China Resources Land Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Land Bundle

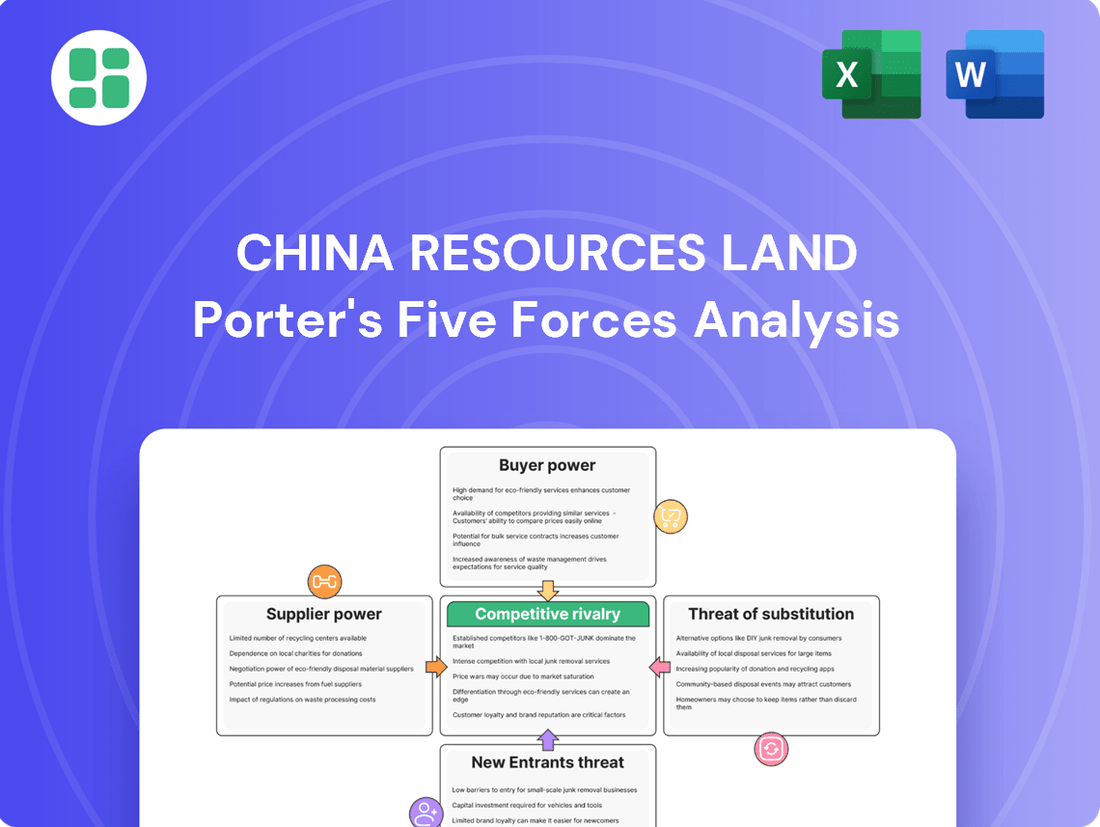

China Resources Land navigates a complex real estate landscape, facing significant buyer power and intense rivalry from established developers. Understanding these forces is crucial for any stakeholder looking to grasp their competitive standing.

The complete report reveals the real forces shaping China Resources Land’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers is a key factor influencing bargaining power. For China Resources Land, a limited number of large suppliers for essential resources like prime land parcels or specialized construction materials can significantly shift power. If these suppliers are few and dominant, they can dictate terms and potentially increase costs, impacting China Resources Land's profitability. For instance, in 2024, the land market in major Chinese cities remained highly competitive, with a few major developers, including China Resources Land, vying for limited prime locations, giving significant leverage to land-owning entities.

China Resources Land's reliance on specialized inputs, such as prime urban land parcels, significantly influences supplier bargaining power. In 2024, the scarcity of readily available development-ready land in Tier 1 and Tier 2 cities across China means that landowners and local governments offering these parcels can command higher prices, thereby increasing their leverage. Conversely, the availability of standardized construction materials and labor means suppliers in these areas have less power to dictate terms.

China Resources Land faces moderate switching costs when dealing with its suppliers, particularly in the construction materials and services sectors. While there are established relationships and some project-specific adaptations, the availability of multiple qualified suppliers in China's vast market generally limits the leverage of individual suppliers.

The company's ability to negotiate favorable terms is enhanced by its scale and the competitive landscape for many of its inputs. For instance, in 2024, China Resources Land's substantial procurement volume likely allowed it to secure competitive pricing for concrete and steel, even with some suppliers having proprietary processes or established delivery networks.

However, for highly specialized components or technology, such as advanced building management systems, switching costs could be higher. These might involve integration challenges and the need for new training, potentially giving those specific suppliers more bargaining power. This was evident in the integration of smart home technologies in their premium developments during 2024, where a limited number of providers meant less room for negotiation.

Threat of Forward Integration by Suppliers

The threat of suppliers engaging in forward integration, meaning they start property development or management themselves, could significantly increase their bargaining power over China Resources Land. If land providers, for example, could easily transition into becoming developers, they could bypass China Resources Land altogether, forcing the company to accept less favorable terms. This is a notable concern, especially when considering local governments as primary land suppliers.

- Forward Integration Risk: Suppliers of critical inputs or land possess the potential to enter China Resources Land's core business, thereby strengthening their negotiating leverage.

- Land Supplier Leverage: Local governments, as key land suppliers in China, hold the inherent capability to develop land directly, potentially diminishing China Resources Land's purchasing power.

- Competitive Landscape Shift: If suppliers can effectively become competitors, they can dictate terms by threatening to cut off supply or offer land directly to end-users, increasing costs for China Resources Land.

Importance of China Resources Land to Suppliers

China Resources Land's (CRL) significance to its suppliers plays a crucial role in shaping supplier bargaining power. If CRL constitutes a substantial portion of a supplier's annual revenue, that supplier is more likely to be dependent on CRL, thereby reducing their leverage. For instance, if a major construction materials producer derives 30% of its sales from CRL, it would be more inclined to offer favorable terms to maintain that vital business relationship.

Conversely, for large, diversified construction firms or major material producers, CRL might represent only a small fraction of their overall client base. In such scenarios, these suppliers possess greater bargaining power, as they are not overly reliant on CRL and can afford to be more selective or demanding regarding contract terms and pricing. This dynamic is evident when a large steel manufacturer supplies to numerous developers, making CRL's business less critical to its overall financial health.

- Supplier Dependence: The degree to which suppliers rely on China Resources Land for revenue directly impacts their bargaining power. Higher dependence weakens supplier power.

- Client Diversification: Suppliers with a broad client base, serving many developers and industries, have more leverage than those heavily concentrated on CRL.

- Market Position of Suppliers: The market share and competitive standing of suppliers in their respective industries also influence their ability to negotiate favorable terms with CRL.

- Contractual Agreements: Existing long-term contracts with fixed pricing or volume commitments can alter the immediate bargaining power dynamics between CRL and its suppliers.

The bargaining power of suppliers for China Resources Land (CRL) is influenced by the concentration of suppliers for critical inputs, such as prime land parcels. In 2024, the scarcity of developable land in China's major cities meant that fewer landowners and local governments had significant leverage, allowing them to command higher prices for these essential assets.

While CRL's scale allows it to negotiate favorable terms for standardized materials like concrete and steel due to its substantial procurement volume in 2024, the threat of forward integration by suppliers, particularly land providers, remains a key concern. Should these suppliers begin developing properties themselves, they could bypass CRL, thereby increasing their negotiating power and potentially CRL's costs.

The degree to which suppliers depend on CRL for revenue also shapes their leverage. Suppliers with a diversified client base, serving numerous developers, are less reliant on CRL and thus possess greater bargaining power compared to those whose sales are heavily concentrated with CRL.

China Resources Land's bargaining power with suppliers is moderately influenced by switching costs, which are generally low for standardized construction materials but can be higher for specialized technology. For instance, integrating advanced smart home systems in premium developments during 2024 involved a limited number of providers, granting them more negotiation leverage.

What is included in the product

This Porter's Five Forces analysis for China Resources Land dissects the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the real estate sector. It offers insights into the competitive pressures shaping China Resources Land's strategic decisions and profitability.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for China Resources Land.

Customers Bargaining Power

The bargaining power of customers for China Resources Land is generally diluted by the sheer volume of individual residential buyers. In 2024, China's vast urban population, numbering over 900 million people, represents millions of potential homebuyers, making it difficult for any single buyer or small group to significantly influence pricing or terms.

However, the landscape shifts when considering institutional investors or large commercial tenants. While individual residential buyers have limited power due to their numbers, a few major institutional investors or significant commercial entities leasing substantial office or retail space could indeed wield considerable influence. For instance, if a large corporation were to lease a significant portion of a new commercial development, they might negotiate more favorable lease terms, impacting China Resources Land's revenue from that specific property.

China Resources Land's customers, particularly individual homebuyers, often have access to a wealth of information regarding property prices and market trends through online portals and real estate agencies. This transparency can empower buyers, making them more sensitive to price fluctuations and competitive offerings. For instance, in 2023, the average price per square meter for new homes in major Chinese cities saw a slight decrease, indicating a market where buyers are keenly aware of value.

The ease with which customers can switch from China Resources Land (CR Land) properties or services to competitors is a key factor in their bargaining power. For residential buyers, these costs can be substantial, encompassing transaction fees, relocation expenses, and the emotional toll of moving. In 2023, the average transaction cost for property resale in major Chinese cities could range from 2-5% of the property value, making frequent switching economically prohibitive.

For commercial tenants, switching costs are generally higher. These include the significant expenses of fitting out new premises to meet specific business needs and the inevitable disruption to operations during a relocation. These factors tend to lock in tenants, reducing their immediate incentive to switch, thereby lowering their bargaining power against CR Land.

Threat of Backward Integration by Customers

The threat of backward integration by customers for China Resources Land (CRL) is relatively low, particularly for its core property development business. While individual homeowners are highly unlikely to develop their own properties, large corporate clients or institutional investors might consider developing or managing their own facilities to reduce reliance on external developers. However, this is a complex and capital-intensive undertaking, making it less common as a direct substitute for CRL's primary services.

For instance, in 2024, the commercial real estate sector saw significant investment, but the majority of large corporations continued to outsource development and management to specialized firms like CRL due to the expertise and scale required. The cost and complexity of acquiring land, navigating zoning regulations, and managing construction projects typically outweigh the benefits of in-house development for most businesses.

- Low Likelihood for Individual Homeowners: Developing properties requires specialized knowledge, capital, and regulatory compliance, making it impractical for most individual buyers.

- Potential for Large Corporate Clients: Major corporations with substantial real estate needs might explore self-development or management of facilities, especially for bespoke operational requirements.

- Limited Impact on Core Development: Backward integration is less feasible as a direct replacement for the entire property development lifecycle, which involves land acquisition, design, construction, and sales.

- Cost and Complexity Barriers: The significant financial investment, time commitment, and expertise needed for property development act as major deterrents for most customers considering backward integration.

Product Differentiation and Brand Loyalty

China Resources Land distinguishes itself by developing high-quality urban living spaces and unique mixed-use complexes. This focus on premium offerings and integrated community development fosters strong brand loyalty among its customer base, effectively diminishing their bargaining power.

For instance, China Resources Land's commitment to creating desirable living environments, often featuring extensive amenities and prime locations, cultivates a preference that transcends mere price considerations. This customer allegiance means buyers are less likely to switch to competitors based solely on cost, thereby strengthening the company's position.

- Brand Reputation: China Resources Land's established reputation for quality and reliability reduces customer price sensitivity.

- Product Quality: The company's emphasis on superior construction and design creates a premium product that commands customer loyalty.

- Customer Loyalty: High levels of customer satisfaction and repeat business limit the ability of individual buyers to negotiate better terms.

- Mixed-Use Development: Integrated projects offering residential, commercial, and recreational facilities provide a unique value proposition that differentiates them from single-purpose developments.

The bargaining power of customers for China Resources Land is generally low, especially for individual residential buyers who are numerous and face high switching costs. However, large corporate tenants or institutional investors can exert more influence through negotiations on substantial leases or investments. The company's strong brand reputation and focus on quality developments further reduce customer price sensitivity and the inclination to switch.

| Factor | Impact on Bargaining Power | Reasoning for China Resources Land |

|---|---|---|

| Number of Buyers | Low | Millions of individual residential buyers in China dilute individual power. |

| Switching Costs (Residential) | High | Transaction fees, relocation, and emotional factors make frequent switching uneconomical. |

| Switching Costs (Commercial) | High | Fit-out expenses and operational disruption deter large tenants from frequent moves. |

| Customer Loyalty/Differentiation | Low | Premium offerings and integrated developments foster brand loyalty, reducing price sensitivity. |

Preview Before You Purchase

China Resources Land Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It offers a comprehensive Porter's Five Forces analysis of China Resources Land, detailing the competitive landscape and strategic implications for the company's operations and market position.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It thoroughly examines the bargaining power of buyers and suppliers within the Chinese real estate sector, as well as the threat of new entrants and substitute products.

You're looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing deep insights into the intensity of rivalry among existing competitors in China's dynamic property market.

Rivalry Among Competitors

The Chinese property market is characterized by a high number of competitors, encompassing both large state-owned enterprises and a multitude of private developers. This sheer volume creates a dynamic and often aggressive competitive landscape, forcing companies to innovate and optimize their strategies to stand out.

China Resources Land operates within this intensely competitive environment, holding a significant position as the third-largest developer by property sales. In 2023, for instance, the company reported contracted sales of approximately RMB 210.5 billion, underscoring its substantial market presence amidst a sector with numerous players vying for market share.

The Chinese real estate market is currently in a phase of stabilization, marked by a slowdown in growth and, in many areas, declining property prices. This shift from a period of rapid expansion to a more mature and challenging environment intensifies competition among developers like China Resources Land.

As of early 2024, data indicates a contraction in new home sales in major Chinese cities, with some reports showing year-on-year decreases exceeding 30% in certain regions. This contraction means that companies are fighting harder for a smaller piece of the pie, making aggressive pricing and innovative product offerings crucial for survival and market share retention.

China Resources Land distinguishes itself through a commitment to high-quality urban living and commercial spaces, focusing on superior design and construction. This differentiation, coupled with strong brand recognition, helps to mitigate direct price competition from rivals in the crowded Chinese real estate market. For instance, in 2023, the company's sales reached RMB 212.9 billion, reflecting a robust market presence built on perceived value.

Exit Barriers for Competitors

Competitors in China's real estate market face substantial exit barriers, which can keep even struggling firms in play and intensify competition. These barriers include massive investments in fixed assets like land and construction projects, along with the need for specialized expertise in development, sales, and local regulatory navigation. Many developers also carry significant long-term debt, making a swift or orderly exit financially prohibitive.

The persistence of these high exit barriers means that even when market conditions are unfavorable, many companies are compelled to continue operations. This situation directly fuels competitive rivalry, as these entrenched players fight for market share. While some consolidation has occurred in the sector, a considerable number of developers remain active, contributing to the crowded competitive landscape.

- High Fixed Asset Investments: Real estate development requires substantial capital outlay for land acquisition and construction, creating a significant barrier to exiting the market.

- Specialized Skills and Knowledge: Navigating China's complex property market, including regulations, financing, and consumer preferences, demands unique expertise that is not easily transferable.

- Long-Term Debt Obligations: Many developers are burdened by considerable debt, making it difficult to liquidate assets and repay creditors without incurring substantial losses, thus discouraging exit.

- Market Persistence: Despite market fluctuations and some consolidation, a large number of developers continue to operate, maintaining a high level of competitive intensity due to these exit challenges.

Strategic Stakes and Aggressiveness of Competitors

Competitive rivalry within China's property sector is intense, with developers frequently engaging in aggressive strategies to capture market share. This often translates into price wars and heavy investment in marketing campaigns, particularly in Tier 1 and Tier 2 cities where demand is highest. For China Resources Land, this means constant pressure on profit margins as competitors vie for prime land and customer attention.

The aggressiveness of these players is further fueled by government policies and their own financial health. Developers with strong financial backing and favorable policy environments can undertake rapid expansion, acquiring land and launching projects at a pace that challenges rivals. This dynamic can significantly impact China Resources Land's ability to maintain its profitability and market position.

- Aggressive Expansion: Many competitors, including Country Garden and Evergrande (prior to its financial difficulties), have historically pursued aggressive land acquisition and development strategies, aiming for rapid scale.

- Price Competition: In 2023 and early 2024, reports indicated that several developers offered discounts and incentives to boost sales amidst a cooling market, directly impacting pricing power.

- Government Influence: Policies like the "three red lines" introduced in 2020 have shaped developer behavior, with some financially stable companies able to leverage the situation for market consolidation.

- Market Share Focus: Competitors are deeply committed to gaining or defending market share, often prioritizing sales volume over immediate profitability, which forces China Resources Land to respond in kind.

The competitive rivalry in China's property market is exceptionally fierce, driven by a large number of developers, including state-owned enterprises and private firms, all vying for market share. This intense competition is exacerbated by a market slowdown and declining property prices, forcing companies to adopt aggressive pricing and innovative strategies.

China Resources Land, as the third-largest developer by sales, faces constant pressure to maintain its position. For instance, in 2023, the company achieved contracted sales of RMB 212.9 billion, a testament to its performance amidst this challenging environment. The sector's high exit barriers, such as substantial fixed asset investments and long-term debt, compel even struggling firms to remain active, thus sustaining the high level of rivalry.

| Developer | 2023 Contracted Sales (RMB Billion) | Market Position |

| China Resources Land | 212.9 | 3rd Largest |

| Country Garden | 271.2 | 1st Largest (historically, facing challenges) |

| Vanke | 223.6 | 2nd Largest |

SSubstitutes Threaten

The threat of substitutes for China Resources Land's residential properties is significant, particularly from alternative housing solutions. These include long-term rental markets and the continued use of older, existing housing stock, both of which offer ways for consumers to meet their housing needs without purchasing new developments.

Government policies are actively bolstering these substitutes. For instance, China's ongoing focus on expanding affordable and rental housing supply directly increases the attractiveness and availability of these alternatives, potentially diverting demand from new property purchases.

The relative price and performance of substitutes significantly influence the threat they pose to China Resources Land. If alternative housing options, such as renting or investing in different asset classes like bonds, offer comparable or superior value at a lower cost, customers will be more inclined to switch. For instance, a substantial increase in rental yields or a downturn in property values could make renting a more attractive proposition than purchasing property developed by China Resources Land.

China Resources Land faces a moderate threat from substitutes, particularly in the residential property market. While the cultural preference for homeownership remains strong in China, shifting economic conditions and affordability concerns are making renting a more viable alternative for some segments of the population. This propensity to substitute is influenced by factors like rising property prices and changing lifestyle preferences, especially among younger generations.

For instance, in 2024, the average home price in major Chinese cities continued to present a significant barrier to entry for many first-time buyers. This affordability gap, coupled with the flexibility offered by rental markets, could see a growing number of individuals and families opting to rent rather than purchase. The government's policies aimed at stabilizing the housing market and promoting rental housing development also contribute to this evolving landscape.

Technological Advancements and Lifestyle Changes

Technological advancements and evolving lifestyle preferences present a significant threat of substitutes for China Resources Land. The widespread adoption of remote work, accelerated by events in recent years, directly impacts demand for traditional office spaces. For instance, a 2024 survey indicated that 30% of companies planned to maintain hybrid work models permanently, reducing the need for large, centralized office footprints.

Furthermore, shifts in consumer behavior, such as the ongoing surge in e-commerce, continue to challenge the viability of physical retail properties. By the end of 2023, online sales accounted for approximately 22% of total retail sales in China, a figure expected to grow. This trend necessitates a re-evaluation of retail space strategies, potentially favoring experiential retail or mixed-use developments over traditional single-purpose retail centers.

These evolving dynamics create new substitute offerings:

- Remote Work Infrastructure: Virtual collaboration tools and home office setups offer an alternative to traditional office leases.

- E-commerce Platforms: Online marketplaces and direct-to-consumer channels substitute for physical retail store purchases.

- Flexible Workspace Solutions: Co-working spaces and serviced offices provide adaptable alternatives to long-term commercial leases.

- Digital Entertainment and Services: Online streaming, gaming, and digital service delivery can reduce the demand for certain types of entertainment and leisure venues.

Government Policy and Regulation

Government policies play a crucial role in shaping the threat of substitutes for real estate developers like China Resources Land. Regulations aimed at increasing housing affordability or stabilizing the rental market can directly impact the attractiveness of alternative housing solutions.

For instance, policies that encourage the development of affordable rental housing or impose restrictions on property ownership can make renting or shared living arrangements more appealing compared to outright homeownership. This was evident in China's continued focus on housing affordability and rental market stability throughout 2024, with local governments implementing various measures to control housing prices and boost rental supply.

- Government policies can significantly influence the viability of substitutes by promoting or restricting alternative housing options.

- Policies focused on housing affordability and rental market stability, as seen in China's 2024 initiatives, can bolster the appeal of renting.

- Restrictions on property ownership or incentives for rental development directly enhance the threat of substitutes.

The threat of substitutes for China Resources Land's offerings is moderate, with rental housing and existing properties being key alternatives. Government initiatives in 2024 to boost rental supply and affordability directly enhance these substitutes, potentially diverting demand from new purchases.

The relative attractiveness of substitutes is heavily influenced by economic factors. For example, if rental yields improve significantly or property values decline, renting becomes a more appealing option than buying new developments.

Furthermore, evolving lifestyle preferences, such as the rise of remote work and e-commerce, create new substitutes. Virtual collaboration tools and online marketplaces reduce the need for traditional office and retail spaces, respectively. By late 2023, online sales represented about 22% of China's total retail, a figure projected to increase.

| Substitute Category | Examples | Impact on China Resources Land | 2024 Trend/Data Point |

|---|---|---|---|

| Alternative Housing | Long-term rentals, existing housing stock | Reduces demand for new residential property purchases. | Government focus on affordable rental housing supply. |

| Flexible Work Solutions | Co-working spaces, home office setups | Decreases demand for traditional office leases. | 30% of companies planned permanent hybrid work models in 2024. |

| E-commerce | Online marketplaces, direct-to-consumer channels | Challenges the demand for physical retail spaces. | Online sales reached ~22% of total retail in China by end of 2023. |

Entrants Threaten

Entering China's property development sector demands immense capital. Think billions of dollars for land acquisition, design, and construction of even moderate-sized projects. China Resources Land's reported revenue of RMB 206.2 billion in 2023 and its extensive land holdings, acquired over time, underscore the scale of investment required to compete effectively.

New companies entering the Chinese real estate market face significant hurdles in acquiring prime land parcels. China Resources Land, with its deep-rooted connections to local governments, often secures preferential access to development sites. This advantage is amplified by their substantial purchasing power for construction materials, which allows for better pricing and supply chain reliability compared to smaller, less established players.

Government policy and regulation significantly shape the threat of new entrants in China's real estate sector. Strict licensing requirements, stringent environmental standards, and specific urban planning directives, like those seen in Beijing's development zones, act as substantial barriers to entry. For instance, the requirement for developers to secure multiple permits and approvals before commencing projects, a process that can take years, deters smaller or less experienced entities.

Recent government interventions, such as the "three red lines" policy introduced in 2020 to curb developer debt, have aimed to stabilize the market. This policy, which restricts the financial leverage of property companies, indirectly favors established, financially robust players like China Resources Land, as they are better positioned to navigate these tighter lending conditions. Companies unable to meet these financial benchmarks face significant hurdles, effectively limiting new, highly leveraged entrants.

Economies of Scale and Experience Curve

China Resources Land, like other major developers in China, benefits significantly from economies of scale. This means their sheer size allows them to negotiate better prices for materials and labor, and spread fixed costs like marketing and R&D over a larger output. For instance, in 2023, China Resources Land reported a total contracted sales area of 27.1 million square meters, a scale that inherently reduces per-unit costs compared to smaller, emerging developers.

The experience curve also plays a crucial role. Years of operation have allowed China Resources Land to refine its construction processes, optimize supply chains, and develop efficient property management strategies. This accumulated know-how translates into lower operational costs and higher quality, creating a substantial barrier for newcomers who lack this institutional knowledge and operational efficiency.

The Chinese real estate market has undergone significant consolidation in recent years. This trend favors well-capitalized, established players like China Resources Land, as smaller or less efficient firms have exited the market. This industry-wide consolidation further strengthens the position of leading companies by reducing the number of competitors and increasing the average scale of remaining players.

- Economies of Scale: China Resources Land's 27.1 million square meters of contracted sales in 2023 showcases its massive operational footprint, enabling superior purchasing power and cost absorption.

- Experience Curve Advantages: Decades of development have honed China Resources Land's construction, procurement, and management efficiencies, leading to cost savings unavailable to new entrants.

- Industry Consolidation: The ongoing consolidation in China's property sector has naturally weeded out weaker players, leaving larger, more resilient companies like China Resources Land with a more dominant market position.

Brand Identity and Customer Loyalty

Brand identity and customer loyalty are crucial barriers to entry in China's real estate sector. Established developers like China Resources Land have cultivated significant trust and recognition over decades, making it difficult for newcomers to quickly win over consumers. This loyalty translates into a preference for developers with proven track records, impacting sales velocity and market share acquisition for new entrants.

China Resources Land, for instance, has consistently ranked among the top developers in China, a testament to its brand strength. In 2023, the company reported a strong performance, with contracted sales reaching approximately RMB 211.1 billion. This established reputation allows them to command premium pricing and maintain a stable customer base, posing a significant hurdle for emerging competitors seeking to establish a foothold.

- Brand Recognition: Decades of development have solidified China Resources Land's reputation as a reliable and high-quality developer.

- Customer Trust: Proven delivery and consistent quality have fostered deep trust among Chinese homebuyers.

- Market Acceptance: New entrants struggle to achieve the same level of immediate market acceptance and confidence.

- Competitive Advantage: Brand loyalty directly translates into a competitive advantage, impacting sales and market penetration for new players.

The threat of new entrants into China's property development market is significantly low, primarily due to the immense capital requirements and established advantages held by firms like China Resources Land. These barriers, including economies of scale and strong brand recognition, make it exceedingly difficult for newcomers to compete effectively. Government policies and industry consolidation further solidify the dominance of established players.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Resources Land leverages data from official company filings, industry-specific market research reports, and reputable financial news outlets to provide a comprehensive view of the competitive landscape.