Dart Container Corp. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dart Container Corp. Bundle

Dart Container Corp. faces a complex competitive landscape shaped by intense rivalry, moderate buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating the disposable packaging industry.

The complete report reveals the real forces shaping Dart Container Corp.’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dart Container Corp. relies heavily on commodity-based raw materials like plastic resins, paperboard, and foam chemicals. The prices of these materials are directly tied to the volatile global markets for crude oil and petrochemicals. For instance, in 2023, plastic raw materials averaged approximately USD 1,200 per ton, while paper materials were around USD 700 per ton, showcasing significant price points that suppliers can influence.

When demand for these commodities surges or production capacity tightens, suppliers gain considerable leverage. This can lead to increased costs for Dart, impacting their profitability. While Dart's substantial size might provide some negotiation strength, the overarching global market conditions for these essential inputs remain a critical factor in supplier power.

While common resins are readily available, Dart Container Corp. might face suppliers with significant leverage when sourcing specialized additives, coatings, or cutting-edge biodegradable materials. This limited supplier base for niche components can empower those suppliers, particularly if Dart needs materials with very specific performance attributes or needs to meet stringent sustainability standards that narrow its procurement choices.

The burgeoning market for biodegradable plastics, projected for substantial growth in the coming years, suggests that suppliers of these advanced materials will likely command increased bargaining power. For example, reports from market research firms in late 2024 and early 2025 indicate a compound annual growth rate exceeding 8% for the bioplastics market, underscoring the potential for these specialized suppliers to influence pricing and terms.

Suppliers' costs, particularly those of raw materials and transportation, are significantly impacted by fluctuating energy prices. For instance, the average price of West Texas Intermediate (WTI) crude oil, a key benchmark for energy costs, saw considerable volatility in 2024, with prices ranging from approximately $70 to over $90 per barrel at various points. This directly translates to higher manufacturing and shipping expenses for suppliers to Dart Container Corp.

As these energy-related costs increase, suppliers are likely to pass these higher expenses onto Dart, thereby inflating its cost of goods sold. This dynamic puts pressure on Dart's profit margins if it cannot effectively absorb or pass on these increased costs to its own customers.

Consequently, the efficiency of Dart's logistics and overall supply chain management becomes paramount. By optimizing transportation routes, consolidating shipments, and exploring more energy-efficient logistics solutions, Dart can better mitigate the external cost pressures exerted by suppliers whose own costs are driven by energy prices.

Supplier Switching Costs

Supplier switching costs can significantly impact Dart Container Corp.'s bargaining power. For instance, if Dart needs to switch suppliers for a critical raw material like polystyrene, the costs associated with re-tooling its manufacturing equipment and conducting rigorous quality assurance testing on new materials can be substantial. These expenses act as a deterrent to changing suppliers, giving existing suppliers more leverage.

These switching costs can include not only direct financial outlays but also the time and resources spent on vendor qualification and integration. For the packaging industry, where supply chain stability is paramount, these barriers are particularly important. Dart's reliance on specialized components or materials can further amplify these costs, making it more challenging to shift to alternative suppliers quickly.

- High Re-tooling Expenses: Switching suppliers for key manufacturing components can necessitate significant investment in modifying or replacing existing machinery, impacting operational efficiency and upfront costs for Dart.

- Quality Assurance and Certification Hurdles: New suppliers require thorough vetting, including extensive testing and potential re-certification processes, adding time and expense before production can resume at full capacity.

- Strategic Contractual Agreements: Dart often employs long-term contracts and strategic partnerships to secure stable supply chains and mitigate the risks associated with supplier switching, thereby solidifying relationships with incumbent suppliers.

- Industry-Wide Supply Chain Volatility: The packaging sector frequently faces disruptions, making the stability offered by established supplier relationships, even with higher switching costs, a crucial factor in maintaining consistent production for Dart.

Vertical Integration Potential

The potential for suppliers to integrate forward into packaging manufacturing is relatively low for Dart Container Corp. This is primarily due to the significant capital investment and specialized knowledge required to operate in Dart's manufacturing space. For instance, the advanced machinery and proprietary processes used in producing expanded polystyrene (EPS) foam products represent a substantial barrier to entry.

Dart's own capacity for backward integration into raw material production, such as styrene monomer, is also constrained. The sheer scale and technical expertise involved in petrochemical production are beyond the typical scope for a packaging company. In 2024, global styrene prices experienced volatility, averaging around $1,200-$1,500 per metric ton, highlighting the complexity and cost of this upstream market.

The broader packaging sector, however, contends with sourcing challenges and supply chain vulnerabilities. These disruptions can impact Dart's ability to introduce new products and can indirectly bolster the bargaining power of its raw material suppliers. For example, disruptions in the petrochemical supply chain in early 2024 led to temporary price spikes for key inputs, impacting manufacturers across the board.

- Limited Supplier Forward Integration: High capital and technical barriers deter suppliers from entering Dart's specialized packaging manufacturing.

- Dart's Backward Integration Constraints: The scale and expertise needed for raw material production, like styrene, make backward integration difficult for Dart.

- Industry Supply Chain Risks: Packaging firms face material sourcing issues and disruptions, influencing supplier leverage and product launch feasibility.

- 2024 Market Data: Styrene prices in 2024 ranged from $1,200-$1,500/metric ton, reflecting upstream market complexity.

The bargaining power of suppliers to Dart Container Corp. is influenced by the availability of raw materials and the costs associated with switching suppliers. For instance, in 2024, the price of plastic resins, a key input for Dart, saw fluctuations tied to global petrochemical markets, with average prices for some commodity resins hovering around $1,300 per ton. These price points are significantly impacted by energy costs, with crude oil prices in 2024 ranging from $70 to over $90 per barrel.

High switching costs, including re-tooling expenses and rigorous quality assurance for new materials, further empower incumbent suppliers. Dart's reliance on specialized components or materials with specific performance attributes also narrows its supplier options, particularly for emerging biodegradable plastics, which experienced an estimated 8% compound annual growth rate in late 2024 and early 2025. This limited supplier base for niche inputs grants these suppliers increased leverage.

| Factor | Impact on Dart | Supporting Data (2024/Early 2025) |

| Raw Material Price Volatility | Increases cost of goods sold | Plastic resins: ~$1,300/ton; Crude oil: $70-$90/barrel |

| Supplier Switching Costs | Reduces Dart's negotiation leverage | Significant re-tooling and quality assurance expenses |

| Niche Material Demand | Empowers specialized suppliers | Biodegradable plastics CAGR: ~8% |

| Energy Cost Pass-Through | Pressures Dart's profit margins | Directly linked to fluctuating oil prices |

What is included in the product

This analysis reveals the competitive forces impacting Dart Container Corp., including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the disposable packaging industry.

Easily identify and mitigate competitive threats from rivals, new entrants, substitute products, buyer power, and supplier power.

Customers Bargaining Power

Dart Container Corp.'s key customers, such as major restaurant chains, hospital systems, and educational institutions, frequently buy packaging in massive quantities. This significant volume grants them considerable leverage to negotiate for lower prices, better payment schedules, and tailored product offerings.

For instance, large fast-food chains might account for a substantial percentage of Dart's sales, giving them a strong voice in pricing discussions. The concentration of such major clients means their purchasing decisions can significantly impact Dart's overall revenue and profit margins, underscoring the intense bargaining power derived from volume-based purchasing.

For standard, commodity-like single-use packaging products, customers often face relatively low switching costs. This means if a competitor offers a slightly better price or service, customers can easily shift their orders. For instance, in 2024, the foodservice packaging market saw intense competition, with many suppliers offering similar polystyrene foam cups, a core Dart product, leading to price sensitivity among buyers.

The foodservice industry, Dart Container's core market, exhibits significant price sensitivity. This means businesses like restaurants and catering services are very focused on the cost of essential items, including packaging.

In 2024, the average restaurant's cost of goods sold (COGS) remained a critical metric, with packaging often representing a notable portion of this expense. Any fluctuations in packaging prices directly impact a foodservice operator's profitability, driving them to seek the most economical options available.

This sensitivity translates into strong bargaining power for Dart's customers. They can readily switch suppliers or negotiate harder on price if they perceive better value elsewhere, putting pressure on Dart's pricing strategies and profit margins.

Customer Demand for Sustainable Options

Customer demand for sustainable options is a significant factor influencing Dart Container Corp. As consumer and regulatory pressure mounts for environmentally responsible practices, customers are increasingly seeking out eco-friendly packaging. This shift is substantial, with data from 2024 indicating that 67% of consumers consider sustainability when making purchasing decisions for packaged goods. This heightened awareness directly translates into a stronger bargaining position for Dart's customers, who can leverage this trend to demand innovative solutions like compostable, recyclable, or recycled-content packaging.

This growing preference for sustainability empowers Dart's customers to negotiate terms that favor the adoption of greener materials. They can effectively push Dart to invest in research and development for more environmentally sound packaging alternatives. For instance, a customer might prioritize suppliers who can offer packaging with a higher percentage of post-consumer recycled content, a trend that gained further traction throughout 2024 as supply chains adapted to increased demand for recycled materials.

- Consumer Preference: 67% of consumers consider sustainability in purchasing decisions (2024 data).

- Regulatory Pressure: Increasing mandates for reduced environmental impact drive demand for eco-friendly packaging.

- Customer Leverage: Demand for compostable, recyclable, and recycled-content packaging strengthens customer bargaining power.

- Supplier Investment: Customers can compel Dart to invest in and develop sustainable packaging solutions.

Availability of Alternative Packaging Suppliers

The availability of alternative packaging suppliers significantly bolsters customer bargaining power in the food and beverage sector. Companies like Pactiv Evergreen, Huhtamaki, and Genpak compete fiercely, offering customers a wide array of choices for their single-use packaging needs. This competitive landscape means customers can easily switch suppliers if Dart Container Corp. doesn't meet their price or quality expectations.

In 2024, the packaging industry continued to see robust competition, with many regional and national manufacturers vying for market share. This fragmentation means that buyers, from large restaurant chains to smaller food producers, have numerous options at their disposal. Consequently, Dart must focus on delivering exceptional value, including competitive pricing and innovative product solutions, to maintain customer loyalty and attract new business.

- Competitive Market: The single-use food and beverage packaging market features numerous regional and national players, such as Pactiv Evergreen, Huhtamaki, and Genpak.

- Customer Choice: Customers possess multiple sourcing options for their packaging requirements, enhancing their negotiation leverage.

- Dart's Imperative: Dart Container Corp. must prioritize continuous innovation and superior value delivery to retain and attract customers in this fragmented market.

Dart Container Corp.'s customers possess significant bargaining power due to their substantial purchasing volumes and the availability of numerous alternative suppliers in the competitive foodservice packaging market. This leverage is amplified by customer price sensitivity and a growing demand for sustainable packaging solutions, compelling Dart to offer competitive pricing and innovative products to retain market share.

| Factor | Impact on Dart | Customer Leverage | 2024 Data/Example |

| Purchasing Volume | High dependence on large accounts | Negotiate lower prices, better terms | Major restaurant chains account for significant sales percentages. |

| Availability of Alternatives | Increased competition | Easily switch suppliers if dissatisfied | Competitors like Pactiv Evergreen, Huhtamaki offer similar products. |

| Price Sensitivity | Pressure on profit margins | Demand most economical options | Packaging is a notable component of restaurant Cost of Goods Sold (COGS). |

| Sustainability Demand | Need for R&D investment | Push for eco-friendly materials | 67% of consumers consider sustainability in purchases. |

Preview the Actual Deliverable

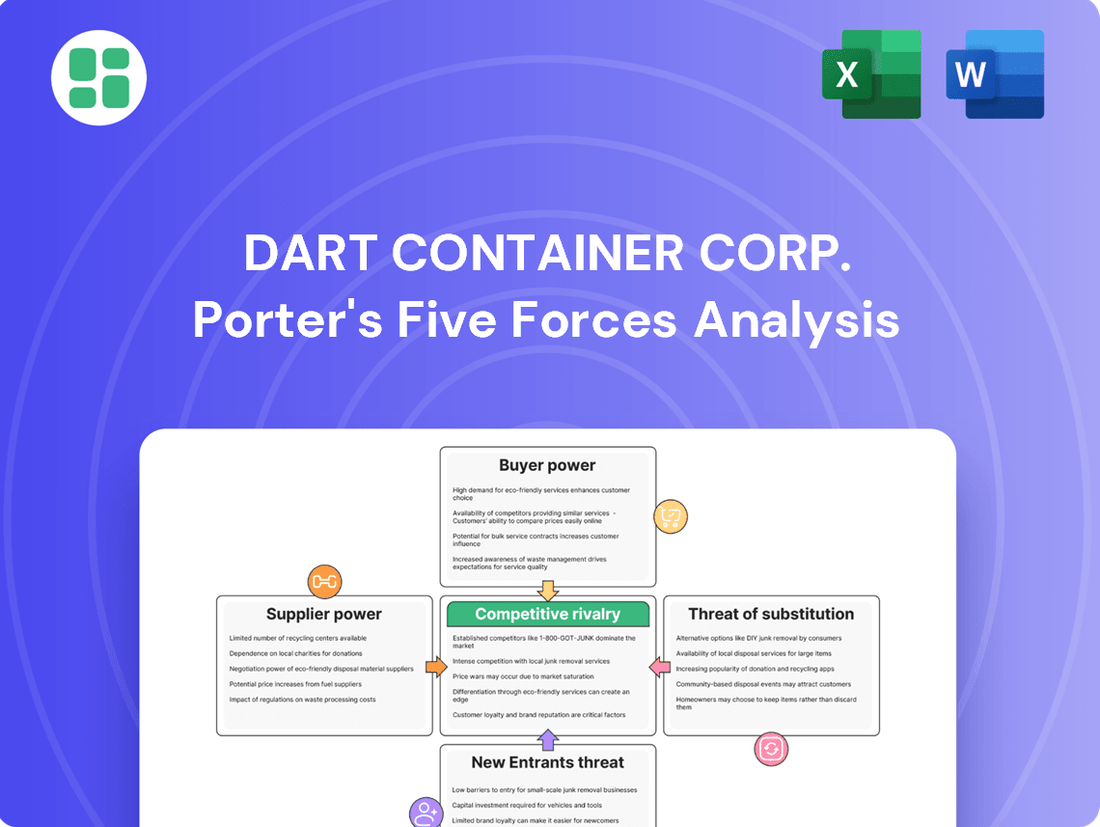

Dart Container Corp. Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis of Dart Container Corp., providing an in-depth examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The single-use food and beverage packaging sector is crowded, featuring many companies from global giants to niche regional players. This means Dart Container Corp. faces stiff competition from established names like Pactiv Evergreen, Huhtamaki, and Amcor. This crowded landscape naturally drives down prices and prevents any one firm from easily seizing market leadership.

Dart Container Corp. faces intense competitive rivalry, particularly due to product commoditization. Many of its foundational products, like basic foam cups and plastic food containers, are so similar across manufacturers that price becomes the primary deciding factor for buyers. This lack of unique features means companies must compete aggressively on cost.

This commoditization inherently squeezes profit margins, forcing Dart to maintain highly efficient manufacturing operations and a streamlined supply chain to stay competitive. For instance, in the broader disposable tableware market, which saw significant demand surges in 2024 due to increased foodservice activity post-pandemic, companies like Dart are pressured to keep production costs low to avoid losing market share to lower-priced alternatives.

To counter this, innovation in materials, such as developing more sustainable or durable alternatives, and in product design becomes a crucial differentiator. Companies that can offer slightly improved functionality or a better environmental profile can command a premium, even within a largely commoditized market.

The production of packaging, like that done by Dart Container Corp., demands substantial upfront investment in factories, machinery, and logistics. This capital intensity results in high fixed costs, pushing companies to run at maximum capacity to spread these expenses and gain efficiency. For instance, in 2024, the packaging industry continued to see significant capital expenditures as companies upgraded to more automated and sustainable production lines.

When the industry experiences overcapacity, it often leads to intense price competition. Companies are pressured to lower prices to keep their production lines running and cover their fixed costs, which can significantly impact profitability for all players. This dynamic was particularly evident in certain segments of the rigid plastic packaging market in early 2024, where a surge in new capacity coincided with a slight slowdown in consumer demand.

Slow Market Growth in Mature Segments

The U.S. foodservice packaging market is expected to see a CAGR of 2.62% between 2024 and 2029. This indicates a mature market with relatively slow expansion in its traditional segments.

In such an environment, competition tends to heat up as companies fight for existing market share. This often leads to aggressive strategies like price wars.

- Mature Market Dynamics: The U.S. foodservice packaging market's projected 2.62% CAGR from 2024-2029 signals a mature industry.

- Intensified Rivalry: Slow growth in established segments forces companies to compete more aggressively for market share.

- Pricing as a Weapon: Companies may engage in price reductions to attract customers and gain an advantage over competitors.

Brand Loyalty and Service Differentiation

Even when products become similar, companies like Dart Container Corp. can stand out through their brand name, dependability, and how they treat their customers. Offering a wide range of products also plays a big role. For instance, Dart's commitment to eco-friendly options, like their certified home compostable molded fiber and recyclable polypropylene items, strengthens their market position.

Building strong customer relationships through reliable distribution and quick support makes it tough for rivals to win over customers based on price alone. This customer loyalty is a significant barrier. In 2023, Dart reported a strong market presence, with their sustainability initiatives being a key driver of customer preference in a growing segment of the packaging market.

- Brand Reputation: Dart's established name builds trust, reducing customer price sensitivity.

- Service Differentiation: Superior customer service and reliable delivery foster loyalty.

- Product Breadth: A comprehensive product line caters to diverse customer needs, increasing stickiness.

- Sustainability Focus: Investments in eco-friendly packaging, like compostable and recyclable materials, attract environmentally conscious buyers and create a competitive edge.

The competitive rivalry within the foodservice packaging sector is intense, driven by a high number of players and the commoditized nature of many core products. This means companies like Dart Container Corp. must constantly focus on cost efficiency and differentiation to maintain their market standing.

The U.S. foodservice packaging market is projected for a 2.62% CAGR between 2024 and 2029, indicating a mature landscape where companies fight fiercely for existing market share, often leading to price-based competition.

Dart Container Corp. leverages brand reputation, a broad product portfolio, and a strong focus on customer service and sustainability to stand out. For instance, their commitment to eco-friendly options, such as compostable and recyclable materials, was a significant factor in customer preference in 2023.

| Metric | Dart Container Corp. Competitive Factor | Impact on Rivalry |

| Market Growth (2024-2029 CAGR) | 2.62% (U.S. Foodservice Packaging) | Intensifies rivalry as companies battle for limited growth. |

| Product Nature | High degree of commoditization for basic items | Price becomes a primary competitive lever. |

| Brand & Service | Strong brand recognition and customer loyalty | Creates a barrier to entry and reduces price sensitivity. |

| Sustainability Initiatives | Investment in eco-friendly packaging | Offers a key differentiator and attracts environmentally conscious buyers. |

SSubstitutes Threaten

The rise of reusable packaging, fueled by growing environmental awareness and stricter regulations, presents a significant threat to Dart Container Corp. For instance, a 2024 survey indicated that 65% of consumers are more likely to choose businesses that offer sustainable packaging options, including reusables. This directly impacts the demand for single-use products like those Dart primarily manufactures.

Many coffee shops and universities are actively implementing reusable cup programs or transitioning to durable dishware, thereby reducing reliance on disposable containers. This shift is not just a consumer preference but is increasingly being mandated; by early 2025, several major cities are expected to have bans or significant fees on single-use plastics, further accelerating the adoption of reusable alternatives.

To counter this trend, Dart Container Corp. must consider substantial investments in circular economy models or explore innovative alternative materials. Failure to adapt could lead to a substantial erosion of market share as consumers and businesses increasingly opt for more sustainable, albeit sometimes less convenient, packaging solutions.

The increasing availability and adoption of compostable and biodegradable packaging, often derived from plant-based materials like PLA and bagasse, present a significant substitution threat to Dart Container Corp.'s traditional foam and plastic offerings. As these eco-friendly options become more affordable and accessible, consumer demand is shifting, compelling Dart to re-evaluate its product strategy.

The global market for sustainable packaging is experiencing robust growth, with projections indicating continued expansion. For instance, the sustainable packaging market was valued at approximately USD 273.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 6.5% from 2024 to 2030. This trend underscores the competitive pressure Dart faces from these emerging alternatives.

Growing consumer awareness about plastic pollution is a significant threat. Surveys in 2024 showed that over 60% of consumers actively seek out eco-friendly packaging options, directly impacting demand for single-use plastics.

This shift means businesses are increasingly exploring alternatives, like reusable containers or compostable materials. For instance, many major food service chains have announced plans to phase out single-use plastics by 2025, a trend that will likely accelerate.

Alternative Food Service Models

Changes in how food is served, like a resurgence in dine-in experiences or a push for zero-waste practices, could lessen the demand for disposable packaging. These shifts, while not direct product replacements, can indirectly shrink the market for Dart's main products.

For instance, the National Restaurant Association reported a 10% increase in dine-in traffic in early 2024 compared to the previous year, indicating a potential slowdown in takeout volume. Companies actively promoting reusable systems or package-free options also present an indirect threat by altering consumer behavior and expectations around disposables.

- Shifting Dining Habits: Increased dine-in service reduces reliance on takeout packaging.

- Zero-Waste Initiatives: Growing consumer and corporate focus on sustainability can favor reusable over disposable options.

- Indirect Market Erosion: Systemic changes in food consumption patterns can indirectly impact demand for single-use containers.

- Industry Adaptation: Dart Container must monitor and respond to evolving service models and consumer preferences.

Regulatory Bans and Taxes on Specific Materials

Governments are increasingly enacting bans and taxes on single-use plastics and foam packaging, directly impacting customer choices. For instance, by 2024, many regions have implemented or are planning stricter regulations on polystyrene foam, forcing businesses to seek alternatives. This trend significantly amplifies the threat of substitutes, as consumers and businesses are compelled to explore paper, compostable, or reusable packaging options.

Dart Container Corp. must navigate this evolving regulatory environment by innovating and adapting its product offerings. The company's commitment to developing sustainable packaging solutions, such as their recognized compostable and recyclable materials, is crucial in mitigating this substitution threat. Failure to align with these regulations could lead to a substantial shift in market demand away from their traditional products.

- Increased regulatory scrutiny on single-use plastics and foam.

- Growing consumer demand for environmentally friendly packaging alternatives.

- Dart's strategic imperative to develop and promote compliant, sustainable products.

- Potential for significant market share erosion if substitution threats are not addressed proactively.

The threat of substitutes for Dart Container Corp. is substantial, driven by the growing availability and consumer preference for reusable and eco-friendly packaging. For example, a 2024 survey revealed that 65% of consumers are more inclined to patronize businesses offering sustainable packaging, including reusables, directly challenging Dart's single-use product dominance.

Many businesses, such as coffee shops and universities, are actively adopting reusable cup programs and durable dishware, reducing their dependence on disposable containers. By early 2025, several major cities are expected to implement bans or significant fees on single-use plastics, further accelerating this shift towards reusable alternatives.

Compostable and biodegradable packaging materials, derived from sources like PLA and bagasse, also pose a significant substitution threat to Dart's traditional foam and plastic offerings. As these eco-friendly options become more accessible and cost-effective, consumer demand is steering towards them, compelling Dart to reconsider its product strategy.

The global sustainable packaging market is experiencing robust growth, projected to expand significantly. Valued at approximately USD 273.5 billion in 2023, this market is anticipated to grow at a CAGR of around 6.5% from 2024 to 2030, highlighting the competitive pressure Dart faces from these emerging alternatives.

| Substitute Type | Key Drivers | Impact on Dart | Market Trend (2024-2025) |

|---|---|---|---|

| Reusable Packaging | Environmental awareness, regulatory pressure, cost savings for businesses | Reduced demand for single-use products | Increasing adoption by major chains and institutions |

| Compostable/Biodegradable Packaging | Consumer demand for eco-friendly options, corporate sustainability goals | Direct competition with existing product lines | Growing market share, increasing affordability |

| Paper-based Packaging | Perceived environmental friendliness, recyclability | Alternative to plastic and foam | Steady growth, especially in food service |

Entrants Threaten

The threat of new entrants for Dart Container Corp. is significantly mitigated by the high capital investment required to enter the food and beverage packaging manufacturing sector. Establishing a competitive presence necessitates substantial outlays for advanced machinery, dedicated production lines, and robust distribution networks. For instance, setting up a state-of-the-art injection molding facility, common in plastic packaging production, can easily run into tens of millions of dollars.

This considerable financial hurdle acts as a strong deterrent, preventing many potential competitors from even attempting to enter the market. Newcomers would struggle to achieve the economies of scale that established players like Dart have already leveraged, making it difficult to compete on price or efficiency. In 2024, the global food packaging market was valued at over $300 billion, with significant investment needed to capture even a small market share.

Established distribution networks are a significant hurdle for new entrants aiming to compete with companies like Dart Container Corp. Dart has cultivated deep, long-standing relationships with a vast range of foodservice clients over many years. Replicating this extensive reach and the trust associated with it presents a formidable challenge for any newcomer.

These established channels are not easily bypassed. Newcomers would struggle to match the reliability and widespread availability that Dart's existing infrastructure provides to its customers. Customer loyalty, often cemented by long-term contracts, further reinforces this barrier to entry, making it difficult for new players to gain traction.

Existing players in the disposable food service packaging industry, like Dart Container Corp., benefit from substantial economies of scale. This advantage is particularly pronounced in the purchasing of raw materials, such as polystyrene and paper, where larger volumes lead to lower per-unit costs. In 2024, the global disposable tableware market was valued at approximately $25 billion, with significant consolidation among major players contributing to their scale advantages.

Manufacturing efficiency is another area where scale plays a critical role. Companies with high-volume production lines can spread fixed costs over a larger output, leading to lower per-unit production expenses. Dart, as a leading producer, likely operates highly optimized and automated facilities that are difficult for smaller, newer entrants to replicate without a massive initial capital outlay. This efficiency is crucial in a market where cost competitiveness is paramount.

The ability to manage waste effectively also contributes to economies of scale. Larger operations can invest in more sophisticated waste reduction and recycling technologies, further lowering their overall cost structure. For new entrants, achieving comparable cost efficiencies would require a substantial initial investment to build production capacity and infrastructure that rivals established, scaled competitors, posing a significant barrier to entry.

Regulatory Hurdles and Compliance Costs

The packaging industry faces significant regulatory challenges, especially concerning food contact materials. New companies must invest heavily in understanding and complying with these health, safety, and environmental standards, which often include rigorous certification processes. This adds substantial upfront costs and delays market entry, acting as a considerable barrier.

For instance, the U.S. Food and Drug Administration (FDA) has strict regulations for food packaging. In 2024, compliance with these evolving standards, alongside increasing state-level bans on certain single-use plastics, requires significant capital expenditure for new entrants. These regulatory complexities mean that companies like Dart Container Corp. benefit from established compliance infrastructure and expertise.

- Complex Compliance: Navigating FDA and other agency regulations for food contact materials is time-consuming and costly.

- Certification Investment: Obtaining necessary certifications for safety and environmental standards requires substantial financial outlay.

- Evolving Sustainability Rules: Adapting to new regulations on plastic use and recyclability adds ongoing compliance burdens.

- Market Entry Delays: The time and resources needed for regulatory approval can significantly slow down new competitors.

Brand Recognition and Customer Trust

While many products in the disposable tableware and packaging sector might seem like commodities, established players like Dart Container Corp. have cultivated significant brand recognition and customer trust through decades of consistent quality, reliability, and service. For instance, Dart's commitment to product innovation, such as their advancements in sustainable foam products, has solidified their market position.

New entrants face a considerable hurdle in replicating this established reputation. Without a proven track record, they struggle to gain the confidence of large-scale buyers, making it more challenging to secure initial contracts and build the necessary market share to compete effectively. This intangible asset of brand equity is a powerful barrier, as customers often prioritize known quantities for critical supply chain needs.

- Brand Loyalty: Dart's long-standing presence has fostered deep customer loyalty, making it difficult for newcomers to sway established relationships.

- Perceived Quality: Years of consistent product performance have built a perception of superior quality, a key differentiator in a competitive market.

- Service Reputation: Dart's reputation for reliable delivery and responsive customer service acts as a significant deterrent to potential new entrants.

The threat of new entrants for Dart Container Corp. is significantly low due to substantial capital requirements and established economies of scale. Building production facilities and distribution networks comparable to Dart's would demand tens of millions of dollars, a prohibitive cost for most newcomers. Furthermore, the global disposable tableware market, valued at approximately $25 billion in 2024, is dominated by a few large players who benefit from lower per-unit costs due to high-volume purchasing and manufacturing.

Regulatory hurdles also act as a strong deterrent. New entrants must navigate complex compliance with food contact material standards, such as those set by the FDA, which require significant investment in certifications and can lead to market entry delays. The evolving landscape of sustainability regulations, including bans on certain single-use plastics, adds further complexity and cost, favoring established companies with existing compliance infrastructure.

Brand loyalty and established customer relationships present another formidable barrier. Dart has cultivated trust and a reputation for quality over decades, making it difficult for new companies to secure initial contracts with large buyers. Replicating Dart's extensive reach and the perceived quality associated with its products requires a significant investment in marketing and building a proven track record, which new entrants often lack.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dart Container Corp. is built upon a foundation of comprehensive data, including publicly available financial statements, industry-specific market research reports from firms like IBISWorld, and trade publications that track trends in the packaging sector.