China Merchants Expressway Network & Technology Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Merchants Expressway Network & Technology Holdings Bundle

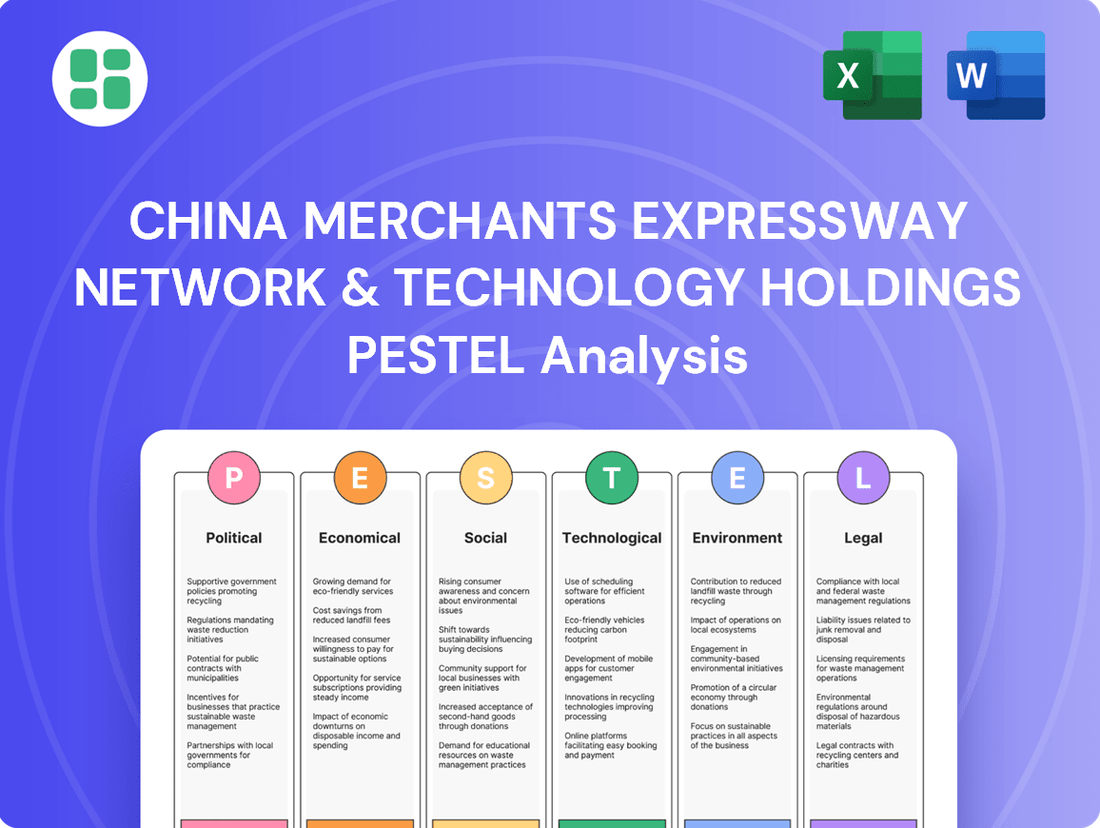

China Merchants Expressway Network & Technology Holdings operates within a dynamic environment shaped by significant political, economic, social, technological, legal, and environmental factors. Understanding these external forces is crucial for anticipating market shifts and identifying strategic opportunities. Our comprehensive PESTLE analysis delves deep into these influences, offering actionable intelligence for your business strategy.

Gain a competitive edge by leveraging our expert-crafted PESTLE analysis for China Merchants Expressway Network & Technology Holdings. Discover how evolving regulations, economic fluctuations, and technological advancements are impacting the company's trajectory. Download the full version now to unlock critical insights and inform your investment decisions.

Political factors

China's commitment to enhancing its transportation infrastructure is a significant political factor. The 14th Five-Year Plan (2021-2025) and the 'National Comprehensive Three-dimensional Transportation Network Planning Outline' (2021-2035) clearly prioritize the expansion and modernization of expressways, directly benefiting China Merchants Expressway.

These national strategies signal sustained government investment and policy support for new expressway development and the upkeep of existing networks. By 2035, the plan aims for a physical network of 700,000 km, with 460,000 km dedicated to roads, providing ongoing opportunities for expressway operators.

China Merchants Expressway, as a state-owned enterprise (SOE), navigates evolving SOE reforms designed to boost efficiency and market responsiveness. These reforms, while potentially introducing operational adjustments, also offer advantages like preferential access to state-backed funding and projects aligned with national infrastructure plans.

Recent developments, such as leadership transitions and active share buyback initiatives in 2024, highlight the company's dynamic approach to capital management and operational strategy within the SOE framework. For example, in early 2024, the company announced a significant share repurchase plan, demonstrating management's confidence in its valuation and commitment to shareholder returns.

China's national strategies prioritize regional integration, channeling substantial investment into transportation networks. Key initiatives like the Beijing-Tianjin-Hebei coordinated development, the Yangtze River Delta integration, and the Guangdong-Hong Kong-Macao Greater Bay Area are prime examples. These plans specifically target enhanced connectivity to foster economic growth and population mobility.

China Merchants Expressway Network & Technology Holdings is well-positioned to capitalize on these regional development strategies. The expansion and modernization of expressways are crucial for facilitating trade and movement within these designated economic zones. The company's ongoing and planned projects are strategically located along these vital corridors, aligning with national development objectives.

For instance, the Guangdong-Hong Kong-Macao Greater Bay Area, a region with a GDP exceeding $1.7 trillion as of 2023, heavily relies on advanced transportation infrastructure. China Merchants Expressway's investments in this area directly support the integration goals, enabling smoother logistics and greater economic exchange. The company’s operational revenue from expressways in key economic regions saw a notable increase in the first half of 2024, reflecting the direct impact of these national strategies.

Toll Road Policy and Pricing Regulation

Government policies are the bedrock for toll road operations, dictating everything from how much drivers pay and how tolls are collected, to how long companies can operate their concessions. This directly shapes China Merchants Expressway's revenue streams. For instance, the recent nationwide shift away from manual toll booths to standardized, distance-based electronic toll collection (ETC) systems, which includes a mandatory 5% discount for ETC users, has streamlined operations and boosted user adoption, with ETC penetration rates reaching over 90% on many expressways by early 2024.

Future policy shifts by the Ministry of Transport regarding pricing or concession agreements hold significant sway over the company's financial performance. These adjustments could impact profitability by altering revenue potential or extending/shortening operational lifespans. For example, any move towards further toll rate reductions or increased government oversight on concession terms could present challenges.

- Policy Influence: Government policies directly control toll rates, collection methods, and concession durations, fundamentally impacting China Merchants Expressway's revenue.

- Recent Reforms: The nationwide elimination of manual toll booths and the implementation of standardized, distance-based pricing, coupled with a 5% ETC discount, have enhanced operational efficiency and user uptake.

- Future Risks: Potential changes in pricing policies or concession terms by the Ministry of Transport represent a significant factor that could affect the company's future profitability.

Geopolitical Stability and Trade Relations

China's geopolitical standing and its trade relationships significantly impact its economic trajectory, directly affecting traffic and freight volumes on expressways. While China Merchants Expressway primarily focuses on domestic operations, initiatives like the Belt and Road Initiative (BRI) can indirectly stimulate demand for robust internal logistics networks by enhancing cross-border trade. For instance, the BRI aims to connect Asia with Europe and Africa, potentially increasing the movement of goods that require efficient transit across China's vast expressway system.

Shifts in global trade policies or domestic political stability can create volatility. During 2024 and early 2025, ongoing trade tensions, particularly with the United States, have presented challenges. However, China's continued emphasis on domestic consumption and infrastructure development, as seen in its 2024 government work report targeting GDP growth of around 5%, provides a baseline for economic activity. This economic resilience is crucial for maintaining traffic volumes, as expressways are vital arteries for commerce and personal travel.

- Trade Dynamics: China's trade surplus in goods reached a record $827.8 billion in 2023, indicating strong export performance which underpins freight movement. Fluctuations in these trade flows, influenced by geopolitical factors, directly impact expressway usage.

- BRI Impact: The BRI continues to facilitate infrastructure development and trade routes. By mid-2024, over 150 countries had signed BRI cooperation agreements, suggesting a sustained, albeit evolving, global engagement that can indirectly benefit China's logistics infrastructure.

- Domestic Stability: Maintaining domestic stability is paramount. Any perceived instability could dampen consumer confidence and business investment, leading to reduced travel and freight volumes on the network.

- Policy Focus: Government policies prioritizing economic growth and connectivity, such as continued investment in transportation infrastructure, are key to mitigating risks associated with external geopolitical pressures.

China's national infrastructure plans, like the 14th Five-Year Plan, prioritize expressway expansion, directly benefiting China Merchants Expressway. These plans aim for a 700,000 km road network by 2035, ensuring continued development opportunities.

As an SOE, China Merchants Expressway benefits from state-backed funding and alignment with national projects, though it must adapt to ongoing SOE reforms aimed at increasing efficiency. The company's 2024 share buyback program underscores its strategic capital management within this framework.

Regional integration initiatives, such as the Greater Bay Area, heavily rely on enhanced transportation. China Merchants Expressway's investments in these zones are crucial for facilitating trade and movement, with revenue from these areas showing growth in early 2024.

Government policies dictate tolling and concessions, directly impacting revenue. The widespread adoption of electronic toll collection (ETC), with over 90% penetration on many expressways by early 2024 and a mandatory 5% discount, has streamlined operations.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental forces impacting China Merchants Expressway Network & Technology Holdings, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights into how these dynamics present both strategic opportunities and potential threats for the company's future growth and operational planning.

The PESTLE analysis for China Merchants Expressway provides a clear, summarized version of external factors impacting the company, acting as a pain point reliever by offering actionable insights for strategic decision-making.

This analysis is designed to be easily shareable, facilitating quick alignment across teams on the political, economic, social, technological, environmental, and legal landscapes affecting China Merchants Expressway.

Economic factors

China Merchants Expressway's revenue is intrinsically linked to the nation's economic pulse. Higher GDP growth typically translates to increased traffic volume on its expressways, both for passenger and freight movement. For instance, China's GDP growth was projected to be around 5% in 2025, reflecting a continued, albeit moderate, expansion of economic activity.

However, the economic landscape presents challenges. A complex external environment and the ongoing transition away from a real estate-driven economy mean that demand might not always keep pace. This dynamic underscores the importance of sustained or even accelerated economic growth for ensuring robust revenue performance for China Merchants Expressway.

China Merchants Expressway's growth is significantly fueled by robust investment in transportation infrastructure, both from the government and private sectors. This is a key economic factor for the company.

From 2021 through 2024, fixed-asset investment in China's transport sector reached an impressive 15.2 trillion yuan, representing a 23.3 percent jump compared to the prior period. Projections indicate that approximately 3.8 trillion yuan will be invested by the close of 2024 alone.

This sustained, high level of capital expenditure creates a continuous stream of new projects and opportunities for infrastructure upgrades, directly benefiting China Merchants Expressway's business pipeline.

China's ongoing urbanization is a significant driver for China Merchants Expressway. The nation is aiming for nearly 70% urbanization by 2029, which directly translates to increased demand for efficient transportation networks. This trend fuels both passenger and freight traffic on expressways, as more people reside in and commute between urban areas, a core benefit for the company.

The strategic development of 'one-hour commuting circles' for major city clusters further amplifies this demand. As these circles expand, they create more interconnected economic zones, necessitating robust expressway infrastructure to facilitate movement. This expansion directly supports China Merchants Expressway's business model by increasing traffic volume and revenue potential.

Inflation and Cost of Operations

Inflationary pressures, particularly on construction materials, labor, and energy, can significantly impact China Merchants Expressway Network & Technology Holdings' operational costs and new project development expenses. For instance, in 2024, global commodity prices, including steel and asphalt, experienced volatility, directly affecting infrastructure project budgets.

While broader inflation in China might appear subdued, the company must vigilantly manage these specific input costs to maintain profitability. The ability to pass on these rising expenses through toll adjustments is often subject to regulatory approval, underscoring the critical importance of stringent cost control measures.

- Construction Material Costs: Fluctuations in the price of steel and cement directly influence the expense of building and maintaining expressways.

- Labor Expenses: Wage inflation and the availability of skilled labor are key determinants of operational expenditure.

- Energy Prices: The cost of fuel for maintenance vehicles and electricity for operational facilities contributes to overall cost management.

Availability of Funding and Interest Rates

Access to capital at favorable interest rates is crucial for China Merchants Expressway Network & Technology Holdings to fund its extensive infrastructure development. The company's position as a state-owned enterprise (SOE) likely grants it an advantage in securing government-backed financing and potentially lower borrowing costs compared to private entities.

However, shifts in China's monetary policy, including adjustments to benchmark lending rates, can directly impact the cost of borrowing for new projects. For instance, if the People's Bank of China (PBOC) raises its key interest rates, the financing expenses for China Merchants Expressway's future investments would likely increase, affecting project feasibility and profitability.

- Interest Rate Impact: An increase in benchmark lending rates by the PBOC, such as a hike in the Loan Prime Rate (LPR), would raise the cost of debt for China Merchants Expressway.

- SOE Advantage: As an SOE, the company may benefit from preferential lending terms or access to specific government infrastructure funds, mitigating some interest rate volatility.

- Long-term Financing: The availability and cost of long-term project financing are critical; any tightening in the credit markets or increased demand for capital could make securing funds for large-scale expressways more challenging and expensive.

China's economic trajectory, particularly its GDP growth, directly influences traffic volumes and toll revenue for China Merchants Expressway. With China's GDP projected to grow around 5% in 2025, this indicates continued economic expansion, which generally supports increased transportation demand. However, the ongoing economic restructuring and external uncertainties present a more nuanced picture, potentially moderating this growth.

Significant government investment in transportation infrastructure, totaling approximately 3.8 trillion yuan in 2024 alone, provides a robust pipeline for China Merchants Expressway. This sustained capital expenditure, coupled with a national urbanization target of nearly 70% by 2029, creates a strong demand for efficient expressway networks, directly benefiting the company's revenue potential.

| Economic Factor | Impact on China Merchants Expressway | Data Point/Trend |

|---|---|---|

| GDP Growth | Drives traffic volume and toll revenue. | Projected ~5% GDP growth in 2025. |

| Infrastructure Investment | Creates new project opportunities and upgrades. | ~3.8 trillion yuan invested in transport in 2024. |

| Urbanization | Increases demand for efficient transport networks. | Targeting ~70% urbanization by 2029. |

Preview the Actual Deliverable

China Merchants Expressway Network & Technology Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of China Merchants Expressway Network & Technology Holdings provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market dynamics and strategic considerations.

Sociological factors

China continues to see significant migration from rural to urban areas, a trend that directly fuels demand for expressway services. By the end of 2023, China's urbanization rate reached 66.16%, meaning over 930 million people lived in cities. This demographic shift necessitates more inter-city travel for work and leisure, and also boosts the need for efficient logistics to supply these expanding urban centers.

The expansion of urban agglomerations, such as the Yangtze River Delta and the Pearl River Delta, further intensifies commuting and freight transport needs. These densely populated economic hubs rely heavily on well-developed expressway networks to connect their components and facilitate the movement of goods. In 2024, China Merchants Expressway reported a significant increase in traffic volume, reflecting this ongoing urbanization and economic activity.

Public sentiment towards toll roads in China is a significant sociological factor for China Merchants Expressway. While expressways are vital for connectivity, user satisfaction hinges on pricing, transparency, and service quality. For instance, in 2023, average daily traffic on China's expressways reached approximately 20.9 million vehicles, highlighting widespread usage, but public perception of toll rates remains a point of discussion.

The perceived value proposition of faster travel versus the cost of tolls can influence user behavior and potentially lead to calls for policy adjustments. As of early 2024, discussions around toll road fees and their impact on logistics costs continue, suggesting that public opinion on these matters can shape future regulatory approaches and affect the operational environment for companies like China Merchants Expressway.

As China's economy continues to grow, leading to higher disposable incomes and improved living standards, there's a clear societal shift towards demanding more efficient, safer, and comfortable travel. This translates directly into increased expectations for the quality and speed of transportation infrastructure.

China Merchants Expressway Network & Technology Holdings is responding by prioritizing investments in road maintenance, advanced safety features, and sophisticated intelligent traffic management systems. These efforts are crucial for meeting public demand and staying ahead in a competitive landscape. For instance, significant capital was allocated in 2023 towards road safety upgrades and the renovation of aging infrastructure, including critical bridge projects.

Impact of Holidays and Major Events

China Merchants Expressway Network & Technology Holdings experiences significant fluctuations in traffic volume due to major holidays and events. For instance, during the 2024 Spring Festival travel rush, an estimated 481 million passenger trips were made on railways, highways, waterways, and civil aviation, highlighting the immense scale of population movement. This surge directly translates to increased toll revenue but also necessitates advanced operational planning to manage congestion and ensure smooth traffic flow.

The company's ability to effectively manage these peak periods is crucial for both revenue maximization and user satisfaction. Strategies such as intelligent traffic management systems and efficient toll collection technologies are vital. For example, the adoption of electronic toll collection (ETC) systems has been a key focus, with China aiming for over 90% ETC usage on national expressways by the end of 2024, streamlining transactions and improving throughput during high-demand periods.

- Holiday Traffic Surges: National holidays like Chinese New Year and Golden Week drive substantial increases in expressway usage, impacting operational demands.

- Operational Preparedness: Robust strategies are required to manage peak traffic, including dynamic lane management and real-time traffic information dissemination.

- Technology Integration: Advanced toll collection systems, such as ETC, are essential for efficient processing and enhancing the user experience during busy travel times.

Digital Lifestyle and Service Expectations

The pervasive integration of digital tools into daily routines has dramatically reshaped how people approach travel, fostering a strong demand for effortless experiences. This includes a clear preference for services like electronic toll collection (ETC) and the availability of up-to-the-minute traffic data.

China has embraced ETC with remarkable speed, boasting 180 million users by 2024. The nation's ambitious goal of achieving 100% ETC adoption by 2025 underscores the public's growing expectation for smooth, digitally-enabled transactions.

- Digital Convenience: Consumers now expect travel services to be as seamless as other digital interactions.

- ETC Adoption: 180 million ETC users in China as of 2024 indicates a strong preference for automated tolling.

- Future Expectations: The push for 100% ETC adoption by 2025 signals a societal shift towards fully digitized travel processes.

China's rapid urbanization continues to drive demand for expressway services, with 66.16% of the population living in cities by the end of 2023, totaling over 930 million people. This demographic shift fuels increased inter-city travel for work and leisure, alongside greater demand for efficient logistics to support expanding urban centers.

Public sentiment regarding toll road pricing and service quality is a key sociological consideration. While expressways are crucial for connectivity, user satisfaction is influenced by perceived value. In 2023, average daily traffic on China's expressways reached approximately 20.9 million vehicles, underscoring their widespread use, yet public discourse on toll rates persists.

Growing disposable incomes and improved living standards are fostering a societal expectation for more efficient, safer, and comfortable travel. This translates into higher demands for the quality and speed of transportation infrastructure, pushing companies like China Merchants Expressway to invest in upgrades and advanced management systems.

| Sociological Factor | Description | Impact on China Merchants Expressway | Relevant Data (2023-2024) |

| Urbanization | Increasing rural-to-urban migration | Boosts demand for inter-city travel and logistics | Urbanization rate: 66.16% (end of 2023) |

| Public Opinion on Tolls | User perception of value vs. cost | Influences user behavior and potential policy changes | Average daily traffic: ~20.9 million vehicles (2023) |

| Rising Living Standards | Demand for improved travel experience | Drives investment in infrastructure quality and safety | Focus on road safety upgrades and infrastructure renovation (2023) |

Technological factors

Technological advancements are revolutionizing expressway management. The integration of AI, IoT, and big data is making operations smarter and more efficient. China is heavily investing in intelligent transportation systems, with plans to upgrade extensive highway networks.

By the close of 2024, China aimed to have over 4,000 kilometers of highways equipped with intelligent systems. These smart highways feature advanced traffic management, real-time monitoring, and dynamic tolling systems. This technological push significantly boosts operational efficiency, enhances safety, and optimizes the utilization of highway capacity.

China's ambitious goal of achieving 100% Electronic Toll Collection (ETC) adoption by 2025 is a significant technological driver. With 180 million users already onboard as of 2024, this widespread adoption directly benefits China Merchants Expressway by streamlining operations and cutting costs. This move towards digital tolling not only reduces traffic bottlenecks but also enhances the efficiency of managing its extensive expressway network.

The integration of popular mobile payment platforms like WeChat Pay and Alipay into the ETC system further amplifies user convenience. This seamless payment experience encourages greater adoption and contributes to smoother traffic flow across the network, positively impacting China Merchants Expressway's operational efficiency and customer satisfaction.

The ongoing development of autonomous vehicles (AVs) and vehicle-to-infrastructure (V2I) communication presents a significant technological shift for expressway operators. China's commitment to this future is evident, with 32,000 kilometers of roads designated for AV testing as of August 2024, showcasing active robotaxi and robo-bus trials.

China Merchants Expressway must proactively consider how to adapt its existing infrastructure to facilitate seamless V2I communication. This adaptation could involve upgrading sensors, communication systems, and data processing capabilities to support the needs of automated transport, potentially unlocking new revenue streams and operational efficiencies.

New Construction Materials and Techniques

Innovations in civil engineering are significantly reshaping China's infrastructure development. For China Merchants Expressway Network & Technology Holdings, embracing new construction materials and techniques offers a clear path to enhanced efficiency and cost savings. For instance, the adoption of high-performance concrete and advanced steel alloys can lead to structures with greater longevity and reduced need for frequent repairs.

These advancements directly impact the company's operational strategy. By integrating more durable materials and employing rapid deployment methods, such as modular construction for bridges, China Merchants Expressway can shorten project timelines and lower overall maintenance expenditures. This translates into optimized capital allocation for new expressway projects and existing network upkeep.

Consider the impact on project economics:

- Reduced Construction Time: Advanced techniques can cut project durations by an estimated 10-15%, accelerating revenue generation.

- Lower Maintenance Costs: Utilizing self-healing concrete or composite materials can decrease long-term maintenance expenses by up to 20% over a 30-year lifespan.

- Extended Infrastructure Lifespan: New materials can extend the operational life of expressways and bridges by 25% or more, improving return on investment.

- Increased Durability: The use of advanced materials like basalt fiber-reinforced polymers (BFRP) in bridge decks offers superior corrosion resistance compared to traditional steel reinforcement.

Data Analytics for Traffic Management and Revenue Optimization

China Merchants Expressway is leveraging big data analytics to refine traffic management and boost revenue. By analyzing information from traffic flows, toll transactions, and incident logs, the company can predict congestion hotspots and pinpoint areas for revenue enhancement. This sophisticated analysis underpins improvements in operational efficiency and guides strategic decisions for network growth.

This data-driven strategy is crucial for developing dynamic pricing models, where regulations allow, to optimize toll collection based on real-time demand. For instance, by understanding peak travel times and traffic volumes, they can implement variable toll rates that maximize revenue while managing traffic flow more effectively.

- Operational Efficiency: Data analytics helps streamline toll collection processes and incident response, reducing delays and improving user experience.

- Predictive Capabilities: Advanced algorithms forecast traffic patterns, enabling proactive measures to mitigate congestion.

- Revenue Optimization: Insights from data allow for the implementation of dynamic pricing and identification of new revenue streams.

- Strategic Planning: Traffic data informs decisions on network expansion and infrastructure upgrades, ensuring investments align with demand.

Technological advancements are central to China Merchants Expressway's operational evolution, with a focus on intelligent transportation systems. The nation's push for smart highways, aiming for over 4,000 kilometers equipped by the end of 2024, directly enhances traffic management and efficiency.

The widespread adoption of Electronic Toll Collection (ETC), targeting 100% by 2025, with 180 million users by 2024, streamlines operations and reduces costs. Integration with mobile payment platforms further improves user experience and traffic flow.

The burgeoning autonomous vehicle sector, supported by 32,000 kilometers of roads designated for AV testing as of August 2024, necessitates infrastructure upgrades for V2I communication. China Merchants Expressway must adapt its systems to support automated transport, potentially creating new revenue avenues.

Innovations in civil engineering, such as high-performance concrete and modular construction, are improving efficiency and reducing maintenance costs. These material advancements can extend infrastructure lifespan by up to 25%, positively impacting return on investment.

Big data analytics is key to optimizing traffic management and revenue. Predictive capabilities for congestion and dynamic pricing models, informed by traffic and transaction data, are crucial for strategic planning and operational efficiency.

| Technological Factor | Impact on China Merchants Expressway | Key Data/Trend (2024-2025) |

| Intelligent Transportation Systems (ITS) | Enhanced traffic management, operational efficiency, safety | 4,000+ km of highways targeted for ITS by end of 2024 |

| Electronic Toll Collection (ETC) | Streamlined operations, cost reduction, improved traffic flow | 100% adoption target by 2025; 180 million users by 2024 |

| Autonomous Vehicles (AV) & V2I | Need for infrastructure adaptation, potential new revenue streams | 32,000 km roads designated for AV testing (as of Aug 2024) |

| Advanced Civil Engineering Materials | Improved durability, reduced maintenance costs, extended lifespan | Potential 10-15% reduction in construction time; 20% lower maintenance costs |

| Big Data Analytics | Optimized traffic flow, predictive maintenance, revenue enhancement | Data-driven insights for dynamic pricing and strategic planning |

Legal factors

China's transportation sector operates under a robust legal and policy framework, notably guided by the National Comprehensive Three-dimensional Transportation Network Planning Outline (2021-2035) and the 14th Five-Year Plan. These initiatives are crucial for China Merchants Expressway, as they dictate investment priorities, construction standards, and operational regulations for expressways.

This structured approach ensures a predictable and stable environment for expressway development and management. For instance, the 14th Five-Year Plan (2021-2025) emphasizes the high-quality development of transportation infrastructure, including expressways, aiming to further integrate national and regional economic development.

China's toll road sector operates under specific laws and regulations, including concession agreement durations, toll rate adjustments, and maintenance standards. These legal frameworks are crucial as they directly shape China Merchants Expressway's revenue potential and the long-term value of its assets. For instance, concession periods dictate how long the company can collect tolls on a given road, impacting its overall profitability horizon.

Further legal stipulations, such as the mandated 5% minimum discount for Electronic Toll Collection (ETC) users, directly influence revenue streams. In 2023, ETC usage continued its upward trend, with reports indicating that over 90% of transactions on many expressways were conducted via ETC, highlighting the significant financial impact of these regulatory incentives on toll collection efficiency and revenue realization.

China Merchants Expressway Network & Technology Holdings faces increasing regulatory scrutiny under China's evolving environmental protection laws. The forthcoming Ecological and Environmental Code, currently open for public comment until June 2025, along with existing carbon emission reduction targets, directly influences expressway development and ongoing operations.

Compliance with these stringent regulations, covering emissions, land use, and waste management, is paramount. While these requirements may elevate project expenses, they also serve as a catalyst for adopting more sustainable construction and operational methodologies, aligning with national environmental goals.

Land Acquisition and Resettlement Policies

China Merchants Expressway Network & Technology Holdings, like any major infrastructure developer, navigates a landscape where land acquisition is a cornerstone of expansion. This process is heavily regulated, with national and provincial laws dictating procedures for acquiring land for public use, including toll roads. Compensation for acquired land and the resettlement of affected populations are governed by specific policies designed to ensure fairness, though their implementation can be complex and vary by region.

The company must meticulously adhere to these legal frameworks to avoid project delays and potential litigation. For instance, in 2023, China's Ministry of Natural Resources continued to emphasize stricter enforcement of land use regulations for infrastructure projects, aiming to balance development needs with environmental protection and social equity. Failure to comply with resettlement policies, which often include provisions for housing, livelihoods, and community infrastructure, can lead to significant public opposition and legal challenges, impacting project budgets and timelines.

Key considerations for China Merchants Expressway include:

- Compliance with Land Use Laws: Ensuring all land acquisition activities align with China's Land Administration Law and related regulations.

- Fair Compensation and Resettlement: Developing and implementing transparent compensation packages and resettlement plans that meet legal requirements and community expectations.

- Community Engagement: Proactively engaging with local communities to address concerns and build consensus during the land acquisition process.

- Risk Mitigation: Establishing robust internal processes to identify and manage legal risks associated with land acquisition and resettlement.

Road Safety and Vehicle Standards

China Merchants Expressway operates within a framework of evolving road safety and vehicle standards. Regulations governing everything from highway design and barrier specifications to speed limits and vehicle maintenance directly impact operational costs and infrastructure development. For instance, the Ministry of Transport continually updates technical standards for highway construction and safety features, requiring ongoing investment to ensure compliance.

Ensuring infrastructure meets these stringent safety standards is paramount to minimizing accidents and fulfilling legal obligations. This includes adhering to national road safety laws and implementing necessary upgrades. In 2024, China's focus on intelligent transportation systems is driving new regulations for connected and autonomous vehicle infrastructure, which China Merchants Expressway will need to consider for future network integration.

The company's commitment to safety is reflected in its operational practices and capital expenditure. Adherence to these legal factors is not just about compliance but also about maintaining public trust and operational efficiency.

- Stricter enforcement of traffic laws: Increased penalties for speeding and drunk driving incidents directly affect traffic flow and toll revenue.

- Mandatory safety upgrades: Compliance with new national standards for guardrails, lighting, and signage requires significant capital investment.

- Vehicle emission standards: Evolving environmental regulations for vehicles may indirectly influence traffic patterns and the types of vehicles using expressways.

- Data security and privacy laws: Regulations concerning the collection and use of traffic data necessitate robust cybersecurity measures.

China Merchants Expressway operates under a comprehensive legal framework, including the National Comprehensive Three-dimensional Transportation Network Planning Outline and the 14th Five-Year Plan, which guide infrastructure development and operational standards. Specific laws governing toll collection, concession durations, and maintenance directly impact revenue potential and asset value.

The company must also navigate evolving environmental regulations, such as the forthcoming Ecological and Environmental Code (comment period until June 2025), and adhere to strict land acquisition and resettlement laws, which require fair compensation and community engagement to avoid delays and litigation. In 2023, stricter enforcement of land use regulations was a key focus for the Ministry of Natural Resources.

Road safety and vehicle standards are also critical legal factors, with ongoing updates from the Ministry of Transport requiring continuous investment in infrastructure upgrades and compliance with new national safety features. The increasing focus on intelligent transportation systems in 2024 necessitates consideration of regulations for connected and autonomous vehicles.

Environmental factors

China's ambitious climate goals, aiming for peak carbon emissions by 2030 and carbon neutrality by 2060, significantly impact infrastructure sectors like expressways. The transportation industry is a focal point for these reductions, with a specific target to lower carbon intensity by 5% by 2025 compared to 2020 levels.

This environmental imperative directly influences China Merchants Expressway's operational strategies. The company must increasingly adopt greener construction techniques, invest in energy-efficient technologies for its facilities, and potentially facilitate the growth of new energy vehicles across its network to align with national sustainability objectives.

China's commitment to improving air quality, evident in its increasingly strict standards, directly influences the transportation sector. For China Merchants Expressway, this translates to potential shifts in traffic composition as policies may encourage the adoption of electric vehicles and cleaner fuels, impacting revenue streams from traditional fuel sales at service areas. For instance, China's "Blue Sky Protection Campaign" has been a continuous effort, with targets set to reduce PM2.5 concentrations in key regions.

Adherence to these evolving emission standards is not merely a compliance issue but a core element of corporate social responsibility. The company's operational footprint, from vehicle emissions on its expressways to emissions from its service facilities, must align with national environmental goals. As of late 2024, China continues to push for stricter emission controls on heavy-duty vehicles, a segment that heavily utilizes expressway networks.

China Merchants Expressway's development projects must navigate the critical issue of land use and biodiversity conservation. Expressway construction inherently leads to land fragmentation and can result in habitat loss for various species, impacting local ecosystems.

The company must adhere to stringent environmental regulations, such as China's Ecological Protection Law for the Qinghai-Tibet Plateau, enacted in September 2023. These laws mandate thorough environmental impact assessments and the implementation of mitigation strategies to minimize ecological disruption, directly influencing project planning, timelines, and overall development costs.

Water Resource Management and Pollution Control

The construction and ongoing operation of China Merchants Expressway's network present environmental considerations, particularly concerning water resources. Runoff from extensive paved surfaces can carry pollutants into local water bodies, impacting water quality. Furthermore, waste generated during construction and maintenance activities requires careful management to prevent contamination.

China Merchants Expressway must navigate a complex regulatory landscape for water pollution control. Adherence to national and provincial environmental protection laws is paramount. This includes implementing robust stormwater management systems, such as permeable pavements and retention ponds, to filter runoff before it reaches rivers or lakes. Effective wastewater treatment is also crucial for any operational facilities.

In 2024, China's Ministry of Ecology and Environment continued to emphasize stringent water pollution controls. For instance, the Yangtze River Economic Belt, a critical waterway for many of China's economic activities, saw intensified enforcement of regulations targeting industrial and urban wastewater discharge. Companies like China Merchants Expressway are increasingly held accountable for their environmental footprint, with penalties for non-compliance becoming more significant. Best practices in water resource management are not just a regulatory requirement but a strategic imperative for long-term operational sustainability and corporate reputation.

Key aspects of water resource management for China Merchants Expressway include:

- Stormwater Management: Implementing green infrastructure solutions to capture and treat runoff.

- Wastewater Treatment: Ensuring all operational wastewater meets discharge standards.

- Erosion Control: Employing measures during construction to prevent sediment from entering waterways.

- Monitoring and Reporting: Regularly assessing water quality impacts and reporting to regulatory bodies.

Resilience to Extreme Weather Events

China Merchants Expressway Network & Technology Holdings faces increasing risks from climate change, with a projected rise in the frequency and intensity of extreme weather events like heavy rainfall and heatwaves. These events can directly impact its extensive expressway infrastructure, potentially causing damage and operational disruptions. For instance, in 2024, China experienced significant flooding in several regions, impacting transportation networks.

To mitigate these environmental threats, the company must prioritize investments in climate-resilient design and robust maintenance strategies. This proactive approach is crucial for ensuring the long-term safety and reliability of its expressway assets.

- Infrastructure Vulnerability: Extreme weather can lead to road damage, landslides, and closures, directly affecting revenue streams.

- Increased Maintenance Costs: Repairing weather-related damage will likely increase operational expenses.

- Investment in Resilience: The company needs to allocate capital for upgrading infrastructure to withstand climate impacts, such as enhanced drainage systems and reinforced structures.

- Operational Continuity: Ensuring uninterrupted service during adverse weather is vital for maintaining customer trust and operational efficiency.

China's commitment to environmental protection, including its ambitious carbon reduction targets for 2030 and 2060, directly shapes the operational landscape for China Merchants Expressway. The transportation sector is a key focus, with a goal to lower carbon intensity by 5% by 2025 compared to 2020 levels, necessitating greener construction and energy-efficient technologies.

Stricter air quality standards, like those from the Blue Sky Protection Campaign, influence traffic composition, potentially favoring electric vehicles and impacting service area revenues. Furthermore, the company must manage water resource impacts, adhering to regulations for stormwater management and wastewater treatment, with intensified enforcement seen in 2024 along major waterways like the Yangtze River.

Climate change also presents tangible risks, as extreme weather events in 2024, such as regional flooding, demonstrated the vulnerability of infrastructure. China Merchants Expressway must invest in climate-resilient designs and robust maintenance to mitigate potential damage and operational disruptions, ensuring long-term asset reliability.

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Merchants Expressway Network & Technology Holdings is informed by a comprehensive review of official Chinese government reports, economic data from international bodies like the IMF and World Bank, and industry-specific publications. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.