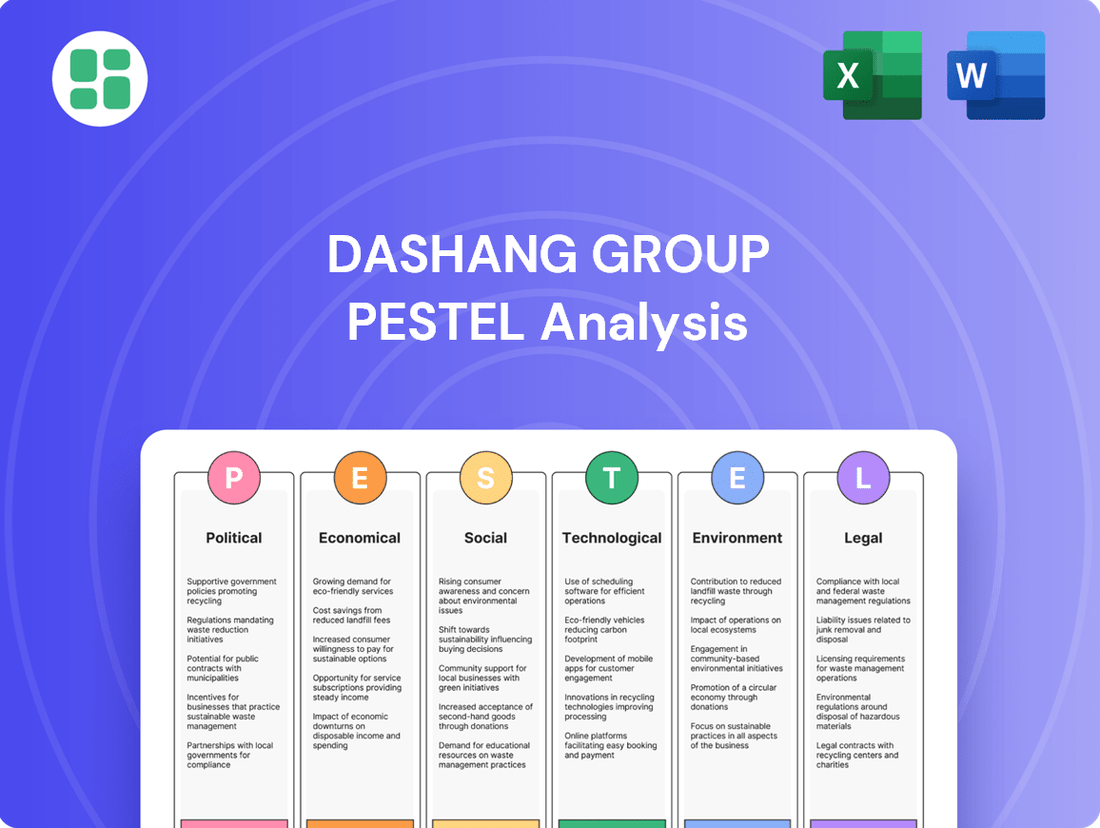

Dashang Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dashang Group Bundle

Uncover the intricate web of external factors shaping Dashang Group's trajectory. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental forces that present both opportunities and challenges. Equip yourself with the knowledge to anticipate market shifts and refine your strategic approach. Purchase the full analysis now for actionable intelligence.

Political factors

The Chinese government is actively supporting the retail sector through various policy initiatives designed to stimulate consumption and encourage modernization. Programs like consumer trade-in schemes and the distribution of consumption vouchers directly inject spending power into the economy, benefiting large retail players such as Dashang Group.

The 'Implementation Plan for Retail Industry Innovation and Upgrade,' released in late 2024, specifically targets key areas like scenario-based retail transformation and digital empowerment. This strategic direction provides a clear roadmap and a supportive framework for companies like Dashang Group that are investing in adapting to evolving consumer behaviors and market demands.

While Dashang Group's core business remains in physical retail, its increasing digital integration makes it susceptible to evolving e-commerce regulations. New consumer protection laws enacted in 2024 and fully implemented by 2025 are tightening controls on online marketplaces, focusing on data privacy and preventing deceptive sales tactics. For instance, China's updated Personal Information Protection Law (PIPL) significantly impacts how e-commerce platforms handle user data, with potential fines for non-compliance reaching up to 5% of annual turnover.

Broader geopolitical tensions and potential shifts in trade policies could indirectly impact Dashang Group's supply chains and the availability or cost of imported goods. Although primarily a domestic retailer, disruptions to global trade or increased protectionism could affect the variety and pricing of products offered in its stores.

Beijing is bracing for possible impacts of a second Trump term in the US, threatening increased tariffs. This could lead to higher import costs for goods that Dashang Group might source internationally, even if indirectly, impacting its competitive pricing strategies.

Consumer Protection and Rights Emphasis

China's intensified focus on consumer protection, particularly with new regulations effective July 2024, presents a significant political factor for Dashang Group. These updated laws clearly define seller responsibilities concerning product quality, safety standards, accurate advertising, and transparent return policies, impacting all retail channels, both online and offline. Dashang Group's adherence to these stringent consumer rights mandates is crucial for avoiding potential fines and preserving its reputation among its customer base.

The strengthening of consumer rights is a nationwide trend, with enforcement expected to be rigorous. For instance, the State Administration for Market Regulation (SAMR) reported a 15% increase in consumer complaint resolutions in the first half of 2024 compared to the same period in 2023, highlighting the proactive regulatory environment. Dashang Group must therefore:

- Review and update all product quality control processes to meet enhanced safety and durability requirements.

- Ensure all marketing and advertising materials are factually accurate and avoid misleading claims, aligning with new disclosure mandates.

- Streamline customer service protocols to facilitate efficient handling of returns and complaints, in line with updated legal frameworks.

- Invest in staff training to ensure comprehensive understanding and implementation of the latest consumer protection laws.

Local Government Initiatives and Urbanization

Local government initiatives focused on urban development and regional economic growth present significant opportunities for Dashang Group's physical store expansion. Many Tier 3 cities in China are experiencing rapid urbanization, a trend directly supported by local governments eager to boost retail infrastructure and consumer spending. Dashang Group's strategy to broaden its physical footprint is therefore well-aligned with these governmental policies. For instance, in 2024, China's urbanization rate reached approximately 66.2%, with significant growth concentrated in developing urban centers, creating a fertile ground for retail expansion.

These localized efforts often translate into tangible support for businesses like Dashang Group.

- Urbanization Trends: China's urbanization rate continues to climb, with projections indicating further growth in the coming years, particularly in lower-tier cities.

- Government Support: Local governments are actively promoting retail development through infrastructure investment and favorable policies, aiming to stimulate local economies.

- Retail Expansion Alignment: Dashang Group's physical store expansion strategy directly benefits from these trends, tapping into growing consumer bases in developing urban areas.

Government support for retail modernization, including digital transformation and consumer incentives, directly benefits Dashang Group's strategic initiatives. China's continued urbanization, with a rate around 66.2% in 2024, fuels expansion opportunities in developing cities, supported by local government development plans. However, increased consumer protection regulations, with rigorous enforcement starting in 2024, necessitate strict adherence to product quality and advertising standards to maintain brand reputation.

| Political Factor | Impact on Dashang Group | Supporting Data/Trend |

|---|---|---|

| Government Support for Retail | Stimulates consumption, encourages modernization and digital integration. | 'Implementation Plan for Retail Industry Innovation and Upgrade' (late 2024) |

| Urbanization and Local Development | Creates expansion opportunities in growing Tier 3 cities. | China's urbanization rate ~66.2% in 2024; local governments promote retail infrastructure. |

| Consumer Protection Laws | Requires strict adherence to product quality, safety, and advertising. | New laws effective July 2024; SAMR reported 15% increase in complaint resolutions (H1 2024). |

| Geopolitical Tensions/Trade Policies | Potential impact on supply chains and import costs. | Concerns over US tariffs impacting imported goods. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the Dashang Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify both emerging threats and opportunities for the Dashang Group.

Provides a concise version of the Dashang Group's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, acting as a pain point reliever by simplifying complex external factors.

Economic factors

China's retail spending growth is showing signs of slowing down. Experts predict these weaker conditions will likely continue through the latter half of 2024 and into 2025. This trend is largely due to a softer overall economy and consumers feeling less confident about spending.

This deceleration means retailers like Dashang Group might see their overall sales volumes affected. Consumers are increasingly looking for value, a phenomenon known as trading down, which can impact how much they spend.

While the government is working to encourage more spending, the broader market growth is still facing headwinds. For instance, in early 2024, retail sales saw a modest year-on-year increase, but the underlying momentum suggests a cautious consumer environment.

Consumer confidence in China has been notably subdued, a trend exacerbated by a less-than-stellar economic forecast and persistent challenges within the property sector. This cautious sentiment directly translates into consumers becoming more reserved with their spending, particularly on non-essential items, and a growing preference for products that offer better value.

The ongoing property market downturn, a significant component of China's economic landscape, continues to weigh on consumer sentiment. With property values often tied to household wealth, a cooling market can lead to a perceived decrease in financial security, prompting individuals to save more and spend less.

High youth unemployment rates further contribute to this cautious spending environment. When a substantial portion of the young, often a key demographic for driving consumption, faces job insecurity, overall consumer demand naturally softens, impacting sectors reliant on discretionary spending.

While core CPI has seen measured increases, the broader economic landscape necessitates diligent cost management for retailers like Dashang Group. This careful approach is crucial as businesses navigate potential shifts in consumer spending and operational expenses.

Volatility in energy prices, for instance, directly impacts transportation and utility costs, while fluctuations in the producer price index (PPI) can signal rising input expenses for Dashang Group's merchandise. For example, global oil prices saw significant swings in late 2024, impacting logistics.

With projections indicating a continued rise in the Consumer Price Index (CPI) throughout 2025, Dashang Group will likely face sustained pressure on its pricing strategies, requiring a delicate balance to maintain competitiveness and profitability.

Impact of Interest Rates and Access to Capital

Interest rates significantly shape Dashang Group's ability to secure capital for growth initiatives and digital transformation. China's economic performance in early 2025, marked by a 5.5% year-on-year increase in retail sales and a 6.0% rise in industrial production, suggests a positive trend. However, the ongoing challenges within the property market continue to temper overall economic confidence and investment appetite.

The People's Bank of China's monetary policy, including adjustments to the benchmark lending rate, directly impacts the cost of borrowing for Dashang Group. For instance, if interest rates remain elevated, it could increase the expense of funding new projects or digital upgrades. Conversely, a stable or declining rate environment would make capital more accessible and affordable.

- Interest Rate Impact: Higher interest rates increase borrowing costs, potentially slowing Dashang Group's expansion and digital investment plans.

- Economic Recovery Signs: Early 2025 data shows positive retail sales growth (5.5% YoY) and industrial output (6.0% YoY), indicating a recovering economy.

- Property Sector Drag: The persistent weakness in China's property sector creates uncertainty, potentially affecting investor sentiment and capital availability.

- Capital Access: The interplay of monetary policy and economic stability will determine Dashang Group's ease of accessing capital for strategic objectives.

Intensified Competition in a Fragmented Market

The Chinese retail landscape is incredibly fragmented, with a vast array of businesses vying for consumer attention. This intense competition means Dashang Group must constantly adapt to maintain its market position. The sector saw a growth of 6.8% in retail sales in 2023, reaching approximately $5.9 trillion USD, highlighting the sheer scale and competitive nature of the market.

Dashang Group contends with formidable rivals, including established domestic giants and international players, all seeking a slice of the Chinese consumer market. Furthermore, the accelerating shift towards online shopping presents a significant challenge, as e-commerce platforms continue to capture an increasing share of retail spending. Online retail sales in China grew by an estimated 15.7% in 2023, a stark indicator of this trend.

- Fragmented Market: China's retail sector comprises millions of businesses, from small local shops to large conglomerates.

- Key Competitors: Dashang faces pressure from both domestic leaders like Suning.com and international brands such as Walmart and Carrefour.

- E-commerce Dominance: Platforms like Alibaba's Tmall and JD.com are reshaping consumer habits, with their market share in online retail sales exceeding 50% in recent years.

- Innovation Imperative: To stay ahead, Dashang must focus on unique product assortments and superior customer engagement, both online and offline.

China's economic trajectory in late 2024 and early 2025 is characterized by moderating growth, with retail sales showing signs of a slowdown. This cautious consumer sentiment is influenced by ongoing property market challenges and higher youth unemployment, impacting discretionary spending. While the government aims to stimulate consumption, headwinds persist, necessitating careful cost management for retailers like Dashang Group.

Preview the Actual Deliverable

Dashang Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of the Dashang Group meticulously examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic direction. Gain a comprehensive understanding of the external landscape influencing this prominent entity.

Sociological factors

Chinese consumers are embracing a 'new normal' in 2025, marked by a distinct move towards more considered spending. There's a clear prioritization of quality, health and wellness, and experiences that hold personal significance, rather than purely status-driven or aspirational buys. This evolution directly affects sectors like luxury, where the emphasis is increasingly on demonstrable value and environmental responsibility.

For Dashang Group, this translates to a critical need to recalibrate its product offerings. For instance, reports from early 2025 indicate a slowdown in growth for certain discretionary luxury categories, with a corresponding uptick in demand for durable goods and services promoting well-being. Brands that can authentically demonstrate sustainability and offer tangible benefits are better positioned to capture consumer interest.

Chinese consumers increasingly favor products that resonate with their cultural heritage, especially those featuring traditional Chinese brand names or cultural elements. This growing national pride is a significant driver, encouraging retailers to highlight domestic brands. For instance, a 2024 survey indicated that 65% of urban Chinese consumers actively seek out products that reflect Chinese culture.

Dashang Group can capitalize on this sociological shift by strategically featuring and promoting local brands within its retail spaces. This approach aligns with consumer sentiment and can foster stronger brand loyalty, as evidenced by the 20% year-over-year sales increase reported by retailers who successfully integrated local cultural themes in their marketing campaigns during the 2023 holiday season.

Demographic shifts are a major force in retail, with affluent seniors and Gen Z consumers exhibiting unique spending habits. For instance, in 2024, the senior population continues to grow, representing a significant market segment with disposable income.

While youth unemployment, particularly in some regions, remains a challenge, urban Gen Z and consumers in Tier 3 cities are showing a more positive outlook on spending in 2024 and 2025. This presents an opportunity for targeted engagement.

Dashang Group must adapt its marketing and product offerings to resonate with these varied demographics. Understanding the specific preferences and purchasing power of both older, affluent consumers and younger, digitally-native Gen Z is crucial for success.

Demand for Experience-Based Retail

The retail landscape is shifting, with consumers increasingly seeking engaging experiences over simple purchases. This means investments are flowing into creating immersive environments within physical stores. For instance, a significant portion of retail capital expenditure in 2024 is being directed towards store redesigns that emphasize atmosphere and interactivity.

Department stores are at the forefront of this transformation, re-imagining their spaces as destinations that offer more than just products. They are focusing on creating scenario-based transformations, turning shopping into an event. This trend is supported by data showing that experiential retail can drive a 10-15% increase in customer dwell time.

Dashang Group's strategic emphasis on elevating customer service and bolstering its physical store network directly addresses this growing demand. By prioritizing compelling in-store experiences, the group aims to capture a larger share of consumer spending in a competitive market. Reports indicate that retailers offering strong experiential elements saw revenue growth of up to 8% in the past year compared to those with traditional models.

- Shift to Experiential Retail: Consumers now value engaging store environments, leading to increased investment in creating memorable shopping experiences.

- Department Store Evolution: Traditional department stores are transforming into immersive hubs, offering more than just transactions.

- Dashang Group's Strategy: The group's focus on enhanced customer service and physical store improvements aligns with this consumer preference for experiences.

- Market Impact: Retailers prioritizing experiential elements are showing stronger revenue growth, with some seeing up to an 8% increase.

Increasing Health and Wellness Consciousness

A growing emphasis on health and wellness is reshaping consumer behavior in China, with a significant portion of consumers intending to increase spending on health-related products and experiences in 2025. This trend is not confined to specific sectors but is influencing choices across dining, entertainment, and even cosmetics.

For Dashang Group, this presents a clear opportunity to align its business strategy with evolving consumer priorities. By expanding its product lines and services to cater to this heightened health consciousness, the company can tap into a growing market segment. For instance, promoting organic food options, fitness-related merchandise, or wellness-focused beauty products could resonate strongly with consumers.

Data from early 2025 surveys indicate that over 60% of urban Chinese consumers are prioritizing health and well-being in their purchasing decisions, with a notable increase in spending on preventative healthcare and healthy lifestyle products. This suggests a sustained shift in consumer values.

- Increased Spending Intent: A majority of Chinese consumers plan to allocate more budget towards health and wellness in 2025.

- Cross-Sector Impact: The wellness trend is influencing purchasing decisions in dining, entertainment, and cosmetics.

- Market Opportunity: Dashang Group can leverage this by expanding offerings in health-conscious categories.

- Consumer Prioritization: Over 60% of urban Chinese consumers in early 2025 identified health and well-being as a top priority.

Chinese consumers are increasingly valuing authenticity and cultural relevance, with a 2024 survey showing 65% of urban consumers actively seeking products reflecting Chinese culture. This national pride is driving demand for domestic brands, with retailers integrating cultural themes reporting up to a 20% sales increase in 2023. Dashang Group can leverage this by spotlighting local brands to enhance customer loyalty.

The demographic landscape is shifting, with affluent seniors representing a growing market segment with disposable income in 2024. Concurrently, urban Gen Z and consumers in Tier 3 cities show a more optimistic spending outlook for 2024 and 2025, despite broader youth unemployment challenges. Tailoring marketing and product assortments to these distinct groups is vital for Dashang Group's engagement strategy.

Experiential retail is gaining traction, with capital expenditure in 2024 heavily directed towards creating immersive store environments, boosting customer dwell time by 10-15%. Department stores are transforming into destinations, and retailers with strong experiential elements saw up to an 8% revenue growth in the past year. Dashang Group's investment in customer service and physical store improvements directly addresses this trend.

Health and wellness are paramount, with over 60% of urban Chinese consumers in early 2025 prioritizing well-being in purchasing decisions, increasing spending on healthy lifestyles. This trend spans dining, entertainment, and cosmetics, presenting Dashang Group with an opportunity to expand into health-conscious categories. This focus on preventative healthcare and lifestyle products indicates a sustained shift in consumer values.

Technological factors

Dashang Group's focus on integrating its online platforms with its physical stores is a direct response to the growing omnichannel retail trend in China, aiming to provide a more cohesive customer experience. This strategy is crucial as Chinese consumers increasingly expect seamless transitions between digital browsing and in-store purchasing.

The Chinese government actively supports this digital shift; for instance, the 'Implementation Plan for Retail Industry Innovation and Upgrade' encourages businesses to leverage technology for enhanced customer interaction and operational efficiency. This policy framework provides a favorable environment for companies like Dashang Group to invest in digital transformation, with the retail sector's digital sales in China projected to reach significant growth by 2025, driven by such initiatives.

The retail industry is rapidly integrating artificial intelligence (AI) and big data to create more personalized customer journeys. In 2024, AI adoption in retail is projected to reach 60% for tasks like product recommendations and customer service, significantly enhancing engagement.

Dashang Group can harness big data analytics to gain deep insights into evolving consumer preferences, enabling them to refine product assortments and inventory levels. This data-driven approach is crucial for optimizing marketing campaigns and streamlining operational efficiency in a competitive landscape.

The global e-commerce market is projected to reach $7.4 trillion by 2025, a significant increase from previous years, with social commerce and live streaming sales playing an increasingly crucial role. In 2024, live streaming sales in China alone were estimated to exceed $100 billion, demonstrating its impact as a direct sales channel.

For Dashang Group, this burgeoning online sales trend necessitates a robust digital strategy. While the company has a strong physical presence, its ability to capture market share is directly tied to its capacity to either integrate with or effectively compete against these dominant online channels, including the growing influence of live streaming for product discovery and purchase.

Furthermore, traditional e-commerce platforms are experiencing a resurgence, driven by their vast product selections and established consumer trust. This means Dashang Group must also consider how its offerings stack up against the sheer breadth of products available online, and how to build similar levels of trust in its digital interactions.

Advancements in Payment Technologies

China's payment landscape is remarkably advanced, with digital wallets like Alipay and WeChat Pay dominating transactions. This cashless economy offers consumers a seamless checkout experience, making mobile payments the norm. For Dashang Group, adapting to these preferences is crucial for maintaining customer satisfaction and operational efficiency.

By integrating diverse and up-to-date payment systems, Dashang Group can cater to the widespread adoption of mobile payment methods. This ensures convenience for shoppers and streamlines the purchasing process. In 2023, mobile payments accounted for over 80% of all retail transactions in China, highlighting the critical need for businesses to align with this trend.

- Dominance of Digital Wallets: Alipay and WeChat Pay are the primary payment methods, handling the vast majority of consumer spending.

- Frictionless Transactions: The ease of scanning QR codes for payments has become a standard expectation for Chinese consumers.

- Adaptation Imperative: Dashang Group must ensure its point-of-sale systems fully support these mobile payment solutions to avoid alienating customers.

- Enhanced Convenience: Offering preferred payment options directly translates to improved customer experience and potentially higher sales volumes.

Logistics and Supply Chain Automation

Dashang Group, while primarily a physical retailer, must acknowledge the paramount importance of logistics and supply chain automation in China's e-commerce driven market to maintain consumer satisfaction and sales momentum. Even for brick-and-mortar operations, investing in advanced supply chain technologies can significantly boost efficiency and cut operational expenses. This modernization is key to ensuring products are consistently available across Dashang's wide network of stores.

The Chinese logistics market is experiencing rapid technological advancement. For instance, by the end of 2023, investments in smart logistics infrastructure, including automated warehouses and AI-powered route optimization, reached an estimated ¥500 billion. This trend directly impacts retail efficiency. Dashang's ability to integrate similar technologies can lead to tangible benefits:

- Reduced Inventory Holding Costs: Automation can lead to a projected 15-20% reduction in inventory carrying costs through better demand forecasting and stock management.

- Faster Delivery Times: Implementing automated sorting and dispatch systems can cut order fulfillment times by up to 30%.

- Improved Product Availability: Real-time tracking and automated replenishment systems can increase on-shelf availability by an estimated 10-15%.

- Enhanced Consumer Experience: A more efficient supply chain directly translates to better product availability and potentially faster in-store pickup options, improving overall customer satisfaction.

Technological advancements are reshaping retail, with AI and big data becoming crucial for personalized customer experiences, projected to be used by 60% of retailers for tasks like recommendations in 2024. China's digital payment landscape, dominated by Alipay and WeChat Pay, necessitates seamless integration for businesses, as mobile payments accounted for over 80% of retail transactions in 2023. Furthermore, the logistics sector's technological leap, with ¥500 billion invested in smart infrastructure by end-2023, offers significant efficiency gains for retailers like Dashang Group.

| Technology Area | 2024/2025 Projection/Status | Impact on Dashang Group |

|---|---|---|

| AI & Big Data | 60% retail adoption for personalization (2024) | Enhanced customer insights, optimized marketing |

| Digital Payments | >80% mobile payment share (2023) | Need for seamless integration of Alipay/WeChat Pay |

| Logistics Automation | ¥500B smart infrastructure investment (end-2023) | Improved inventory management, faster fulfillment |

Legal factors

New consumer protection laws in China, effective July 2024, introduce significant changes that directly impact retailers like Dashang Group. These regulations aim to curb unfair practices such as manipulating sales data and discriminatory pricing, while mandating transparent return policies. For instance, the crackdown on deceptive sales tactics is a key focus, reflecting a broader government push for market integrity.

Dashang Group's adherence to these strengthened consumer rights is paramount. Failure to comply could lead to substantial penalties, potentially impacting financial performance and brand reputation. In 2023, consumer protection agencies across China reported a 15% increase in complaints related to online sales transparency, highlighting the evolving regulatory landscape and consumer expectations.

Dashang Group's expansion into digital channels requires careful navigation of China's robust data privacy and cybersecurity landscape. The Personal Information Protection Law (PIPL), effective November 1, 2021, imposes strict rules on how companies collect, process, and store personal data. Failure to comply can result in significant fines, with penalties potentially reaching up to 5% of annual turnover or RMB 50 million, as seen in enforcement actions against other tech firms.

As of early 2024, the PIPL continues to shape digital operations, demanding transparency and user consent for data handling. Dashang Group must ensure its data management practices align with these regulations to safeguard customer information and maintain trust. This includes clear policies on data collection, secure storage solutions, and protocols for data breach notification, which are critical for avoiding reputational damage and legal repercussions.

As a significant employer of 170,000 individuals, Dashang Group operates under China's comprehensive labor laws, which mandate fair wages, regulated working hours, and workplace safety standards. Compliance with these regulations is paramount for maintaining ethical business practices and avoiding costly legal challenges.

In 2024, China's Ministry of Human Resources and Social Security continued to emphasize enforcement of labor contracts and protection against unpaid wages, impacting large enterprises like Dashang. Failure to adhere to these labor protections can lead to substantial fines and reputational damage, underscoring the critical nature of these legal factors for the group's operations.

Anti-Monopoly and Fair Competition Laws

The Chinese government actively enforces anti-monopoly and fair competition laws, particularly within the retail industry. Dashang Group, given its significant market presence, must meticulously align its operations, including pricing, sales tactics, and growth strategies, with these regulations. This commitment is crucial to avoid accusations of monopolistic practices or unfair competition.

Recent enforcement actions highlight the government's vigilance. For instance, in 2023, China's State Administration for Market Regulation (SAMR) continued to investigate and penalize companies for anti-competitive behavior, with fines often reaching millions of dollars. Dashang Group needs to be particularly mindful of prohibitions against practices such as:

- Bundled sales that unfairly disadvantage competitors.

- Price discrimination leveraging big data to charge different prices to similar customers.

- Exclusive dealing arrangements that restrict market access for rivals.

Compliance ensures not only legal adherence but also fosters a healthier, more competitive market environment, which ultimately benefits consumers and the broader economy. Failure to comply can result in substantial financial penalties and reputational damage.

Property and Commercial Leasing Laws

Dashang Group's operations, particularly its commercial leasing activities, are governed by China's comprehensive property and commercial leasing laws. These regulations dictate the framework for lease agreements, ensuring clarity on tenant rights, landlord responsibilities, and property usage. Compliance is paramount to avoid legal disputes and maintain operational stability.

Key legal considerations include adherence to the Contract Law of the People's Republic of China and specific regulations on commercial property leasing. These laws cover aspects like lease registration, rent control where applicable, and dispute resolution mechanisms. For instance, the validity of lease terms and conditions, including renewal clauses and termination rights, are strictly defined by statute.

- Lease Agreement Compliance: Ensuring all lease contracts meet the statutory requirements of Chinese law, including clear terms on rent, duration, and responsibilities.

- Property Rights Protection: Upholding the property rights of both Dashang Group as the lessor and its commercial tenants, as stipulated by national property laws.

- Regulatory Adherence: Staying updated with evolving commercial leasing regulations, which can impact operational flexibility and tenant management strategies.

Dashang Group must navigate evolving consumer protection laws, effective July 2024, which mandate transparency and curb unfair sales practices, with penalties for non-compliance impacting financial performance. The Personal Information Protection Law (PIPL) continues to impose strict data handling rules, requiring clear consent and secure practices to avoid significant fines, potentially up to 5% of annual turnover. Furthermore, adherence to China's labor laws, including fair wages and safety standards, is critical, as evidenced by increased enforcement actions in 2024 against companies for labor contract violations. Anti-monopoly regulations also demand careful attention to pricing and market strategies to prevent penalties, with the State Administration for Market Regulation actively issuing fines for anti-competitive behavior.

Environmental factors

Consumers in China are increasingly prioritizing environmental sustainability, leading to a surge in demand for green and low-carbon products. This shift is evident in the growing market for organic goods and energy-efficient appliances. For instance, the market for sustainable packaging in China was projected to reach over $20 billion by 2025, indicating a strong consumer preference.

Government policies are actively reinforcing this trend. Initiatives such as the promotion of large-scale equipment renewal and trade-in programs directly encourage the adoption of more environmentally friendly technologies and products. These programs aim to boost domestic demand and drive industrial upgrades, aligning with national carbon reduction goals.

Dashang Group can effectively capitalize on this growing environmental consciousness by strategically integrating sustainable product lines into its offerings. Promoting eco-friendly choices and highlighting the environmental benefits of its merchandise will resonate with a significant and expanding consumer segment. This alignment not only meets current market demands but also positions the group for long-term growth in a more sustainable economy.

As environmental consciousness grows, Chinese retailers are increasingly embracing sustainability. For instance, the Dishang Group, a major player, has committed to achieving carbon and climate neutrality by 2050, surpassing national timelines. This ambitious goal encompasses reducing its impact across climate, resources, water usage, chemical substances, and upholding human rights.

Dashang Group can anticipate heightened expectations from consumers, investors, and regulators to implement robust sustainability strategies. This will involve actively working to shrink its carbon footprint and minimize chemical pollution throughout its operations, mirroring the proactive approach of its industry peers.

China's commitment to waste sorting and recycling is intensifying, with a national goal to have urban waste sorted by 2025. This regulatory push directly impacts retailers like Dashang Group, requiring them to enhance their waste management strategies across operations, from product packaging to in-store waste disposal.

Dashang Group has an opportunity to proactively address these evolving environmental regulations. Implementing comprehensive recycling programs and investigating sustainable, eco-friendly packaging alternatives can not only ensure compliance but also potentially reduce operational costs and improve brand image. For instance, by 2023, China's recycling rate for municipal solid waste had reached approximately 42%, indicating a growing infrastructure and consumer awareness that Dashang can leverage.

Energy Consumption and Efficiency in Operations

China's commitment to energy efficiency and renewables significantly impacts the retail sector, including Dashang Group. As the nation targets carbon neutrality, companies like Dashang face increasing pressure to manage their energy consumption.

Dashang Group, operating a vast retail network, has a prime opportunity to enhance its sustainability and reduce operational costs by adopting energy-efficient solutions. This includes upgrading lighting, HVAC systems, and exploring renewable energy sources for its stores and facilities.

- 2023 saw Chinese industrial energy intensity decrease by 2.7% compared to 2022, reflecting a national drive for efficiency.

- The retail sector accounts for a substantial portion of commercial building energy use, making efficiency upgrades critical for companies like Dashang.

- Investments in LED lighting can reduce electricity consumption for retail lighting by up to 80%.

- Dashang Group's large physical footprint presents a significant area for potential energy savings through technological adoption.

Consumer Demand for Eco-friendly Products

Chinese consumers are increasingly prioritizing value and sustainability, with a noticeable shift towards eco-friendly products and packaging. This growing demand is particularly evident in sectors like fashion, where sustainable choices are becoming a key purchasing driver.

For Dashang Group, this translates into a strategic imperative to embed sustainable sourcing practices and actively promote environmentally responsible merchandise. By aligning with these evolving consumer expectations, Dashang Group can not only meet market demand but also bolster its brand image and long-term competitiveness.

Data from 2024 indicates a significant uptick in consumer interest for green products. For example, a survey by China Dialogue in early 2024 found that over 60% of urban Chinese consumers are willing to pay a premium for sustainable goods. This trend is further supported by the projected growth of China's sustainable fashion market, which is expected to reach over $30 billion by 2025, according to industry analysts.

- Growing Consumer Preference: 60%+ of urban Chinese consumers are willing to pay more for sustainable products as of early 2024.

- Market Expansion: China's sustainable fashion market is projected to exceed $30 billion by 2025.

- Brand Image Enhancement: Integrating eco-friendly practices can improve Dashang Group's reputation.

- Meeting Evolving Expectations: Adapting to consumer demand for sustainability is crucial for market relevance.

Chinese consumers are increasingly prioritizing sustainability, with over 60% of urban consumers willing to pay a premium for eco-friendly products as of early 2024. This trend is driving demand for green goods and energy-efficient appliances, with the sustainable packaging market in China projected to exceed $20 billion by 2025. Dashang Group can leverage this by integrating sustainable product lines and promoting their environmental benefits to capture this growing market segment.

| Environmental Factor | Impact on Dashang Group | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Consumer Demand for Sustainability | Increased demand for eco-friendly products and packaging. | 60%+ urban Chinese consumers willing to pay premium for sustainable goods (early 2024). Sustainable packaging market projected to reach over $20 billion by 2025. |

| Government Regulations & Initiatives | Support for green technologies, waste sorting, and carbon reduction goals. | National goal for urban waste sorting by 2025. China's recycling rate for municipal solid waste reached ~42% by 2023. |

| Energy Efficiency & Renewables | Pressure to reduce energy consumption and adopt efficient solutions. | Industrial energy intensity decreased by 2.7% in 2023. Investments in LED lighting can reduce retail lighting electricity consumption by up to 80%. |

| Corporate Sustainability Commitments | Expectations for reduced carbon footprint and minimized pollution. | Dashang Group committed to carbon neutrality by 2050. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Dashang Group is built on a robust foundation of data from official government publications, reputable economic forecasting agencies, and leading industry-specific market research reports. This ensures that each factor, from political stability to technological advancements, is supported by credible and current information.