Citi Trends Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Citi Trends Bundle

Citi Trends operates in a highly competitive retail landscape, facing significant pressure from rivals and the ever-present threat of new entrants. Understanding the intensity of these forces is crucial for any strategic decision.

The complete report reveals the real forces shaping Citi Trends’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Supplier concentration in the apparel and home décor sectors typically leans towards fragmentation, particularly for private label goods. This broad supplier base generally limits the bargaining power of any single supplier over a retailer like Citi Trends. For instance, in 2024, the global apparel market was served by thousands of manufacturers, many of whom specialize in producing goods for multiple brands.

However, this dynamic can shift for specific branded merchandise or when a supplier controls a unique fashion trend. In such cases, a supplier might command greater leverage due to the exclusivity or high demand for their products. Citi Trends' strategy of sourcing both branded and private label items provides them with significant flexibility, allowing them to balance relationships and mitigate the impact of any single supplier’s increased power.

Switching costs for Citi Trends are generally low. For many of its core products like generic apparel and home décor, numerous global manufacturers can supply similar items, meaning Citi Trends isn't heavily reliant on any single supplier. This low switching cost significantly limits the bargaining power of these suppliers.

Because Citi Trends can readily switch suppliers for many of its goods, it has more leverage to negotiate favorable pricing and terms. This flexibility allows the company to source products from manufacturers offering the best value, thereby reducing its cost of goods sold.

To counter potential supply chain vulnerabilities and enhance its position, Citi Trends can focus on building strong, strategic relationships with its key suppliers. These partnerships can lead to more reliable supply chains, better quality control, and potentially collaborative innovation, even with low switching costs.

Citi Trends' reliance on a broad range of suppliers for both branded and private label apparel means that the uniqueness of many individual products is often limited. This widespread availability of similar items generally reduces the bargaining power of any single supplier. For instance, in 2024, the fast-fashion market, where Citi Trends operates, saw continued intense competition, pushing suppliers to maintain competitive pricing to secure orders.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward, meaning they might open their own retail stores, is generally quite low for companies like Citi Trends operating in the value-priced apparel and home décor market. Most manufacturers in this space don't have the resources or expertise to handle the complexities of retail operations.

The significant capital investment required for opening and managing numerous retail locations, coupled with the intricate demands of diverse inventory management, customer service, and site selection, presents substantial hurdles. This makes it unlikely for many suppliers to successfully transition into direct retail competition.

Consequently, this low threat of forward integration by suppliers directly contributes to limiting their overall bargaining power within the industry. For instance, major apparel manufacturers often focus on production and distribution, not on the direct-to-consumer retail experience which requires a different skillset and infrastructure.

- Low Forward Integration Threat: Suppliers in the value-priced apparel sector typically lack the capital and operational expertise to open their own retail stores.

- Barriers to Entry: The significant investment in retail infrastructure, inventory management, and customer service deters most manufacturers from pursuing forward integration.

- Supplier Focus: Manufacturers generally concentrate on production and wholesale, leaving the retail segment to specialized companies.

- Impact on Bargaining Power: The limited threat of suppliers becoming direct competitors reduces their leverage over retailers like Citi Trends.

Importance of Citi Trends to Suppliers

Citi Trends' substantial footprint, with over 590 locations, makes it a crucial partner for many smaller or niche manufacturers. This scale grants Citi Trends considerable bargaining power, as these suppliers rely heavily on the retailer for sales volume and market access. For instance, during fiscal year 2024, Citi Trends reported net sales of $1.7 billion, underscoring the significant revenue stream it provides to its supply chain.

Conversely, for major, well-established brands, Citi Trends is merely one of many outlets. These dominant suppliers often have diversified distribution strategies, selling through numerous other retailers and direct-to-consumer channels. This diffusion of Citi Trends' importance means these larger suppliers possess greater leverage in negotiations, potentially dictating terms and pricing, thereby diminishing Citi Trends' ability to exert significant pressure.

- Supplier Dependence: Smaller manufacturers often depend on Citi Trends for a substantial portion of their revenue, increasing Citi Trends' bargaining power.

- Brand Diversification: Larger, established brands have multiple sales channels, reducing their reliance on any single retailer like Citi Trends.

- Market Share: Citi Trends' $1.7 billion in net sales for fiscal year 2024 highlights its significant purchasing volume, which can be a negotiating tool with less diversified suppliers.

- Brand Power: The market power of a supplier's brand can significantly influence the negotiation dynamic, often outweighing the retailer's size for globally recognized names.

The bargaining power of suppliers for Citi Trends is generally low due to the fragmented nature of the apparel and home décor markets. With thousands of manufacturers globally, especially for private label goods, Citi Trends can easily switch suppliers, limiting individual supplier leverage. For example, the global apparel market in 2024 comprised numerous manufacturers, many serving multiple brands, which inherently dilutes the power of any single entity.

However, this can change if a supplier offers a unique, in-demand product or controls a significant trend, granting them temporary leverage. Citi Trends' strategy of sourcing both branded and private label items provides crucial flexibility to manage these relationships and mitigate supplier power. The company's extensive network of over 590 stores, contributing to $1.7 billion in net sales in fiscal year 2024, makes it a vital sales channel for smaller suppliers, thereby strengthening Citi Trends' negotiating position.

| Factor | Impact on Citi Trends | Supporting Data (2024) |

| Supplier Concentration | Low | Thousands of global apparel manufacturers |

| Switching Costs | Low | Availability of similar products from multiple sources |

| Forward Integration Threat | Low | High capital and operational requirements for retail |

| Supplier Dependence | Mixed (High for small, Low for large brands) | $1.7 billion in net sales (Citi Trends' purchasing volume) |

What is included in the product

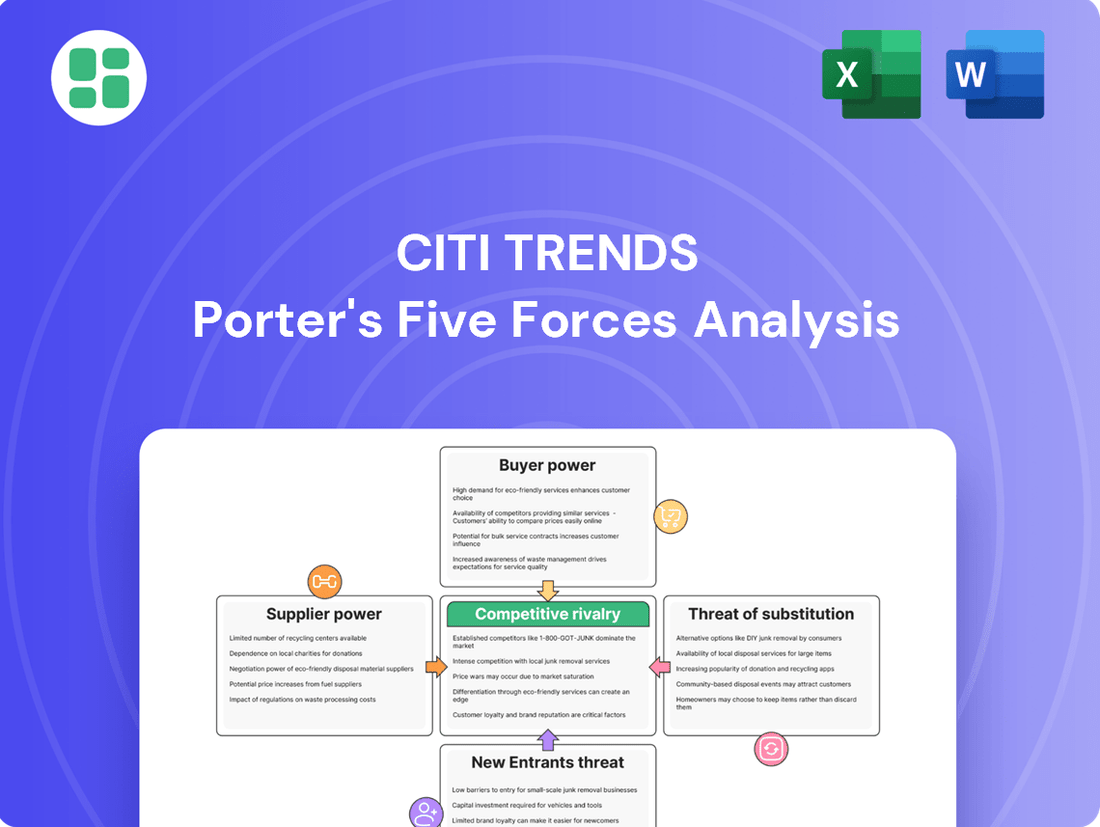

This analysis of Citi Trends reveals the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Quickly identify and address competitive threats by visualizing the intensity of each of Porter's Five Forces for Citi Trends.

Gain actionable insights into market dynamics by seeing how changes in buyer power or supplier leverage directly impact Citi Trends' profitability.

Customers Bargaining Power

Citi Trends' customer base is predominantly composed of individuals in urban and underserved areas who are highly attuned to pricing. This means that the cost of goods is a major driver of their purchasing behavior, making them very sensitive to price changes.

These customers actively hunt for promotions and markdowns, demonstrating that price is a paramount consideration when they decide to buy. For instance, in 2023, the average consumer spent approximately 15% more on essential goods due to inflation, a trend that directly impacts how they evaluate apparel retailers like Citi Trends.

Furthermore, prevailing economic conditions, including rising inflation rates and cost-of-living pressures, intensify this price sensitivity. Consumers are increasingly compelled to seek out the best value for their money, making Citi Trends' ability to offer competitive pricing crucial for maintaining its market position.

Customers at Citi Trends face a highly competitive landscape with many readily available substitutes for value-priced apparel and home décor. Retailers like Ross Dress for Less, TJ Maxx, and Burlington, alongside online giants such as SHEIN and Amazon, offer similar product categories. This abundance of choice means customers can easily shift their spending if they find better prices or trends elsewhere, significantly amplifying their bargaining power.

For consumers, the cost of switching from Citi Trends to another apparel retailer is incredibly low. It typically involves nothing more than walking into a different store or navigating a new website. This ease of transition means customers can quickly shift their spending if they find better deals or a wider variety of products elsewhere, directly impacting Citi Trends' ability to retain them.

This minimal switching cost significantly empowers customers. They can easily compare prices and offerings across various retailers, forcing companies like Citi Trends to remain competitive. In 2023, the apparel retail sector saw intense price competition, with many brands offering discounts exceeding 30% to attract and retain shoppers, a direct consequence of low switching costs.

Customer Information and Transparency

In the current retail landscape, customers wield significant influence due to readily available online information. Price comparison websites, product reviews, and detailed specifications empower shoppers to pinpoint the most advantageous offers. This heightened transparency directly increases their bargaining power, enabling them to readily switch between retailers if pricing or value propositions are not met.

This trend is particularly impactful for value-oriented retailers like Citi Trends. For instance, in 2024, a significant portion of retail sales are influenced by online research. A survey indicated that over 70% of consumers compare prices online before making a purchase, a figure that has steadily climbed year over year. This means customers can easily assess if Citi Trends' pricing is competitive against other apparel providers.

- Informed Purchasing Decisions: Customers leverage online platforms to compare prices, read reviews, and gather product details, leading to more informed purchasing decisions.

- Price Sensitivity: The ease of price comparison makes consumers more sensitive to pricing differences, pressuring retailers to offer competitive rates.

- Brand Loyalty Erosion: Increased transparency can lead to a decrease in brand loyalty as customers are more willing to switch to competitors offering better value.

- Impact on Retailers: Retailers like Citi Trends must focus on competitive pricing and value-added services to retain customers in this transparent market.

Customer Volume and Purchase Frequency

While individual transactions at Citi Trends might be modest, the retailer's success hinges on a substantial volume of purchases from its core customer base. The sheer number of repeat buyers translates into considerable collective leverage.

A small fluctuation in the buying patterns of this large customer group can notably influence Citi Trends' overall sales figures and profit margins. This highlights the sensitivity of the business to customer loyalty and purchasing frequency.

- High Transaction Volume: Citi Trends thrives on a large number of individual sales, demonstrating the importance of consistent customer traffic.

- Repeat Purchase Dependence: The company's business model relies heavily on customers returning frequently to make purchases, building a stable revenue stream.

- Impact of Shifting Habits: Even minor changes in the collective purchasing behavior of its customer base can have a material effect on Citi Trends' financial performance.

- Value Proposition Focus: By emphasizing everyday value, Citi Trends actively works to foster consistent engagement and encourage ongoing purchases from its target demographic.

Citi Trends faces significant bargaining power from its price-sensitive customer base, particularly those in urban and underserved areas. These consumers actively seek promotions and are heavily influenced by economic factors like inflation, which was around 3.4% year-over-year in the US as of May 2024, impacting their purchasing decisions.

The ease with which customers can switch between retailers, coupled with readily available online price comparisons, further amplifies their leverage. For instance, in 2023, the apparel retail sector saw widespread discounts, with many brands offering sales exceeding 30% to attract shoppers, a direct result of this low switching cost and increased transparency.

This environment necessitates that Citi Trends maintain competitive pricing and a strong value proposition to retain its large, high-volume customer base, as even minor shifts in collective purchasing behavior can significantly impact sales and profit margins.

| Factor | Impact on Citi Trends | Supporting Data (2023-2024) |

|---|---|---|

| Price Sensitivity | High | US inflation ~3.4% (May 2024); Consumers prioritize value. |

| Switching Costs | Low | Easy access to online comparisons and multiple competitors. |

| Information Availability | High | Over 70% of consumers compare prices online before purchase. |

| Customer Volume | High | Success depends on repeat purchases from a large base. |

| Competitive Discounts | Significant Pressure | Apparel discounts often exceeded 30% in 2023. |

What You See Is What You Get

Citi Trends Porter's Five Forces Analysis

This preview displays the complete Citi Trends Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the retail apparel industry. You're looking at the actual document; once your purchase is complete, you'll gain instant access to this exact, professionally formatted file detailing threats from new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitute products.

Rivalry Among Competitors

The value-priced retail sector, especially for apparel and home goods, is intensely competitive. Citi Trends faces a crowded market with many participants, including major off-price retailers like Ross Stores, TJ Maxx, and Burlington, alongside dollar stores and rapidly growing online fast fashion brands.

This broad array of competitors, each vying for the same budget-conscious customer, significantly escalates the rivalry. For instance, in 2024, the off-price retail segment continued its robust growth, with companies like TJX Companies reporting strong sales figures, demonstrating the market's attractiveness and the pressure on players like Citi Trends.

The overall apparel market is projected for modest growth, likely in the low single digits, through 2025. This slow expansion can heat up competition as businesses fight for market share in a gradually growing market.

However, the off-price retail sector, where Citi Trends operates, has demonstrated notable resilience and continued expansion. This suggests that Citi Trends is positioned within a more promising segment of the broader apparel industry.

Product differentiation in the value-priced apparel and home décor sector is inherently difficult, as many offerings are quite similar, and price often dictates consumer choice. Citi Trends aims to stand out by concentrating on urban fashion trends, carefully selecting both branded and private label items, and situating its stores within communities.

High Fixed Costs and Exit Barriers

Citi Trends operates in an industry characterized by substantial fixed costs. These include expenses for store leases, maintaining inventory, and the general operational infrastructure necessary for a retail business. For instance, in 2024, retailers often face escalating lease costs, which can represent a significant portion of their overhead.

The presence of high exit barriers further intensifies competitive rivalry. Long-term lease agreements and the challenge of selling off excess inventory without incurring substantial losses can trap companies in the market. This forces businesses like Citi Trends to continue competing aggressively, even when market conditions are unfavorable, to mitigate further financial damage.

- High Fixed Costs: Retailers like Citi Trends incur significant expenses for store leases, inventory, and operational setup.

- Exit Barriers: Long-term leases and inventory liquidation challenges make it difficult and costly for companies to leave the market.

- Aggressive Competition: These factors compel businesses to remain competitive, even during downturns, to avoid greater losses.

- Industry Pressure: The retail sector's cost structure inherently fuels a competitive environment.

Strategic Stakes and Aggressiveness of Competitors

The off-price and value retail sector is characterized by intense rivalry, with competitors frequently engaging in aggressive pricing and rapid expansion. This is evident in the consistent increases in customer traffic observed at major off-price chains.

Companies in this space are constantly refining their supply chains and product assortments to capture and hold onto price-sensitive shoppers, fueling a highly competitive environment.

- Aggressive Pricing: Leading off-price retailers, such as TJX Companies and Ross Stores, have demonstrated sustained revenue growth, with TJX reporting net sales of $50.5 billion for fiscal year 2023, indicating strong customer response to their value proposition.

- Expansion Strategies: Competitors are actively opening new stores; for example, Ross Stores planned to open approximately 100 new stores in fiscal year 2024, underscoring a commitment to market penetration.

- Supply Chain Optimization: Retailers are investing in logistics and inventory management to ensure a consistent flow of desirable merchandise at attractive price points, a critical factor in retaining market share.

- Product Assortment: The ability to offer a constantly changing selection of branded goods at significant discounts remains a key differentiator, requiring agile sourcing and merchandising capabilities.

Competitive rivalry is a significant force for Citi Trends, operating in the value-priced apparel and home goods sector. This market is crowded with numerous players, including large off-price retailers like TJ Maxx and Burlington, as well as dollar stores and online fast fashion brands, all targeting the same budget-conscious consumer.

The intense competition is further fueled by high fixed costs associated with retail operations, such as store leases and inventory management, alongside substantial exit barriers like long-term lease commitments. These factors compel companies to compete aggressively to avoid greater losses, as seen in the consistent growth and expansion strategies of competitors like Ross Stores, which planned to open around 100 new stores in fiscal year 2024.

Product differentiation is challenging in this segment, with price often being the primary driver for consumers. Citi Trends attempts to differentiate by focusing on urban fashion trends and curated merchandise, but the overall market pressure remains high, especially as the broader apparel market is expected to see only modest growth through 2025.

| Competitor Type | Key Players | 2024/2025 Market Dynamics |

| Off-Price Retailers | TJ Maxx, Ross Stores, Burlington | Continued robust growth; TJX Companies reported net sales of $50.5 billion for fiscal year 2023. Ross Stores planned ~100 new stores in FY2024. |

| Dollar Stores | Dollar General, Dollar Tree | Expanding market share, particularly in value segments. |

| Online Fast Fashion | Shein, Temu | Rapidly growing, impacting traditional retail through aggressive pricing and trend adoption. |

| Traditional Apparel Retailers | Various brands and department stores | Facing pressure to compete on price and value. |

SSubstitutes Threaten

The primary substitutes for Citi Trends' brick-and-mortar stores are the ever-expanding online shopping channels. These include not only the e-commerce platforms of direct competitors but also massive online marketplaces like Amazon and eBay, which offer an immense variety of apparel and accessories. Furthermore, the rise of direct-to-consumer (DTC) brands selling exclusively online presents a significant alternative for shoppers.

These digital alternatives provide unparalleled convenience, allowing consumers to shop anytime, anywhere, and often with faster delivery options. While the ease of online shopping is a powerful draw, it's important to note that physical retail still holds its appeal, particularly for customers who value the immediate gratification of taking items home, trying on clothes, and the tactile experience of assessing quality before purchase. For instance, in 2024, online retail sales are projected to continue their upward trajectory, capturing an increasing share of the apparel market, though physical stores remain crucial for brand engagement and immediate sales.

The rise of second-hand and resale markets poses a significant threat to retailers like Citi Trends. These channels offer value-priced apparel and home décor as direct substitutes for new merchandise. For instance, the resale apparel market is projected to grow significantly, with some estimates suggesting it could reach $77 billion by 2025, indicating a substantial shift in consumer spending habits.

The rise of Do-It-Yourself (DIY) and upcycling presents a growing threat of substitutes for retailers like Citi Trends, especially in home décor and apparel. Consumers increasingly turn to creating their own items or repurposing old ones, bypassing traditional retail channels. This trend is fueled by a desire for personalization and cost savings, particularly among younger, more creative demographics.

Rental Services for Apparel

While not a significant threat for everyday wear, the apparel rental market, particularly for special occasions and fast fashion, presents a potential long-term challenge for traditional retailers like Citi Trends. This model allows consumers to access trendy items without the upfront cost of ownership. For instance, by mid-2024, the global online clothing rental market was projected to reach approximately $2.4 billion, indicating growing consumer interest in this alternative consumption model.

The expansion of rental services into more casual and everyday wear could erode demand for outright purchases. This shift would require retailers to adapt their value propositions. Reports from 2023 highlighted that a notable percentage of Gen Z consumers expressed openness to renting clothing for daily use, signaling a potential market evolution.

- Apparel rental services are growing, especially for special occasions.

- The global online clothing rental market was estimated to be worth around $2.4 billion by mid-2024.

- A growing segment of younger consumers, particularly Gen Z, are showing interest in renting clothes for everyday wear.

Customers Opting for Fewer Purchases

During periods of economic strain, like the inflation experienced in 2023 and continuing into 2024, consumers often tighten their belts. This means they might buy fewer new clothes or other discretionary items, choosing to make do with what they have or purchase less frequently. This general reduction in spending across the board acts as a significant substitute for specific retail purchases.

For instance, if a consumer decides to postpone buying a new outfit due to rising living costs, they are effectively substituting that purchase with keeping their existing wardrobe or opting for less frequent shopping trips. This behavioral shift directly impacts sales volumes for retailers like Citi Trends.

- Reduced Discretionary Spending: Inflationary pressures in 2023 and 2024 have led many consumers to cut back on non-essential purchases.

- Behavioral Shift: Consumers are opting to buy fewer items overall, prioritizing necessities over new apparel.

- Impact on Retailers: This broad substitution effect directly affects sales volume and revenue for fashion retailers.

The threat of substitutes for Citi Trends is significant, primarily stemming from the convenience and variety offered by online retail channels and the growing appeal of resale markets. Consumers are increasingly turning to digital platforms and pre-owned goods, which directly compete with Citi Trends' traditional brick-and-mortar offerings.

| Substitute Category | Key Characteristics | Impact on Citi Trends | 2024 Data/Projections |

|---|---|---|---|

| Online Retail | Convenience, wide selection, competitive pricing | Diverts sales from physical stores | Online apparel sales continue to grow, capturing increasing market share. |

| Resale/Second-hand Market | Value-driven, sustainable option | Offers lower-priced alternatives to new merchandise | Projected to reach $77 billion by 2025, indicating substantial consumer shift. |

| Apparel Rental | Access to trendy items without ownership cost | Potential long-term challenge, especially for fast fashion | Global online clothing rental market estimated at $2.4 billion by mid-2024. |

Entrants Threaten

Launching a retail chain like Citi Trends demands significant financial backing. Think about securing leases for multiple store locations, stocking them with merchandise, and building a reliable supply chain. Citi Trends, for instance, has maintained a strong financial position with ample liquidity and no outstanding debt, which is a testament to managing these capital needs effectively. This substantial upfront investment creates a considerable hurdle for any new player looking to enter the market.

Established retailers like Citi Trends leverage significant economies of scale in purchasing, logistics, and marketing. This allows them to secure better pricing on inventory and operational costs, creating a substantial cost advantage. For instance, in 2023, Citi Trends reported a cost of goods sold of $1.08 billion, reflecting their ability to manage large volumes efficiently.

New entrants would find it incredibly challenging to replicate these cost advantages, especially in sourcing the discounted branded and private label merchandise that Citi Trends excels at. This initial hurdle makes competing on price a difficult proposition for any newcomer attempting to enter the value-oriented apparel market.

Citi Trends has cultivated strong brand recognition and a loyal customer following, especially within its core urban and multicultural demographics, over its operational history. This established presence makes it difficult for newcomers to quickly gain traction.

New competitors would require substantial financial outlay for marketing campaigns and considerable time to foster the same level of brand trust and customer loyalty that Citi Trends currently enjoys, presenting a significant hurdle to market entry.

Access to Distribution Channels and Supplier Relationships

New retailers entering the apparel market, particularly those targeting value-conscious consumers like Citi Trends, face significant hurdles in accessing prime distribution channels and forging strong supplier relationships. Securing desirable retail locations in target communities is paramount, and established players often have an advantage due to long-standing leases and brand recognition in those areas. For instance, in 2024, the retail vacancy rate in many urban and suburban centers remained a competitive factor, making it harder for newcomers to find accessible and high-traffic spots.

Building reliable supplier relationships is equally critical for ensuring a consistent and appealing product flow. Citi Trends has cultivated a robust supplier network over years of operation, allowing them to negotiate favorable terms and secure diverse merchandise. New entrants would need to invest considerable time and resources to establish similar connections, facing potential difficulties in securing inventory from key manufacturers who may already be committed to existing, larger clients. This can lead to higher initial inventory costs or limited product selection for emerging competitors.

- Distribution Channel Access: New entrants struggle to secure prime retail locations, often facing higher rental costs and limited availability in desirable areas where Citi Trends already has a presence.

- Supplier Relationships: Establishing strong ties with apparel manufacturers and distributors is challenging for newcomers, as established retailers like Citi Trends often have preferential agreements and volume discounts.

- Inventory Management: The ability to consistently source a wide range of merchandise at competitive prices is a barrier, as suppliers may prioritize existing relationships with retailers that offer predictable order volumes.

- Market Saturation: In many of Citi Trends' operating markets, the value apparel segment is already competitive, making it difficult for new entrants to gain market share without significant differentiation and investment in distribution and supply chain infrastructure.

Regulatory and Legal Barriers

While not as formidable as in heavily regulated sectors, new retail entrants like Citi Trends still encounter a spectrum of regulatory and legal hurdles. These include navigating zoning laws for store locations, obtaining necessary business licenses, and complying with labor regulations, which can significantly impact operational setup and costs. For instance, in 2024, the average time to obtain a business license in the U.S. can range from a few days to several weeks, depending on the specific municipality and business type, adding to the initial investment and complexity for new players.

Adhering to these requirements, particularly when expanding across multiple states, introduces considerable complexity and financial commitment. These compliance costs, though often perceived as a minor barrier compared to capital requirements, can still deter potential entrants by increasing the upfront investment and operational overhead. For example, state-specific labor laws, minimum wage requirements, and employee benefit mandates can vary significantly, requiring tailored compliance strategies.

- Zoning Laws: Retail businesses must comply with local zoning ordinances dictating where stores can operate, impacting site selection and expansion.

- Business Licensing: Obtaining federal, state, and local licenses and permits is a prerequisite for legal operation, with varying requirements and fees.

- Labor Regulations: Compliance with wage and hour laws, workplace safety standards (OSHA), and anti-discrimination statutes is essential and can be costly.

- Tax Compliance: Understanding and adhering to sales tax, income tax, and employment tax regulations across different jurisdictions adds administrative burden.

The threat of new entrants for Citi Trends is moderate. While the apparel retail sector is generally accessible, significant capital is needed for inventory, store leases, and supply chain development. Citi Trends' established economies of scale and brand loyalty also present considerable challenges for newcomers aiming to compete on price and customer trust in the value-oriented market.

Porter's Five Forces Analysis Data Sources

Our Citi Trends Porter's Five Forces analysis is built upon a robust foundation of data, integrating information from company financial statements, investor relations disclosures, and industry-specific market research reports. This comprehensive approach allows for a thorough evaluation of competitive rivalry, buyer and supplier power, and the threat of new entrants and substitutes.