CITIC Telecom International Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CITIC Telecom International Holdings Bundle

CITIC Telecom International Holdings operates in a dynamic telecom landscape, facing moderate threats from new entrants and intense rivalry among established players. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this market.

The full analysis reveals the strength and intensity of each market force affecting CITIC Telecom International Holdings, complete with visuals and summaries for fast, clear interpretation.

Ready to move beyond the basics? Get a full strategic breakdown of CITIC Telecom International Holdings’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The telecommunications sector's dependence on a select group of global suppliers for essential network hardware, like 5G infrastructure from companies such as Ericsson and Nokia, highlights a significant concentration of power. This limited supplier base means these vendors can wield considerable influence, particularly when it comes to advanced technologies and niche components.

For CITIC Telecom International Holdings, navigating these supplier relationships is crucial. The company needs to ensure it can secure competitive pricing and maintain access to the latest technological advancements. For instance, in 2024, the global 5G infrastructure market saw continued dominance by a few key players, with substantial R&D investments required to stay competitive, reinforcing the bargaining power of these equipment providers.

Changing core network infrastructure suppliers involves substantial financial investment, technical complexities, and operational disruptions for a telecommunications company like CITIC Telecom. These high switching costs significantly reduce CITIC Telecom's flexibility and consequently empower existing infrastructure and software suppliers.

The deep integration of current systems, often cemented by long-term contracts, further locks in these supplier relationships. For instance, a major network upgrade could cost billions of dollars, making frequent supplier changes economically unfeasible. In 2024, the global telecommunications infrastructure market saw continued investment, with companies prioritizing stability and reliability over frequent vendor shifts, reinforcing the bargaining power of established players.

Suppliers investing heavily in proprietary technologies, such as advanced AI for network management or next-generation optical fiber, possess greater leverage. CITIC Telecom's reliance on these innovations to enhance its service offerings and maintain competitiveness grants these high-tech suppliers considerable power. This is especially true as the industry progresses towards 5.5G and 6G technologies, demanding specialized components and expertise.

Access to Specific Spectrum and Licenses

Governments and regulatory bodies hold immense power through their control over essential spectrum licenses, which are critical for CITIC Telecom's mobile and wireless operations. Their decisions on license allocation, renewal terms, and associated fees directly influence the company's operational expenditures and future expansion plans. This indirect supplier relationship is characterized by exceptionally high, non-negotiable bargaining power.

For instance, in 2024, spectrum auctions continued to be a significant cost factor for telecom operators globally. While specific figures for CITIC Telecom's spectrum acquisition costs in 2024 are not publicly detailed, the trend shows substantial investment. In the UK, for example, the 5G spectrum auction in March 2024 raised £1.37 billion for the government, indicating the high value and cost associated with these essential assets.

- Government Control: Regulators dictate access to spectrum, a fundamental resource for telecom services.

- Cost Impact: License fees and allocation policies directly affect CITIC Telecom's operating costs.

- Strategic Influence: Government decisions on spectrum availability and renewal shape the company's growth strategies.

- High Bargaining Power: This indirect supplier power is exceptionally strong and generally non-negotiable.

Specialized Software and Cloud Service Providers

Specialized software and cloud service providers hold significant bargaining power over CITIC Telecom. This is particularly true for niche solutions in network management, cybersecurity, and advanced enterprise applications where a limited number of dominant players or highly specialized firms exist. For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, with a substantial portion driven by specialized software solutions, indicating the concentrated nature of this supplier segment.

As CITIC Telecom continues its strategic shift towards digital and intelligent services, its dependence on cloud infrastructure and AI platforms from hyperscalers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud is growing. This reliance increases the bargaining power of these providers, as CITIC Telecom needs their scalable and advanced capabilities to deliver its new service offerings. The cloud computing market, valued at over $600 billion globally in 2024, is dominated by a few major players, granting them considerable leverage.

- Dominant Cloud Providers: Hyperscalers like AWS, Microsoft Azure, and Google Cloud control a significant share of the global cloud infrastructure market, enabling them to set terms and pricing.

- Niche Software Expertise: Companies offering specialized network management or cybersecurity software often have unique, hard-to-replicate solutions, giving them strong bargaining leverage.

- Increasing Digital Reliance: CITIC Telecom's strategic focus on digital and intelligent services amplifies its dependence on these specialized software and cloud providers.

CITIC Telecom International Holdings faces significant bargaining power from its suppliers, especially in specialized hardware and software critical for its network infrastructure. The concentration of key technology providers, such as those supplying 5G equipment like Ericsson and Nokia, means these vendors can dictate terms due to high switching costs and the proprietary nature of their innovations.

The company’s increasing reliance on cloud services from hyperscalers like AWS, Microsoft Azure, and Google Cloud, which dominate the over $600 billion global cloud market in 2024, further amplifies supplier leverage. Similarly, specialized cybersecurity and network management software firms hold sway due to their unique, hard-to-replicate solutions.

Government control over essential spectrum licenses also represents a powerful, albeit indirect, supplier relationship. The substantial costs associated with spectrum acquisition, exemplified by the £1.37 billion raised in the UK's March 2024 5G auction, underscore the non-negotiable influence of regulators on CITIC Telecom's operational landscape.

| Supplier Type | Key Players Examples | Bargaining Power Factors | Impact on CITIC Telecom | 2024 Market Context |

|---|---|---|---|---|

| Network Hardware | Ericsson, Nokia | Concentrated market, proprietary tech, high switching costs | Affects pricing, access to latest tech | Continued dominance by few players in 5G infrastructure |

| Cloud Services | AWS, Microsoft Azure, Google Cloud | Dominant market share, essential for digital services | Influences pricing, service terms | Global market >$600 billion |

| Specialized Software | Cybersecurity, Network Management | Niche expertise, limited alternatives | Impacts operational efficiency, security | Cybersecurity market >$200 billion |

| Spectrum Licenses | Governments/Regulators | Exclusive control over essential resource | Dictates operational costs, expansion limits | Spectrum auctions remain significant cost drivers |

What is included in the product

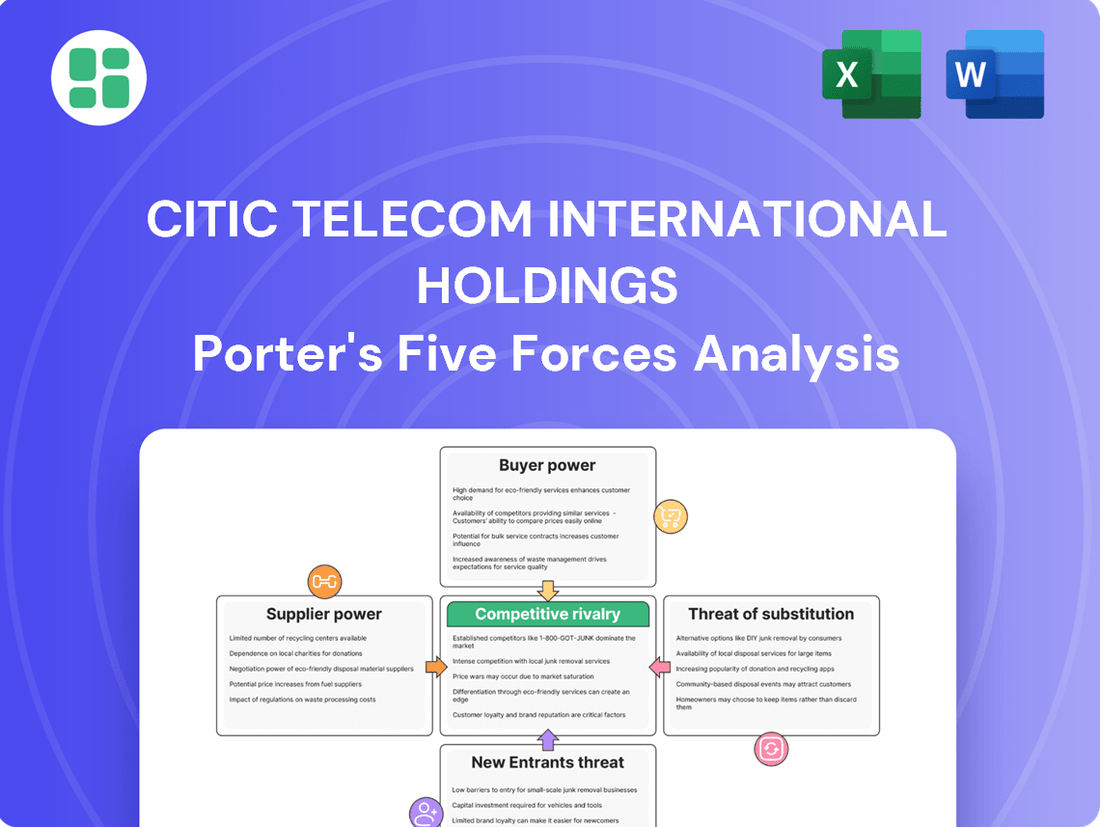

Tailored exclusively for CITIC Telecom International Holdings, analyzing its position within its competitive landscape by examining the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes.

Simplify complex competitive landscapes by visualizing CITIC Telecom International Holdings' Porter's Five Forces with a dynamic, interactive dashboard.

Gain immediate clarity on strategic vulnerabilities and opportunities within the telecommunications sector, enabling proactive responses to market shifts.

Customers Bargaining Power

CITIC Telecom International Holdings caters to a diverse customer base, including major global carriers, large multinational corporations (MNCs), and individual consumers. The bargaining power varies significantly across these segments.

Global carriers and MNCs typically wield greater negotiation leverage. Their substantial business volumes and the potential for customized service demands allow them to negotiate favorable terms and pricing. For instance, in 2023, CITIC Telecom’s wholesale business, which often involves large carrier agreements, represented a significant portion of its revenue, underscoring the importance of these relationships.

Individual users, while possessing less power individually, can collectively influence market dynamics. In highly competitive markets like Macau, where CITIC Telecom also operates, the aggregate demand of individual users can pressure providers on pricing and service quality. This collective influence is a key factor in maintaining competitive pricing structures.

For individual mobile and internet users, switching service providers can be relatively easy. Mobile number portability, a common feature in many markets, allows customers to keep their existing numbers when changing carriers. This, coupled with frequent competitive offers from rivals, significantly reduces the friction involved in changing providers.

This ease of switching directly enhances the bargaining power of individual consumers. It compels companies like CITIC Telecom to actively compete on price and to offer compelling value-added services to retain their customer base. For instance, in Macau's mobile market, where such dynamics are prevalent, providers must continuously innovate and offer attractive plans to maintain market share.

Core telecommunications services, like basic voice and data, are increasingly seen as commodities, making customers very sensitive to price. This is especially true for global carriers and large businesses needing wholesale capacity.

CITIC Telecom International Holdings feels this pressure to offer competitive rates, which can squeeze profit margins. For instance, global revenue from messaging services saw a decrease, highlighting this trend.

Availability of Multiple Service Providers

The availability of numerous service providers significantly amplifies customer bargaining power. For instance, in 2024, the global telecommunications market features a dense competitive landscape, with major players and regional specialists vying for market share.

Multinational corporations and large enterprises, in particular, can leverage this extensive choice to solicit competitive bids. They can easily switch providers if pricing or service levels are not met, forcing companies like CITIC Telecom to offer more favorable terms to retain their business.

This dynamic is evident in the increasing trend of bundled services and customized pricing models that providers are offering. Customers can compare not just basic connectivity but also value-added services like cloud integration and cybersecurity solutions across various vendors.

- Increased Negotiation Leverage: Customers can demand lower prices or better service agreements due to the presence of many alternatives.

- Price Sensitivity: The ease of switching makes customers more sensitive to price differences between providers.

- Customization Demands: Customers expect tailored solutions, pushing providers to innovate and adapt their offerings.

- Reduced Switching Costs: In many cases, the cost and complexity of switching telecom providers have decreased, further empowering customers.

Demand for Integrated and Customized Solutions

Multinational corporations and large enterprises are increasingly seeking comprehensive, adaptable, and secure Information and Communications Technology (ICT) solutions. This includes advanced services like cloud computing, robust cybersecurity, and Software-Defined Wide Area Networks (SD-WAN), moving beyond basic connectivity demands.

This evolving customer preference significantly shifts bargaining power towards these clients. They can now negotiate complex Service Level Agreements (SLAs) and demand highly customized solutions, compelling providers like CITIC Telecom to enhance their enterprise solution portfolios. For instance, in 2024, the global market for managed SD-WAN services was projected to reach over $10 billion, highlighting the scale of this integrated solutions trend.

- Growing demand for integrated ICT solutions: Enterprises prioritize bundled services like cloud, security, and connectivity.

- Customer leverage through complex SLAs: Large clients can dictate specific performance and security requirements.

- Need for tailored solutions: Generic offerings are insufficient; customization is key to meeting diverse business needs.

- CITIC Telecom's strategic response: Expansion of enterprise-focused offerings to cater to these sophisticated demands.

The bargaining power of customers for CITIC Telecom International Holdings is substantial, driven by market saturation and increasing customer sophistication. Large enterprises, in particular, can leverage their purchasing power and the availability of numerous providers to negotiate favorable terms and demand highly customized ICT solutions, including cloud and cybersecurity. This forces CITIC Telecom to offer competitive pricing and enhanced service packages to retain these valuable clients.

| Customer Segment | Bargaining Power Drivers | Impact on CITIC Telecom |

|---|---|---|

| Global Carriers & MNCs | High volume, customized demands, ease of switching | Pressure on pricing, need for tailored wholesale solutions |

| Large Enterprises | Demand for integrated ICT (cloud, security, SD-WAN), complex SLAs | Need for advanced enterprise solutions, negotiation on bundled services |

| Individual Consumers | Mobile number portability, competitive offers, price sensitivity | Focus on competitive retail pricing and value-added services |

What You See Is What You Get

CITIC Telecom International Holdings Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This preview accurately reflects the comprehensive Porter's Five Forces analysis of CITIC Telecom International Holdings, detailing the competitive landscape and strategic implications you will receive upon purchase. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing you with actionable insights into the industry's dynamics.

Rivalry Among Competitors

The telecommunications landscape is a crowded arena, with numerous large, established companies vying for market share. These competitors, both global giants and strong regional players, engage in fierce competition across mobile services, internet connectivity, and enterprise solutions. This intense rivalry puts pressure on pricing and innovation.

While CITIC Telecom International Holdings enjoys a dominant position in Macau, its global carrier and multinational corporation segments encounter formidable competition. This means that even with its strengths, the company must constantly adapt to a dynamic market where rivals are actively seeking to capture its customers and market opportunities.

The core connectivity services offered by telecommunications companies, such as basic voice and data transmission, have become largely commoditized. This means that the services are seen as interchangeable by customers, and price becomes the main factor in purchasing decisions. As a result, intense price competition is common, with companies employing aggressive pricing strategies to attract and retain customers. For instance, in 2024, average revenue per user (ARPU) for mobile data services in many developed markets remained under pressure due to this competitive landscape.

This commoditization directly impacts profitability, as shrinking margins on basic services necessitate a strategic shift towards higher-value offerings. Companies are actively pursuing diversification into areas like cloud services, cybersecurity, and managed network solutions. These newer, more specialized services offer greater potential for differentiation and improved profit margins, allowing businesses to seek sustainable growth beyond the increasingly competitive core connectivity market.

The telecommunications sector, including CITIC Telecom, is inherently capital-intensive. Significant investments are continuously needed for network infrastructure and technological advancements like 5G and fiber optics. These substantial upfront costs create high fixed expenses for operators.

This high fixed-cost structure pressures companies like CITIC Telecom to achieve high capacity utilization. To ensure a return on their massive investments, there's a constant drive to fill network capacity, often leading to aggressive pricing strategies and potential price wars as firms compete to attract and retain customers.

In 2023, global telecom capital expenditure was projected to reach over $220 billion, highlighting the industry's investment intensity. This scale of investment directly contributes to the high fixed costs faced by players like CITIC Telecom, intensifying the need for efficient capacity utilization to remain competitive.

Strategic Expansion into Value-Added Services

Competitive rivalry is heating up as companies move beyond basic telecom services into more advanced areas like cloud, cybersecurity, AI, and the Internet of Things (IoT). CITIC Telecom International Holdings is actively participating in this trend by focusing on integrated solutions such as 'AI+ Cloud, Network, Security' and smart city projects. This means competition is increasingly driven by who can offer the most innovative and comprehensive packages.

The landscape is shifting, with a greater emphasis on innovation and the ability to deliver integrated solutions. For instance, in 2024, the global cloud computing market was projected to reach over $1 trillion, highlighting the significant growth and competitive pressure in this segment. CITIC Telecom's strategic positioning in these growth areas is crucial for maintaining its competitive edge.

- Intensified Competition: Competitors are aggressively expanding into cloud computing, cybersecurity, AI, and IoT.

- CITIC Telecom's Strategy: Focus on 'AI+ Cloud, Network, Security' and smart city initiatives to counter rivalry.

- Innovation as a Differentiator: Success hinges on developing and offering integrated, innovative solutions.

- Market Growth: The global cloud market's projected growth in 2024 underscores the importance of these advanced service areas.

Geographical Market Dynamics

While CITIC Telecom International Holdings enjoys a commanding presence in Macau, its competitive environment shifts dramatically across its other international markets. The intensity of rivalry differs considerably, reflecting the varying maturity and structure of telecommunications sectors in different regions.

In Hong Kong, mainland China, and Southeast Asia, CITIC Telecom faces a more fragmented and dynamic competitive landscape. This is due to the presence of a multitude of established local operators and influential global telecommunications providers, each vying for market share and customer loyalty.

- Macau Dominance: CITIC Telecom holds a significant market share in Macau, creating a relatively stable competitive environment there.

- Hong Kong Competition: In Hong Kong, the company contends with major players like PCCW and SmarTone, who offer a wide array of services and aggressive pricing strategies.

- Mainland China Dynamics: Mainland China presents a complex competitive arena, with state-owned giants China Mobile, China Unicom, and China Telecom dominating, alongside emerging digital service providers.

- Southeast Asian Fragmentation: Southeast Asia's markets, such as Vietnam and the Philippines, feature numerous local operators like Viettel and PLDT, alongside regional heavyweights, leading to diverse competitive pressures.

Competitive rivalry within the telecommunications sector is exceptionally high, driven by commoditized core services and the ongoing race to innovate in advanced areas like AI and cloud. CITIC Telecom International Holdings, while strong in Macau, faces intense competition from global and regional players across its international operations, necessitating a strategic focus on integrated solutions to differentiate and maintain market share.

| Market Segment | Key Competitors | Competitive Intensity |

|---|---|---|

| Macau | Limited local players | Low to Moderate |

| Hong Kong | PCCW, SmarTone | High |

| Mainland China | China Mobile, China Unicom, China Telecom | Very High |

| Southeast Asia | Viettel, PLDT, regional operators | High |

SSubstitutes Threaten

Over-the-top (OTT) communication services present a significant threat to CITIC Telecom International Holdings. Applications such as WhatsApp, WeChat, and Zoom provide voice and messaging functionalities over the internet, often at no or very low cost. This directly competes with and substitutes traditional mobile voice and SMS services, which have historically been a core revenue stream for telecom operators.

This substitution trend directly impacts CITIC Telecom's revenue from legacy services. For instance, the global mobile messaging market, heavily influenced by OTT players, is projected to see continued growth in user adoption of these alternative platforms. This necessitates that CITIC Telecom actively innovates its mobile value-added services and focuses on expanding its data offerings to remain competitive and generate new revenue streams.

Large multinational corporations are increasingly exploring private networks and direct connectivity, like satellite internet solutions, to manage their internal communications. This trend allows them to bypass traditional telecom providers for certain services, potentially impacting CITIC Telecom's enterprise business segment. For instance, companies might choose dedicated fiber optic lines or even private 5G networks for enhanced security and control over their data transmission.

The rise of alternative connectivity options presents a significant threat of substitutes for CITIC Telecom. Companies like SpaceX with its Starlink service are offering global broadband internet access via satellite, which could be an alternative for businesses needing connectivity in remote areas where traditional infrastructure is lacking. This directly competes with the managed network services that CITIC Telecom provides to its enterprise clients.

In 2024, the demand for customized and secure network solutions continues to grow, pushing enterprises to evaluate all available options. While CITIC Telecom offers robust solutions, the increasing availability and improving cost-effectiveness of direct connectivity and private network builds mean that some clients might find these alternatives more appealing for specific use cases, thereby reducing their reliance on standard carrier services.

Fixed Wireless Access (FWA), particularly leveraging 5G, is emerging as a strong substitute for traditional cable and fiber broadband. While CITIC Telecom International Holdings offers both, other providers are increasingly pushing FWA solutions. This trend could divert customers, especially in regions where fiber deployment is slower, impacting CITIC Telecom's market share in fixed broadband.

Cloud-Based Communication and Collaboration Tools

The increasing adoption of cloud-based communication and collaboration tools presents a significant threat of substitution for traditional enterprise voice and data services. Platforms like Microsoft Teams and Google Workspace offer integrated voice, video, and data sharing, directly competing with core offerings from telecom providers.

These unified communication solutions can replace the need for separate, dedicated voice and data lines, forcing companies like CITIC Telecom to adapt. For instance, by mid-2024, it's estimated that over 300 million people actively use Microsoft Teams daily, highlighting the scale of this shift.

- Integrated Functionality: Cloud platforms bundle voice, video conferencing, instant messaging, and file sharing, offering a one-stop solution.

- Cost-Effectiveness: Many businesses find these cloud-based services more cost-effective than maintaining separate legacy communication systems.

- Scalability and Flexibility: The ability to easily scale services up or down to meet changing business needs is a key advantage over traditional infrastructure.

- Competitive Pressure: CITIC Telecom must either integrate similar unified communication capabilities into its portfolio or risk losing market share to these agile, software-centric competitors.

Emerging Technologies and Decentralized Connectivity

Emerging technologies are poised to challenge traditional connectivity models. Advanced satellite internet constellations, like Starlink, which saw significant expansion in 2024, offer high-speed internet access directly to consumers and businesses, bypassing the need for extensive terrestrial infrastructure. This presents a potential substitute for CITIC Telecom's traditional services.

Decentralized mesh networks, another burgeoning area, could enable peer-to-peer communication and data sharing without relying on centralized carriers. While still in early development, the potential for these networks to provide alternative connectivity solutions, particularly in underserved areas, represents a long-term threat to established players.

- Satellite Internet Growth: By early 2024, Starlink had deployed over 5,000 satellites, reaching more than 3 million users globally, demonstrating a tangible alternative for internet access.

- Mesh Network Potential: Projects focusing on decentralized wireless technologies reported increased research and development funding in 2024, indicating a growing interest in these non-traditional connectivity methods.

- Disruption of Traditional Models: The increasing viability of these substitutes could lead to reduced demand for traditional fixed-line and mobile services offered by companies like CITIC Telecom, impacting market share and revenue streams.

Over-the-top (OTT) services like WhatsApp and Zoom directly substitute traditional voice and SMS, eroding a key revenue source for CITIC Telecom. The global mobile messaging market, dominated by these platforms, continues to grow, forcing CITIC Telecom to innovate its mobile offerings and focus on data services.

Emerging technologies like satellite internet, with services such as Starlink, offer high-speed connectivity, bypassing traditional infrastructure. By early 2024, Starlink had deployed over 5,000 satellites and served more than 3 million users, presenting a tangible alternative for internet access, particularly in remote regions.

Cloud-based collaboration tools, including Microsoft Teams, are replacing dedicated enterprise voice and data lines. By mid-2024, over 300 million daily active users on Microsoft Teams underscore the significant shift towards integrated, cost-effective, and scalable communication solutions.

| Substitute Technology | Impact on CITIC Telecom | Key Growth Driver (2024) |

| OTT Communication Services | Reduced revenue from voice/SMS | Increasing user adoption of free/low-cost internet-based communication |

| Satellite Internet (e.g., Starlink) | Competition for managed network services, especially in underserved areas | Expansion of satellite constellations and user base |

| Cloud Collaboration Platforms (e.g., Microsoft Teams) | Substitution of traditional enterprise voice and data lines | High daily active user numbers and integrated functionality |

Entrants Threaten

The telecommunications sector demands substantial upfront capital for building and maintaining critical infrastructure like fiber optic networks and data centers. For instance, in 2024, the global telecom infrastructure market was valued in the hundreds of billions of dollars, with significant ongoing investment required for 5G expansion and upgrades. This enormous financial requirement acts as a formidable barrier, deterring most new players from entering the market.

The telecommunications sector, particularly for players like CITIC Telecom International Holdings, is heavily regulated. New entrants must navigate a complex maze of rules, including securing essential spectrum licenses which can be incredibly expensive and time-consuming. For instance, in 2024, many countries continued to auction 5G spectrum, with some auctions generating billions of dollars, demonstrating the significant upfront capital required.

Beyond spectrum, stringent data privacy laws, such as GDPR-like regulations being adopted globally, and diverse national and international telecommunications policies present substantial barriers. These compliance requirements demand considerable legal and technical expertise, adding to the cost and complexity of market entry. This intricate regulatory landscape effectively deters many potential new competitors from entering the market.

Established players like CITIC Telecom International Holdings leverage substantial economies of scale in their network operations, customer acquisition, and service delivery. For instance, in 2023, CITIC Telecom reported revenue of HKD 17.9 billion, indicating the scale of their existing operations.

New entrants face a significant hurdle in matching these cost efficiencies and the extensive network reach that CITIC Telecom has built. Achieving comparable economies of scale would necessitate enormous upfront capital investment, making it challenging for newcomers to compete effectively on price or service coverage.

Brand Loyalty and Established Customer Bases

Brand loyalty and established customer bases present a significant barrier to new entrants in the telecommunications sector, especially for companies like CITIC Telecom International Holdings. Incumbent operators often benefit from strong brand recognition and deep-rooted customer relationships, particularly in markets where they hold a dominant position, such as Macau. For instance, in 2024, CITIC Telecom's extensive network and long-standing presence likely translated into a substantial portion of its revenue being derived from loyal, repeat customers.

Newcomers would face the daunting task of not only matching existing service quality but also investing heavily in marketing and offering highly differentiated services to lure customers away from established providers. This requires substantial capital outlay and a compelling value proposition to overcome customer inertia and build trust from scratch.

Consider these points regarding brand loyalty:

- Strong Brand Recognition: Established players benefit from years of brand building, creating trust and familiarity.

- Customer Inertia: Switching providers can be inconvenient for consumers, leading them to stick with their current services.

- Loyalty Programs: Incumbents often offer loyalty rewards and bundled services that are difficult for new entrants to replicate cost-effectively.

- Market Dominance: In markets like Macau, CITIC Telecom's significant market share in 2024 means a large existing customer pool is less likely to switch without a compelling reason.

Technological Expertise and Talent Acquisition

The telecommunications industry, including companies like CITIC Telecom International Holdings, requires deep technological expertise. This spans critical areas such as advanced network engineering, robust cybersecurity protocols, the integration of artificial intelligence, and sophisticated cloud computing solutions. Newcomers would find it incredibly difficult to recruit and retain the highly specialized talent needed to build and maintain these complex systems.

Developing the cutting-edge research and development capabilities essential for innovation and competitive advantage presents another substantial hurdle for potential new entrants. Without this specialized knowledge and the talent to implement it, entering the market and challenging established players like CITIC Telecom would be a formidable task.

- High Demand for Specialized Skills: The telecommunications sector continually seeks experts in areas like 5G deployment, network virtualization, and data analytics.

- Talent Acquisition Costs: Companies like CITIC Telecom invest heavily in attracting and retaining top engineering and IT professionals, creating a high barrier to entry for new firms.

- R&D Investment: Significant capital is required for ongoing research into next-generation technologies, a commitment that new entrants may struggle to match.

The threat of new entrants for CITIC Telecom International Holdings is generally low due to high capital requirements for infrastructure, stringent regulatory hurdles like spectrum licensing that cost billions in 2024, and the need for specialized technological expertise. Established players benefit from significant economies of scale, with CITIC Telecom reporting HKD 17.9 billion in revenue in 2023, and strong brand loyalty, making it difficult for newcomers to compete on price or service coverage.

These barriers are amplified by the need for extensive R&D investment and the difficulty in acquiring specialized talent, which are critical for innovation in areas like 5G deployment. Consequently, the market entry for new telecommunications companies is significantly challenging, protecting incumbents like CITIC Telecom.

| Barrier Type | Description | Example (2024 Data where applicable) |

| Capital Requirements | High upfront investment for network infrastructure. | Global telecom infrastructure market valued in hundreds of billions; 5G spectrum auctions generating billions. |

| Regulation | Complex licensing and compliance. | Spectrum license costs, GDPR-like data privacy laws. |

| Economies of Scale | Cost advantages for established players. | CITIC Telecom's 2023 revenue of HKD 17.9 billion indicates operational scale. |

| Brand Loyalty | Customer retention for incumbents. | Established customer base in markets like Macau. |

| Technological Expertise | Need for specialized skills and R&D. | Demand for 5G engineers, cybersecurity experts; R&D for next-gen tech. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for CITIC Telecom International Holdings is built upon a foundation of verified data, drawing from the company's annual reports, investor relations materials, and official regulatory filings. This ensures a comprehensive understanding of their financial health and strategic positioning.

Furthermore, we incorporate insights from reputable industry publications, market research reports from firms like Gartner and IDC, and macroeconomic data to accurately assess the competitive landscape and identify key industry trends impacting CITIC Telecom International Holdings.