Enterprise Bank & Trust PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enterprise Bank & Trust Bundle

Navigate the complex external landscape impacting Enterprise Bank & Trust with our comprehensive PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors shaping its operations and future growth. Gain a strategic advantage by leveraging these expert-level insights to inform your own market strategies and investment decisions. Download the full version now for actionable intelligence that can drive success.

Political factors

Regulatory policy shifts are a critical political factor for Enterprise Bank & Trust. Changes in government regulations and supervisory frameworks directly impact the bank's operations, compliance costs, and strategic decisions.

New policies, such as those related to capital requirements or consumer protection, can necessitate significant operational adjustments. For instance, the Federal Reserve's stress tests, which evaluate banks' resilience under adverse economic conditions, directly influence capital planning and risk management strategies for institutions like Enterprise Bank & Trust.

The political climate significantly influences the likelihood and direction of such regulatory reforms. In 2024, ongoing discussions around potential adjustments to banking regulations, particularly concerning regional banks following events in 2023, could affect Enterprise Bank & Trust's risk exposure and profitability.

Government fiscal policies, encompassing spending and taxation, alongside monetary policies like the Federal Reserve's interest rate decisions, significantly shape the economic landscape for Enterprise Bank & Trust. For instance, the US national debt reached over $34 trillion by early 2024, potentially influencing future fiscal adjustments that could impact corporate profitability and consumer behavior.

Monetary policy directly affects Enterprise Bank & Trust through interest rate changes. The Federal Reserve's target for the federal funds rate, which has seen fluctuations in 2024, directly influences the bank's net interest margin and the demand for loans. A higher rate environment can boost interest income but may also dampen borrowing activity.

Enterprise Bank & Trust's operations are significantly influenced by the political stability of the United States and any international markets it engages with. A stable political landscape generally boosts investor confidence and encourages broader economic activity, which directly benefits financial institutions through increased lending and investment opportunities.

Geopolitical events, such as the ongoing trade tensions between major economies or regional conflicts, can introduce considerable market volatility. For example, disruptions stemming from international disputes can impact supply chains for client businesses, potentially leading to higher loan default rates for Enterprise Bank & Trust. The U.S. inflation rate, which stood at 3.3% in May 2024, is also a key indicator influenced by political decisions and global events, affecting interest rate policies and the overall economic climate.

Industry-Specific Lobbying and Advocacy

The banking sector, including institutions like Enterprise Bank & Trust, actively engages in lobbying to shape financial regulations. For instance, in 2024, the American Bankers Association reported spending approximately $25 million on lobbying efforts, aiming to influence legislation concerning capital requirements and consumer protection. This advocacy is crucial for navigating the complex regulatory environment.

Enterprise Bank & Trust, by participating in industry groups, contributes to shaping laws that impact its operations in banking, finance, and wealth management. These collective efforts can influence everything from interest rate policies to digital banking regulations. The effectiveness of this advocacy directly affects the bank's operational costs and market positioning.

- Regulatory Burden: Lobbying success can reduce compliance costs, potentially saving banks millions in operational expenses.

- Competitive Landscape: Favorable regulations can create an uneven playing field, benefiting larger or more politically connected institutions.

- Profitability: Direct impacts on lending rules, fees, and investment opportunities can significantly alter a bank's bottom line.

- Industry Growth: Advocacy for supportive policies can foster innovation and expansion within the financial services sector.

Government Support and Bailout Policies

While direct government bailouts for banks like Enterprise Bank & Trust are infrequent, the mere possibility shapes the political landscape. Policies designed to manage systemic risk, such as those enacted during the 2008 financial crisis or more recent discussions around regional bank stability in 2023, directly impact how the market views the safety of financial institutions. This implicit government backing can lower borrowing costs and bolster investor trust.

The U.S. government's approach to financial stability, as seen in the Federal Deposit Insurance Corporation (FDIC) deposit insurance limits, provides a baseline of security. For instance, the FDIC insures deposits up to $250,000 per depositor, per insured bank, for each account ownership category. This framework, while not a direct bailout, influences customer confidence and the overall stability of the banking sector.

- Government Intervention: The potential for government support during financial distress, though rare, remains a political factor affecting bank stability.

- Systemic Risk Management: Policies aimed at managing systemic risk, like those seen in 2023 regional bank stress, influence market perceptions of financial institutions.

- Implicit Backing: Government guarantees, such as FDIC deposit insurance up to $250,000, can lower funding costs and enhance investor confidence.

Government fiscal and monetary policies profoundly shape Enterprise Bank & Trust's operating environment. For example, the Federal Reserve's interest rate decisions in 2024 directly impact the bank's net interest margin and loan demand, with the federal funds rate target seeing notable shifts. The U.S. national debt exceeding $34 trillion by early 2024 also signals potential future fiscal adjustments that could influence corporate profitability and consumer spending.

Political stability, both domestically and internationally, is crucial for Enterprise Bank & Trust. A stable U.S. political climate fosters investor confidence and economic activity, leading to more lending and investment opportunities. Conversely, geopolitical events, such as trade tensions or regional conflicts, can create market volatility, potentially increasing loan default rates for the bank's clients, as seen with the U.S. inflation rate at 3.3% in May 2024 being influenced by global events.

Lobbying by financial institutions like Enterprise Bank & Trust is a key political factor. In 2024, industry groups, such as the American Bankers Association with its reported $25 million lobbying expenditure, actively seek to influence legislation on capital requirements and consumer protection. These efforts can directly impact the bank's compliance costs, competitive landscape, and overall profitability.

The potential for government intervention and systemic risk management policies significantly influence market perceptions of financial institutions like Enterprise Bank & Trust. While direct bailouts are rare, government frameworks like FDIC deposit insurance, capped at $250,000 per depositor, provide a baseline of security that can lower funding costs and bolster investor confidence, especially in light of regional bank stability discussions in 2023.

What is included in the product

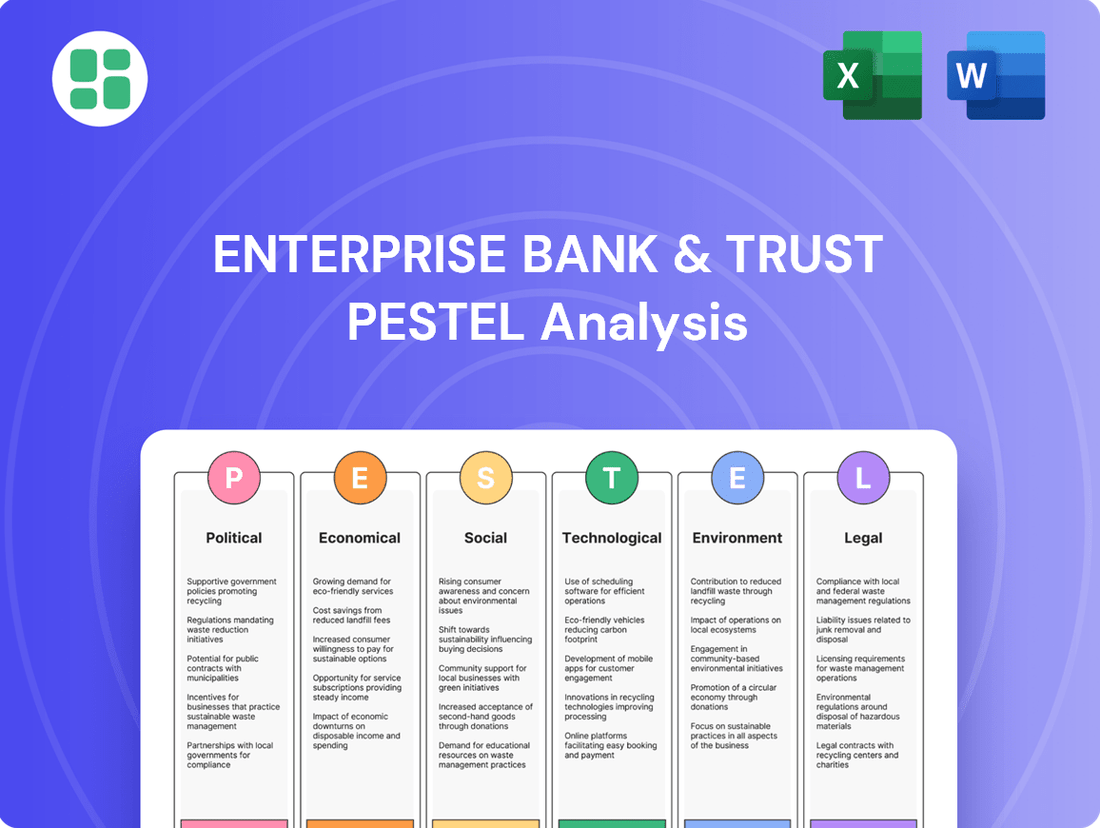

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Enterprise Bank & Trust, providing actionable insights for strategic decision-making.

The Enterprise Bank & Trust PESTLE Analysis offers a clear, summarized version of the full analysis for easy referencing during meetings or presentations, acting as a pain point reliever by simplifying complex external factors.

Economic factors

The Federal Reserve's monetary policy significantly shapes Enterprise Bank & Trust's operating landscape. As of mid-2024, the Fed has maintained a target range for the federal funds rate, influencing borrowing costs across the economy. For Enterprise Bank & Trust, this means that while higher rates can boost interest income on loans, they also increase the cost of funds for deposits and other borrowings, potentially narrowing the net interest margin.

Fluctuations in interest rates directly affect Enterprise Bank & Trust's profitability, particularly its net interest margin. For instance, if the Fed raises rates, Enterprise Bank & Trust can charge more for loans, but it also has to pay more for customer deposits. This delicate balance is key to their financial performance. In late 2023 and early 2024, many banks saw their net interest margins compress as deposit costs rose faster than asset yields.

The bank must strategically manage its asset and liability portfolios to optimize returns in varying interest rate climates. This involves making smart decisions about the types of loans they offer and how they fund those loans. For example, during periods of rising rates, Enterprise Bank & Trust might focus on shorter-term loans or variable-rate products to better align with potentially increasing funding costs.

The overall health and growth rate of the economy are critical drivers for Enterprise Bank & Trust. For instance, the US economy experienced a 2.5% GDP growth in 2023, indicating a generally healthy environment that supports demand for banking services like commercial loans and treasury management. This economic expansion typically translates to higher employment and increased consumer spending, which positively impacts the bank's loan portfolio quality and fee-based income streams.

Conversely, economic slowdowns present challenges. A projected slowdown in global GDP growth for 2024, with many forecasts hovering around 2.7%, suggests a more cautious economic outlook. This could lead to reduced business investment and potentially higher loan default rates, directly affecting Enterprise Bank & Trust's profitability and risk exposure.

Inflation directly impacts Enterprise Bank & Trust's purchasing power, affecting operational costs and the real value of its assets and liabilities. For instance, if inflation runs at 3% in 2024, the bank's revenue needs to grow at least that much to maintain its real value. Conversely, deflation can dampen consumer and business spending, potentially leading to lower loan demand and increased risk in the loan portfolio.

Managing the balance sheet effectively is crucial for Enterprise Bank & Trust to navigate these price level shifts. High inflation, like the 3.4% annual inflation rate recorded in the US as of April 2024, can diminish the value of fixed-rate loans and investments, while simultaneously increasing expenses for salaries and technology. The bank must employ strategies to hedge against these erosive effects, ensuring profitability and stability.

Unemployment Rates and Consumer Confidence

High unemployment rates directly impact banks like Enterprise Bank & Trust by increasing credit risk. When more people are out of work, the likelihood of defaults on both retail and commercial loans rises, which can significantly degrade the bank's asset quality. For instance, if the US unemployment rate, which stood at 3.9% in April 2024, were to climb substantially, the bank would likely see a rise in non-performing loans.

Consumer confidence is a powerful indicator of economic health and directly influences spending and borrowing habits. When consumers feel secure about their financial future, they are more likely to take out mortgages, apply for personal loans, and invest in wealth management services. A strong consumer confidence index, such as the Conference Board's Consumer Confidence Index which registered 97.0 in May 2024, signals a positive environment for banks seeking to expand their lending and service offerings.

- Impact on Credit Risk: Rising unemployment, such as the 3.9% US rate in April 2024, directly correlates with increased potential for loan defaults, affecting a bank's asset quality.

- Consumer Spending and Borrowing: High consumer confidence, reflected in indices like the Conference Board's reading of 97.0 in May 2024, encourages greater demand for mortgages and personal loans.

- Demand for Services: A confident consumer base typically leads to increased activity in wealth management and other financial services, creating more business opportunities for banks.

- Economic Outlook: Fluctuations in unemployment and consumer confidence provide crucial insights into the broader economic environment, guiding a bank's strategic planning and risk management.

Real Estate Market Dynamics

The real estate market's performance directly impacts Enterprise Bank & Trust, especially given its significant exposure to commercial and retail property loans. Fluctuations in property values and market liquidity directly affect the quality of collateral backing these loans, influencing the bank's credit risk and overall lending capacity.

For instance, in 2024, the U.S. commercial real estate sector faced headwinds, with rising interest rates impacting property valuations and transaction volumes. Data from CoStar indicated a significant slowdown in investment sales activity compared to previous years, potentially increasing the risk for banks with substantial CRE loan portfolios.

A strong real estate market generally translates to increased loan demand and lower default rates for Enterprise Bank & Trust. Conversely, a downturn, characterized by falling prices and reduced liquidity, can lead to a rise in non-performing loans and necessitate loan loss provisions, as seen during previous economic contractions.

- Property Values: Declining property values in key markets can erode collateral coverage for existing loans.

- Market Liquidity: Reduced transaction activity makes it harder for borrowers to refinance or sell properties, increasing default risk.

- Lending Opportunities: A healthy market supports new loan origination, while a weak one can dry up lending opportunities.

- Non-Performing Loans: Downturns in real estate often correlate with an increase in delinquent and defaulted loans on a bank's balance sheet.

Economic factors significantly influence Enterprise Bank & Trust's operational environment and profitability. The prevailing interest rate environment, set by the Federal Reserve, directly impacts the bank's net interest margin. For example, the Fed's continued stance on interest rates in mid-2024 affects both loan yields and deposit costs.

Economic growth or contraction plays a crucial role in loan demand and credit quality. A robust economy, evidenced by the 2.5% GDP growth in the US in 2023, generally supports higher loan origination and lower default rates for Enterprise Bank & Trust. Conversely, a projected global GDP slowdown for 2024, estimated around 2.7%, signals potential headwinds for loan portfolios.

Inflation impacts the bank's operational costs and the real value of its assets. With US inflation at 3.4% annually as of April 2024, Enterprise Bank & Trust must manage its balance sheet to mitigate the erosive effects of price increases on fixed-rate assets and rising expenses.

Unemployment rates and consumer confidence are key indicators of credit risk and demand for banking services. The US unemployment rate of 3.9% in April 2024, coupled with a Consumer Confidence Index of 97.0 in May 2024, provides insights into potential loan default levels and consumer borrowing appetite.

| Economic Indicator | Value/Trend (2023-2024) | Impact on Enterprise Bank & Trust |

|---|---|---|

| US GDP Growth | 2.5% (2023) | Supports loan demand and asset quality. |

| Global GDP Growth Projection | ~2.7% (2024) | Indicates a potentially slower environment for loan growth. |

| US Inflation Rate (Annual) | 3.4% (April 2024) | Increases operational costs and erodes real asset value. |

| US Unemployment Rate | 3.9% (April 2024) | Higher rates increase credit risk and potential loan defaults. |

| Consumer Confidence Index | 97.0 (May 2024) | Higher confidence encourages borrowing and demand for financial services. |

Preview Before You Purchase

Enterprise Bank & Trust PESTLE Analysis

The preview shown here is the exact Enterprise Bank & Trust PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive document details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. You'll gain valuable insights into the strategic landscape for Enterprise Bank & Trust.

Sociological factors

Demographic shifts significantly impact banking needs. For instance, the U.S. population aged 65 and over is projected to reach 73.1 million by 2030, a nearly 50% increase from 2012, according to the U.S. Census Bureau. This aging trend will likely boost demand for wealth management, estate planning, and retirement-focused financial services at Enterprise Bank & Trust.

Conversely, younger generations, like Millennials and Gen Z, are increasingly entering the workforce and seeking financial independence. Data from the Federal Reserve in late 2023 shows these groups are more inclined towards digital banking solutions and are crucial for first-time homebuyer mortgages. Enterprise Bank & Trust needs to adapt its product suite and digital platforms to cater to these evolving client segments.

Consumers are increasingly shifting towards digital channels for their banking needs, with mobile banking adoption continuing to surge. For instance, by the end of 2024, it's projected that over 80% of banking transactions will be conducted digitally. This evolving preference for mobile and online platforms, including investment portals, directly influences how Enterprise Bank & Trust must adapt its service delivery and invest in technology to remain competitive.

Furthermore, a heightened awareness of financial literacy is shaping consumer expectations, with many seeking more personalized advice and transparent product offerings. This trend, coupled with a growing comfort with digital payment solutions, means banks like Enterprise Bank & Trust need to focus on user-friendly digital interfaces and educational resources to maintain customer loyalty and capture market share in the coming years.

Societal wealth and income distribution significantly shape demand for financial services. For instance, in 2024, the top 1% of households in the U.S. continued to hold a disproportionate amount of wealth, suggesting a robust market for high-net-worth services and wealth management, areas where Enterprise Bank & Trust can focus its offerings.

Rising income inequality, a trend observed globally and within the U.S. economy through 2025, presents both challenges and opportunities. While it may increase the demand for specialized lending and financial inclusion products for lower-income segments, it also necessitates a strategic emphasis on sophisticated wealth management solutions for the growing affluent population to maintain market share.

Enterprise Bank & Trust's strategic planning must acknowledge these evolving economic structures. Adapting to a landscape where a significant portion of the population faces financial precarity while a smaller group accumulates substantial wealth requires a diversified product suite and targeted marketing efforts to serve a broad spectrum of clients effectively.

Social Attitudes Towards Financial Institutions

Public trust in financial institutions is a critical element influencing Enterprise Bank & Trust's operations. Following the 2008 financial crisis, consumer confidence in banks generally dipped, and while there have been some improvements, a segment of the population remains wary. For instance, a 2023 Gallup poll indicated that while trust in banks had risen to 32%, it still lagged behind other institutions like the military or small businesses.

Negative societal perceptions can translate into tangible challenges. Increased regulatory scrutiny often follows periods of low public trust, potentially leading to more stringent compliance requirements for banks like Enterprise Bank & Trust. Furthermore, a societal preference for alternative financial services, such as fintech companies or credit unions, can emerge, diverting customers and market share.

Maintaining a strong reputation is therefore paramount. Enterprise Bank & Trust's commitment to ethical practices and active community engagement are key strategies to build and sustain this trust. Initiatives that demonstrate social responsibility and customer-centricity can help counter any lingering skepticism and foster a loyal customer base.

Key aspects influencing social attitudes include:

- Customer Experience: Positive interactions and transparent dealings are crucial for building trust.

- Ethical Conduct: Perceptions of fairness and integrity in lending and investment practices significantly impact public opinion.

- Community Involvement: Banks that actively support local communities often enjoy higher levels of public regard.

- Financial Literacy Initiatives: Efforts to educate the public can demystify banking and foster greater confidence.

Workforce Dynamics and Talent Availability

Sociological shifts are significantly reshaping the workforce landscape for institutions like Enterprise Bank & Trust. Evolving employee expectations around work-life balance and flexible arrangements, particularly the persistent demand for remote and hybrid work models, directly influence talent acquisition and retention strategies. The ability to adapt to these preferences is paramount for maintaining operational efficiency and fostering innovation.

The availability of skilled talent, especially in critical areas such as technology, cybersecurity, data analytics, and financial compliance, presents both opportunities and challenges. As of early 2024, the U.S. Bureau of Labor Statistics reported a strong demand for financial managers and information security analysts, with projected growth rates indicating continued need. Enterprise Bank & Trust must actively compete for this specialized talent to drive product development, enhance risk management, and ensure superior customer service in a dynamic market.

- Talent Attraction: 60% of workers consider flexible work options a top priority when evaluating job offers, according to a 2024 survey by a leading HR research firm.

- Skills Gap: The U.S. faces a projected shortage of 1.4 million cybersecurity professionals by the end of 2025, highlighting a critical need for specialized talent in banking.

- Employee Retention: Companies offering robust professional development and flexible work arrangements see a 20% higher retention rate among their tech-focused employees.

Societal attitudes towards financial institutions are evolving, with a growing emphasis on ethical practices and transparency. Public trust, while showing some recovery, remains a key consideration, with a 2023 Gallup poll showing only 32% trust in banks, highlighting the need for banks like Enterprise Bank & Trust to actively build and maintain confidence through responsible operations and community engagement.

Consumer demand for personalized financial advice and accessible digital platforms is increasing, driven by a desire for greater financial literacy. Enterprise Bank & Trust must adapt its offerings to meet these expectations, focusing on user-friendly interfaces and educational resources to foster customer loyalty and capture market share.

The banking sector is experiencing a significant shift in workforce expectations, with a strong preference for flexible and hybrid work models. Attracting and retaining skilled talent, particularly in technology and analytics, is crucial, as evidenced by the projected shortage of 1.4 million cybersecurity professionals by the end of 2025.

Technological factors

The digital banking landscape is evolving at breakneck speed, directly impacting how customers engage with Enterprise Bank & Trust. By Q4 2024, over 75% of retail banking transactions were projected to occur through digital channels, highlighting the critical need for robust mobile and online platforms.

Enterprise Bank & Trust must prioritize offering seamless, secure, and user-friendly digital experiences to attract and retain customers. Failure to do so risks falling behind competitors who are heavily investing in these areas; for instance, many neobanks saw a 20% year-over-year increase in mobile app usage in early 2025.

Continuous investment in technological upgrades for these platforms is non-negotiable. Meeting customer expectations for instant access and intuitive design, a trend that saw mobile banking adoption rise by 15% in 2024 alone, requires ongoing innovation and development.

As financial transactions increasingly migrate online, Enterprise Bank & Trust faces significant cybersecurity risks, including data breaches and fraud. The growing sophistication of cyber threats necessitates constant vigilance. For instance, global cybercrime costs are projected to reach $10.5 trillion annually by 2025, highlighting the immense financial stakes involved.

Maintaining robust cybersecurity and data protection protocols is absolutely critical for Enterprise Bank & Trust to safeguard sensitive customer information and preserve its reputation. A single major breach could erode customer trust, leading to significant financial and reputational damage. This underscores the need for proactive defense strategies.

Continuous investment in advanced security technologies, such as AI-powered threat detection and encryption, alongside comprehensive employee training on best practices, is essential for Enterprise Bank & Trust to stay ahead of evolving threats. In 2024, financial institutions are significantly increasing their cybersecurity budgets, with many allocating over 15% of their IT spending to security initiatives.

Enterprise Bank & Trust can significantly boost its operations by adopting AI and machine learning. These technologies are key to improving efficiency, strengthening risk management, and creating more personalized customer interactions. For instance, AI can automate tasks like fraud detection and credit scoring, which are critical in the banking sector.

The application of AI extends to predictive analytics, allowing the bank to better anticipate market trends and customer behavior. By leveraging these advanced tools, Enterprise Bank & Trust can gain a substantial competitive advantage. In 2024, the global AI market was projected to reach over $200 billion, highlighting the widespread investment and adoption across industries, including finance.

FinTech Innovation and Competition

The burgeoning FinTech sector presents a dual challenge and opportunity for Enterprise Bank & Trust. These nimble companies are disrupting traditional banking by focusing on niche services and leveraging cutting-edge technology for innovative solutions.

For instance, digital payment platforms and peer-to-peer lending services have seen significant growth. In 2024, the global FinTech market was valued at over $2.4 trillion, with projections indicating continued expansion. Enterprise Bank & Trust needs to strategize by either building its own technological prowess, acquiring promising FinTech startups, or forging strategic alliances to maintain its competitive edge and broaden its service portfolio.

- FinTech Market Growth: Global FinTech market expected to reach $3.5 trillion by 2025.

- Digital Payments Adoption: Mobile payment transaction volume is projected to exceed $10 trillion globally by 2025.

- Investment in FinTech: Venture capital funding for FinTech startups remained robust in 2024, with billions invested globally.

- Customer Expectations: Consumers increasingly expect seamless, digital-first banking experiences.

Data Analytics and Big Data

Enterprise Bank & Trust leverages data analytics and big data to gain deep insights into customer behavior and market trends. This allows for more precise targeting of marketing campaigns and the development of products that truly resonate with customer needs. For instance, by analyzing transaction data, the bank can identify emerging customer preferences for digital-first banking services, influencing its product roadmap.

The application of big data analytics is instrumental in enhancing risk management. By processing extensive datasets, Enterprise Bank & Trust can more accurately assess creditworthiness, detect fraudulent activities, and predict potential financial downturns. This proactive approach to risk mitigation is vital in maintaining financial stability and protecting assets.

Investing in robust data infrastructure and advanced analytical tools is a strategic imperative. As of late 2024, the financial services sector saw significant investment in AI and machine learning for data analysis, with many institutions dedicating upwards of 15% of their IT budgets to these areas. Enterprise Bank & Trust's commitment to these technologies underpins its data-driven strategy.

- Enhanced Customer Insights: Data analytics allows for granular understanding of customer needs, leading to personalized service offerings.

- Improved Risk Assessment: Big data models enable more accurate credit scoring and fraud detection, reducing potential losses.

- Operational Efficiency Gains: Analyzing operational data can identify bottlenecks and streamline processes, cutting costs.

- Data-Driven Product Development: Market and customer data inform the creation and refinement of banking products and services.

Enterprise Bank & Trust must continually upgrade its digital platforms to meet evolving customer expectations, as over 75% of retail banking transactions were projected to be digital by Q4 2024. Failure to invest in seamless, secure, and user-friendly experiences risks losing ground to competitors, with neobanks reporting a 20% year-over-year increase in mobile app usage in early 2025.

Cybersecurity is paramount, with global cybercrime costs anticipated to reach $10.5 trillion annually by 2025, necessitating robust defenses and proactive strategies. Financial institutions are increasing cybersecurity budgets, with many allocating over 15% of IT spending to security in 2024.

AI and machine learning offer significant advantages for Enterprise Bank & Trust in enhancing efficiency, risk management, and customer personalization, as the global AI market surpassed $200 billion in 2024.

The FinTech sector, valued at over $2.4 trillion in 2024, presents both challenges and opportunities, requiring strategic responses like acquisitions or alliances to maintain competitiveness.

| Technological Factor | Impact on Enterprise Bank & Trust | Key Data/Trend (2024-2025) |

|---|---|---|

| Digital Banking Adoption | Customer engagement and transaction channels | >75% of retail transactions digital by Q4 2024; 15% rise in mobile banking adoption in 2024. |

| Cybersecurity Threats | Risk of data breaches, fraud, and reputational damage | Global cybercrime costs projected to reach $10.5 trillion by 2025; 15%+ IT budget allocation to security by financial institutions in 2024. |

| Artificial Intelligence (AI) | Operational efficiency, risk management, personalization | Global AI market >$200 billion in 2024; AI adoption increasing across financial services. |

| FinTech Innovation | Competition and potential for partnerships/acquisitions | Global FinTech market valued at >$2.4 trillion in 2024; robust VC funding for FinTech startups in 2024. |

Legal factors

Enterprise Bank & Trust navigates a complex web of banking regulations, including capital adequacy requirements set by bodies like the Federal Reserve and the FDIC. For instance, as of late 2024, capital ratios remain a critical focus, with Basel III finalization continuing to shape compliance landscapes.

Adherence to lending practices and consumer protection laws is paramount, with agencies like the Consumer Financial Protection Bureau (CFPB) actively enforcing rules designed to safeguard borrowers. Violations can lead to substantial penalties, impacting profitability and public trust, underscoring the importance of robust compliance programs.

Enterprise Bank & Trust, like all financial institutions, must navigate a complex web of Anti-Money Laundering (AML) and sanctions laws. These regulations are designed to prevent illicit financial activities, including money laundering and terrorist financing. For instance, the Bank Secrecy Act (BSA) in the U.S. mandates robust Know Your Customer (KYC) procedures, requiring banks to verify customer identities and monitor transactions for suspicious activity.

Compliance with global sanctions regimes, such as those imposed by the Office of Foreign Assets Control (OFAC) in the United States, is paramount. These sanctions target individuals, entities, and countries involved in activities deemed a threat to national security or foreign policy. In 2023, OFAC imposed over $2.7 billion in sanctions-related penalties, highlighting the significant financial and reputational risks of non-compliance.

Failure to adhere to these legal frameworks can result in substantial fines, reputational damage, and even the revocation of banking licenses. For example, in late 2023, a major financial institution faced a multi-billion dollar penalty for AML violations, underscoring the critical importance of rigorous compliance programs for entities like Enterprise Bank & Trust.

Enterprise Bank & Trust must navigate a complex web of data privacy and consumer protection laws. In the US, the Gramm-Leach-Bliley Act (GLBA) mandates how financial institutions handle customer information, while state laws like the California Consumer Privacy Act (CCPA) offer even broader protections. These regulations are critical for maintaining customer trust and avoiding severe penalties.

Failure to comply with these data privacy mandates can result in significant financial repercussions. For instance, violations of GLBA can lead to fines of up to $100,000 per violation, and CCPA violations can incur penalties of $2,500 per unintentional violation and $7,500 per intentional violation. Enterprise Bank & Trust's commitment to robust data security and transparent consumer practices is not just good business; it's a legal imperative to safeguard against costly litigation and reputational damage.

Contract Law and Lending Agreements

Enterprise Bank & Trust's operations, from lending to wealth management, are deeply intertwined with contract law. This means every deposit agreement and lending contract must be meticulously crafted to be legally sound and enforceable, a critical step in managing risk and safeguarding the bank's financial health. Failure to ensure compliance with statutes can expose the bank to significant legal challenges.

Disputes stemming from these contracts can prove extremely costly, often leading to protracted litigation that drains resources. For instance, in 2024, the U.S. banking sector saw an increase in contract-related litigation, with average legal costs for disputes exceeding $150,000, highlighting the financial impact of contractual disagreements.

- Compliance with Lending Statutes: Ensuring all loan agreements adhere to federal and state regulations, such as the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA), is paramount.

- Enforceability of Deposit Agreements: Bank policies and customer agreements regarding deposit accounts must be clearly defined and legally binding to prevent disputes over fees, interest, and account closures.

- Wealth Management Contracts: Agreements with wealth management clients require precise language regarding investment strategies, fees, and fiduciary duties to avoid litigation related to performance or advice.

- Risk Mitigation through Due Diligence: Thorough legal review of all contracts minimizes the likelihood of future disputes and associated financial penalties.

Employment and Labor Laws

Enterprise Bank & Trust, like all employers, navigates a complex web of employment and labor laws. These regulations, covering everything from equal opportunity and minimum wage to workplace safety and employee benefits, are critical for avoiding legal challenges and fostering a productive atmosphere. For instance, in 2024, the U.S. Department of Labor continued to enforce wage and hour laws, with penalties for violations remaining significant.

Staying compliant is not just about risk mitigation; it's a strategic imperative for attracting and retaining skilled employees. The ability to offer competitive benefits, influenced by legislation like the Affordable Care Act, directly impacts Enterprise Bank & Trust's human capital strategy. Changes in labor laws, such as potential adjustments to overtime eligibility or new mandates for paid leave, can necessitate adjustments to operational costs and HR policies.

- Non-Discrimination: Compliance with Title VII of the Civil Rights Act of 1964 and subsequent amendments ensures fair treatment in hiring and promotion.

- Wage and Hour Laws: Adherence to the Fair Labor Standards Act (FLSA) dictates minimum wage, overtime pay, and record-keeping requirements.

- Workplace Safety: The Occupational Safety and Health Act (OSHA) mandates safe working conditions, with fines for non-compliance.

- Employee Benefits: Laws like ERISA govern the administration of employee benefit plans, impacting costs and fiduciary responsibilities.

Enterprise Bank & Trust must strictly adhere to evolving financial regulations, including capital requirements and consumer protection laws enforced by agencies like the CFPB and FDIC. For 2024, regulatory scrutiny on capital adequacy and fair lending practices remains high, with potential penalties for non-compliance.

The bank also faces stringent Anti-Money Laundering (AML) and sanctions compliance mandates, such as the Bank Secrecy Act (BSA) and OFAC regulations. In 2023, OFAC penalties alone exceeded $2.7 billion, underscoring the significant financial and reputational risks associated with these legal areas.

Data privacy laws like GLBA and CCPA are critical for maintaining customer trust, with potential fines reaching thousands of dollars per violation. Contract law governs all agreements, and litigation costs for disputes in the U.S. banking sector averaged over $150,000 in 2024.

Employment laws, including wage and hour regulations and workplace safety standards, are also key considerations. The Department of Labor's continued enforcement in 2024 means significant penalties for violations of the Fair Labor Standards Act (FLSA) and OSHA standards.

| Legal Factor | Key Regulations/Agencies | 2023-2024 Data/Impact |

|---|---|---|

| Capital Adequacy | Federal Reserve, FDIC, Basel III | Continued focus on capital ratios; potential for increased compliance costs. |

| Consumer Protection | CFPB, Truth in Lending Act (TILA) | Active enforcement; fines for violations can impact profitability. |

| AML/Sanctions | FinCEN (BSA), OFAC | OFAC penalties exceeded $2.7 billion in 2023; robust KYC essential. |

| Data Privacy | GLBA, CCPA | Fines up to $100,000 (GLBA) or $7,500 per intentional CCPA violation. |

| Contract Law | General Contract Statutes | Average U.S. banking litigation costs over $150,000 in 2024. |

| Employment Law | FLSA, OSHA, Title VII | Significant penalties for wage, hour, and safety violations; DOL enforcement active. |

Environmental factors

Enterprise Bank & Trust faces significant climate change risks. Physical risks, like more frequent extreme weather events, could devalue real estate collateral in its loan portfolios, especially in areas prone to flooding or wildfires. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, totaling over $159 billion in damages.

Transition risks also pose a threat. As policies shift towards a low-carbon economy and markets favor sustainable industries, investments in carbon-intensive sectors could lose value. This could impact the bank's exposure to industries like fossil fuels, potentially affecting loan performance and investment returns. The International Energy Agency (IEA) projects that global investment in clean energy is set to reach $2 trillion in 2024, highlighting a significant market shift.

Effectively assessing and managing these physical and transition risks is crucial for Enterprise Bank & Trust's long-term stability and profitability. This involves understanding portfolio exposures and developing strategies to mitigate potential financial impacts from climate-related events and policy changes.

Investor and public demand for Environmental, Social, and Governance (ESG) considerations is significantly shaping Enterprise Bank & Trust's strategies. In 2024, a significant majority of investors globally expressed a preference for ESG-integrated portfolios, with some reports indicating over 70% of millennials and Gen Z actively seeking sustainable investment options.

This growing emphasis translates into increasing pressure for the bank to offer sustainable finance products, such as green bonds or loans for renewable energy projects. Furthermore, integrating ESG factors into lending and investment decisions, alongside robust disclosure of climate-related financial risks, is becoming a benchmark for financial institutions.

While these shifts present new market opportunities, particularly in the burgeoning sustainable finance sector, they also necessitate adjustments to existing operational practices and risk management frameworks for Enterprise Bank & Trust.

Financial regulators globally are intensifying pressure on banks to disclose their exposure to climate-related risks and detail their sustainability initiatives. This trend is particularly evident in 2024 and 2025, with many jurisdictions implementing or strengthening disclosure mandates.

Enterprise Bank & Trust, like its peers, is likely to encounter specific requirements to report on its carbon footprint, financed emissions, and strategies for climate resilience. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) framework, which many regulators are adopting, sets out recommendations for consistent climate-related financial risk disclosures.

Compliance with these evolving environmental disclosure requirements is not merely a regulatory obligation but a critical factor for maintaining regulatory standing and bolstering investor confidence. As of early 2025, a significant percentage of the largest global banks are already incorporating TCFD recommendations into their reporting, signaling a clear industry-wide shift.

Resource Scarcity and Operational Footprint

Resource scarcity, particularly concerning water and energy, presents a growing challenge for financial institutions like Enterprise Bank & Trust. The bank's operational footprint, including the significant energy demands of its data centers and its overall waste management, directly impacts operational costs and public perception. For instance, rising global energy prices, projected to remain volatile through 2025, could increase the bank's utility expenses.

By adopting energy-efficient practices and sustainable office operations, Enterprise Bank & Trust can effectively reduce these expenses. Initiatives such as optimizing data center cooling systems and implementing robust recycling programs can lead to tangible cost savings. This strategic focus also significantly enhances the bank's corporate social responsibility (CSR) image, aligning with increasing investor and customer demand for environmentally conscious businesses.

- Energy Consumption: Data centers are major energy consumers, with global data center energy consumption projected to rise, impacting operational budgets.

- Waste Management: Efficient waste reduction and recycling programs can lower disposal costs and improve environmental metrics.

- Public Perception: Demonstrating commitment to sustainability can bolster brand reputation and attract environmentally-minded customers and investors.

- Regulatory Landscape: Evolving environmental regulations may impose further requirements on operational efficiency and resource management.

Reputational Risk from Environmental Practices

Enterprise Bank & Trust faces reputational risks tied to its environmental practices. Public perception of the bank's commitment to sustainability directly influences its brand image and customer trust. Negative associations, such as financing industries with significant environmental impact, could result in adverse media attention and potential customer attrition.

For instance, a 2024 report highlighted that 65% of consumers consider a company's environmental stance when making purchasing decisions, a figure that has steadily climbed. This trend underscores the financial implications of environmental stewardship for institutions like Enterprise Bank & Trust.

- Reputational Impact: Negative environmental associations can damage brand perception, impacting customer loyalty and market share.

- Consumer Behavior: A growing majority of consumers (65% in 2024 studies) factor environmental responsibility into their choices.

- Mitigation Strategies: Proactive environmental initiatives and transparent reporting can build trust and attract environmentally conscious clientele.

- Financial Consequences: Poor environmental reputation can lead to boycotts and decreased investment, directly affecting financial performance.

Enterprise Bank & Trust must navigate increasing regulatory scrutiny regarding environmental disclosures and sustainable practices. Many global regulators are adopting frameworks like the TCFD, pushing banks to report on carbon footprints and climate resilience strategies. By early 2025, a substantial portion of major global banks are already integrating TCFD recommendations, signaling a clear industry-wide trend toward enhanced transparency and accountability.

Resource scarcity, particularly concerning water and energy, poses an operational challenge, with volatile energy prices projected through 2025 impacting utility expenses. Embracing energy-efficient practices in operations, such as optimizing data center cooling, can yield cost savings and bolster the bank's corporate social responsibility image.

The bank's environmental reputation is directly linked to customer trust and brand image, with a significant percentage of consumers factoring environmental stances into purchasing decisions. Proactive environmental initiatives and transparent reporting are crucial for building trust and attracting environmentally conscious clientele.

| Environmental Factor | Impact on Enterprise Bank & Trust | Data/Trend (2024-2025) |

|---|---|---|

| Climate Change Risks (Physical & Transition) | Devaluation of collateral, loan performance impact, investment returns | 28 billion-dollar weather disasters in U.S. in 2023 ($159B damages); Global clean energy investment projected at $2 trillion in 2024 |

| Investor & Public Demand (ESG) | Pressure for sustainable finance products, ESG integration in decisions | Over 70% of millennials and Gen Z seek sustainable investments |

| Regulatory Disclosure Requirements | Mandatory reporting on carbon footprint, financed emissions, climate resilience | Many jurisdictions strengthening disclosure mandates; High adoption of TCFD recommendations by major banks |

| Resource Scarcity (Energy, Water) | Increased operational costs (utilities), reputational impact | Volatile energy prices projected through 2025; Data center energy consumption rising |

| Reputational Risk | Customer attrition, adverse media, impact on market share | 65% of consumers consider environmental stance in purchasing decisions (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Enterprise Bank & Trust is meticulously constructed using data from official government publications, reputable financial news outlets, and leading economic forecasting firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable information.