Duskin SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Duskin Bundle

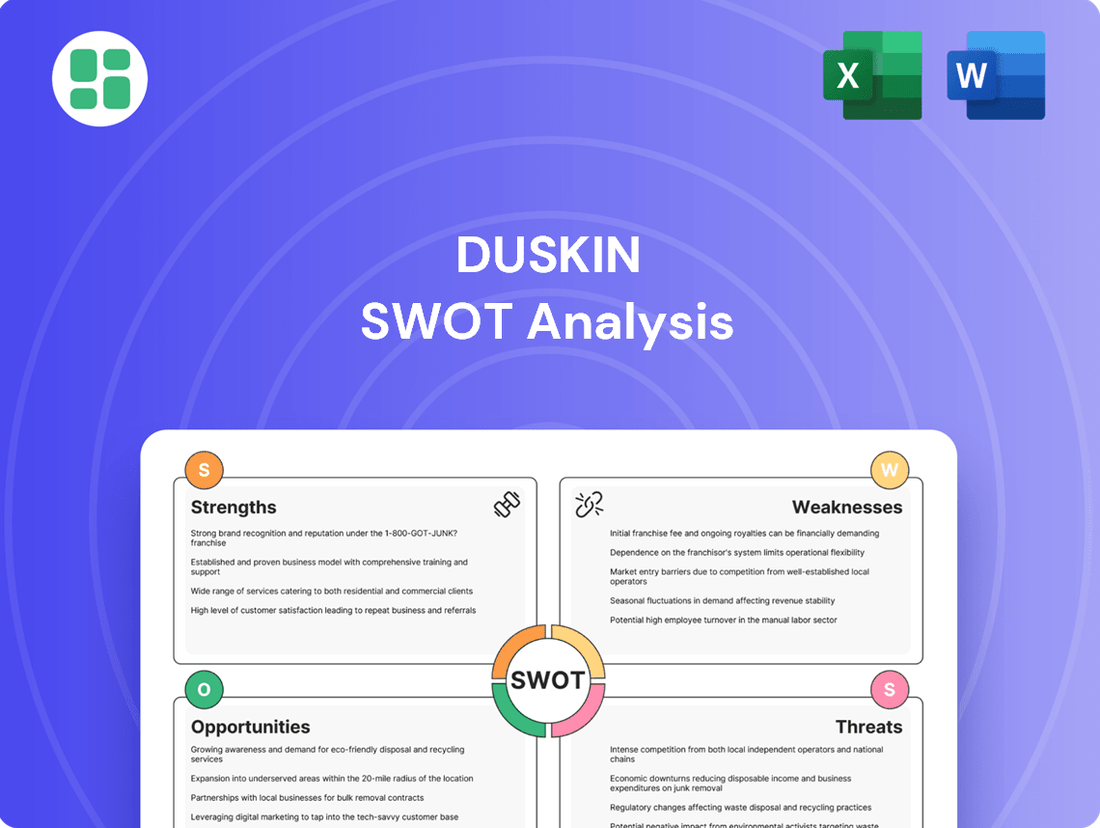

Discover the core strengths and potential challenges facing Duskin with our insightful SWOT analysis. This preview offers a glimpse into their market position, but the full report unlocks a comprehensive understanding of their competitive landscape and future opportunities.

Want the full story behind Duskin's strategic advantages, potential threats, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your own strategic planning and market research.

Strengths

Duskin's extensive franchise network is a cornerstone of its market leadership, allowing for deep penetration across Japan and other Asian markets. This widespread presence is a critical advantage in reaching a broad customer base.

The company's dominance in key sectors is remarkable. Duskin holds roughly 90% of the residential dust control market and a substantial 55% in the commercial sector, demonstrating its strong competitive position and customer trust.

Furthermore, its Mister Donut brand is a powerhouse, capturing an impressive 83% share of the domestic doughnut market. This brand recognition and market share highlight Duskin's ability to build and maintain leading consumer franchises.

Duskin's diversified business portfolio is a significant strength, extending beyond its foundational cleaning and hygiene services. The company boasts a robust presence in food services, most notably with its popular Mister Donut chain, which consistently contributes to its revenue. This strategic expansion into food, alongside its growing healthcare and elderly care segments, creates multiple, independent revenue streams.

This multi-sector approach significantly reduces Duskin's reliance on any single market, offering substantial resilience against sector-specific downturns or economic volatility. For instance, in the fiscal year ending February 2024, Duskin reported total revenue of ¥198.4 billion, with its food service segment, particularly Mister Donut, playing a crucial role in this overall financial performance.

Duskin benefits from a robust brand reputation, cultivated through its unique 'Prayerful Management' philosophy. This approach prioritizes customer satisfaction and sincerity, fostering deep connections with its clientele.

This dedication to exceptional service quality translates directly into strong customer loyalty. In fiscal year 2023, Duskin achieved an impressive customer retention rate of 85%, underscoring the success of its customer-centric strategy.

Commitment to Innovation and Sustainability

Duskin demonstrates a strong commitment to innovation, evidenced by its planned ¥3 billion investment in research and development for 2024. This focus aims to cultivate novel solutions and services, positioning the company for future growth and market relevance.

Furthermore, Duskin is proactively addressing environmental concerns through its sustainability initiatives. The company has set an ambitious target to achieve a 20% reduction in carbon emissions by 2025.

This dedication to sustainability is being integrated directly into its business operations and product development. Duskin is actively incorporating eco-friendly practices and developing products that align with environmental responsibility.

Key aspects of this strength include:

- Significant R&D Investment: ¥3 billion allocated to R&D in 2024 for new solutions.

- Environmental Targets: Aiming for a 20% reduction in carbon emissions by 2025.

- Integration of Sustainability: Embedding eco-friendly practices and products across the business.

Adaptability and Strategic Vision

Duskin has shown impressive adaptability, pivoting to new revenue streams and service offerings. A prime example is their initiative in establishing vaccination sites during the COVID-19 pandemic, demonstrating a quick response to evolving societal needs. Furthermore, the company has launched disaster risk reduction support services, showcasing a proactive approach to emerging challenges.

The company's strategic vision is clearly articulated in its Medium-Term Business Plan 2028, titled 'Do-Connect.' This plan emphasizes key areas for growth and development:

- Human Resource Development: Investing in employee skills and capabilities.

- Corporate Culture Enhancement: Fostering an environment conducive to innovation and collaboration.

- Customer Touchpoint Improvement: Strengthening relationships and engagement with customers.

This forward-looking strategy, with a target year of 2028, positions Duskin to navigate future market dynamics effectively. Their commitment to these strategic pillars suggests a robust plan for sustained growth and relevance.

Duskin's extensive franchise network provides deep market penetration across Japan and other Asian markets, enabling broad customer reach. The company holds a commanding 90% share in the residential dust control market and 55% in the commercial sector, underscoring its strong competitive standing and customer trust.

The Mister Donut brand is a significant asset, capturing 83% of the domestic doughnut market, a testament to Duskin's ability to build and sustain leading consumer franchises. This diversified portfolio, including food services and growing healthcare segments, creates multiple resilient revenue streams, as evidenced by ¥198.4 billion in total revenue for the fiscal year ending February 2024.

Duskin's robust brand reputation, built on a 'Prayerful Management' philosophy, fosters strong customer loyalty, reflected in an 85% customer retention rate in fiscal year 2023. The company's commitment to innovation is highlighted by a ¥3 billion R&D investment planned for 2024, alongside an environmental target of a 20% carbon emission reduction by 2025.

Duskin demonstrates notable adaptability, exemplified by its rapid deployment of vaccination sites during the COVID-19 pandemic and its launch of disaster risk reduction services. The company's strategic 'Do-Connect' Medium-Term Business Plan 2028 focuses on human resource development, corporate culture enhancement, and customer touchpoint improvement to ensure sustained growth.

| Strength Category | Specific Example | Impact/Data Point |

|---|---|---|

| Market Dominance | Residential Dust Control Market Share | 90% |

| Brand Strength | Mister Donut Market Share | 83% |

| Financial Performance | Total Revenue (FY ending Feb 2024) | ¥198.4 billion |

| Customer Loyalty | Customer Retention Rate (FY 2023) | 85% |

| Innovation Investment | Planned R&D Investment (2024) | ¥3 billion |

| Environmental Commitment | Carbon Emission Reduction Target | 20% by 2025 |

What is included in the product

Analyzes Duskin’s competitive position through key internal and external factors.

Duskin's SWOT analysis offers a clear, actionable framework, transforming complex strategic thinking into easily digestible insights for efficient decision-making.

Weaknesses

Duskin's Direct Selling Group, a foundational part of its operations, is struggling to sustain its traditional face-to-face sales approach. This is largely due to a shrinking and aging sales force, making it harder to connect with customers directly.

This reliance on an outdated model directly impedes Duskin's capacity for substantial revenue growth, especially considering the direct selling market is already quite mature and saturated. For instance, in 2023, the number of active direct sellers in the industry saw a slight decline, highlighting broader sector challenges.

Despite a reported increase in net sales for Duskin, notably from its Mister Donut segment, the company faced a downturn in operating profit. This profitability squeeze stems directly from escalating operating costs across various fronts.

Key drivers behind these increased expenses include higher staff costs, significant investments in IT infrastructure, and the persistent rise in raw material prices. For instance, in the first half of fiscal year 2024, Duskin reported a 1.4% increase in net sales to ¥38.5 billion, but operating profit declined by 18.9% to ¥2.6 billion, highlighting the pressure from these rising costs.

Duskin faces a significant hurdle in clearly articulating the long-term value and superior quality of its dust control solutions to the average consumer. Many potential customers may gravitate towards lower-cost, disposable alternatives, failing to grasp the enhanced efficiency and durability Duskin offers.

This perception gap makes it challenging for Duskin to command premium pricing and effectively differentiate its offerings in a crowded marketplace. For instance, while a disposable mop might cost $5, Duskin's reusable systems, though more expensive upfront, offer substantial savings and better performance over time, a benefit that isn't always immediately apparent.

Overcapitalized Balance Sheet

Duskin's balance sheet shows a significant overcapitalization, with a large chunk of its adjusted shareholders' equity tied up in cash, marketable securities, and long-term investments. As of the latest reports, this excess liquidity, while a sign of financial strength, suggests that the company might not be deploying its capital as effectively as it could to boost shareholder returns.

This overcapitalization can be seen as a missed opportunity. For instance, if Duskin holds a substantial amount of low-yielding cash equivalents, it could be foregoing higher returns from strategic investments or share buybacks. This situation might indicate a conservative financial strategy or a lack of compelling internal investment opportunities.

- Overcapitalization: A significant portion of equity is in liquid assets, indicating potential for better capital allocation.

- Missed Returns: Low-yielding cash holdings may represent foregone opportunities for higher investment gains.

- Strategic Deployment: Suggests a need to explore more efficient ways to deploy capital for enhanced shareholder value.

Slower Growth in Direct Selling Business

Adjusted earnings estimates for fiscal years 2025 and 2026 point to a continued slowdown in the Direct Selling Business segment. This suggests that revitalizing growth in this established area remains a hurdle, even with expanded service options.

For instance, analysts have revised down their fiscal 2025 earnings per share (EPS) estimates for Duskin by approximately 5% in recent months, reflecting this anticipated slower growth. This trend highlights a persistent challenge in re-energizing this core business segment.

- Slower Earnings Growth: Fiscal 2025 and 2026 adjusted earnings estimates indicate a deceleration in the Direct Selling Business.

- Persistent Challenge: Revitalizing growth in this traditional segment is proving difficult despite new service introductions.

- Analyst Revisions: Recent downward revisions to fiscal 2025 EPS estimates underscore the ongoing growth concerns.

Duskin's direct selling segment faces significant headwinds due to an aging and shrinking sales force, making traditional face-to-face sales increasingly challenging. This reliance on an outdated model directly hinders substantial revenue growth in a mature and saturated market, as evidenced by a slight decline in active direct sellers industry-wide in 2023.

The company's profitability is being squeezed by escalating operating costs, including higher staff expenses, substantial IT investments, and rising raw material prices. This pressure is evident in the first half of fiscal year 2024, where a 1.4% net sales increase to ¥38.5 billion was accompanied by an 18.9% operating profit decline to ¥2.6 billion.

Duskin struggles to effectively communicate the long-term value and superior quality of its dust control solutions, as consumers often opt for cheaper, disposable alternatives. This perception gap impedes premium pricing and differentiation, despite the long-term cost-effectiveness of Duskin's reusable systems compared to one-time purchases.

The company's overcapitalization, with significant equity tied up in liquid assets, suggests potential inefficiencies in capital deployment for boosting shareholder returns. Holding low-yielding cash equivalents may mean foregoing higher returns from strategic investments or share buybacks, indicating a conservative financial approach or a lack of compelling internal opportunities.

| Weakness | Description | Impact | Supporting Data (H1 FY24) |

|---|---|---|---|

| Aging Direct Selling Force | Shrinking and aging sales force hinders traditional sales methods. | Limits revenue growth potential in a mature market. | Industry-wide slight decline in active direct sellers in 2023. |

| Rising Operating Costs | Increased staff costs, IT investments, and raw material prices. | Squeezes profitability despite sales growth. | Operating profit declined 18.9% to ¥2.6 billion on ¥38.5 billion net sales. |

| Value Perception Gap | Difficulty communicating long-term value of dust control solutions. | Hinders premium pricing and differentiation against cheaper alternatives. | Consumers often choose lower-cost disposable options over durable systems. |

| Overcapitalization | Excess liquidity in cash and investments. | Potential for missed returns from more strategic capital allocation. | Significant portion of equity held in low-yielding liquid assets. |

Same Document Delivered

Duskin SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The global elderly care services market is on a significant upward trajectory, with projections indicating it could reach approximately $1.1 trillion by 2029. This surge is fueled by a rapidly aging global population and a corresponding rise in demand for specialized care and support services. Duskin, through its existing footprint in healthcare and its investment in JP-Holdings, which operates in the child and elderly care sectors, is well-positioned to tap into this expanding market opportunity.

The Japanese cleaning services market is poised for impressive expansion, with projections indicating a compound annual growth rate of 9.2% between 2025 and 2030. This growth trajectory presents a significant opportunity for companies like Duskin, which already has a well-established presence.

This burgeoning market offers dual avenues for growth in both the residential and commercial sectors. Duskin's existing strong foothold in these areas positions it favorably to capitalize on increasing demand for professional cleaning solutions across Japan.

Duskin's strategic investment of ¥1.5 billion by 2024 into digital transformation initiatives is a key opportunity. This focus on digital solutions aims to significantly boost customer engagement and operational efficiency across the company.

By embracing new technologies, Duskin can streamline internal processes, leading to cost savings and faster service delivery. This digital push also positions them to better understand and respond to changing consumer preferences, a critical factor in today's market.

International Market Expansion

Duskin's strategic vision includes aggressive international market expansion, with a target of 15% growth in overseas markets by 2025. This ambitious goal is supported by ongoing exploration of new geographic regions, notably Europe, which presents a significant untapped market. The company aims to replicate its proven franchise model and diverse product/service portfolio in these new territories, projecting substantial revenue growth opportunities.

The company's international strategy is designed to leverage its established operational success and brand recognition. By carefully selecting and entering new markets, Duskin anticipates a significant uplift in its global sales figures. This expansion is not just about increasing presence but about capturing market share and diversifying revenue streams away from its domestic base.

Key opportunities for Duskin's international market expansion include:

- Targeting 15% growth in overseas markets by 2025.

- Exploring new regions such as Europe for market entry.

- Replicating the successful franchise model in international territories.

- Diversifying offerings to cater to a broader global customer base.

Strategic Partnerships and New Business Development

Duskin is actively expanding its portfolio by developing new business lines and pursuing strategic mergers and acquisitions. This forward-thinking strategy enables the company to address evolving market demands and incorporate fresh capabilities, such as disaster risk reduction support and innovative pet care solutions.

The company's commitment to new business development is underscored by its proactive exploration of emerging sectors. For example, Duskin is investigating opportunities in disaster risk reduction, a market projected to see significant growth due to increasing global climate events. Similarly, the pet care industry continues its robust expansion, with global pet care market revenue expected to reach approximately $280 billion by 2025, presenting a fertile ground for new product lines.

- Strategic M&A Activity: Duskin actively seeks acquisitions to integrate new technologies and market access.

- Emerging Market Focus: The company is targeting growth areas like disaster risk reduction and specialized pet products.

- Capability Enhancement: Partnerships and acquisitions aim to broaden Duskin's service and product offerings.

The global elderly care services market is expected to reach $1.1 trillion by 2029, presenting a significant growth avenue for Duskin, especially through its investment in JP-Holdings. Furthermore, the Japanese cleaning services market is projected to grow at a 9.2% CAGR from 2025 to 2030, offering Duskin substantial domestic expansion opportunities in both residential and commercial sectors. Duskin's ¥1.5 billion investment in digital transformation by 2024 is set to enhance customer engagement and operational efficiency, streamlining processes and improving service delivery.

Duskin is targeting 15% growth in overseas markets by 2025, with Europe identified as a key expansion region. The company plans to replicate its successful franchise model internationally to diversify revenue. Additionally, Duskin is exploring new business lines such as disaster risk reduction and pet care, with the global pet care market projected to reach $280 billion by 2025, indicating strong potential for new product and service development.

Threats

Japan's demographic challenges, including a declining birthrate and an aging population, are creating a shrinking domestic market and exacerbating labor shortages. This trend directly impacts Duskin's business model, particularly its service segments that rely heavily on a readily available workforce. For instance, by 2023, Japan's population had fallen below 124 million, with the working-age population (15-64 years) shrinking significantly.

These demographic shifts translate into increased operational costs for Duskin due to higher wages needed to attract and retain staff, and a reduced pool of potential customers. The contraction of the domestic consumer market means fewer opportunities for growth within Japan, forcing a greater reliance on international expansion or innovative service delivery to maintain revenue streams.

Duskin faces significant competitive pressures across its core business areas. In the doughnut segment, for instance, the market is saturated with both global chains and local bakeries, making it challenging to maintain market share. For example, in 2023, the global doughnut market was valued at approximately $31.5 billion, with intense competition from brands like Dunkin' and Krispy Kreme.

The cleaning services sector also presents a crowded landscape, with numerous local and national providers vying for contracts. This can lead to price wars and reduced profit margins as companies compete to offer the lowest bids. Similarly, Duskin's healthcare services operate within a highly regulated and competitive environment, where established players and new entrants constantly challenge existing market positions.

Duskin is contending with escalating operating expenses, notably due to the increasing costs of raw materials and investments in energy diversification. For instance, global commodity prices saw significant upticks throughout 2024, impacting manufacturing inputs across many sectors.

Persistent inflation and broader economic headwinds in 2024 and early 2025 are squeezing profit margins. These conditions also diminish consumer purchasing power, potentially leading to reduced demand for Duskin's products or services.

Evolving Consumer Preferences and Digital Disruption

Duskin must navigate rapidly evolving consumer preferences, which are increasingly shaped by digital advancements and a demand for personalized experiences. Failure to adapt to these shifts, especially in how customers engage with brands online and the tailored services offered, poses a significant risk to market relevance. For instance, in 2024, a significant portion of retail sales are projected to occur online, highlighting the critical need for robust digital strategies.

The constant churn of digital disruption means that companies like Duskin must invest heavily in understanding and responding to changing consumer behaviors. This includes embracing new technologies for customer interaction and service delivery. A missed step in this area could result in a loss of competitive edge as consumers gravitate towards more digitally adept competitors.

- Digital Engagement: Consumers expect seamless online experiences, from browsing to purchase and post-sale support.

- Personalization: Tailored product recommendations and marketing messages are becoming standard, not exceptions.

- Adaptability: Businesses must be agile enough to integrate new digital tools and platforms as they emerge.

- Market Relevance: Staying ahead of consumer trends is crucial to avoid becoming obsolete in a fast-paced market.

Geopolitical Risks and Natural Disasters

Geopolitical tensions and political instability globally present a significant external threat. For instance, ongoing conflicts and trade disputes can directly impact international markets and sourcing, as seen with disruptions affecting global shipping routes throughout 2024. These events can lead to increased operational costs and uncertainty for companies like Duskin, which rely on global supply chains.

The escalating frequency and severity of natural disasters also pose a considerable risk. Events such as the devastating 2024 Noto Peninsula earthquake in Japan, which caused widespread damage and economic disruption, highlight the vulnerability of businesses to extreme weather and seismic activity. Such occurrences can cripple infrastructure, disrupt production, and necessitate substantial investment in emergency preparedness and recovery efforts, impacting financial performance.

- Supply Chain Vulnerability: Geopolitical instability in key manufacturing regions can lead to material shortages and price volatility, impacting production schedules and profitability. For example, disruptions in East Asian semiconductor supply chains during 2024 have affected numerous industries.

- Operational Disruptions: Natural disasters can halt operations, damage facilities, and lead to significant downtime, as demonstrated by the economic impact of major floods in Southeast Asia in late 2023 and early 2024, which affected regional manufacturing output.

- Increased Costs: Responding to geopolitical crises or natural disasters often requires unplanned expenditures for emergency logistics, repairs, and business continuity measures, diverting resources from strategic growth initiatives.

Duskin faces a shrinking domestic market due to Japan's aging population and declining birthrate, a trend that directly impacts its service-based segments. By 2023, Japan's population was under 124 million, with a notable decrease in the working-age demographic, leading to labor shortages and increased wage pressure.

Intense competition characterizes Duskin's core markets, from the crowded doughnut sector, valued at approximately $31.5 billion in 2023, to the highly competitive cleaning and healthcare services industries. This saturation often results in price wars, squeezing profit margins.

Rising operating expenses, fueled by inflation and volatile commodity prices throughout 2024, are a significant threat, diminishing consumer purchasing power and potentially reducing demand for Duskin's offerings.

The company must also contend with rapidly evolving consumer preferences, particularly the demand for seamless digital engagement and personalization, as a substantial portion of retail sales shifted online in 2024.

SWOT Analysis Data Sources

This Duskin SWOT analysis is built on a foundation of robust data, encompassing financial statements, detailed market research, and expert industry commentary to provide a comprehensive and actionable assessment.