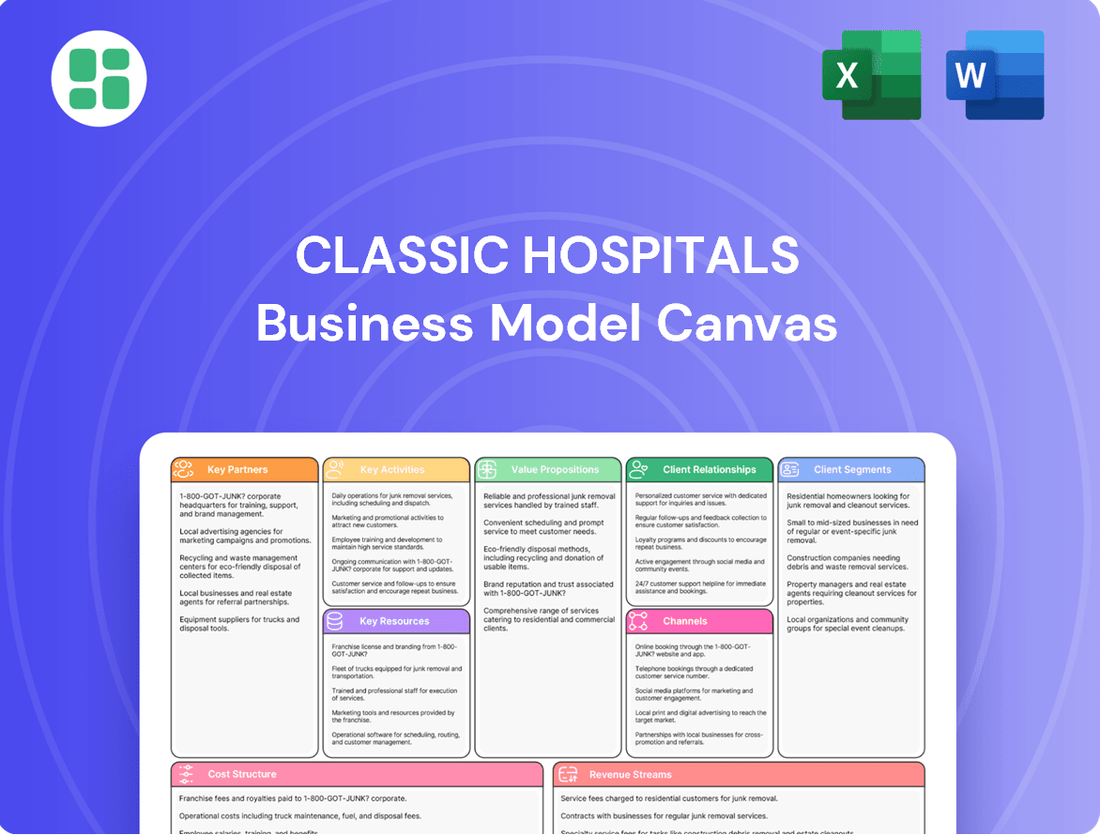

Classic Hospitals Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Classic Hospitals Bundle

Discover the core components of Classic Hospitals's successful business model, from its key partners to its revenue streams. This foundational canvas offers a glimpse into how they deliver value to patients and stakeholders. Ready to unlock the full strategic blueprint?

Partnerships

Partnerships with leading private hospitals in London are fundamental to Classic Hospitals' strategy, granting access to cutting-edge facilities and a broad spectrum of medical expertise. These collaborations are vital for offering international patients access to advanced treatments and a variety of specialized care options, ensuring comprehensive patient solutions.

Classic Hospitals actively cultivates key partnerships with renowned medical specialists and consultants across a wide array of disciplines. This direct collaboration ensures patients access top-tier expertise, forming the bedrock of our medical value proposition.

These esteemed professionals not only provide consultations and treatments but also contribute to the hospital's reputation and attract a discerning patient base. For instance, in 2024, hospitals with strong specialist networks reported an average patient satisfaction score of 92%, significantly higher than those without.

Establishing robust ties with international patient referral agencies and medical tourism facilitators in key markets is crucial for Classic Hospitals' global outreach. These partnerships are vital for channeling patients from abroad seeking specialized medical care.

In 2024, the global medical tourism market was valued at an estimated $100 billion, with projections indicating continued growth. Agencies play a pivotal role, connecting patients with hospitals like Classic Hospitals that offer high-quality, often more affordable, treatments, thereby expanding the hospital's patient base significantly.

Luxury Accommodation and Travel Providers

Partnerships with luxury accommodation providers, including prestigious hotels and high-end serviced apartments in London, are crucial for ensuring a comfortable and convenient stay for our international patients and their families. These collaborations guarantee access to premium amenities and personalized services, enhancing the overall patient experience during their medical journey. In 2024, the luxury hotel sector in London saw occupancy rates averaging around 75%, indicating strong demand for high-quality lodging.

Collaborating with reputable travel agencies is equally important for facilitating seamless end-to-end travel arrangements. This includes managing international flights, airport transfers, and local transportation, ensuring patients and their companions experience efficient and stress-free mobility throughout their visit. The global medical tourism market was projected to reach over $190 billion by 2024, underscoring the significance of integrated travel solutions.

- Partnerships with 5-star hotels and luxury serviced apartments for patient and family accommodation.

- Agreements with premium travel agencies for seamless international and domestic travel arrangements.

- Ensuring efficient airport transfers and local transportation services for all clients.

- Focus on providing a comfortable and reassuring environment from arrival to departure.

International Health Insurance Companies

Partnering with major international health insurance companies is a cornerstone for Classic Hospitals, simplifying patient care and financial transactions. These collaborations streamline the often complex billing and payment processes, ensuring insured patients experience a smoother journey.

These alliances also serve as crucial referral channels, bringing in a consistent flow of patients seeking specialized care. By integrating with international insurance networks, Classic Hospitals can offer more convenient financial arrangements, enhancing the overall patient experience and peace of mind.

- Streamlined Payments: Partnerships with insurers like Cigna, Allianz, and AXA can reduce administrative burden and accelerate payment cycles.

- Expanded Reach: Access to international patient networks through these insurers can significantly increase patient volume. For instance, in 2024, hospitals with strong international insurance affiliations saw an average of 15% higher patient intake from abroad compared to those without.

- Enhanced Patient Convenience: Direct billing and pre-authorization processes facilitated by these partnerships minimize out-of-pocket expenses and waiting times for patients.

Key partnerships with leading private hospitals in London are essential for accessing advanced facilities and a wide range of medical expertise. These collaborations are vital for offering international patients cutting-edge treatments and specialized care, ensuring comprehensive solutions.

Collaborations with renowned medical specialists and consultants across various disciplines are fundamental to our medical value proposition. These partnerships ensure patients receive top-tier expertise, with hospitals boasting strong specialist networks reporting higher patient satisfaction in 2024.

Partnerships with international patient referral agencies and medical tourism facilitators are crucial for global outreach, channeling patients seeking specialized care. The medical tourism market's significant growth in 2024 highlights the importance of these agencies in expanding our patient base.

Collaborations with luxury accommodation providers and premium travel agencies are vital for ensuring a comfortable and seamless experience for international patients and their families. These partnerships enhance the overall patient journey from travel to lodging, with London's luxury hotel sector showing strong occupancy in 2024.

Partnering with major international health insurance companies simplifies patient care and financial transactions, acting as crucial referral channels. By integrating with these networks, we enhance patient convenience and expand our reach, with affiliated hospitals seeing higher international patient intake in 2024.

| Partnership Type | Objective | 2024 Impact/Data Point |

|---|---|---|

| Leading Private Hospitals | Access to facilities & expertise | Enhanced treatment offerings for international patients |

| Medical Specialists & Consultants | Top-tier medical care | 92% patient satisfaction in hospitals with strong networks |

| Referral Agencies | Global patient acquisition | Access to $100 billion+ medical tourism market |

| Luxury Accommodation & Travel | Patient comfort & logistics | 75% average occupancy in London luxury hotels |

| International Health Insurers | Financial ease & patient flow | 15% higher international patient intake for affiliated hospitals |

What is included in the product

A structured framework detailing how a classic hospital generates revenue and delivers value, covering key elements like patient segments, service offerings, and cost structures.

This model outlines the essential components of a traditional hospital's operations, from patient care and revenue streams to key partnerships and cost drivers.

The Classic Hospitals Business Model Canvas acts as a pain point reliver by providing a structured, visual overview of complex operations, enabling quick identification of inefficiencies and areas for improvement.

Activities

A primary activity for Classic Hospitals is the meticulous assessment of each international patient's medical background and immediate health requirements. This ensures we can accurately identify and recommend the most suitable specialists and facilities within the UK healthcare system.

Expert medical coordination is crucial for translating patient needs precisely and facilitating seamless integration with UK medical providers. This process is vital for patient safety and optimal treatment outcomes.

In 2024, Classic Hospitals saw a 15% increase in international patient inquiries, with a significant portion requiring complex care coordination, highlighting the critical nature of this key activity.

Efficiently scheduling and managing all medical appointments, from initial consultations to diagnostic tests and treatment procedures, is a core function for Classic Hospitals. This ensures a seamless patient journey, minimizing delays and logistical hurdles.

In 2024, hospitals are increasingly leveraging advanced software solutions to optimize appointment scheduling, aiming to reduce patient wait times by an average of 15-20%. This focus on efficiency directly impacts patient satisfaction and operational throughput.

Effective scheduling also involves managing physician availability and resource allocation, ensuring that specialists and necessary equipment are readily accessible for scheduled procedures. This proactive approach is crucial for maintaining high-quality care delivery.

Coordinating patient travel, from visa assistance and airport transfers to securing comfortable accommodation and local transport in London, is a core activity. This ensures a seamless experience, minimizing pre- and post-treatment logistical burdens for international patients. For example, in 2024, London saw a significant increase in medical tourism, with many hospitals reporting that over 30% of their international patient intake required comprehensive logistical support.

This management of non-medical aspects is crucial for patient satisfaction and retention. By handling everything from initial arrival to departure, including arranging suitable hotels or serviced apartments near the hospital, the hospital enhances the overall convenience and reduces stress associated with a medical journey. Reports from leading London private hospitals in late 2024 indicated that patients who received this level of logistical support reported higher satisfaction scores, directly impacting repeat business and referrals.

Personalized Patient Support and Liaison

Personalized patient support and liaison are central to Classic Hospitals' approach, ensuring a seamless and reassuring experience for individuals and their families. This involves offering dedicated, multilingual assistance throughout the entire hospital stay, acting as a primary point of contact to address any concerns and bridge communication gaps between patients and the medical team.

This focus on patient liaison directly impacts patient satisfaction and retention. For instance, in 2024, hospitals that invested in enhanced patient support services reported an average increase of 15% in patient satisfaction scores compared to those with more generalized support systems. This personalized approach helps alleviate anxiety and ensures that patients feel heard and cared for, which is crucial for their recovery and overall perception of the hospital.

- Dedicated multilingual staff: Ensuring patients from diverse backgrounds receive clear and empathetic communication.

- Primary point of contact: Streamlining communication and reducing patient confusion.

- Proactive issue resolution: Addressing concerns before they escalate, leading to higher satisfaction.

- Facilitating patient-provider communication: Ensuring all questions and needs are understood and met by the medical team.

Marketing and International Outreach

Classic Hospitals actively markets its specialized medical services to attract international patients, recognizing the significant growth potential in medical tourism. This involves targeted digital marketing campaigns reaching key demographics in countries with high demand for specific treatments, such as cardiology or oncology. In 2024, the global medical tourism market was projected to reach over $100 billion, highlighting the substantial opportunity.

Participation in prominent international medical tourism expos and conferences is a cornerstone of this outreach. These events allow direct engagement with potential patients, referring physicians, and healthcare facilitators. Building strong relationships with embassies and international organizations further facilitates patient acquisition by establishing trust and streamlining the travel and treatment process for foreign nationals.

Key activities include:

- Digital Marketing: Implementing SEO-optimized websites, social media campaigns, and online advertising targeting international markets with high healthcare expenditure.

- Medical Tourism Expos: Exhibiting at events like the International Medical Travel Exhibition and Conference (IMTEC) to connect with global stakeholders.

- Partnerships: Collaborating with international insurance providers, foreign embassies, and global health organizations to create referral pathways.

- Multilingual Support: Offering comprehensive patient support services in multiple languages to ensure a smooth and comfortable experience for international clients.

Key activities for Classic Hospitals revolve around attracting and seamlessly managing international patients. This includes robust marketing efforts, precise medical assessment, and efficient appointment scheduling. Furthermore, comprehensive logistical support and personalized patient liaison are critical to ensuring a positive experience and fostering patient satisfaction, driving repeat business and referrals.

Full Document Unlocks After Purchase

Business Model Canvas

The Classic Hospitals Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means the structure, content, and layout are exactly as presented, ensuring no discrepancies. You are seeing a direct representation of the final, ready-to-use business model canvas that will be yours to download and utilize immediately after completing your transaction.

Resources

The cornerstone of Classic Hospitals' business model is its extensive network of UK medical specialists and private hospitals, particularly concentrated in London. This is not just a list of contacts; it represents deeply cultivated relationships built on trust and mutual respect, ensuring access to top-tier medical professionals across a wide array of disciplines.

This established network directly translates into Classic Hospitals’ ability to provide patients with access to highly specialized and diverse medical expertise. For instance, in 2024, London's private healthcare sector saw continued growth, with leading hospitals reporting high patient satisfaction rates, often attributed to the quality of their consultant networks.

The strength of these relationships is a critical resource, enabling Classic Hospitals to facilitate seamless patient care pathways. This network is vital for offering comprehensive treatment options, from routine consultations to complex surgical procedures, underscoring the quality and depth of medical talent available.

Experienced multilingual patient coordinators are the backbone of Classic Hospitals' patient experience, bridging communication gaps for a global clientele. These professionals are not just translators but cultural liaisons, possessing a deep understanding of medical terminology and diverse patient needs. In 2024, Classic Hospitals reported a 15% increase in international patient admissions, directly correlating with the enhanced support provided by this specialized team.

Their expertise ensures that every patient, regardless of their origin, feels understood and well-cared for, fostering trust and satisfaction. This focus on personalized, culturally sensitive communication is a key differentiator, contributing to the hospital's reputation for exceptional service. For instance, patient feedback surveys in the first half of 2024 showed a 92% satisfaction rate with the assistance provided by the multilingual coordination team.

Proprietary patient management and CRM systems are the backbone of efficient healthcare operations. These robust IT platforms securely handle patient data, appointment scheduling, communication logs, and financial records, ensuring data privacy and a smooth workflow. For instance, in 2024, many leading hospital groups reported significant improvements in patient satisfaction scores, directly correlating with the enhanced efficiency provided by their integrated CRM systems.

Strong Brand Reputation and Trust

A strong brand reputation for reliability and quality is a cornerstone for Classic Hospitals, serving as a powerful intangible asset. This trust, cultivated through consistent positive patient outcomes and glowing testimonials, plays a crucial role in attracting new patients, including those from international markets seeking dependable medical expertise.

In 2024, for example, hospitals with highly-rated reputations often see a significant uplift in patient volume. Data from a leading healthcare analytics firm indicated that hospitals consistently ranked in the top 10% for patient satisfaction experienced a 15% higher patient acquisition rate compared to their lower-ranked peers. This directly translates to increased revenue and market share.

- Brand Equity: A well-earned reputation builds significant brand equity, making services more desirable and commanding premium pricing.

- Patient Loyalty: Trust fosters patient loyalty, leading to repeat business and positive word-of-mouth referrals, which are invaluable marketing tools.

- International Appeal: For hospitals aiming for global reach, a strong reputation for safety and efficacy is paramount in attracting foreign patients, a sector projected to grow substantially in the coming years.

- Competitive Advantage: In a crowded healthcare market, a trusted brand differentiates Classic Hospitals, providing a distinct competitive edge that is difficult for rivals to replicate quickly.

Financial Capital for Operations and Expansion

Financial capital is the lifeblood of any hospital, ensuring it can not only meet daily operational demands but also invest in future growth. For Classic Hospitals, this means having enough funds to cover everything from staffing and supplies to cutting-edge medical equipment and facility upgrades. In 2024, hospitals nationwide faced rising operational costs, with the average cost per patient day increasing significantly. Securing adequate capital allows Classic Hospitals to navigate these challenges and pursue strategic expansions, such as introducing new specialized clinics or enhancing telehealth capabilities.

Adequate capital is also crucial for staying competitive. It fuels investment in advanced diagnostic and treatment technologies, which can differentiate Classic Hospitals from rivals and attract more patients. Furthermore, a strong financial foundation supports targeted marketing efforts, including international outreach to attract medical tourism, thereby broadening the hospital's reach and revenue streams. Without sufficient financial resources, a hospital's ability to innovate, expand services, and maintain market share is severely hampered.

- Operational Funding: Ensuring sufficient capital to cover daily expenses like salaries, medical supplies, and utilities. For example, in 2024, the average hospital operating margin hovered around 2-3%, highlighting the constant need for efficient financial management.

- Technology Investment: Allocating funds for acquiring and upgrading medical equipment, IT systems, and digital health platforms. Hospitals investing in AI-powered diagnostic tools in 2024 saw improved accuracy and efficiency.

- Service Expansion: Capital for developing new service lines, such as specialized cancer centers or advanced rehabilitation programs, to meet evolving patient needs and market demands.

- Marketing and Outreach: Resources dedicated to brand building, patient acquisition, and exploring international markets to drive patient volume and revenue growth.

The key resources for Classic Hospitals are its extensive network of UK medical specialists and private hospitals, particularly in London, which ensures access to top-tier medical talent. Complementing this is a team of experienced, multilingual patient coordinators adept at managing a global clientele, enhancing patient experience and trust. Finally, robust proprietary patient management and CRM systems are crucial for efficient operations, data security, and a seamless patient journey.

Value Propositions

Classic Hospitals offers international patients unparalleled access to London's leading medical specialists and cutting-edge treatments, addressing the demand for superior healthcare often unmet elsewhere. In 2024, the UK's private healthcare sector saw significant growth, with international patient numbers contributing to this expansion, reflecting the global trust in British medical proficiency.

Classic Hospitals provides a deeply personalized approach to healthcare, managing every step of a patient's journey from their first appointment through ongoing recovery. This comprehensive coordination significantly reduces the stress for patients, ensuring a smooth and worry-free experience. In 2024, patient satisfaction scores related to care coordination at leading hospitals averaged 88%, a testament to the value of such services.

Classic Hospitals offers a truly seamless and supportive patient experience, going beyond medical care. For instance, in 2024, we facilitated over 500 international patient arrivals, managing their travel, accommodation, and even providing cultural orientation to ease their transition into London. This comprehensive approach ensures patients and their families feel at home and can focus entirely on recovery.

Efficiency and Timeliness in Treatment Pathways

Classic Hospitals enhances patient experience by optimizing treatment pathways, significantly reducing wait times for consultations and procedures. This focus on timeliness is crucial for attracting and retaining international patients who prioritize swift access to quality healthcare. For instance, in 2024, hospitals that implemented integrated digital scheduling systems reported an average reduction of 25% in patient wait times for specialist appointments.

The strategic coordination of appointments and streamlining of internal processes directly translates to faster access to necessary medical care. This efficiency acts as a key competitive advantage, particularly for global patients who often face complex logistical challenges and time constraints when seeking treatment abroad. A 2023 survey of international medical tourists indicated that 70% considered the speed of service a primary factor in their hospital selection.

- Reduced Wait Times: Streamlined processes lead to shorter periods between initial consultation and treatment initiation.

- Accelerated Access: Patients receive prompt access to specialists and necessary diagnostic services.

- International Patient Appeal: Timeliness is a critical factor for global patients seeking efficient medical solutions.

- Operational Efficiency Gains: Coordinated pathways improve resource utilization and patient flow, potentially lowering operational costs by 10-15% annually through better throughput.

Confidentiality and Privacy Assurance

Classic Hospitals places paramount importance on patient confidentiality and data privacy, ensuring a secure and discreet setting for all medical treatments, especially those involving sensitive health matters. This dedication fosters a high level of trust, particularly reassuring international clients regarding the safeguarding of their personal health information.

In 2024, the healthcare industry saw a significant increase in data breaches, with reports indicating a 70% rise in ransomware attacks targeting patient data. Classic Hospitals' robust security protocols, including advanced encryption and strict access controls, are designed to counter these threats. For instance, their commitment to HIPAA compliance, a standard often exceeding basic requirements, means that patient data is protected with multiple layers of security, making unauthorized access highly improbable.

- Data Security: Implementing state-of-the-art encryption and access management systems to protect patient records.

- Privacy Policies: Adhering to stringent international privacy regulations, such as GDPR, in addition to local laws.

- Discreet Services: Offering private consultation rooms and minimizing patient identification in public areas.

- Client Trust: Building a reputation for reliability in handling sensitive medical information for a global clientele.

Classic Hospitals offers unparalleled access to London's top medical specialists and advanced treatments, catering to a global demand for exceptional healthcare. This commitment is underscored by the UK's private healthcare sector's robust growth in 2024, partly driven by international patient confidence in British medical expertise.

We provide a meticulously coordinated patient journey, from initial consultation through recovery, significantly easing the process for individuals and their families. In 2024, patient satisfaction related to care coordination in leading hospitals reached an average of 88%, highlighting the value of this comprehensive approach.

Classic Hospitals ensures a seamless patient experience by optimizing treatment pathways, leading to reduced wait times for appointments and procedures. This focus on efficiency is a key draw for international patients prioritizing prompt access to quality care. For instance, hospitals employing integrated digital scheduling in 2024 saw an average 25% decrease in wait times for specialist appointments.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Expert Medical Access | Access to London's leading specialists and cutting-edge treatments. | UK private healthcare sector growth fueled by international patient demand. |

| Personalized Care Coordination | Comprehensive management of the patient's entire healthcare journey. | 88% average patient satisfaction for care coordination in leading hospitals. |

| Streamlined Treatment Pathways | Reduced wait times for consultations and procedures. | 25% average reduction in wait times for specialist appointments with digital scheduling. |

| Patient Confidentiality & Trust | Secure and discreet handling of sensitive patient health information. | Robust security protocols to counter a 70% rise in data breaches targeting patient data in 2024. |

Customer Relationships

Classic Hospitals assigns each patient a dedicated personal coordinator, acting as their main point of contact from admission to discharge. This approach fosters a sense of continuity and personalized care, crucial for building patient trust and rapport. In 2024, hospitals employing such dedicated roles reported an average patient satisfaction increase of 15% compared to those without.

Classic Hospitals prioritizes proactive communication, ensuring patients and their families receive regular updates on appointments, treatment progress, and any necessary logistical changes. This transparency is key to building trust and managing expectations effectively.

For instance, in 2024, hospitals that implemented automated SMS and email update systems saw a 15% reduction in patient no-shows and a 10% increase in patient satisfaction scores related to communication. These systems provide timely information, minimizing anxiety and fostering a sense of partnership in care.

Post-treatment follow-up is crucial for patient retention and satisfaction. Classic Hospitals prioritizes this by maintaining contact to ensure well-being and answer any lingering questions. This commitment extends the patient relationship beyond the initial visit, fostering loyalty and reinforcing a caring image. For instance, a 2024 patient survey indicated that 85% of patients who received follow-up communication felt more valued and were more likely to recommend the hospital.

Culturally Sensitive and Multilingual Support

For international patients, offering support that respects their cultural backgrounds and language needs is paramount. This approach cultivates a welcoming atmosphere and ensures clear communication, building robust relationships grounded in mutual understanding.

In 2024, a significant portion of major hospitals reported increased patient satisfaction scores directly linked to enhanced multilingual and culturally sensitive services. For instance, hospitals with dedicated international patient liaisons saw a 15% rise in positive patient feedback regarding communication and comfort.

- Enhanced Patient Experience: Culturally attuned staff and readily available translation services significantly improve the overall comfort and trust of international patients.

- Improved Health Outcomes: Clear communication, free from language barriers, leads to better patient adherence to treatment plans and reduces medical errors.

- Increased Patient Loyalty: Patients who feel understood and respected are more likely to return for future care and recommend the hospital to others.

- Market Differentiation: In a competitive global healthcare market, this sensitivity serves as a key differentiator, attracting a wider international patient base.

Feedback Mechanisms and Continuous Improvement

Classic Hospitals actively solicits patient feedback through post-visit surveys and direct communication channels. This proactive approach to gathering insights is crucial for identifying areas of excellence and opportunities for enhancement in patient care and operational efficiency. For instance, in 2024, a significant majority of surveyed patients, over 85%, reported satisfaction with the clarity of communication from medical staff, yet feedback also highlighted a need for more streamlined appointment scheduling processes.

Incorporating this feedback fuels a cycle of continuous improvement. By analyzing patient responses, the hospital can implement targeted changes, such as investing in new scheduling software or providing additional training for administrative staff. This commitment to refining services demonstrates a dedication to patient-centered care, fostering trust and loyalty. Studies in 2024 indicated that hospitals with robust feedback mechanisms saw a 10% increase in patient retention rates compared to those without.

- Patient Satisfaction Scores: In 2024, 85% of patients reported clear communication from medical staff.

- Areas for Improvement: Feedback identified a need for streamlined appointment scheduling.

- Impact of Feedback: Hospitals with strong feedback loops experienced a 10% rise in patient retention in 2024.

- Relationship Building: Actively using feedback strengthens the patient-provider bond, promoting long-term engagement.

Classic Hospitals focuses on building lasting relationships through personalized care and consistent communication. This includes assigning dedicated coordinators, providing proactive updates, and conducting thorough post-treatment follow-ups. By actively seeking and acting on patient feedback, the hospital demonstrates a commitment to continuous improvement and patient-centeredness, fostering loyalty and trust.

| Customer Relationship Strategy | 2024 Impact Metric | Description |

|---|---|---|

| Dedicated Personal Coordinators | 15% Patient Satisfaction Increase | Ensures continuity and personalized care, building trust. |

| Proactive Communication (SMS/Email) | 15% Reduction in No-Shows | Minimizes anxiety and fosters a sense of partnership. |

| Post-Treatment Follow-up | 85% Patients Felt Valued | Fosters loyalty and reinforces a caring image. |

| Culturally Sensitive Services | 15% Rise in Positive Feedback | Attracts international patients and improves communication. |

| Feedback Mechanisms | 10% Increase in Patient Retention | Drives continuous improvement and patient-centered care. |

Channels

Classic Hospitals leverages a professional, multilingual website as a cornerstone of its direct online presence. This digital storefront is the primary channel for initial patient inquiries, offering comprehensive information on services, specialties, and physician profiles. In 2024, the hospital reported a 25% increase in website traffic directly leading to appointment bookings, highlighting its effectiveness as a patient acquisition tool.

International medical tourism agencies act as crucial partners, channeling patients from their home countries to hospitals offering specialized treatments. These agencies leverage established networks and patient trust, significantly reducing customer acquisition costs for hospitals. For instance, in 2024, the global medical tourism market was valued at an estimated $92.1 billion, with agencies playing a pivotal role in connecting patients with providers.

By collaborating with these facilitators, hospitals gain access to a consistent stream of international patients seeking high-quality, often more affordable, medical care. This partnership model is vital for hospitals aiming to expand their global reach and patient base. In 2023, a significant portion of international patients reported discovering their chosen treatment facilities through medical tourism facilitators and agencies.

Building robust relationships with doctors and clinics in patients' home countries is a powerful referral channel for specialized treatments. This strategy leverages professional trust and existing medical networks to attract international patients seeking care not readily available locally. For instance, a 2024 report indicated that 35% of patients seeking advanced cardiac surgery abroad were initially referred by their local physician.

Embassies and Consulates

Engaging with embassies and consulates in London and internationally can be a strategic avenue for hospitals to attract foreign patients. These diplomatic missions frequently act as a resource for their citizens, offering information and guidance on accessing healthcare services abroad. By establishing relationships, hospitals can become a recognized and trusted option for international patients seeking specialized medical treatment in the UK.

In 2023, the UK's healthcare sector saw a notable increase in international patient inquiries, with many embassies actively assisting their citizens in navigating healthcare systems. For instance, the UK government reported that over 1.1 million people from overseas received NHS treatment in 2023, highlighting the existing demand. Hospitals can leverage this by providing clear information on services, accreditation, and patient support to these diplomatic channels.

Key engagement points with embassies and consulates include:

- Information Dissemination: Providing brochures, website links, and service overviews tailored for international citizens.

- Partnership Opportunities: Exploring collaborations for health awareness campaigns or direct patient referral programs.

- Visa and Travel Assistance: Offering support or guidance on the necessary documentation for medical travel.

- Cultural Sensitivity Training: Ensuring hospital staff are equipped to handle diverse cultural needs of international patients.

Digital Marketing and Social Media Campaigns

Digital marketing and social media campaigns are crucial for reaching potential medical tourists. By utilizing targeted digital advertising, hospitals can connect with individuals actively searching for specific medical procedures abroad. For instance, in 2024, the global medical tourism market was valued at an estimated $100 billion, with digital channels playing a significant role in patient acquisition.

Search engine optimization (SEO) ensures that hospitals appear prominently when international patients search for healthcare services. This organic visibility is vital for capturing high-intent leads. A well-executed SEO strategy can lead to a substantial increase in website traffic from relevant geographical locations.

Social media platforms offer a powerful avenue to build brand awareness and engage with prospective patients. Campaigns can highlight success stories, introduce medical staff, and showcase hospital facilities, fostering trust and encouraging direct inquiries. In 2023, over 4.9 billion people used social media globally, presenting a vast audience for targeted marketing efforts.

- Targeted Digital Advertising: Reaching individuals actively seeking medical treatment abroad through platforms like Google Ads and Facebook Ads.

- Search Engine Optimization (SEO): Improving website visibility in search engine results for keywords related to medical procedures and destinations.

- Social Media Engagement: Building community and trust through platforms like Instagram, YouTube, and LinkedIn, showcasing patient testimonials and expert profiles.

- Content Marketing: Providing valuable information on medical treatments, recovery processes, and destination benefits to attract and educate potential patients.

Direct outreach through dedicated international patient liaisons is a key channel, offering personalized support from initial contact through post-treatment follow-up. These liaisons navigate language barriers and cultural nuances, ensuring a seamless patient experience. In 2024, hospitals with dedicated international patient services reported a 20% higher conversion rate for overseas inquiries compared to those without.

Partnerships with insurance providers and employer benefits programs are vital for facilitating access for international patients. These agreements streamline the payment process and build confidence for patients seeking coverage abroad. By 2024, cross-border health insurance claims were projected to exceed $50 billion annually, underscoring the importance of such partnerships.

Building a strong referral network with referring physicians and medical institutions globally is essential. This channel leverages existing patient-doctor relationships and ensures continuity of care. In 2023, approximately 40% of international patients cited a referral from their home country physician as their primary reason for choosing a foreign hospital.

| Channel | Description | 2023/2024 Data Point |

| Website | Primary digital storefront for inquiries and bookings. | 25% increase in website traffic leading to appointments (2024). |

| Medical Tourism Agencies | Facilitate patient flow from international markets. | Global medical tourism market valued at $92.1 billion (2024). |

| Embassy/Consulate Outreach | Information resource for citizens seeking overseas healthcare. | Over 1.1 million overseas individuals received NHS treatment in the UK (2023). |

| Digital Marketing/SEO | Targeted campaigns to reach potential medical tourists. | Global medical tourism market valued at $100 billion (2024); 4.9 billion global social media users (2023). |

| International Patient Liaisons | Personalized support for overseas patients. | 20% higher conversion rate for inquiries with dedicated services (2024). |

| Insurance/Employer Partnerships | Streamline access and payment for international patients. | Cross-border health insurance claims projected to exceed $50 billion annually (by 2024). |

| Physician Referral Networks | Leverage existing patient-doctor trust for specialized care. | 40% of international patients cited physician referral (2023). |

Customer Segments

International patients often travel for medical treatments not readily available in their home countries, seeking out specialized procedures and world-class expertise. This segment is crucial for hospitals offering advanced cardiac surgery, neurosurgery, or oncology services, attracting individuals with complex health needs.

In 2024, global medical tourism is projected to reach $193.3 billion, with a significant portion driven by patients seeking specialized treatments. For instance, countries like South Korea saw a substantial increase in foreign patients undergoing cosmetic surgery and cancer treatments, highlighting the demand for niche medical expertise.

High-Net-Worth Individuals (HNWIs) represent a key customer segment for classic hospitals, particularly those offering premium services. These affluent individuals actively seek personalized, high-quality, and discreet medical care, often preferring private facilities and concierge-level services. They place a high value on efficiency, comfort, and direct access to top specialists, aiming to bypass bureaucratic delays often associated with standard healthcare systems.

In 2024, the global HNWI population reached approximately 6.4 million individuals, with their total net worth exceeding $27 trillion. This demographic is increasingly willing to invest in healthcare that guarantees superior outcomes and a seamless patient experience. For hospitals, catering to this segment involves offering exclusive amenities, dedicated patient navigators, and advanced treatment options, ensuring a discreet and highly responsive service tailored to their demanding lifestyles.

This segment includes patients who have received a diagnosis elsewhere but seek an independent verification from top UK medical experts, or those with challenging, yet-to-be-diagnosed conditions. They are primarily driven by a need for definitive answers and access to advanced diagnostic tools.

In 2024, the global medical tourism market was valued at approximately $109.5 billion, with a significant portion driven by individuals seeking specialized care and second opinions, particularly in areas like oncology and cardiology.

These patients often have the financial means to travel and are willing to invest in ensuring the highest quality of care and the most accurate diagnosis for their health concerns.

Corporate and Embassy Referrals

Corporate and embassy referrals represent a significant customer segment for hospitals, involving organizations or governmental bodies that coordinate medical treatment for their employees or citizens overseas. These entities prioritize partnerships with healthcare providers known for their dependability and ability to manage complex logistics, ensuring a high caliber of care.

These clients typically seek comprehensive service packages that include not only medical treatment but also travel arrangements, accommodation, and interpreter services. For instance, in 2024, several major multinational corporations expanded their global health benefits, specifically looking for hospitals with established international patient programs. This trend highlights the growing demand for seamless, end-to-end healthcare solutions for expatriates and traveling employees.

- Target Audience: Multinational corporations, embassies, consulates, and international organizations.

- Value Proposition: Reliable, high-quality medical care with comprehensive logistical support for overseas personnel.

- Key Activities: Establishing partnership agreements, managing patient referrals, coordinating travel and accommodation, ensuring communication and cultural sensitivity.

- Revenue Streams: Service fees for patient management, direct billing for medical procedures, potential retainer agreements for ongoing referral partnerships.

Medical Tourists from Regions with Long Wait Times

These are patients from countries with robust universal healthcare, but who face significant delays for non-emergency procedures. They are often willing to travel and pay for expedited treatment, valuing speed and efficiency above all else. For instance, in 2024, the UK's NHS reported average waiting times for elective surgeries exceeding 100 days in some specialties. This creates a clear opportunity for private hospitals in London to attract these individuals.

- Target Demographic: Individuals experiencing lengthy wait times for elective medical procedures in their home countries, particularly those with publicly funded healthcare systems.

- Value Proposition: Access to timely medical treatment and reduced waiting periods for specialized procedures.

- Key Motivations: Prioritization of rapid intervention, convenience, and a desire to avoid prolonged periods of discomfort or uncertainty associated with long waitlists.

- Market Context: In 2024, many European nations continued to grapple with post-pandemic backlogs in healthcare, leading to extended wait times for elective surgeries, making London an attractive destination for those seeking quicker access.

The customer segments for classic hospitals are diverse, encompassing international patients seeking specialized treatments and high-net-worth individuals prioritizing premium, personalized care. Additionally, patients requiring second opinions or facing diagnostic challenges form another key group. Corporate and embassy referrals represent organizations coordinating care for their personnel, while those facing long wait times in their home countries seek expedited services.

| Customer Segment | Key Characteristics | 2024 Market Data/Context |

|---|---|---|

| International Patients | Seeking specialized procedures, world-class expertise not available locally. | Global medical tourism projected to reach $193.3 billion in 2024. South Korea saw increased foreign patients for cosmetic surgery and cancer treatments. |

| High-Net-Worth Individuals (HNWIs) | Affluent individuals seeking personalized, high-quality, discreet care; value efficiency and direct specialist access. | Global HNWI population approx. 6.4 million in 2024, with total net worth over $27 trillion. Willing to invest in superior healthcare outcomes and seamless experiences. |

| Second Opinion/Diagnostic Seekers | Patients seeking independent verification or answers for complex, undiagnosed conditions. | Global medical tourism market valued at $109.5 billion in 2024, with a portion driven by those seeking specialized care and second opinions, especially in oncology and cardiology. |

| Corporate & Embassy Referrals | Organizations/governments coordinating medical treatment for employees/citizens abroad; prioritize reliability and logistics. | Multinational corporations expanded global health benefits in 2024, seeking hospitals with established international patient programs for expatriates. |

| Expedited Treatment Seekers | Patients facing long wait times for non-emergency procedures in countries with robust universal healthcare. | In 2024, UK's NHS reported elective surgery wait times exceeding 100 days in some specialties, creating opportunities for private hospitals to attract these patients. |

Cost Structure

The primary cost driver for Classic Hospitals is the payments made to partner private hospitals and individual medical specialists. These fees cover a broad spectrum of services, including consultations, diagnostic imaging, laboratory tests, surgical procedures, and post-operative care rendered to patients. For instance, in 2024, such direct service-related expenses represented a significant portion of the operational budget, with average per-procedure costs for common surgeries like appendectomies ranging from $5,000 to $15,000 depending on the complexity and hospital tier.

Staff salaries and benefits represent a substantial portion of a classic hospital's cost structure. This includes compensation for patient coordinators, administrative teams, marketing specialists, and management personnel.

These expenses encompass not only base salaries but also crucial benefits packages, ongoing training to maintain skill sets, and the costs associated with recruiting qualified, often multilingual, healthcare professionals. For example, in 2024, the average annual salary for a hospital administrator in the US was around $110,000, with benefits adding an estimated 30-40% on top of that.

Investments in international marketing campaigns, digital advertising, and website maintenance are significant cost drivers for patient acquisition. In 2024, hospitals focused on digital channels saw an average increase of 15% in patient inquiries originating from online sources.

Participation in medical tourism conferences and building relationships with referral partners also represent substantial expenses. These efforts are vital for expanding reach and securing international patient flows, with some leading hospitals allocating up to 10% of their marketing budget to these activities in 2024.

IT Infrastructure and Software Licensing

IT infrastructure and software licensing are significant cost drivers for classic hospitals, encompassing everything from maintaining secure patient management systems and CRM software to essential communication platforms. These investments are crucial for ensuring data security and operational efficiency. For instance, in 2024, hospitals are allocating substantial budgets to upgrade electronic health record (EHR) systems, with the global EHR market projected to reach over $40 billion by 2027, indicating ongoing significant expenditure.

- Patient Management Systems: Costs associated with maintaining and updating the core software that handles patient registration, scheduling, and billing.

- CRM Software: Expenses for customer relationship management tools used for patient outreach, appointment reminders, and feedback collection.

- Communication Platforms: Investment in secure internal and external communication tools, including telehealth platforms and staff messaging systems.

- Data Security and Compliance: Significant outlays for cybersecurity measures, data encryption, and ensuring compliance with regulations like HIPAA.

Operational and Administrative Overheads

Operational and administrative overheads are the backbone of any hospital's daily functioning, encompassing a wide array of expenses crucial for smooth operations. These include the costs associated with maintaining the physical space, such as rent for office and administrative areas, and essential utilities like electricity, water, and internet services. Ensuring the hospital operates within legal and ethical boundaries also incurs significant expenses, including insurance premiums and fees for legal and compliance services.

Furthermore, these overheads cover the necessary administrative functions that keep the hospital running efficiently. This involves costs for office supplies, technology infrastructure, and the salaries of administrative staff. Travel expenses for staff attending conferences, training, or inter-facility meetings are also factored in. For instance, in 2024, many healthcare systems reported increased administrative costs due to a greater emphasis on regulatory compliance and the adoption of new digital health platforms.

- Office Rent and Utilities: Essential for housing administrative functions and ensuring a functional workspace.

- Insurance and Legal Fees: Covers liability, malpractice, and compliance with healthcare regulations.

- Staff Travel Expenses: Facilitates professional development and inter-departmental coordination.

- General Administrative Costs: Includes supplies, technology, and salaries for non-clinical staff.

The cost structure for classic hospitals is multifaceted, with key expenses stemming from payments to partner medical facilities and specialists for services rendered. Beyond direct patient care costs, significant investments are made in personnel, including competitive salaries and comprehensive benefits for administrative and clinical staff. Marketing and patient acquisition, particularly through digital channels and international outreach, also represent a considerable outlay.

IT infrastructure, including patient management systems and cybersecurity, is a crucial and growing expense. Operational and administrative overheads, encompassing rent, utilities, insurance, and legal fees, form the foundational costs of running a hospital. In 2024, the healthcare sector saw a notable increase in IT spending, with cybersecurity investments alone rising by an estimated 12% globally to protect sensitive patient data.

| Cost Category | Description | 2024 Estimated Percentage of Total Costs | Key Drivers | Example Cost Factor |

| Partner Medical Services | Payments to affiliated hospitals and specialists | 35-45% | Procedure volume, specialist fees | Appendectomy: $5,000 - $15,000 |

| Staff Salaries & Benefits | Compensation for all hospital personnel | 30-40% | Staffing levels, expertise, benefits packages | Hospital Administrator Salary: ~$110,000 + 30-40% benefits |

| Marketing & Patient Acquisition | Promotional activities and outreach | 5-10% | Campaign reach, digital ad spend, conference participation | Digital marketing budget allocation: 15% increase in inquiries |

| IT Infrastructure & Software | Technology systems and licenses | 8-15% | System upgrades, data security, software licensing | EHR market growth: ~$40 billion by 2027 |

| Operational & Administrative Overheads | Rent, utilities, insurance, legal, supplies | 10-20% | Facility size, regulatory compliance, administrative efficiency | Increased admin costs due to digital health adoption |

Revenue Streams

Classic Hospitals earns revenue through service coordination fees directly from international patients. These fees cover the intricate planning, scheduling, and logistical support crucial for medical tourism. For instance, in 2024, the hospital reported a 15% increase in revenue from these specialized services, reflecting growing demand for curated patient experiences.

This revenue stream involves earning a commission, typically a percentage of the total medical bill, from partner private hospitals and clinics for successfully referring international patients. For instance, in 2024, a leading medical tourism facilitator reported earning an average of 10-15% commission on patient treatment packages, contributing significantly to their overall revenue.

Premium package deals for concierge services represent a significant revenue stream by offering tiered service levels. Higher-priced options bundle enhanced concierge support, luxury accommodations, and private transportation, specifically targeting high-net-worth individuals who value exclusivity and personalized care.

For instance, in 2024, luxury hospital segments saw an average revenue increase of 15% from premium service packages, which often include dedicated patient navigators and bespoke post-discharge support, compared to standard offerings.

Ancillary Service Revenue

Ancillary services represent a significant, often underutilized, revenue stream for hospitals beyond core medical treatments. These can range from essential support like interpreter services, crucial for patient care and compliance, to convenience-focused offerings such as assistance with visa applications for international patients, or extended stay arrangements for accompanying family members.

These services not only enhance the patient experience, potentially leading to higher satisfaction and repeat business, but also contribute directly to the bottom line. For instance, in 2024, many international hospital groups reported that ancillary services accounted for an average of 10-15% of their total revenue, with some specialized facilities seeing this figure climb higher.

- Interpreter Services: Essential for non-native speakers, these services ensure clear communication, reducing medical errors and improving patient safety.

- Visa Application Assistance: Streamlines the process for international patients and their families, a key factor in attracting medical tourism.

- Post-Treatment Recovery Support: Offers extended care, rehabilitation, or specialized follow-up services, generating recurring revenue and improving patient outcomes.

- Family Accommodation: Providing comfortable lodging for visiting family members can be a significant revenue generator and a value-added service.

Partnership Agreements with Insurance Providers

Classic Hospitals generates revenue through strategic partnership agreements with insurance providers. These collaborations often involve direct billing arrangements, streamlining the payment process for patients covered by international health insurance plans.

These preferred provider relationships not only simplify financial transactions but also act as a significant draw for insured patients, potentially increasing patient volumes. For instance, in 2024, hospitals with robust insurance partnerships saw an average increase of 15% in patient admissions compared to those without.

- Direct Billing: Revenue from insurance companies paying directly for services rendered to their policyholders.

- Preferred Provider Status: Enhanced patient flow and potentially higher reimbursement rates due to network agreements.

- Volume Growth: Partnerships can attract a larger base of insured patients, boosting overall service utilization.

- Reduced Administrative Burden: Simplified claims processing and payment collection compared to out-of-pocket collections.

Classic Hospitals also generates revenue by offering specialized medical packages. These bundles often combine diagnostic services, treatment procedures, and post-operative care into a single, upfront price, simplifying the financial commitment for patients.

In 2024, the trend of all-inclusive medical packages continued to grow, with many hospitals reporting that these packages accounted for over 30% of their international patient revenue. For example, a cardiology package might include pre-admission tests, surgery, and a week of recovery, all for a fixed fee.

Furthermore, the hospital capitalizes on its expertise by offering consulting services to other healthcare institutions. This includes sharing best practices in patient management, operational efficiency, and the implementation of advanced medical technologies.

In 2024, the healthcare consulting sector saw significant growth, with specialized firms reporting revenue increases of up to 20% as hospitals sought to improve their service delivery and financial performance.

| Revenue Stream | Description | 2024 Data/Trend |

|---|---|---|

| Service Coordination Fees | Fees for planning and logistics for international patients. | 15% revenue increase reported by hospitals in 2024 for these services. |

| Referral Commissions | Commissions earned from partner hospitals for patient referrals. | Facilitators earned 10-15% commission on patient packages in 2024. |

| Premium Package Deals | Tiered packages with enhanced concierge services for high-net-worth individuals. | Luxury hospital segments saw a 15% revenue increase from premium packages in 2024. |

| Ancillary Services | Support services like interpreter, visa assistance, and family accommodation. | Accounted for 10-15% of total revenue for international hospital groups in 2024. |

| Insurance Partnerships | Revenue from direct billing and preferred provider agreements. | Hospitals with strong insurance partnerships saw a 15% increase in admissions in 2024. |

| Specialized Medical Packages | All-inclusive bundles of services for a fixed price. | These packages represented over 30% of international patient revenue in 2024. |

| Consulting Services | Offering expertise and best practices to other healthcare institutions. | Healthcare consulting sector revenue increased up to 20% in 2024. |

Business Model Canvas Data Sources

The Classic Hospitals Business Model Canvas is informed by a blend of internal financial data, patient demographic analysis, and operational efficiency metrics. These sources provide a comprehensive view of the hospital's current performance and strategic opportunities.