Domino's Pizza Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Domino's Pizza Bundle

Curious about Domino's Pizza's product portfolio performance? Our BCG Matrix analysis reveals which offerings are driving growth, which are generating steady profits, and which might need a strategic rethink. Understand the nuances of their market share and growth rate to make informed decisions.

Ready to move beyond a surface-level understanding? Purchase the full BCG Matrix report for a comprehensive breakdown of Domino's Pizza's Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights and strategic recommendations to optimize your own business strategy.

Stars

Domino's digital ordering platforms are a cornerstone of its business, reflecting its strong position as a star in the BCG matrix. In 2024, a remarkable 85% of U.S. sales originated from these digital channels, underscoring their dominance.

The company's commitment to innovation is evident in its ongoing website and app enhancements, with a significant overhaul slated for Q4 2024. This focus on user experience and personalization is key to maintaining its market leadership and driving continued order volume.

Domino's Pizza is making significant strides in emerging markets, particularly in China and India, which represent substantial growth opportunities. These regions are crucial for the company's global strategy, demonstrating robust same-store sales growth.

In China, Domino's has ambitious plans, targeting the opening of 1,000 stores by the close of 2024. Furthermore, the company intends to ramp up net store openings to between 300 and 350 annually by 2025, highlighting a strong commitment to this market.

This aggressive expansion in high-potential areas like China and India positions these international operations as vital contributors to Domino's future revenue streams, likely classifying them as Stars within the BCG Matrix.

Domino's 'Hungry for MORE' strategy, initiated in late 2023, targets ambitious growth objectives. The plan aims for over 7% annual global retail sales growth and over 8% annual operating income growth. This strategy is built on key pillars like marketing, menu innovation, operational efficiency, and delivering value to customers.

Loyalty Program (Domino's Rewards)

The Domino's Rewards program is a cornerstone of their customer retention strategy. By actively engaging customers, it significantly boosts repeat purchases. This program saw substantial growth, reaching 35.7 million active users in 2024, demonstrating its effectiveness.

Initiatives like the 'Emergency Pizza' are specifically designed to enhance loyalty membership. This not only encourages more sign-ups but also drives increased sales by providing appealing incentives and broadening the program's reach across different customer segments.

- Domino's Rewards Active Users (2024): 35.7 million

- Program Objective: Drive repeat business and customer loyalty

- Key Initiative: 'Emergency Pizza' program to boost membership and sales

Strategic Third-Party Aggregator Partnerships

Domino's Pizza has strategically leveraged third-party aggregators, a move that positions its delivery services as a potential star within the broader food delivery market. By partnering with platforms like Uber Eats and DoorDash, Domino's is tapping into a vast customer base that might not otherwise engage with their direct ordering channels. This integration is projected to be a substantial growth driver, with estimates suggesting it could contribute as much as $1 billion in incremental sales over time.

These partnerships are crucial for expanding Domino's market presence and capturing a larger share of the rapidly growing food delivery landscape. The ability to reach new customer segments through these established aggregators is a key advantage. For instance, in 2024, a significant portion of online food orders were placed through third-party apps, highlighting the importance of this channel for any major player in the sector.

- Strategic Reach: Partnerships with Uber Eats and DoorDash expand Domino's customer acquisition channels.

- Incremental Sales Potential: Aggregator integration is anticipated to generate up to $1 billion in additional revenue.

- Market Share Growth: These collaborations aim to capture a larger slice of the overall food delivery market.

Domino's digital ordering platforms are a cornerstone of its business, reflecting its strong position as a star in the BCG matrix. In 2024, a remarkable 85% of U.S. sales originated from these digital channels, underscoring their dominance and the company's leadership in this high-growth area.

The company's commitment to innovation, including app enhancements and ambitious expansion plans in markets like China, further solidifies these segments as Stars. China alone aims for 1,000 store openings by the end of 2024, with a target of 300-350 net annual openings by 2025, indicating strong market share and growth potential.

Domino's Rewards program, boasting 35.7 million active users in 2024, is another key Star, driving customer loyalty and repeat purchases. Similarly, strategic partnerships with third-party aggregators like Uber Eats and DoorDash are positioned as Stars, projected to contribute up to $1 billion in incremental sales by expanding reach into new customer segments.

| BCG Category | Domino's Business Segment | Key Metrics/Data (2024) | Growth Potential |

|---|---|---|---|

| Stars | Digital Ordering Platforms (US) | 85% of US sales from digital channels | High (Dominant market position, ongoing innovation) |

| Stars | International Expansion (China) | Target 1,000 stores by end of 2024; 300-350 net openings annually by 2025 | High (Aggressive growth strategy in a key market) |

| Stars | Domino's Rewards Program | 35.7 million active users | High (Drives customer loyalty and repeat business) |

| Stars | Third-Party Aggregator Partnerships | Projected $1 billion in incremental sales | High (Expands customer reach and market share in delivery) |

What is included in the product

Domino's Pizza's BCG Matrix highlights its strong Cash Cow position with its core pizza business, while exploring growth potential in newer offerings as Question Marks.

Domino's Pizza's BCG Matrix analysis offers a clear, distraction-free view of its portfolio, simplifying strategic decisions for C-level executives.

This export-ready design allows for quick drag-and-drop into presentations, streamlining the communication of strategic insights.

Cash Cows

Domino's core pizza offerings, such as pepperoni and cheese, are undeniably its cash cows. These staples hold a significant market share in the mature pizza industry, consistently driving substantial revenue and profit. Their established demand and streamlined production mean they require minimal marketing spend to maintain their strong performance.

Domino's Pizza's established global franchise model, with approximately 99% of its nearly 20,000 locations operated by independent franchisees, is a prime example of a cash cow. This structure generates substantial and consistent revenue through royalties and fees, significantly reducing the parent company's operational burden and costs. In 2023, Domino's reported global retail sales of $17.5 billion, with a significant portion flowing back to the company through its franchise agreements.

Domino's robust in-house supply chain is a prime example of a Cash Cow within its business operations. This segment, responsible for delivering high-quality dough and ingredients across its extensive store network, operates with exceptional efficiency and profitability.

In 2023, Domino's supply chain segment demonstrated strong financial performance. For instance, its supply chain revenue grew by 6.2% year-over-year, reaching $1.3 billion, with gross margins holding steady at a healthy 20.5%. This consistency underscores its ability to manage costs effectively while ensuring product quality, a critical factor in its overall profitability.

Carryout Service

Domino's carryout service is a clear Cash Cow. This segment consistently demonstrates robust profitability and steady growth, as evidenced by a 7.9% increase in carryout comparable sales during the second quarter of 2025.

The inherent cost advantages of carryout, compared to delivery, translate into higher profit margins for Domino's. The company actively leverages value-focused promotions for collection orders, further enhancing the profitability of this channel.

- Strong Profitability: Carryout operations contribute significantly to Domino's bottom line due to lower overhead.

- Consistent Growth: The segment shows sustained positive comparable sales growth.

- Cost Efficiency: Reduced delivery expenses make carryout a high-margin revenue stream.

- Marketing Focus: Value-driven marketing campaigns continue to boost carryout order volume.

U.S. Market Operations (Overall)

The U.S. market operations for Domino's Pizza represent a classic Cash Cow within its business portfolio. Despite facing a mature market, Domino's has maintained a high market share, consistently generating substantial revenue and profits. For instance, in 2023, U.S. same-store sales saw a healthy increase, underscoring its continued strength.

Domino's actively expands its U.S. footprint, opening new locations to capitalize on its established brand recognition and extensive digital ordering capabilities. This strategic growth, coupled with a significant advertising budget, allows the company to defend its dominant market position and achieve positive sales growth, even in a competitive landscape.

- U.S. Market Share: Domino's holds a leading position in the U.S. pizza delivery market.

- Revenue Contribution: The U.S. segment is a primary driver of Domino's overall financial performance.

- Store Growth: The company continues to strategically open new stores within the U.S.

- Digital Dominance: Leveraging its advanced digital infrastructure supports consistent sales growth.

Domino's Pizza's established franchise model is a significant Cash Cow. This structure, with nearly all of its locations operated by franchisees, consistently generates substantial revenue through royalties and fees, minimizing the parent company's operational costs. In 2023, Domino's reported global retail sales of $17.5 billion, with a considerable portion flowing back to the company via these franchise agreements.

The company's robust in-house supply chain is another prime example of a Cash Cow. This segment efficiently manages the delivery of dough and ingredients across its vast store network, contributing to strong profitability. In 2023, the supply chain segment saw revenue grow by 6.2% year-over-year, reaching $1.3 billion, with gross margins maintained at a healthy 20.5%.

Domino's carryout service also functions as a Cash Cow, demonstrating robust profitability and steady growth. This segment benefits from lower overhead compared to delivery, leading to higher profit margins. The company actively promotes value-focused offers for collection orders, further boosting this high-margin revenue stream.

The U.S. market operations represent a classic Cash Cow for Domino's. Despite operating in a mature market, the company maintains a leading market share, consistently generating significant revenue and profits. U.S. same-store sales saw a healthy increase in 2023, highlighting its continued strength and the effectiveness of its digital ordering capabilities.

| Business Segment | BCG Matrix Category | Key Financial Indicator (2023 Data) | Notes |

|---|---|---|---|

| Franchise Model | Cash Cow | Global Retail Sales: $17.5 Billion | Generates consistent revenue via royalties and fees. |

| Supply Chain Operations | Cash Cow | Supply Chain Revenue: $1.3 Billion (up 6.2% YoY) | High efficiency and profitability in ingredient delivery. |

| Carryout Service | Cash Cow | Comparable Sales Growth: 7.9% (Q2 2025 est.) | Lower overhead leads to higher profit margins. |

| U.S. Market Operations | Cash Cow | U.S. Same-Store Sales Growth: Positive | Maintains leading market share in a mature industry. |

Preview = Final Product

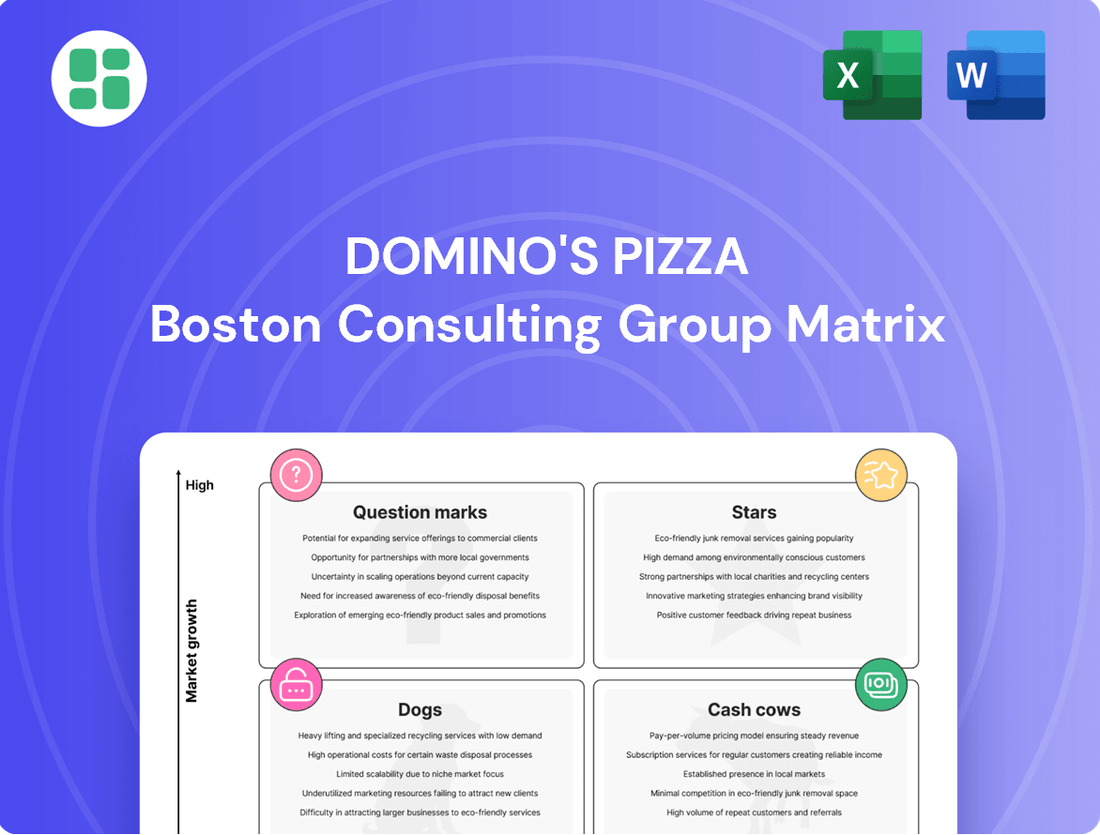

Domino's Pizza BCG Matrix

The Domino's Pizza BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means you'll get the complete strategic analysis, without any watermarks or placeholder content, ready for immediate application in your business planning.

Dogs

Domino's Pizza Enterprises is strategically closing a significant number of underperforming stores, with up to 80 in Japan and 20-30 in France slated for closure by early 2025. This move addresses challenges such as increased media expenses and slowing sales in these specific markets.

These locations represent a low market share within regions experiencing growth headwinds. The divestiture of these struggling units is a direct effort to bolster the company's overall financial performance and unit economics.

Discontinued or less popular menu items at Domino's, while not always explicitly highlighted, represent potential 'Dogs' in their product portfolio. These are items that likely didn't resonate with customers, leading to their removal from menus due to low sales. For example, while specific data on discontinued items isn't readily available, a pizza chain's general experience suggests that experimental or niche offerings often struggle to gain traction against core favorites.

Inefficient legacy store formats at Domino's Pizza represent a significant challenge, often characterized by older layouts that don't fully integrate modern digital ordering capabilities or optimized kitchen workflows. These older locations may struggle with profitability due to these inherent inefficiencies.

Domino's is actively investing in new oven technology and modernizing store setups, particularly for new and corporate-owned locations. This strategic focus implies that older, less efficient stores are likely underperforming in terms of both market share and financial returns, potentially classifying them as Dogs within the BCG framework.

Non-core or Niche Product Failures

Domino's has historically experimented with niche product lines that ultimately didn't gain traction. For instance, their introduction of pasta dishes in the early 2000s, while intended to broaden appeal, didn't significantly alter their core pizza-centric market share and were eventually phased out. These types of ventures can divert resources from more successful core offerings.

Another example could be limited-time offers or regional specialties that, despite initial buzz, failed to establish a consistent sales base. These can be costly to develop and market, tying up capital without delivering substantial returns. In 2024, companies are increasingly scrutinizing such initiatives, focusing on data-driven decisions to avoid these pitfalls.

The failure of these niche products means they represent a drain on resources without contributing to market share or growth.

- Pasta Dishes: Introduced to diversify menu, but failed to capture significant market share from core pizza offerings.

- Limited-Time Offers (LTOs): While creating buzz, many LTOs haven't translated into sustained sales growth, leading to resource allocation questions.

- Regional Experiments: Products tailored for specific markets often struggle to scale nationally, representing a financial risk.

High-Cost, Low-Return Promotional Activities

Promotional activities that prove to be expensive without generating a proportional increase in sales or customer base fall into the 'dog' category within a marketing strategy, much like in the BCG Matrix for business units. For Domino's Pizza, this means evaluating campaigns that, despite their cost, don't effectively boost traffic or build lasting customer loyalty.

For instance, a high-spend national TV advertisement campaign in 2023 that coincided with a slight dip in same-store sales growth, despite a 5% increase in marketing expenditure, might be flagged as a potential 'dog' if it didn't demonstrably drive higher order volumes or attract new, repeat customers. This highlights the need for rigorous ROI analysis on all promotional efforts.

- Evaluating promotional ROI: Campaigns must demonstrate a clear positive return on investment, measured by incremental sales, customer acquisition cost, and customer lifetime value.

- Focus on value-driven promotions: Domino's core strategy emphasizes value, so promotions should align with this, offering tangible benefits that resonate with price-sensitive consumers without excessive marketing outlay.

- Data-driven campaign optimization: Analyzing data from past promotions, such as the performance of a 2023 "buy one get one free" offer versus a "percentage off" deal, can inform future decisions to cut or refine underperforming activities.

- Minimizing high-cost, low-impact initiatives: Identifying and reducing investment in promotional strategies that consistently fail to meet key performance indicators is crucial for efficient resource allocation.

Within Domino's Pizza's portfolio, underperforming stores and past product experiments often represent 'Dogs' in the BCG Matrix. These are ventures with low market share and low growth potential, draining resources without significant returns. For example, the company's strategic closures of up to 80 stores in Japan and 20-30 in France by early 2025 highlight a move to divest these underperforming units.

Past product line extensions, such as pasta dishes introduced in the early 2000s, also fit this category. While aiming to broaden appeal, they failed to capture substantial market share from core pizza offerings and were eventually phased out, illustrating how such ventures can divert capital from more successful products.

Similarly, promotional activities that incur high costs without a proportionate increase in sales or customer acquisition are considered 'Dogs'. A 2023 TV campaign that coincided with slower sales growth despite increased marketing spend, for instance, would be scrutinized for its return on investment.

The strategic focus on modernizing store formats and investing in new technology implicitly identifies older, less efficient locations as potential 'Dogs'. These legacy stores may struggle with profitability due to outdated layouts and a lack of integration with modern digital ordering systems.

Question Marks

Domino's is making significant strides in advanced AI integration, notably with its proprietary Dom.OS and an AI-powered personal ordering assistant. This assistant is slated for a 2024 beta launch, signaling a substantial investment in improving customer interaction and operational efficiency.

These technological advancements position Domino's for high growth, aiming to enhance both the customer experience and internal processes. However, the true market adoption and the extent to which these innovations will translate into increased market share remain to be seen, placing them in a category with high potential but unproven outcomes.

Domino's is actively innovating its menu, with items like Mac & Cheese launching in late 2024 and Parmesan Stuffed Crust planned for early 2025. These new offerings target the fast-growing market for unique food experiences.

Currently, these novelties represent a small portion of Domino's total sales, placing them in the "question mark" category of the BCG matrix. Their future performance hinges on gaining traction with consumers and maintaining interest beyond initial novelty.

Domino's Pizza is actively trialing autonomous delivery and drone delivery, signaling a push into high-growth logistics. These innovative methods, while promising for the future of food delivery, are currently in nascent stages with minimal market penetration.

In 2024, companies like Wing, a Google subsidiary, have expanded their drone delivery services, with some reports indicating millions of successful deliveries. Domino's collaborations in this space are exploring similar potential, aiming to leverage these technologies for faster and more efficient deliveries in select markets.

The significant investment required for infrastructure, regulatory approvals, and scaling these operations places autonomous and drone delivery firmly in the question mark category of the BCG matrix. While the long-term growth potential is substantial, the immediate return on investment and market viability are still being determined.

Expansion into Non-Traditional Delivery Locations (Pinpoint Delivery)

Domino's Pinpoint Delivery, introduced in June 2023, allows customers to receive pizzas at non-traditional locations like parks and beaches, tapping into a growing demand for ultimate convenience.

While this innovative service targets a potentially high-growth niche, its impact on Domino's overall market share is still being assessed as it relies on further customer adoption and ongoing operational enhancements.

- Pinpoint Delivery launched: June 2023.

- Targeted locations: Parks, beaches, and other places without traditional addresses.

- Market share impact: Still developing, dependent on customer adoption and operational efficiency.

Strategic Partnerships for New Technology Development

Domino's strategic partnerships with tech leaders like Microsoft for AI and Databricks for Generative AI are clear indicators of its investment in future growth engines. These collaborations are designed to enhance customer experience and operational efficiency, aiming for long-term competitive advantages.

While the immediate impact on market share is not yet substantial, these ventures position Domino's to capitalize on emerging technologies. For instance, by leveraging AI for personalized marketing and GenAI for analyzing vast amounts of customer feedback, Domino's aims to refine its offerings and customer engagement strategies. The company's commitment to these advanced technological areas suggests a forward-looking approach, aligning with the characteristics of a Star or Question Mark in the BCG matrix, depending on the current market penetration and growth potential of these specific AI applications.

- AI and GenAI Investments: Collaborations with Microsoft and Databricks focus on high-growth technology sectors.

- Future Competitive Advantage: These partnerships are geared towards securing long-term market positioning.

- Nascent Market Share Impact: The direct influence on current market share is still developing.

- Potential for Growth: The full realization of these technological investments is anticipated in the future.

Domino's AI-powered personal ordering assistant, set for a 2024 beta launch, and its proprietary Dom.OS represent significant investments in future growth. While these innovations aim to boost customer interaction and efficiency, their market adoption and impact on market share are still uncertain, placing them in the question mark category. The company's menu innovations, like Mac & Cheese and Parmesan Stuffed Crust, also target growth but currently represent a small sales fraction, further solidifying their question mark status.

Domino's exploration of autonomous and drone delivery, alongside its Pinpoint Delivery service, taps into high-growth logistics and convenience. However, these ventures require substantial investment and face regulatory hurdles, with minimal current market penetration. While companies like Wing reported millions of drone deliveries in 2024, Domino's collaborations are still in nascent stages, making their long-term viability and market share impact a key question mark.

Strategic partnerships with tech giants like Microsoft and Databricks for AI and Generative AI underscore Domino's commitment to future competitive advantages. These collaborations aim to enhance customer experience and operational efficiency, but their immediate impact on market share remains developing. The full realization of these technological investments, which could position Domino's as a Star or keep them as a Question Mark, is anticipated in the future.

| Initiative | Status | BCG Category | Potential Impact | Key Considerations |

| AI Personal Ordering Assistant | 2024 Beta Launch | Question Mark | Enhanced Customer Experience, Operational Efficiency | Market Adoption, Scalability |

| Autonomous/Drone Delivery | Trials/Exploration | Question Mark | Faster, Efficient Delivery | Infrastructure Investment, Regulatory Approvals |

| Pinpoint Delivery | Launched June 2023 | Question Mark | Niche Convenience Market Growth | Customer Adoption, Operational Refinement |

| AI/GenAI Partnerships | Ongoing | Question Mark (potential Star) | Long-term Competitive Advantage | Nascent Market Share Impact, Future Realization |

BCG Matrix Data Sources

Our Domino's Pizza BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.