Erste Group Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Erste Group Bank Bundle

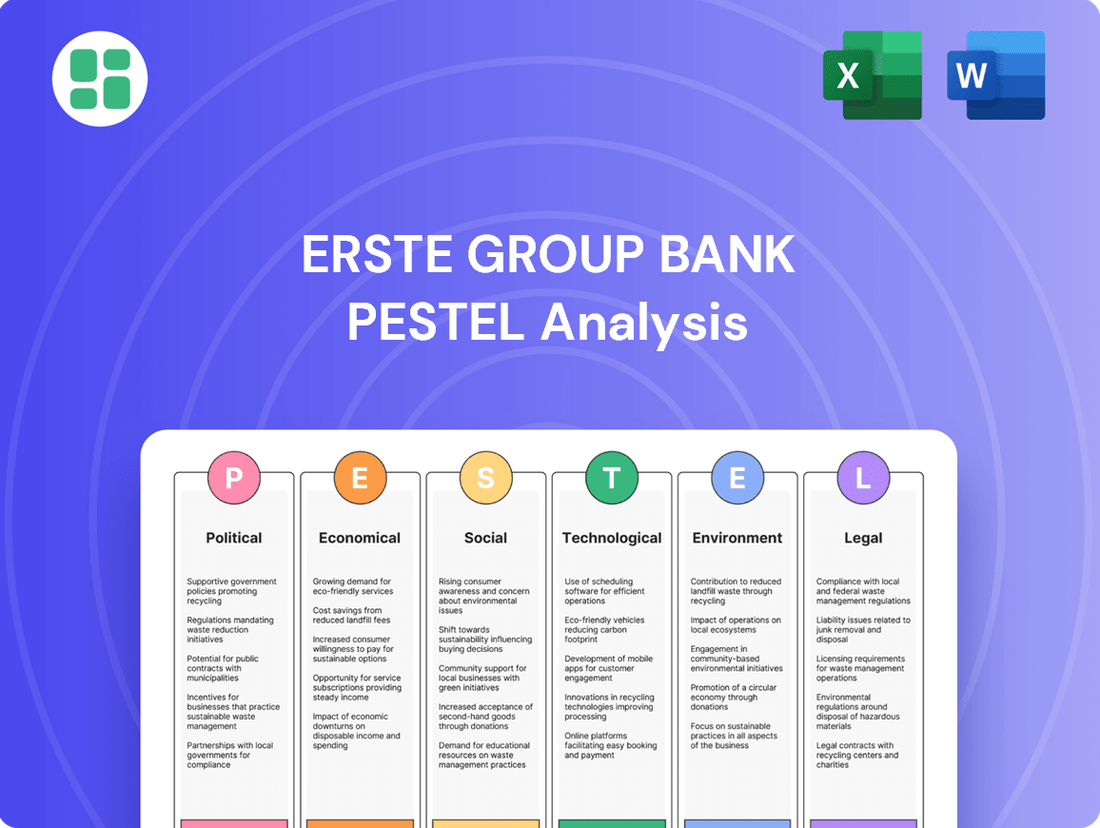

Navigate the complex external forces impacting Erste Group Bank with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, social trends, technological advancements, environmental concerns, and legal frameworks are shaping its operational landscape. This in-depth analysis is your key to identifying opportunities and mitigating risks. Download the full version now to gain actionable intelligence and sharpen your strategic advantage.

Political factors

Geopolitical stability in Central and Eastern Europe (CEE) is a critical factor for Erste Group Bank, as approximately two-thirds of its profits are generated within this region. The ongoing conflict in Ukraine and tensions in the Middle East, while not directly impacting Erste Group's physical operations, create significant indirect risks. These include heightened financial market volatility, potential sanctions spillover effects, and disruptions to global supply chains, all of which can influence economic conditions in its core markets.

Erste Group's 2025 outlook specifically highlights potential headwinds stemming from geopolitical and economic uncertainties in its key operating countries. For instance, the bank's exposure to markets like Austria, Czech Republic, Slovakia, Hungary, Romania, and Serbia means it is susceptible to regional instability. The International Monetary Fund (IMF) projected in its April 2024 World Economic Outlook that while global growth is expected to be modest, risks remain tilted to the downside, with geopolitical factors being a significant contributor.

Governments in Central and Eastern European (CEE) nations have a history of implementing specific banking taxes and windfall taxes, which can directly affect the profitability of financial entities like Erste Group. These measures are often introduced to bolster state revenues or address perceived market imbalances.

For example, Austria is set to introduce a new banking tax in 2025, which is projected to increase operating expenses and regulatory burdens for banks operating within the country. This tax is part of a broader trend of increased financial sector levies across the region.

Such governmental interventions require financial institutions like Erste Group to engage in meticulous financial forecasting and strategic adaptation. The bank must adjust its operational models and capital allocation strategies to effectively navigate these evolving fiscal landscapes and sustain its profitability objectives amidst these additional costs.

Erste Group Bank, operating significantly in Eastern Europe, must navigate a complex web of EU banking regulations. These include stringent capital adequacy requirements, such as the Common Equity Tier 1 (CET1) ratio, which for major EU banks, including Erste, generally needs to be maintained at robust levels, often exceeding the minimum regulatory thresholds set by the European Banking Authority (EBA). For instance, as of early 2024, many large banks were maintaining CET1 ratios well above 13%, demonstrating a proactive approach to regulatory demands.

The ongoing harmonization of banking laws across the European Union, driven by directives like Basel III and its subsequent iterations, presents both opportunities and challenges. While this creates a more unified and stable operating environment, it necessitates continuous adaptation by Erste Group to new rules on areas such as liquidity coverage ratios (LCR) and net stable funding ratios (NSFR). Staying abreast of these evolving standards is paramount for maintaining market access and ensuring operational resilience.

Compliance with these EU regulations is not merely a legal obligation but a fundamental pillar for Erste Group's sustained operational integrity and market standing. Failure to adhere to directives concerning things like the Bank Recovery and Resolution Directive (BRRD) and its Minimum Requirement for own funds and Eligible Liabilities (MREL) could lead to significant penalties, reputational damage, and restrictions on business activities, impacting its ability to serve customers and maintain investor confidence.

Political Will for Economic Reforms

The political will of Central and Eastern European (CEE) governments to implement structural economic reforms is a critical driver for sustained growth and investor confidence. These reforms, especially those impacting labor costs and the ease of doing business, directly shape the economic landscape in Erste Group's core markets.

A proactive policy environment, characterized by predictable regulations and a commitment to fiscal stability, is essential for fostering stable loan growth and ensuring a favorable operating environment for financial institutions like Erste Group. For instance, reforms aimed at improving the efficiency of public administration or reducing bureaucratic hurdles can significantly enhance business sentiment and investment flows.

- Commitment to reforms: Many CEE countries are actively pursuing reforms to enhance competitiveness, with some aiming to align with EU standards and best practices.

- Impact on labor costs: Government policies on minimum wage, social contributions, and labor market flexibility directly affect business operating expenses, influencing borrowing demand.

- Business environment improvements: Initiatives to streamline business registration, reduce corruption, and improve contract enforcement can attract foreign direct investment, boosting economic activity.

- Fiscal prudence: Government commitment to managing public debt and deficits supports macroeconomic stability, which is crucial for the banking sector's health and lending capacity.

Regulatory Stability and Enforcement

Regulatory stability is paramount for Erste Group, impacting its operations across Central and Eastern Europe. Predictable banking laws, consumer protection, and data privacy frameworks are essential for smooth operations and cost management. For instance, in 2024, the European Banking Authority (EBA) continued to emphasize harmonized prudential requirements, aiming to reduce regulatory fragmentation. Erste Group's proactive approach to compliance, including investments in robust IT infrastructure and personnel, is key to navigating these evolving landscapes and mitigating potential increases in compliance costs, which can affect profitability.

The bank's financial performance is directly linked to its ability to manage regulatory costs effectively. For example, adherence to stringent capital adequacy ratios, such as those under Basel III reforms, requires careful capital planning. Erste Group reported its Common Equity Tier 1 (CET1) ratio at 13.7% at the end of 2024, demonstrating a solid buffer above regulatory minimums, which helps absorb potential shocks and allows for strategic growth initiatives while managing compliance expenditures.

- Regulatory Stability: Predictable legal frameworks in CEE countries are crucial for Erste Group's operational efficiency.

- Compliance Costs: Frequent regulatory changes can increase operational expenses and necessitate ongoing investment in compliance measures.

- Data Privacy: Evolving data protection laws, such as GDPR extensions, require continuous adaptation and investment in secure data handling.

- Capital Adequacy: Maintaining strong capital ratios, like Erste Group's 13.7% CET1 ratio in 2024, is vital for meeting regulatory demands and ensuring financial resilience.

Geopolitical tensions in Central and Eastern Europe (CEE) pose a significant risk to Erste Group Bank, as the region generates a substantial portion of its profits. The ongoing conflict in Ukraine and broader regional instability contribute to financial market volatility and potential economic disruptions in Erste's core markets, impacting its 2025 outlook.

Governmental policies in CEE, including banking taxes, directly influence Erste Group's profitability. For instance, Austria's planned banking tax for 2025 is expected to increase operating costs. Such interventions necessitate strategic financial planning and adaptation by the bank.

Erste Group must navigate a complex EU regulatory environment, adhering to capital adequacy requirements like CET1 ratios, which it maintained at a strong 13.7% at the end of 2024. Harmonization of banking laws, such as Basel III, demands continuous adaptation to new rules, ensuring operational integrity and market access.

The commitment of CEE governments to structural economic reforms, particularly those affecting labor costs and the business environment, is crucial for Erste Group's growth. A stable and predictable regulatory framework, coupled with fiscal prudence, supports economic stability and investor confidence, vital for the banking sector.

| Factor | Description | Impact on Erste Group | 2024/2025 Data/Outlook |

| Geopolitical Instability | Tensions in CEE region | Increased market volatility, economic disruption | Ongoing conflict in Ukraine; IMF projects downside risks in April 2024 |

| Banking Taxation | Government levies on financial sector | Increased operating costs, reduced profitability | Austria to introduce new banking tax in 2025 |

| EU Banking Regulations | Capital adequacy, liquidity, recovery and resolution | Compliance costs, need for strong capital buffers | Erste Group's CET1 ratio at 13.7% end of 2024; EBA emphasizes harmonized requirements |

| Structural Economic Reforms | Labor costs, ease of doing business, fiscal policy | Influences economic growth, borrowing demand, and investor sentiment | Reforms aimed at enhancing competitiveness and stability are ongoing across CEE |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Erste Group Bank, covering political stability, economic conditions, social trends, technological advancements, environmental regulations, and legal frameworks.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats derived from these dynamic forces.

A concise PESTLE analysis of Erste Group Bank provides a clear overview of external factors, acting as a pain point reliever by highlighting potential challenges and opportunities for strategic planning.

Economic factors

The interest rate environment in Central and Eastern Europe (CEE) and the Eurozone is a critical factor for Erste Group's net interest income (NII). While central banks in these regions have been adjusting policy rates, the bank's ability to adapt has been key. For instance, even as rates have seen shifts, Erste Group has effectively managed its NII through strategies focusing on lower deposit costs and the repricing of its loan portfolio.

Erste Group's financial performance in the first half of 2025 demonstrates this resilience. The bank reported a slight increase in net interest income, a positive trend that is expected to continue throughout 2025. This sustained growth in NII is a testament to the bank's strategic positioning and its capacity to navigate evolving interest rate landscapes.

While inflation across Central and Eastern Europe (CEE) has been trending downwards, it continues to exert pressure on Erste Group Bank's operating expenses. Specifically, personnel and IT-related costs remain elevated due to the lingering effects of a high-inflationary period.

In the first quarter of 2025, Erste Group reported a notable increase in operating expenses, directly attributable to these higher personnel and IT expenditures. This trend underscores the ongoing challenge of managing costs in the current economic climate.

Effectively controlling these operating costs is paramount for Erste Group to maintain a healthy cost/income ratio. Success in this area is also critical for achieving the bank's target return on tangible equity, ensuring continued profitability and shareholder value.

The economic recovery across Central and Eastern Europe (CEE) is a significant tailwind for Erste Group. Projections for 2025 indicate robust GDP growth in its core markets, with many CEE countries expected to outpace Western European economies. For instance, the International Monetary Fund (IMF) forecast for 2025 suggests average GDP growth in the CEE region could reach around 3.5%, a notable figure compared to the projected 1.5% for the Eurozone.

This anticipated economic expansion directly fuels loan demand. As businesses grow and consumer confidence rises, there's a natural increase in the need for credit. Erste Group is well-positioned to capitalize on this trend, with expectations of strong loan growth in both the retail and corporate segments throughout 2025. This increased lending activity is a primary driver for the bank's overall performance and profitability in the coming year.

Currency Fluctuations and Exchange Rate Risks

Fluctuations in Central and Eastern European (CEE) currencies against the Euro can significantly impact Erste Group's financial performance, particularly given its extensive operations across the region. For instance, a strengthening Czech Koruna or Romanian Leu against the Euro would positively affect reported earnings when translated back into Euros, while a weakening would have the opposite effect.

While many CEE currencies demonstrated relative stability throughout much of 2024, the potential for significant volatility remains a key consideration. This volatility can influence the valuation of assets held in local currencies and complicate cross-border transactions and capital flows. For example, a sudden depreciation of the Hungarian Forint could reduce the Euro-denominated value of Erste's Hungarian assets.

Erste Group actively manages these currency risks through various strategies. These include employing financial hedging instruments, such as forward contracts and options, to lock in exchange rates for anticipated transactions. Furthermore, maintaining a diversified operational footprint across multiple CEE countries helps to naturally hedge some of these exposures, as losses in one currency market might be offset by gains in another.

- CEE Currency Performance (2024 Average vs. EUR): While specific average figures for the entirety of 2024 are still solidifying, early indicators suggested relative stability for currencies like the Czech Koruna and Polish Zloty against the Euro, with some minor fluctuations observed in the Hungarian Forint and Romanian Leu.

- Hedging Strategies: Erste Group's financial reports often detail the use of derivative instruments to mitigate currency risk, with the volume of such hedges fluctuating based on market conditions and the bank's exposure.

- Diversification Benefits: The bank's presence in markets such as Austria, Czech Republic, Slovakia, Hungary, Romania, Serbia, Croatia, and Slovenia inherently diversifies its currency exposure, reducing the impact of adverse movements in any single currency.

Asset Quality and Non-Performing Loan Ratios

Erste Group's asset quality, as indicated by its non-performing loan (NPL) ratio, is a crucial barometer of economic vitality and borrower creditworthiness in its operating regions. The bank has demonstrated resilience, with its NPL ratio showing a stable trend and a slight improvement in the first half of 2025. This robust asset quality is significantly bolstered by the prevailing low unemployment rates across Central and Eastern Europe (CEE), which directly contribute to keeping risk costs manageable.

Key indicators for Erste Group's asset quality in the context of its CEE operations:

- NPL Ratio Trend: Erste Group reported a stable NPL ratio, with a marginal decrease observed in H1 2025, signaling improved credit performance.

- Impact of Unemployment: Low unemployment rates in the CEE region are a primary driver of strong asset quality, reducing the likelihood of loan defaults.

- Risk Costs: The bank's ability to maintain low risk costs is directly linked to the healthy financial standing of its borrowers, supported by stable employment.

- Regional Economic Health: The overall asset quality of Erste Group is reflective of the broader economic health and credit environment within its key CEE markets.

The economic outlook for Central and Eastern Europe (CEE) in 2025 presents a mixed but generally positive landscape for Erste Group. While inflation has been moderating, it continues to influence operating expenses, particularly in personnel and IT. However, the region's projected GDP growth, expected to outpace Western Europe, is a significant tailwind, driving loan demand and supporting the bank's performance.

Erste Group's net interest income (NII) has shown resilience, with a slight increase reported in the first half of 2025, reflecting effective management of interest rate environments. This trend is anticipated to continue throughout the year, bolstered by strategic loan repricing and cost control on deposits.

Currency fluctuations in the CEE region remain a key consideration, though many currencies have shown relative stability. Erste Group employs hedging strategies and benefits from operational diversification to mitigate these risks, ensuring a more predictable financial outcome.

Asset quality, measured by the non-performing loan (NPL) ratio, has been stable with a slight improvement in early 2025. This is largely due to low unemployment rates across CEE, which contribute to manageable risk costs and reflect the overall economic health of the bank's operating markets.

| Economic Factor | 2024 Trend (Est.) | 2025 Projection | Impact on Erste Group |

|---|---|---|---|

| GDP Growth (CEE Avg.) | ~3.0% | ~3.5% | Positive - drives loan demand and economic activity |

| Inflation (CEE Avg.) | Moderating from 2023 highs | Continuing downward trend, but above target in some markets | Mixed - pressure on operating costs, but potential for rate stabilization |

| Unemployment Rate (CEE Avg.) | Low, ~4-6% | Expected to remain low | Positive - supports asset quality and reduces risk costs |

| Interest Rate Environment | Policy rates adjusted by central banks | Continued adjustments, potential for stabilization or slight easing later in 2025 | Key for NII; bank adapting through loan repricing and deposit cost management |

| Currency Volatility (CEE vs. EUR) | Some minor fluctuations, overall relative stability for key currencies | Potential for volatility remains, active management employed | Risk factor managed through hedging and diversification |

Preview Before You Purchase

Erste Group Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Erste Group Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and potential challenges for this prominent European financial institution.

Sociological factors

Customers across Central and Eastern Europe are clearly shifting their expectations towards banking services that are both convenient and readily accessible online. This trend is a significant sociological factor influencing the financial sector.

Erste Group Bank is actively responding to this by enhancing its digital offerings. Their digital platform, George, has experienced substantial user growth, reaching 10.8 million users by the end of 2023. This figure underscores the strong embrace of digital channels by consumers.

The bank's strategic approach, emphasizing human connection within a digital framework and simplifying financial information through intuitive interfaces, directly addresses these evolving customer preferences. This focus on user experience is crucial for maintaining relevance and customer loyalty in the current market landscape.

Erste Group actively champions financial literacy, recognizing its pivotal role in empowering customers. By simplifying complex financial products and providing accessible educational resources, particularly for those new to investing, the bank aims to cultivate more informed financial decisions across its operating regions.

These efforts directly support broader financial inclusion goals. For instance, in 2023, Erste Group's financial education programs reached over 500,000 individuals, a significant increase from previous years, contributing to a potential expansion of its customer base by fostering greater engagement and trust.

Demographic shifts present a dual challenge and opportunity for Erste Group. In several Central and Eastern European (CEE) markets, aging populations and declining birth rates contribute to a shrinking, aging workforce. This can constrain the supply of skilled labor, potentially increasing recruitment costs and impacting operational efficiency. For instance, in 2024, several CEE countries continued to grapple with below-replacement fertility rates, a trend that directly affects the long-term talent pool available to financial institutions.

These demographic trends also shape demand for banking products. An aging population may increase demand for retirement planning services, wealth management, and healthcare-related financing. Conversely, a smaller younger demographic could mean lower demand for traditional retail banking products like mortgages for first-time buyers. Erste Group must adapt its product offerings and marketing strategies to cater to these evolving customer needs.

Labor market dynamics, including mandatory salary increases and competition for talent, directly influence Erste Group's operating expenses, particularly personnel costs. In 2024, inflation in many CEE countries continued to put upward pressure on wages, forcing banks like Erste Group to adjust compensation packages to remain competitive. This necessitates careful cost management and strategic investments in technology to offset potential increases in labor expenditure.

Social Responsibility and Community Engagement

Erste Group Bank's commitment to social responsibility is deeply ingrained, stemming from its founding charter which emphasizes creating prosperity and equal opportunities. This dedication manifests in its comprehensive sustainability strategy, which prominently features social dimensions. For instance, fostering financial health among its diverse customer base and actively participating in community development programs are key priorities, directly impacting societal well-being.

These initiatives not only bolster Erste Group's corporate reputation but also cultivate stronger customer loyalty. In 2023, Erste Group reported a significant increase in its community investment, with over €15 million allocated to various social projects across its operating regions. This focus on social impact is a strategic imperative, aligning business goals with broader societal needs and contributing to a more inclusive economic landscape.

- Financial Health Programs: Erste Group offers a range of educational tools and advisory services aimed at improving financial literacy among individuals and small businesses, reaching over 500,000 people in 2023.

- Community Investment: The bank actively supports local communities through sponsorships and partnerships, contributing to cultural, educational, and social welfare initiatives.

- Employee Volunteering: Erste Group encourages its employees to engage in volunteer activities, with over 10,000 employee volunteer hours logged in 2023.

- Sustainable Lending: The bank is increasing its focus on lending to social enterprises and projects with a positive social impact.

Trust and Reputation in the Banking Sector

Public trust is the bedrock of the banking sector, particularly in Central and Eastern Europe where economic landscapes have seen significant shifts. Erste Group actively cultivates this trust by focusing on customer satisfaction, aiming for high scores that reflect their commitment to service excellence. Their reputation is built on a foundation of responsible business practices and transparent dealings with clients.

In 2023, Erste Group reported a customer satisfaction score of 8.2 out of 10 across its core markets, a testament to their ongoing efforts. This focus on ethical conduct and robust governance principles is not merely a compliance exercise but a strategic imperative for sustained growth and stability in the competitive financial environment.

- Customer Satisfaction: Erste Group's commitment to customer satisfaction is a key driver of trust.

- Responsible Conduct: Adherence to ethical standards and transparent operations bolsters their reputation.

- Governance: Strong governance frameworks are essential for long-term banking sector stability.

- Regional Context: Navigating diverse historical and economic backgrounds in CEE requires a heightened focus on trust-building.

Sociological factors significantly shape Erste Group Bank's operational landscape, with evolving customer expectations for digital convenience being paramount. The bank's digital platform, George, saw its user base climb to 10.8 million by the end of 2023, illustrating a strong societal shift towards online banking services.

Demographic trends, such as aging populations and declining birth rates in Central and Eastern Europe, present both challenges and opportunities. While an aging populace may drive demand for retirement and wealth management services, a shrinking younger demographic could impact demand for products like first-time buyer mortgages.

Erste Group's commitment to financial literacy and community investment, exemplified by reaching over 500,000 individuals with financial education programs in 2023 and investing over €15 million in social projects, reinforces public trust. This focus on social responsibility and customer satisfaction, reflected in an 8.2 out of 10 customer satisfaction score in 2023, is crucial for maintaining its standing in the region.

| Sociological Factor | Erste Group Response/Impact | Key Data (2023/2024) |

|---|---|---|

| Digitalization Demand | Enhancing digital platforms like George | 10.8 million George users (end of 2023) |

| Demographic Shifts | Adapting product offerings for aging populations and smaller younger demographics | Continued below-replacement fertility rates in several CEE countries (2024) |

| Financial Literacy & Inclusion | Promoting financial education and community programs | Over 500,000 individuals reached by financial education programs (2023) |

| Public Trust & Ethics | Focusing on customer satisfaction and responsible conduct | 8.2/10 customer satisfaction score (2023) |

Technological factors

Erste Group Bank is making substantial investments in its digital transformation journey, a key technological factor influencing its operations. This commitment is evidenced by significant IT spending aimed at modernizing its infrastructure and improving customer interactions. For instance, the bank is actively migrating to advanced platforms such as z16, a move designed to boost efficiency and pave the way for future innovations.

Further enhancing its digital capabilities, Erste Group is leveraging cloud services, notably partnering with Google Cloud. This strategic adoption of cloud technology is crucial for streamlining operations, reducing reliance on manual processes, and accelerating the launch of new financial products and services. These digital initiatives are expected to yield tangible benefits in operational agility and customer service delivery throughout 2024 and into 2025.

As banking increasingly moves online, Erste Group faces growing cybersecurity threats. In 2023, the financial sector experienced a significant uptick in sophisticated cyberattacks, with ransomware and phishing attempts posing major risks. Protecting customer data and maintaining operational integrity requires continuous, substantial investment in advanced security protocols and threat detection systems to counter these evolving dangers.

The financial technology (FinTech) sector continues to be a major disruptive force, presenting both significant challenges and avenues for growth for established institutions like Erste Group. FinTechs are rapidly innovating, offering specialized, often more user-friendly digital services that can attract customers away from traditional banking models. For instance, by early 2024, digital-only banks and payment providers have captured a notable share of the retail banking market in many European countries where Erste operates, forcing traditional players to accelerate their own digital transformation efforts.

Erste Group is proactively addressing this competitive landscape by investing heavily in its digital platforms, most notably its George app. George aims to provide a comprehensive and intuitive banking experience, directly competing with the agility and feature sets offered by FinTech startups. This strategy is crucial for retaining and attracting customers in an increasingly digital-first environment, with George reporting millions of active users across its markets by mid-2024, demonstrating its importance in the bank's digital strategy.

To stay ahead, Erste Group is also pursuing strategic partnerships and making targeted investments in promising FinTech companies and technologies. This approach allows the bank to leverage external innovation, integrate new capabilities, and expand its service offerings without necessarily building everything from scratch. These collaborations are vital for accessing emerging technologies like AI-driven financial advice or blockchain-based payment solutions, ensuring Erste remains competitive and relevant in the evolving financial services ecosystem throughout 2024 and into 2025.

Artificial Intelligence (AI) and Machine Learning (ML) Adoption

Erste Group is actively pursuing the integration of artificial intelligence (AI) and machine learning (ML) to drive innovation and operational excellence. The bank intends to invest in these emerging technologies to refine decision-making processes, streamline operations, and deliver highly personalized customer interactions. This strategic focus aims to create a digitally advanced banking environment, leveraging AI for enhanced efficiency in critical functions.

The adoption of AI and ML is expected to yield significant improvements across various banking operations. Key areas benefiting from this technological shift include more accurate credit risk assessment, robust fraud detection mechanisms, and elevated customer service capabilities. By automating and optimizing these processes, Erste Group is positioning itself for a future where AI plays a central role in its digital transformation strategy.

- AI Investment: Erste Group's strategic plan includes substantial investment in AI and ML technologies.

- Efficiency Gains: Expected improvements in credit risk assessment and fraud detection through AI implementation.

- Customer Experience: AI will be leveraged to personalize customer interactions and enhance service delivery.

- Digital Future: The bank aims to build a future-ready digital infrastructure powered by AI.

Mobile Banking and Platform Development

Erste Group Bank's commitment to advancing its mobile banking and digital platforms, particularly George, is crucial for its success in Central and Eastern Europe (CEE). These platforms are designed not just for transactions but also to educate users, making financial management more accessible. By focusing on intuitive design and valuable content, Erste Group aims to cultivate a more financially savvy customer base, a key differentiator in the competitive banking landscape.

The bank's investment in digital channels reflects a broader industry trend. For instance, by the end of 2023, Erste Group reported that its digital channels were used by over 5.8 million customers, with George, its flagship digital banking platform, seeing significant adoption. This digital push is vital for serving a geographically dispersed customer base efficiently. The ongoing development of these platforms ensures they remain competitive and meet evolving customer expectations for seamless, integrated financial services.

Key technological advancements and their impact include:

- Enhanced User Experience: Continuous updates to George aim to simplify complex financial tasks, increasing customer engagement.

- Digital Reach: Mobile banking allows Erste Group to serve a wider demographic across the CEE region, overcoming geographical barriers.

- Financial Literacy: The integration of educational content on platforms like George empowers customers with financial knowledge, fostering loyalty and trust.

- Data-Driven Insights: Digital platforms provide valuable data for personalizing services and identifying new market opportunities.

Erste Group's technological strategy centers on robust digital transformation, evidenced by significant IT spending and a focus on modernizing infrastructure. The bank's ongoing migration to advanced platforms like z16 and its strategic partnership with Google Cloud for cloud services underscore a commitment to operational efficiency and innovation throughout 2024 and 2025.

The bank is actively integrating AI and machine learning to enhance credit risk assessment, fraud detection, and customer personalization, aiming for a digitally advanced banking environment. This focus on AI is crucial for staying competitive and improving operational excellence.

Erste Group's digital platforms, particularly the George app, are central to its strategy, aiming to provide a comprehensive and intuitive banking experience that rivals FinTech offerings. By mid-2024, George reported millions of active users, highlighting its importance in customer retention and acquisition.

The bank is also investing in FinTech partnerships to leverage external innovation, accessing emerging technologies like AI-driven advice and blockchain solutions to ensure continued relevance in the evolving financial services landscape.

Legal factors

Erste Group Bank operates within a robust regulatory environment, adhering to international standards like Basel III, and soon Basel IV, which mandate stringent capital adequacy. These frameworks, particularly the Common Equity Tier 1 (CET1) ratio, are critical for ensuring the bank's financial stability and its ability to absorb unexpected losses.

Demonstrating its commitment to these requirements, Erste Group Bank consistently maintained a strong capital position. For instance, its CET1 ratio saw a positive trend, reaching 14.8% at the end of Q1 2025 and further strengthening to 15.1% by the close of H1 2025, comfortably surpassing the minimum regulatory thresholds.

Erste Group Bank, like all financial institutions, faces stringent legal requirements regarding Anti-Money Laundering (AML) and sanctions compliance. These regulations are paramount, especially given the bank's operations across multiple jurisdictions in Central and Eastern Europe, where cross-border transactions are frequent.

Failure to adhere to AML and sanctions laws can result in severe penalties, including substantial fines and reputational damage. For instance, in 2023, global financial institutions paid billions in AML-related fines, underscoring the financial and operational risks associated with non-compliance.

Erste Group must maintain sophisticated internal controls, including customer due diligence, transaction monitoring, and suspicious activity reporting, to detect and prevent illicit financial flows. This proactive approach is essential for mitigating legal exposure and safeguarding the bank's integrity.

Erste Group Bank must navigate a complex web of data privacy laws, with the General Data Protection Regulation (GDPR) being a cornerstone for its European operations. Compliance is non-negotiable, impacting how customer data is collected, stored, and processed.

Failure to adhere to these regulations can result in significant financial penalties; for instance, GDPR fines can reach up to 4% of a company's annual global turnover or €20 million, whichever is higher. This underscores the critical importance of robust data protection measures for maintaining trust and avoiding legal repercussions.

Consumer Protection Laws

Erste Group operates under a complex web of consumer protection laws across its various European markets, dictating everything from product disclosure to complaint resolution. These regulations are crucial for ensuring fair customer treatment and mitigating legal risks, underscoring the bank's dedication to ethical financial practices. For instance, in 2024, the European Union continued to strengthen consumer rights, with new directives impacting digital services and data privacy, areas where Erste Group must maintain strict compliance.

Adherence to these consumer protection frameworks is not merely a legal obligation but a cornerstone of building trust and maintaining a positive brand reputation. Failure to comply can result in significant fines and reputational damage, as seen in various cases across the banking sector where consumer protection breaches have led to substantial penalties.

- Regulatory Scrutiny: Erste Group faces ongoing scrutiny from national and EU regulators regarding its consumer-facing operations.

- Data Privacy Compliance: Laws like GDPR (General Data Protection Regulation) mandate stringent data handling practices for customer information.

- Fair Lending Practices: Regulations ensure transparency and fairness in credit product offerings and loan agreements.

- Complaint Handling Mechanisms: Banks are required to establish robust and accessible procedures for addressing customer grievances.

Competition Law and Market Consolidation

Competition law plays a crucial role in the Central and Eastern European (CEE) banking landscape, which is currently undergoing significant consolidation. Erste Group's strategic moves, like its acquisition of a 4.2% stake in Santander Bank Polska in late 2023, are directly impacted by these regulations. Such transactions require approval from competition authorities to ensure they do not stifle market competition or create monopolies.

Navigating these complex legal frameworks is paramount for Erste Group's growth ambitions. For instance, the European Commission's merger control regulations scrutinize deals that could significantly alter market dynamics. As of early 2024, the banking sector in countries like Poland continues to see consolidation trends, making adherence to competition law a critical factor for expanding market share and maintaining fair play.

- Merger Scrutiny: Acquisitions and mergers in the CEE banking sector, including those involving Erste Group, are subject to rigorous review by national and EU competition authorities.

- Market Share Thresholds: Regulators assess whether a transaction would lead to an excessive concentration of market power, potentially impacting pricing and service availability for consumers.

- Fair Competition: Ensuring that consolidation efforts do not disadvantage smaller players or limit consumer choice is a key objective of competition law in the banking industry.

- Regulatory Approvals: Successful market expansion for Erste Group hinges on obtaining necessary approvals from competition watchdogs, a process that can influence deal timelines and structures.

Erste Group Bank's operations are deeply intertwined with evolving legal landscapes, particularly concerning capital adequacy and financial stability. The bank's commitment to maintaining robust capital ratios, such as a Common Equity Tier 1 (CET1) ratio of 15.1% by H1 2025, demonstrates its proactive approach to regulatory compliance under frameworks like Basel III and upcoming Basel IV.

The bank also navigates stringent Anti-Money Laundering (AML) and sanctions regulations, crucial for its multi-jurisdictional presence. Given that global financial institutions paid billions in AML-related fines in 2023, Erste Group's investment in sophisticated internal controls is vital for mitigating legal exposure and reputational risk.

Data privacy laws, notably GDPR, impose strict requirements on how Erste Group handles customer data, with potential fines up to 4% of annual global turnover. Similarly, consumer protection laws across its operating regions dictate fair practices and transparent complaint resolution, reinforcing the bank's commitment to ethical conduct and trust-building.

Competition law significantly influences Erste Group's strategic decisions, such as its stake acquisition in Santander Bank Polska in late 2023. These moves require approval from authorities to prevent market monopolization, highlighting the importance of regulatory adherence for market expansion and fair competition in the consolidating CEE banking sector.

| Regulatory Area | Key Legislation/Framework | Erste Group's Compliance Focus | Potential Impact of Non-Compliance |

|---|---|---|---|

| Capital Adequacy | Basel III, Basel IV | Maintaining strong CET1 ratios (e.g., 15.1% by H1 2025) | Fines, reduced lending capacity, reputational damage |

| Financial Crime | AML, Sanctions Laws | Robust internal controls, transaction monitoring | Substantial fines (billions paid globally in 2023), legal action |

| Data Protection | GDPR | Strict data handling and processing protocols | Fines up to 4% of global turnover, loss of customer trust |

| Consumer Protection | EU Directives, National Laws | Fair product disclosure, accessible complaint resolution | Significant penalties, reputational harm |

| Market Competition | EU Merger Control, National Competition Laws | Securing regulatory approvals for strategic acquisitions | Blocked mergers, market access limitations |

Environmental factors

Erste Group is navigating a landscape of evolving ESG regulations, including the comprehensive European Sustainability Reporting Standards (ESRS) and the EU Taxonomy, which are shaping how financial institutions report on their environmental impact and sustainable activities. These mandates require detailed disclosures, influencing investment strategies and operational practices.

In response, Erste Group has proactively integrated its sustainability commitments into its core financial reporting, notably within its management report, and provides a specific Climate Report. This demonstrates a commitment to transparency and adherence to growing stakeholder expectations for robust ESG performance data.

For instance, in its 2023 Sustainability Report, Erste Group highlighted a significant increase in its sustainable finance volume, reaching €37.5 billion by the end of 2023, up from €26.8 billion in 2022, underscoring its alignment with sustainable finance objectives and regulatory trends.

Erste Group Bank is actively integrating climate risks into its core risk management, a crucial step in its sustainability drive. This means thoroughly evaluating the environmental impact and climate-related risks present in its lending and investment portfolios. This proactive approach aligns with global standards, such as the recommendations set forth by the Task Force on Climate-related Financial Disclosures (TCFD), ensuring greater transparency and preparedness.

By quantifying these climate-related exposures, Erste Group aims to build resilience against physical and transition risks. For instance, in 2024, the bank continued to enhance its methodologies for assessing climate scenarios, including those impacting sectors like real estate and energy, which are particularly vulnerable to climate change impacts. This focus helps in making more informed lending and investment decisions, steering capital towards more sustainable ventures.

Customers and investors are increasingly seeking out green financing and sustainable banking solutions. Erste Group has responded by establishing a robust sustainable finance framework. This includes the issuance of 'Sustainability Bonds', which specifically channel funds into projects delivering environmental and social advantages, reflecting a clear commitment to responsible finance.

These initiatives directly support the European Union's overarching objective of redirecting financial flows towards a low-emission economy. For instance, in 2023, Erste Group reported that its sustainable finance portfolio grew significantly, with new sustainable loans reaching €5.2 billion, demonstrating tangible progress in this area.

Net-Zero Commitments and Carbon Footprint Reduction

Erste Group Bank is proactively addressing climate change, notably by being the first Austrian and Central and Eastern European bank to join the UN's Net-Zero Banking Alliance (NZBA). This commitment means aligning its lending and investment portfolios to achieve net-zero emissions by 2050, with a target for its own operations to reach net-zero by 2030.

The bank's strategy involves a dual approach: reducing its direct operational carbon footprint and, crucially, influencing and reducing emissions financed through its lending and investment activities. This includes setting interim targets for portfolio decarbonization.

- NZBA Commitment: Erste Group aims for net-zero financed emissions by 2050 and net-zero operational emissions by 2030.

- Portfolio Alignment: The bank is actively working to align its lending and investment portfolios with net-zero pathways.

- Carbon Footprint Reduction: Erste Group is focused on reducing its own operational carbon footprint.

Environmental Impact of Operations and Resource Management

Erste Group Bank is actively working to lower its environmental impact. A key part of this strategy involves upgrading its IT infrastructure, aiming for greater energy efficiency and a reduced carbon footprint. This modernization is crucial for achieving their broader sustainability objectives.

Responsible resource management is a cornerstone of Erste Group's operations. By focusing on efficiency, the bank seeks to minimize its consumption of natural resources, ensuring its activities are sustainable in the long term and do not lead to depletion.

These efforts align with Erste Group's commitment to operating in an environmentally conscious manner. The bank recognizes the importance of sustainability in its business model and actively pursues initiatives that support this goal.

- IT Modernization: Erste Group is investing in upgrading its IT systems to enhance energy efficiency and reduce its environmental footprint, a process that continued through 2024 with ongoing projects.

- Resource Efficiency: The bank emphasizes responsible resource management across its operations, aiming to minimize waste and optimize the use of materials.

- Sustainability Goals: Initiatives in environmental impact reduction are directly tied to Erste Group's overarching sustainability targets, reflecting a strategic commitment to long-term ecological responsibility.

Erste Group is actively integrating climate risks into its risk management, evaluating environmental impacts within its portfolios to build resilience against physical and transition risks. The bank continued to enhance its climate scenario assessment methodologies in 2024, particularly for vulnerable sectors like real estate and energy.

The bank's commitment to net-zero is demonstrated by its membership in the UN's Net-Zero Banking Alliance (NZBA), aiming for net-zero financed emissions by 2050 and operational emissions by 2030. This involves aligning portfolios and reducing financed emissions through strategic lending and investment decisions.

Erste Group is also focused on reducing its direct environmental footprint, including upgrading IT infrastructure for greater energy efficiency and practicing responsible resource management to minimize consumption. These efforts are integral to achieving its broader sustainability targets.

| Metric | 2022 | 2023 | Target |

|---|---|---|---|

| Sustainable Finance Volume | €26.8 billion | €37.5 billion | Growth |

| New Sustainable Loans | N/A | €5.2 billion | Growth |

| Operational Emissions | N/A | N/A | Net-zero by 2030 |

| Financed Emissions | N/A | N/A | Net-zero by 2050 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Erste Group Bank is meticulously constructed using data from reputable financial institutions, economic forecasting agencies, and regulatory bodies. We draw upon reports from the European Central Bank, national statistical offices of key operating countries, and leading market research firms to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.