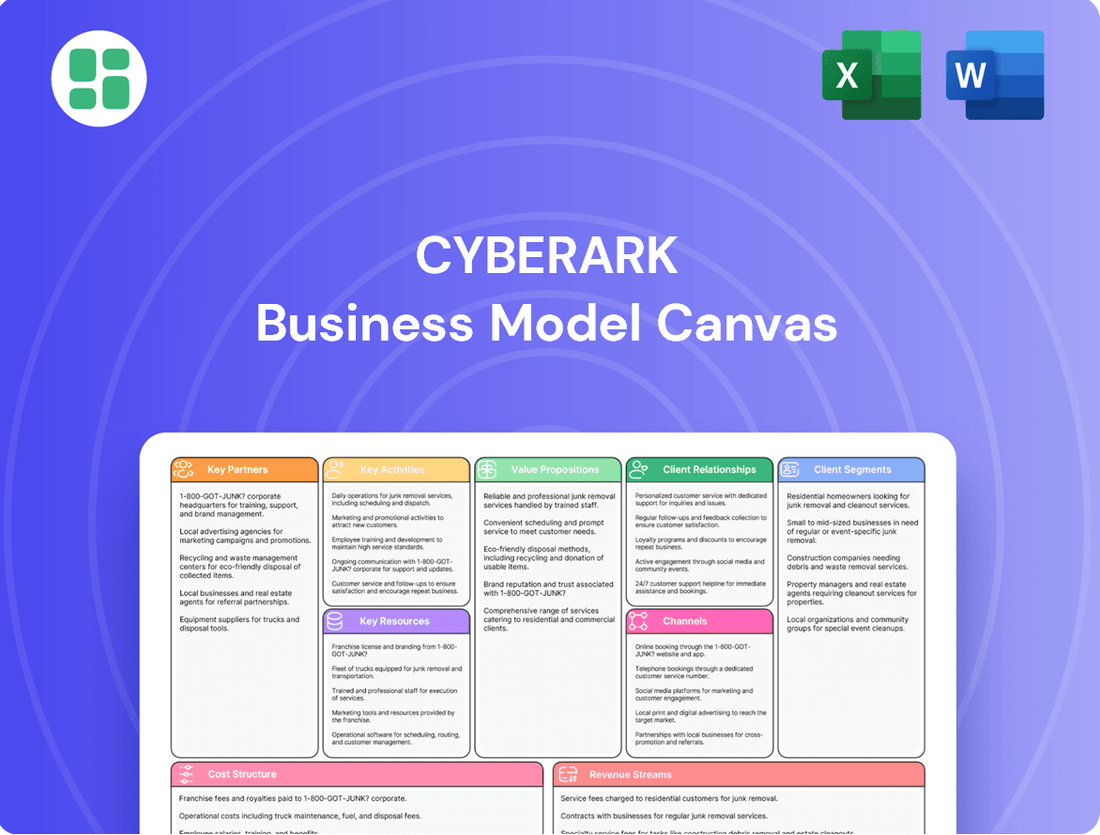

CyberArk Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CyberArk Bundle

Explore the core components of CyberArk's success with our detailed Business Model Canvas. Understand their customer segments, value propositions, and revenue streams that drive their leadership in privileged access security. This canvas provides a strategic overview for anyone looking to dissect a thriving cybersecurity business.

Ready to gain a deeper understanding of CyberArk's strategic framework? Our comprehensive Business Model Canvas breaks down their key resources, activities, and partnerships, offering invaluable insights into their operational efficiency and market positioning. Download the full version to unlock a complete strategic blueprint.

Partnerships

CyberArk actively fosters technology alliances with major players in the IT landscape, ensuring its identity security solutions integrate smoothly with diverse technology stacks. For instance, in 2024, CyberArk continued to deepen its partnerships with cloud providers like AWS and Microsoft Azure, enabling customers to extend robust identity security to their cloud-native applications and infrastructure.

These collaborations are crucial for joint product development and co-selling efforts, allowing CyberArk to offer bundled solutions that address complex customer security needs. This strategic approach ensures that CyberArk's platform functions seamlessly within intricate enterprise environments, reinforcing its position as a comprehensive security provider.

CyberArk's strategic alliances with Global System Integrators (GSIs) like Accenture and Deloitte are fundamental to its go-to-market strategy, particularly for large enterprise deployments. These partnerships are vital for extending CyberArk's reach and delivering its sophisticated identity security solutions across diverse global markets.

GSIs offer critical consulting, implementation, and managed services, enabling CyberArk to effectively scale its offerings and address complex customer requirements. For instance, in 2024, GSIs played a significant role in helping enterprises navigate evolving cybersecurity regulations and implement robust privileged access management (PAM) strategies.

CyberArk collaborates with Managed Service Providers (MSPs) like HCLTech to extend its identity security solutions. This partnership is crucial for reaching mid-sized businesses that benefit from a managed service approach.

The launch of the MSP Hub in 2025 signifies CyberArk's commitment to this channel, facilitating the delivery of its platform as a service. This initiative empowers MSPs to offer robust identity security with multi-tenant capabilities and simplified management.

Through MSPs, CyberArk can tap into a wider customer base, providing scalable and efficient identity security management. This strategic alliance allows for broader market penetration and enhanced service delivery for end-clients.

Cloud Providers

CyberArk's strategic alliances with major cloud providers like Amazon Web Services (AWS) are fundamental to its business model. These partnerships are crucial for delivering and scaling cloud-native identity security solutions, enabling CyberArk to effectively reach customers adopting cloud technologies. By collaborating closely, CyberArk ensures its products are optimized for cloud environments, facilitating robust identity and access management across diverse cloud platforms. This integration is vital as organizations increasingly shift their operations to the cloud, a trend that saw cloud infrastructure spending reach an estimated $270 billion in 2024.

These collaborations provide several key benefits:

- Market Expansion: Access to the vast customer bases of cloud providers opens new avenues for CyberArk's solutions.

- Product Optimization: Ensuring CyberArk's offerings are seamlessly integrated and perform optimally within cloud ecosystems.

- Enhanced Security: Joint efforts help address the unique security challenges of cloud deployments, protecting sensitive identities and data.

- Innovation Acceleration: Partnerships foster joint development, leading to more advanced and tailored identity security features for cloud users.

Strategic Acquisition Partners

CyberArk's strategic acquisition of Venafi in October 2024 and Zilla Security in February 2025 significantly bolsters its position. These moves are not merely purchases; they are foundational partnerships that extend CyberArk's reach into crucial areas like machine identity management and identity governance. This integration is designed to create a more robust, unified identity security platform.

The integration of Venafi's machine identity management and Zilla Security's identity governance and administration capabilities allows CyberArk to address a broader spectrum of security needs. By bringing these specialized functions under its umbrella, CyberArk can offer more comprehensive protection. This expansion directly addresses the growing complexity of managing identities across human, machine, and emerging AI entities.

- Venafi Acquisition (October 2024): Enhanced machine identity management capabilities, strengthening cybersecurity for critical infrastructure and cloud environments.

- Zilla Security Acquisition (February 2025): Bolstered identity governance and administration (IGA) to streamline access controls and compliance for all digital identities.

- Unified Platform Expansion: These partnerships are key to CyberArk's strategy of providing a single pane of glass for managing human, machine, and AI identities.

CyberArk's key partnerships are multifaceted, encompassing technology alliances, global system integrators (GSIs), and managed service providers (MSPs). These collaborations are vital for extending market reach, enhancing product integration, and delivering comprehensive identity security solutions.

In 2024, deepening ties with cloud giants like AWS and Microsoft Azure facilitated the extension of robust identity security to cloud-native environments, a sector projected to see significant growth.

Partnerships with GSIs such as Accenture and Deloitte were critical for large-scale enterprise deployments, aiding organizations in navigating complex regulatory landscapes and implementing effective privileged access management strategies throughout 2024.

The strategic acquisitions of Venafi in October 2024 and Zilla Security in February 2025 further solidified CyberArk's ecosystem by integrating advanced machine identity management and identity governance capabilities, aiming for a unified identity security platform.

| Partner Type | Key Partners (Examples) | Strategic Importance | 2024/2025 Focus |

|---|---|---|---|

| Technology Alliances | AWS, Microsoft Azure | Seamless integration, cloud-native security | Expanding cloud identity security |

| Global System Integrators (GSIs) | Accenture, Deloitte | Large enterprise deployments, consulting & implementation | Regulatory compliance, PAM strategy |

| Managed Service Providers (MSPs) | HCLTech | Mid-market reach, service delivery | MSP Hub launch (2025), platform-as-a-service |

| Acquisitions (as partnerships) | Venafi (Oct 2024), Zilla Security (Feb 2025) | Machine identity, identity governance | Unified identity security platform |

What is included in the product

A robust business model outlining CyberArk's strategy for delivering privileged access security solutions to enterprise clients, focusing on customer relationships and key resources.

Details CyberArk's value proposition of reducing cyber risk through privileged access management, supported by its technology and channel partnerships.

CyberArk's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that quickly identifies the core components of their privileged access security strategy, simplifying complex solutions for stakeholders.

Activities

CyberArk's core activity revolves around relentless Research and Development to stay ahead in identity security. This means constantly innovating its platform, particularly by integrating AI for advanced threat detection and response, and anticipating new security challenges like those posed by AI agents.

The company actively designs new features and refines its existing product suite. A significant part of this R&D effort also involves seamlessly integrating technologies from strategic acquisitions, ensuring a cohesive and cutting-edge offering that maintains CyberArk's competitive advantage in a rapidly evolving market.

This dedication to R&D is clearly reflected in its financial performance. For instance, CyberArk's R&D expenses have seen consistent year-over-year growth, demonstrating a substantial and ongoing investment in future innovation. This commitment fuels the development of its AI-driven capabilities and its proactive approach to emerging security threats.

CyberArk's key activity in product development and management centers on building and refining its comprehensive Identity Security Platform. This involves continuous innovation across privileged access management (PAM), secrets management, endpoint privilege management, and identity governance. The focus is on creating a unified solution that addresses the evolving threat landscape for all identity types.

This process spans the entire product lifecycle, from initial ideation and rigorous development to successful market release and sustained customer support. CyberArk invests heavily in research and development to ensure its offerings remain at the forefront of cybersecurity, addressing the complex needs of modern enterprises.

In 2024, CyberArk continued to enhance its platform capabilities, responding to the increasing demand for robust identity security solutions. The company’s commitment to innovation is reflected in its ongoing updates and new feature rollouts designed to simplify security operations and reduce risk for its global customer base.

CyberArk's key activities in sales and marketing focus on a multi-pronged approach to drive adoption of its identity security solutions. This includes a robust direct sales force engaging with enterprise clients, alongside a strong emphasis on channel partner enablement to expand market reach and provide localized support.

Global marketing campaigns are crucial for building brand awareness and educating the market about the critical need for advanced identity security. These efforts involve digital marketing, content creation, and participation in industry events to showcase CyberArk's value proposition and differentiate it in a crowded cybersecurity landscape.

In 2024, CyberArk reported significant investments in sales and marketing, reflecting its commitment to growth. For instance, its operating expenses often show sales and marketing as a substantial line item, underscoring the resource allocation needed to acquire and retain customers in this dynamic sector.

Customer Support and Professional Services

CyberArk's commitment to high-quality customer support, comprehensive training, and expert professional services is fundamental to ensuring clients can successfully implement and maximize the value of its identity security solutions. These services are designed to facilitate effective deployment, ongoing management, and optimization, directly contributing to enhanced security postures and fostering enduring customer loyalty.

By offering tailored support and professional services, CyberArk empowers organizations to address their specific security challenges and integrate solutions seamlessly into their existing infrastructure. This focus on customer success is a key differentiator, ensuring clients achieve optimal security outcomes and realize the full potential of their investment.

- Customer Support: Offering 24/7 technical assistance and issue resolution to ensure continuous operation of CyberArk solutions.

- Professional Services: Providing expert guidance for implementation, configuration, and integration tailored to unique client environments.

- Training Programs: Delivering comprehensive training for administrators and end-users to maximize the effectiveness and adoption of CyberArk's platform.

- Customer Satisfaction: In 2023, CyberArk reported strong customer retention rates, with over 90% of its recurring revenue coming from existing customers, underscoring the value derived from its support and services.

Strategic Acquisitions and Integration

CyberArk actively pursues strategic acquisitions to enhance its identity security platform. For instance, in 2023, CyberArk announced its intent to acquire Venafi, a leader in machine identity management, aiming to bolster its comprehensive approach to securing all digital identities. This move, alongside other strategic additions like Zilla Security, significantly expands CyberArk's capabilities and market presence.

A crucial element of this strategy is the seamless integration of acquired technologies and talent. CyberArk dedicates substantial resources to merging these new assets into its existing operations and product development cycles. This meticulous process ensures that newly acquired capabilities are effectively incorporated, contributing to CyberArk's unified vision for identity security and delivering enhanced value to customers.

- Acquisition of Venafi: Announced in September 2023, this acquisition aimed to strengthen machine identity management, a critical component of modern cybersecurity.

- Integration Focus: CyberArk prioritizes the technical and organizational integration of acquired companies to ensure a cohesive product offering.

- Platform Expansion: Strategic acquisitions are key to broadening CyberArk's platform capabilities, addressing a wider range of identity security challenges.

- Market Reach Enhancement: By acquiring complementary technologies, CyberArk expands its addressable market and strengthens its competitive position.

CyberArk's key activities are centered on innovation and market expansion through strategic initiatives. The company consistently invests in research and development to advance its identity security platform, particularly focusing on AI-driven capabilities and addressing emerging threats. This commitment is evident in its substantial R&D spending, which fuels continuous product enhancement and the integration of new technologies.

Sales and marketing efforts are crucial for driving customer acquisition and expanding market reach. CyberArk employs a direct sales force and leverages channel partners, complemented by global marketing campaigns to build brand awareness and educate the market. In 2024, the company continued to invest significantly in these areas to support its growth objectives.

Customer success is paramount, with CyberArk providing robust support, professional services, and training programs to ensure clients maximize the value of its solutions. This focus on customer satisfaction contributes to high retention rates, with over 90% of recurring revenue in 2023 stemming from existing customers.

Strategic acquisitions, such as the announced intent to acquire Venafi in September 2023, are key activities that broaden CyberArk's platform capabilities, particularly in machine identity management, and enhance its competitive market position.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Research & Development | Continuous innovation and platform enhancement, including AI integration. | Ongoing investment in AI-driven threat detection and response capabilities. |

| Sales & Marketing | Driving customer acquisition and market penetration. | Significant investment in sales and marketing to support growth and brand awareness. |

| Customer Support & Services | Ensuring client success through expert support and training. | High customer retention rates, exceeding 90% of recurring revenue from existing clients in 2023. |

| Strategic Acquisitions | Expanding platform capabilities and market reach. | Integration of acquired technologies, such as Venafi for machine identity management. |

What You See Is What You Get

Business Model Canvas

The CyberArk Business Model Canvas preview you are viewing is the actual, complete document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering full transparency and immediate usability. You can trust that what you see is precisely what you’ll get, ready for your strategic analysis and planning.

Resources

CyberArk's core proprietary technology in Privileged Access Management (PAM) and its broader Identity Security Platform is a critical resource, protected by extensive intellectual property. This includes patented algorithms, unique security architectures, and software code that differentiate its offerings. This technological edge is fundamental to its leadership position.

As of early 2024, CyberArk held over 200 patents globally, underscoring its commitment to innovation in identity security. This robust IP portfolio safeguards its unique approaches to securing privileged accounts and credentials, a vital component of its business model.

CyberArk's core strength lies in its highly specialized workforce. This includes cybersecurity researchers, software engineers, threat intelligence analysts, and professional services consultants. Their deep knowledge in identity security and cyber threats is crucial for developing innovative solutions and providing top-tier customer support.

This human capital is continuously developed, ensuring CyberArk stays ahead in the rapidly evolving cybersecurity landscape. In 2024, a significant portion of CyberArk's operating expenses was allocated to research and development, directly reflecting the investment in its skilled workforce and their expertise.

CyberArk's brand reputation as a global leader in identity security, particularly in Privileged Access Management (PAM), is a crucial intangible asset. This strong market standing, cultivated over years, fosters trust among major enterprises and government entities. For instance, in 2023, CyberArk was recognized as a Leader in Gartner's Magic Quadrant for Access Management for the seventh consecutive year, underscoring its authoritative market position.

Customer Base and Data

CyberArk's customer base is a significant asset, boasting over 9,700 customers. This extensive network includes a strong representation within the Fortune 500 and Global 2000 companies, indicating a high level of trust and adoption among major enterprises.

This large and loyal customer base translates into a stable and predictable revenue stream for CyberArk. The consistent demand from these established organizations provides a solid foundation for continued growth and investment.

Furthermore, the data and feedback generated from these numerous customers are invaluable. This direct insight allows CyberArk to continuously refine its existing product offerings and identify emerging market needs and opportunities for innovation.

- Customer Count: Over 9,700 customers.

- Enterprise Penetration: Significant presence in Fortune 500 and Global 2000 companies.

- Revenue Stability: Provides a predictable and stable revenue stream.

- Product Development Input: Customer data and feedback drive product refinement and new market identification.

Financial Capital and Acquired Assets

CyberArk's robust financial capital, underscored by its strong Annual Recurring Revenue (ARR) and healthy cash flow, is a cornerstone of its business model. This financial muscle enables significant investments in research and development, crucial for staying ahead in the cybersecurity landscape. For instance, in fiscal year 2023, CyberArk reported ARR of $778 million, a 30% increase year-over-year, demonstrating its capacity to fund innovation and growth initiatives.

Strategic acquisitions are another key element, allowing CyberArk to rapidly expand its technological capabilities and market presence. The integration of companies like Venafi, a leader in machine identity management, and Zilla Security, which enhances privileged access security for cloud environments, are prime examples. These acquisitions not only add sophisticated technologies to CyberArk's portfolio but also bring valuable customer bases, broadening its market reach and competitive advantage.

- Financial Strength: CyberArk's fiscal year 2023 results show ARR of $778 million, a 30% year-over-year increase, highlighting its financial capacity.

- R&D Investment: Substantial cash flow fuels continuous investment in research and development to enhance its cybersecurity solutions.

- Acquisition Strategy: Key acquisitions, such as Venafi and Zilla Security, have integrated advanced technologies and expanded CyberArk's customer base.

- Market Expansion: Acquired assets and technologies directly contribute to broadening CyberArk's product offerings and increasing its penetration in global markets.

CyberArk's intellectual property, including over 200 patents globally as of early 2024, forms the bedrock of its competitive advantage. This extensive patent portfolio protects its unique algorithms and security architectures within its Identity Security Platform. These technological innovations are critical for maintaining its market leadership in Privileged Access Management (PAM).

The company's skilled workforce, comprising cybersecurity experts and engineers, is a vital resource, with significant investment in R&D in 2024 reflecting this emphasis. This human capital drives the continuous development of its cutting-edge solutions. Their expertise ensures CyberArk remains at the forefront of the rapidly evolving cybersecurity landscape.

CyberArk's strong brand reputation, recognized by its seventh consecutive year as a Leader in Gartner's Magic Quadrant for Access Management in 2023, builds essential trust with enterprise clients. This established market position, coupled with over 9,700 customers including a strong Fortune 500 and Global 2000 presence, provides a stable revenue stream and invaluable customer feedback for product enhancement.

Financial strength, evidenced by $778 million in ARR for fiscal year 2023 (a 30% year-over-year increase), fuels CyberArk's strategic growth. This financial capacity supports substantial R&D investments and key acquisitions like Venafi and Zilla Security, which enhance its technological offerings and market reach.

| Key Resource | Description | Supporting Data (as of early 2024/FY23) |

| Intellectual Property | Patented algorithms, unique security architectures, and software code. | Over 200 patents globally. |

| Human Capital | Cybersecurity researchers, software engineers, threat intelligence analysts. | Significant R&D allocation in 2024. |

| Brand Reputation | Global leader in Identity Security and PAM. | 7 consecutive years as Gartner Magic Quadrant Leader for Access Management (2023). |

| Customer Base | Large, loyal base of enterprise clients. | Over 9,700 customers; strong Fortune 500/Global 2000 penetration. |

| Financial Capital | Strong ARR and cash flow for investment. | $778 million ARR in FY23 (30% YoY growth). |

| Strategic Acquisitions | Integration of complementary technologies and customer bases. | Acquisition of Venafi and Zilla Security. |

Value Propositions

CyberArk's Comprehensive Identity Security Platform offers a unified solution for safeguarding all identity types, from human users to machine identities and even nascent AI agents, throughout their entire lifecycle. This integrated approach is crucial as organizations grapple with the expanding attack surface, where identities have effectively become the new security perimeter.

By consolidating disparate security tools, CyberArk provides organizations with unparalleled visibility and granular control over access. This is particularly important in 2024, where the proliferation of cloud environments and remote workforces has made identity management more complex than ever. For instance, a 2024 report indicated that over 60% of successful cyberattacks involved compromised credentials, highlighting the critical need for robust identity security.

CyberArk's leadership in Privileged Access Management (PAM) is built on its ability to offer superior controls for safeguarding privileged credentials, the prime targets for cybercriminals. This focus is essential as organizations increasingly rely on digital assets, making these accounts high-value targets.

By enforcing least privilege and zero trust, CyberArk dramatically shrinks the potential attack surface. This strategy is vital in preventing attackers from moving freely within a network once initial access is gained, a common tactic in advanced persistent threats.

In 2023, CyberArk reported revenue of $750 million, underscoring the significant market demand for its robust PAM solutions. This growth reflects the growing recognition of PAM's critical role in enterprise cybersecurity defenses.

CyberArk's core value proposition is to significantly lower an organization's cybersecurity risk by proactively safeguarding all identities, whether human or machine, and identifying potential threats throughout their entire lifecycle. This proactive approach ensures critical assets are protected before they can be compromised.

Furthermore, CyberArk's solutions are instrumental in meeting complex regulatory demands. By offering comprehensive audit trails, enforcing granular access policies, and providing clear evidence of control over privileged accounts, they empower businesses to demonstrate compliance with mandates like GDPR, SOX, and HIPAA, thereby mitigating legal and financial penalties.

For instance, in 2024, organizations faced an average of 300 new cyber threats per day, highlighting the critical need for robust risk reduction. CyberArk's ability to secure privileged access, a common attack vector, directly addresses this escalating threat landscape, helping companies avoid costly breaches and maintain operational continuity.

Operational Efficiency and Automation

CyberArk's platform boosts operational efficiency through capabilities like no-code automation and streamlined workflows, significantly cutting down manual effort in identity security management. This allows security teams to reallocate their time to more critical tasks and accelerate threat response times.

By automating repetitive processes, CyberArk enhances the consistency of security operations and minimizes the risk of human error. For instance, in 2024, organizations leveraging CyberArk reported an average reduction of 30% in the time spent on routine identity and access management tasks, freeing up valuable resources.

- Reduced Manual Effort: Automating tasks like access provisioning and credential rotation streamlines operations.

- Faster Threat Response: Automated workflows enable quicker identification and remediation of security incidents.

- Improved Consistency: Automation ensures standardized execution of security policies, minimizing errors.

Future-Ready Security for Emerging Threats

CyberArk is at the forefront of securing the rapidly expanding universe of machine identities, a critical challenge as AI agents proliferate. By embedding AI assistants directly into its platform, CyberArk provides a proactive defense against evolving cyber threats, ensuring organizations can manage and secure these new identity types. This strategic focus on future-ready security is essential for navigating complex, dynamic digital landscapes.

The increasing reliance on AI and automation means that machine identities are no longer a niche concern but a central pillar of cybersecurity. CyberArk's commitment to addressing this trend is underscored by its platform's ability to secure these identities. For instance, in 2024, the number of machine identities is projected to far outstrip human identities, creating a significant attack surface that requires specialized security solutions.

- Securing Machine Identities: Addressing the exponential growth of non-human identities in cloud, DevOps, and IoT environments.

- AI-Powered Defense: Integrating AI assistants to detect and respond to threats targeting machine identities.

- Proactive Threat Mitigation: Preparing organizations for emerging cyber threats by securing new and proliferating identity types.

- Future-Ready Architecture: Building a security framework that anticipates and adapts to the evolving threat landscape.

CyberArk's core value proposition is to reduce cybersecurity risk by securing all identities, human and machine, and proactively identifying threats across their lifecycles. This unified approach simplifies security, enhances visibility, and provides granular control, which is critical as identities become the new perimeter.

By enforcing least privilege and zero trust, CyberArk shrinks the attack surface, preventing lateral movement by attackers. This is vital in today's complex environments, where compromised credentials are a leading cause of breaches; in 2024, over 60% of successful attacks involved such compromises.

The platform also boosts operational efficiency by automating tasks, reducing manual effort and the risk of human error. For example, in 2024, users reported a 30% reduction in time spent on routine identity management tasks.

CyberArk is also a leader in securing machine identities, essential as AI agents proliferate. This focus on future-ready security addresses the exponential growth of non-human identities, a key challenge in 2024.

Customer Relationships

CyberArk cultivates robust customer ties through specialized account management and sales professionals who directly engage with major enterprise clients. This focused approach ensures a deep understanding of unique customer requirements, paving the way for tailored solutions and enduring collaborations.

These dedicated teams are instrumental in CyberArk's 'land and expand' strategy, a sales model that thrives on building trust and demonstrating value over time. For instance, in Q1 2024, CyberArk reported a 26% increase in total revenue, reaching $754.8 million for the fiscal year 2023, underscoring the success of this relationship-driven growth.

CyberArk's professional services, including implementation, integration, and optimization, are crucial for building strong customer ties. These services ensure clients fully leverage their CyberArk solutions, fostering confidence and long-term partnerships. For instance, in 2024, CyberArk reported significant growth in its services segment, reflecting the demand for expert guidance in deploying and managing privileged access security.

CyberArk actively cultivates a vibrant customer community through dedicated user forums and direct feedback channels. This engagement allows them to gather insights on evolving needs and challenges faced by their users.

By soliciting feedback via surveys and direct interactions with product development teams, CyberArk ensures its solutions remain aligned with market demands. This collaborative process is crucial for prioritizing product enhancements and building features that solve real-world security problems.

For instance, CyberArk's commitment to customer feedback was evident in the development of their 2024 product roadmap, which incorporated key suggestions from their user base regarding privileged access management automation and cloud security integration.

Strategic Customer Engagement Events

CyberArk's strategic customer engagement events, like their annual Impact conference, are crucial for fostering strong relationships. These gatherings serve as vital hubs for knowledge exchange, allowing customers to learn about the latest cybersecurity innovations and best practices directly from CyberArk experts. In 2024, CyberArk Impact continued to be a cornerstone, bringing together thousands of cybersecurity professionals.

These events go beyond mere product showcases; they are designed to build community and loyalty. By providing direct access to CyberArk leadership and technical specialists, the company demonstrates its dedication to supporting its customer base. This direct interaction helps address customer needs and reinforces CyberArk's position as a trusted partner in identity security.

- CyberArk Impact 2024 Attendance: Thousands of cybersecurity professionals attended, highlighting significant customer engagement.

- Knowledge Sharing: Events facilitate deep dives into new product features and industry trends.

- Networking Opportunities: Customers connect with peers and CyberArk leadership, strengthening the ecosystem.

- Reinforced Loyalty: Direct engagement and commitment to customer success build lasting relationships.

Partner-Enabled Support

CyberArk’s partner ecosystem is a cornerstone of its customer support strategy, ensuring that clients benefit from localized expertise and tailored services. This approach allows for flexible deployment and management of identity security solutions, meeting diverse customer needs.

- Extensive Partner Network: CyberArk collaborates with a broad range of system integrators and managed service providers globally.

- Localized Support: Partners deliver region-specific assistance, enhancing customer experience and responsiveness.

- Specialized Services: Customers gain access to specialized skills for deployment, integration, and ongoing management of CyberArk solutions.

- Flexible Options: This model provides customers with adaptable choices for how they implement and maintain their identity security posture.

CyberArk's customer relationships are built on a foundation of dedicated account management, expert professional services, and active community engagement. This multifaceted approach ensures clients receive tailored solutions and ongoing support, fostering long-term loyalty and driving growth.

The company's 'land and expand' strategy, supported by strong customer ties, contributed to significant financial performance. For example, CyberArk reported a 26% increase in total revenue for fiscal year 2023, reaching $754.8 million, demonstrating the effectiveness of its customer-centric model.

CyberArk actively solicits customer feedback through forums, surveys, and direct interaction with product teams. This ensures its solutions, like those highlighted in its 2024 product roadmap, directly address evolving market needs and user challenges in privileged access management and cloud security.

Strategic events like the annual CyberArk Impact conference, which saw thousands of cybersecurity professionals attend in 2024, are crucial for knowledge sharing, networking, and reinforcing customer loyalty by providing direct access to leadership and technical experts.

| Customer Relationship Aspect | Description | Key Data/Example |

|---|---|---|

| Dedicated Account Management | Direct engagement with enterprise clients by specialized sales professionals. | Focus on understanding unique needs for tailored solutions. |

| Professional Services | Implementation, integration, and optimization support. | Ensures clients fully leverage solutions, fostering confidence and long-term partnerships. |

| Customer Community & Feedback | User forums, surveys, and direct interaction with product teams. | Informs product roadmap, like 2024 enhancements for PAM automation and cloud security. |

| Customer Engagement Events | Annual Impact conference and similar gatherings. | Thousands of attendees in 2024, facilitating knowledge sharing, networking, and loyalty building. |

| Partner Ecosystem | Collaboration with system integrators and managed service providers. | Provides localized expertise and tailored services for flexible deployment and management. |

Channels

CyberArk’s direct sales force is instrumental in connecting with large enterprises, especially for intricate cybersecurity implementations. This approach allows for personalized discussions and the development of highly customized solutions, directly addressing the unique needs of major clients.

This direct engagement is key to securing substantial, high-value contracts. For instance, in 2024, CyberArk continued to emphasize its direct sales strategy for its privileged access management solutions, which often involve complex integration projects requiring deep technical expertise and a consultative sales process.

The direct sales channel facilitates building robust, long-term relationships with strategic accounts. It provides a platform for in-depth technical discussions and ensures that customers receive tailored support, which is vital for the adoption and ongoing success of advanced security technologies.

Global System Integrators (GSIs) such as Accenture, Deloitte, and PwC are vital conduits for CyberArk, enabling access to and deployment within massive, intricate enterprises globally. These firms embed CyberArk's identity security solutions into comprehensive cybersecurity frameworks and IT infrastructures, acting as a scalable delivery engine for CyberArk's products.

In 2024, the cybersecurity consulting market, a key area for GSIs, was projected to reach over $100 billion, highlighting the significant revenue potential these partnerships unlock for CyberArk. GSIs' extensive reach and implementation expertise allow CyberArk to penetrate markets and serve clients that might otherwise be difficult to access directly.

Managed Service Providers (MSPs) are a crucial channel for CyberArk, allowing them to deliver their identity security platform as a service. This approach is vital for reaching a broader customer base that prefers managed security solutions, thereby increasing market reach.

Initiatives like the new MSP Hub demonstrate CyberArk's commitment to this channel. In 2024, the managed security services market was projected to reach over $300 billion globally, highlighting the significant opportunity for growth through MSP partnerships.

Value-Added Resellers (VARs) and Solution Providers

CyberArk leverages a robust global network of Value-Added Resellers (VARs) and solution providers to extend its market reach. These partners are crucial for reselling CyberArk's identity security solutions, often integrating them with their own specialized services and expertise.

This partnership model allows CyberArk to tap into regional market nuances and deliver localized support. In 2024, CyberArk continued to expand its partner ecosystem, with a significant portion of its revenue attributed to channel sales, reflecting the critical role these VARs play in customer acquisition and retention.

- Global Reach: VARs provide CyberArk with an extensive international presence, enabling access to a wider customer base than direct sales alone could achieve.

- Bundled Offerings: Partners frequently bundle CyberArk's solutions with their own consulting, implementation, and managed services, creating comprehensive security packages for clients.

- Specialized Expertise: VARs bring deep industry-specific knowledge and technical skills, allowing them to tailor CyberArk's offerings to unique customer needs and compliance requirements.

- Extended Distribution: This channel strategy significantly amplifies CyberArk's sales and distribution capabilities, ensuring its identity security solutions are accessible across diverse markets and customer segments.

Cloud Marketplaces and Strategic Alliances

CyberArk leverages cloud marketplaces, such as AWS Marketplace and Microsoft Azure Marketplace, to connect with organizations prioritizing cloud adoption. This strategy allows for streamlined purchasing and integration of CyberArk's identity security solutions directly within their cloud infrastructure. In 2024, cloud marketplaces continued to be a significant growth driver for SaaS vendors, with Gartner projecting worldwide end-user spending on public cloud services to reach $679 billion in 2024, up from $601 billion in 2023.

Strategic alliances with major cloud providers like Amazon Web Services (AWS) and Microsoft Azure are crucial. These partnerships enable CyberArk to offer its solutions as part of broader cloud offerings, enhancing visibility and accessibility for cloud-native customers. For instance, CyberArk's presence on these marketplaces simplifies procurement, reducing sales cycles and allowing customers to utilize existing cloud budgets.

These channels are vital for reaching a broad customer base actively migrating to or operating within cloud environments. By integrating with cloud provider ecosystems, CyberArk ensures its identity security solutions are easily discoverable and deployable, supporting organizations' cloud-first digital transformation initiatives. The increasing adoption of cloud security solutions is a direct reflection of evolving threat landscapes and regulatory demands.

- Cloud Marketplaces: Facilitate easier procurement and deployment for cloud-centric customers.

- Strategic Alliances: Deepen integration with cloud providers like AWS and Microsoft.

- Customer Reach: Access organizations actively adopting cloud strategies.

- Market Growth: Align with the significant expansion of the public cloud services market.

CyberArk's channel strategy is multifaceted, encompassing direct sales for large enterprise deals, global system integrators for broad enterprise reach, and managed service providers for a service-based delivery model. Value-added resellers and cloud marketplaces further extend market penetration, especially within cloud-native environments.

These diverse channels are critical for CyberArk's growth, allowing it to cater to various customer segments and deployment preferences. The emphasis on partners, particularly in the burgeoning managed security services and cloud markets, underscores CyberArk's strategy to scale its identity security solutions effectively.

| Channel Type | Key Role | 2024 Market Context | CyberArk's Focus |

| Direct Sales | Complex enterprise solutions, high-value contracts | Intricate cybersecurity implementations | Personalized discussions, long-term relationships |

| Global System Integrators (GSIs) | Large-scale enterprise deployment, embedding solutions | Cybersecurity consulting market > $100 billion | Extensive reach, implementation expertise |

| Managed Service Providers (MSPs) | Delivering platform as a service, broader customer base | Managed security services market > $300 billion | Increasing market reach, partner ecosystem expansion |

| Value-Added Resellers (VARs) | Reselling, integrating with specialized services | Significant revenue attributed to channel sales | Regional market access, localized support |

| Cloud Marketplaces | Streamlined purchasing, cloud infrastructure integration | Public cloud services spending $679 billion | Accessibility for cloud-native customers |

Customer Segments

Large enterprises and Global 2000 organizations represent CyberArk's foundational customer base. These entities, often including a substantial number of Fortune 500 companies, grapple with incredibly intricate IT infrastructures and operate under rigorous compliance mandates.

Their critical need for robust identity security solutions stems from the imperative to safeguard highly sensitive data and vital digital assets. For instance, in 2023, CyberArk reported that its revenue from enterprise customers significantly outweighed that from smaller businesses, underscoring the strategic importance of this segment.

CyberArk's core customer base includes organizations operating within highly regulated sectors like financial services, healthcare, and government. These industries face stringent compliance demands, such as those outlined by HIPAA, PCI DSS, and SOX, which necessitate robust controls over privileged access. For example, the financial services sector alone manages trillions of dollars in assets, making the security of its systems paramount to prevent breaches that could have catastrophic economic impacts.

The company's solutions are specifically designed to help these entities adhere to critical regulatory mandates concerning privileged account security, data privacy, and comprehensive audit trails. In 2024, the global cybersecurity market, particularly the identity and access management segment serving these regulated industries, continued its rapid expansion, with many organizations allocating significant portions of their IT budgets to compliance-driven security measures.

Organizations increasingly embrace hybrid and multi-cloud strategies, creating a significant demand for unified identity security. These companies, seeking to leverage the flexibility of cloud while maintaining on-premises assets, face the challenge of inconsistent security policies across disparate environments. By 2024, over 90% of enterprises are expected to utilize a mix of on-premises and public cloud infrastructure, highlighting the critical need for solutions that bridge these gaps.

CyberArk's platform directly addresses this complexity by providing consistent identity and access management controls, whether resources reside on-premises, in a private cloud, or across multiple public cloud providers like AWS, Azure, and Google Cloud. This capability is vital for organizations aiming to reduce their attack surface and ensure least privilege access, a key concern as cloud adoption accelerates.

Businesses Facing Advanced Cyber Threats

Organizations grappling with sophisticated cyberattacks, insider threats, and identity-based breaches are prime targets for CyberArk's solutions. These businesses are actively seeking robust defenses against persistent and evolving cyber risks. CyberArk's specialization in privileged access management, threat detection, and incident response directly addresses their critical security needs.

For instance, a 2024 report indicated that 76% of organizations experienced an increase in cyberattacks, with a significant portion citing insider threats as a major concern. This data underscores the demand for advanced security solutions like those offered by CyberArk. Companies prioritizing the protection of their most sensitive data and critical infrastructure are particularly drawn to CyberArk's capabilities.

- Targeted Industries: Financial services, healthcare, government, and critical infrastructure sectors are highly vulnerable to advanced cyber threats.

- Key Concerns: Organizations are primarily concerned with preventing unauthorized access to privileged accounts, detecting and responding to insider threats, and mitigating the impact of identity-related breaches.

- Value Proposition: CyberArk offers a comprehensive approach to securing privileged access, thereby reducing the attack surface and enhancing overall cybersecurity posture.

Developers and DevOps Teams

CyberArk is increasingly focusing on developers and DevOps teams, recognizing their critical need for secure secrets management. This segment is vital for modern application development, where automation and CI/CD pipelines are standard. In 2024, the demand for robust solutions to manage machine identities and credentials within these workflows continued to surge.

- Developer Productivity: Providing secure access to necessary credentials without compromising security, thereby speeding up development cycles.

- DevOps Automation: Integrating secrets management seamlessly into CI/CD pipelines and automated deployments to prevent vulnerabilities.

- Machine Identity Security: Ensuring that the vast number of machine identities, from containers to microservices, are securely managed and rotated.

- Compliance and Governance: Helping development teams adhere to strict security policies and regulatory requirements by embedding security controls early in the development lifecycle.

CyberArk's customer base extends to organizations of all sizes that are actively defending against sophisticated cyber threats and insider risks. These entities prioritize the safeguarding of their most sensitive data and critical infrastructure, making them prime candidates for CyberArk's specialized security solutions.

A significant portion of CyberArk's clientele operates within highly regulated industries such as finance, healthcare, and government, where adherence to mandates like PCI DSS and HIPAA is non-negotiable. In 2024, the global cybersecurity market, particularly the identity and access management segment, continued its robust growth, driven by these compliance requirements.

Furthermore, CyberArk serves businesses adopting hybrid and multi-cloud strategies, which require unified identity security across diverse environments. By 2024, over 90% of enterprises were expected to utilize a mix of on-premises and public cloud infrastructure, underscoring the demand for consistent security controls.

The company also targets developers and DevOps teams, addressing their critical need for secure secrets management in modern application development. The surge in demand for managing machine identities and credentials within CI/CD pipelines was a notable trend in 2024.

| Customer Segment | Key Needs | CyberArk Value Proposition | 2024 Market Context |

|---|---|---|---|

| Large Enterprises & Global 2000 | Protecting sensitive data, compliance, complex IT | Robust privileged access management, reduced attack surface | Significant IT budget allocation to cybersecurity |

| Regulated Industries (Finance, Healthcare, Govt.) | HIPAA, PCI DSS, SOX compliance, data privacy | Ensuring regulatory adherence, audit trails | Continued rapid expansion of IAM segment |

| Hybrid & Multi-Cloud Adopters | Consistent security across environments, cloud flexibility | Unified identity security, bridging on-prem and cloud | Over 90% of enterprises using mixed infrastructure |

| Developers & DevOps Teams | Secure secrets management, CI/CD integration | Streamlined development, machine identity security | Surging demand for secrets management solutions |

Cost Structure

CyberArk dedicates a substantial portion of its financial resources to Research and Development (R&D), underscoring its drive for innovation and leadership in the identity security sector. This investment fuels the creation of novel product functionalities, the refinement of its existing platform, and the seamless integration of technologies acquired through strategic purchases. For the fiscal year 2023, CyberArk reported R&D expenses of $277.3 million, a notable increase from $222.6 million in 2022, highlighting their commitment to staying ahead.

A key focus within R&D is the development of advanced, AI-driven capabilities. These investments are crucial for enhancing the security posture of their clients by anticipating and mitigating evolving cyber threats. The company's strategic emphasis on R&D is a direct reflection of the rapidly changing landscape of cybersecurity and the constant need to evolve its offerings to meet emerging challenges.

Sales and marketing are CyberArk’s biggest operating costs, reflecting significant investment in its worldwide sales teams, partner networks, and customer acquisition efforts. These expenses are crucial for driving growth by attracting new clients and deepening relationships with existing ones.

In 2023, CyberArk reported sales and marketing expenses of $469.4 million. This substantial figure underscores the company's commitment to expanding its market reach and reinforcing its brand presence through advertising, promotional campaigns, and sales force compensation.

General and Administrative (G&A) expenses for CyberArk encompass essential corporate functions like legal, finance, and human resources. These costs, while typically less than research and development or sales and marketing, are critical for smooth operations and regulatory adherence. For the fiscal year 2023, CyberArk reported G&A expenses of $135.7 million, representing about 13% of their total revenue.

Cost of Revenue (Cloud Operations and Professional Services)

As CyberArk transitions to a subscription and SaaS model, its cost of revenue is increasingly driven by cloud operations and professional services. This shift means expenses for cloud infrastructure, hosting, and the delivery of expert professional services are now central to their operational costs. Maintaining the reliability and scalability of these cloud-based solutions is a key financial consideration.

For the fiscal year 2023, CyberArk reported a cost of revenue of $432.3 million, a notable increase from $348.7 million in 2022. This growth directly reflects the expanding investment in their cloud infrastructure and the resources required to support their growing SaaS customer base and associated professional services.

- Cloud Infrastructure Expenses: Costs associated with hosting, maintaining, and scaling the cloud platforms that deliver CyberArk's SaaS solutions.

- Professional Services Costs: Direct expenses incurred for delivering implementation, training, and support services to customers, often tied to subscription onboarding and ongoing success.

- Data Center and Hosting Fees: Payments to third-party providers for the physical infrastructure and network connectivity necessary to operate their cloud services.

- Personnel Costs for Operations: Salaries and benefits for the teams directly involved in managing and operating the cloud environment and delivering professional services.

Acquisition and Integration Costs

CyberArk's growth strategy often involves strategic acquisitions, which come with significant acquisition and integration costs. For instance, the acquisition of Venafi, a leader in machine identity management, and Zilla Security, focused on cloud infrastructure entitlement management, represent substantial investments. These aren't just about the purchase price; they include extensive legal and financial advisory fees, alongside the complex and costly process of merging disparate technologies, teams, and operational workflows to realize the full strategic value.

The integration phase is particularly crucial and resource-intensive. CyberArk must invest in aligning IT systems, standardizing security protocols, and harmonizing corporate cultures to ensure a smooth transition and maximize the return on these strategic moves. These efforts are vital for unlocking synergies and expanding CyberArk's market leadership in identity security.

- Acquisition Expenses: Purchase price, legal fees, financial advisory services.

- Integration Expenses: Technology merging, team alignment, operational consolidation.

- Strategic Rationale: Enhancing market position through targeted acquisitions like Venafi and Zilla Security.

CyberArk's cost structure is heavily influenced by its significant investments in research and development, aiming to maintain its edge in the identity security market. Sales and marketing represent the largest operational expense, reflecting the company's aggressive growth strategy and global market penetration efforts. The shift towards a subscription and SaaS model has also increased costs related to cloud infrastructure and professional services.

| Expense Category | FY 2023 (Millions USD) | FY 2022 (Millions USD) | % Change |

|---|---|---|---|

| Research & Development | 277.3 | 222.6 | 24.6% |

| Sales & Marketing | 469.4 | N/A | N/A |

| General & Administrative | 135.7 | N/A | N/A |

| Cost of Revenue | 432.3 | 348.7 | 24.0% |

Revenue Streams

Subscription revenue is CyberArk's primary and fastest-growing income source, forming a substantial part of its Annual Recurring Revenue (ARR). This model generates predictable and scalable income through recurring fees for access to CyberArk's comprehensive cloud-based Identity Security Platform and its specialized modules like Privileged Access Management (PAM) and Secrets Manager.

Maintenance revenue stems from ongoing support and upkeep contracts, particularly for CyberArk's perpetual software licenses and its on-premises solutions. This stream ensures a consistent income from customers who have already purchased these products.

While not as large a component of Annual Recurring Revenue (ARR) as subscription services, this maintenance income offers a predictable and reliable revenue source from CyberArk's established customer base. For instance, in fiscal year 2023, CyberArk reported total revenue of $857.7 million, with a significant portion of its recurring revenue coming from these established customer relationships.

CyberArk generates revenue through professional services, which encompass implementation, consulting, and training. These offerings are crucial for customers to effectively deploy and utilize CyberArk's sophisticated identity security solutions. For instance, in fiscal year 2023, CyberArk reported professional services revenue of $120.5 million, highlighting its importance as a supplementary income stream.

Licensing Revenue (Legacy Perpetual Licenses)

CyberArk continues to generate some revenue from legacy perpetual software licenses, though this stream is actively diminishing. The company is strategically shifting its focus and customer base towards its more modern subscription-based offerings.

This transition means that while perpetual licenses still contribute, their significance is decreasing as CyberArk prioritizes its recurring revenue model. For instance, in their Q1 2024 earnings report, while subscription revenue growth was strong, the contribution from perpetual licenses represented a smaller, declining portion of the overall revenue mix.

- Diminishing Contribution: Revenue from perpetual licenses is a shrinking segment of CyberArk's total income.

- Strategic Shift: The company is actively encouraging customers to migrate to subscription models.

- Focus on Recurring Revenue: Prioritizing subscriptions aligns with industry trends and provides more predictable revenue streams.

Expansion and Cross-Selling

CyberArk sees substantial revenue growth by deepening relationships with its existing customer base. This expansion involves selling more modules, offering additional services, and increasing the number of users within organizations already utilizing their solutions. For instance, during the first quarter of 2024, CyberArk reported that a significant portion of their revenue came from these existing customer expansions.

The company's unified platform approach is a key driver for cross-selling new functionalities. As customers become more integrated with CyberArk's core offerings, they are more likely to adopt adjacent solutions. This strategy directly supports the introduction and adoption of newer capabilities, such as machine identity management and identity governance, further diversifying revenue streams.

- Expansion Revenue: Growth derived from increasing product adoption and user counts within the existing customer base.

- Cross-Selling Opportunities: Leveraging the unified platform to introduce and sell new security capabilities.

- New Capabilities: Focus on expanding into areas like machine identity management and identity governance.

- Q1 2024 Performance: Evidence of strong revenue contribution from existing customer relationships and new product adoption.

CyberArk's revenue streams are predominantly driven by its subscription-based Identity Security Platform, which forms the bulk of its Annual Recurring Revenue (ARR). This model offers predictable income from access to core services like Privileged Access Management (PAM) and Secrets Manager. Additionally, maintenance revenue from perpetual licenses and on-premises solutions provides a steady, albeit diminishing, income. Professional services, including implementation and training, contribute supplementary revenue, as seen with $120.5 million in FY2023, supporting customer adoption of their complex solutions.

| Revenue Stream | Description | FY2023 Contribution (Approx.) |

|---|---|---|

| Subscription Revenue | Recurring fees for cloud-based Identity Security Platform and modules. | Largest and fastest-growing component of ARR. |

| Maintenance Revenue | Ongoing support for perpetual licenses and on-premises solutions. | Consistent income from established customer base. |

| Professional Services | Implementation, consulting, and training for solution deployment. | $120.5 million (FY2023) |

| Perpetual Licenses | Legacy software license sales, actively declining. | Decreasing portion of overall revenue mix. |

Business Model Canvas Data Sources

The CyberArk Business Model Canvas is informed by a blend of internal financial data, market intelligence reports, and competitive analysis. These sources provide a robust foundation for understanding customer segments, value propositions, and revenue streams.