Dave & Buster's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dave & Buster's Bundle

Dave & Buster's operates in a dynamic entertainment and dining landscape, facing significant pressure from direct competitors and the ever-present threat of substitutes. Understanding the interplay of buyer power and supplier leverage is crucial for navigating this competitive arena.

The complete report reveals the real forces shaping Dave & Buster's’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dave & Buster's faces a moderate bargaining power from suppliers of specialized gaming and VR equipment. The company depends on a select group of manufacturers for its unique arcade and virtual reality attractions, granting these suppliers a degree of influence. The proprietary nature of advanced gaming tech can lead to significant switching costs for Dave & Buster's when seeking high-performance games, as evidenced by Andamiro USA being named Supplier Partner of the Year, underscoring crucial supplier relationships.

The bargaining power of food and beverage suppliers for Dave & Buster's is generally low due to a wide and commoditized supplier base. This broad market means individual suppliers have limited leverage. However, suppliers of premium or branded alcoholic beverages, and those providing unique, high-quality ingredients, can exert slightly more influence.

Dave & Buster's significant scale and national presence are key factors in mitigating supplier power. The company's ability to make large volume purchases allows for strong negotiation positions, securing more favorable pricing and contract terms. For instance, in 2024, major restaurant chains often negotiate discounts of 5-10% on bulk food purchases, a benefit Dave & Buster's likely leverages.

Dave & Buster's increasing adoption of technology, like tableside ordering and advanced POS systems, means it relies more on specialized tech providers. Companies such as OneDine, which was recognized as a Vendor Partner of the Year, are vital for smooth operations, offering critical support.

However, the market for these technology solutions is competitive, with numerous vendors offering similar services. This competition among suppliers of POS systems and other tech solutions generally keeps their individual bargaining power in check, preventing any single provider from dictating terms too aggressively to Dave & Buster's.

Real Estate Landlords

Real estate landlords wield considerable bargaining power over Dave & Buster's due to the company's reliance on leased locations, especially those situated in prime, high-traffic areas. Lease terms, renewal negotiations, and escalating property values directly influence the company's occupancy costs, a significant component of its operating expenses.

For instance, in 2023, Dave & Buster's reported total operating lease liabilities of approximately $1.2 billion, highlighting the substantial financial commitment tied to its real estate portfolio. The company's strategic use of sale-leaseback transactions, while potentially offering immediate capital, can also alter its negotiating leverage with landlords in the long run.

- Prime Locations: Landlords of desirable, high-foot-traffic sites can command higher rents and more favorable lease terms.

- Lease Renewals: As leases expire, landlords have the opportunity to renegotiate terms, potentially increasing costs for Dave & Buster's.

- Property Value Increases: Rising real estate values in key markets strengthen landlords' positions, allowing them to demand higher lease payments.

- Sale-Leasebacks: While providing liquidity, these transactions can sometimes reduce a tenant's long-term bargaining power with the new property owner.

Labor Market (Indirect Supplier)

The labor market, while not a direct supplier in the traditional sense, exerts significant bargaining power over Dave & Buster's due to its impact on operational costs. Rising wage expectations and the ongoing challenge of attracting and retaining qualified staff within the competitive hospitality industry can directly translate to higher labor expenses. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that average hourly earnings for leisure and hospitality workers saw an increase, reflecting this upward pressure on wages.

Dave & Buster's must actively compete for talent, which inherently involves offering competitive compensation and benefits packages. This competition can lead to increased labor costs, impacting the company's profitability. The need to invest in training and development to ensure service quality further adds to these indirect supplier costs.

- Labor Availability: Shortages in available workers can drive up wages.

- Wage Inflation: General economic trends and minimum wage adjustments directly affect labor costs.

- Staff Retention: High turnover necessitates increased recruitment and training expenses.

- Industry Competition: Other entertainment and dining venues vie for the same talent pool.

The bargaining power of suppliers for Dave & Buster's is a mixed bag, with certain categories holding more sway than others. While the company benefits from a broad base of food and beverage providers, specialized gaming equipment manufacturers and landlords of prime real estate can exert considerable influence, impacting operational costs and strategic flexibility.

The company's scale and purchasing power help to mitigate supplier leverage across most categories. However, the reliance on proprietary technology and the necessity of securing prime locations mean that specific suppliers and landlords can still negotiate from positions of strength, particularly when lease renewals or specialized equipment upgrades are involved.

In 2024, the competitive landscape for technology suppliers, while offering choice, also means Dave & Buster's must ensure robust support from key partners like OneDine to maintain seamless operations. Similarly, while landlords' power is significant, the company's strategic lease management and potential for sale-leaseback transactions can influence long-term negotiations.

The labor market presents a distinct form of supplier power, with rising wages and competition for talent directly impacting Dave & Buster's operating expenses. The U.S. Bureau of Labor Statistics noted wage increases in the leisure and hospitality sector in 2024, underscoring this trend.

| Supplier Category | Bargaining Power Level | Key Factors |

| Food & Beverage (Commoditized) | Low | Numerous suppliers, high substitutability |

| Specialized Gaming Equipment | Moderate to High | Proprietary technology, high switching costs |

| Real Estate Landlords (Prime Locations) | High | Limited prime locations, lease renewal terms |

| Technology Providers (POS, etc.) | Low to Moderate | Competitive market, but reliance on key partners |

| Labor | High | Wage inflation, talent shortages, industry competition |

What is included in the product

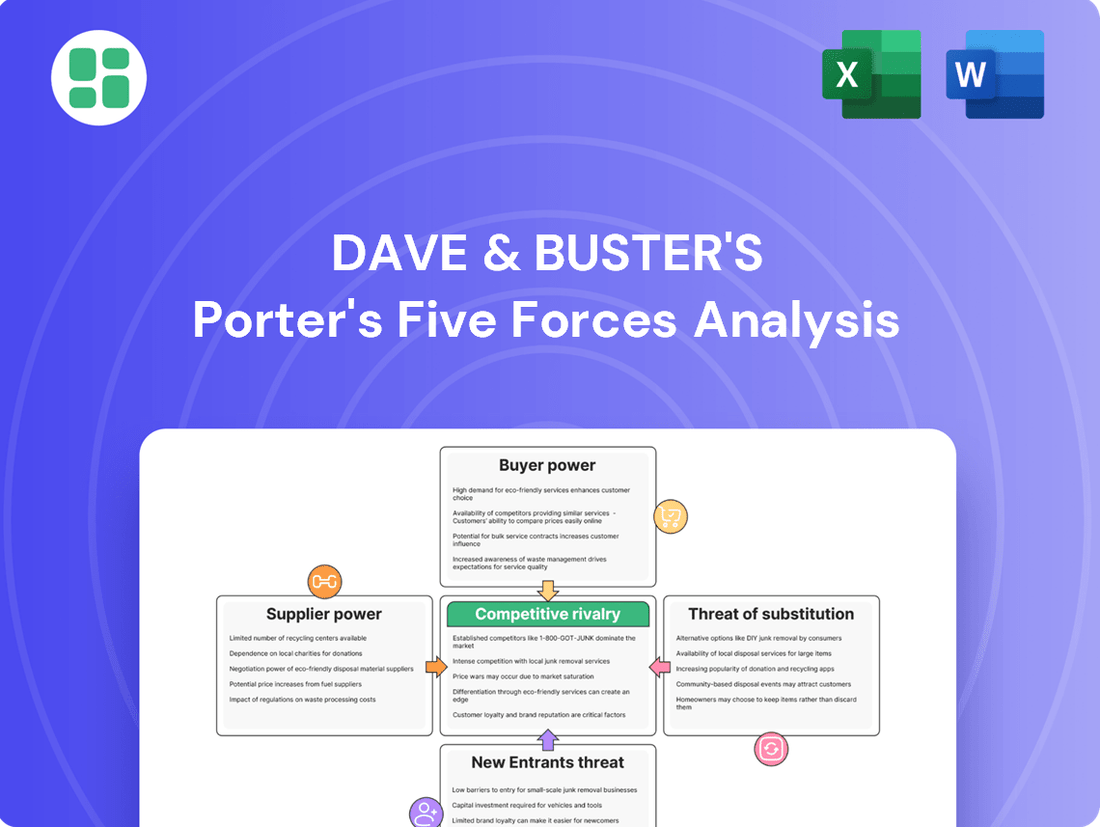

This Porter's Five Forces analysis for Dave & Buster's dissects the competitive intensity by examining rivalry among existing competitors, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products.

Instantly visualize competitive pressures on Dave & Buster's with a dynamic Porter's Five Forces model, allowing for rapid identification of key strategic challenges.

Customers Bargaining Power

Customers today have a vast sea of entertainment and dining choices, making it easier than ever to find alternatives to Dave & Buster's. Think about it: they can opt for casual dining restaurants, trendy sports bars, classic movie theaters, or even a night of bowling. Plus, with the rise of streaming services and home gaming, staying in is a compelling option. This abundance of substitutes directly translates to increased bargaining power for consumers.

For Dave & Buster's, this means they can't just rely on their existing model. They need to continuously innovate and highlight what makes their unique blend of eating, drinking, playing, and watching sports stand out. In 2024, the entertainment and dining sector saw continued growth in casual dining, with many establishments focusing on experiential dining to capture market share. Dave & Buster's reported that its same-store sales increased by 5.8% in the first quarter of 2024, indicating a positive response to their efforts to differentiate.

Consumers are definitely more mindful of their spending right now. For Dave & Buster's, this means people are paying closer attention to prices, and how much they feel they're getting for their money. This heightened price sensitivity, particularly among those with tighter budgets, can directly affect how often customers choose to visit and how much they spend when they do.

To combat this, Dave & Buster's has been actively working on presenting stronger value. They've brought back some of their most popular deals and are carefully adjusting their pricing strategies to make sure customers feel they're getting a good deal. For instance, in early 2024, the company highlighted efforts to enhance its value menu and promotional offerings to better align with current consumer expectations.

Customers at Dave & Buster's face very low switching costs. They can easily choose to go to a different restaurant or entertainment venue without incurring significant expenses or effort. This freedom means that if a competitor offers a better deal or a more appealing experience, customers can readily switch their patronage.

Access to Information and Reviews

Customers today have an unprecedented amount of information at their fingertips, significantly boosting their bargaining power. Online review platforms, social media discussions, and dedicated comparison websites allow potential visitors to easily research and contrast different entertainment venues. This wealth of readily available data empowers them to make well-informed choices, seeking out the best deals and experiences that align with their preferences.

For a business like Dave & Buster's, this means customers can readily compare pricing, menu options, and the overall atmosphere of various entertainment centers. For instance, a quick search in 2024 might reveal numerous local arcades, bowling alleys, and family entertainment centers offering competitive pricing structures or unique promotions. This transparency forces venues to be more competitive and responsive to customer demands, as dissatisfied patrons can easily voice their opinions and influence others.

- Increased Transparency: Customers can easily access and compare pricing, services, and reviews from various entertainment venues online.

- Informed Decision-Making: The availability of extensive information enables customers to identify the best value and specific experiences they seek.

- Social Proof Influence: Online reviews and social media chatter significantly impact customer perceptions and choices, holding venues accountable.

- Demand for Value: Customers are more likely to seek out and patronize establishments offering superior quality or more attractive pricing due to easy comparisons.

Demand for Integrated Experiences

Customers increasingly seek integrated, high-quality entertainment experiences. In 2024, consumer spending on experiences, particularly those combining dining and activities, continued to rise, putting pressure on venues to innovate. If Dave & Buster's doesn't consistently deliver fresh and engaging offerings, patrons can readily shift their spending to competitors providing more novel or immersive entertainment, thereby increasing customer bargaining power.

The demand for integrated experiences means customers have more choices than ever for how they spend their leisure time and money. For instance, the rise of escape rooms, interactive dining concepts, and specialized activity bars offers alternatives to the traditional Dave & Buster's model. This broadens the competitive landscape and gives customers greater leverage to dictate terms, such as price or quality of service, as they can easily opt for a different venue if their expectations aren't met.

- Evolving Consumer Preferences: A 2024 survey indicated that 65% of consumers prioritize unique experiences over material goods.

- Competitive Alternatives: The market for entertainment and dining includes a growing number of specialized venues offering niche or novel experiences.

- Impact on Bargaining Power: Failure to innovate can lead to customers easily switching to competitors, enhancing their ability to demand better value.

The bargaining power of customers for Dave & Buster's is significant due to the wide array of entertainment and dining options available, coupled with low switching costs. Consumers in 2024 are highly informed, readily comparing prices and experiences online, which compels venues like Dave & Buster's to offer compelling value and continuous innovation to retain patronage. This environment allows customers to easily shift their spending to competitors if their expectations for price, quality, or novelty are not met.

| Factor | Description | 2024 Context/Data |

|---|---|---|

| Availability of Substitutes | Numerous dining, entertainment, and home-based leisure options exist. | Continued growth in casual dining and home entertainment services. |

| Switching Costs | Minimal financial or effort required to choose an alternative venue. | Customers can easily visit competing arcades, bars, or restaurants. |

| Price Sensitivity | Consumers are increasingly mindful of spending and seek good value. | Dave & Buster's highlighted efforts to enhance its value menu and promotions in early 2024. |

| Information Availability | Online reviews and comparison sites empower customers with data. | Consumers can easily research pricing, deals, and atmosphere of competitors. |

Preview Before You Purchase

Dave & Buster's Porter's Five Forces Analysis

This preview showcases the complete Dave & Buster's Porter's Five Forces Analysis, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning needs.

Rivalry Among Competitors

Dave & Buster's faces significant competition from other family entertainment centers and eatertainment venues that blend dining with gaming. Companies like Main Event, which Dave & Buster's acquired in 2022, and Bowlero, along with numerous regional players, directly vie for the same customer base seeking integrated entertainment experiences. This intense rivalry necessitates constant upgrades to game offerings and menu selections to maintain customer appeal.

Dave & Buster's faces significant competition not just from other entertainment venues but also from a broad spectrum of traditional restaurants and sports bars. These establishments vie for the same customer dollars allocated for dining and social gatherings, offering familiar dining experiences and sports viewing environments without the arcade component.

In 2024, the casual dining sector, a key competitor, continued to show resilience. Data from the National Restaurant Association indicated that while the industry faced ongoing labor and cost challenges, consumer spending on dining out remained robust, with millions of Americans eating at restaurants daily.

Sports bars, in particular, offer a direct alternative for consumers seeking a social atmosphere centered around watching games, often with competitive food and beverage pricing. This segment directly challenges Dave & Buster's ability to capture discretionary spending on entertainment and dining.

Standalone gaming and VR arcades present a significant competitive threat to Dave & Buster's. These specialized venues, including dedicated virtual reality arcades and esports arenas, offer a more immersive and focused gaming experience that can draw customers away. For instance, the global VR arcades market was valued at approximately $1.7 billion in 2023 and is projected to grow significantly, indicating a strong consumer interest in these more specialized entertainment options.

The broader arcade gaming market itself is seeing modest growth, fueled by advancements in immersive technologies and the enduring appeal of social gaming. Competitors in this space are actively adopting these trends, meaning Dave & Buster's must continually innovate its own offerings to remain competitive. This trend suggests that while Dave & Buster's offers a broad entertainment experience, niche competitors can capture segments of the market seeking deeper, more specialized gaming engagement.

Fragmented Industry Landscape

The restaurant and entertainment sector, where Dave & Buster's operates, is incredibly fragmented. This means there are a vast number of businesses, from small local diners to large national chains, all competing for the same customer dollars. This intense competition means Dave & Buster's faces rivals at every level, making it challenging to capture and retain market share.

This fragmentation extends to various segments of the leisure and dining market. For instance, in 2024, the casual dining segment alone includes thousands of establishments across the United States, each offering different experiences and price points. Dave & Buster's must differentiate itself not only from other eatertainment venues but also from traditional restaurants, bars, and other entertainment options that consumers might choose.

- Fragmented Market: The broader restaurant and entertainment industry is highly fragmented, featuring numerous local, regional, and national competitors.

- Diverse Competition: Dave & Buster's contends with a wide array of rivals, including casual dining restaurants, bars, arcades, and other entertainment venues.

- Consumer Spending Battle: This fragmentation intensifies the competition for discretionary consumer spending, forcing Dave & Buster's to constantly innovate and offer compelling value.

Intense Pressure for Innovation and Remodels

Dave & Buster's faces significant competitive rivalry, compelling it to continuously innovate and update its entertainment and dining experiences. This pressure is evident in the company's substantial investments in strategic initiatives aimed at revitalizing its brand and attracting customers. For instance, in 2023, Dave & Buster's reported capital expenditures of $160.5 million, a notable increase from $109.9 million in 2022, with a significant portion allocated to store remodels and technology upgrades to enhance the guest experience and keep pace with evolving consumer preferences.

The need for constant refresh is driven by the dynamic nature of the entertainment and dining sectors. To combat declining comparable store sales, which saw a slight dip in certain periods of 2023 compared to the strong post-pandemic recovery, the company is actively pursuing store remodels and menu enhancements. These efforts are crucial for maintaining customer engagement and attracting new demographics in a market where competitors are also vying for consumer attention with novel attractions and dining concepts.

- Strategic Investments: Dave & Buster's is channeling significant capital into store remodels, new game installations, and menu revamps to stay competitive.

- Comparable Store Sales Focus: Efforts to boost comparable store sales underscore the intense pressure to drive repeat business and attract new patrons through updated offerings.

- Market Dynamics: The entertainment and dining landscape demands continuous innovation, as rivals frequently introduce new attractions and dining experiences.

Dave & Buster's operates in a highly competitive landscape, facing rivals from eatertainment centers like Main Event and Bowlero, as well as traditional restaurants and sports bars. The fragmentation of the market means countless businesses vie for discretionary consumer spending. In 2024, the casual dining sector remained robust, with millions of Americans dining out daily, intensifying the battle for customer dollars. Specialized venues, such as VR arcades, also pose a threat by offering more focused gaming experiences.

| Competitor Type | Examples | Competitive Pressure |

|---|---|---|

| Eatertainment Centers | Main Event, Bowlero | Directly compete for integrated dining and gaming experiences. |

| Casual Dining Restaurants | Thousands of establishments nationwide | Vie for dining dollars with familiar experiences. |

| Sports Bars | Various regional and national chains | Compete on social atmosphere and dining/drink specials. |

| Specialized Gaming Venues | VR Arcades, Esports Arenas | Offer immersive and niche gaming experiences. |

SSubstitutes Threaten

The rise of advanced home entertainment systems presents a significant threat to Dave & Buster's. High-definition gaming consoles like the PlayStation 5 and Xbox Series X, coupled with immersive virtual reality headsets, offer compelling entertainment experiences directly in consumers' homes. These systems, along with a vast array of streaming services, provide a convenient and increasingly cost-effective alternative to visiting an entertainment venue.

For customers primarily seeking a dining or social experience, traditional full-service restaurants, casual dining chains, and local bars represent significant substitutes for Dave & Buster's. These establishments offer comparable food and beverage options, and a social atmosphere, directly competing for consumer leisure spending without the integrated entertainment component. In 2024, the casual dining sector, a close competitor, continued to see robust activity, with many chains reporting steady customer traffic and revenue growth, indicating a strong preference for these more traditional social venues among a segment of the population.

Consumers have a wide array of choices for their entertainment spending, beyond Dave & Buster's. Movie theaters, bowling alleys, concert venues, live sports, and theme parks all vie for that same discretionary dollar. In 2024, the global market for location-based entertainment, which includes many of these substitutes, continued its strong recovery post-pandemic, with many segments reporting significant revenue growth.

Outdoor and Activity-Based Recreation

The threat of substitutes for Dave & Buster's is significant, as consumers have numerous alternatives for leisure and entertainment spending. Activities such as mini-golf, escape rooms, laser tag, and various outdoor recreational pursuits provide direct competition by offering engaging experiences that cater to a desire for active participation and novelty. These substitutes often appeal to the same demographic seeking fun and social interaction outside the home.

For instance, the growth in the escape room industry, with hundreds of locations now operating across major metropolitan areas, demonstrates a strong consumer appetite for immersive, activity-based entertainment. Similarly, outdoor recreation, from hiking and camping to organized sports, continues to be a popular choice, especially as many Americans prioritize health and wellness. In 2024, the U.S. Bureau of Labor Statistics reported that Americans spent an average of $5,700 per year on recreation, a figure that encompasses a wide array of activities, many of which can be seen as substitutes for the eatertainment model.

- Alternative Entertainment: Consumers can opt for activities like bowling alleys, arcades, movie theaters, or even home-based entertainment options such as streaming services and video games.

- Active Lifestyle Choices: Outdoor activities like hiking, cycling, and visiting parks offer a more physically engaging and often less expensive way to spend leisure time.

- Experiential Spending: The rise of unique local experiences, such as craft breweries with live music or community events, also draws consumer dollars away from larger entertainment chains.

- Cost Sensitivity: Many substitute options, particularly those focused on a single activity or outdoor pursuits, can be more budget-friendly than a full meal and gaming experience at Dave & Buster's, especially for families.

Social Gatherings and Events at Other Venues or Private Homes

For group events, parties, or casual social gatherings, consumers can opt for private parties at homes, community centers, or other dedicated event spaces. These alternatives often offer a more intimate or tailored experience, directly competing with Dave & Buster's group booking services. For instance, the rise of the "experience economy" in 2024 has seen a surge in demand for unique, personalized event settings, potentially drawing customers away from more standardized entertainment venues.

These substitute venues can provide a greater degree of customization regarding food, décor, and entertainment, which might appeal to specific customer segments seeking a distinct atmosphere. In 2023, the market for event rentals and private party services saw significant growth, indicating a strong preference for bespoke gatherings over more commercialized options.

- Home-based parties offer cost savings and complete control over the guest experience.

- Community centers provide affordable rental options for larger groups.

- Specialty event venues cater to niche interests and offer unique ambiance.

- The flexibility of these substitutes can be a significant draw for event planners prioritizing personalization.

The threat of substitutes for Dave & Buster's is substantial, encompassing everything from advanced home entertainment to traditional dining and unique local experiences. Consumers increasingly have access to high-quality, convenient, and often more affordable alternatives for leisure spending. In 2024, the casual dining sector continued to thrive, demonstrating a strong preference for traditional social venues among many consumers, while the broader location-based entertainment market also showed robust recovery and growth.

These substitutes range from immersive home gaming setups and streaming services to bowling alleys, movie theaters, and even outdoor activities like hiking. The rise of the experience economy in 2024 further fueled demand for unique, personalized events, potentially diverting customers from more commercialized entertainment chains. Americans' average annual spending on recreation in 2024, reported by the U.S. Bureau of Labor Statistics at $5,700, highlights the diverse range of activities competing for discretionary dollars.

| Substitute Category | Examples | 2024 Market Trend/Data Point |

|---|---|---|

| Home Entertainment | Gaming consoles (PS5, Xbox Series X), VR headsets, streaming services | Continued growth in console sales and streaming subscriptions |

| Traditional Dining/Social | Casual dining restaurants, bars | Robust activity and revenue growth in the casual dining sector |

| Location-Based Entertainment | Movie theaters, bowling alleys, concert venues, arcades | Strong post-pandemic recovery and revenue growth across segments |

| Active/Outdoor Recreation | Hiking, cycling, parks, mini-golf, escape rooms | Increased consumer focus on health and wellness, growth in experience-based activities |

Entrants Threaten

The significant capital expenditure required to establish a large-scale entertainment and dining venue, like those operated by Dave & Buster's, acts as a substantial barrier to entry. This includes costs for real estate, extensive construction, and outfitting the venue with high-tech arcade games and kitchen equipment. For instance, a new flagship Dave & Buster's location can easily cost tens of millions of dollars to build and equip, a figure that deters many potential new competitors.

Dave & Buster's has cultivated significant brand recognition and customer loyalty over many years, presenting a formidable barrier for newcomers aiming to quickly gain traction. A new entrant would require considerable investment in marketing and promotions to establish a similar brand image and secure a reliable customer base. For instance, in fiscal year 2024, Dave & Buster's reported total revenue of $2.4 billion, showcasing the scale of its established operations and market presence.

The operational complexity of a dual concept, combining restaurant and entertainment, acts as a significant barrier to new entrants. Dave & Buster's must manage distinct supply chains for food and arcade games, a feat that requires specialized logistics and vendor relationships. For instance, ensuring a consistent supply of fresh ingredients while also sourcing and maintaining a diverse inventory of arcade equipment presents a dual challenge. This intricate operational model makes it difficult for newcomers to replicate the efficiency and integrated experience that an established player like Dave & Buster's has honed over years.

Challenges in Securing Key Supplier Relationships

New entrants to the entertainment dining sector often struggle to establish robust relationships with key suppliers, particularly for specialized gaming equipment and high-volume food and beverage inputs. Securing favorable terms, reliable delivery, and early access to innovative products can be a significant hurdle.

Dave & Buster's, with its established presence and substantial purchasing power, likely leverages long-standing supplier partnerships to its advantage. This scale allows them to negotiate preferential pricing and gain early access to new gaming technologies and menu innovations, creating a barrier for emerging competitors.

- Supplier Dependence: New entrants may find it challenging to secure contracts with exclusive gaming hardware providers or major food distributors without a proven track record.

- Scale Advantages: Dave & Buster's 2023 revenue of $2.2 billion allows for significant volume discounts and stronger negotiation leverage with suppliers compared to smaller, newer establishments.

- Technological Access: Established players often get first access to cutting-edge arcade games and interactive technologies, a critical differentiator that new entrants might miss.

Regulatory Hurdles and Licensing

The amusement and dining sector, including businesses like Dave & Buster's, faces substantial regulatory challenges. Obtaining the necessary licenses and permits for both food service and amusement operations is a complex and time-consuming process, often varying significantly by state and municipality. This intricate web of regulations acts as a considerable barrier to entry for potential new competitors.

For instance, in 2024, the average time to obtain a liquor license in some major US cities could range from several months to over a year, depending on the specific jurisdiction and completeness of the application. Similarly, amusement ride safety inspections and certifications require adherence to stringent guidelines, adding further layers of compliance. These regulatory hurdles demand significant investment in legal counsel and administrative resources, deterring many nascent businesses from entering the market.

- License Complexity: Obtaining dual licenses for food service and amusement operations creates a multifaceted compliance challenge.

- State-Specific Variations: Regulatory requirements differ greatly across states and local municipalities, increasing the burden for national expansion.

- Time and Cost Investment: Navigating these hurdles requires substantial time and financial resources for legal and administrative processes.

- Barrier to Entry: The sheer complexity and cost of regulatory compliance can effectively deter new entrants from challenging established players like Dave & Buster's.

The threat of new entrants for Dave & Buster's is moderately low due to significant capital requirements for establishing similar venues, which can run into tens of millions of dollars. Brand loyalty and operational complexity further erect barriers, as new players must invest heavily in marketing and manage intricate dual supply chains for food and gaming equipment. For example, Dave & Buster's reported $2.4 billion in revenue for fiscal year 2024, illustrating its established market presence.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dave & Buster's is built upon comprehensive data from industry research reports, financial statements, and competitor analysis platforms. We also incorporate insights from market share data and trade publications to provide a robust understanding of the competitive landscape.