85% occupancy in 2024 indicates provider differentiation is key. |

Preview Before You Purchase

Estia Health Porter's Five Forces Analysis

This preview showcases the comprehensive Estia Health Porter's Five Forces Analysis, providing an in-depth examination of the competitive landscape within the aged care sector. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this valuable strategic tool. You can confidently expect the same professionally formatted and detailed analysis, ready for your immediate use and strategic planning.

Rivalry Among Competitors

The Australian aged care sector, including residential providers like Estia Health, is characterized by its fragmentation, featuring a multitude of smaller and larger operators. However, a notable trend of consolidation is underway, driven by a desire for economies of scale and greater market influence among larger entities. This M&A activity, particularly in residential care, is reshaping the competitive landscape.

Australia's demographic shift, with an aging population, is a powerful driver for the aged care sector. By 2024, the number of Australians aged 65 and over is projected to reach over 5 million, a figure that will continue to climb, creating a robust and expanding market for services like those offered by Estia Health.

This escalating demand, while potentially supporting multiple providers, also sharpens competition in crucial areas. Companies are locked in a fierce battle for skilled nurses and care staff, a challenge exacerbated by workforce shortages. Furthermore, the need for capital investment to expand facilities and meet growing occupancy needs intensifies competition for funding and resources.

Extensive regulatory reforms, such as the new Aged Care Act 2024/2025, introduce mandatory care minutes and heightened oversight. These changes significantly increase compliance costs and operational burdens for providers like Estia Health.

This regulatory environment intensifies competitive pressure, forcing providers to prove high quality and safety standards. Companies struggling with compliance or financial viability may exit the market, reshaping the competitive landscape.

Financial Viability Pressures

The aged care sector, including providers like Estia Health, is grappling with substantial financial viability pressures. In 2024, a significant portion of residential aged care homes, nearly half, are operating at a loss, highlighting the widespread financial strain. This environment can intensify competitive rivalry, forcing providers to engage in aggressive price wars or implement stringent cost-cutting measures. Such pressures, if not managed carefully, could potentially compromise the quality of care delivered to residents.

These financial challenges directly impact competitive dynamics within the industry. Providers facing losses may become more aggressive in their pricing strategies to attract and retain residents, putting pressure on established players like Estia Health. The imperative to maintain financial health while upholding service standards creates a complex balancing act, influencing how companies compete.

- Industry-wide financial strain: Nearly 50% of Australian residential aged care facilities reported operating at a loss in recent periods, a stark indicator of the sector's financial fragility.

- Impact on competition: Financial pressures can lead to heightened price competition and a focus on cost reduction, potentially affecting service quality and innovation.

- Estia Health's challenge: As a major operator, Estia Health must strategically manage these financial headwinds to sustain its operations and service delivery standards amidst a challenging economic landscape.

Differentiation on Quality and Specialised Services

Competitive rivalry in the aged care sector is intensifying, with providers increasingly differentiating themselves on the quality of care, the overall resident experience, and the availability of specialized services, such as dedicated dementia support programs. This shift means that operators are actively promoting their unique strengths to attract residents, moving beyond simply meeting regulatory requirements.

Estia Health, for instance, emphasizes its commitment to providing comprehensive services and enhancing residents' quality of life. This focus serves as a crucial differentiator in a market where consumers are actively seeking personalized and tailored solutions that meet specific needs and preferences.

- Quality of Care: Providers are competing on clinical outcomes, staffing ratios, and the overall well-being of residents.

- Resident Experience: This includes factors like food quality, activities, social engagement, and the general atmosphere of the facility.

- Specialised Services: Demand is growing for niche offerings such as memory support units, palliative care, and allied health services.

- Brand Reputation: Positive reviews and strong community standing are becoming significant competitive advantages.

Competitive rivalry within Australia's aged care sector, including for Estia Health, is escalating due to industry-wide financial strain, with nearly half of residential aged care homes operating at a loss in 2024. This pressure forces providers to compete more aggressively on price and cost reduction, potentially impacting service quality. Differentiation is increasingly focused on the quality of care, resident experience, and specialized services like dementia support, as operators strive to attract residents in a challenging market.

| Competitive Factor | Description | Impact on Rivalry |

|---|---|---|

| Financial Viability | Nearly 50% of Australian residential aged care homes reported operating at a loss in 2024. | Intensifies price competition and cost-cutting measures. |

| Quality of Care | Focus on clinical outcomes, staffing ratios, and resident well-being. | Providers differentiate on high-quality service delivery. |

| Resident Experience | Includes food, activities, social engagement, and facility atmosphere. | Operators compete to offer a superior living environment. |

| Specialized Services | Growing demand for memory support, palliative care, and allied health. | Niche offerings become key differentiators. |

SSubstitutes Threaten

The most significant substitute for residential aged care is in-home care, strongly supported by government policy encouraging seniors to age in place. The upcoming Support at Home program, launching in November 2025, will replace current home care packages, offering more personalized assistance and technology, directly impacting the demand for traditional residential facilities.

Retirement villages and independent living communities present a notable threat of substitution for Estia Health's residential aged care services. These options, particularly those with integrated support or a continuum of care, appeal to seniors who prefer to maintain independence for as long as possible, delaying or avoiding the need for full-time residential care. In 2024, the demand for independent living solutions remained robust, with many providers expanding their offerings to include social activities and basic assistance, directly competing for a segment of the senior population that might otherwise consider residential aged care.

Family and informal care acts as a significant substitute for formal aged care services. Many families prioritize caring for their elderly loved ones at home, which can delay or even eliminate the need for residential facilities. For instance, in 2024, a substantial portion of aged care needs in Australia were met through informal care arrangements, reflecting a strong preference for home-based support.

The capacity and willingness of family members to provide this informal care directly influence the demand for Estia Health's services. When family support is robust, it can reduce the immediate need for paid care. However, government initiatives aimed at supporting family carers, such as respite care subsidies or carer payments, could indirectly affect the flow of clients to formal providers by making informal care more sustainable.

Technological Solutions for Remote Monitoring and Support

Technological advancements are presenting significant substitutes for traditional aged care services. Wearable devices, remote monitoring tools, and telehealth platforms are becoming more sophisticated, allowing individuals to manage their health and receive support from the comfort of their own homes. This trend is particularly impactful as it directly addresses the need for continuous health tracking and virtual consultations, thereby reducing the immediate reliance on residential aged care facilities.

The increasing adoption of these technologies facilitates aging in place, a preference for many seniors. For instance, the global remote patient monitoring market was valued at approximately USD 30.1 billion in 2023 and is projected to grow significantly, indicating a strong shift towards home-based care solutions. This growth suggests that a growing number of individuals may opt for these technological alternatives over traditional in-person care models.

- Growing Remote Patient Monitoring Market: Valued at roughly USD 30.1 billion in 2023, this market signifies a substantial shift towards home-based health solutions.

- Advancements in Wearable Tech: Devices now offer continuous health tracking, providing real-time data that can substitute for some in-person health checks.

- Telehealth Expansion: Virtual consultations and support services are increasingly accessible, offering a viable alternative for routine medical advice and monitoring.

- Facilitating Aging in Place: These technologies empower individuals to remain in their homes longer, directly impacting the demand for residential aged care.

Specialized or Bespoke Services

The emergence of specialized or bespoke services presents a significant threat of substitutes for traditional aged care providers like Estia Health. These tailored offerings, often powered by technology or innovative care models, cater to specific needs that standard residential care might not address. For instance, niche providers focusing on particular cultural communities or offering highly individualized care plans, blending home support with intermittent residential services, directly compete by meeting a growing demand for personalized solutions.

This trend is fueled by a desire for greater autonomy and customized support, moving away from one-size-fits-all models. As of 2024, the home care sector, a key substitute, has seen substantial growth, with reports indicating an increase in government funding and private investment aimed at supporting aging in place. This allows individuals to receive a higher degree of personalized care within their own homes, potentially reducing the need for residential aged care facilities.

- Growing Home Care Market: The Australian home care market is projected to expand significantly, with demand driven by an aging population and preferences for in-home support.

- Niche Service Providers: Specialized providers focusing on specific conditions like dementia or offering culturally sensitive care are gaining traction, attracting clients seeking tailored solutions.

- Technological Integration: The use of telehealth, remote monitoring, and smart home technology in substitute services enhances their appeal by offering convenience and improved care management.

The threat of substitutes for Estia Health's residential aged care is substantial, driven by government policy, technological advancements, and evolving consumer preferences. In-home care, retirement villages, and informal family care all offer alternatives that allow seniors to age in place, directly impacting demand for residential facilities. The growing remote patient monitoring market, valued at approximately USD 30.1 billion in 2023, highlights the increasing viability of technology-enabled home care.

| Substitute Type | Key Features | Impact on Residential Care Demand | 2024 Market Trend/Data Point |

|---|---|---|---|

| In-Home Care | Personalized assistance, aging in place focus | Reduces need for residential placement | Robust growth driven by government support for home-based care. |

| Retirement Villages | Independent living with optional support | Delays or avoids residential care | Continued expansion of offerings to include social and basic assistance. |

| Family/Informal Care | Home-based support by relatives | Directly offsets demand for formal services | Significant portion of aged care needs met informally in Australia. |

| Technology (RPM, Telehealth) | Remote monitoring, virtual consultations | Enables aging in place, reduces reliance on facilities | Global RPM market ~USD 30.1 billion in 2023, showing strong adoption. |

Entrants Threaten

The residential aged care sector, including providers like Estia Health, demands significant upfront capital. Establishing a new aged care facility involves substantial costs for land acquisition, construction, and fitting out with specialized equipment and compliant safety features. For instance, the average cost to build a new 100-bed aged care facility in Australia can range from AUD 25 million to AUD 40 million, depending on location and specifications.

This high financial barrier effectively deters many potential new entrants. The sheer scale of investment required means that only well-capitalized organizations or those with strong access to funding can realistically consider entering the market. This limits the competitive pressure from new players, as demonstrated by the relatively stable number of major operators in the Australian market over recent years.

The Australian aged care sector faces significant hurdles for new players due to stringent regulatory and licensing demands. The sector is governed by rigorous standards for quality, mandatory care minutes, and the requirement for a registered nurse to be present around the clock.

The upcoming Aged Care Act 2024/2025 is set to introduce even more demanding compliance measures, making it a challenging environment for new entrants to navigate and achieve the necessary accreditation.

The severe and ongoing shortage of skilled aged care workers, particularly nurses, presents a substantial hurdle for any potential new entrants into the sector. Recruiting and retaining qualified staff to meet care minute requirements and uphold quality standards would be a monumental task for newcomers.

In 2023, the Australian aged care sector faced a critical deficit, with reports indicating thousands of unfilled nursing positions. This scarcity directly translates to increased recruitment costs and longer onboarding times, making it exceptionally difficult for new organizations to establish a competitive workforce and deliver adequate care from the outset.

Established operators like Estia Health are already grappling with these persistent workforce pressures, highlighting the entrenched nature of this barrier. Any new entity would need to overcome not only the general market shortage but also compete directly with existing providers for a limited pool of experienced professionals.

Established Brand Loyalty and Reputation

Established brand loyalty and reputation present a significant hurdle for new entrants in the aged care sector. Companies like Estia Health have cultivated a strong market presence and a reputation for quality care, making it difficult for newcomers to gain traction. Families often prioritize trusted providers and rely on recommendations when making crucial decisions about aged care services. For instance, in 2024, Estia Health reported a strong occupancy rate of 94.5% across its facilities, underscoring the loyalty of its resident base.

New entrants would need substantial investment to build the trust and brand recognition necessary to compete effectively in this sensitive industry. Overcoming established customer loyalty requires not only competitive pricing but also a demonstrable commitment to high-quality care and resident well-being. The inherent emotional nature of choosing aged care means that reputation and familiarity play a disproportionately large role in decision-making.

- Brand Recognition: Estia Health, like other established providers, benefits from years of brand building and consistent service delivery.

- Reputation for Quality: Positive word-of-mouth and a track record of good care are powerful deterrents for new, unproven competitors.

- Customer Trust: Families often seek established names they can rely on during vulnerable times, making trust a key competitive advantage.

- Investment Barrier: New entrants must allocate significant resources to marketing, reputation management, and achieving operational excellence to even approach the standing of incumbents.

Access to Government Funding and Market Understanding

New entrants into the aged care sector face significant hurdles due to the industry's heavy reliance on government funding. A profound understanding of complex funding models and subsidy arrangements is essential for financial sustainability. For instance, in 2024, the Australian government continued to allocate substantial funds to aged care, with the Royal Commission into Aged Care Quality and Safety driving reforms aimed at improving funding transparency and efficiency. New players must adeptly navigate these intricate financial mechanisms and the prevailing policy landscape to effectively compete for government-subsidised places, a critical revenue stream.

The ability to secure government funding and interpret market dynamics presents a substantial barrier to entry. New entrants require a sophisticated grasp of these financial lifelines and the broader policy environment to operate successfully. This includes understanding the allocation of funds for various care services and the regulatory frameworks governing them. For example, the Australian Aged Care Funding Instrument (AACFI) and the upcoming changes to residential aged care funding models in 2024-2025 necessitate specialized knowledge that established providers already possess.

- Government Funding Dependency: The aged care sector's financial viability is intrinsically linked to government subsidies and funding programs.

- Navigational Complexity: New entrants must possess deep expertise in understanding and managing intricate funding models and subsidy arrangements.

- Policy Environment Acumen: Success hinges on a thorough comprehension of the broader policy landscape and its impact on operations and competition for government-supported clients.

- Competitive Advantage: Established providers benefit from existing relationships and a proven track record in securing and managing government funding, creating a barrier for newcomers.

The threat of new entrants into the residential aged care sector, particularly for providers like Estia Health, is generally low. This is primarily due to the substantial capital investment required for establishing new facilities, with costs for a 100-bed facility in Australia potentially ranging from AUD 25 million to AUD 40 million as of 2024. Furthermore, stringent regulatory compliance, including the upcoming Aged Care Act 2024/2025, and a persistent shortage of skilled workers, especially nurses, create significant operational hurdles for newcomers. For instance, thousands of nursing positions remained unfilled in 2023, driving up recruitment costs and timeframes.

Established brand loyalty and deep-seated trust are also formidable barriers. Families often rely on established providers with proven track records, making it difficult for new entities to gain market share. Estia Health's strong occupancy rate of 94.5% in 2024 exemplifies this entrenched customer loyalty. Navigating complex government funding models and subsidy arrangements, which are critical for financial sustainability, requires specialized knowledge that incumbents already possess.

| Barrier Type | Description | Impact on New Entrants | Example Data (2023-2024) |

|---|---|---|---|

| Capital Requirements | High upfront costs for land, construction, and equipment. | Deters less capitalized entrants. | AUD 25-40 million for a 100-bed facility. |

| Regulatory Hurdles | Strict compliance with quality standards, care minutes, and staffing. | Increases complexity and time to market. | Upcoming Aged Care Act 2024/2025 adds new compliance measures. |

| Workforce Shortages | Difficulty recruiting and retaining skilled staff, especially nurses. | Elevates recruitment costs and operational challenges. | Thousands of unfilled nursing positions in 2023. |

| Brand Loyalty & Trust | Established reputation and customer relationships. | Requires significant investment in marketing and reputation building. | Estia Health's 94.5% occupancy rate in 2024. |

| Government Funding Complexity | Navigating intricate funding models and subsidy arrangements. | Requires specialized financial and policy expertise. | Royal Commission driving reforms in funding transparency. |

Porter's Five Forces Analysis Data Sources

Our Estia Health Porter's Five Forces analysis is built upon a foundation of comprehensive data, drawing from industry-specific market research reports, government health statistics, and publicly available financial statements of Estia Health and its competitors.

We supplement this with insights from reputable aged care industry publications, regulatory body disclosures, and expert commentary to provide a thorough assessment of competitive intensity, bargaining power, and industry threats.