China Tourism Group Duty Free Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Tourism Group Duty Free Bundle

China Tourism Group Duty Free operates within a dynamic retail landscape, facing significant pressures from powerful suppliers and intense rivalry among existing players. Understanding the bargaining power of buyers and the constant threat of substitutes is crucial for navigating this competitive arena.

The complete report reveals the real forces shaping China Tourism Group Duty Free’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

China Tourism Group Duty Free (CTG Duty-Free) faces significant supplier bargaining power due to its reliance on a concentrated group of global luxury brands. These brands, including those in perfumes, cosmetics, fashion, and watches, possess strong brand equity and desirability, granting them considerable leverage in price and supply negotiations. For instance, in 2023, the luxury goods market continued its robust growth, with key players maintaining strong pricing power, which directly influences CTG Duty-Free's cost of goods sold and overall profitability.

Switching major luxury brand suppliers can be costly and complex for CTG Duty-Free. This involves significant effort in contract renegotiations, managing inventory adjustments, and potentially facing a decline in customer appeal if sought-after brands are no longer accessible. Such complexities foster a reliance on current supplier relationships, thereby amplifying the suppliers' bargaining power.

In 2023, China Tourism Group Duty Free Corporation reported revenue of ¥56.06 billion RMB. This scale of operation means that even minor disruptions in securing key luxury brands could significantly impact sales and profitability, underscoring the importance of maintaining strong supplier ties.

While suppliers hold considerable sway, CTG Duty-Free's vast store network, a key asset in 2024, and its deeply entrenched customer base offer some leverage. This established market presence allows CTG Duty-Free to negotiate from a position of strength, balancing the suppliers' power with its own market influence.

The bargaining power of suppliers is significantly influenced by their brand strength and the exclusivity they offer. Many luxury brands meticulously control their distribution channels, often providing unique products or limited-edition collections only to specific, chosen retailers. This selective approach inherently boosts their leverage.

China Tourism Group Duty Free Corporation's (CTG Duty-Free) success hinges on its capacity to present a wide array of these coveted luxury items. This reliance makes the company vulnerable to supplier demands concerning pricing strategies, the terms of promotional campaigns, and even the physical placement of goods within their stores. The specialized nature of the duty-free market further amplifies these supplier-driven dynamics.

Direct-to-Consumer (DTC) Trend by Luxury Brands

Luxury brands are increasingly adopting direct-to-consumer (DTC) strategies, opening their own online platforms and physical stores. This trend potentially lessens their dependence on intermediaries like China Tourism Group Duty Free (CTG Duty Free). For instance, LVMH reported strong growth in its own retail channels in 2023, indicating a shift in brand distribution. This could empower suppliers with greater control over pricing and direct customer relationships. This dynamic may compel CTG Duty Free to enhance its offerings beyond tax advantages to remain competitive.

The shift towards DTC channels for luxury goods means suppliers can capture more margin and customer data. In 2024, many luxury conglomerates have continued to invest heavily in their proprietary retail networks. This strategic move allows them to curate the brand experience precisely and gather valuable insights into consumer behavior. Consequently, CTG Duty Free faces pressure to differentiate itself by offering unique services or exclusive products that complement the brands' DTC efforts.

- DTC Growth: Luxury brands are expanding their direct sales channels, impacting traditional retail partners.

- Supplier Power: Increased DTC control can give suppliers leverage in negotiations and data ownership.

- CTG Duty Free's Challenge: The need to offer more than just tax benefits to retain luxury brand partnerships.

- Market Dynamics: The travel retail channel remains vital for brand visibility, creating a balancing act for luxury houses.

Global Supply Chain Dynamics and Disruptions

Global supply chain disruptions, exacerbated by geopolitical tensions and manufacturing challenges, can significantly influence the availability and pricing of luxury goods. This environment often empowers suppliers, allowing them to exert greater control over terms and conditions. For instance, the ongoing semiconductor shortage, which began impacting various industries in 2020 and continued through 2024, demonstrated how limited supply can drive up costs and lead to allocation challenges for downstream buyers like CTG Duty-Free.

While CTG Duty-Free has invested in optimizing its supply chain, external factors remain a significant consideration. The company's reliance on a diverse range of international suppliers for its luxury product portfolio means it is susceptible to events like trade disputes or regional instability. A notable example from 2023 was the impact of certain export controls on high-tech components, which, while not directly luxury goods, illustrated the ripple effect such policies can have across global manufacturing and logistics, potentially affecting the production and delivery schedules of various consumer products.

- Supplier Power Drivers: Geopolitical events and manufacturing bottlenecks can limit product availability, increasing supplier leverage.

- CTG Duty-Free's Vulnerability: Despite supply chain optimization, external disruptions can lead to higher supplier demands and reduced product allocations.

- Market Context (2023-2024): Ongoing global supply chain volatility, including the lingering effects of the pandemic and new geopolitical risks, continues to shape supplier-buyer relationships.

The bargaining power of suppliers for China Tourism Group Duty Free (CTG Duty-Free) remains a significant factor, primarily driven by the concentrated nature of luxury brands and their increasing direct-to-consumer (DTC) strategies.

In 2023, CTG Duty-Free's substantial revenue of ¥56.06 billion RMB highlights its importance as a distribution channel, yet the growing DTC investments by luxury conglomerates like LVMH in 2023 empower these suppliers with greater control over margins and customer relationships.

This shift compels CTG Duty-Free to differentiate itself beyond tax benefits, potentially facing increased supplier demands regarding pricing and promotional terms, a dynamic amplified by the specialized travel retail market.

External factors such as ongoing global supply chain volatility, evident through 2024, further bolster supplier leverage by limiting product availability and increasing costs for buyers like CTG Duty-Free.

| Factor | Impact on CTG Duty-Free | Supplier Leverage |

|---|---|---|

| Luxury Brand Concentration | Reliance on key brands | High |

| DTC Growth (2023-2024) | Reduced dependence on intermediaries | Increasing |

| Supply Chain Volatility (2024) | Potential for higher costs and allocation issues | Increased |

| Brand Exclusivity | Limited product availability | High |

What is included in the product

This analysis reveals the intense competitive rivalry, significant buyer power from discerning travelers, and moderate threat of new entrants faced by China Tourism Group Duty Free, alongside the low bargaining power of suppliers and the limited threat of substitutes in its unique market.

Understand the competitive landscape at a glance, identifying key threats and opportunities for China Tourism Group Duty Free to strategically navigate. This analysis provides a clear roadmap to address potential disruptions and capitalize on market advantages.

Customers Bargaining Power

Customers, even with the appeal of duty-free prices, are showing more price sensitivity, especially given economic uncertainties. They are actively comparing prices across different platforms, including online and traditional retail stores. This comparison shopping empowers them to seek out the best value.

The accessibility of luxury goods through diverse channels means consumers can easily find alternative sources, potentially bypassing duty-free shops if better deals are available elsewhere. While price sensitivity has lessened somewhat, it remains a significant factor influencing purchasing decisions.

The resurgence of outbound international travel from China significantly amplifies customer bargaining power. As Chinese consumers increasingly explore global destinations, they gain access to a wider array of duty-free shopping opportunities beyond China Tourism Group Duty Free's (CTG Duty Free) domestic and Hainan-based offerings. This expanded choice directly translates into reduced reliance on any single provider.

In 2023, Chinese outbound tourism saw a remarkable recovery, with over 80 million outbound trips recorded, a substantial increase from previous years. This surge means consumers have more opportunities to purchase duty-free goods in international hubs like South Korea, Japan, and Southeast Asia, directly diverting spending away from CTG Duty Free's domestic and Hainan operations. Consequently, customers possess greater leverage to seek out competitive pricing and product selections elsewhere, weakening CTG Duty Free's pricing power.

Customers in China's duty-free market are increasingly digitally savvy, using platforms like WeChat and Tmall for pre-purchase research and price comparisons. This digital access means they can easily scout for the best deals, directly impacting China Tourism Group Duty Free's pricing strategies.

The expectation of a smooth omnichannel experience, where online research seamlessly transitions to in-store purchases, further strengthens customer leverage. In 2023, the Chinese duty-free market saw significant growth, with companies needing to offer personalized promotions and robust loyalty programs to retain customers who are well-informed and have high expectations for convenience and value.

Changing Consumer Preferences and Demographics

The bargaining power of customers is significantly shaped by evolving consumer preferences and demographics in China. Younger generations, particularly millennials and Gen Z, are increasingly prioritizing sustainability, exclusivity, and value-driven experiences over traditional purchasing habits. This shift means CTG Duty-Free must actively adapt its product selection and marketing to align with these evolving demands, thereby granting these informed consumer segments greater influence over the company's offerings.

For instance, a 2024 survey indicated that over 60% of Chinese Gen Z consumers consider a brand's commitment to sustainability when making purchasing decisions. This growing awareness empowers customers to demand more ethical and environmentally conscious products from retailers like CTG Duty-Free. Furthermore, the desire for unique and personalized experiences means customers are less likely to accept standardized offerings, pushing CTG Duty-Free to innovate and curate more exclusive product assortments.

- Shifting Consumer Priorities: Chinese consumers, especially younger demographics, increasingly value sustainability and unique experiences.

- Influence of Gen Z and Millennials: These groups exert greater bargaining power due to their conscious purchasing decisions.

- Demand for Exclusivity and Value: Customers are seeking differentiated products and experiences that offer perceived high value.

- Adaptation Necessity for CTG Duty-Free: The company must adjust its strategies to meet these evolving customer expectations.

Impact of Policy Changes on Purchase Allowances

Changes in duty-free purchase allowances, particularly in key markets like Hainan, directly influence customer spending habits. For instance, Hainan's duty-free allowance was increased to RMB 100,000 per person per year in 2020, significantly boosting sales. However, any future policy tightening or the emergence of competitive shopping channels can shift customer power, as consumers can easily redirect their spending if perceived value diminishes.

The bargaining power of customers is amplified when governments adjust duty-free shopping regulations. For example, the expansion of the Hainan duty-free policy in 2020, which raised the annual purchase limit to RMB 100,000, initially increased customer demand. However, if future policies were to restrict these allowances or if other regions offered more attractive duty-free options, customers would gain leverage to seek better deals elsewhere.

- Policy Impact: Hainan's duty-free allowance increase to RMB 100,000 in 2020 demonstrably boosted consumer spending.

- Customer Leverage: Any reduction in allowances or expansion of competing shopping options empowers customers to seek alternative value.

- Market Responsiveness: Duty-free operators must adapt to policy shifts to maintain customer loyalty and purchasing power.

The bargaining power of customers is significantly influenced by the increasing availability of duty-free shopping options globally, especially with the robust recovery of Chinese outbound tourism. As more Chinese travelers explore international destinations, they gain access to a wider array of choices beyond CTG Duty Free's offerings, directly reducing their reliance on any single provider and enhancing their ability to seek competitive pricing.

In 2023, Chinese outbound trips surged to over 80 million, providing consumers with ample opportunities to purchase duty-free goods in international hubs like South Korea and Japan. This increased accessibility empowers customers to compare prices and product selections across different markets, thereby strengthening their leverage over CTG Duty Free.

Furthermore, the digital savviness of Chinese consumers, who actively use platforms for price comparisons, coupled with evolving preferences for sustainability and exclusivity, grants them substantial bargaining power. A 2024 survey revealed that over 60% of Chinese Gen Z consumers consider sustainability in their purchasing decisions, pushing CTG Duty Free to adapt its offerings to meet these informed demands.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Outbound Tourism Recovery | Increased | Over 80 million Chinese outbound trips in 2023. |

| Global Duty-Free Accessibility | Increased | Availability of options in South Korea, Japan, Southeast Asia. |

| Digital Price Comparison | Increased | Use of WeChat, Tmall for price research. |

| Consumer Preferences (Sustainability, Exclusivity) | Increased | 60%+ of Gen Z consider sustainability (2024 survey). |

What You See Is What You Get

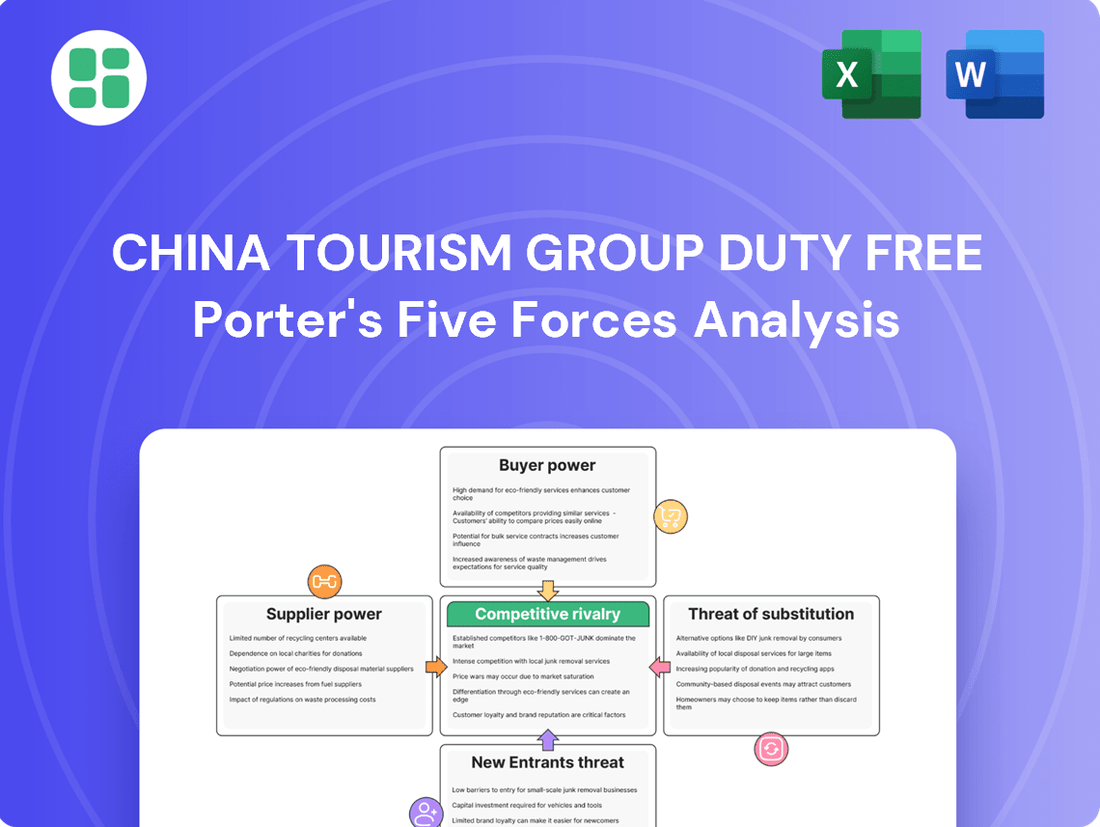

China Tourism Group Duty Free Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders, detailing the China Tourism Group Duty Free Porter's Five Forces Analysis. It thoroughly examines the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry among existing competitors, and the threat of substitute products or services. You'll gain a comprehensive understanding of the strategic positioning and potential challenges faced by CTG Duty Free.

Rivalry Among Competitors

China Tourism Group Duty Free (CTG Duty-Free) stands as a towering figure in China's duty-free landscape, particularly in the burgeoning Hainan offshore market. Its substantial market share, especially in Hainan, underscores its dominant position.

This high concentration, however, doesn't eliminate rivalry; instead, it intensifies competition among the few large, licensed players vying for continued growth and deeper market penetration. For instance, CTG Duty-Free reported a revenue of approximately RMB 60.5 billion in 2023, highlighting its scale and the significant market share it commands.

Even with a restricted number of duty-free operating licenses, China Tourism Group Duty Free (CTG Duty Free) faces significant rivalry from established players. Companies such as Sunrise Duty-Free, DFS Group, and Lagardere Travel Retail actively compete for advantageous retail spaces and exclusive partnerships with high-end brands. This competitive pressure is evident in their aggressive bidding for airport operating rights and strategic efforts to establish a presence in burgeoning downtown duty-free zones.

Competitors are actively broadening their reach, establishing new downtown duty-free locations and opening boutiques abroad. This aggressive geographic expansion directly targets the growing segment of Chinese outbound travelers, intensifying the competitive pressure on China Tourism Group Duty Free (CTG Duty Free).

This trend is particularly evident as rivals, much like CTG Duty Free itself, are diversifying their operations beyond traditional hubs like Hainan. For instance, Dufry AG, a major global duty-free operator, has been strategically acquiring businesses to bolster its presence in key Asian markets, aiming to capture a larger share of international travel retail. The year 2024 has seen continued consolidation and new market entries across the Asia-Pacific region, creating a more complex and challenging competitive environment.

Impact of Hainan's Evolving Duty-Free Landscape

Hainan's duty-free market, a critical revenue driver for China Tourism Group Duty-Free (CTG Duty-Free), has experienced a significant uptick in competitive intensity. Since 2020, the island has welcomed additional duty-free operators, expanding the competitive landscape. This influx, coupled with policy shifts, means CTG Duty-Free, despite its dominant market position, faces heightened rivalry for the spending power of domestic travelers.

The increased number of players directly impacts CTG Duty-Free's market share dynamics. For instance, in 2023, Hainan's offshore duty-free sales reached approximately 43.75 billion yuan (around $6.1 billion USD). While CTG Duty-Free remains the largest operator, the presence of competitors like China International Travel Service (CITS) and others necessitates continuous strategic adjustments to maintain its edge in this dynamic environment.

- Increased Competition: Hainan's duty-free sector saw new entrants post-2020, intensifying rivalry.

- CTG Duty-Free's Dominance: The company still holds a leading share, but faces greater pressure.

- Policy Evolution: Changing regulations contribute to the dynamic and competitive nature of the market.

- Domestic Traveler Focus: Operators are vying for the same pool of domestic consumer spending.

Digitalization and Omnichannel Strategies

The competitive rivalry in China's duty-free sector is intensifying as companies embrace digitalization and omnichannel strategies. This includes the widespread implementation of loyalty programs, sophisticated e-commerce platforms, and highly personalized marketing campaigns. For instance, in 2023, the overall retail e-commerce sales in China reached approximately 15.42 trillion yuan, highlighting the significant shift towards online channels.

Players like China Tourism Group Duty Free Corporation (CTGF) are actively leveraging technology to boost customer engagement and create seamless shopping experiences. This digital transformation is not just about convenience; it's becoming a crucial battleground for capturing market share. In 2024, the focus on integrating online and offline touchpoints is expected to further differentiate leading retailers.

- Digital Integration: Companies are investing heavily in technology to create unified customer journeys across physical stores and online platforms.

- Loyalty Programs: Enhanced loyalty programs are being used to foster customer retention and encourage repeat purchases in a competitive market.

- Personalized Marketing: Data analytics are employed to deliver tailored promotions and product recommendations, increasing engagement and conversion rates.

- E-commerce Dominance: The continued growth of e-commerce, with China's online retail sales a significant portion of its GDP, forces all players to maintain robust digital presences.

Competitive rivalry within China's duty-free market is fierce, with China Tourism Group Duty Free (CTG Duty-Free) facing significant pressure from established and emerging players. The expansion of duty-free licenses, particularly in Hainan since 2020, has broadened the competitive landscape, forcing CTG Duty-Free to continually adapt its strategies to maintain its leading position. This heightened competition is evident in aggressive bidding for retail spaces and strategic brand partnerships.

Companies are actively pursuing omnichannel strategies, integrating digital platforms with physical stores to enhance customer engagement and loyalty. For instance, China's overall retail e-commerce sales reached approximately 15.42 trillion yuan in 2023, underscoring the importance of a strong online presence. This digital push is a key differentiator in capturing market share.

| Competitor | Key Strategies | Market Focus |

|---|---|---|

| Sunrise Duty-Free | Airport retail, brand partnerships | Major Chinese airports |

| DFS Group | Luxury retail, global presence | International hubs, downtown locations |

| Lagardère Travel Retail | Diverse retail formats, brand exclusives | Airports, urban centers |

| Dufry AG | Acquisitions, Asian market expansion | Asia-Pacific travel retail |

SSubstitutes Threaten

The growing trend of domestic luxury consumption in mainland China presents a substantial threat of substitutes for duty-free operators. Consumers are increasingly opting for luxury goods purchased online or directly from brand boutiques within China, bypassing the need for international travel. This shift is fueled by the convenience and expanding accessibility of these channels. For instance, in 2024, the Chinese luxury market continued its robust growth, with online sales accounting for a significant portion of this expansion, directly diverting potential revenue from duty-free channels.

Cross-border e-commerce platforms and the informal daigou network present a significant threat of substitutes for China Tourism Group Duty Free Corporation. These channels allow consumers to purchase international luxury goods directly, often bypassing traditional duty-free stores. For instance, in 2023, China's cross-border e-commerce imports were valued at over 1.5 trillion yuan, demonstrating the scale of this alternative purchasing behavior.

While regulatory measures have aimed to curb the daigou trade, its persistent nature, especially for price-sensitive consumers, continues to offer a viable substitute. These channels provide access to a wide range of products, often with price advantages that traditional retail, including duty-free, struggles to match. This competitive pricing and convenience directly siphon demand away from established duty-free operators.

Chinese outbound travelers increasingly consider overseas non-duty-free retailers as viable alternatives for luxury purchases. This trend is amplified when favorable exchange rates, as seen with the Yuan's fluctuations against major currencies in 2024, make these regular stores more appealing. For instance, a stronger Yuan in early 2024 could significantly reduce the price differential between duty-free and regular retail.

The overall overseas shopping experience itself acts as a substitute. Tourists often integrate shopping into broader travel itineraries, visiting diverse retail environments and attractions that may offer a more engaging experience than a dedicated duty-free outlet. This holistic approach to travel and consumption can divert spending away from traditional duty-free channels.

Experiences Over Goods

The growing preference for experiential travel over traditional luxury goods consumption poses a threat of substitution for duty-free retailers like China Tourism Group Duty Free. Travelers are increasingly allocating their discretionary income towards unique cultural immersions, adventure activities, and local services rather than solely focusing on physical products. For instance, global spending on travel experiences saw a significant rebound in 2024, with many consumers prioritizing memorable journeys over material possessions.

This shift means that money spent on authentic local tours, gourmet dining, or wellness retreats might otherwise have been spent on perfumes, cosmetics, or spirits at duty-free shops. By 2024, reports indicated that a substantial portion of travel budgets, often exceeding 40% in popular destinations, was dedicated to activities and experiences, directly impacting the potential spend on duty-free items.

- Experiential Tourism Growth: Travelers are prioritizing unique experiences, diverting funds from traditional luxury goods.

- Shifting Consumer Values: The desire for memorable journeys over material possessions is a long-term trend impacting duty-free sales.

- Impact on Discretionary Spending: Funds allocated to local culture and services reduce the pool of money available for duty-free purchases.

- Data Point (Illustrative): In 2024, some travel segments saw over 40% of budgets dedicated to experiences, a key indicator of this substitution threat.

Duty-Paid Retail and Local Shopping

The availability of luxury goods in domestic duty-paid retail, particularly when enhanced by promotional activities or loyalty programs, can diminish the appeal of waiting for duty-free shopping opportunities. For instance, in 2024, major Chinese cities continued to see robust growth in their domestic luxury retail sectors, with brands actively engaging consumers through exclusive events and personalized offers.

Local high-end malls and boutiques present a convenient and immediate alternative for consumers who are not traveling or who desire instant gratification. This accessibility directly competes with the planned nature of duty-free purchases.

- Domestic Luxury Retail Growth: China's domestic luxury market experienced significant expansion in 2024, with sales in key cities like Shanghai and Beijing showing strong year-over-year increases, often driven by localized promotions.

- Accessibility Advantage: Local retail offers immediate access to products, bypassing the travel requirements and potential stock limitations sometimes associated with duty-free channels.

- Promotional Impact: Aggressive discounting and loyalty rewards from domestic retailers can erode the price advantage typically enjoyed by duty-free shopping, making local purchases more attractive.

The rise of domestic luxury consumption in mainland China directly substitutes duty-free purchases, as consumers increasingly buy luxury goods online or in local boutiques. This trend was evident in 2024, with the Chinese luxury market continuing its strong growth, fueled by convenient and accessible channels that bypass international travel requirements.

Cross-border e-commerce and informal networks like daigou also offer significant alternatives, allowing direct purchase of international luxury goods. China's cross-border e-commerce imports exceeded 1.5 trillion yuan in 2023, highlighting the scale of these substitute channels, which often provide price advantages over traditional duty-free operators.

Furthermore, overseas non-duty-free retailers are becoming more attractive, especially with favorable exchange rates. For instance, a stronger Yuan in early 2024 could narrow the price gap between regular retail and duty-free, making international shopping more appealing even outside designated zones.

| Substitute Channel | Key Driver | 2023/2024 Impact |

|---|---|---|

| Domestic Luxury Retail | Convenience, Brand Promotions | Robust growth in major Chinese cities, increased localized offers. |

| Cross-Border E-commerce | Accessibility, Wide Product Range | Over 1.5 trillion yuan in imports (2023), offering direct access to international goods. |

| Overseas Regular Retail | Exchange Rates, Shopping Experience | Potential for reduced price differentials due to Yuan fluctuations in 2024. |

Entrants Threaten

The duty-free sector in China operates under a stringent regulatory framework, with the government issuing a finite number of operating licenses. This scarcity of licenses presents a formidable hurdle for potential newcomers, effectively deterring new entrants from challenging established operators such as China Tourism Group Duty Free.

Establishing and operating duty-free shops, especially in prime locations like airports and major downtown areas, demands significant capital. China Tourism Group Duty Free Corporation, for instance, operates in a sector where initial outlays for retail space, inventory, and robust supply chain management are considerable. For example, in 2023, the company reported significant investments in its retail network and operational capabilities, reflecting the high financial hurdle for newcomers.

Established relationships with luxury brands present a significant barrier to entry for new players in the duty-free market. China Tourism Group Duty Free (CTG Duty-Free), for instance, has cultivated deep, long-standing partnerships and secured exclusive agreements with many of the world's most sought-after luxury brands. These relationships are not easily replicated, as they are built on trust, volume, and a proven track record of successful collaboration.

New entrants would struggle to gain access to the premium merchandise that is essential for attracting and retaining duty-free shoppers. For example, CTG Duty-Free's strong ties allow them preferential access to new product launches and limited editions, giving them a competitive edge. In 2023, luxury goods accounted for a substantial portion of duty-free sales globally, underscoring the importance of these brand relationships.

Brand Recognition and Customer Loyalty

China Tourism Group Duty Free (CTG Duty-Free) enjoys a significant advantage due to its robust brand recognition and a substantial, loyal customer base. With over 38 million members in its loyalty program, the company has cultivated deep trust and repeat business among travelers. This established presence makes it exceptionally challenging for newcomers to replicate the same level of customer engagement and patronage. New entrants would face considerable hurdles, requiring massive marketing expenditures and a considerable timeframe to build comparable brand equity and customer loyalty in the competitive duty-free market.

New entrants face a significant barrier in overcoming CTG Duty-Free's established brand recognition and customer loyalty. The company's extensive membership base, exceeding 38 million users, represents a powerful competitive moat. Building a similar level of trust and consistent patronage requires substantial investment in marketing and a prolonged period of operation. For instance, in 2023, CTG Duty-Free reported a revenue of ¥92.4 billion, demonstrating the scale of its operations and customer reach, which new players would struggle to match quickly.

- Strong Brand Equity: CTG Duty-Free benefits from decades of operation and extensive marketing, creating a well-recognized and trusted brand among international travelers.

- Loyal Customer Base: Over 38 million members in their loyalty program translate to a predictable and consistent revenue stream, making it difficult for new entrants to attract and retain customers.

- High Marketing Investment Required: New competitors would need to invest heavily in advertising and promotional activities to build brand awareness and attract customers away from CTG Duty-Free's established network.

Government Support and Strategic Importance

The threat of new entrants for China Tourism Group Duty Free (CTG Duty Free) is significantly mitigated by its status as a state-owned enterprise, often enjoying substantial government backing. This strategic importance, particularly in fostering domestic tourism and consumption, translates into preferential policies and access to prime locations, creating considerable barriers for newcomers. For instance, in 2023, CTG Duty Free reported operating 241 stores, a testament to its established footprint and government-facilitated expansion.

New entrants would face challenges in replicating CTG Duty Free's access to favorable locations and policy support. The Chinese government's focus on developing its duty-free sector as a key component of its economic strategy means that existing, strategically aligned players like CTG Duty Free are likely to receive continued facilitations. This creates an uneven playing field where new, independent entrants may struggle to secure the same advantages, impacting their ability to compete effectively.

- Government backing provides preferential policy treatment for CTG Duty Free.

- Strategic importance in tourism promotion creates access advantages for CTG Duty Free.

- New entrants face hurdles in securing similar policy support and prime locations.

- CTG Duty Free's extensive network of 241 stores as of 2023 highlights its established market presence.

The threat of new entrants into China's duty-free market is considerably low, largely due to the sector's heavily regulated nature and the substantial capital investment required. China Tourism Group Duty Free (CTG Duty-Free) benefits from this, as obtaining operating licenses is a significant hurdle. For example, in 2023, the company's continued expansion and investments in its retail network underscored the high financial barriers for any potential newcomers looking to establish a presence in this lucrative market.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Regulatory Licenses | Government issues a finite number of operating licenses. | Limits the number of potential competitors. |

| Capital Requirements | High initial outlays for retail space, inventory, and supply chain. | Deters new players due to significant financial commitment. |

| Brand Equity & Customer Loyalty | CTG Duty-Free has over 38 million loyalty program members. | New entrants need massive marketing to build comparable brand recognition and customer trust. |

| Supplier Relationships | Exclusive agreements with luxury brands. | New entrants struggle to gain access to premium merchandise. |

| Government Support | State-owned enterprise status provides preferential policies. | Creates an uneven playing field for independent new entrants. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Tourism Group Duty Free leverages data from official company filings, including annual reports and investor presentations. We also incorporate insights from reputable market research firms and industry-specific publications to capture competitive dynamics.