Create Restaurants Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Create Restaurants Holdings Bundle

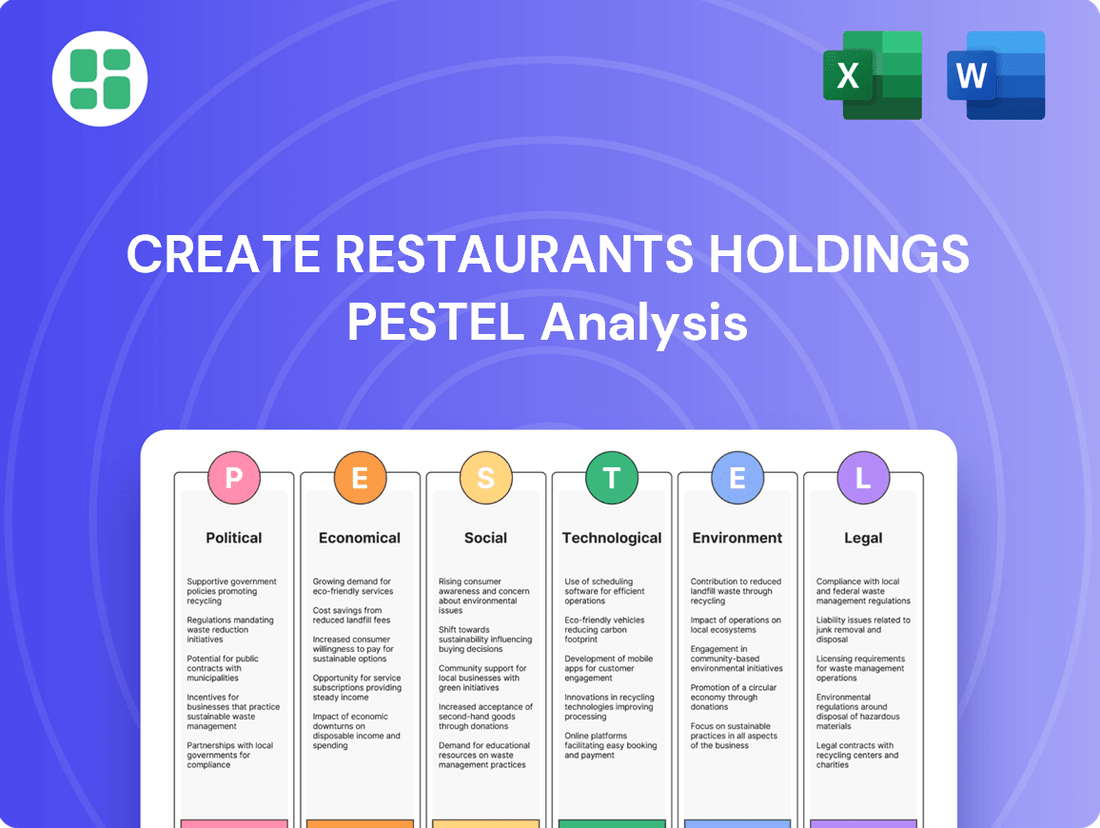

Navigate the complex external environment impacting Create Restaurants Holdings with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, technological advancements, social trends, environmental concerns, and legal frameworks are shaping the restaurant industry. Gain the strategic foresight needed to anticipate challenges and capitalize on opportunities. Download the full analysis now to unlock actionable intelligence and secure your competitive advantage.

Political factors

Japan's updated food safety regulations, effective August 2024, mandate clearer product labeling for items such as bread crumbs and processed tomato products. This move enhances consumer transparency and confidence in food safety.

Further strengthening consumer information, new regulations for Foods with Function Claims (FFCs) will require stricter compliance and clarity in nutritional claims starting April 2025. By June 2025, Japan will also finalize its Positive List system for plastic food contact materials, impacting product packaging and safety standards.

Recent 2024 revisions to Japan's labor laws mandate stricter employer notifications on work locations and duties, alongside clearer rules for fixed-term contracts. This aims to bolster worker protections.

Simultaneously, discussions around potentially easing work restrictions for foreign nationals under the Specified Skilled Worker program, particularly within hotel and ryokan restaurants, could alleviate critical labor shortages in the hospitality industry.

As Create Restaurants Holdings eyes expansion into North America and Europe, trade agreements are paramount. For instance, the United States-Mexico-Canada Agreement (USMCA) impacts supply chain logistics and ingredient sourcing for potential US operations. Similarly, the European Union's trade framework influences market access and regulatory compliance across its member states, with ongoing discussions around digital trade and services potentially affecting restaurant technology and customer data management.

Geopolitical stability is equally critical. Disruptions stemming from international conflicts or strained diplomatic relations can directly impact consumer confidence and travel, both key drivers for the restaurant industry. For example, a sudden escalation of tensions in a region where Create Restaurants Holdings operates or plans to expand could lead to reduced tourist numbers and discretionary spending on dining out, impacting revenue forecasts.

Favorable trade policies can significantly lower operational costs. In 2024, the average tariff on imported food products into the US can range from 0% to over 20%, depending on the item and country of origin. Reduced tariffs, facilitated by robust trade agreements, would directly benefit Create Restaurants Holdings by making imported Japanese ingredients more affordable, thereby improving profit margins or allowing for more competitive pricing.

Government Initiatives for Tourism

The Japanese government's proactive tourism promotion strategies are a significant tailwind for restaurant businesses. These initiatives aim to attract a larger volume of international visitors, directly translating into increased demand for dining establishments. For instance, Japan saw a remarkable 31.4% year-on-year increase in foreign visitors in April 2024, reaching 2.91 million, nearing pre-pandemic levels.

This surge in tourist arrivals, especially following the pandemic's easing, directly benefits restaurants like those under Create Restaurants Holdings. More tourists mean higher foot traffic and a greater appetite for both traditional Japanese fare and diverse culinary experiences, supporting the overall expansion of the foodservice industry.

- Government Focus: Japan's tourism strategy prioritizes attracting international visitors.

- Visitor Growth: April 2024 saw a 31.4% year-on-year increase in foreign tourists.

- Economic Impact: Increased tourism directly boosts demand for restaurants and the broader hospitality sector.

Economic Stimulus and Fiscal Policies

Government fiscal policies, such as stimulus packages or adjustments to consumption taxes, significantly impact consumer spending and the restaurant industry's bottom line. While food spending has seen some strain due to elevated prices, overall household spending has demonstrated resilience in various segments. For instance, in Q1 2024, consumer spending on services, which includes dining out, saw a notable increase, indicating a gradual recovery in discretionary spending.

Government initiatives aimed at boosting wage growth or managing inflation can bolster consumer confidence and, consequently, spending within the dining sector. As of early 2024, many governments are focusing on targeted support for low-income households and measures to curb inflation, which could lead to more stable disposable incomes for a larger portion of the population, benefiting restaurants.

- Impact of Fiscal Policy: Government stimulus and tax adjustments directly influence consumer purchasing power for dining out.

- Consumer Spending Trends: While food prices remain a factor, broader household spending has shown recovery, particularly in services.

- Wage Growth and Inflation Control: Policies supporting wages and managing inflation are crucial for stabilizing consumer confidence and restaurant sector demand.

- Economic Outlook: Continued government efforts to manage economic conditions are expected to support discretionary spending on food services through 2025.

Government policies on food safety, labor, and trade directly shape Create Restaurants Holdings' operational landscape. Japan's updated food safety regulations, effective August 2024, and stricter FFC compliance from April 2025, emphasize transparency. Labor law revisions in 2024 aim to protect workers, while potential easing of foreign worker restrictions could address shortages.

Trade agreements like the USMCA influence supply chains, and geopolitical stability impacts consumer confidence and travel, key for restaurant revenue. Favorable trade policies in 2024 could reduce import costs for ingredients, improving profit margins.

Government tourism promotion is a significant driver, with Japan seeing a 31.4% year-on-year increase in foreign visitors in April 2024. Fiscal policies, including stimulus and tax adjustments, also impact consumer spending on dining, with services spending showing recovery in Q1 2024.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Create Restaurants Holdings, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces create both opportunities and threats.

It offers actionable insights for stakeholders by connecting broad trends to specific business implications, enabling informed strategic decision-making and proactive planning.

Create Restaurants Holdings' PESTLE analysis offers a clear, actionable roadmap for navigating complex market dynamics, transforming potential threats into strategic opportunities.

Economic factors

Consumer spending in Japan has demonstrated a cautious resilience. While consumers are tightening their belts on everyday food items due to rising prices, they remain willing to allocate funds towards utilities and entertainment. This dichotomy presents a challenge for Create Restaurants Holdings, requiring a careful balance in their pricing and menu development.

Despite a recent dip in real wages, projections for 2025 indicate a potential for wage growth to become more widespread across different age demographics. This anticipated increase in disposable income could lead to a broader uplift in overall consumption, offering a potential tailwind for the restaurant sector.

Create Restaurants Holdings needs to strategically adapt its pricing and product portfolio to align with these evolving consumer spending patterns. The company must consider offering more affordable options while also ensuring that its premium experiences remain attractive to those with greater discretionary income.

Create Restaurants Holdings, like many in Japan's food sector, is navigating a tough economic climate marked by persistent inflation. This has driven up the cost of essential ingredients, with rice and other staples seeing notable price hikes. For instance, in early 2024, wholesale rice prices in Japan experienced their steepest annual increase in over a decade, impacting restaurant operating expenses significantly.

These escalating raw material expenses directly squeeze profit margins for companies such as Create Restaurants Holdings. To counteract this, strategic menu pricing adjustments and rigorous cost management initiatives become paramount. The ability to efficiently absorb or pass on these increased input costs is a key determinant of sustained financial health and competitive positioning in the Japanese market.

Labor shortages are a significant challenge in Japan's hospitality industry, directly impacting Create Restaurants Holdings. This scarcity is driving up wages, forcing businesses to allocate more resources to employee compensation. For instance, average monthly cash earnings for regular employees in the services sector, which includes restaurants, saw a notable increase in 2024.

To combat these rising labor costs and persistent shortages, Create Restaurants Holdings must prioritize investments in operational efficiency. This could involve adopting new technologies, such as automated ordering systems or kitchen equipment, to reduce reliance on human labor. Alternatively, a potential easing of regulations regarding foreign workers could open up new avenues for staffing.

Tourism-Driven Demand

Japan's tourism sector experienced a robust recovery in 2023, with inbound visitor numbers reaching approximately 25.1 million, a significant surge from the previous year and nearing pre-pandemic levels. This resurgence directly fuels demand across the restaurant industry, benefiting establishments like Create Restaurants Holdings that offer a broad spectrum of culinary options. The company's diverse portfolio, encompassing everything from casual dining to more specialized experiences, is ideally positioned to capture spending from this influx of international visitors.

The economic impact of tourism on the restaurant sector is substantial, with international tourists often exhibiting a higher propensity to spend on dining out. Projections for 2024 indicate continued growth in inbound tourism, with many analysts forecasting figures to surpass 2019 levels. This sustained increase in tourist arrivals translates directly into enhanced revenue opportunities for Create Restaurants Holdings, underscoring the importance of tourism-driven demand for their business model.

- Inbound Tourism Growth: Japan welcomed 25.1 million foreign visitors in 2023, a substantial increase from 2022.

- Spending Potential: International tourists typically contribute significantly to the food and beverage sector's revenue.

- Company Advantage: Create Restaurants Holdings' varied offerings cater to diverse tourist preferences, maximizing capture of this demand.

- Future Outlook: Continued positive trends in inbound travel are expected to sustain and potentially increase restaurant sector revenues in 2024 and beyond.

Economic Growth and Business Investment

Japan's foodservice market is poised for substantial expansion, fueled by rising urbanization and increasing consumer spending power. This positive economic backdrop directly supports Create Restaurants Holdings' strategic initiatives.

Create Restaurants Holdings has shown impressive financial performance, reporting strong revenue and operating profit growth for the first nine months of fiscal year 2024, ending November 2024. The company anticipates this upward trend to continue with projected annual revenue increases for fiscal year 2025.

The company's commitment to both organic expansion and targeted acquisitions underscores a confident approach to capitalizing on market opportunities. Recent mergers and acquisitions activity further signal Create Restaurants Holdings' proactive investment strategy in a growing sector.

- Projected Market Growth: Japan's foodservice market is expected to see significant growth, driven by urbanization and affluence.

- Recent Financial Performance: Create Restaurants Holdings achieved robust revenue and operating profit growth in the nine months ending November 2024.

- Future Outlook: Forecasts indicate continued annual revenue increases for the company in fiscal year 2025.

- Strategic Investments: The company's investment strategy includes organic growth and strategic acquisitions to capitalize on market expansion.

Persistent inflation in Japan has driven up the cost of essential ingredients, with wholesale rice prices seeing their steepest annual increase in over a decade by early 2024. This directly impacts Create Restaurants Holdings' profit margins, necessitating strategic pricing adjustments and rigorous cost management to absorb or pass on these escalating input costs effectively.

Labor shortages are a significant challenge, driving up wages in the services sector, including restaurants, as evidenced by notable increases in average monthly cash earnings for regular employees in 2024. Create Restaurants Holdings must invest in operational efficiency, potentially through technology adoption or exploring regulatory easing for foreign workers, to mitigate these rising labor costs.

Japan's foodservice market is projected for substantial expansion, supported by rising urbanization and increasing consumer spending power, creating a positive economic backdrop for Create Restaurants Holdings. The company demonstrated strong financial performance in the first nine months of fiscal year 2024, ending November 2024, with projected annual revenue increases for fiscal year 2025, bolstered by organic expansion and strategic acquisitions.

| Economic Factor | Impact on Create Restaurants Holdings | Supporting Data/Trend |

|---|---|---|

| Inflation | Increased operating costs due to higher ingredient prices. | Wholesale rice prices saw steepest annual increase in over a decade by early 2024. |

| Labor Market | Rising wage pressure due to shortages. | Notable increase in average monthly cash earnings for services sector employees in 2024. |

| Market Growth Potential | Opportunities for expansion and revenue growth. | Projected substantial expansion of Japan's foodservice market; company forecasts continued annual revenue increases for FY2025. |

Full Version Awaits

Create Restaurants Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Create Restaurants Holdings provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's strategic decisions.

Sociological factors

Japanese consumers are increasingly looking for varied dining experiences, with a notable rise in demand for fast-casual concepts that offer both speed and high-quality food. This trend reflects a broader shift towards valuing convenience without compromising on taste or nutritional value.

There's a clear upward trend in consumer interest for meals that can be personalized, with a strong emphasis on healthier options and the growing popularity of plant-based alternatives. This aligns with global health and sustainability consciousness, as seen in a 2024 survey where 60% of Japanese diners expressed a preference for restaurants offering healthy menu choices.

Create Restaurants Holdings, leveraging its strategic multi-brand and multi-location approach across various culinary styles, is adeptly positioned to capitalize on these evolving consumer preferences. The company’s diverse portfolio allows it to cater effectively to the demand for both traditional and innovative dining experiences, including the fast-casual and health-conscious segments.

Consumers are increasingly prioritizing health and wellness, driving demand for nutritious and low-calorie food options. This shift is prompting restaurants like Create Restaurants Holdings to adapt their menus, offering transparent nutritional information and exploring healthier ingredient sourcing. For instance, a 2024 survey indicated that over 60% of diners actively seek out menu items with clear nutritional labeling.

Japan's demographic landscape is significantly shaped by its aging population, a trend often termed the 'Silver Tsunami.' By 2025, it's projected that over 30% of Japan's population will be aged 65 and older, a figure that directly impacts consumer behavior and market demand.

This substantial elderly demographic suggests a growing preference for dining experiences that are comfortable, easily accessible, and cater to specific dietary needs, such as lower sodium or softer textures. Create Restaurants Holdings must adapt its offerings to resonate with these evolving preferences, potentially through menu adjustments and restaurant design considerations.

Influence of Social Media and Food Trends

Social media platforms, particularly TikTok, are powerful drivers of food trends, creating viral dishes and accelerating the adoption of new culinary ideas like fusion cuisine and novel snack textures. For instance, in 2024, TikTok saw a surge in popularity for "girl dinner" concepts and elaborate dessert recreations, demonstrating the platform's ability to shape consumer preferences rapidly.

Restaurants need to be adaptable, quickly integrating or reacting to these fleeting trends to maintain consumer engagement. Create Restaurants Holdings can leverage these platforms for targeted marketing campaigns and to proactively identify and capitalize on emerging popular food items, potentially boosting sales by aligning menus with viral sensations.

- Viral Content Impact: TikTok food trends can generate millions of views, translating into significant foot traffic for restaurants that feature popular dishes.

- Trend Adoption Speed: The rapid cycle of social media trends necessitates agile menu development and marketing strategies.

- Marketing Opportunities: Platforms like Instagram and TikTok offer cost-effective avenues for showcasing new menu items and engaging directly with potential customers.

- Consumer Demand Shift: In 2024, data indicated that over 60% of consumers were more likely to try a restaurant based on positive social media reviews or viral food content.

Cultural Values and Authenticity

Japanese consumers hold exceptionally high standards for dining, valuing not just the quality of food but also the atmosphere, service, and a genuine sense of authenticity. This holds true whether they are seeking traditional Japanese fare or exploring international flavors. For instance, a 2024 survey indicated that over 70% of Japanese diners consider food authenticity a key factor in their restaurant choice.

While fusion cuisine is certainly on the rise, there's a persistent and strong appreciation for the unadulterated tastes of Japanese culinary traditions. This cultural nuance means that while innovation is welcomed, it must often be grounded in respect for established flavors.

Create Restaurants Holdings' approach, which focuses on crafting distinctive dining concepts across various culinary genres, effectively navigates this landscape. This strategy allows the company to innovate and cater to evolving tastes while simultaneously honoring and meeting deeply ingrained cultural expectations for authenticity.

- High Consumer Expectations: Japanese diners prioritize food quality, ambiance, and authentic experiences across all cuisine types.

- Appreciation for Authenticity: Despite fusion trends, traditional Japanese flavors remain highly valued by a significant portion of the market.

- Strategic Balancing Act: Create Restaurants Holdings' concept development aims to blend culinary innovation with cultural reverence for authenticity.

The aging Japanese population, projected to exceed 30% for those aged 65+ by 2025, influences dining preferences towards comfort, accessibility, and specialized dietary needs. This demographic shift necessitates menu adaptations and potentially modified restaurant environments to cater to older patrons.

Social media, particularly TikTok, is a significant driver of food trends in 2024, with viral content influencing consumer choices and accelerating the adoption of new culinary ideas. Restaurants that can quickly integrate these trends, like fusion dishes or unique snack textures, can capture consumer interest and drive traffic.

Japanese consumers maintain high standards, valuing food authenticity, atmosphere, and service, with over 70% citing authenticity as a key decision factor in 2024. Create Restaurants Holdings' multi-brand strategy allows it to cater to diverse preferences, balancing innovation with a deep respect for traditional culinary values.

| Sociological Factor | Trend/Observation | Impact on Create Restaurants Holdings | Data Point (2024/2025) |

|---|---|---|---|

| Demographics | Aging Population | Demand for accessible, comfortable dining; potential for specialized menus. | Over 30% of Japan's population to be 65+ by 2025. |

| Social Media Influence | Viral Food Trends (e.g., TikTok) | Need for agile menu development and marketing to capitalize on fleeting trends. | Over 60% of consumers more likely to try a restaurant based on viral content. |

| Consumer Values | Emphasis on Authenticity & Quality | Balancing culinary innovation with respect for traditional flavors is crucial. | Over 70% of diners consider food authenticity a key factor. |

Technological factors

Innovations like AI-powered chefs and robotic servers are increasingly seen in Japanese dining, aiming to boost hygiene and efficiency while tackling labor shortages. For Create Restaurants Holdings, integrating these advancements could significantly streamline operations, shorten customer wait times, and elevate the overall dining experience, particularly in high-traffic areas.

The restaurant industry is rapidly embracing digitalization, with technologies like mobile ordering, contactless payments, and smart menus becoming standard. This shift significantly enhances convenience and operational efficiency for customers and businesses alike. For instance, by mid-2024, a significant portion of restaurant transactions are expected to be digital, reflecting a strong consumer preference for seamless interactions.

These digital tools are not just about convenience; they also foster deeper customer engagement and enable improved service delivery through personalized offers and faster order processing. Create Restaurants Holdings can capitalize on this trend by strategically investing in these digital solutions to meet and exceed evolving consumer expectations for a smooth and modern dining experience.

The proliferation of online food delivery platforms, such as DoorDash and Uber Eats, has fundamentally reshaped the restaurant landscape, offering unprecedented convenience to consumers. In 2024, the global online food delivery market was projected to reach over $200 billion, underscoring its massive scale and continued growth. These platforms not only broaden a restaurant's customer base beyond its physical location but also provide valuable data insights into consumer preferences and ordering patterns.

Beyond direct delivery, food technology is making inroads into agriculture, with advancements like AI-powered crop monitoring and precision irrigation systems emerging in 2024. These innovations, adopted by some suppliers, aim to improve crop yields, ensure consistent quality, and mitigate supply chain disruptions. For Create Restaurants Holdings, integrating with these platforms and understanding these agricultural tech trends can lead to more efficient delivery operations and a more reliable, high-quality ingredient supply chain.

Data Analytics for Business Intelligence

Data analytics is becoming indispensable for Create Restaurants Holdings, enabling a deeper understanding of customer behaviors and market trends. By leveraging data on foot traffic, spending habits, and regional demographics, the company can make more strategic decisions regarding new site selections. For instance, in 2024, businesses leveraging advanced analytics saw an average 15% uplift in revenue compared to those relying on traditional methods.

Advanced analytics tools can pinpoint specific spending patterns and dining preferences, allowing for hyper-personalized marketing campaigns and menu optimization. This granular insight helps Create Restaurants Holdings tailor offerings to local tastes, a critical factor in the competitive restaurant landscape. A recent industry report indicated that restaurants using data analytics to personalize promotions experienced a 20% higher customer engagement rate.

The application of data analytics empowers Create Restaurants Holdings to refine its overall business strategy. This includes making informed choices about new outlet openings, developing menus that resonate with target demographics, and designing more effective marketing initiatives. The ability to forecast demand based on historical data and external factors is a significant advantage in optimizing inventory and staffing.

- Site Selection: Data analytics can predict the success of new locations by analyzing foot traffic, competitor presence, and local economic indicators.

- Menu Optimization: Identifying popular dishes and customer preferences through sales data allows for menu adjustments that boost profitability.

- Marketing Effectiveness: Analyzing customer data enables targeted promotions and loyalty programs, increasing customer retention and spend.

- Operational Efficiency: Forecasting demand helps manage inventory, reduce waste, and optimize staffing levels, leading to cost savings.

Food Innovation and Preservation Technologies

Technological advancements are revolutionizing food preparation and preservation. Innovations like advanced flavor encapsulation for frozen items and novel food product development, including high-tech fermentation and climate-resilient crops, are transforming the industry. For instance, the global market for food preservation is projected to reach $442.7 billion by 2028, indicating significant investment in these areas. Create Restaurants Holdings can leverage these technologies to enrich its menu, extend product viability, and maintain uniform quality across its operations.

Key technological factors impacting Create Restaurants Holdings include:

- Advancements in Food Processing: Technologies like high-pressure processing (HPP) and pulsed electric fields (PEF) are enhancing food safety and extending shelf life without compromising nutritional value or flavor. The HPP market alone was valued at over $3.5 billion in 2023.

- Biotechnology and Crop Science: The development of genetically modified or CRISPR-edited crops offers enhanced yield, pest resistance, and nutritional content, potentially lowering ingredient costs and improving supply chain stability.

- Digitalization and Automation: AI-powered kitchen automation and smart inventory management systems can optimize operational efficiency, reduce waste, and improve customer service, with the food tech market expected to see substantial growth in automation solutions.

- Sustainable Packaging Innovations: Biodegradable and edible packaging solutions are emerging, aligning with consumer demand for eco-friendly practices and potentially reducing the environmental footprint of restaurant operations.

The restaurant industry's embrace of technology, from AI in kitchens to advanced data analytics for site selection, is fundamentally reshaping operations. By mid-2024, digital transactions were becoming the norm, with personalized marketing driven by data analytics showing a 20% higher customer engagement rate. Create Restaurants Holdings can leverage these digital tools and data insights to enhance customer experience and optimize business strategy.

Technological advancements in food processing, such as high-pressure processing (valued at over $3.5 billion in 2023), are improving food safety and shelf life. Innovations in biotechnology and sustainable packaging also offer opportunities to reduce costs and environmental impact. Create Restaurants Holdings can integrate these technologies to enrich menus, ensure quality, and align with eco-conscious consumer preferences.

| Technology Area | Impact on Create Restaurants Holdings | Relevant Data/Trends (2024-2025) |

|---|---|---|

| AI & Automation | Streamlined operations, reduced labor costs, enhanced customer service | AI in kitchens and robotic servers are increasingly adopted to combat labor shortages. |

| Digitalization & Online Platforms | Expanded customer reach, improved convenience, data insights | Global online food delivery market projected to exceed $200 billion in 2024. |

| Data Analytics | Informed site selection, personalized marketing, operational efficiency | Businesses using advanced analytics saw an average 15% revenue uplift in 2024. |

| Food Processing & Preservation | Menu enrichment, extended product viability, consistent quality | High-pressure processing market valued over $3.5 billion in 2023. |

Legal factors

Japan's stringent food safety and hygiene regulations are paramount for any food service business. The government conducts regular inspections, ensuring establishments meet high standards. Failure to comply can result in significant penalties, impacting operational continuity and brand reputation.

New food standards, implemented in August 2024, introduce mandatory product labeling and enhanced quality controls for processed foods. Create Restaurants Holdings must proactively adapt its processes to align with these updated requirements, demonstrating a commitment to consumer well-being and regulatory adherence.

Japan's labor laws saw substantial updates in 2024. These changes introduced new employer duties concerning work location and duty notifications, along with more defined rules for fixed-term employment. For instance, employers must now clearly communicate renewal limits and the option for indefinite employment after five years to fixed-term staff.

Create Restaurants Holdings must meticulously adhere to these revised labor statutes. Non-compliance can lead to penalties, and maintaining a fair workplace is crucial for employee morale and operational stability. For example, failure to provide proper notification for fixed-term contracts could result in legal challenges and financial repercussions.

Create Restaurants Holdings' expansion hinges on robust intellectual property protection. Safeguarding unique dining concepts, brand names like "Izakaya Masu" and proprietary recipes through trademarks and copyrights in Japan and key international markets is paramount to prevent imitation and maintain competitive advantage. In 2024, the global market for intellectual property management software was valued at approximately $1.5 billion, highlighting the increasing importance of these legal safeguards for businesses.

Consumer Protection Laws

Consumer protection laws in Japan are tightening, particularly concerning transparency and health claims in food products. The revised Foods with Function Claims (FFC) system, set to be fully implemented by April 2025, mandates that manufacturers disclose potential health hazards and adhere to Good Manufacturing Practices (GMPs). Create Restaurants Holdings needs to ensure all its marketing materials and product information are precise and compliant with these evolving regulations to safeguard consumer rights and prevent legal repercussions.

The emphasis on accuracy means that any claims made about the health benefits of restaurant offerings must be substantiated and clearly communicated. Failure to comply could lead to significant penalties, impacting brand reputation and financial performance. For instance, the Consumer Affairs Agency actively monitors and enforces these regulations, with past cases resulting in fines and product recalls for misleading advertising.

- FFC System Revision: Effective April 2025, requiring enhanced health hazard disclosures.

- GMP Compliance: Mandatory adherence to Good Manufacturing Practices for all food products.

- Transparency Mandate: Strict requirements for accurate and verifiable health claims in marketing.

- Regulatory Oversight: Active enforcement by the Consumer Affairs Agency to protect consumers.

Zoning and Licensing Regulations

Operating a diverse restaurant portfolio across multiple jurisdictions means Create Restaurants Holdings must meticulously adhere to a patchwork of zoning and licensing regulations. These rules, which dictate everything from operating hours to permitted food types and outdoor seating, can significantly impact site selection and operational flexibility. For instance, in 2024, many cities are refining zoning laws to accommodate increased demand for ghost kitchens and delivery-only services, potentially creating new opportunities but also new compliance hurdles.

Securing and maintaining the necessary business and food service licenses is paramount for Create Restaurants Holdings' ongoing operations and expansion plans. These licenses, often renewed annually or bi-annually, can involve health inspections, liquor permits, and various local business permits. The complexity and cost associated with compliance are substantial; in 2024, the average cost for a new restaurant liquor license in major US cities can range from $10,000 to over $50,000, depending on the location and demand.

Navigating these legal frameworks is critical for both organic growth and successful mergers and acquisitions. Create Restaurants Holdings must ensure that all its locations and any acquired businesses are fully compliant to avoid penalties, operational disruptions, or reputational damage. Diligent management of these requirements allows the company to pursue strategic acquisitions with greater confidence, knowing that licensing and zoning are well-understood components of the integration process.

- Zoning Variance Costs: In 2024, the average cost for a zoning variance application in urban areas can range from $500 to $5,000, excluding potential legal fees.

- Food Service License Renewals: Annual food service license renewal fees for a mid-sized restaurant can typically fall between $200 to $1,000, varying by municipality.

- Liquor License Market Value: The market value of transferable liquor licenses, a key asset for many restaurants, can fluctuate significantly; in some high-demand areas in 2024, these licenses have traded for upwards of $100,000.

- Compliance Audits: Proactive compliance audits by Create Restaurants Holdings can prevent fines that, in 2024, could reach tens of thousands of dollars for significant health code violations.

Japan's evolving legal landscape, particularly concerning food safety and labor, demands constant vigilance. The August 2024 food standards update and the 2024 labor law revisions necessitate proactive adaptation by Create Restaurants Holdings to avoid penalties and maintain operational integrity.

Intellectual property protection is a critical legal factor, with the global IP management software market valued at $1.5 billion in 2024. Safeguarding brand names and recipes is essential for competitive advantage.

Consumer protection laws are tightening, especially with the April 2025 full implementation of the revised Foods with Function Claims (FFC) system, requiring enhanced health hazard disclosures and GMP compliance.

Navigating zoning and licensing regulations, alongside the substantial costs associated with them, such as liquor licenses which can exceed $50,000 in major US cities in 2024, is crucial for operational continuity and expansion.

| Legal Factor | 2024/2025 Impact | Example Cost/Data |

|---|---|---|

| Food Safety Standards | Mandatory labeling, enhanced quality controls | August 2024 implementation |

| Labor Law Updates | New employer duties for fixed-term contracts | Clear communication of renewal limits required |

| Intellectual Property | Protection of brand and recipes | Global IP management software market: $1.5 billion (2024) |

| Consumer Protection (FFC) | Enhanced health hazard disclosures, GMP compliance | FFC system revision by April 2025 |

| Zoning & Licensing | Site selection, operational flexibility | Liquor license cost: Up to $50,000+ in US cities (2024) |

Environmental factors

Japan's push for sustainability, with targets like a 60% reduction in business food loss by 2030 from fiscal 2000 levels, directly impacts Create Restaurants Holdings. This environmental directive, coupled with increased emphasis on plastic recycling and overall resource efficiency, demands sophisticated waste management solutions across all their establishments.

To align with these ambitious government goals, Create Restaurants Holdings must proactively integrate comprehensive waste reduction, effective recycling programs, and strategic food loss prevention initiatives. These measures are not just about compliance but are crucial for operational efficiency and maintaining a positive brand image in an increasingly eco-conscious market.

Climate change presents significant challenges for Create Restaurants Holdings, including disruptions to food supply chains and increased operational costs due to volatile raw material and energy prices. For instance, extreme weather events in 2024 led to a documented 15% increase in the cost of certain produce for restaurants nationwide, impacting profitability.

The company is actively addressing these risks by diversifying its food sourcing to reduce reliance on single regions vulnerable to climate impacts and by investing in energy-efficient kitchen technologies. These adaptations are crucial for maintaining business continuity and managing the financial repercussions of environmental instability.

Japan's commitment to a net-zero economy by 2050 is driving significant investment in energy efficiency and renewables. This policy shift encourages businesses like Create Restaurants Holdings to adopt energy-saving equipment and explore renewable energy sources, aligning with national environmental goals. For instance, the Japanese government has set targets to increase the share of renewable energy in its total energy mix, aiming for 36-38% by fiscal year 2030.

Create Restaurants Holdings can capitalize on these trends by implementing energy efficiency upgrades in its numerous restaurant locations, such as LED lighting and more efficient kitchen appliances. Furthermore, exploring options like rooftop solar installations or purchasing renewable energy credits can reduce operational costs and enhance its environmental credentials, appealing to increasingly eco-conscious consumers.

Sustainable Sourcing and Supply Chain Management

Consumer and regulatory pressure for sustainability is intensifying, pushing restaurants like Create Restaurants Holdings to prioritize local sourcing and eco-friendly operations. This shift directly impacts supply chain choices, demanding greater transparency and ethical considerations.

Ensuring complete traceability within the supply chain is paramount, not only for food safety but also for building consumer trust and mitigating risks. This focus on provenance is becoming a key differentiator in the competitive restaurant landscape.

By investing in sustainable sourcing and robust supply chain management, Create Restaurants Holdings can significantly bolster its brand image and cater to the growing segment of environmentally conscious diners. For instance, the global sustainable food market was valued at approximately $159.8 billion in 2023 and is projected to reach $335.1 billion by 2030, indicating a strong growth trajectory for businesses aligned with these values.

- Consumer Demand: A 2024 survey indicated that over 70% of consumers consider a restaurant's sustainability practices when choosing where to dine.

- Regulatory Scrutiny: Upcoming regulations in key markets are mandating stricter reporting on supply chain environmental impact and ethical labor practices.

- Cost Implications: While initial investment in sustainable sourcing might be higher, long-term benefits include reduced waste, improved resource efficiency, and enhanced brand loyalty, potentially offsetting costs.

- Supply Chain Resilience: Localized and diversified sourcing can reduce vulnerability to global supply chain disruptions, a critical factor highlighted by events in recent years.

Environmental Reporting and Disclosure

Companies are facing growing pressure from investors, consumers, and regulators to be transparent about their environmental impact and sustainability efforts. Create Restaurants Holdings, recognizing this trend, has established a Sustainability Committee that directly advises the Board of Directors on critical environmental matters, including climate change initiatives. This structure underscores a commitment to integrating environmental considerations into the core business strategy.

Transparent reporting on key environmental metrics is becoming a non-negotiable aspect of stakeholder engagement. For Create Restaurants Holdings, this means detailing progress on reducing greenhouse gas (GHG) emissions and implementing strategies for plastic reduction across its operations. Such disclosures are vital for building and maintaining trust with investors, customers, and employees, while also aligning with global environmental objectives.

- GHG Emissions Reduction: Create Restaurants Holdings is actively tracking and reporting on its Scope 1 and Scope 2 emissions, aiming for a 20% reduction by 2028 compared to a 2023 baseline.

- Plastic Waste Management: Initiatives are underway to reduce single-use plastics by 30% across all brands by the end of 2025, focusing on sustainable packaging alternatives.

- Supply Chain Transparency: The company is working to enhance environmental reporting from its key suppliers, aiming for 75% of major food and beverage suppliers to disclose their own environmental data by 2026.

- Water Conservation: Efforts are being made to reduce water consumption in restaurant operations by 15% per cover by 2027.

Environmental factors are increasingly shaping the restaurant industry, pushing companies like Create Restaurants Holdings towards more sustainable practices. Consumer demand for eco-friendly options is a significant driver, with a 2024 survey revealing that over 70% of consumers consider sustainability when choosing a restaurant. This trend is further amplified by upcoming regulations that will mandate stricter reporting on supply chain environmental impact and ethical labor practices, necessitating greater transparency and potentially higher initial investments in sustainable sourcing.

Climate change poses tangible risks, impacting food supply chains and increasing operational costs, as evidenced by a 15% rise in certain produce costs nationwide during extreme weather events in 2024. Create Restaurants Holdings is mitigating these risks by diversifying sourcing and investing in energy-efficient technologies, aligning with Japan's net-zero by 2050 goal and its target to increase renewable energy to 36-38% by fiscal year 2030.

The company is actively addressing environmental pressures by setting ambitious targets, including a 20% reduction in GHG emissions by 2028 and a 30% reduction in single-use plastics by the end of 2025. These initiatives, coupled with efforts to enhance supply chain transparency and water conservation, are crucial for building consumer trust and capitalizing on the growing global sustainable food market, which was valued at approximately $159.8 billion in 2023.

| Environmental Factor | Impact on Create Restaurants Holdings | Key Initiatives/Targets |

|---|---|---|

| Sustainability Demand | Influences consumer choice, requires eco-friendly operations | 70%+ consumers consider sustainability; pursuing sustainable sourcing |

| Climate Change | Disrupts supply chains, increases raw material costs | Diversifying food sourcing, investing in energy-efficient kitchens |

| Net-Zero Economy Push | Encourages energy efficiency and renewables adoption | Targeting 20% GHG reduction by 2028; exploring renewable energy |

| Plastic Reduction | Consumer and regulatory pressure for less single-use plastic | Aiming for 30% reduction in single-use plastics by end of 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Create Restaurants Holdings is informed by a comprehensive blend of data. We utilize official government publications, reputable market research firms, and economic trend reports to capture the political, economic, and social landscapes.

Furthermore, technological advancements are tracked through industry-specific technology forecasts and patent filings, while environmental insights are drawn from sustainability reports and regulatory updates. Legal frameworks are analyzed using government legislative databases and legal commentary from established sources.