Shanghai Dashen Agriculture Finance Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai Dashen Agriculture Finance Technology Bundle

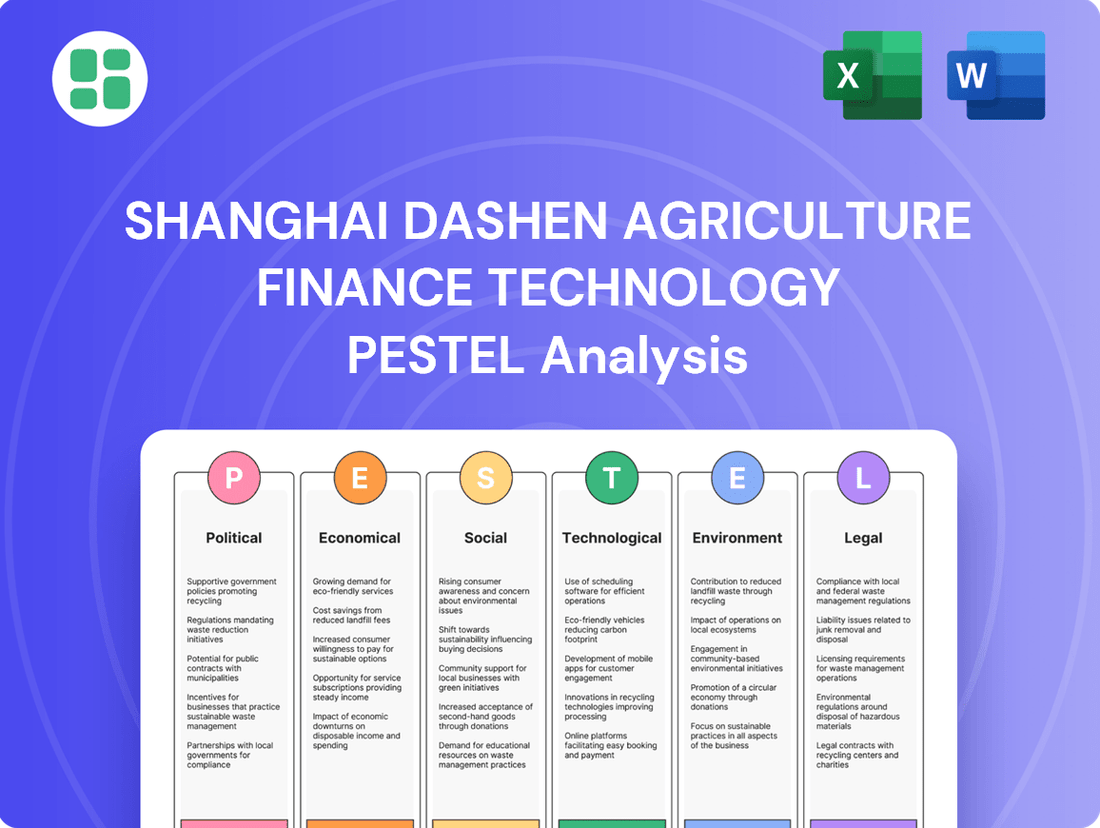

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Shanghai Dashen Agriculture Finance Technology’s trajectory. This comprehensive PESTLE analysis offers actionable insights into market dynamics, regulatory shifts, and emerging opportunities. Equip yourself with the strategic intelligence needed to navigate this evolving landscape and secure a competitive advantage. Download the full PESTLE analysis now to make informed decisions.

Political factors

China's unwavering commitment to food security and rural revitalization significantly shapes its agricultural landscape, directly impacting companies like Shanghai Dashen Agriculture Finance Technology. Government initiatives, such as direct subsidies to farmers and evolving land use regulations, are key drivers in this sector. For instance, in 2023, China's central government continued to emphasize agricultural modernization, with specific programs aimed at increasing grain production efficiency.

These policies, including the management of national grain reserves, have a tangible effect on the availability and pricing of essential agricultural commodities. This, in turn, influences Dashen's operational costs related to sourcing raw materials and managing its distribution networks. The government's focus on stabilizing agricultural supply chains aims to mitigate volatility, providing a more predictable environment for finance technology providers operating within the sector.

Global trade relations significantly influence Shanghai Dashen Agriculture Finance Technology. For instance, ongoing trade discussions between China and the United States, major players in agricultural and petrochemical markets, could lead to shifts in import/export dynamics. If tariffs on agricultural products increase, it could raise costs for Dashen’s sourcing or sales, impacting profitability.

The Chinese government’s strong emphasis on bolstering supply chain resilience, particularly for agricultural products, directly impacts Shanghai Dashen Agriculture Finance Technology. For instance, the Central Economic Work Conference in December 2023 highlighted food security as a top priority, signaling continued government investment in agricultural infrastructure and logistics.

These government-led initiatives, such as upgrades to port facilities and rural road networks, present opportunities for Dashen by potentially reducing transportation costs and improving the efficiency of agricultural commodity flows. However, they also necessitate compliance with new regulations concerning traceability and quality standards, which could add operational complexity.

Industrial Policy for Petrochemicals

Government initiatives aimed at upgrading China's petrochemical industry directly impact the cost and availability of key inputs for agriculture, such as fertilizers derived from petrochemicals. For instance, policies promoting higher environmental standards, which were further tightened in 2024, can increase production costs for petrochemical companies, potentially leading to higher prices for agricultural inputs.

These policies also influence capacity control within the sector. In 2024, China continued its efforts to manage overcapacity in certain petrochemical segments, which can lead to consolidation. This consolidation might affect the number of suppliers available to companies like Dasheng Agriculture Finance Technology, potentially altering their sourcing strategies and negotiating power.

- Industrial Upgrading: China's 14th Five-Year Plan (2021-2025) emphasizes high-quality development in the petrochemical sector, focusing on advanced materials and cleaner production methods.

- Environmental Standards: Stricter environmental regulations, including those for emissions and waste management, have been progressively implemented, with significant enforcement in 2024, increasing operational costs for producers.

- Capacity Control: Measures to curb inefficient and polluting capacity in the petrochemical industry are ongoing, aiming to optimize the sector's structure and reduce its environmental footprint.

Financial Sector Regulation

Government oversight of financial services, particularly in areas like financial leasing and commercial factoring, directly influences Dasheng Agriculture Finance Technology's operations. For instance, in 2024, China's financial regulators continued to emphasize prudent supervision, with the People's Bank of China and the China Banking and Insurance Regulatory Commission (CBIRC) issuing updated guidelines on risk management for financial institutions. These directives often focus on strengthening capital adequacy ratios and improving transparency in lending practices.

Regulatory shifts concerning capital requirements, lending standards, or risk management protocols can significantly alter the operational scope and profitability of Dasheng's financial product offerings. For example, an increase in required capital reserves for leasing companies, as seen in some global markets in late 2024, could necessitate adjustments to Dasheng's funding strategies and potentially impact its ability to expand its financial services portfolio. Similarly, stricter compliance demands related to data security and anti-money laundering measures add to operational costs.

- Increased Scrutiny: Chinese financial regulators are maintaining a close watch on the fintech sector, including agricultural finance, to ensure stability and prevent systemic risks.

- Capital Adequacy: Potential adjustments to capital requirements for financial leasing and factoring entities could impact Dasheng's leverage and expansion capabilities.

- Lending Standards: Evolving regulations on credit risk assessment and loan provisioning directly affect the terms and availability of financing for agricultural clients.

- Compliance Burden: New or updated regulations on data privacy, cybersecurity, and consumer protection necessitate ongoing investment in compliance infrastructure and processes.

China's government prioritizes agricultural modernization and rural development, influencing companies like Shanghai Dashen Agriculture Finance Technology through subsidies and land use policies. For instance, in 2023, the government continued to focus on increasing grain production efficiency, impacting commodity prices and Dashen's sourcing costs.

The government's commitment to food security, as highlighted by the Central Economic Work Conference in December 2023, means continued investment in agricultural infrastructure. This can reduce transportation costs for Dashen but also requires adherence to stricter traceability and quality regulations.

What is included in the product

This PESTLE analysis of Shanghai Dashen Agriculture Finance Technology provides a comprehensive examination of the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations.

It offers actionable insights for strategic decision-making by highlighting key trends and potential challenges within China's agricultural finance technology sector.

This PESTLE analysis offers a clear, summarized version of Shanghai Dashen Agriculture Finance Technology's external landscape, simplifying complex factors into actionable insights for strategic decision-making.

By dissecting external influences by PESTEL category, this analysis provides a quick, visual understanding of market dynamics, acting as a pain point reliever for companies navigating agricultural finance technology in Shanghai.

Economic factors

Fluctuations in global agricultural commodity prices, such as white sugar, and petrochemicals like fuel oil and chemical fertilizers, directly influence Dasheng Agriculture Finance Technology's revenue and the cost of goods sold. For instance, the International Sugar Organization reported that raw sugar prices averaged approximately $0.19 per pound in early 2024, a significant shift from earlier highs, impacting the profitability of sugar-related ventures.

Market speculation, geopolitical tensions, and imbalances in supply and demand are primary catalysts for this price volatility. The ongoing conflict in Eastern Europe, for example, continued to affect fertilizer prices throughout 2024, with European natural gas prices, a key input for nitrogen fertilizers, remaining elevated, impacting agricultural input costs globally and subsequently agricultural finance needs.

China's economic growth is a critical factor for Shanghai Dashen Agriculture Finance Technology. A strong GDP expansion fuels consumer spending on food and boosts industrial needs for petrochemicals, directly impacting Dashen's revenue streams. For instance, China's GDP grew by 5.2% in 2023, indicating a healthy economic environment that supports increased demand for agricultural products and related financial services.

Changes in China's benchmark interest rates directly impact Shanghai Dasheng Agriculture Finance Technology's cost of capital for its financial leasing and commercial factoring operations. For instance, if the People's Bank of China (PBOC) raises its Loan Prime Rate (LPR), Dasheng's own borrowing costs will likely increase, potentially squeezing profit margins.

Higher interest rates can also make financing more expensive for Dasheng's agricultural clients. This could lead to reduced demand for leasing and factoring services as businesses become more hesitant to take on debt, or it might increase the risk of clients defaulting on their obligations, especially if their own revenues are sensitive to economic downturns.

As of early 2024, China's monetary policy has been cautiously accommodative, with the PBOC maintaining relatively stable LPR rates to support economic recovery. However, any significant upward adjustments in interest rates or tightening of credit availability would present a direct challenge to Dasheng's business model and profitability.

Inflation and Purchasing Power

Inflationary pressures in China significantly affect Shanghai Dasheng Agriculture Finance Technology. For instance, the Consumer Price Index (CPI) in China saw an increase, reaching 2.3% year-on-year in November 2023, indicating rising costs across various sectors. This directly impacts Dasheng's operational expenses, from logistics and labor to agricultural inputs.

Simultaneously, this inflation erodes the purchasing power of end-users, potentially leading to reduced demand for agricultural products. If consumers have less disposable income, they may cut back on non-essential food items or seek cheaper alternatives, impacting Dasheng's sales volumes and revenue streams.

Key impacts include:

- Increased operational costs: Higher prices for fuel, fertilizer, and wages directly affect Dasheng's profitability.

- Reduced consumer spending: Lower purchasing power can lead to decreased demand for agricultural commodities, especially higher-value products.

- Margin compression: Dasheng may struggle to pass on increased costs to consumers, leading to tighter profit margins.

- Potential shift in product demand: Consumers might opt for staple goods over premium agricultural products.

Exchange Rate Fluctuations

Exchange rate fluctuations, especially between the Chinese Yuan (RMB) and the US Dollar (USD), directly influence Shanghai Dashen Agriculture Finance Technology's profitability in international commodity trading. A stronger RMB, for instance, can reduce the cost of imported agricultural inputs, a benefit for the company. However, this same strength makes its exported agricultural products more expensive for foreign buyers, potentially shrinking trade margins.

For example, if the RMB strengthens significantly against the USD, the cost of purchasing commodities priced in dollars decreases. Conversely, revenue generated from selling commodities in USD will translate into fewer RMB when repatriated. This dynamic creates a constant need for sophisticated hedging strategies to mitigate currency risk.

- RMB vs. USD Performance: In early 2024, the RMB experienced some volatility against the USD, with analysts anticipating continued fluctuations throughout the year due to varying economic growth rates and monetary policies.

- Impact on Import Costs: A stronger RMB can lower the landed cost of imported grains and fertilizers, potentially improving Shanghai Dashen's cost of goods sold.

- Impact on Export Revenues: Conversely, a stronger RMB can make Chinese agricultural exports less competitive on the global market, impacting the RMB value of sales.

- Hedging Strategies: Companies like Shanghai Dashen often employ forward contracts and options to lock in exchange rates, thereby protecting their profit margins from adverse currency movements.

Economic factors significantly shape Shanghai Dashen Agriculture Finance Technology's operational landscape. Fluctuations in global commodity prices, like sugar and fertilizers, directly impact revenue and costs, with raw sugar averaging around $0.19 per pound in early 2024. China's GDP growth, at 5.2% in 2023, fuels demand for agricultural products and petrochemicals, bolstering Dashen's revenue streams.

Monetary policy, particularly interest rate changes by the People's Bank of China, affects Dashen's cost of capital and client financing. Cautiously accommodative policies in early 2024 aimed to support recovery, but rate hikes would challenge profitability. Inflation, evidenced by China's 2.3% CPI increase in November 2023, raises operational costs and can reduce consumer spending on agricultural goods, potentially compressing profit margins.

Exchange rate volatility, especially between the RMB and USD, impacts international trading profits. A stronger RMB can lower import costs but make exports less competitive. Companies like Dashen utilize hedging strategies to mitigate these currency risks, as seen with the RMB's fluctuations against the USD in early 2024.

| Economic Factor | Impact on Dashen | Relevant Data (Early 2024/2023) |

| Commodity Prices | Affects revenue and cost of goods sold. | Raw sugar averaged ~$0.19/lb (early 2024). Fertilizer prices remain influenced by energy costs. |

| GDP Growth (China) | Drives demand for agricultural products and petrochemicals. | China's GDP grew 5.2% in 2023. |

| Interest Rates (China) | Influences cost of capital and client financing. | PBOC maintained relatively stable LPR rates (early 2024) to support recovery. |

| Inflation (China) | Increases operational costs and can reduce consumer spending. | CPI rose 2.3% year-on-year (Nov 2023). |

| Exchange Rates (RMB/USD) | Impacts international trading and hedging needs. | RMB experienced volatility against USD (early 2024). |

What You See Is What You Get

Shanghai Dashen Agriculture Finance Technology PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Shanghai Dashen Agriculture Finance Technology provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into the market landscape and potential challenges and opportunities.

Sociological factors

Chinese consumers are increasingly prioritizing health, safety, and the origins of their food. This shift is evident in the growing demand for organic produce and foods with verifiable traceability, a trend that directly impacts Dasheng's food distribution business. For instance, a 2024 report indicated that 65% of urban Chinese consumers are willing to pay a premium for food products with clear safety certifications.

Dasheng's food distribution segment must proactively adapt its product offerings to cater to these evolving preferences for organic, specialty, and sustainably sourced items. Failure to align with these changing consumer tastes, such as a preference for plant-based alternatives which saw a 20% market growth in China in 2024, could lead to a decline in market share and revenue for the company.

China's ongoing urbanization continues to draw significant numbers of people from rural areas to cities, impacting the agricultural labor pool. This trend, which has been accelerating, means fewer hands are available for farming. For instance, by the end of 2023, China's urbanization rate reached 66.16%, a notable increase from previous years, indicating a sustained shift away from rural employment.

This shrinking rural workforce directly translates into higher labor costs for agricultural operations like those managed by Shanghai Dashen Agriculture Finance Technology. As demand for agricultural labor outstrips supply, wages are pushed upwards, potentially increasing Dashen's operational expenses and affecting the cost-competitiveness of its produce within the broader supply chain.

Growing public awareness about the environmental impact of agricultural chemicals is a significant sociological factor for Shanghai Dashen. Increased scrutiny of pesticides and fertilizers, driven by environmental consciousness, directly translates into potential regulatory tightening and shifts in consumer demand. For instance, a 2024 survey indicated that 65% of Chinese consumers are willing to pay a premium for sustainably produced food, signaling a growing preference away from conventionally grown produce reliant on heavy chemical inputs.

This evolving public perception necessitates that Dasheng Agriculture Finance Technology proactively considers consumer sentiment and the potential market shift towards more eco-friendly agricultural solutions. Failure to adapt could impact product acceptance and market share, especially as younger demographics, who tend to be more environmentally aware, gain more purchasing power. The company's strategy must therefore incorporate an understanding of these changing attitudes to maintain its competitive edge and ensure long-term viability in the agricultural finance and technology sector.

Food Security and Safety Concerns

Public and government focus on food security and safety is intensifying, leading to stricter regulations and a growing consumer demand for transparency throughout the food supply chain. For instance, China's Ministry of Agriculture and Rural Affairs has been actively promoting traceability systems, with a goal to cover 80% of key agricultural products by 2025. This emphasis directly impacts companies like Dasheng, which operate within the food distribution sector.

Dasheng's position as a distributor means it must implement rigorous quality control measures and robust traceability systems. This is crucial for building and maintaining consumer trust, especially in light of past food safety incidents that have eroded public confidence. By ensuring the integrity of its distributed food products, Dasheng can mitigate risks and capitalize on the increasing consumer preference for safe, traceable food sources.

Key considerations for Dasheng include:

- Enhanced Traceability: Implementing blockchain or similar technologies to track food products from farm to fork, providing verifiable safety data.

- Quality Assurance Protocols: Strengthening internal quality checks and partnering with certified suppliers to guarantee product safety and standards.

- Regulatory Compliance: Staying abreast of evolving food safety laws and ensuring all operations meet or exceed government mandates.

- Consumer Communication: Transparently communicating safety measures and product origins to build and maintain consumer trust.

Digital Adoption and E-commerce Trends

China's digital landscape is rapidly evolving, with a significant portion of its population embracing online platforms for daily transactions. By the end of 2024, it's projected that over 70% of retail sales will have an online component, a trend that directly impacts agricultural supply chains. Dasheng's strategic integration of digital tools for procurement and logistics can streamline operations, potentially reducing costs and delivery times.

The growth of e-commerce in China, particularly in rural areas, presents a substantial opportunity for companies like Dasheng to expand their market reach. By Q3 2024, online grocery sales alone were estimated to have grown by 15% year-over-year. Leveraging these digital channels for direct sales or improved distribution can significantly enhance Dasheng's competitive edge.

- Digital Penetration: Over 70% of Chinese retail sales are expected to involve online channels by year-end 2024.

- E-commerce Growth: Online grocery sales in China saw a 15% year-over-year increase by Q3 2024.

- Supply Chain Impact: Digital adoption necessitates agile and tech-enabled supply chain solutions for efficiency.

- Market Access: E-commerce provides avenues for agricultural businesses to reach a wider consumer base.

Consumer demand for healthier, safer, and traceable food is a dominant sociological trend in China, impacting Dasheng's operations. By 2024, 65% of urban consumers expressed willingness to pay more for verified food safety, highlighting a market shift towards premium, ethically sourced products.

The ongoing urbanization in China, with the rate reaching 66.16% by late 2023, is shrinking the agricultural labor force. This scarcity drives up labor costs, potentially increasing Dasheng's operational expenses and affecting its pricing strategy.

Heightened environmental awareness is leading consumers to favor sustainably produced goods, with a 2024 survey showing 65% of Chinese consumers willing to pay a premium for such products. This necessitates Dasheng's adaptation to eco-friendly agricultural practices and offerings.

Public and governmental emphasis on food security and safety is driving demand for transparent supply chains. By 2025, China aims for 80% of key agricultural products to have traceability systems, a move Dasheng must align with through robust quality control.

Technological factors

The integration of technologies like Internet of Things (IoT) sensors, blockchain, and advanced data analytics is transforming agricultural supply chains. These tools offer unprecedented visibility and traceability, allowing for real-time tracking of goods from farm to fork. For Shanghai Dashen, this means a significant upgrade in how they manage logistics and inventory.

By leveraging IoT for real-time condition monitoring and blockchain for secure transaction records, Dashen can drastically improve operational transparency. This digital overhaul is crucial for optimizing inventory levels, reducing waste, and ensuring product quality throughout the supply chain. For instance, China's agricultural IoT market was projected to reach over $10 billion by 2025, indicating strong adoption trends.

Fintech advancements are revolutionizing supply chain finance for companies like Shanghai Dashen Agriculture. AI-powered credit scoring, for instance, can dramatically improve risk assessment for financial leasing and factoring, potentially reducing default rates by an estimated 15-20% based on industry trends in 2024.

Digital payment platforms and peer-to-peer lending are streamlining Dashen's operations. These technologies can cut transaction times by up to 50% and lower operational costs in financial leasing, allowing for greater capital efficiency and wider service reach in the agricultural sector.

Technological advancements in agriculture are transforming how food is produced. Precision farming, which uses GPS and sensors to optimize resource use, is becoming more widespread. In 2024, the global precision agriculture market was valued at approximately $10.5 billion, with projections indicating continued strong growth.

Biotechnology is also playing a crucial role, with developments in gene editing leading to crops with enhanced yields and disease resistance. Smart irrigation systems, leveraging IoT technology, are improving water efficiency, a critical factor in many agricultural regions. For instance, in 2024, adoption rates for smart irrigation in large-scale farms saw a notable increase, contributing to an estimated 15% reduction in water usage in pilot programs.

Shanghai Dasheng's ability to integrate these innovations, such as investing in AI-driven crop monitoring or partnering with biotech firms, can significantly bolster its sourcing capabilities. This strategic engagement ensures access to more consistent, higher-quality agricultural outputs, mitigating risks associated with traditional farming methods and market volatility.

Green Chemical Production and Biopesticides

Technological advancements in green chemical production and the increasing adoption of biopesticides present significant opportunities for Shanghai Dashen Agriculture Finance Technology. The global biopesticides market is projected to reach approximately USD 11.5 billion by 2025, indicating a strong growth trajectory and a growing demand for sustainable agricultural inputs.

By integrating or distributing these environmentally friendly alternatives, Dashen can tap into this expanding market. This strategic move would not only align the company with global sustainability trends but also potentially unlock new revenue streams and enhance its brand reputation among environmentally conscious consumers and agricultural producers.

- Market Growth: The global biopesticides market is expected to grow at a CAGR of around 12.5% from 2020 to 2025.

- Regulatory Support: Many governments are actively promoting the use of biopesticides through subsidies and favorable regulations, creating a conducive environment for companies like Dashen.

- Consumer Demand: There's a rising consumer preference for organically produced food, which directly drives the demand for biopesticide solutions in agriculture.

Data Analytics for Market Insights

The evolution of data analytics is profoundly reshaping market understanding. Advanced tools now offer unprecedented depth in dissecting market trends, consumer habits, and the efficiency of supply chains. For Shanghai Dashen Agriculture Finance Technology, this translates into a significant advantage.

By harnessing these sophisticated analytics, Dashen can refine its decision-making processes across critical areas. This includes optimizing procurement strategies, setting competitive pricing, and identifying promising avenues for strategic growth. For instance, in early 2024, agricultural data analytics firms reported a 25% increase in the accuracy of yield predictions when incorporating advanced AI-driven models, a capability Dashen can leverage.

- Enhanced Market Trend Analysis: Utilizing big data to predict agricultural commodity price fluctuations with greater accuracy.

- Customer Behavior Profiling: Analyzing purchasing patterns of farmers and agribusinesses to tailor financial product offerings.

- Supply Chain Optimization: Identifying bottlenecks and inefficiencies in agricultural logistics through real-time data tracking.

- Informed Strategic Expansion: Using predictive analytics to pinpoint regions with high demand for agricultural financing and services.

Technological advancements, particularly in AI and data analytics, are revolutionizing agricultural finance by enabling more accurate risk assessment and personalized financial products. For Shanghai Dashen, this means leveraging AI for credit scoring, potentially reducing default rates by 15-20% as seen in 2024 industry trends, and using data analytics to refine procurement and pricing strategies, boosting yield prediction accuracy by 25% with AI models.

| Technology Area | Impact on Shanghai Dashen | 2024/2025 Data Point |

| IoT & Blockchain | Enhanced supply chain visibility and traceability | China's agricultural IoT market projected over $10 billion by 2025 |

| AI & Data Analytics | Improved credit scoring, risk assessment, and yield prediction | AI models increased yield prediction accuracy by 25% in early 2024 |

| Fintech Platforms | Streamlined digital payments and P2P lending | Transaction times cut by up to 50% |

| Precision Agriculture | Optimized resource use and improved crop yields | Global precision agriculture market valued at approx. $10.5 billion in 2024 |

| Biotechnology & Biopesticides | Access to higher-quality, sustainable agricultural outputs | Global biopesticides market projected to reach USD 11.5 billion by 2025 |

Legal factors

China's food safety landscape is characterized by increasingly stringent regulations governing every stage of the food supply chain, from farm to fork. These laws, which are constantly being updated, mandate rigorous standards for production processes, storage conditions, transportation logistics, and product labeling. For Shanghai Dashen Agriculture Finance Technology, adherence to these evolving legal frameworks is not merely a matter of compliance but a fundamental requirement for operational integrity and market access.

Failure to meet these demanding food safety and quality standards can result in severe consequences, including substantial fines, costly product recalls, and significant damage to the company's brand reputation. For instance, in 2023, China's Ministry of Agriculture and Rural Affairs reported over 500 cases of food safety violations, leading to significant financial penalties and business disruptions for the involved entities. This underscores the critical need for Dashen to maintain robust internal controls and proactive compliance strategies to navigate this complex regulatory environment effectively.

Environmental protection laws significantly impact Shanghai Dashen Agriculture Finance Technology, particularly concerning its petrochemical and pesticide operations. Regulations on pollution control, waste disposal, and the safe handling of chemicals are paramount. For instance, China's stringent environmental protection laws, updated in 2024 with a focus on stricter enforcement and higher penalties for violations, directly influence Dashen's production processes and compliance costs.

Failure to adhere to these environmental mandates can lead to substantial financial penalties, operational disruptions, and reputational damage. In 2024, environmental inspections across China resulted in billions of yuan in fines for non-compliant businesses, highlighting the critical need for Dashen to maintain robust environmental management systems to avoid such consequences and ensure continued operational viability.

Shanghai Dashen Agriculture Finance Technology's operations, particularly in financial leasing and commercial factoring, are strictly governed by Chinese financial regulators. Obtaining the necessary licenses is a critical first step, with ongoing compliance ensuring adherence to capital adequacy ratios, robust anti-money laundering protocols, and fair lending practices. Failure to meet these legal stipulations can result in significant penalties, impacting the company's ability to operate and its overall financial standing within the market.

Anti-Monopoly and Competition Laws

China's evolving anti-monopoly and competition laws significantly impact Shanghai Dashen Agriculture Finance Technology's operations. These regulations can influence how Dashen conducts business, especially concerning its commodity distribution and supply chain management services. For instance, any moves towards market dominance or potential mergers and acquisitions will likely face rigorous scrutiny from regulatory bodies, necessitating a proactive and legally astute approach.

The State Administration for Market Regulation (SAMR) actively enforces these laws. In 2023, SAMR continued its focus on ensuring fair competition across various sectors, including agriculture and finance technology. While specific enforcement actions directly targeting Dashen may not be publicly detailed, the general regulatory environment mandates compliance with rules against monopolistic practices and unfair competition. This means Dashen must ensure its business strategies do not stifle competition or lead to the abuse of a dominant market position.

- Regulatory Scrutiny: Dashen must navigate China's anti-monopoly framework, which can impact its market conduct in commodity distribution and supply chain services.

- Merger and Acquisition Oversight: Potential consolidation activities by Dashen could attract attention from regulators, requiring careful legal planning.

- Fair Competition Mandate: Compliance with laws preventing monopolistic behavior is crucial for maintaining operational legitimacy and market access.

Import and Export Regulations

Import and export regulations are critical for Shanghai Dashen Agriculture Finance Technology's international operations. These include tariffs, quotas, and licensing requirements that affect the cost and volume of agricultural commodities traded across borders. For instance, China’s average tariff on agricultural products was around 15.7% in 2023, impacting the landed cost of imported goods.

Navigating these legal frameworks is essential for maintaining efficient global supply chains. Dashen must adhere to specific product certifications and standards, such as phytosanitary certificates for agricultural produce, to ensure compliance and market access. Failure to comply can lead to delays, penalties, or outright rejection of shipments, directly affecting profitability.

- Customs Duties: China's average tariff on agricultural products stood at 15.7% in 2023, influencing import costs.

- Import Quotas: Specific quotas for certain commodities, like soybeans, can limit market access for foreign suppliers.

- Export Controls: Regulations on exporting certain agricultural technologies or sensitive products can impact Dashen's international reach.

- Product Certifications: Compliance with international standards like HACCP or GlobalG.A.P. is often mandatory for market entry.

Shanghai Dashen Agriculture Finance Technology must meticulously adhere to China's evolving intellectual property (IP) laws. This includes protecting its proprietary technologies, financial models, and data analytics platforms from infringement. The company's ability to secure patents, trademarks, and copyrights is paramount for maintaining a competitive edge and preventing unauthorized use of its innovations.

Failure to safeguard IP can lead to significant financial losses and erosion of market position. For instance, in 2024, Chinese courts awarded substantial damages in IP infringement cases, with some settlements exceeding tens of millions of yuan. Dashen needs robust internal policies and legal counsel to proactively defend its intellectual assets and ensure compliance with IP regulations.

Environmental factors

Climate change is significantly altering global weather patterns, leading to more frequent extreme events like droughts and floods. For instance, the UN's Intergovernmental Panel on Climate Change (IPCC) reports that the frequency of heavy precipitation events has increased in many regions. These shifts directly impact agricultural yields and can cause volatility in commodity prices, posing a risk to supply chains.

Dasheng's agricultural operations are particularly susceptible to these environmental changes. Shifts in growing seasons and increased pest outbreaks, also linked to climate change, can disrupt production cycles. This vulnerability means that supply stability for key agricultural commodities could be compromised, potentially affecting Dasheng's financial performance and market position.

The petrochemical and chemical industries, crucial for agricultural inputs, are under mounting scrutiny for their environmental impact, particularly concerning air, water, and soil pollution. This directly affects the sourcing and production costs for companies like Shanghai Dashen Agriculture Finance Technology.

China's commitment to ambitious emissions reduction targets, such as achieving carbon neutrality by 2060, translates into increasingly stringent pollution control measures. For Dashen, this means a growing need to invest in cleaner production technologies and adopt more sustainable operational practices to comply with evolving regulations and mitigate potential fines.

In 2023, China's Ministry of Ecology and Environment reported a significant decrease in major air pollutant concentrations in key regions, reflecting the impact of these policies. This trend suggests that companies failing to adapt to these environmental pressures will face higher operational costs and potential market disadvantages.

Water availability and quality are paramount for Shanghai Dashen Agriculture Finance Technology, impacting both its agricultural sourcing and chemical manufacturing operations. China's ongoing efforts to address water stress, particularly in key agricultural regions, could lead to increased costs for raw materials. For instance, by 2024, several provinces faced significant water shortages, driving up irrigation expenses.

This scarcity necessitates a strategic focus on water efficiency within Dashen's chemical production facilities. By investing in advanced water recycling technologies, the company can mitigate risks associated with fluctuating water availability and quality. Reports from 2024 indicated that industries adopting closed-loop water systems saw a reduction in water consumption by up to 30%, a benchmark Dashen could strive for.

Sustainable Sourcing Requirements

The increasing global emphasis on sustainability is directly impacting agricultural finance. Consumers are actively seeking products that are produced responsibly, and this trend is amplified by governmental regulations. For a company like Shanghai Dashen Agriculture Finance Technology, this means its sourcing strategies must adapt to these evolving demands. For instance, a significant portion of global palm oil production, a key commodity in many food products, faces scrutiny regarding its environmental impact, with reports in early 2024 highlighting continued deforestation concerns in some regions.

Dashen may need to implement robust verification processes for its supply chain partners. This could involve auditing their environmental practices and ensuring compliance with sustainability standards. The pressure extends to commodities like sugar, where water usage and pesticide application are critical environmental considerations. By mid-2024, several major food manufacturers announced stricter sourcing policies, requiring suppliers to demonstrate reduced water footprints and adherence to integrated pest management techniques.

Key considerations for Dashen regarding sustainable sourcing include:

- Consumer Demand: Growing consumer preference for ethically and sustainably produced food items.

- Regulatory Pressure: Increasing government mandates and international agreements on environmental impact in agriculture.

- Supply Chain Verification: The necessity to audit and confirm the environmental footprint of suppliers for key commodities.

- Commodity Specifics: Addressing unique environmental concerns for items like palm oil (deforestation) and sugar (water usage, pesticides).

Waste Management and Circular Economy Initiatives

China's commitment to a circular economy is intensifying, driving a strong focus on waste reduction, recycling, and reuse across all sectors. This national strategy directly impacts companies like Dasheng Agriculture Finance Technology, particularly in its chemical manufacturing and packaging operations.

By 2025, China aims to significantly increase its recycling rates, with specific targets for industrial waste. Dasheng will likely encounter more stringent regulations regarding the disposal and treatment of chemical byproducts and packaging materials. The company may need to invest in advanced waste treatment technologies and explore partnerships for material recovery and recycling programs to comply with evolving environmental standards.

- Increased regulatory scrutiny on industrial waste management.

- Potential for new compliance costs related to recycling and waste reduction.

- Opportunities to develop new revenue streams through circular economy participation.

- Growing consumer and investor preference for environmentally responsible businesses.

Environmental regulations in China are becoming increasingly stringent, particularly concerning pollution control and emissions. Companies like Shanghai Dashen Agriculture Finance Technology must adapt to these evolving standards to avoid penalties and maintain operational efficiency. For instance, by 2025, China is targeting a significant increase in recycling rates for industrial waste, directly impacting how Dashen manages its chemical byproducts and packaging.

Water scarcity is a growing concern in key agricultural regions, potentially increasing raw material costs for Dashen. By 2024, several provinces experienced significant water shortages, driving up irrigation expenses. This necessitates a focus on water efficiency within Dashen's chemical production facilities, with companies adopting closed-loop water systems reporting up to a 30% reduction in water consumption in 2024.

The global shift towards sustainability is influencing agricultural finance, with consumers demanding ethically produced goods. Dashen needs to verify its supply chain partners' environmental practices, especially for commodities like palm oil and sugar, which faced scrutiny in early 2024 for deforestation and high water usage, respectively.

China's commitment to a circular economy by 2025 means an intensified focus on waste reduction and recycling across all sectors. Dashen will likely face more rigorous rules for chemical byproduct disposal, creating both compliance costs and opportunities for material recovery partnerships.

| Environmental Factor | Impact on Dashen | 2024/2025 Data/Trend |

|---|---|---|

| Stricter Pollution Control | Increased compliance costs, need for cleaner tech investment | China's 2060 carbon neutrality goal driving stricter regulations; reduced air pollutant concentrations reported in key regions in 2023. |

| Water Scarcity | Higher raw material costs, need for water efficiency in production | Water shortages in provinces by 2024 increased irrigation costs; closed-loop systems reduced water use by up to 30% in 2024. |

| Sustainability Demand | Supply chain verification, adaptation to ethical sourcing | Palm oil and sugar faced scrutiny in early 2024 for deforestation and water usage; major food manufacturers announced stricter sourcing policies mid-2024. |

| Circular Economy Push | Waste management compliance, potential for recycling partnerships | China aims to significantly increase recycling rates by 2025, impacting industrial waste disposal. |

PESTLE Analysis Data Sources

Our Shanghai Dashen Agriculture Finance Technology PESTLE Analysis is meticulously constructed using data from official Chinese government publications, agricultural industry reports, and financial market data providers. We integrate insights from regulatory bodies, economic forecasting agencies, and technology adoption surveys to ensure comprehensive coverage.