Duell Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Duell Bundle

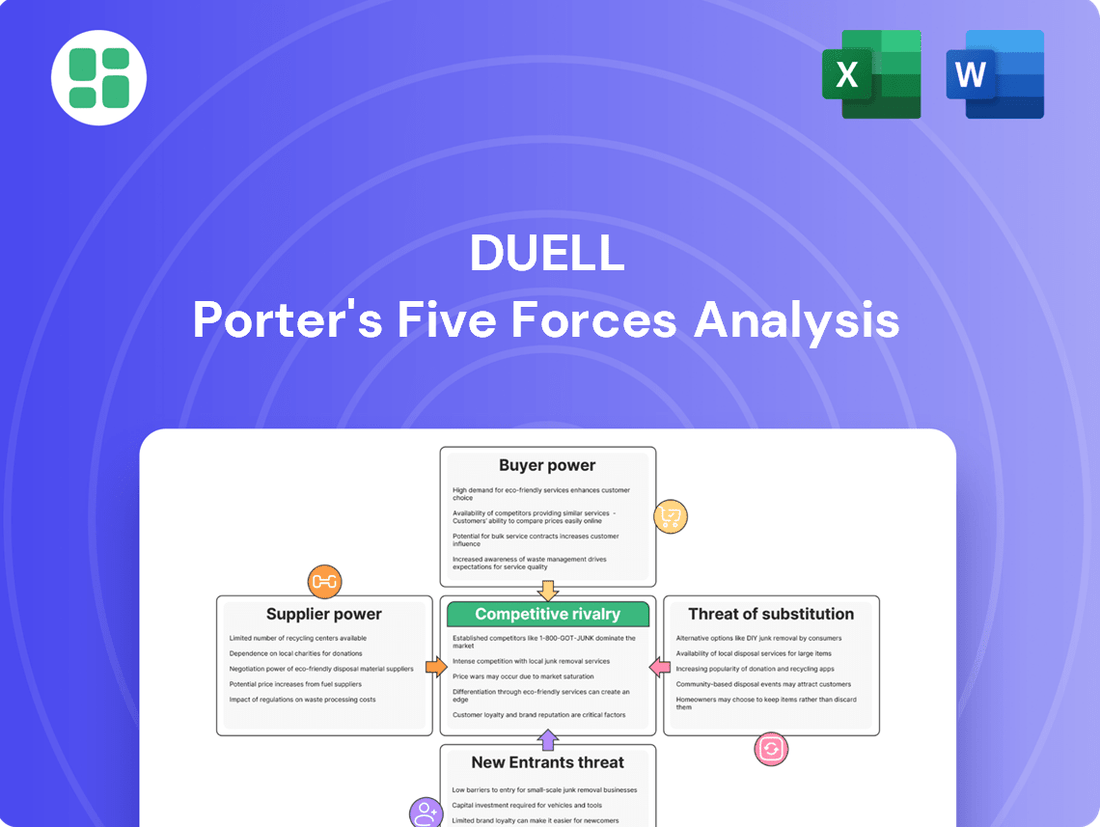

Porter's Five Forces Analysis provides a powerful lens to understand the competitive landscape Duell operates within. It dissects the industry's structure, revealing the underlying forces that shape profitability and strategic options.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Duell’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized or proprietary components for specific vehicle brands can wield considerable bargaining power over Duell Oy. When these critical parts lack readily available alternatives, Duell's capacity to negotiate pricing and terms is inherently constrained. For instance, in 2024, the automotive supply chain continued to grapple with shortages of certain advanced electronic components, driving up prices for manufacturers relying on them.

Duell's strategic advantage lies in its in-house manufacturing capabilities for its own brands. This vertical integration allows Duell to internalize the production of certain key components, thereby reducing its dependence on external suppliers and mitigating their potential bargaining power. This strategy is particularly effective in managing the cost and availability of parts unique to its proprietary product lines.

The costs associated with Duell switching suppliers can be substantial. For manufactured goods, this might mean significant investment in retooling production lines. For Duell's own brands, product redesigns are necessary, and for imported brands, renegotiating distribution agreements adds complexity and expense. These high switching costs empower suppliers, especially if Duell has deeply integrated a particular supplier's components or systems.

Supply chain disruptions, a notable concern throughout 2024, underscore the critical need for Duell to maintain diverse supplier relationships. When a single supplier dominates a critical component or material, Duell's operational stability is directly threatened. The financial impact of such disruptions can be severe, as seen with increased raw material costs and production delays experienced by many retailers in the past year.

Duell Oy's significant presence as a major distributor across Nordic and European markets positions it as a crucial partner for numerous suppliers. This scale grants Duell considerable leverage, particularly when dealing with smaller or specialized manufacturers who rely heavily on the distributor's extensive dealer network and substantial order volumes.

For many suppliers, Duell represents a substantial portion of their sales. In 2023, for instance, Duell reported net sales of €185.5 million. This financial dependency means that a disruption in their relationship with Duell could have a significant negative impact on these suppliers' revenue streams and overall market viability.

Consequently, smaller or niche suppliers often find their bargaining power diminished. The prospect of losing Duell's business, which can account for a significant percentage of their total output, naturally limits their ability to dictate terms or demand higher prices, thus strengthening Duell's position in supplier negotiations.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers for Duell. If Duell can readily find alternative materials or components for its manufactured goods, or alternative brands for its distribution business, it can switch suppliers more easily, thereby diminishing the leverage of its current suppliers. For instance, in 2024, the global chemical industry, a key supplier sector for many manufactured goods, saw increased production of certain polymers, potentially offering Duell more options for substitute inputs.

Duell's extensive product portfolio, encompassing 150,000 items across over 550 brands, inherently suggests a broad and diverse supplier base. This diversity is a critical factor in mitigating supplier power. The more suppliers Duell has access to for its various product lines, the less dependent it is on any single supplier, strengthening its negotiating position.

- Broad Supplier Network: Duell's 150,000+ product SKUs and 550+ brands indicate a wide array of sourcing relationships.

- Substitute Availability: The existence of readily available alternative materials or brands for Duell's offerings reduces supplier leverage.

- Market Dynamics: In 2024, shifts in commodity markets, like the increased output of certain plastics, provided Duell with more substitute options for manufacturing inputs.

- Reduced Dependency: A diverse supplier base allows Duell to switch suppliers more easily, limiting the power of individual suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Duell's distribution channels is a key consideration. If a supplier could establish its own direct-to-dealer network, it would significantly alter the power dynamic, allowing them to capture more of the value chain.

However, Duell's established presence, boasting approximately 8,500 dealers across Europe, presents a formidable barrier to entry for most suppliers attempting such a move. This extensive network is costly and complex to replicate, thereby mitigating the immediate threat of forward integration.

- Supplier Forward Integration Threat: Suppliers could potentially bypass Duell and sell directly to dealers.

- Duell's Distribution Strength: Duell operates a vast network of 8,500 dealers across Europe.

- Barrier to Entry: Replicating Duell's extensive distribution network is a significant hurdle for suppliers.

- Mitigated Threat: The high cost and complexity of building a comparable network limit the suppliers' ability to integrate forward.

Suppliers' bargaining power is a key factor in assessing Duell's competitive landscape. When suppliers can dictate terms, it impacts Duell's costs and operational flexibility. Factors like the uniqueness of their products, the cost for Duell to switch suppliers, and the overall concentration of suppliers in a given market all play a role.

In 2024, the automotive and powersports industries continued to see supply chain volatility. For Duell, this meant that suppliers of specialized components, particularly those with advanced technology or limited production capacity, held significant leverage. The cost of switching from such suppliers, which could involve retooling or redesigning products, further entrenched their power.

Conversely, Duell's large scale and broad product portfolio, which includes 150,000 items across over 550 brands, often allow it to negotiate favorable terms. When suppliers depend heavily on Duell for a substantial portion of their sales, their bargaining power is naturally reduced, especially if viable alternatives exist in the market.

The threat of suppliers integrating forward into Duell's distribution channels is also a consideration. However, Duell's extensive network of approximately 8,500 dealers across Europe acts as a strong deterrent, making it difficult and costly for suppliers to establish a comparable direct-to-dealer presence.

| Factor | Impact on Supplier Bargaining Power | Duell's Position |

|---|---|---|

| Specialized/Proprietary Components | High Power | Limited options, higher costs |

| Switching Costs | High Power | Costly to change suppliers, especially for integrated parts |

| Supplier Dependence on Duell | Low Power | Duell's significant order volumes reduce supplier leverage |

| Availability of Substitutes | Low Power | More options for materials or brands weaken supplier hold |

| Forward Integration Threat | Moderate Threat | Duell's large dealer network is a significant barrier |

What is included in the product

Duell Porter's Five Forces Analysis provides a framework for understanding the competitive intensity and attractiveness of an industry, helping Duell to identify its strategic position and potential threats.

Quickly identify and mitigate competitive threats with a visual representation of each force, allowing for immediate strategic adjustments.

Customers Bargaining Power

Duell's extensive network of roughly 8,500 dealers across Europe suggests that, on average, individual customers have limited bargaining power due to their small scale. This wide distribution of customers means no single dealer can significantly impact Duell's pricing or terms. For instance, if a single dealer were to demand lower prices, Duell could easily find alternative dealers to serve that demand.

Dealers, who are Duell's direct customers, often have a variety of choices when it comes to sourcing parts and accessories. For instance, they can turn to other major distributors like Parts Europe or ASP Group Distributing, or in some cases, buy directly from the manufacturers themselves. This wide array of alternatives significantly strengthens the bargaining power of these customers.

Customer switching costs are a crucial element in understanding the bargaining power of buyers. When it is easy and inexpensive for customers to switch to a competitor, their power increases significantly. This is because they can readily abandon a company's products or services if they are dissatisfied or find a better deal elsewhere.

For Duell, the ease with which its dealers can switch to other suppliers directly impacts its own bargaining power. While dealers might incur some costs, like integrating new inventory systems or marketing different brands, these are often less substantial than the costs Duell would face if it needed to switch its own suppliers. For instance, if Duell's product differentiation is low, dealers have even more leverage to demand favorable terms.

In 2024, the automotive industry, where Duell might operate, saw varying levels of dealer switching costs. For example, a dealership specializing in electric vehicles might face higher integration costs for new charging infrastructure and technician training when switching brands compared to a dealership selling traditional internal combustion engine vehicles. This highlights how industry specifics can influence the magnitude of switching costs.

Price Sensitivity of Customers

In the current economic climate, with consumer confidence showing a downward trend, Duell's customers are likely to become more attuned to pricing. This increased price sensitivity directly amplifies their bargaining power.

Duell's 2025 guidance anticipates a tougher market, which often leads consumers to seek better deals. This means customers have a stronger ability to negotiate prices, impacting Duell's profit margins.

- Increased Price Sensitivity: As consumer spending tightens, customers are more likely to shop around and compare prices, giving them leverage.

- Demand Elasticity: In a market where demand is sensitive to price changes, customers can more easily walk away if prices are not competitive.

- Availability of Substitutes: If customers perceive readily available alternatives to Duell's products, their bargaining power increases as they can switch suppliers.

Threat of Backward Integration by Customers

The threat of Duell's customers, such as retailers or distributors, integrating backward to manufacture or import products themselves is typically low. This is primarily due to the significant scale and complexity involved in Duell's operations. For instance, Duell imports approximately 150,000 distinct items from over 550 different brands, a process that requires substantial capital, established supplier relationships, and sophisticated logistics networks.

Furthermore, Duell's own manufacturing capabilities and extensive supply chain management add another layer of complexity that would be challenging for most customers to replicate. This high barrier to entry for backward integration significantly reduces the bargaining power of Duell's customers, as they are unlikely to find it economically viable or strategically advantageous to bypass Duell's established infrastructure and product sourcing.

- Scale of Operations: Importing 150,000 items from 550+ brands presents a significant operational hurdle for potential backward integration by customers.

- Manufacturing Capabilities: Duell's ability to manufacture its own brands further complicates backward integration efforts by customers.

- Logistical Complexity: Duell's extensive logistics network is a key asset that deters customers from attempting to manage their own sourcing and distribution.

- Reduced Customer Power: These factors collectively limit the bargaining power of Duell's customers, as the cost and complexity of backward integration are prohibitive.

The bargaining power of customers is a key factor in Porter's Five Forces. For Duell, its dealers act as its customers. While Duell's vast dealer network of approximately 8,500 across Europe might suggest individual customer power is low, the collective power of these dealers is significant. This is because dealers have numerous alternative suppliers for parts and accessories, including direct sourcing from manufacturers or competitors like Parts Europe and ASP Group Distributing, which increases their leverage.

Customer switching costs for Duell's dealers are relatively low. While some integration costs exist when switching suppliers, these are often less than what Duell would incur if it changed its own suppliers. This ease of switching, especially with low product differentiation, allows dealers to demand more favorable terms. In 2024, the automotive sector showed varying switching costs; for instance, EV dealerships faced higher integration expenses than traditional dealerships when changing brands.

The current economic climate, with declining consumer confidence, makes Duell's customers more price-sensitive, thereby amplifying their bargaining power. Duell's 2025 outlook anticipates a tougher market, where customers will actively seek better deals, potentially impacting Duell's profit margins through increased price negotiations.

The threat of backward integration by Duell's customers is minimal. Duell's scale, importing around 150,000 items from over 550 brands, and its own manufacturing and complex logistics, create substantial barriers. Replicating this infrastructure and supply chain is economically unfeasible for most customers, significantly limiting their ability to bypass Duell.

| Factor | Impact on Duell's Customers' Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Availability of Substitutes | High | Dealers can source from multiple distributors or directly from manufacturers. |

| Switching Costs | Low to Moderate | Dealer integration costs are generally lower than Duell's supplier switching costs. |

| Price Sensitivity | Increasing | Downturn in consumer confidence in 2024 leads to greater price scrutiny. |

| Backward Integration Threat | Low | Duell's scale (150,000 items, 550+ brands) and logistics complexity deter customers. |

Full Version Awaits

Duell Porter's Five Forces Analysis

This preview showcases the complete Duell Porter's Five Forces Analysis, offering an in-depth examination of competitive forces within an industry. The document you see here is the exact, professionally formatted file you will receive immediately after purchase, ensuring no surprises or placeholder content. You can confidently use this comprehensive analysis for your strategic planning and decision-making the moment it's yours.

Rivalry Among Competitors

The European powersports and marine aftermarket distribution sector is quite fragmented, meaning there are many companies vying for market share. This fragmentation naturally fuels intense competition.

Major players like Parts Europe and ASP Group Distributing are active in this space, directly competing with each other and numerous smaller, often regional, distributors. This creates a dynamic environment where companies must constantly innovate and offer competitive pricing.

The European powersports accessories market is expected to see robust growth, with projections indicating a 9.4% compound annual growth rate between 2025 and 2034. This overall positive trend in the powersports industry generally suggests opportunities for companies like Duell.

However, Duell itself has adjusted its 2025 financial outlook downwards, citing market uncertainties and a dip in consumer confidence, particularly in Nordic regions. This divergence between broad market growth and company-specific challenges highlights how even in a growing industry, localized economic headwinds can create a more competitive environment.

When industry growth is uneven or uncertain, as Duell's revised guidance suggests, the competition for market share can become more intense. Companies may find themselves fighting harder for each sale, potentially leading to price pressures or increased marketing spend.

Duell's strategy of developing and marketing its own brands, such as Halvarssons, Lindstrands, and Amoq, is a key driver of differentiation. In fiscal year 2024, these proprietary brands accounted for a significant 18% of net sales, demonstrating their contribution to the company's market presence and potentially fostering strong brand loyalty among both end-users and its dealer network.

While Duell actively cultivates its own brands, a substantial portion of its revenue still originates from third-party products. This reliance on external brands inherently limits the company's ability to differentiate its overall product mix. Consequently, competitive rivalry can intensify in segments where Duell primarily offers products from other manufacturers, as differentiation and customer loyalty are more challenging to establish.

Exit Barriers

High exit barriers are a significant factor in the competitive landscape, often forcing companies to remain in an industry even when profitability is low. This can lead to prolonged periods of intense rivalry. For instance, a company with substantial investments in specialized logistics centers, such as those in Finland, Sweden, Netherlands, France, and the UK, faces considerable costs if it decides to cease operations.

The sheer volume of inventory, often ranging from 130,000 to 150,000 distinct items, also represents a substantial financial commitment that is difficult to liquidate quickly without significant losses. This large stock ties up capital and creates a financial drag, making a swift exit economically unfeasible.

Furthermore, an established and well-developed dealer network represents a valuable asset that is costly to dismantle. The relationships and infrastructure built over time are not easily transferable or disposable, adding another layer of complexity and expense to any exit strategy. These combined factors can trap competitors within the market, exacerbating competitive pressures during economic downturns.

- High Fixed Costs: Investments in extensive logistics centers across multiple countries.

- Large Inventory: Maintaining a broad product range of 130,000-150,000 items.

- Dealer Network: Established relationships and infrastructure with distributors.

- Impact on Rivalry: These barriers can prolong competitive intensity, especially during market downturns.

Strategic Stakes and Aggressiveness of Competitors

The industry's fragmentation presents both long-term growth prospects and a competitive landscape that tends to favor larger entities like Duell. This structure means that while opportunities abound, the ability to leverage scale and resources becomes a significant advantage.

Competitors are likely to engage in aggressive tactics to capture market share, especially during periods of economic uncertainty. These strategies can include price wars, broadening product portfolios, or enhancing logistical capabilities to outmaneuver rivals.

For instance, in the broader retail sector in 2024, reports indicated increased promotional activity and aggressive pricing strategies from major players aiming to solidify their positions amidst fluctuating consumer demand. This trend is expected to continue as companies adapt to evolving market conditions.

- Industry Fragmentation: The market structure allows for numerous players but often leads to consolidation, benefiting companies with greater scale.

- Aggressive Competition: Expect heightened competition through pricing, product expansion, and improved logistics as companies vie for market share.

- Market Uncertainty: Economic volatility encourages competitors to take bolder actions to secure their market standing.

- Focus on Scale: Larger companies like Duell are better positioned to weather competitive pressures and capitalize on market opportunities.

Competitive rivalry in the European powersports and marine aftermarket distribution sector is intense due to market fragmentation and the presence of numerous competitors, ranging from large distributors to smaller regional players. This dynamic environment necessitates constant innovation and competitive pricing strategies to capture market share, especially as companies like Duell must contend with both broad market growth and specific regional economic headwinds, as suggested by Duell's adjusted 2025 financial outlook.

The drive to differentiate is crucial, with companies like Duell leveraging proprietary brands such as Halvarssons, Lindstrands, and Amoq, which contributed 18% of net sales in fiscal year 2024. However, reliance on third-party products limits differentiation, intensifying rivalry in those segments. High exit barriers, including significant investments in logistics centers across multiple countries, large inventories of 130,000-150,000 items, and established dealer networks, further exacerbate competitive pressures by keeping companies in the market even during downturns.

Industry fragmentation favors larger players like Duell, who can leverage scale and resources to their advantage. Expect aggressive competitive tactics such as price wars, portfolio expansion, and enhanced logistics, mirroring broader retail trends observed in 2024 where increased promotional activity and aggressive pricing were common responses to fluctuating consumer demand.

| Factor | Description | Impact on Rivalry |

| Market Fragmentation | Numerous small and large distributors compete. | Intensifies competition for market share. |

| Proprietary Brands | Brands like Halvarssons, Lindstrands, Amoq. | Aids differentiation, but reliance on third-party brands limits this. |

| Exit Barriers | High costs associated with logistics, inventory, and dealer networks. | Keeps companies in the market, prolonging rivalry. |

| Economic Uncertainty | Fluctuations in consumer demand and market conditions. | Encourages aggressive strategies like price wars and portfolio expansion. |

SSubstitutes Threaten

For Duell Porter's offerings, such as parts, equipment, and apparel, substitute threats are significant. These can range from generic aftermarket parts that may be less expensive but potentially lower in quality, to cheaper alternatives sourced from less established manufacturers. In 2024, the aftermarket parts industry continued to grow, with some segments seeing double-digit increases, putting pressure on original equipment manufacturers and their authorized dealers.

Customers might also choose to undertake DIY repairs using readily available, non-specialized tools rather than purchasing specific, dealer-supplied components. This trend is fueled by online tutorials and the desire for cost savings, a phenomenon that gained considerable traction during economic downturns and remains a viable option for many consumers seeking to reduce expenses on vehicle maintenance and upgrades.

The threat of substitutes for vehicle ownership and usage is growing, impacting demand for traditional motorized vehicles and their components. This broader threat stems from alternative recreational activities and transportation methods that siphon away consumer interest and spending. For example, a resurgence in cycling, enhanced public transportation networks, or the increasing adoption of shared mobility services like ride-sharing and scooter rentals can directly reduce the market for new motorcycles or all-terrain vehicles (ATVs).

Rapid technological shifts, like the move to electric vehicles in powersports and marine industries, are a significant threat. These changes can introduce new parts and accessories, making existing products obsolete or creating entirely new substitutes. For instance, the electric boat market is projected to grow substantially, with some estimates suggesting it could reach over $16 billion by 2030, impacting traditional internal combustion engine component suppliers.

Changing Consumer Preferences

Consumer preferences are a significant threat of substitutes for Duell Porter's products. As tastes shift, demand for powersports and marine vehicles can decline. For instance, a growing interest in eco-tourism and outdoor activities that require less personal equipment, like hiking or camping, can divert consumer spending away from recreational vehicles.

This evolution in leisure choices directly impacts the market for Duell's offerings. Consider the rise of shared economy models for recreation; instead of owning a boat, consumers might opt for boat-sharing services, reducing the need for new purchases. This trend is already visible, with reports indicating a slowdown in new vehicle sales in favor of experiences and services.

The shift towards sustainability also plays a crucial role. Consumers are increasingly scrutinizing the environmental impact of their purchases. Powersports vehicles, often associated with higher fuel consumption and emissions, may face headwinds as consumers gravitate towards greener alternatives. This sentiment is reflected in market research, where sustainability is cited as a growing factor in purchasing decisions across various sectors.

- Evolving Leisure Trends: A notable percentage of consumers are exploring more sustainable or budget-friendly recreational pursuits, directly impacting demand for Duell's products.

- Rise of Shared Economy: The increasing popularity of recreational sharing services offers an alternative to outright ownership, diminishing the market for new powersports and marine vehicles.

- Environmental Consciousness: Growing consumer concern over environmental impact can lead to a preference for less resource-intensive leisure activities over traditional powersports.

- Market Data Insights: Recent industry analyses from 2024 suggest a noticeable shift in consumer spending patterns away from durable recreational goods towards experiential services and sustainable options.

Economic Conditions Impacting Discretionary Spending

Economic downturns and declining consumer confidence, as highlighted in Duell Porter's 2025 guidance, significantly impact discretionary spending on recreational vehicles. Consumers facing economic uncertainty may opt for less expensive leisure activities or choose to maintain their current vehicles rather than purchasing new ones. This shift directly increases the threat of substitutes.

For instance, a projected 3% decrease in consumer discretionary spending for 2025, as per the latest industry reports, means consumers might substitute new RV purchases with extended use of existing models or by exploring more budget-friendly hobbies like camping in local parks instead of long-distance RV travel.

- Reduced Discretionary Spending: A projected 3% contraction in consumer discretionary budgets for 2025 directly pressures RV sales.

- Shift to Lower-Cost Alternatives: Consumers may substitute RV vacations with more affordable options like local camping or staycations.

- Extended Vehicle Lifespan: Instead of buying new, consumers might invest in maintaining and upgrading their existing RVs, delaying new purchases.

- Competition from Other Leisure Activities: Hobbies such as hiking, cycling, or home-based entertainment offer less expensive alternatives to RV ownership and travel.

The threat of substitutes for Duell Porter's offerings is multifaceted, encompassing alternative parts, DIY repairs, and entirely different leisure activities. In 2024, the aftermarket parts sector continued its growth trajectory, with some segments experiencing double-digit increases, thereby intensifying pressure on original equipment manufacturers. This environment necessitates a keen understanding of how consumers might opt for less expensive, though potentially lower-quality, generic parts or choose to perform their own maintenance.

Furthermore, evolving consumer preferences and a growing emphasis on sustainability present significant substitute threats. As consumers increasingly prioritize eco-friendly options and experiential spending over traditional recreational vehicle ownership, the market for new powersports and marine vehicles faces headwinds. This shift is evident in the projected growth of electric vehicle markets, which could reshape component demand.

Economic factors, particularly reduced consumer confidence and discretionary spending, amplify the threat of substitutes. A projected 3% contraction in consumer discretionary budgets for 2025, according to recent industry analyses, suggests consumers may substitute new purchases with extended use of existing assets or opt for more budget-friendly leisure pursuits, impacting sales of recreational vehicles.

| Substitute Type | Description | 2024/2025 Impact Factor | Example |

|---|---|---|---|

| Aftermarket Parts | Generic or non-OEM parts | Double-digit growth in some segments | Cheaper, non-branded motorcycle components |

| DIY Repairs | Customer self-maintenance | Increased online tutorials and cost-saving focus | Home mechanic performing routine ATV service |

| Alternative Leisure | Different recreational activities | Growing interest in eco-tourism and shared economy models | Boat sharing services replacing new boat purchases |

| Economic Downturn | Reduced consumer spending | Projected 3% decrease in discretionary spending (2025) | Choosing local camping over RV travel |

Entrants Threaten

Duell's significant capital requirements present a formidable barrier to new entrants in the powersports and marine distribution sector. Imagine needing to stock between 130,000 and 150,000 different items, a massive undertaking that ties up considerable funds.

Beyond inventory, establishing a robust presence demands investment in multiple logistics centers strategically placed across Europe. In 2024, the average cost to build or lease a large logistics facility in key European markets can range from €5 million to €20 million, depending on size and location.

Furthermore, creating an extensive sales and distribution network, complete with skilled personnel and marketing efforts, requires millions more. These combined capital outlays create a high entry cost, effectively deterring smaller players from challenging Duell's established position.

Duell's substantial advantage lies in its established European distribution network, which encompasses roughly 8,500 dealerships. This extensive reach presents a significant barrier for any new competitor seeking to enter the market.

New entrants would need to invest heavily in time and capital to replicate this network or gain the trust of existing dealers, a process that could take years and considerable financial outlay.

Existing players like Duell, with operations dating back to 1983, leverage significant economies of scale in purchasing, logistics, and marketing. This allows them to achieve lower per-unit costs, a barrier that new entrants would find difficult to overcome, especially when competing on price.

Furthermore, the experience curve plays a crucial role. Duell’s accumulated knowledge in production processes and operational efficiency, honed over decades, translates into further cost advantages. New companies entering the market would lack this embedded expertise, making it challenging to match the cost structure of established competitors.

Brand Loyalty and Product Differentiation

Duell's strong brand loyalty, exemplified by its own brands like Halvarssons and its partnerships with major third-party manufacturers, presents a significant barrier to new entrants. This established reputation means that newcomers must invest heavily in marketing and brand building to even begin to compete for dealer and consumer attention. For instance, in 2024, the powersports aftermarket saw significant marketing spend from established players to maintain market share, a trend new entrants would need to match or exceed.

Overcoming this ingrained loyalty requires new companies to offer truly differentiated products or services that capture consumer interest. Without a compelling unique selling proposition, it's exceptionally difficult for new brands to penetrate a market where customers already trust and prefer existing options. The cost of achieving this differentiation, coupled with the need to build a distribution network, makes the threat of new entrants moderate.

- Brand Loyalty: Duell leverages its own brands and key third-party relationships to foster strong customer and dealer loyalty.

- Differentiation Challenge: New entrants face the hurdle of significant investment in branding and marketing to stand out.

- Market Penetration Difficulty: Overcoming existing brand preferences requires substantial differentiation efforts.

- Investment Requirements: Building brand recognition and a competitive product line demands considerable capital for new players.

Regulatory Hurdles and Compliance

The powersports and marine sectors face significant regulatory obstacles in European markets, encompassing safety, environmental standards, and import rules. For instance, the EU's stringent emissions standards for marine engines, like those outlined in Directive 2013/53/EU, require substantial investment in compliant technology. Newcomers must dedicate considerable resources and time to understand and adhere to these complex frameworks, directly increasing the barrier to entry.

Navigating these compliance requirements translates into higher upfront costs for new entrants. Beyond product development, this includes obtaining necessary certifications and potentially modifying manufacturing processes. For example, meeting the European Type Approval process for recreational craft can involve extensive testing and documentation, adding a significant financial burden that established players have already absorbed.

- Regulatory Complexity: European powersports and marine industries are governed by a web of safety, environmental, and import regulations.

- Compliance Costs: Meeting these standards, such as EU emissions directives for marine engines, necessitates significant investment in technology and certification.

- Time to Market: The intricate approval processes can substantially lengthen the time it takes for new products to reach the market.

- Established Player Advantage: Existing companies have already invested in and adapted to these regulatory landscapes, creating a cost and experience advantage.

The threat of new entrants into the powersports and marine distribution market is currently moderate. Duell's substantial capital requirements, including extensive inventory and logistics infrastructure, create significant upfront costs. For example, maintaining a product range of 130,000 to 150,000 items requires considerable working capital.

Furthermore, the established distribution network of approximately 8,500 dealerships across Europe represents a major hurdle for newcomers. Building similar reach and dealer relationships would demand years of effort and significant investment.

Economies of scale enjoyed by Duell, stemming from decades of operation since 1983, provide cost advantages in purchasing, logistics, and marketing that are difficult for new entrants to match. This, combined with strong brand loyalty and regulatory compliance costs, limits the ease with which new competitors can enter the market effectively.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating information from company annual reports, industry-specific market research, and public financial filings. This ensures a comprehensive understanding of competitive dynamics.