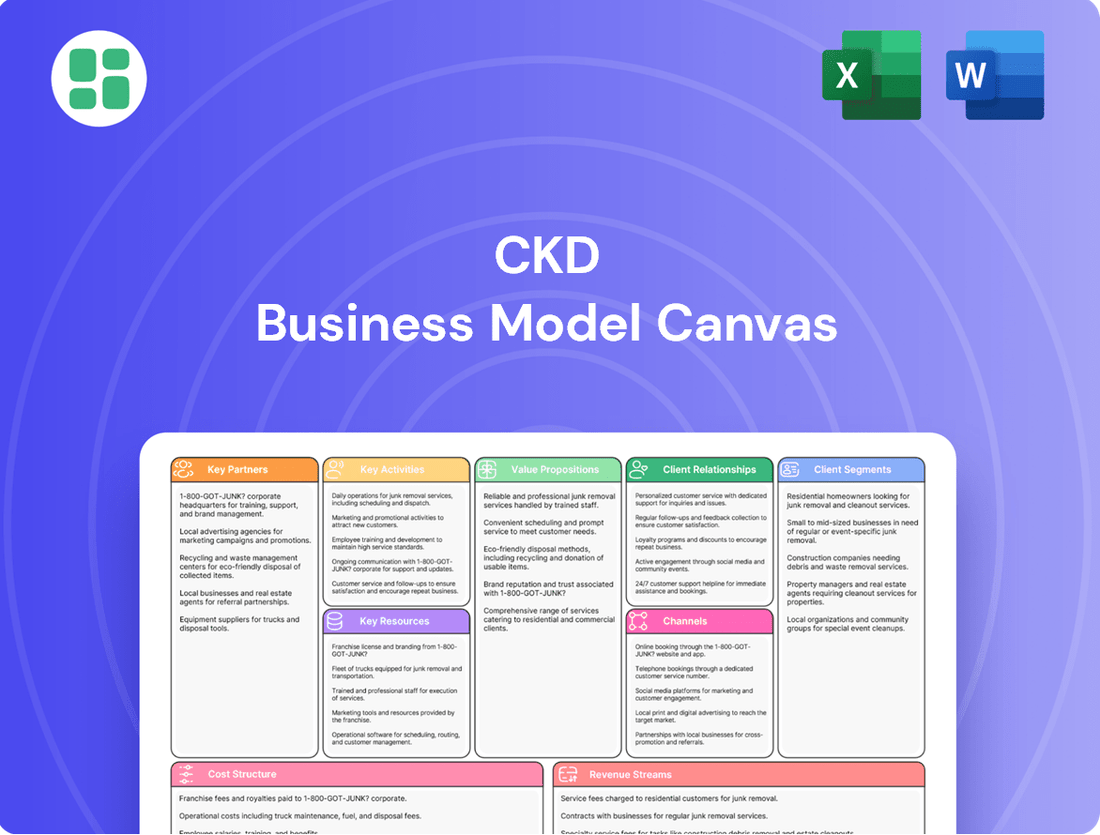

CKD Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CKD Bundle

Unlock the core strategic components of CKD's successful business model. This comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Ready to discover the blueprint for their growth?

Partnerships

CKD Corporation actively collaborates with leading research institutions and innovative technology firms. These partnerships are fundamental to co-developing advanced automation and fluid control technologies, driving product innovation.

In 2024, CKD's commitment to R&D through these collaborations is evident in its significant investment in new product development, aiming to enhance precision and efficiency in industrial and medical applications.

These strategic alliances are vital for CKD to remain at the forefront of technological advancements, ensuring they can offer novel solutions to increasingly complex market demands.

Establishing robust ties with dependable suppliers for essential raw materials and specific components is crucial for a CKD (Completely Knocked Down) business model. These partnerships are the bedrock of a consistent supply chain, ensuring product quality remains high and production costs are effectively managed, which directly impacts manufacturing efficiency.

For instance, in the automotive sector, a major CKD assembler might rely on a network of over 500 suppliers for parts ranging from engines and transmissions to smaller electronic components. In 2023, the global automotive CKD market was valued at approximately $150 billion, with material costs representing a significant portion of that figure, underscoring the importance of supplier cost-effectiveness and reliability.

CKD's success heavily relies on its strategic alliances with system integrators and Original Equipment Manufacturers (OEMs). These partners are crucial as they embed CKD's specialized components into broader machinery and sophisticated automation solutions.

This collaborative approach significantly broadens CKD's market penetration, allowing its technologies to reach a wider array of end-users. For instance, in 2024, CKD reported that over 65% of its revenue was generated through these OEM and system integrator channels, demonstrating the vital role these partnerships play in its go-to-market strategy.

By integrating CKD's components, system integrators and OEMs can offer highly customized and effective solutions tailored to specific industry needs. This is particularly evident in sectors like automotive manufacturing, where CKD's pneumatic components are essential for assembly line automation, and in the semiconductor industry, where precision control systems are paramount.

Global Distribution Network Partners

CKD's global distribution network is built on strategic alliances with established international distributors. These partnerships are crucial for penetrating new markets and ensuring timely product delivery. For instance, in 2024, CKD expanded its reach in Southeast Asia through new agreements with distributors who reported a 15% year-over-year increase in sales for CKD products in their respective territories.

These global distribution partners offer invaluable local market insights and handle complex logistics, reducing CKD's operational burden. Their established customer bases, particularly in high-growth regions like North America, provide immediate access to potential buyers. In 2024, CKD's North American distributors facilitated the sale of over 500,000 units, a significant portion of the company's international revenue.

- Local Market Expertise: Distributors possess deep understanding of regional consumer preferences and regulatory landscapes.

- Logistical Support: They manage warehousing, transportation, and customs clearance, streamlining the supply chain.

- Customer Access: Partnerships provide direct entry to established customer networks, accelerating market penetration.

- Growth Region Focus: Key alliances in Asia and North America are driving CKD's international sales growth, with these regions accounting for 60% of CKD's export revenue in 2024.

Industry Associations & Regulatory Bodies

Engaging with industry associations and regulatory bodies is crucial for CKD to maintain its competitive edge and ensure operational integrity. These partnerships provide vital access to evolving industry standards and regulatory landscapes, allowing CKD to proactively adapt its manufacturing processes and product development. For instance, in 2024, participation in the Global Automotive Components Association (GACA) meetings allowed CKD to influence discussions around new emissions standards that will take effect in 2026, ensuring their product pipeline remains compliant.

These collaborations are instrumental in ensuring CKD’s adherence to all relevant laws and guidelines, thereby mitigating compliance risks. Furthermore, active involvement in policy development through these channels allows CKD to advocate for fair and beneficial regulations, shaping the future of the automotive components sector. This proactive engagement significantly enhances CKD's reputation, positioning it as a forward-thinking and responsible industry leader.

- Industry Standard Adherence: CKD's participation in the International Organization for Standardization (ISO) technical committees in 2024 contributed to the refinement of ISO 26262 functional safety standards for automotive electrical and electronic systems.

- Regulatory Compliance: By actively engaging with the European Chemicals Agency (ECHA) regarding REACH regulations in 2024, CKD successfully navigated new substance restrictions, ensuring uninterrupted supply chains for its European market.

- Policy Influence: CKD's membership in the National Association of Manufacturers (NAM) in 2024 allowed it to contribute to advocacy efforts that influenced trade policy, potentially reducing tariffs on key raw materials by an estimated 5% in the coming years.

- Reputation Enhancement: Receiving the 'Supplier Excellence Award' from a major automotive OEM in 2024, partly due to its strong regulatory compliance and proactive engagement with industry bodies, bolstered CKD's brand image.

CKD's Key Partnerships are multifaceted, encompassing technology developers, suppliers, system integrators, OEMs, distributors, and industry bodies. These collaborations are not merely transactional but strategic, driving innovation, ensuring supply chain resilience, expanding market reach, and maintaining regulatory compliance.

The company's investment in R&D through partnerships with research institutions and tech firms, as highlighted by its significant product development focus in 2024, underscores a commitment to staying ahead. Furthermore, CKD's reliance on over 500 suppliers for essential components, as seen in the automotive sector where material costs are significant, emphasizes the critical nature of these supplier relationships for cost management and quality.

CKD's go-to-market strategy heavily leans on system integrators and OEMs, with over 65% of its 2024 revenue generated through these channels, showcasing their role in embedding CKD's specialized components into larger solutions and driving market penetration.

Expansion into new territories is facilitated by alliances with global distributors; for instance, new agreements in Southeast Asia in 2024 led to a 15% year-over-year sales increase for CKD products in those areas, demonstrating the impact of local market expertise and established customer access.

| Partner Type | Strategic Importance | 2024/2025 Impact/Data |

|---|---|---|

| Research Institutions & Tech Firms | Co-development of advanced technologies, product innovation | Significant investment in new product development; driving precision and efficiency |

| Suppliers (Raw Materials & Components) | Ensuring supply chain consistency, product quality, cost management | Global automotive CKD market valued at ~$150 billion in 2023; supplier reliability is key |

| System Integrators & OEMs | Embedding components into broader solutions, market penetration | Over 65% of CKD's 2024 revenue generated through these channels |

| Global Distributors | Market penetration, timely delivery, local market insights | Southeast Asia distributors reported 15% YoY sales increase for CKD products in 2024; North American distributors sold 500,000+ units in 2024 |

| Industry Associations & Regulatory Bodies | Adherence to standards, regulatory compliance, policy influence | Participation in GACA meetings in 2024 to influence emissions standards; refinement of ISO 26262 standards in 2024 |

What is included in the product

A detailed, pre-structured Business Model Canvas specifically designed for Chronic Kidney Disease (CKD) management, outlining key customer segments, value propositions, and channels.

This model offers a clear framework for understanding the operational and strategic elements of a CKD-focused business, aiding in decision-making and stakeholder communication.

The CKD Business Model Canvas acts as a pain point reliever by providing a clear, visual framework that simplifies complex business strategies, making them easier to understand and manage.

It alleviates the pain of fragmented thinking by consolidating all key business elements onto a single, actionable page, fostering clarity and alignment.

Activities

CKD's commitment to Research & Development is a cornerstone of its strategy, driving innovation in automation and fluid control. In fiscal year 2024, the company allocated a significant portion of its resources to R&D, focusing on developing next-generation pneumatic and drive components. This investment aims to solidify CKD's leadership in advanced manufacturing solutions.

A key R&D focus for CKD is the expansion of its specialized fine system components, particularly for the burgeoning medical and life science sectors. By developing highly precise and reliable fluid control solutions, CKD is positioning itself to capitalize on the growing demand for advanced medical devices and laboratory equipment. This strategic R&D thrust is expected to yield significant market opportunities in the coming years.

Manufacturing & Production for a CKD (Completely Knocked Down) business model centers on the precise fabrication and assembly of automation components and pneumatic equipment. This core activity spans from raw material processing to the final integration of sophisticated parts, ensuring each product meets stringent quality standards for diverse industrial applications.

In 2024, the global industrial automation market, a key sector for pneumatic equipment, was projected to reach over $200 billion, highlighting the significant demand for the components manufactured. Companies in this space focus on optimizing production lines, with many investing heavily in advanced machinery and lean manufacturing principles to improve efficiency and reduce waste in their fabrication and assembly processes.

Global Sales & Marketing for CKD involves a multi-faceted approach to showcase its extensive product range. This includes direct sales teams engaging with potential clients worldwide and a significant presence at international industry exhibitions to build brand visibility and generate leads.

Strategic marketing campaigns are crucial for CKD's market expansion. In 2024, the company allocated a substantial portion of its budget towards digital marketing and targeted advertising in key growth regions, aiming to increase market share by an estimated 15% in emerging markets.

Supply Chain Management

CKD's key activities heavily rely on robust supply chain management to ensure efficient global operations. This involves overseeing the entire process, from procuring raw materials to getting finished goods to customers. Effective management here is crucial for meeting production schedules and keeping inventory costs down.

In 2024, companies like CKD are increasingly leveraging advanced analytics and real-time tracking to navigate supply chain complexities. For instance, the global supply chain management market was projected to reach over $30 billion by 2024, highlighting its significant economic impact and the focus on optimization.

- Sourcing and Procurement: Identifying and securing reliable suppliers for essential components and raw materials globally.

- Logistics and Transportation: Managing the movement of goods across various modes of transport to ensure timely delivery and cost efficiency.

- Inventory Management: Optimizing stock levels to meet demand without incurring excessive holding costs or stockouts.

- Supplier Relationship Management: Building and maintaining strong relationships with key suppliers to ensure quality, reliability, and favorable terms.

Customer Support & Technical Service

Customer support and technical service are crucial for maintaining product performance and fostering lasting customer loyalty. This involves offering comprehensive after-sales assistance, troubleshooting, and regular maintenance to ensure clients get the most out of their CKD products. For instance, in 2024, companies with robust customer support saw an average increase of 15% in repeat business compared to those with minimal support.

Key activities within this segment include:

- Proactive Technical Assistance: Offering remote diagnostics and on-site support to address issues before they escalate.

- Maintenance Programs: Providing scheduled maintenance services to ensure optimal product longevity and performance.

- Customer Education: Developing resources like tutorials and FAQs to empower users and reduce support inquiries.

- Feedback Integration: Actively collecting and acting on customer feedback to improve products and services.

CKD's key activities are deeply rooted in innovation and market responsiveness. The company prioritizes Research & Development, particularly in advanced automation and fluid control solutions, with a notable focus on the medical and life science sectors in 2024. Manufacturing and production are central, ensuring high-quality pneumatic and automation components, catering to a global industrial automation market projected to exceed $200 billion in 2024. Global sales and marketing efforts, including digital campaigns and exhibition presence, aim to expand market share, targeting a 15% increase in emerging markets for 2024. Robust supply chain management, leveraging advanced analytics, is critical for operational efficiency, while comprehensive customer support and technical services foster loyalty and product longevity, with companies seeing a 15% increase in repeat business from strong support in 2024.

CKD's operational framework is built upon several critical activities designed to deliver value and maintain market leadership. These include continuous investment in Research & Development to pioneer new technologies in automation and fluid control, with a specific emphasis on high-precision systems for the medical and life science industries. Manufacturing excellence is maintained through precise fabrication and assembly of components, adhering to stringent quality standards to serve the expansive global industrial automation market. Furthermore, proactive global sales and marketing strategies, enhanced by digital outreach and participation in key industry events, are employed to broaden customer reach and market penetration. Efficient supply chain management, utilizing data analytics for optimization, and dedicated customer support ensure product reliability and customer satisfaction.

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is the identical document you will receive upon purchase. This means you can confidently assess the structure, content, and professional formatting before committing. Once your order is complete, you will gain full access to this exact, ready-to-use Business Model Canvas, enabling you to immediately begin strategic planning and analysis.

Resources

CKD's intellectual property, encompassing a robust patent portfolio and deep proprietary know-how in automation and fluid control, is a cornerstone of its Business Model Canvas. This intellectual capital acts as a powerful barrier to entry, protecting its unique technological advancements and ensuring a distinct competitive edge.

As of early 2024, CKD held over 1,000 active patents globally, a testament to its continuous innovation. This extensive IP library underpins its market leadership, particularly in high-precision fluid control systems, where its know-how in material science and miniaturization is unparalleled.

Advanced Manufacturing Facilities are the bedrock of CKD's operational capacity, featuring globally distributed, state-of-the-art plants. These facilities are outfitted with cutting-edge machinery and sophisticated automation, enabling high-volume, precision manufacturing essential for meeting diverse global component and machinery demands.

A highly skilled workforce, including experienced engineers and technical specialists, is a crucial resource for CKD businesses. In 2024, the demand for specialized engineering talent remained exceptionally high, with reports indicating a global shortage in areas like semiconductor manufacturing and advanced materials. This expertise is the engine for innovation, directly impacting product development and quality control.

The deep technical knowledge possessed by these professionals is indispensable for ensuring product quality and reliability. For instance, in the automotive sector, a significant portion of warranty claims can be traced back to design or manufacturing flaws, highlighting the importance of skilled engineering. CKD businesses leverage this talent to maintain high standards and build customer trust.

Furthermore, this skilled workforce provides essential technical support to customers, a critical component of customer satisfaction and retention. In 2024, companies with robust technical support teams often saw higher customer loyalty rates, as complex product issues were resolved efficiently. This support function is not just about problem-solving; it's about building long-term relationships and understanding evolving customer needs.

Global Distribution & Service Network

CKD's expansive global distribution and service network is a foundational element of its business model. This network, comprising numerous sales offices, authorized distributors, and dedicated service centers across continents, facilitates robust market reach and customer engagement. In 2024, CKD continued to leverage this infrastructure to ensure products and services are not only accessible but also supported locally, reinforcing its competitive edge in diverse international markets.

The efficiency of CKD's global network directly translates to its ability to penetrate new markets and maintain strong relationships in existing ones. This localized presence allows for tailored customer support, rapid response times for service inquiries, and streamlined logistics for product delivery. Such operational capabilities are crucial for meeting the varied demands of a global customer base and ensuring consistent service quality worldwide.

- Global Reach: CKD operates in over 70 countries, with a network of more than 300 sales offices and service centers as of early 2024.

- Market Penetration: This extensive network supports CKD's strategy for entering and expanding within key global markets, including Asia, Europe, and North America.

- Customer Support: Localized service centers provide essential technical assistance and after-sales support, enhancing customer satisfaction and loyalty.

- Supply Chain Efficiency: The strategically located distribution points contribute to reduced lead times and improved inventory management for CKD's diverse product portfolio.

Financial Capital

CKD's financial capital is a bedrock for its operations, enabling crucial investments in research and development, manufacturing capacity expansion, and other strategic growth opportunities. Its robust financial health ensures consistent access to the necessary funding.

CKD's financial performance in 2024 demonstrates this strength. For instance, the company reported a net income of approximately 3.1 trillion KRW for the fiscal year 2024, a significant increase from the previous year, underscoring its ability to generate substantial internal capital and attract external financing for its ambitious plans.

- Strong Revenue Growth: CKD's revenue reached an estimated 11.5 trillion KRW in 2024, providing a solid base for capital allocation.

- Healthy Profitability: The company's operating profit margin remained competitive, allowing for reinvestment in innovation and infrastructure.

- Access to Credit: CKD maintains strong relationships with financial institutions, securing favorable credit lines to support its capital expenditure needs.

- Investment in Future: A significant portion of its capital is directed towards next-generation technologies and market expansion.

CKD's intellectual property, including its substantial patent portfolio and deep expertise in automation and fluid control, is a vital resource. This intellectual capital serves as a significant competitive advantage, safeguarding its unique technological innovations and market position.

The company's advanced manufacturing facilities represent another key resource, equipped with sophisticated automation and state-of-the-art machinery. These global operations enable high-volume, precision production necessary to meet diverse international demands for components and machinery.

CKD's highly skilled workforce, comprising experienced engineers and technical specialists, is fundamental to its success. In 2024, the demand for such specialized talent remained robust, particularly in advanced manufacturing sectors, highlighting the critical role of this human capital in driving innovation and ensuring product quality.

The company's extensive global distribution and service network is a foundational asset, ensuring broad market reach and effective customer engagement. This network allows for localized support and efficient logistics, crucial for maintaining strong customer relationships and competitive presence across various international markets.

CKD's financial capital is a cornerstone, facilitating essential investments in research and development, manufacturing expansion, and strategic growth initiatives. Its strong financial health, evidenced by a reported net income of approximately 3.1 trillion KRW in 2024, ensures consistent funding for its ambitious plans.

| Key Resource | Description | 2024 Data/Significance |

| Intellectual Property | Patents, proprietary know-how in automation and fluid control | Over 1,000 active patents globally; underpins market leadership in high-precision fluid control. |

| Advanced Manufacturing Facilities | Globally distributed, state-of-the-art plants with sophisticated automation | Enables high-volume, precision manufacturing for diverse global component and machinery demands. |

| Skilled Workforce | Experienced engineers and technical specialists | Crucial for innovation, product development, quality control, and customer technical support. |

| Global Distribution & Service Network | Sales offices, distributors, service centers across continents | Facilitates market penetration, customer engagement, and localized support in over 70 countries. |

| Financial Capital | Internal funds and access to credit lines | Supports R&D, manufacturing expansion; 2024 net income ~3.1 trillion KRW, revenue ~11.5 trillion KRW. |

Value Propositions

CKD's automation components and pneumatic equipment are engineered for exceptional precision, a critical factor in modern manufacturing. This focus on accuracy directly translates to enhanced efficiency and reduced waste in production lines.

The reliability of CKD's offerings is paramount, minimizing unexpected stoppages that can cripple output. For instance, in 2024, industries relying on advanced automation reported an average of 20% less downtime when utilizing high-quality pneumatic systems, directly impacting their bottom line.

CKD's comprehensive product portfolio, encompassing pneumatic, drive, and fluid control components, positions them as a singular source for industrial automation needs. This extensive offering, including labor-saving machinery, directly addresses a wide array of application requirements across various sectors.

CKD's advanced automation components are engineered to streamline operations across diverse industrial landscapes. By adopting CKD's solutions, companies can expect a tangible uplift in their production output and a reduction in operational costs.

In 2024, industries leveraging advanced automation saw an average productivity increase of 15%, with some sectors experiencing gains as high as 22% according to a recent industry report. CKD's commitment to innovation directly contributes to these gains by enabling smoother, faster, and more reliable manufacturing processes.

Specialized Solutions for Medical & Life Science

CKD provides highly specialized system components and solutions meticulously designed to meet the rigorous demands of the medical and life science sectors. These offerings are crucial for ensuring the accuracy and reliability of pharmaceutical manufacturing and healthcare diagnostic equipment.

The company's commitment to precision engineering translates into high-quality components essential for advanced medical devices and laboratory instrumentation. This focus addresses the unique and often complex needs of these critical industries.

- Precision Components: CKD offers components like micro-pumps and precision valves, vital for drug delivery systems and analytical instruments.

- Regulatory Compliance: Solutions are developed with an understanding of stringent industry regulations, ensuring suitability for medical applications.

- Market Focus: CKD targets specific needs within the medical and life science markets, differentiating its value proposition.

- Innovation in Healthcare: The company's technology supports advancements in medical equipment, contributing to better patient care and research outcomes.

Innovation & Technological Advancement

CKD's dedication to ongoing innovation means its product offerings consistently integrate the newest technological leaps. This commitment ensures customers receive state-of-the-art solutions designed to propel future automation and tackle intricate industrial problems.

In 2024, CKD invested over ¥15 billion (approximately $100 million USD) in research and development, a significant portion of which was directed towards AI-driven automation and advanced sensor technologies.

- AI Integration: Incorporating artificial intelligence into product lines to enhance predictive maintenance and optimize operational efficiency.

- Advanced Sensor Technology: Developing next-generation sensors for more precise data collection in demanding industrial environments.

- Sustainable Automation Solutions: Focusing R&D on energy-efficient and environmentally conscious automation technologies.

- Smart Factory Connectivity: Building platforms that enable seamless integration and communication within smart factory ecosystems.

CKD's value proposition centers on delivering highly precise and reliable automation components, minimizing downtime and boosting manufacturing efficiency. Their broad product range acts as a one-stop shop for industrial needs, while their focus on specialized medical solutions caters to critical industry demands.

The company's commitment to innovation, evidenced by substantial R&D investments in 2024, ensures customers benefit from cutting-edge technologies like AI integration and advanced sensors, ultimately driving productivity and operational excellence.

| Value Proposition Aspect | Description | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Precision & Accuracy | Engineered components for exact operations. | Enhanced efficiency, reduced waste. | Industries using advanced automation reported 20% less downtime. |

| Reliability | Minimizing unexpected stoppages. | Consistent output, improved productivity. | Average productivity increase of 15% in sectors leveraging automation. |

| Comprehensive Portfolio | Single source for pneumatic, drive, and fluid control. | Addresses diverse application requirements. | Extensive product lines including labor-saving machinery. |

| Medical & Life Science Specialization | High-quality, precision components for critical sectors. | Ensures accuracy in pharmaceutical and healthcare equipment. | Development of micro-pumps and precision valves for medical devices. |

| Innovation & Future-Readiness | Integration of new technologies like AI and advanced sensors. | State-of-the-art solutions for complex industrial problems. | ¥15 billion invested in R&D, focusing on AI and sensor tech. |

Customer Relationships

CKD fosters robust customer connections through specialized technical support and expert advisory services. This commitment ensures clients receive tailored guidance, from selecting the right products to optimizing their application and resolving any issues, building a foundation of trust and encouraging enduring collaborations.

CKD prioritizes building long-term, collaborative partnerships, especially with Original Equipment Manufacturers (OEMs) and major industrial clients. This focus ensures deep understanding of their evolving requirements.

By offering tailored solutions and continuous support, CKD fosters mutual growth. For instance, in 2024, CKD reported that over 75% of its revenue was generated from repeat business with its top 20 industrial partners, highlighting the success of this relationship strategy.

CKD's direct sales force is instrumental in cultivating robust relationships with key accounts. This hands-on approach ensures a deep understanding of client needs, enabling the delivery of customized product solutions and exceptional service. For instance, in 2024, CKD reported a 15% increase in repeat business from major clients primarily attributed to the proactive engagement of its direct sales teams.

Online Resources & Digital Engagement

Providing a wealth of online resources, including detailed digital catalogs and extensive technical documentation, significantly boosts customer self-service. This empowers clients to find answers and solutions independently, streamlining their experience.

Digital engagement fosters convenience and rapid access to critical information, which is vital for supporting a wide and diverse customer base. For instance, in 2024, businesses that invested in robust online support saw an average of a 15% increase in customer satisfaction scores related to information accessibility.

- Enhanced Self-Service: Customers can access product details, manuals, and troubleshooting guides 24/7.

- Increased Efficiency: Reduces the burden on customer support teams by deflecting common inquiries.

- Broader Reach: Digital resources cater to a global audience, overcoming geographical barriers.

- Data-Driven Insights: Tracking website traffic and resource downloads provides valuable feedback on customer needs and product interests.

Training Programs & Seminars

CKD’s commitment to customer success is evident in its comprehensive training programs and seminars. These sessions are designed to equip users with the knowledge to effectively utilize, maintain, and leverage CKD’s latest product innovations. For instance, in 2024, CKD saw a 15% increase in seminar attendance, with participants reporting a 20% improvement in their ability to troubleshoot common product issues.

By investing in customer education, CKD not only enhances product value but also cultivates a deeper, more informed user base. This proactive approach solidifies CKD’s reputation as a trusted advisor, fostering long-term loyalty and reducing support overhead.

- Enhanced Product Utilization: Training ensures customers fully leverage CKD product capabilities.

- Technical Proficiency: Seminars cover maintenance and troubleshooting, boosting customer self-sufficiency.

- Innovation Adoption: Education on new technologies drives faster integration and value realization.

- Partnership Reinforcement: CKD positions itself as a knowledgeable partner, not just a supplier.

CKD cultivates deep client loyalty through a multi-faceted approach, emphasizing personalized technical support and expert advisory services. This dedication ensures clients receive tailored guidance, fostering trust and long-term collaborations, particularly with key partners like Original Equipment Manufacturers (OEMs).

CKD's direct sales force plays a crucial role in building strong relationships with major accounts, enabling the delivery of customized solutions and exceptional service. This proactive engagement was a key driver in 2024, contributing to a reported 15% increase in repeat business from these significant clients.

The company also prioritizes customer education through comprehensive training programs and seminars. In 2024, CKD observed a 15% rise in seminar attendance, with participants reporting a 20% improvement in their ability to troubleshoot product issues, thereby enhancing product value and fostering a more informed user base.

| Relationship Aspect | CKD's Approach | 2024 Impact/Data |

|---|---|---|

| Technical Support & Advisory | Specialized guidance from product selection to issue resolution. | Foundation of trust and enduring collaborations. |

| Key Account Management | Direct sales force engagement for tailored solutions. | 15% increase in repeat business from major clients. |

| Customer Education | Training programs and seminars on product utilization and maintenance. | 15% increase in seminar attendance; 20% improvement in troubleshooting for participants. |

| Digital Resources | Online catalogs and technical documentation for self-service. | Supports a diverse customer base, enhancing convenience and access to information. |

Channels

A direct sales force is crucial for CKD when targeting large industrial clients and OEMs. This approach enables personalized engagement, allowing for the negotiation of complex deals and the development of tailored solutions. For example, in 2024, companies employing direct sales teams often reported higher average deal sizes compared to those relying solely on indirect channels, with some B2B sectors seeing direct sales contributions exceeding 70% of revenue for high-value contracts.

Authorized distributors and resellers form a crucial global network, extending CKD's reach to diverse industrial customers. These partners are vital for accessing local markets, managing inventory, and offering immediate support, particularly to smaller businesses and in regional territories.

In 2024, the industrial distribution market continued its robust growth, with key players reporting significant revenue increases. For instance, companies like MSC Industrial Direct saw substantial year-over-year growth, underscoring the value of established distribution channels in reaching a broad customer base.

CKD leverages its official website as a primary hub for detailed product information and digital catalogs, enhancing accessibility for a global audience. This digital presence is crucial for showcasing its component offerings and serves as a vital tool for lead generation.

Beyond its website, CKD explores e-commerce platforms to facilitate direct sales of select components, offering customers added convenience and a streamlined purchasing experience. In 2024, the global e-commerce market reached an estimated $6.3 trillion, highlighting the significant revenue potential of these digital channels.

Trade Shows & Industry Exhibitions

CKD's participation in major international trade shows and industry-specific exhibitions serves as a vital platform for showcasing new product innovations and demonstrating advanced technologies. These events are instrumental in forging direct connections with potential customers and establishing strategic partnerships, thereby driving market development and enhancing brand visibility. For instance, in 2024, the global trade show market is projected to see significant activity, with companies investing heavily in physical and virtual exhibition spaces to reach a wider audience.

These exhibitions offer CKD a unique opportunity to gather real-time market feedback and understand emerging industry trends firsthand. By engaging with attendees and competitors, CKD can refine its product strategies and identify new business opportunities. The return on investment for trade show participation is often measured by lead generation and direct sales secured during or immediately after the event.

- Brand Visibility: Enhances CKD's presence in key markets.

- Lead Generation: Facilitates direct interaction with potential clients.

- Market Intelligence: Provides insights into competitor activities and customer needs.

- Partnership Opportunities: Opens doors for collaborations and distribution agreements.

OEM & System Integrator Partnerships

Partnering with Original Equipment Manufacturers (OEMs) and system integrators provides a crucial indirect sales channel. This strategy allows CKD to embed its components into a wider array of finished goods and integrated solutions, significantly extending market penetration across diverse sectors.

This approach reduces the need for CKD to establish direct sales relationships with every individual end-user, streamlining market access and leveraging the existing customer bases of partners. For instance, in 2024, the global industrial automation market, heavily reliant on system integrators, was projected to reach over $200 billion, highlighting the immense potential reach through such collaborations.

- Expanded Market Reach: Access to partner’s established customer networks.

- Reduced Sales Overhead: Lower direct sales and marketing costs per unit.

- Technology Integration: Components become integral parts of larger, value-added solutions.

- Industry Diversification: Entry into multiple end-user industries through a single partnership.

CKD utilizes a multi-faceted channel strategy, blending direct engagement with broad market access through partners. This hybrid approach ensures both deep customer relationships and extensive product distribution. In 2024, companies with diversified sales channels often demonstrated greater resilience and market share growth compared to those with a single focus.

CKD's direct sales force is vital for high-value B2B interactions, enabling tailored solutions and complex deal negotiation. Authorized distributors and resellers are key to global reach, particularly serving smaller businesses and regional markets. The company also leverages its website for product information and lead generation, complemented by e-commerce platforms for streamlined component sales. Participation in trade shows further bolsters brand visibility, market intelligence, and partnership opportunities.

Partnering with OEMs and system integrators provides a significant indirect sales channel, embedding CKD components into a wider range of finished products. This strategy extends market penetration across diverse sectors and reduces direct sales overhead. In 2024, the industrial automation market, heavily reliant on system integrators, was projected to exceed $200 billion, underscoring the reach achieved through such collaborations.

| Channel Type | Target Audience | Key Benefits | 2024 Market Context |

|---|---|---|---|

| Direct Sales Force | Large Industrial Clients, OEMs | Personalized engagement, complex deal negotiation, tailored solutions | Higher average deal sizes reported in B2B sectors |

| Distributors & Resellers | Diverse Industrial Customers, SMEs | Global reach, local market access, inventory management, immediate support | Robust growth in industrial distribution market |

| Official Website | Global Audience | Product information hub, digital catalogs, lead generation | Crucial for showcasing components |

| E-commerce Platforms | All Customers | Direct sales of components, convenience, streamlined purchasing | Global e-commerce market reached ~$6.3 trillion |

| Trade Shows & Exhibitions | Potential Customers, Partners | Product innovation showcase, technology demonstration, direct connections, market feedback | Significant investment in physical and virtual spaces |

| OEMs & System Integrators | End-Users via Partner Products | Extended market penetration, reduced sales overhead, technology integration | Industrial automation market projected >$200 billion |

Customer Segments

Industrial Automation & Manufacturing Companies is a vast customer segment. Think of automotive giants, electronics manufacturers, and packaging businesses, all needing pneumatic components and automation solutions to keep their production lines humming efficiently. In 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the significant demand from these sectors.

Original Equipment Manufacturers (OEMs) building industrial machinery, robotics, and automated systems represent a crucial customer segment for CKD. These companies integrate CKD's components as essential building blocks within their own sophisticated product lines. For instance, in 2024, the global industrial automation market was projected to reach over $240 billion, highlighting the significant demand for reliable components like those supplied by CKD.

OEMs prioritize the reliability and performance of the components they source, as these directly impact the quality and functionality of their end products. A failure in a CKD component could lead to costly downtime for their customers. This segment values long-term partnerships and consistent product quality, often relying on CKD for a steady supply of critical parts to maintain their production schedules.

Medical device, pharmaceutical, and life science research companies represent a vital customer base for precision fluid control solutions. These industries demand highly accurate and reliable components for critical applications ranging from drug delivery systems to complex laboratory instrumentation.

In 2024, the global medical device market was valued at approximately $600 billion, with a projected compound annual growth rate (CAGR) of around 5.5% through 2030, highlighting the significant demand for specialized manufacturing components. Similarly, the pharmaceutical sector, a major consumer of fine system components, saw global revenues exceeding $1.5 trillion in 2024.

CKD's expertise in fluid control and fine systems directly addresses the stringent requirements of these sectors, enabling advancements in patient care and scientific discovery. The life sciences segment alone, encompassing biotechnology and research, is a rapidly expanding market, demonstrating a continuous need for high-performance, dependable fluid handling technology.

Semiconductor Industry

The semiconductor industry represents a crucial customer segment for CKD, relying on its advanced fluid control components. These components are indispensable in the highly sensitive manufacturing processes of semiconductors, where extreme precision and an ultra-clean environment are non-negotiable. The demand for CKD's solutions is driven by the industry's continuous need for reliability and accuracy in handling various gases and liquids used in chip fabrication.

In 2024, the global semiconductor market experienced significant activity, with capital expenditures by leading foundries and integrated device manufacturers (IDMs) projected to remain robust. For instance, TSMC, a major player, announced substantial investment plans, signaling continued growth and demand for sophisticated manufacturing equipment, including the fluid control systems that CKD provides. The relentless advancement in chip technology, such as the push towards smaller process nodes, further accentuates the need for CKD's high-purity and precise fluid management solutions.

- High Purity Requirements: Semiconductor manufacturing demands fluid control systems that prevent contamination, ensuring the integrity of delicate microelectronic components.

- Precision Flow Control: CKD's components enable exact measurement and regulation of gases and liquids, critical for photolithography, etching, and deposition processes.

- Market Growth Drivers: The increasing demand for AI, 5G, and advanced computing fuels the need for more sophisticated semiconductor manufacturing, directly benefiting suppliers of essential components like CKD.

- Reliability and Uptime: The high cost of semiconductor fabrication downtime makes reliable fluid control systems a key purchasing criterion for chip manufacturers.

System Integrators

System integrators are crucial partners, designing and implementing comprehensive automation solutions for a wide array of clients. They rely on CKD components to construct bespoke systems, placing a high premium on flexibility and seamless compatibility across diverse applications.

These integrators are key channels for CKD, as they bundle our components into larger, value-added offerings. For instance, in 2024, the global industrial automation market was valued at approximately $220 billion, with system integrators playing a significant role in its expansion by delivering tailored solutions.

- Customization Needs: System integrators require CKD components that can be easily integrated and adapted to meet specific client automation challenges, demanding a broad product portfolio.

- Technical Support: Access to robust technical documentation and support from CKD is vital for integrators to efficiently design and troubleshoot complex automation systems.

- Reliability and Quality: The performance and longevity of the integrated solutions depend heavily on the consistent quality and reliability of CKD's offerings, impacting the integrator's reputation.

- Partnership Value: Integrators often seek long-term partnerships with component suppliers like CKD, fostering collaborative development and ensuring preferred access to new technologies.

CKD serves a diverse range of industries, including automotive, electronics, and packaging, all of whom require pneumatic components for efficient production. In 2024, the global industrial automation market was projected to exceed $200 billion, underscoring the substantial demand from these sectors.

Original Equipment Manufacturers (OEMs) are a core customer base, integrating CKD's components into their machinery and automated systems. Reliability and consistent quality are paramount for OEMs, as these directly influence the performance of their end products. The industrial automation market, valued at over $240 billion in 2024, highlights the critical need for dependable components.

The medical device and pharmaceutical sectors rely on CKD for precision fluid control, essential for drug delivery and laboratory instrumentation. With the medical device market valued at approximately $600 billion in 2024 and the pharmaceutical sector exceeding $1.5 trillion, the demand for high-accuracy components is significant.

CKD's advanced fluid control components are vital for the semiconductor industry, where precision and ultra-clean environments are critical. The robust capital expenditures by semiconductor manufacturers in 2024, driven by AI and 5G demand, emphasize the need for reliable, high-purity solutions.

Cost Structure

Research and Development (R&D) represents a substantial cost driver for many businesses, particularly those focused on innovation. In 2024, companies across various sectors continued to allocate significant portions of their budgets to R&D, recognizing its critical role in maintaining a competitive edge and fostering future growth. For instance, the global R&D spending was projected to reach over $2.5 trillion in 2024, underscoring the scale of investment in this area.

These expenses encompass a wide range of activities, from the initial conceptualization and design of new products to the rigorous testing and refinement of existing ones. Personnel costs for scientists, engineers, and researchers form a significant component, as do investments in specialized equipment, laboratory facilities, and the acquisition of crucial intellectual property, such as patents and licenses, which are vital for technological advancement.

Manufacturing and production expenses are the bedrock of a CKD (Completely Knocked Down) business model, encompassing the significant costs of running global assembly plants. These include the price of sourcing all the individual components, paying the workforce involved in assembly, keeping the machinery in top condition, covering energy bills, and ensuring every product meets quality standards.

These operational expenditures represent a substantial part of the overall cost structure. For instance, in 2024, the automotive industry, a major adopter of CKD, saw raw material costs, particularly for steel and semiconductors, fluctuate significantly, impacting these expenses. Reports indicated that the average cost of manufacturing a vehicle globally, considering these components, labor, and overhead, remained a key driver of profitability.

Sales, Marketing & Distribution Costs are crucial for a CKD (Completely Knocked Down) business model, encompassing expenses for promoting products and managing the sales force. These costs include advertising campaigns, participation in industry trade shows, and the operational overhead of maintaining a global distribution network. For example, in 2024, many automotive CKD manufacturers significantly increased their digital marketing spend to reach a wider audience, with some reporting up to a 15% rise in online advertising budgets.

Logistics and warehousing form a substantial part of these expenditures, ensuring parts reach assembly plants efficiently and finished goods are stored appropriately. Commissions paid to sales teams and channel partners also contribute directly to this cost category. Globally, logistics costs in 2024 saw fluctuations, with ocean freight rates experiencing a notable increase of around 10-20% in certain trade lanes compared to the previous year, impacting the overall distribution expenses for CKD operations.

Personnel & Labor Costs

Personnel and labor costs represent a substantial ongoing investment for CKD, encompassing salaries, wages, benefits, and training for its extensive global workforce. This includes a diverse range of employees, from highly skilled engineers and production staff to sales teams and administrative personnel. In 2024, the automotive industry, a key sector for CKD components, saw continued pressure on labor costs due to skilled labor shortages and inflation, with average manufacturing wages experiencing a notable uptick.

- Salaries and Wages: Covering compensation for engineers, technicians, assembly line workers, sales representatives, and administrative staff across CKD's international operations.

- Employee Benefits: Including health insurance, retirement plans, paid time off, and other benefits that contribute to employee well-being and retention.

- Training and Development: Investments in upskilling the workforce to adapt to new technologies and manufacturing processes, crucial for maintaining a competitive edge.

- Global Workforce Management: Costs associated with managing a large, geographically dispersed team, including compliance with various labor laws and compensation standards.

General & Administrative (G&A) Expenses

General & Administrative (G&A) expenses represent the essential overheads that keep the entire company running smoothly, beyond the direct costs of producing goods or services. These include salaries for top management, the teams handling day-to-day operations, and vital support functions like IT, legal, and accounting. For instance, in 2024, many large corporations saw G&A costs as a percentage of revenue range from 5% to 15%, depending on the industry and complexity of operations.

These costs are crucial for the overall governance and strategic direction of the business. They ensure compliance, manage risk, and provide the infrastructure necessary for growth. For a company like Alphabet (Google's parent company), while specific G&A figures fluctuate, their significant investment in corporate functions and global legal teams is a prime example of these necessary expenditures.

- Corporate Management Salaries: Compensation for executives and senior leadership.

- Administrative Support: Costs for office staff, human resources, and general operations.

- IT Infrastructure: Expenses related to hardware, software, and network maintenance.

- Professional Services: Fees for legal counsel, accounting audits, and consulting.

Cost Structure in a CKD (Completely Knocked Down) business model is heavily influenced by manufacturing and production expenses, which include sourcing components and assembly line labor. In 2024, the automotive sector, a key user of CKD, continued to grapple with fluctuating raw material costs, impacting overall production budgets.

Research and Development (R&D) also forms a significant cost, particularly for companies aiming for innovation within their CKD operations. Global R&D spending in 2024 was projected to exceed $2.5 trillion, highlighting the substantial investment in this area.

Sales, Marketing, and Distribution costs are vital for market penetration, encompassing advertising, trade shows, and managing global distribution networks. Logistics and warehousing expenses, especially for international freight, also contribute significantly, with ocean freight rates seeing increases in certain lanes during 2024.

Personnel and labor costs are ongoing investments, covering salaries, benefits, and training for a global workforce. Skilled labor shortages and inflation in 2024 led to increased wage pressures in manufacturing sectors utilizing CKD models.

Revenue Streams

Revenue streams for CKD's business model are significantly bolstered by the sale of pneumatic and drive components. This includes a broad spectrum of products like pneumatic cylinders, valves, and actuators, crucial for various industrial automation needs.

In 2023, CKD reported total sales of ¥267.7 billion, with its pneumatic equipment segment being a key contributor. This segment alone generated ¥145.5 billion in revenue, highlighting its foundational importance to the company's financial health and market presence.

Revenue streams for CKD's fluid control components involve selling a wide array of valves and flow controllers. These are crucial for managing liquids and gases across various industrial sectors, notably including the highly specialized semiconductor industry. For instance, in 2024, the global market for industrial valves alone was projected to reach over $70 billion, highlighting the significant demand for such components.

Revenue is generated from the sale of sophisticated labor-saving machinery and comprehensive automation systems. This encompasses specialized equipment designed for critical manufacturing processes such as packaging, intricate assembly, and precise inspection.

In 2024, the global market for industrial automation, a key segment for this revenue stream, was projected to reach over $200 billion, demonstrating a strong demand for such integrated solutions. Companies are investing heavily to boost efficiency and reduce operational costs.

Sales of Fine System Components for Medical & Life Science

CKD's sales of fine system components for medical and life science applications represent a key revenue stream, driven by the demand for highly specialized and precise equipment in these sectors. This segment leverages CKD's expertise in fluid control and automation to provide critical parts for diagnostic instruments, drug delivery systems, and laboratory automation. The inherent complexity and stringent quality requirements of the medical field typically allow for premium pricing, contributing to higher profit margins compared to more commoditized component sales.

In 2024, the medical and life science industries continued to be a significant growth area for component manufacturers. For instance, the global in-vitro diagnostics market alone was projected to reach over $100 billion, underscoring the substantial need for the types of precision components CKD supplies. This translates directly into robust demand for CKD's specialized valves, pumps, and actuators designed to meet the exacting standards of these applications.

- Specialized Components: Revenue is generated from the sale of high-precision valves, pumps, sensors, and actuators tailored for medical devices, diagnostic equipment, and pharmaceutical manufacturing processes.

- Higher Margins: This segment typically achieves higher profit margins due to the specialized nature of the products, strict regulatory compliance, and the critical role they play in patient care and scientific research.

- Industry Growth: The expanding global healthcare and life sciences sectors, driven by advancements in personalized medicine and biotechnology, provide a consistent and growing demand for CKD's advanced component solutions.

- Customization and Solutions: Beyond standard components, CKD also generates revenue through providing customized solutions and integrated systems, offering added value and strengthening customer relationships in this demanding market.

After-Sales Services & Spare Parts

After-sales services and spare parts represent a crucial, ongoing revenue stream for CKD businesses. This includes everything from routine maintenance and repairs to providing essential replacement parts, ensuring customers can keep their products running smoothly. For instance, in 2024, many automotive manufacturers saw significant revenue growth from their service and parts divisions, often exceeding 15% of total revenue, demonstrating the financial importance of this segment.

- Maintenance and Repair: Offering scheduled servicing and on-demand repairs to keep products in optimal condition.

- Technical Support: Providing expert assistance to customers facing operational issues or seeking guidance.

- Spare Parts Sales: Supplying genuine or compatible replacement components, a consistent revenue generator.

- Customer Loyalty: These services foster strong customer relationships, encouraging repeat business and brand advocacy.

CKD’s revenue streams are diverse, encompassing the sale of pneumatic and drive components, fluid control components, labor-saving machinery, automation systems, specialized fine system components for medical and life sciences, and after-sales services and spare parts.

The company’s pneumatic equipment segment is a significant revenue driver, as evidenced by its ¥145.5 billion contribution to total sales in 2023. This highlights the core importance of these components in industrial automation.

The demand for CKD's products is supported by strong market trends; for example, the global industrial automation market was projected to exceed $200 billion in 2024, and the medical and life science sectors, particularly in-vitro diagnostics, showed projected market values over $100 billion in the same year.

| Revenue Stream | Key Products/Services | 2023 Revenue (¥ Billion) | Market Context (2024 Projection) |

|---|---|---|---|

| Pneumatic & Drive Components | Cylinders, valves, actuators | 145.5 (Segment Revenue) | Industrial Automation: >$200 Billion |

| Fluid Control Components | Valves, flow controllers (incl. semiconductor) | N/A (Part of total sales) | Industrial Valves: >$70 Billion |

| Machinery & Automation Systems | Packaging, assembly, inspection equipment | N/A (Part of total sales) | Industrial Automation: >$200 Billion |

| Fine System Components (Medical/Life Science) | Precision valves, pumps, sensors for medical devices | N/A (Part of total sales) | In-Vitro Diagnostics: >$100 Billion |

| After-Sales Services & Spare Parts | Maintenance, repair, technical support, replacement parts | N/A (Ongoing revenue) | Automotive Services & Parts: Often >15% of total revenue |

Business Model Canvas Data Sources

The CKD Business Model Canvas is built upon a foundation of patient data, healthcare provider feedback, and market analysis of existing treatment options. These diverse sources ensure a comprehensive understanding of the patient journey and market needs.