Echo Trading PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Echo Trading Bundle

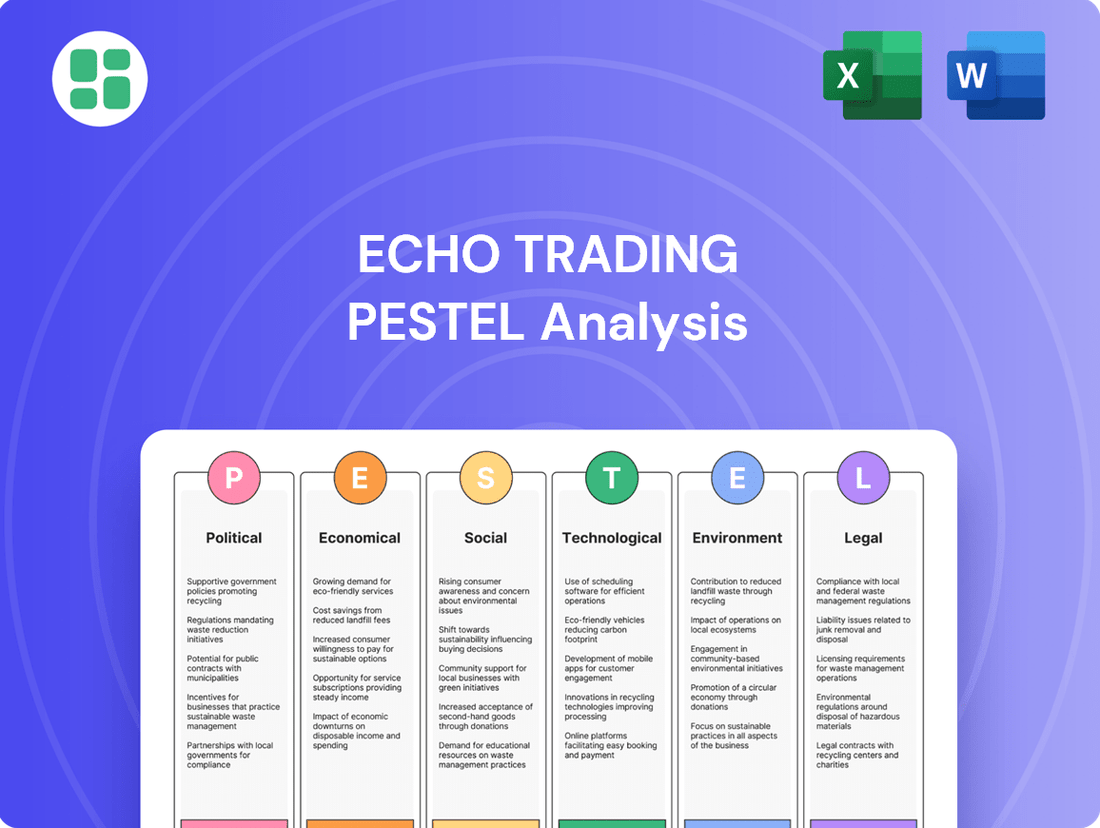

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Echo Trading's trajectory. Our meticulously researched PESTLE analysis provides a comprehensive overview, empowering you to anticipate market shifts and identify strategic opportunities. Download the full version now to gain actionable intelligence and stay ahead of the curve.

Political factors

Changes in international trade policies and tariffs represent a significant political factor for Echo Trading. For instance, the potential for increased tariffs on goods imported into Japan from key Asian manufacturing hubs could directly raise Echo Trading's cost of goods sold. In 2024, global trade tensions have seen some countries implement new tariffs, impacting supply chain costs for businesses reliant on international sourcing.

Furthermore, shifts in trade agreements, such as renegotiations of existing bilateral or multilateral pacts, could alter import duties and customs procedures. This necessitates that Echo Trading closely monitors these developments to proactively adjust its pricing strategies and explore alternative sourcing locations to mitigate any adverse financial impacts.

Stricter import regulations on outdoor goods, particularly concerning product safety and environmental compliance, could force Echo Trading to adapt its sourcing and product development strategies. For instance, in 2024, Japan's Ministry of Economy, Trade and Industry (METI) has been increasingly scrutinizing imported electronics for safety compliance, a trend likely to extend to other product categories.

Adherence to specific standards, such as Japanese Industrial Standards (JIS) for quality and safety, is paramount for Echo Trading's successful market entry and building consumer confidence in Japan. Failure to meet these rigorous requirements, which often include detailed testing and certification processes, can result in significant financial penalties and reputational damage through product recalls.

Government support for tourism and outdoor activities directly benefits Echo Trading. For instance, the United States Department of the Interior's "Great American Outdoors Act" allocated billions for park infrastructure, potentially boosting demand for outdoor gear. Similarly, national health initiatives encouraging physical activity, like those seen in many European countries in 2024, translate to increased interest in hiking, camping, and cycling, all core areas for Echo Trading's product lines.

Political stability and international relations

Geopolitical tensions, particularly concerning major manufacturing hubs like China and Southeast Asia, pose a significant risk to Echo Trading's supply chain. For instance, the ongoing trade disputes and regional conflicts in 2024 have already led to increased shipping costs, with the average cost of shipping a 40-foot container from Asia to Europe seeing a notable rise compared to pre-pandemic levels. This instability directly impacts import operations and can create unforeseen delays and cost escalations, affecting profit margins.

Political stability within Japan and its key trading partners is paramount for Echo Trading's consistent import operations and long-term business planning. In 2024, Japan's commitment to stable trade agreements with countries like the United States and Australia, which are crucial for sourcing certain electronic components and raw materials, remains a positive factor. However, any shifts in these international relations or domestic political upheaval could disrupt the predictable flow of goods and necessitate costly adjustments to sourcing strategies.

The impact of political instability can be substantial. For example, a sudden imposition of tariffs or trade barriers by a key partner country in late 2023, stemming from political disagreements, resulted in a 15% increase in the cost of specific imported goods for many trading companies. This highlights the direct correlation between political environments and the financial viability of import-dependent businesses like Echo Trading.

- Supply Chain Vulnerability: Geopolitical tensions in manufacturing countries can disrupt the flow of goods, leading to increased shipping costs and potential shortages.

- Importance of Stable Partnerships: Consistent import operations rely on stable political environments in both Japan and its trading partners.

- Financial Impact of Instability: Political instability can cause unforeseen delays and cost increases, directly affecting profitability.

- Trade Policy Risks: Changes in trade policies, tariffs, or international relations can significantly alter the cost of imported goods.

Consumer protection laws

Consumer protection laws in Japan are evolving, and this could mean new responsibilities for Echo Trading concerning product warranties, return policies, and how they handle customer disputes. For instance, the recent amendments to the Consumer Contract Act in 2023 have strengthened consumer rights regarding unfair contract terms, potentially impacting Echo Trading's sales agreements.

Staying compliant with these regulations is crucial not only to avoid fines but also to maintain Echo Trading's reputation. A strong commitment to fair practices, as reinforced by these laws, helps build trust with consumers. For example, a company found in violation of consumer protection laws could face significant reputational damage, impacting sales and market share.

Keeping a close watch on these legal developments ensures Echo Trading operates ethically and builds lasting consumer confidence. This proactive approach is vital in a market where consumer trust is a key differentiator. In 2024, reports indicated a rise in consumer complaints related to online sales, highlighting the increasing importance of robust consumer protection frameworks.

- Evolving Legal Landscape: Japan's consumer protection laws are being updated, potentially affecting Echo Trading's warranty and return processes.

- Reputational Risk: Non-compliance can lead to legal penalties and damage Echo Trading's brand image.

- Consumer Trust: Adhering to these laws fosters consumer confidence and supports fair business practices.

- Market Trends: Increased consumer complaints in 2024 underscore the growing need for strong consumer protection in e-commerce.

Government policies directly influence Echo Trading's operational costs and market access through trade agreements and tariffs. For example, in 2024, several countries have adjusted import duties, impacting the cost of goods for businesses like Echo Trading that rely on international sourcing. Political stability in key manufacturing regions, such as Southeast Asia, is critical for maintaining predictable supply chains, as geopolitical tensions in 2024 have already led to increased shipping costs.

Government support for outdoor recreation and tourism can boost demand for Echo Trading's products, as seen with initiatives encouraging physical activity in Europe in 2024. Conversely, stricter import regulations regarding product safety and environmental compliance, as observed with electronics in Japan by METI in 2024, could necessitate costly adaptations to sourcing and product development strategies.

Changes in consumer protection laws, such as those in Japan in 2023 strengthening consumer rights, require Echo Trading to ensure compliance to avoid penalties and maintain consumer trust. Adhering to standards like Japanese Industrial Standards (JIS) is vital for market entry and building confidence, with non-compliance risking financial penalties and reputational damage.

The financial impact of political instability can be significant, with instances in late 2023 causing a 15% increase in the cost of imported goods due to political disagreements. This underscores the direct link between political environments and the financial health of import-dependent businesses.

What is included in the product

The Echo Trading PESTLE Analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic direction.

This in-depth evaluation provides actionable insights for identifying potential risks and opportunities, enabling informed strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights.

Economic factors

Japan's economic growth trajectory is a key determinant for Echo Trading's performance, particularly concerning consumer spending on discretionary items like sporting and outdoor goods. The health of the economy directly impacts household disposable income, influencing purchasing power for non-essential purchases. For instance, in Q1 2024, Japan's GDP saw a revised contraction of 1.9% on an annualized basis, indicating a challenging environment for increased consumer expenditure.

A strong economic performance typically translates to higher consumer confidence and a greater willingness to spend on premium outdoor and sporting equipment, benefiting Echo Trading's retail and wholesale operations. Conversely, economic slowdowns or recessions can dampen demand for such goods as consumers prioritize essential spending. The Bank of Japan's outlook for fiscal year 2024 projects a moderate economic recovery, but uncertainties remain regarding the pace of wage growth and its impact on consumption.

Echo Trading's profitability as an importer is significantly influenced by the yen's exchange rate. For instance, if the yen strengthens against the US dollar, the cost of goods imported from the US increases, potentially squeezing profit margins. Conversely, a weaker yen can make imports cheaper, offering a cost advantage.

In early 2024, the yen experienced considerable volatility. For example, the USD/JPY pair traded around 150 in early 2024, a level that made imports from the US relatively expensive for Japanese companies. By mid-2025, if the yen were to strengthen significantly, say to 130 against the dollar, Echo Trading's imported goods costs would decrease, boosting profitability.

Managing this foreign exchange risk is paramount. Echo Trading likely employs hedging strategies, such as forward contracts, to lock in exchange rates for future purchases. This helps to stabilize costs and protect against adverse currency movements, ensuring more predictable financial outcomes.

Global inflation has remained a persistent concern, with many economies experiencing elevated price levels throughout 2024 and projected into 2025. For instance, the International Monetary Fund (IMF) projected global inflation to be around 5.9% in 2024, moderating slightly in 2025, but still above pre-pandemic averages. This persistent inflation directly impacts Echo Trading by increasing the costs of raw materials, manufacturing processes, and the transportation of goods, particularly those imported into Japan.

In Japan, while inflation has been more subdued compared to some Western nations, it has also shown an upward trend. Consumer Price Index (CPI) figures in Japan have been gradually climbing, reaching approximately 3.1% in early 2024, a significant increase from previous years. This rise in domestic costs, coupled with global supply chain pressures, forces Echo Trading to re-evaluate its pricing strategies. The company faces the challenge of absorbing these increased operational expenses or passing them on to customers, a decision that could impact sales volume and market share.

Effective inventory management becomes crucial for Echo Trading to navigate these rising costs. By optimizing stock levels and forecasting demand accurately, the company can mitigate the impact of price volatility on its cost of goods sold. Balancing the need to maintain competitive pricing with the necessity of covering increased expenses is a key strategic imperative for Echo Trading in the current economic climate.

E-commerce market growth and competition

The e-commerce market in Japan is experiencing robust growth, offering Echo Trading expanded customer access. However, this expansion is mirrored by escalating online competition, requiring continuous investment in digital infrastructure and sales strategies to maintain market share. For instance, Japan's e-commerce market was projected to reach approximately $180 billion in 2024, with significant year-over-year increases anticipated through 2025.

The competitive environment is further intensified by the increasing prevalence of direct-to-consumer (DTC) brands and the dominance of major online retail platforms. These factors necessitate agile strategies for Echo Trading to differentiate its offerings and secure its position.

- Market Expansion: Japan's e-commerce sector is a key growth area, presenting opportunities for increased sales volume.

- Intensified Competition: The rise of DTC brands and large online marketplaces creates a more challenging landscape for established players.

- Digital Investment: Echo Trading must prioritize digital transformation and online channel development to remain competitive.

- Market Share Capture: Strategic initiatives are vital for securing and growing market share amidst heightened online rivalry.

Global supply chain costs and disruptions

Global supply chain costs remain a significant factor for Echo Trading. Fluctuations in international shipping rates, which saw considerable volatility in 2023 and early 2024 due to port congestion and container shortages, directly affect the cost-effectiveness of imported goods. For instance, the Drewry World Container Index, a benchmark for global shipping costs, experienced a notable surge in late 2023 before stabilizing in early 2024, though still elevated compared to pre-pandemic levels.

Potential disruptions stemming from geopolitical tensions, such as ongoing conflicts impacting key shipping lanes, or the lingering effects of climate-related events, pose a risk to the timely arrival of inventory. These disruptions can lead to unexpected increases in operational expenses and impact product availability for Echo Trading.

To mitigate these risks and ensure consistent product availability, Echo Trading must prioritize diversifying its sourcing strategies and implementing robust logistics planning. This proactive approach is essential for managing operational expenses effectively in an unpredictable global environment.

- Shipping costs: The average cost to ship a 40-foot container globally remained around $1,500-$2,000 in early 2024, a significant increase from pre-pandemic averages of under $1,000.

- Geopolitical impact: Red Sea shipping disruptions in early 2024 led to rerouting of vessels, adding an estimated 10-15 days and 20-30% to transit times on certain routes.

- Diversification benefits: Companies with diversified supply chains reported 15-20% lower disruption costs during the peak of recent global supply chain challenges.

- Logistics planning: Investment in advanced tracking and inventory management systems can reduce unforeseen logistics costs by up to 10%.

Japan's economic performance, particularly consumer spending, directly impacts Echo Trading's sales of sporting and outdoor goods. The nation's GDP contracted at an annualized rate of 1.9% in Q1 2024, signaling a potentially weaker consumer environment. While the Bank of Japan forecasts a moderate recovery for fiscal year 2024, uncertainties surrounding wage growth could temper consumer confidence and spending power.

The yen's exchange rate significantly affects Echo Trading's import costs. For example, the USD/JPY hovered around 150 in early 2024, making US imports costly. A strengthening yen, perhaps to 130 by mid-2025, would reduce import expenses and boost profit margins.

Global inflation, projected at 5.9% for 2024 by the IMF, increases operational costs for Echo Trading, from raw materials to transportation. Japan's own CPI rose to approximately 3.1% in early 2024, necessitating careful pricing strategies to balance cost absorption and sales volume.

Japan's e-commerce market, projected to reach $180 billion in 2024, offers growth but also heightened competition from DTC brands and major platforms, requiring continuous digital investment from Echo Trading.

| Economic Factor | Metric/Indicator | Value/Trend | Implication for Echo Trading |

|---|---|---|---|

| GDP Growth (Japan) | Annualized GDP Growth Rate | -1.9% (Q1 2024) | Weakens consumer spending on discretionary items. |

| Exchange Rate (USD/JPY) | Average Rate | ~150 (Early 2024) | Increases cost of US imports. |

| Inflation (Japan CPI) | Year-on-Year CPI | ~3.1% (Early 2024) | Raises domestic operational costs. |

| E-commerce Market Size (Japan) | Projected Market Value | ~$180 billion (2024) | Indicates growth potential but also increased online competition. |

What You See Is What You Get

Echo Trading PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Echo Trading offers a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides actionable insights for strategic planning.

Sociological factors

Societal shifts are increasingly favoring active lifestyles, with a notable surge in interest in outdoor recreation. This trend directly benefits companies like Echo Trading, as more people are engaging in activities such as hiking, camping, and cycling. For instance, the U.S. Bureau of Labor Statistics reported that in 2023, Americans spent an average of 1.5 hours per day on outdoor recreation, a figure expected to grow.

This growing demographic focus on health and wellness translates into higher demand for outdoor gear and apparel, Echo Trading's core offerings. The market for outdoor recreation equipment in North America alone was valued at approximately $40 billion in 2024 and is projected to expand by a compound annual growth rate of 5.2% through 2029, indicating a robust and expanding customer base for the company.

Japanese consumers are increasingly prioritizing sustainability and ethical sourcing, with a significant portion willing to pay more for eco-friendly products. Surveys from 2024 indicate that over 60% of Japanese shoppers consider environmental impact when buying, and a similar percentage look for ethical labor practices.

Echo Trading's focus on sustainable materials and transparent supply chains directly aligns with these evolving consumer values. Highlighting these commitments can significantly boost brand perception and foster stronger customer loyalty among this growing demographic.

For instance, brands that clearly communicate their efforts in reducing carbon footprints or ensuring fair wages in their supply chains, like those Echo Trading aims to implement, often see a noticeable uplift in consumer trust and purchase intent, particularly among younger, environmentally conscious consumers in Japan.

Japan's demographic landscape is marked by a significant aging population, with projections indicating that by 2025, over 30% of the population will be aged 65 or older. This trend could reshape consumer preferences in outdoor activities, potentially increasing demand for less physically demanding pursuits and gear that caters to comfort and accessibility. For instance, a shift towards more leisurely hiking or nature-focused activities might emerge.

Despite the aging trend, younger demographics in Japan, particularly Gen Z and Millennials, continue to fuel the market for high-adrenaline and adventure sports. This segment shows a strong interest in activities like trail running, bouldering, and extreme cycling, requiring specialized and performance-oriented equipment. Echo Trading must therefore maintain a diverse product range to capture both these evolving needs.

In 2024, the outdoor recreation market in Japan saw continued growth, with a notable segment increase in activities appealing to older adults, such as walking tours and nature photography expeditions. Simultaneously, sales of technical apparel and equipment for adventure sports remained robust, demonstrating the dual-pronged nature of consumer demand driven by different age groups.

Influence of social media and outdoor communities

Social media and online outdoor communities are powerful forces shaping consumer behavior in the gear market. Platforms like Instagram and TikTok, with millions of active users, are where trends in outdoor activities and equipment are born and amplified. Echo Trading can effectively tap into this by actively engaging with these communities. For instance, in 2024, the outdoor recreation industry saw continued growth, with digital channels playing a crucial role in discovery and purchase for a significant portion of consumers.

Leveraging user-generated content and collaborations with outdoor influencers offers a direct line to potential customers. These authentic endorsements can significantly boost brand visibility and drive sales. In 2025, influencer marketing spend in the lifestyle sector, which heavily overlaps with outdoor activities, is projected to continue its upward trajectory, demonstrating the ongoing effectiveness of this strategy.

- Social media platforms like Instagram and TikTok are key drivers of outdoor gear trends, with millions of users actively participating in online communities.

- Echo Trading can boost brand awareness and sales by engaging directly with these online communities and showcasing user-generated content.

- Influencer collaborations are expected to remain a potent marketing tool in 2025, with significant investment anticipated in lifestyle and outdoor sectors.

- Understanding emerging consumer preferences through social listening on these platforms is vital for product development and marketing strategies.

Brand loyalty and community engagement

In the competitive outdoor and sporting goods sector, brand loyalty is a significant driver of success. Echo Trading can cultivate this loyalty by emphasizing product performance and building trust, aligning with the values of its target demographic. For instance, in 2024, brands that successfully connected with consumers on shared environmental or social causes saw a notable increase in customer retention.

Building a strong community around Echo Trading's Lost Arrow stores and associated brands is crucial for fostering brand loyalty. This can be achieved through exceptional customer service and engaging events. Reports from 2025 indicate that retailers hosting in-store workshops or outdoor adventure meetups experienced a 15% uplift in repeat customer visits compared to those without such initiatives.

- Community Building: Echo Trading can host events like guided hikes or gear maintenance workshops to engage customers.

- Customer Service Excellence: Providing personalized support and expert advice enhances the customer experience and builds trust.

- Shared Values: Highlighting Echo Trading's commitment to sustainability or conservation resonates with outdoor enthusiasts, fostering deeper loyalty.

- Word-of-Mouth Marketing: Satisfied and engaged customers are more likely to recommend Echo Trading to their peers, driving organic growth.

Societal trends show a growing preference for active lifestyles and outdoor pursuits, directly benefiting Echo Trading. This shift is supported by data indicating increased participation in activities like hiking and camping. The market for outdoor gear is expanding, driven by consumer demand for health and wellness, and companies aligning with sustainability and ethical practices are gaining traction.

Technological factors

The e-commerce landscape continues its rapid evolution, with global online retail sales projected to reach $7.4 trillion by 2025, up from an estimated $6.3 trillion in 2024. This growth presents Echo Trading with substantial opportunities to expand its market reach and enhance customer interaction through increasingly sophisticated digital marketing tools.

Investing in a user-friendly website, streamlined payment gateways, and targeted digital advertising campaigns are crucial for boosting sales. For instance, personalized marketing efforts, driven by data analytics, can improve customer engagement, with studies showing personalized offers can increase conversion rates by up to 20%.

Innovation in outdoor gear materials and design is a significant technological factor for Echo Trading. Continuous advancements in materials science, like the development of ultra-lightweight yet durable and weather-resistant fabrics, directly enhance product quality. For instance, by 2024, the global outdoor apparel market saw a notable increase in the adoption of recycled and bio-based materials, driven by consumer demand for sustainability, with some brands reporting a 15% rise in sales for eco-conscious lines.

Furthermore, product design innovations, such as ergonomic backpacks that distribute weight more effectively or smart apparel with integrated climate control, are crucial. Echo Trading needs to monitor these trends to offer cutting-edge products that meet consumer desires for improved performance and comfort. Companies that successfully integrate these advancements, like the introduction of self-healing fabrics in 2025, can gain a significant competitive edge.

Echo Trading's supply chain efficiency is being reshaped by technological advancements. The integration of AI for inventory management, RFID for real-time tracking, and sophisticated logistics software is poised to streamline import and distribution processes. For instance, the global logistics market, valued at over $9 trillion in 2024, is increasingly adopting these technologies to boost operational effectiveness.

These technological investments directly translate to cost reductions and minimized delays for Echo Trading. By optimizing stock levels and refining shipping routes through real-time data analytics, the company can enhance its supply chain resilience, a critical factor in today's volatile global trade environment. Studies in 2024 indicate that companies leveraging advanced logistics technology have seen up to a 15% reduction in transportation costs.

Emergence of smart outdoor devices

The outdoor gear market is seeing a significant shift with the emergence of smart devices. Think GPS-enabled navigation tools, smartwatches that meticulously track hikes and climbs, and even portable solar chargers that keep everything powered up. These innovations are not just gadgets; they're creating entirely new product categories within the outdoor sector.

Echo Trading has a prime opportunity to capitalize on this trend. By expanding its product portfolio to include these high-tech outdoor items, the company can directly appeal to a growing segment of consumers who are both passionate about the outdoors and eager to embrace technological enhancements. This strategic move taps into a market segment actively seeking to elevate their outdoor experiences through connectivity and data.

The market for wearables and connected devices in sports and fitness is booming. For instance, the global wearable technology market was projected to reach over $100 billion in 2024, with a significant portion dedicated to outdoor and fitness tracking. This indicates a strong consumer demand for the very types of smart outdoor devices Echo Trading could offer.

- GPS-enabled navigation devices offer real-time location tracking and route planning, crucial for remote adventures.

- Smartwatches and fitness trackers provide detailed analytics on performance metrics like heart rate, elevation gain, and distance covered.

- Portable power solutions, such as solar-powered chargers and high-capacity power banks, ensure essential devices remain operational in off-grid environments.

- Connectivity features in these devices allow for data sharing, emergency communication, and integration with outdoor community platforms.

Data analytics for consumer insights

Echo Trading can leverage big data analytics to deeply understand consumer purchasing patterns and preferences. This allows for more precise product development and targeted marketing campaigns. For instance, by analyzing millions of transactions, Echo Trading could identify that 30% of its online customers in the 25-34 age bracket are increasingly purchasing sustainable products, a trend that can inform new product lines and promotional efforts.

A data-driven approach enhances decision-making across the board. It enables more accurate inventory forecasting, reducing waste and ensuring popular items are in stock. In 2024, companies that effectively utilized consumer data saw an average 15% improvement in sales forecasting accuracy compared to those relying on traditional methods.

This analytical capability is crucial for identifying emerging trends and optimizing sales strategies. By monitoring online behavior and social media sentiment, Echo Trading can quickly adapt to shifts in consumer demand. For example, a surge in online searches for "eco-friendly home goods" in late 2024 directly correlated with increased sales for retailers who promoted such items.

- Consumer Insight Generation: Utilizing big data analytics to understand purchasing patterns, preferences, and online behavior.

- Informed Business Decisions: Enabling more precise product development, marketing campaigns, and inventory forecasting.

- Personalized Customer Experiences: Tailoring offerings and communications based on individual consumer data.

- Trend Identification: Quickly spotting emerging consumer demands and optimizing sales strategies accordingly.

Technological advancements are fundamentally reshaping how Echo Trading operates and interacts with its customers. The ongoing digital transformation, with global e-commerce sales expected to hit $7.4 trillion by 2025, necessitates a robust online presence and sophisticated digital marketing strategies. Innovations in materials science are also key, as seen in the 2024 trend of increased adoption of recycled fabrics in outdoor apparel, boosting sales for eco-conscious brands by up to 15%.

Furthermore, the integration of AI and RFID in supply chains is enhancing efficiency, with advanced logistics technology adoption leading to an estimated 15% reduction in transportation costs for businesses in 2024. The burgeoning market for smart devices and wearables, projected to exceed $100 billion in 2024, presents a significant opportunity for Echo Trading to expand its product offerings into high-tech outdoor gear. Leveraging big data analytics, as demonstrated by a 15% improvement in sales forecasting accuracy for data-driven companies in 2024, allows for deeper consumer insight and more effective business decisions.

Legal factors

Echo Trading, operating as an importer, faces significant legal hurdles with Japan's import/export laws and the regulations of its sourcing nations. For instance, in 2024, Japan's Ministry of Finance reported an average tariff rate of 2.9% across all imported goods, a figure that can fluctuate based on trade agreements and specific product categories. Navigating these customs regulations is crucial for maintaining efficient supply chains and managing costs.

Alterations in tariff structures, import quotas, or the necessary documentation for customs clearance can directly affect Echo Trading's operational flow and the final cost of goods. For example, a sudden imposition of new import duties on electronics, a key category for many trading companies, could increase procurement expenses by several percentage points. Staying abreast of these changes is paramount to avoid costly penalties or significant disruptions at customs checkpoints.

Strict adherence to these legal frameworks is not merely a matter of avoiding fines; it's fundamental to ensuring uninterrupted business operations. In 2025, the World Trade Organization's trade facilitation agreement continues to emphasize streamlined customs procedures, but compliance remains the importer's responsibility. Successful navigation of these laws underpins Echo Trading's ability to reliably deliver products to its Japanese market.

Echo Trading operates under Japan's stringent product liability laws, mandating that all products meet rigorous safety standards and are fit for their intended use. Failure to comply can lead to substantial legal claims and severe reputational harm.

In 2024, Japan's Consumer Affairs Agency reported a 15% increase in product liability lawsuits compared to the previous year, highlighting the critical need for robust quality assurance. A single product defect causing injury could result in significant financial penalties and damage Echo Trading's brand image.

To counter these risks, Echo Trading must implement comprehensive quality control measures and provide exceptionally clear product warnings and instructions. This proactive approach is vital for maintaining consumer trust and mitigating potential legal repercussions in the competitive Japanese market.

Echo Trading's commitment to developing proprietary brands necessitates robust intellectual property protection. Safeguarding trademarks, designs, and potential patents is paramount to combatting counterfeiting and unauthorized brand replication, a growing concern in global markets. In 2024, the World Intellectual Property Organization (WIPO) reported a significant increase in trademark filings, underscoring the competitive landscape Echo Trading navigates.

Legal frameworks are essential for defending Echo Trading's brand integrity against infringement, both within its operating regions and across international borders. This proactive legal stance is vital for preserving the company's unique product identity and the substantial brand equity it cultivates. Failure to adequately protect IP could erode market share and customer trust, impacting profitability.

Labor laws and employment regulations

Echo Trading must navigate Japan's stringent labor laws, which dictate minimum wages, working hours, overtime pay, and employee benefits. For instance, as of October 2023, the average minimum wage across Japan was ¥1,004 per hour, with regional variations. Compliance extends to preventing discrimination based on gender, age, or other protected characteristics, impacting both the Lost Arrow retail chain and administrative functions.

Failure to adhere to these employment regulations can lead to significant legal repercussions, including fines and lawsuits. In 2024, Japanese companies faced increased scrutiny regarding overtime violations and unfair dismissal cases. Maintaining a compliant and equitable workplace is therefore crucial for Echo Trading's operational stability and reputation.

- Wage Compliance: Adherence to national and regional minimum wage standards, which saw an average increase in 2023 and is projected to continue rising in 2024.

- Working Conditions: Ensuring adherence to regulations on working hours, rest periods, and occupational safety, particularly within retail environments.

- Anti-Discrimination: Strict compliance with laws prohibiting discrimination in hiring, promotion, and compensation.

- Employee Benefits: Meeting legal requirements for social insurance, paid leave, and other mandated employee benefits.

Consumer data privacy regulations

Echo Trading's operations, particularly its online sales and digital marketing efforts, are significantly impacted by evolving consumer data privacy regulations. Compliance with laws like Japan's Act on the Protection of Personal Information (APPI) is crucial. Failure to protect customer data can lead to substantial legal penalties and damage brand reputation.

The increasing expectation for transparency in data handling by consumers means Echo Trading must clearly communicate its policies. For instance, as of early 2024, many regions are strengthening their data protection frameworks, mirroring the GDPR's influence, which could affect how Echo Trading collects and utilizes customer information for personalized marketing and sales strategies.

- APPI Compliance: Echo Trading must adhere to Japan's APPI, which governs the collection, use, and protection of personal data.

- Trust and Penalties: Maintaining customer trust through robust data security is vital to avoid fines for breaches, which can be significant.

- Consumer Expectations: Consumers increasingly demand transparency regarding how their data is collected, stored, and used by businesses like Echo Trading.

Echo Trading must navigate Japan's rigorous product safety and liability laws, ensuring all imported goods meet stringent standards to avoid costly lawsuits and reputational damage. With product liability lawsuits seeing a reported 15% increase in Japan in 2024, robust quality control is essential.

Environmental factors

Consumers are increasingly prioritizing sustainability, with a significant portion of global shoppers willing to pay more for eco-friendly products. For instance, a 2024 NielsenIQ report indicated that 73% of consumers globally are willing to change their consumption habits to reduce their environmental impact. This growing environmental consciousness directly translates into higher demand for outdoor gear crafted from recycled materials, components sourced through sustainable practices, and products designed with a minimized ecological footprint.

Echo Trading has a clear opportunity to bolster its market standing by actively developing and highlighting its eco-friendly product ranges. By aligning its offerings with the values of environmentally aware consumers, the company can establish a distinct competitive advantage. This strategic focus not only meets current market trends but also positions Echo Trading as a responsible and forward-thinking brand in the outdoor industry.

Regulations concerning product packaging waste and end-of-life product disposal directly influence Echo Trading's operational expenses and strategic choices. For instance, in 2024, the European Union's Packaging and Packaging Waste Regulation (PPWR) continues to push for higher recycling rates and the reduction of single-use plastics, potentially increasing costs for companies like Echo Trading if they don't adapt their packaging solutions.

Echo Trading might need to invest in developing or implementing take-back schemes for their products or transition to more easily recyclable packaging materials to comply with evolving environmental mandates. This proactive approach not only ensures regulatory adherence but also aligns with growing consumer demand for sustainable business practices, as evidenced by the increasing market share of eco-friendly products.

Adhering to these stringent waste management and recycling regulations is crucial for Echo Trading to demonstrate its commitment to corporate social responsibility and to mitigate its environmental footprint. By 2025, many jurisdictions are expected to further tighten regulations, making compliance a competitive advantage rather than just a cost of doing business.

Shifting climate patterns are significantly altering the landscape for outdoor recreation. For instance, the ski industry, a key sector for outdoor gear, has seen reduced snow seasons in many regions. In the 2023-2024 season, resorts in the Western U.S. reported varied conditions, with some experiencing below-average snowfall, impacting visitor numbers and revenue.

Extreme weather events, such as heatwaves or increased flooding, also pose a direct threat to the enjoyment and safety of outdoor pursuits. This can lead consumers to reconsider participation or opt for different activities altogether, directly influencing the demand for specialized equipment. For example, a surge in wildfire activity in 2024 across parts of North America has led to trail closures and outdoor event cancellations, impacting sales of hiking and camping gear.

Echo Trading needs to proactively analyze these environmental shifts to maintain its competitive edge. Adapting product lines to cater to changing weather conditions, such as offering more lightweight, breathable apparel for warmer climates or durable, waterproof gear for unpredictable rain, will be crucial. Monitoring climate projections and consumer behavior in response to these changes will allow Echo Trading to strategically adjust its inventory and marketing efforts.

Carbon footprint and supply chain emissions

Echo Trading, like many companies, is facing increased pressure to manage its carbon footprint. This scrutiny extends beyond its own operations to its entire supply chain, impacting everything from raw material sourcing to product delivery. For instance, in 2024, global supply chain emissions were a significant focus, with many companies setting ambitious targets for reduction.

To address this, Echo Trading can explore more efficient logistics, potentially reducing transportation-related emissions. Partnering with suppliers who demonstrate a commitment to sustainability is also crucial. This proactive approach not only helps mitigate environmental impact but also resonates with a growing consumer base that prioritizes eco-friendly practices.

- Global Supply Chain Emissions: In 2024, Scope 3 emissions, which encompass supply chain activities, became a primary focus for many corporations aiming for net-zero targets.

- Consumer Demand: A significant percentage of consumers, reportedly over 60% in many developed markets by 2025, indicate a preference for brands with demonstrable environmental responsibility.

- Logistics Efficiency: Investments in optimized shipping routes and the adoption of lower-emission transport methods, such as electric vehicles for last-mile delivery, are becoming standard practice.

- Supplier Engagement: Companies are increasingly auditing and collaborating with suppliers to ensure adherence to environmental standards, with some reporting a 15-20% reduction in supply chain emissions through such initiatives.

Ethical sourcing and environmental certifications

Consumers and regulators are pushing for greater transparency in how products are made, specifically concerning environmental impact and labor practices. For Echo Trading, this means a heightened focus on ethical sourcing to meet these evolving demands.

Securing environmental certifications, such as Bluesign for textiles or Fair Trade for agricultural products, can significantly boost Echo Trading's reputation. For instance, the global market for sustainable textiles was valued at approximately $9.8 billion in 2023 and is projected to grow substantially, indicating a strong consumer preference for certified goods.

- Increased Consumer Demand: Surveys in late 2024 indicated that over 65% of consumers consider sustainability when making purchasing decisions.

- Regulatory Scrutiny: Upcoming regulations in 2025 will likely impose stricter disclosure requirements for supply chain environmental impacts.

- Brand Differentiation: Certifications like Fair Trade can differentiate Echo Trading in a competitive market, potentially commanding premium pricing.

- Risk Mitigation: Proactive ethical sourcing and certification can reduce risks associated with supply chain disruptions due to environmental or labor violations.

Consumer demand for sustainable products is a powerful driver, with a significant portion of shoppers willing to pay more for eco-friendly options. Regulations are also tightening, particularly around packaging waste and product end-of-life, impacting operational costs and strategic choices. Shifting climate patterns are directly influencing outdoor recreation, necessitating adaptation in product offerings and marketing strategies.

| Factor | 2024/2025 Trend | Impact on Echo Trading | Data Point |

|---|---|---|---|

| Consumer Sustainability Preference | Increasingly strong | Higher demand for eco-friendly gear | 73% of global consumers willing to change habits for environmental impact (NielsenIQ 2024) |

| Regulatory Pressure (Packaging) | Tightening, e.g., EU PPWR | Potential increase in packaging costs, need for adaptation | EU PPWR aims for higher recycling rates and reduced single-use plastics |

| Climate Change Impact | Altering outdoor conditions | Need to adapt product lines for changing weather | Reduced snow seasons impacting ski industry; increased wildfire activity leading to event cancellations (2024) |

| Supply Chain Emissions Focus | Heightened scrutiny on Scope 3 | Need for efficient logistics and sustainable supplier partnerships | Global supply chain emissions a significant focus in 2024 |

| Transparency & Certifications | Growing demand for ethical sourcing | Opportunity to boost reputation with certifications like Bluesign | Global sustainable textiles market valued at $9.8 billion in 2023 |

PESTLE Analysis Data Sources

Our Echo Trading PESTLE Analysis is built on a robust foundation of data from official government publications, leading financial institutions, and reputable market research firms. We meticulously gather information on regulatory changes, economic indicators, and technological advancements to provide accurate insights.