Coca-Cola Beverages Florida Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coca-Cola Beverages Florida Bundle

Coca-Cola Beverages Florida operates in a dynamic market, facing intense rivalry and significant buyer power that shapes its strategic landscape. Understanding these forces is crucial for navigating the competitive beverage industry.

The complete report reveals the real forces shaping Coca-Cola Beverages Florida’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Coca-Cola Company's position as the exclusive supplier of its proprietary concentrate and syrup grants it immense bargaining power over Coca-Cola Beverages Florida (Coke Florida). This exclusivity means Coke Florida cannot source these vital ingredients from elsewhere, creating a significant dependency for its primary product lines.

This inherent power dynamic is reinforced by the franchise bottling system. Coke Florida operates under long-term agreements that solidify The Coca-Cola Company's control over the supply of concentrate and syrup. Consequently, Coke Florida has limited leverage to negotiate pricing or terms for these essential inputs, which are fundamental to its operations and profitability.

Coca-Cola Beverages Florida's (Coke Florida) reliance on key raw materials like sugar, aluminum, and PET plastic exposes it to significant cost volatility. Fluctuations in global commodity markets, exacerbated by supply chain issues and geopolitical events, directly influence production expenses. For instance, in 2024, the beverage sector grappled with escalating costs for ingredients and packaging, with polymer plastic prices notably doubling from November 2024 levels, alongside ongoing inflation affecting sugar and fruit concentrates.

Suppliers of packaging materials, such as aluminum cans and PET bottles, hold moderate bargaining power. This power is shaped by factors like the fluctuating costs of raw materials, the available manufacturing capacity within the industry, and the increasing stringency of environmental regulations. For instance, the cost of aluminum, a key component for cans, experienced significant volatility in 2024, impacting overall packaging expenses.

The beverage sector's growing emphasis on sustainability has broadened the demand for eco-friendly packaging solutions, potentially shifting power towards specialized suppliers. This trend can lead to higher costs for Coca-Cola Beverages Florida if sustainable options are more expensive or if fewer suppliers can meet these evolving demands. Recent data from 2024 indicated a 5% increase in the price of recycled PET resin, reflecting this market shift.

Furthermore, global supply chain disruptions, which persisted into early 2024, have amplified the bargaining power of packaging material suppliers. These disruptions have led to increased lead times and higher material costs across the board, forcing companies like Coca-Cola Beverages Florida to absorb these added expenses or negotiate more rigorously with their suppliers.

Labor Supply

The bargaining power of labor as a supplier to Coca-Cola Beverages Florida (CCBF) is influenced by the availability and cost of skilled workers for its manufacturing, distribution, and sales functions. In a tight labor market, this power can increase, as seen with persistent labor shortages impacting the food and beverage sector throughout 2024.

CCBF, like many in the industry, faces challenges in securing and retaining talent. For instance, a 2024 report indicated that the manufacturing sector, which includes beverage production, experienced a 4.5% quit rate in the first quarter, suggesting a competitive environment for skilled labor. This scarcity can drive up wage demands and benefit expectations, giving employees more leverage.

- Labor Availability: Shortages in skilled manufacturing and logistics personnel can elevate supplier power.

- Wage Pressures: Increased competition for workers in 2024 has led to higher wage expectations across the industry.

- Distribution Needs: The need for reliable drivers and warehouse staff for efficient distribution directly impacts CCBF’s operational costs and reliance on labor.

Logistics and Transportation Services

Coca-Cola Beverages Florida's reliance on logistics and transportation services positions these providers with significant bargaining power. As the company manages its end-to-end supply chain, disruptions or cost increases from transportation partners directly impact its operational efficiency and profitability.

The trucking sector's challenges, including a net loss of carriers in 2023 and anticipated further reductions in 2024, directly affect freight availability. This scarcity, coupled with rising fuel and labor expenses, grants transportation suppliers increased leverage in negotiating rates and terms with Coke Florida, potentially driving up overall supply chain costs.

- Increased Transportation Costs: Higher fuel prices and labor shortages in the trucking industry are inflating logistics expenses for Coke Florida.

- Carrier Availability: A declining number of trucking carriers, with an estimated net loss continuing into 2024, limits options and strengthens supplier negotiation power.

- Supply Chain Dependence: Coke Florida's responsibility for its entire supply chain means it is highly susceptible to cost pressures and service level changes from transportation providers.

Suppliers of essential raw materials like sugar, aluminum, and PET plastic hold considerable bargaining power over Coca-Cola Beverages Florida (Coke Florida). This power is amplified by global commodity price volatility and supply chain disruptions, which were particularly acute in 2024. For instance, the cost of PET resin saw a 5% increase in 2024 due to sustainability demands, while aluminum prices also experienced significant fluctuations.

| Supplier Category | Bargaining Power Drivers | Impact on Coke Florida (2024 Data) |

|---|---|---|

| Concentrate & Syrup | Exclusivity, Franchise Agreements | Very High (No alternative sourcing) |

| Packaging Materials (Aluminum, PET) | Commodity Prices, Manufacturing Capacity, Environmental Regulations | Moderate to High (e.g., PET resin up 5%, aluminum volatility) |

| Labor (Skilled Manufacturing, Logistics) | Labor Shortages, Wage Pressures | Moderate (4.5% manufacturing quit rate in Q1 2024) |

| Transportation Services | Carrier Availability, Fuel Costs, Labor Shortages | High (Net carrier loss continuing into 2024) |

What is included in the product

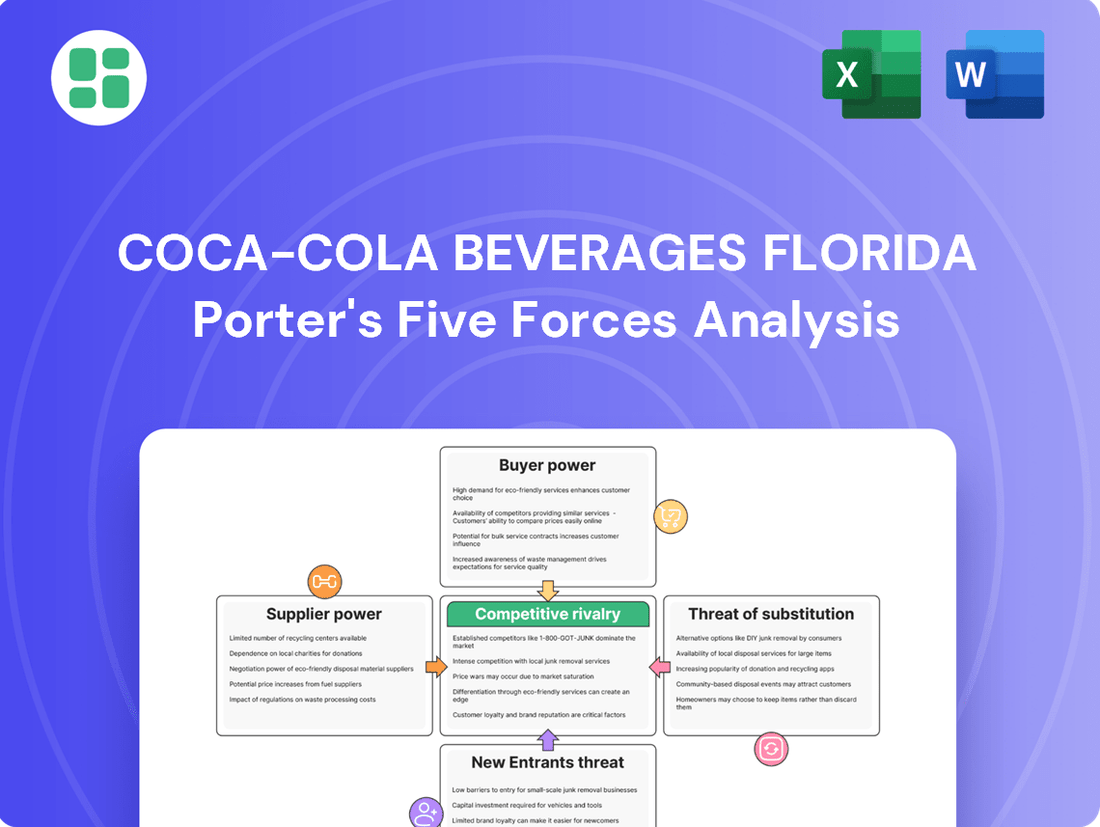

This analysis dissects the competitive forces impacting Coca-Cola Beverages Florida, revealing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly identify and address competitive threats with a visual breakdown of Coca-Cola Beverages Florida's Porter's Five Forces, empowering swift strategic adjustments.

Customers Bargaining Power

Major retailers and large chain customers, like supermarkets and restaurant groups, wield considerable bargaining power because of the sheer volume of Coca-Cola Beverages Florida products they purchase. This allows them to negotiate for better pricing, demand promotional support, and secure more favorable terms, directly influencing Coke Florida's profitability and strategic decisions.

In 2024 and into 2025, these powerful buyers are increasingly pushing for enhanced promotional activities. This includes greater discounts and special offers, a trend driven by a consumer base that remains highly budget-conscious. For instance, the average consumer spending on groceries saw a notable increase in early 2024, making price competitiveness a key factor for these large retailers.

Coca-Cola Beverages Florida (Coke Florida) serves a vast network of smaller customers, including independent convenience stores, local eateries, and vending machine operators. Individually, these customers possess minimal bargaining power due to their limited purchase volumes.

However, the sheer number of these fragmented customers means their collective demand constitutes a significant portion of Coke Florida's overall sales volume. This widespread customer base grants Coke Florida considerable leverage in setting prices and negotiating terms, as no single small customer can dictate unfavorable conditions.

Coke Florida's strategy, aligned with the broader Coca-Cola franchise model, actively seeks to expand its outlet coverage. This focus on increasing the number of points of sale further solidifies the company's position, as a larger customer footprint generally translates to greater pricing power and reduced susceptibility to individual customer demands.

In 2024 and heading into 2025, consumers are showing a heightened awareness of prices, a trend amplified by ongoing economic uncertainties and inflation. This means they are actively seeking more value for their money, making them more inclined to switch brands based on cost.

This heightened price sensitivity among consumers directly impacts retailers, who in turn pass this pressure onto their suppliers, including Coca-Cola Beverages Florida. Retailers are pushing for more competitive pricing and a greater number of promotional offers to attract and retain these value-conscious shoppers.

For instance, during 2024, beverage promotions, such as multi-buy offers and discounts, became even more prevalent as brands vied for market share amidst a challenging economic climate. This dynamic forces bottlers like Coke Florida to carefully manage their pricing strategies and promotional investments to remain competitive at the retail level.

Brand Loyalty vs. Private Labels

Coca-Cola Beverages Florida, like many consumer goods companies, navigates the dynamic between strong brand recognition and the growing influence of private label offerings. While Coca-Cola's iconic brand commands significant loyalty, the increasing availability and perceived value of store brands, especially for budget-conscious shoppers, can amplify customer bargaining power. This dynamic means retailers, acting on behalf of their customers, may leverage the availability of cheaper private label alternatives to negotiate lower wholesale prices for Coca-Cola products.

The impact of private labels is particularly pronounced in certain market segments. For instance, in 2023, private label sales in the U.S. beverage category saw continued growth, capturing a larger share of the market as consumers actively sought cost-effective options. This trend directly influences Coca-Cola's pricing power:

- Brand Loyalty as a Shield: Coca-Cola's extensive marketing and established brand equity foster a degree of customer loyalty, which inherently reduces the bargaining power of individual consumers.

- Private Label Penetration: The increasing market share of private label beverages, often priced 20-30% lower than national brands, provides consumers with viable alternatives, thereby increasing their leverage.

- Retailer Influence: Retailers, by stocking and promoting private label options, can effectively use them as a negotiating tool to secure more favorable terms from Coca-Cola Beverages Florida.

- Price Sensitivity: For a segment of consumers, price remains a primary decision factor, making them more susceptible to switching to private labels, which in turn empowers retailers in their negotiations.

Distribution Channel Influence

The distribution channels themselves, such as online platforms and vending machines, can significantly impact customer power. Large online retailers, for example, might leverage their scale to negotiate favorable terms regarding logistics or data sharing with Coca-Cola Beverages Florida. Similarly, vending machine operators can exert influence based on prime machine placement and the desired product mix they offer to end consumers.

Coca-Cola Beverages Florida operates an extensive distribution network across Florida, reaching a vast array of retail outlets and consumer touchpoints. This broad reach, while a strength, also means managing diverse channel partner relationships, each with its own set of demands and negotiation leverage. For instance, major supermarket chains, acting as significant distribution channels, can command considerable influence due to the volume of Coca-Cola products they sell. In 2024, the beverage industry continued to see consolidation among large retail players, potentially amplifying their bargaining power.

- Channel Specific Demands: Large retailers may require specific inventory management systems or promotional support, increasing their leverage.

- Vending Machine Placement: Operators can negotiate terms based on the foot traffic and sales potential of their machine locations.

- Online Retailer Influence: E-commerce giants might push for exclusive product offerings or preferential delivery schedules.

- Network Reach: Coca-Cola Beverages Florida's extensive network means managing relationships with numerous channel partners, each with varying degrees of bargaining power.

The bargaining power of customers for Coca-Cola Beverages Florida (Coke Florida) is a significant factor, largely driven by the concentration of its buyers and evolving consumer price sensitivity. Major retailers and large chain customers, such as supermarket groups, hold substantial sway due to their high purchase volumes, enabling them to negotiate favorable pricing and promotional support. This trend is amplified in 2024 and into 2025, as consumers remain highly price-conscious, pushing retailers to demand more competitive terms from suppliers like Coke Florida.

While individual small customers have minimal power, their collective demand represents a substantial portion of sales. However, the increasing prevalence of private label beverages, often priced 20-30% lower, provides consumers with alternatives. This empowers retailers to leverage these options in negotiations, as seen with private label sales growth in the U.S. beverage category in 2023. The distribution channels themselves, particularly large online retailers, also exert influence through their scale and data-sharing demands.

| Customer Segment | Bargaining Power Drivers | Impact on Coke Florida | 2024/2025 Trend Highlight |

|---|---|---|---|

| Major Retailers (Supermarkets, Chains) | High Volume Purchases, Consolidation | Negotiate Lower Prices, Demand Promotions | Increased pressure for discounts due to consumer price sensitivity |

| Small, Fragmented Customers (Convenience Stores) | Low Individual Volume, High Collective Demand | Minimal individual impact, collective volume supports Coke Florida's pricing | Continued expansion of outlet coverage to leverage broad customer base |

| Consumers (End-Users) | Price Sensitivity, Brand Loyalty, Private Label Availability | Influences retailer demands, potential shift to lower-cost alternatives | Heightened price awareness and seeking value for money |

| Distribution Channels (Online Retailers) | Scale, Data Sharing Capabilities | Negotiate terms on logistics, data sharing | Push for exclusive offerings or preferential delivery |

What You See Is What You Get

Coca-Cola Beverages Florida Porter's Five Forces Analysis

This preview showcases the complete Coca-Cola Beverages Florida Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the beverage industry. You're viewing the exact, professionally formatted document that will be instantly available to you upon purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The Florida beverage market is a battleground, with Coca-Cola Beverages Florida (Coke Florida) facing off against formidable rivals. PepsiCo and Keurig Dr Pepper are key players, offering a broad spectrum of drinks that directly compete with Coke Florida's portfolio. This intense rivalry means constant pressure to innovate and capture consumer attention.

These national and regional giants are not just offering similar products; they are actively vying for shelf space and consumer loyalty across both sparkling and non-sparkling beverage categories. For instance, PepsiCo's extensive distribution network and brand recognition in Florida pose a significant challenge. Keurig Dr Pepper, with its diverse brands, also commands a substantial market presence.

Adding another layer to this competitive landscape is Coca-Cola Consolidated, a major bottler that, interestingly, also distributes products for Keurig Dr Pepper and the popular energy drink brand, Monster Energy. This dynamic means that even within the broader Coca-Cola system, there are entities that also support competing beverage brands, further intensifying the fight for market share in Florida.

Competitive rivalry within Coca-Cola Beverages Florida is intense, fueled by aggressive marketing and a constant stream of product innovation. Companies are locked in a battle for consumer attention through extensive advertising campaigns and the introduction of new flavors, functional beverages, and zero-sugar alternatives. For instance, in 2024, Coca-Cola itself launched several new products and variations, contributing to this dynamic.

The beverage sector is experiencing a surge in innovation, particularly with functional beverages, the use of natural sweeteners, and the development of hybrid drinks, trends expected to continue strongly into 2025. This drive for differentiation means companies like Coca-Cola Beverages Florida must continually invest in R&D and marketing to stay ahead of competitors who are also actively pursuing these evolving consumer preferences.

Coca-Cola Beverages Florida's (Coke Florida) robust distribution network, spanning 47 counties, is a significant asset, enabling efficient product delivery to a wide range of customers. This extensive reach is a key differentiator, allowing them to serve diverse markets from convenience stores to large grocery chains.

However, the competitive landscape means rivals are also pouring resources into their own distribution capabilities. For instance, PepsiCo, a major competitor, also boasts a substantial distribution infrastructure, creating an ongoing arms race in logistics and market penetration. The ability to swiftly and reliably get products onto shelves and into consumers' hands remains paramount for market share.

Brand Loyalty and Portfolio Diversification

While Coca-Cola commands significant brand loyalty, the competitive landscape is fierce. Rivals also cultivate strong brand recognition and actively diversify their offerings to meet changing consumer tastes. This includes a growing demand for healthier beverages and a wider array of non-alcoholic choices.

Coca-Cola Consolidated, a key player, exemplifies this diversification strategy. In 2024, they continued to expand their product lines, notably with the introduction and promotion of mini cans and bottles, alongside a robust selection of zero-sugar variants. This approach aims to capture a broader market share by appealing to diverse consumer needs and preferences.

- Brand Loyalty: Coca-Cola enjoys high consumer recognition and preference, a significant asset.

- Competitor Diversification: Rivals are actively expanding portfolios with healthier options and non-alcoholic alternatives.

- Product Innovation: Coca-Cola Consolidated's focus on mini cans, bottles, and zero-sugar options reflects market trends.

- Market Adaptation: Diversification is crucial for staying competitive and meeting evolving consumer demands in the beverage industry.

Local and Craft Beverage Growth

The burgeoning popularity of local and craft beverages, encompassing everything from artisanal breweries to specialized non-alcoholic drink spots, intensifies competition, especially within specialized market niches. These smaller, agile businesses frequently tap into distinct consumer tastes and emerging trends. For instance, Florida's craft beer sector experienced a remarkable surge, with the number of licensed craft breweries growing significantly in recent years, indicating a strong consumer demand for unique, locally-produced options that Coca-Cola Beverages Florida must contend with.

These craft players often differentiate themselves through unique flavor profiles, ingredient sourcing, and community engagement, directly challenging the broad appeal of established brands. This trend forces larger bottlers to innovate and potentially adapt their product portfolios to cater to these evolving consumer preferences. The competitive landscape is further shaped by the ability of these smaller entities to quickly respond to market shifts and consumer demands, a flexibility that can be harder for larger organizations to replicate.

- Growth in Craft Beer: Florida's craft beer industry has seen substantial expansion, with the number of licensed breweries increasing by over 50% between 2015 and 2023, according to state data.

- Niche Market Appeal: Craft beverage producers often target specific demographics and consumption occasions, creating specialized demand that can fragment the broader beverage market.

- Consumer Preference Shift: There's a discernible consumer trend towards supporting local businesses and seeking out unique, high-quality beverage experiences, impacting market share for traditional beverage giants.

Coca-Cola Beverages Florida faces intense competition from major players like PepsiCo and Keurig Dr Pepper, who actively vie for market share through aggressive marketing and product innovation. The presence of Coca-Cola Consolidated, which also distributes competing brands like Monster Energy, further intensifies this rivalry.

The market is shaped by a constant influx of new products, including functional beverages and zero-sugar options, with companies investing heavily in R&D and marketing to meet evolving consumer demands. This dynamic is further complicated by the rise of local craft beverages, which appeal to niche markets and force larger bottlers to adapt their strategies.

In 2024, Coca-Cola continued its product expansion, introducing new variations and focusing on popular formats like mini cans and zero-sugar alternatives to maintain its competitive edge. This strategic diversification is crucial for capturing a broader consumer base in a rapidly changing beverage landscape.

| Competitor | Key Strategies | 2024 Focus Areas |

|---|---|---|

| PepsiCo | Extensive distribution, brand recognition, product diversification | Functional beverages, healthier options |

| Keurig Dr Pepper | Diverse brand portfolio, market presence | New flavor introductions, convenience formats |

| Coca-Cola Consolidated | Distribution partnerships, product line expansion | Mini cans/bottles, zero-sugar variants, energy drinks |

| Local Craft Beverage Producers | Unique flavors, ingredient sourcing, community engagement | Artisanal non-alcoholic drinks, niche market appeal |

SSubstitutes Threaten

The most significant threat to Coca-Cola Beverages Florida comes from a growing array of healthier alternatives. Bottled water, both still and sparkling, continues to gain market share as consumers prioritize hydration without added sugar. Functional beverages and options like juices, teas, and plant-based milks are also presenting strong competition, catering to a more health-conscious demographic.

This shift is driven by increasing consumer awareness regarding sugar intake and a desire for natural ingredients. Data from 2024 indicates a continued upward trend in the non-alcoholic beverage market, with a notable surge in demand for products offering wellness benefits. This segment is expected to see robust growth, fueled by innovations in functional ingredients and a heightened focus on consumer well-being.

Coffee and tea, whether ready-to-drink or brewed at home, represent significant substitutes for Coca-Cola's soft drink portfolio. Consumers often opt for these beverages as daily alternatives for hydration or an energy lift. In 2024, the global coffee market was valued at approximately $127.2 billion, with the ready-to-drink segment showing robust growth, indicating a strong competitive force.

The market for energy drinks and sports drinks poses a significant threat of substitutes for Coca-Cola Beverages Florida. While CCBF distributes some brands in these categories, consumers actively seek out specialized functional benefits, readily available from numerous competitors. This broad availability and consumer preference for specific performance-enhancing beverages create a strong substitute pressure.

The sports and energy drink sector experienced robust expansion in 2023, indicating a growing consumer demand for these alternatives. This trend suggests that consumers are increasingly willing to switch from traditional beverages to products offering perceived advantages in energy levels or athletic performance, directly impacting Coca-Cola Beverages Florida's market share in these segments.

Homemade Beverages and Water Filters

Consumers increasingly turn to homemade beverages, such as personalized iced teas, coffees, or infused waters, directly challenging the demand for Coca-Cola's ready-to-drink products. This trend is amplified by growing health consciousness and a desire for customization, allowing consumers to control ingredients and sugar content.

The proliferation of advanced home water filtration systems and popular home carbonation devices, like SodaStream, offers a compelling and often more economical alternative to purchasing bottled or canned beverages. For instance, in 2024, the global home carbonation market was projected to reach over $3.5 billion, indicating a significant shift towards at-home beverage creation.

- Homemade Beverage Trend: Growing consumer preference for customizable, healthier options like infused water and artisanal teas.

- Water Filtration Systems: Widespread availability and improved technology make tap water a viable alternative to bottled options.

- Home Carbonation Devices: Systems like SodaStream provide a cost-effective way for consumers to replicate carbonated drinks at home.

- Cost-Benefit Analysis: For many consumers, the long-term savings associated with making beverages at home are a significant draw.

Non-alcoholic Beer and Spirits

The rise of sophisticated non-alcoholic beers, wines, and spirits presents a growing threat to traditional soft drink consumption, particularly in social contexts. This trend is fueled by the 'sober curious' movement, where consumers are actively seeking alternatives to alcohol. The no- and low-alcohol beverage market experienced substantial growth, with sales seeing significant increases in recent years.

- Market Growth: The global low- and no-alcohol market was valued at approximately $11 billion in 2023 and is projected to reach over $25 billion by 2030, indicating robust expansion.

- Consumer Shift: A significant portion of consumers, especially younger demographics, are reducing their alcohol intake, creating a demand for premium non-alcoholic options.

- Product Innovation: Advancements in brewing and distillation techniques have led to a wider array of high-quality non-alcoholic beverages that closely mimic their alcoholic counterparts, making them more appealing substitutes.

The threat of substitutes for Coca-Cola Beverages Florida is substantial, encompassing a broad range of beverages and even DIY options. Health-conscious consumers are increasingly opting for bottled water, functional beverages, juices, teas, and plant-based milks, driven by a desire for natural ingredients and reduced sugar intake. In 2024, the non-alcoholic beverage market saw a notable surge in demand for wellness-oriented products, highlighting this shift.

Coffee and tea, both ready-to-drink and home-brewed, serve as daily alternatives for hydration and energy. The global coffee market, valued around $127.2 billion in 2024, with its ready-to-drink segment showing strong growth, underscores the competitive pressure from these categories.

Furthermore, the rise of home carbonation devices like SodaStream, with the global market projected to exceed $3.5 billion in 2024, offers a cost-effective way for consumers to create their own sparkling beverages. Similarly, the expanding market for sophisticated non-alcoholic beers, wines, and spirits, which saw sales increases in recent years, caters to consumers seeking alternatives to traditional drinks in social settings.

| Substitute Category | 2024 Market Insight | Impact on Coca-Cola Beverages Florida |

|---|---|---|

| Healthier Alternatives (Water, Functional Drinks) | Growing demand for wellness-focused products. | Direct competition for hydration and daily consumption occasions. |

| Coffee & Tea (Ready-to-Drink & Home-Brewed) | Global coffee market ~$127.2 billion; RTD segment growing. | Offers alternative daily beverage choices and energy boosts. |

| Home Carbonation Devices | Global market projected >$3.5 billion. | Provides a cost-effective, customizable alternative to bottled sodas. |

| Non-Alcoholic Beer, Wine, Spirits | Market growth driven by sober-curious movement. | Competes in social consumption occasions traditionally held by soft drinks. |

Entrants Threaten

The capital required to establish a Coca-Cola bottling plant, acquire necessary distribution rights, and build a robust logistics network is exceptionally high. For instance, constructing a modern bottling facility can easily cost tens of millions of dollars, with some estimates placing the figure upwards of $100 million for large-scale operations. This substantial financial barrier significantly deters potential new entrants into the large-scale beverage bottling and distribution market.

Established bottlers like Coca-Cola Beverages Florida (Coke Florida) benefit from deeply ingrained relationships with a vast network of retailers, restaurants, and other commercial clients. These partnerships, cultivated over many years, grant them preferential access to prime shelf space and ensure widespread product availability, creating a significant barrier for any new competitor seeking to enter the market.

The immense brand loyalty Coca-Cola enjoys, built over decades, presents a formidable barrier. Consumers often reach for familiar brands, making it difficult for newcomers to gain traction. For instance, in 2023, Coca-Cola's global brand value was estimated at over $97 billion, highlighting the significant intangible asset that deters new entrants.

New companies entering the beverage market would face substantial marketing expenses to even begin to challenge this established loyalty. The sheer scale of advertising and promotional activities required to build brand awareness and preference is a significant hurdle, demanding considerable capital investment that many potential entrants may not possess.

Exclusive Bottling Agreements

The threat of new entrants into the Florida beverage market, specifically for Coca-Cola products, is significantly dampened by exclusive bottling agreements. The Coca-Cola Company employs a franchise model where specific territories are granted to authorized bottlers, such as Coca-Cola Beverages Florida (CCBF). This contractual arrangement creates substantial barriers, effectively preventing any new, independent bottler from distributing Coca-Cola products within CCBF's designated Florida territory.

This franchise system inherently limits the number of players authorized to bottle and distribute Coca-Cola. For instance, CCBF serves over 20 million consumers across 47 Florida counties, highlighting the scale of these exclusive rights. Any new entrant would face the insurmountable hurdle of obtaining bottling rights directly from The Coca-Cola Company, which are not readily available and are typically long-term commitments.

- Exclusive Territorial Rights: The Coca-Cola Company grants exclusive rights to its bottlers, preventing new independent bottlers from entering specific geographic markets like Florida.

- High Capital Investment: Establishing a new bottling and distribution operation requires immense capital, further deterring potential new entrants.

- Brand Loyalty and Distribution Networks: Existing bottlers benefit from established distribution networks and strong brand loyalty, making it difficult for new players to gain market share.

- Contractual Barriers: The franchise agreements themselves represent significant legal and contractual barriers that new entrants cannot easily overcome.

Regulatory Hurdles and Compliance

The beverage sector is heavily regulated, with stringent rules covering everything from food safety and accurate product labeling to environmental impact and quality standards. For instance, the U.S. Food and Drug Administration (FDA) sets rigorous guidelines that any new beverage producer must adhere to, which can be a significant barrier.

Navigating these complex compliance requirements adds substantial cost and operational complexity for any new player attempting to enter the market. This includes securing necessary permits, conducting extensive testing, and ensuring all packaging and marketing materials meet legal standards.

- Food Safety Regulations: Ensuring products meet FDA standards for ingredients, manufacturing, and handling.

- Labeling Requirements: Complying with rules on nutritional information, ingredient lists, and allergen warnings.

- Environmental Compliance: Adhering to regulations on packaging waste, water usage, and emissions.

- Product Standards: Meeting specific standards for beverage content, purity, and quality.

The threat of new entrants for Coca-Cola Beverages Florida (CCBF) is significantly low, primarily due to the exclusive territorial rights granted by The Coca-Cola Company. These agreements, which are not easily obtainable, create a substantial barrier, effectively preventing independent bottlers from distributing Coca-Cola products within CCBF's extensive Florida territory. For instance, CCBF serves over 20 million consumers across 47 Florida counties, demonstrating the scale of these exclusive rights.

Furthermore, the immense capital required to establish a bottling and distribution operation, coupled with the need to build established distribution networks and brand loyalty, presents a formidable challenge for any potential newcomer. The regulatory landscape, with its stringent food safety and labeling requirements, adds another layer of complexity and cost, further deterring new market participants.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Exclusive Bottling Agreements | The Coca-Cola Company grants exclusive rights to specific bottlers for defined territories. | Prevents new independent bottlers from distributing Coca-Cola products within CCBF's Florida territory. |

| High Capital Investment | Establishing bottling plants, distribution networks, and logistics requires substantial financial resources. | Deters new entrants due to the immense upfront costs involved, potentially exceeding $100 million for large-scale operations. |

| Brand Loyalty & Distribution Networks | Decades of established consumer preference and existing relationships with retailers and restaurants. | Makes it difficult for new competitors to gain market share and secure prime shelf space. |

| Regulatory Compliance | Adherence to strict food safety, labeling, and environmental standards set by agencies like the FDA. | Adds significant operational complexity and cost for new beverage producers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Coca-Cola Beverages Florida is built upon a foundation of verified data, including publicly available financial reports, industry-specific market research from firms like IBISWorld, and regulatory filings. This blend of internal and external data provides a comprehensive view of the competitive landscape.