Culligan International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Culligan International Bundle

Culligan International navigates a competitive landscape shaped by substantial buyer power and the looming threat of substitutes in the water treatment industry. Understanding these forces is crucial for any business operating within or looking to enter this sector.

The complete report reveals the real forces shaping Culligan International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of advanced filtration membranes and specialized resins possess substantial bargaining power, particularly when their technologies are proprietary and difficult to replicate. Culligan's reliance on these unique purification components for its innovative water treatment systems means fewer alternative suppliers exist, granting these specialized vendors leverage in negotiations. For instance, in 2024, the global market for advanced water filtration membranes saw significant growth, with key players investing heavily in R&D for next-generation materials, further solidifying their specialized positions.

The water purification sector, which includes areas important to Culligan, can experience a concentration of suppliers providing high-quality components, particularly for essential parts. For instance, in 2024, the global market for reverse osmosis membranes, a key component in many water purification systems, was dominated by a handful of major manufacturers, indicating a significant level of supplier concentration.

When a few suppliers control the market for crucial inputs like specialized membranes or ion-exchange resins, their bargaining power escalates. This can translate into increased costs for companies like Culligan, as these dominant suppliers can dictate terms and pricing for their vital materials, impacting overall profitability.

Switching suppliers for critical water filtration components can present significant hurdles for Culligan International. These challenges include substantial costs associated with re-engineering product designs to accommodate new specifications, the expense of re-certifying entire systems for safety and performance, and the investment required to retrain its workforce on new manufacturing processes and equipment.

These elevated switching costs inherently diminish Culligan's negotiating leverage. When the financial and operational disruption of changing suppliers is substantial, it strengthens the hand of existing suppliers. They can leverage this situation to maintain or even increase prices, knowing that Culligan faces considerable barriers to seeking alternative sources for essential parts.

Input Differentiation and Quality Importance

The quality and performance of Culligan's water treatment systems are critical for maintaining its strong brand reputation and ensuring customer satisfaction. This inherent reliance on input quality makes Culligan significantly dependent on its suppliers.

Suppliers who can provide superior or uniquely differentiated materials, such as specialized filtration media or advanced componentry, often possess considerable leverage. This leverage allows them to command higher prices, as their products directly influence the effectiveness and perceived value of Culligan's final water treatment solutions.

- Input Differentiation: Culligan's reliance on specialized components for its advanced water purification systems highlights the importance of supplier differentiation.

- Quality Impact: For instance, the efficacy of a reverse osmosis membrane or a specific ion-exchange resin directly impacts the purity of the water produced, a key selling point for Culligan.

- Supplier Leverage: Suppliers of these critical, high-performance materials can therefore negotiate from a position of strength, potentially increasing costs for Culligan.

- Brand Reputation: In 2023, customer reviews frequently cited water purity and system reliability as primary purchase drivers, underscoring the direct link between supplier input quality and Culligan's brand image.

Threat of Forward Integration by Suppliers

While less common, large, well-resourced suppliers could theoretically consider forward integration into water treatment system manufacturing or service, although this requires significant investment in distribution and brand building. The potential for this, however remote, adds a subtle layer to supplier power, as it underscores the value chain they control.

For instance, a major component supplier might possess the technical expertise and manufacturing capacity to produce filtration media or even complete water purification units. If such a supplier were to enter Culligan's market, it could disrupt existing supply agreements and introduce a new competitor. This threat, though not currently a dominant factor for Culligan, means suppliers hold a degree of leverage.

- Potential for Forward Integration: Suppliers could move into manufacturing or service.

- Investment Barrier: Significant capital is needed for distribution and brand building.

- Leverage: This threat subtly increases supplier bargaining power.

- Value Chain Control: Suppliers' involvement in key components gives them influence.

Suppliers of specialized filtration membranes and resins hold significant bargaining power due to the proprietary nature and difficulty in replicating their technologies. Culligan's dependence on these unique components for its advanced systems means fewer alternative suppliers exist, granting these specialized vendors leverage in pricing and terms. For example, in 2024, the global advanced water filtration membrane market saw key players investing heavily in R&D, further solidifying their specialized market positions.

| Factor | Impact on Culligan | 2024 Market Insight |

|---|---|---|

| Supplier Concentration | High concentration of key component manufacturers grants them pricing power. | Global reverse osmosis membrane market dominated by a few major manufacturers. |

| Switching Costs | High costs for re-engineering, re-certification, and retraining create supplier lock-in. | Significant investment needed for companies to change critical component suppliers. |

| Input Differentiation & Quality | Suppliers of high-performance materials directly influence product efficacy and brand reputation. | Customer reviews in 2023 emphasized water purity and reliability as key purchase drivers. |

What is included in the product

This analysis unpacks the competitive forces shaping Culligan International's water treatment market, focusing on buyer and supplier power, the threat of new entrants and substitutes, and existing rivalry.

Effortlessly identify and mitigate competitive threats with a dynamic framework that highlights key industry pressures impacting Culligan International.

Customers Bargaining Power

Culligan International's customer base is quite varied, encompassing residential, commercial, and industrial sectors. This diversity means the bargaining power of customers isn't uniform across the board.

For residential customers, particularly those seeking standard water treatment solutions, price sensitivity is a significant factor. With numerous alternative providers available, these customers can easily switch, thereby amplifying their negotiating leverage.

Commercial and industrial clients, while often requiring more specialized solutions, can still exert considerable bargaining power. This is frequently driven by the volume of their purchases and the potential for long-term contractual agreements, allowing them to negotiate more favorable terms.

Customers possess significant bargaining power due to the wide array of alternative water solutions available. Beyond Culligan's advanced systems, consumers can easily opt for bottled water, pitcher filters, or even utilize municipal tap water if its quality meets their expectations. This abundance of choice directly impacts Culligan's ability to dictate terms.

The market for home water purification is increasingly diverse and accessible. For instance, the global bottled water market was valued at approximately $350 billion in 2023 and is projected to grow, indicating a strong consumer preference for readily available alternatives. Similarly, the market for water pitcher filters continues to be robust, offering a low-cost entry point for purification.

These readily available and often more affordable options empower customers. They can easily switch to a competitor or a different purification method if Culligan's pricing or product offerings are not perceived as competitive. This dynamic forces Culligan to remain price-sensitive and innovative to retain its customer base.

For basic water filtration needs, customers can often switch between providers or substitute products with minimal cost or effort. This low switching cost, especially prevalent in the residential sector, grants consumers significant bargaining power. For instance, many off-the-shelf water pitcher filters, a direct substitute for some of Culligan's simpler offerings, are readily available at major retailers, allowing consumers to easily change brands based on price or promotions.

Access to Information and Comparison

Customers today possess unprecedented access to information, readily comparing water treatment solutions online. This ease of access allows them to scrutinize prices, features, and user reviews across different brands, significantly increasing their bargaining power. For instance, a 2024 report indicated that over 85% of consumers research products extensively online before making a purchase, directly impacting how companies like Culligan must present their offerings.

This transparency forces Culligan to be highly competitive on value and pricing. Customers can easily identify alternatives and negotiate better terms, or simply opt for a competitor if Culligan's pricing or product features are not perceived as superior. The digital marketplace has essentially leveled the playing field, empowering consumers with knowledge.

- Informed Decision-Making: Online platforms provide detailed product specifications and customer feedback, enabling consumers to make well-researched choices.

- Price Transparency: Aggregator sites and online marketplaces make it simple to compare pricing across multiple vendors for similar water treatment systems.

- Feature Comparison: Consumers can easily benchmark the features and technologies offered by Culligan against those of its competitors.

- Review Influence: Online reviews and testimonials significantly shape purchasing decisions, giving customers collective power to influence market perception.

Importance of Service and Installation

Culligan's dealership network offers more than just water treatment products; they provide a crucial service and installation component. This comprehensive support is a significant differentiator, as customers often prioritize reliable ongoing service over solely focusing on the initial purchase price. This emphasis on service can diminish a customer's bargaining power because the perceived value extends far beyond the product itself.

The importance of service and installation is evident in customer retention rates. For instance, a 2024 industry report indicated that over 60% of B2C customers consider post-purchase support a primary factor in their loyalty. Culligan's ability to deliver consistent, high-quality installation and maintenance directly impacts customer satisfaction and reduces their leverage to negotiate lower prices, as they are investing in a long-term solution.

- Service as a Value Driver: Culligan's installation and maintenance services are integral to the overall customer value proposition.

- Reduced Price Sensitivity: High perceived value in service can make customers less sensitive to initial product pricing.

- Customer Loyalty: Reliable service fosters loyalty, lessening the customer's inclination to bargain aggressively.

- Differentiation Factor: The dealership network's service capabilities set Culligan apart, enhancing its position against competitors.

Customers wield considerable bargaining power due to the wide array of readily available alternatives, from bottled water to pitcher filters, which are often more affordable. This abundance of choice, amplified by online price transparency and extensive product research capabilities, compels Culligan to maintain competitive pricing and value propositions. For example, in 2024, over 85% of consumers researched products online before purchase, directly impacting how companies like Culligan must present their offerings to remain competitive.

| Customer Segment | Bargaining Power Drivers | Impact on Culligan |

|---|---|---|

| Residential (Standard Needs) | High price sensitivity, low switching costs, numerous substitutes (pitcher filters, bottled water) | Forces competitive pricing, necessitates strong value proposition beyond price. |

| Commercial/Industrial | Volume purchases, potential for long-term contracts, specialized solution needs | Ability to negotiate volume discounts and favorable contract terms. |

| All Segments (Information Access) | Online research, price comparison sites, customer reviews | Increases price transparency, empowers informed decision-making, heightens competitive pressure. |

What You See Is What You Get

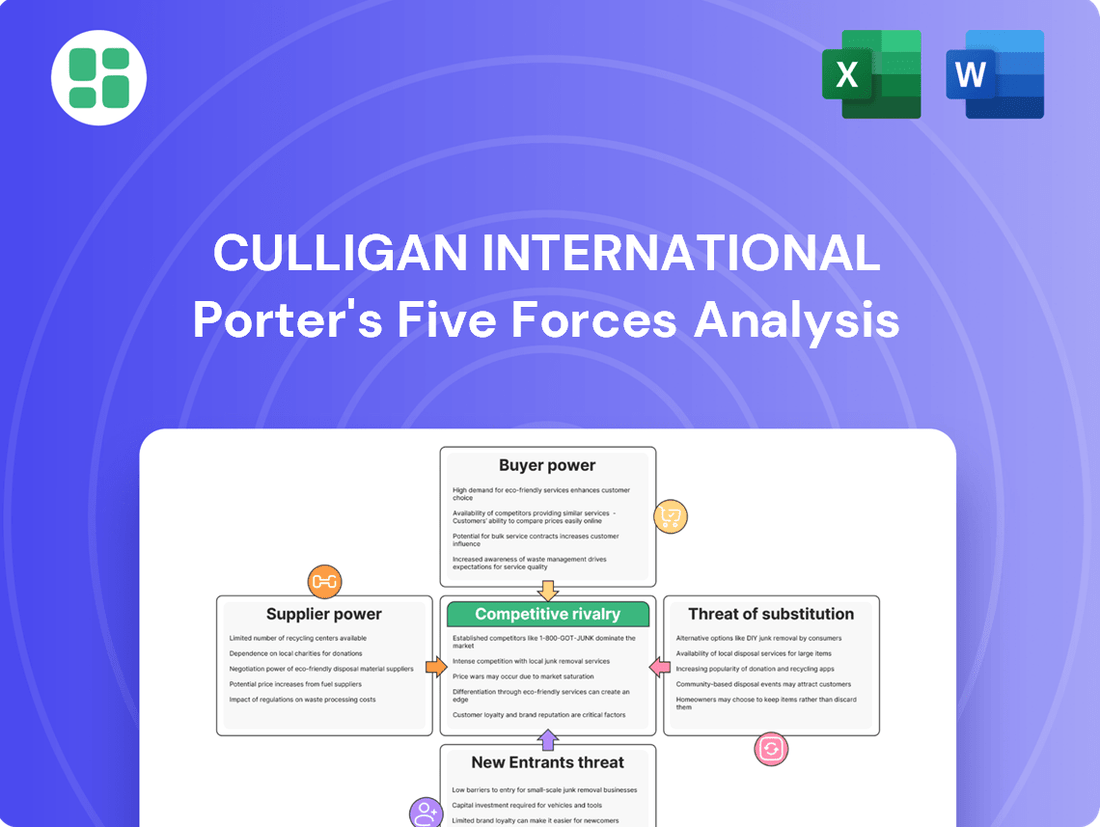

Culligan International Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Culligan International's Porter's Five Forces Analysis, covering the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive analysis is ready for your immediate use.

Rivalry Among Competitors

The global water treatment market is a vast and expanding arena, featuring a diverse array of companies. While giants like Pentair, A.O. Smith, and Xylem hold significant positions, the market is also populated by many smaller, specialized firms. This dynamic creates intense rivalry as all participants strive to capture a piece of the growing demand.

Competitive rivalry in the water treatment sector is intense, fueled by a relentless pursuit of innovation in filtration, smart capabilities, and eco-friendly solutions. Culligan leverages its broad product portfolio, established brand recognition, and widespread service infrastructure to stand out. However, the company faces pressure to continuously innovate as rivals introduce cutting-edge systems, such as IoT-connected purifiers and advanced oxidation processes, to capture market share.

Culligan's established brand, reinforced by recent global marketing initiatives, aims to resonate with a broader customer base, including younger demographics. This focus on brand building is crucial in a sector where consumer perception heavily influences purchasing decisions.

The competitive landscape is characterized by aggressive marketing and branding by rivals, who increasingly highlight sustainability and health advantages of their water purification solutions. For instance, in 2024, many competitors launched campaigns emphasizing plastic waste reduction and the health benefits of filtered water, directly challenging Culligan's market share and requiring continuous innovation in messaging to maintain customer loyalty.

Distribution Network and Service Reach

Culligan's extensive distribution network, comprising authorized dealerships and company-owned operations, forms a formidable barrier to entry and a key competitive strength in sales, installation, and ongoing service. This widespread presence ensures local support and accessibility for customers across numerous regions.

However, rivals who have cultivated equally robust distribution channels, or those employing effective direct-to-consumer strategies, can pose a significant challenge. This is especially true in markets where competitors have established strong local footholds or when targeting specific consumer segments with specialized product offerings.

- Distribution Advantage: Culligan's network facilitates broad market coverage and customer service, a critical factor in the water treatment industry where local support is valued.

- Competitive Challenge: Competitors with strong direct-to-consumer models or established regional dealer networks can effectively compete by offering similar accessibility and specialized service.

- Market Dynamics: The effectiveness of Culligan's distribution is constantly tested by competitors who adapt their sales and service models to capture market share in specific geographic areas or for particular product categories.

Acquisition and Expansion Strategies

The water treatment sector is characterized by significant merger and acquisition (M&A) activity. Companies frequently engage in M&A to broaden their geographical reach, enhance their technological capabilities, and enlarge their customer segments. This trend intensifies the competitive rivalry as players consolidate and gain scale.

Culligan International actively pursues bolt-on acquisitions worldwide to bolster its market presence. For instance, in 2023, Culligan completed several acquisitions, integrating smaller, specialized water treatment providers into its existing operations. This strategy not only strengthens Culligan’s competitive position but also mirrors the broader industry’s consolidation efforts.

- Active M&A Landscape: The water treatment industry witnessed substantial M&A deals in 2023 and early 2024, with transaction volumes indicating a strong appetite for consolidation.

- Culligan's Growth Strategy: Culligan's ongoing acquisition of complementary businesses globally is a key driver of its expansion and a significant factor in the competitive dynamics.

- Impact on Rivalry: These strategic acquisitions lead to larger, more capable competitors, increasing pressure on smaller or less aggressive players and intensifying the overall rivalry.

Competitive rivalry within the water treatment sector is fierce, driven by a crowded market with numerous established players and emerging specialists. Culligan faces direct competition from large, diversified companies like Pentair and Xylem, as well as numerous regional and niche providers, all vying for market share through innovation and aggressive marketing.

In 2024, the competitive landscape saw continued emphasis on smart home integration and advanced filtration technologies, with many rivals launching new IoT-enabled water purifiers. For example, competitors heavily promoted UV sterilization and advanced reverse osmosis systems, directly challenging Culligan’s established product lines and necessitating ongoing R&D investment to maintain parity.

Culligan's extensive distribution network, a key strength, is countered by competitors who have successfully built strong direct-to-consumer channels or robust regional dealership networks. This means that while Culligan benefits from broad accessibility, rivals can effectively compete by focusing on specific customer segments or geographic areas with tailored sales and service approaches.

The industry's active merger and acquisition (M&A) trend, evident in 2023 and continuing into 2024, further intensifies rivalry. Culligan's strategic acquisitions of smaller, specialized firms mirror this consolidation, creating larger, more formidable competitors and increasing pressure on all market participants to innovate and expand their capabilities.

| Key Competitor | 2023 Revenue (USD Billions) | Key Focus Areas | Market Share (Est. %) |

|---|---|---|---|

| Pentair | 4.3 | Filtration, Smart Water Systems | 8-10 |

| Xylem | 5.5 | Water Infrastructure, Treatment Solutions | 7-9 |

| A.O. Smith | 3.7 | Water Heaters, Water Treatment | 5-7 |

| Culligan International | ~2.0 (Est.) | Residential & Commercial Water Treatment | 3-5 |

SSubstitutes Threaten

The most direct and readily available substitutes for Culligan's installed water systems are bottled water and portable filter pitchers. These options provide consumers with immediate access to clean drinking water, often at a lower initial cost compared to a full home installation. For instance, the U.S. bottled water market was valued at approximately $22.7 billion in 2023, highlighting its significant consumer appeal and competitive pressure on services like Culligan's.

Improvements in municipal water quality can act as a substitute for Culligan's products. In 2024, many cities have invested heavily in upgrading their water treatment facilities. For example, the U.S. EPA's Drinking Water Infrastructure Needs Survey and Assessment reported that U.S. community water systems need $624.3 billion over 20 years to maintain and improve the drinking water infrastructure, with a significant portion directed towards improving treatment processes.

As tap water becomes cleaner and safer, the perceived necessity for residential or commercial water filtration systems diminishes. This trend directly impacts demand for Culligan's core offerings, as consumers may find less value in additional purification if their primary water source meets or exceeds their quality expectations.

Stricter government regulations on water contaminants, enforced more rigorously in 2024, further bolster public trust in tap water. When municipalities consistently meet these standards, it reduces the incentive for consumers to seek out private water treatment solutions, thereby threatening the market share of companies like Culligan.

For basic water purification, particularly in developing areas or during emergencies, boiling water acts as a readily available and inexpensive substitute. These simple methods, though less convenient than advanced filtration, address the core need for potable water when advanced systems are out of reach.

DIY water purification methods, such as using activated charcoal or even simple cloth filters, also pose a threat. These solutions can be assembled with readily available materials, offering a low-cost alternative for individuals seeking to improve their water quality without investing in commercial systems. For instance, studies in regions with limited access to clean water show a significant reliance on boiling as a primary purification method, indicating its widespread adoption as a substitute.

Emerging Decentralized Water Treatment Technologies

Advances in decentralized and modular water treatment solutions, such as those focusing on greywater reuse or portable units, are emerging as a significant substitute threat, particularly for commercial and industrial clients seeking localized water management. These innovations provide enhanced flexibility and can prove more cost-effective for specific, targeted applications. For instance, the global market for decentralized water treatment systems was valued at approximately $25 billion in 2023 and is projected to grow substantially.

These emerging technologies offer alternatives to traditional, centralized water infrastructure, potentially reducing reliance on large-scale municipal systems. This shift is driven by a desire for greater control over water resources and a response to increasing water scarcity. Modular systems can be scaled up or down as needed, offering a distinct advantage over fixed, large-capacity plants.

Key substitute threats include:

- Greywater Recycling Systems: Technologies enabling the treatment and reuse of water from sinks, showers, and laundry for non-potable uses like irrigation and toilet flushing.

- Portable Water Treatment Units: Compact, often solar-powered devices capable of purifying water in remote locations or for emergency response, bypassing traditional infrastructure entirely.

- On-site Industrial Water Treatment: Specialized systems designed to treat wastewater generated by specific industrial processes, allowing companies to manage their water footprint independently.

Point-of-Use vs. Point-of-Entry Alternatives

Customers in the water treatment market have choices beyond whole-house systems, opting for point-of-use solutions like faucet filters or pitcher filters. These alternatives, while not always a perfect replacement for a comprehensive point-of-entry system, address specific water quality concerns at the tap. For instance, a consumer might choose a simple faucet filter for drinking water, bypassing the need for a whole-house filtration system, thus limiting the market for larger installations.

This trend presents a threat by offering a lower-cost, simpler way to achieve improved water quality for specific needs. While Culligan's point-of-entry systems offer broader benefits, the accessibility and lower initial investment of point-of-use filters can divert potential customers. For example, the global market for water filters and purifiers was projected to reach over $40 billion in 2024, with a significant portion attributed to smaller, point-of-use devices.

- Lower Initial Cost: Point-of-use filters typically have a much lower upfront purchase price compared to whole-house systems.

- Targeted Solution: They address specific concerns like taste and odor for drinking water, which may be sufficient for many households.

- Ease of Installation and Maintenance: Faucet filters and pitchers are generally easier to install and maintain than complex whole-house filtration setups.

- Market Segmentation: This creates a distinct market segment where customers prioritize convenience and cost-effectiveness for immediate water needs.

The threat of substitutes for Culligan's water treatment solutions is significant, encompassing bottled water, portable filters, and even improvements in municipal water quality. The bottled water market alone was valued at approximately $22.7 billion in 2023, demonstrating a strong consumer preference for readily available alternatives. Furthermore, as municipalities invest in upgrading their water infrastructure, as evidenced by the U.S. EPA's projected $624.3 billion need for water infrastructure improvements over 20 years, the perceived necessity for residential filtration systems may decrease.

DIY methods and emerging decentralized technologies also present viable substitutes. For instance, the global market for decentralized water treatment systems was valued at around $25 billion in 2023. These alternatives offer lower initial costs and greater flexibility, directly challenging Culligan's traditional business model, especially for customers seeking targeted or localized water management solutions.

| Substitute Category | Key Characteristics | Market Relevance (2023-2024 Data) |

|---|---|---|

| Bottled Water | Convenience, perceived purity | Market valued at $22.7 billion (2023) |

| Portable Filters (Pitchers, Faucet) | Lower initial cost, targeted use | Global water filter market projected over $40 billion (2024) |

| Improved Municipal Water | Reduced perceived need for filtration | U.S. water infrastructure needs $624.3 billion over 20 years |

| Decentralized/Modular Systems | Flexibility, localized management | Market valued at approx. $25 billion (2023) |

Entrants Threaten

Establishing a strong foothold in the water treatment sector, especially with sophisticated technologies, necessitates substantial capital. This includes building advanced manufacturing plants, investing heavily in research and development for new solutions, and maintaining a robust inventory. For instance, companies developing proprietary membrane filtration or advanced purification systems often face initial R&D expenditures in the tens of millions of dollars.

Culligan International enjoys a significant advantage due to its strong brand loyalty and established reputation, cultivated over many years. This deep-seated customer trust makes it difficult for newcomers to gain a foothold.

New entrants must overcome the considerable hurdle of building brand recognition and customer confidence in a market where water quality is paramount for health and safety. This process is inherently time-consuming and financially demanding.

For instance, in 2024, brand perception remains a critical differentiator in the water treatment industry, with consumer surveys consistently showing a preference for established brands that have a proven track record of reliability and safety.

Culligan's extensive distribution and service network, encompassing numerous authorized dealerships and direct operations, presents a significant hurdle for potential new entrants. This established infrastructure facilitates widespread sales, efficient installation, and reliable after-sales support, which is crucial in the water treatment industry.

Replicating Culligan's deeply entrenched and experienced service infrastructure, built over decades, is a substantial barrier. New companies would face immense challenges and significant investment requirements to match the geographical reach and service quality that Culligan currently offers its customers.

Regulatory Hurdles and Certifications

The water treatment industry faces significant regulatory hurdles. For instance, in the United States, the Environmental Protection Agency (EPA) sets strict standards for drinking water quality under the Safe Drinking Water Act. New companies must invest heavily in research and development to ensure their products comply with these evolving regulations, which can include NSF/ANSI certifications for materials and performance. This compliance process can add substantial costs and time to market entry, acting as a barrier for potential competitors.

Navigating these complex regulatory landscapes is a significant challenge for new entrants. Obtaining necessary certifications, such as those from NSF International or the Water Quality Association (WQA), often requires extensive testing and documentation. For example, achieving NSF/ANSI 58 certification for reverse osmosis systems can take months and involve significant fees. This can deter smaller or less-resourced companies from entering the market, thereby protecting established players like Culligan.

- Regulatory Compliance Costs: Companies entering the water treatment sector must budget for extensive testing and certification processes, which can run into tens of thousands of dollars per product line.

- Time to Market: The lengthy approval cycles for new water treatment technologies can delay market entry, giving established firms a competitive advantage.

- Evolving Standards: Keeping abreast of and adapting to increasingly stringent health and environmental regulations, such as those related to PFAS (per- and polyfluoroalkyl substances), requires continuous investment and innovation.

- Geographic Variations: Different countries and even states have unique regulatory requirements, adding complexity for companies seeking to operate on a global or national scale.

Technological Expertise and Patents

The water treatment industry demands significant technological expertise, particularly in areas like membrane filtration and reverse osmosis. Culligan’s established position is bolstered by its proprietary technologies and patents, creating a substantial barrier for newcomers. For instance, companies often invest millions in research and development to gain a competitive edge, a cost that new entrants must absorb to even approach parity.

- Technological Barriers: High R&D costs for developing advanced water purification systems.

- Patent Protection: Existing patents held by industry leaders like Culligan limit the ability of new firms to utilize key technologies without licensing.

- Know-How Accumulation: Decades of operational experience and process optimization provide an intangible but critical advantage.

The threat of new entrants in the water treatment market, particularly for a company like Culligan International, is generally considered moderate to low. This is primarily due to the substantial capital requirements for establishing operations, the need for strong brand recognition, and the complex regulatory environment.

New companies face significant upfront costs, often in the millions, for manufacturing, R&D, and distribution. For example, developing and certifying a new residential water filtration system can easily cost upwards of $500,000 to $1 million in 2024, encompassing materials, testing, and regulatory approvals.

The established brand loyalty and extensive service networks of companies like Culligan create a formidable barrier. Replicating decades of trust and a widespread service infrastructure requires immense time and financial investment, making it difficult for newcomers to compete effectively on these fronts.

| Barrier Type | Estimated Cost/Time (USD) | Impact on New Entrants |

|---|---|---|

| Capital Investment (Manufacturing & R&D) | $5M - $50M+ | High |

| Brand Building & Customer Trust | Years & Significant Marketing Spend | High |

| Regulatory Compliance (e.g., NSF/ANSI) | $50K - $500K+ per product | Moderate to High |

| Distribution & Service Network | $10M - $100M+ | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Culligan International leverages data from company annual reports, industry-specific market research reports from firms like IBISWorld, and public financial databases such as S&P Capital IQ to provide a comprehensive view of the competitive landscape.