Catering International & Services SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Catering International & Services Bundle

Catering International & Services possesses unique strengths in its global reach and diversified service offerings, but also faces potential threats from intense competition and economic volatility. Understanding these internal capabilities and external pressures is crucial for navigating the dynamic catering and services market.

Want the full story behind Catering International & Services' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Catering International & Services (CIS) excels in providing services in remote and challenging environments, a significant strength that sets them apart. Their proven track record in difficult locations, such as offshore oil rigs and remote mining sites, demonstrates a unique capability few companies possess.

This specialization is crucial for sectors like oil and gas, mining, and defense, where consistent, high-quality catering and support services are essential despite logistical hurdles. CIS's ability to operate effectively in these demanding settings is a key differentiator, allowing them to secure contracts in markets with limited competition.

With over three decades of experience, CIS has cultivated an unparalleled understanding of the specific needs and operational complexities inherent in these isolated regions. This deep knowledge, built over years of successful project execution, translates into reliable and efficient service delivery, even in the most challenging circumstances.

Catering International & Services (CIS) distinguishes itself with a remarkably comprehensive and integrated service offering. This goes far beyond traditional catering, encompassing hospitality, facility management, and even the construction of living quarters for clients. This all-encompassing approach provides clients with true turnkey solutions.

The depth of CIS's integrated services is impressive, covering essential operational needs like technical maintenance, sophisticated flow management systems, vital wastewater treatment, and thorough cleaning services. This holistic provision ensures that clients’ remote or complex operational sites are fully supported, enhancing both workforce well-being and overall operational efficiency.

By delivering this full suite of services, CIS effectively liberates its clients to concentrate on their core business activities. For instance, in 2023, CIS reported a significant increase in its integrated service contracts, particularly in the energy and resources sector, where clients increasingly value consolidated support to streamline operations and reduce overheads. This strategy allows clients to focus on exploration, production, or other strategic imperatives, knowing their support infrastructure is expertly managed.

Catering International & Services showcased exceptional financial strength in 2024, achieving over €400 million in revenue, a remarkable 36% surge at constant currencies. The company also managed to double its EBITDA, demonstrating highly effective profitability strategies.

This robust financial performance is further bolstered by a positive outlook for 2025, suggesting continued financial health and growth. Key factors driving this success include securing significant new business and renewing contracts across various international markets.

Global Presence and Diversified Operations

Catering International & Services (CIS) boasts a significant global presence, operating across more than 20 countries and managing approximately 250 operational sites. This extensive network spans Africa, Eurasia, and South America, with Africa alone representing 50% of the company's business activities. Such a wide geographical spread is a key strength, effectively reducing the company's exposure to localized economic downturns or political instability.

The company’s strategic approach actively prioritizes geographical diversification and the expansion of its service offerings. This proactive strategy aims to ensure sustained growth and resilience by not being overly dependent on any single market or service line. For instance, in 2024, CIS continued to explore new markets in Asia and the Middle East, alongside strengthening its position in its core African markets.

- Global Reach: Operations in over 20 countries.

- Operational Scale: Manages approximately 250 operational sites.

- Geographic Focus: Africa accounts for 50% of activity, with expansion into Eurasia and South America.

- Diversification Strategy: Actively seeks to broaden geographical footprint and service range for sustained growth.

Commitment to Innovation and Sustainability

Catering International & Services (CIS) demonstrates a strong commitment to innovation, evident in its significant investments in cutting-edge technologies. By integrating digitalization, virtual reality for enhanced training, advanced air treatment systems, and bio-disinfection solutions, CIS has successfully launched 37 new services. This forward-thinking approach not only modernizes its offerings but also positions the company as a leader in adapting to evolving industry demands.

Beyond technological advancements, CIS places a high priority on sustainable development. This commitment is reflected in its focus on local employment, comprehensive staff training programs, and fostering partnerships with local suppliers. These initiatives not only strengthen community ties but also contribute to a more responsible and ethical business model.

The company's dedication to sustainability extends to active participation in community initiatives. By prioritizing local hiring and sourcing, CIS aims to reduce its environmental footprint and ensure greater transparency across its operations. This dual focus on innovation and sustainability provides a robust foundation for future growth and market differentiation.

- Innovation Investment: CIS has invested in digitalization, VR training, advanced air treatment, and bio-disinfection.

- New Services: The company has launched 37 new services as a result of its innovation efforts.

- Sustainability Focus: Prioritizes local hiring, staff training, and local supplier partnerships.

- Community Engagement: Actively participates in community initiatives to reduce environmental impact and enhance transparency.

Catering International & Services (CIS) possesses a significant competitive advantage through its specialization in providing services in remote and challenging environments. This expertise, honed over three decades, allows them to operate effectively in demanding sectors like oil and gas and mining, where consistent service delivery is paramount despite logistical complexities.

The company's integrated service model is another core strength, offering a comprehensive suite of solutions from catering and hospitality to facility management and even infrastructure construction. This turnkey approach simplifies operations for clients, allowing them to focus on their primary business objectives.

Financially, CIS demonstrated remarkable performance in 2024, with revenues exceeding €400 million, a 36% increase at constant currencies, and a doubling of EBITDA, indicating strong profitability and efficient management.

CIS's extensive global footprint, spanning over 20 countries and managing around 250 sites, provides resilience against localized economic fluctuations. Their strategic diversification into new markets and service offerings further solidifies this strength for sustained growth.

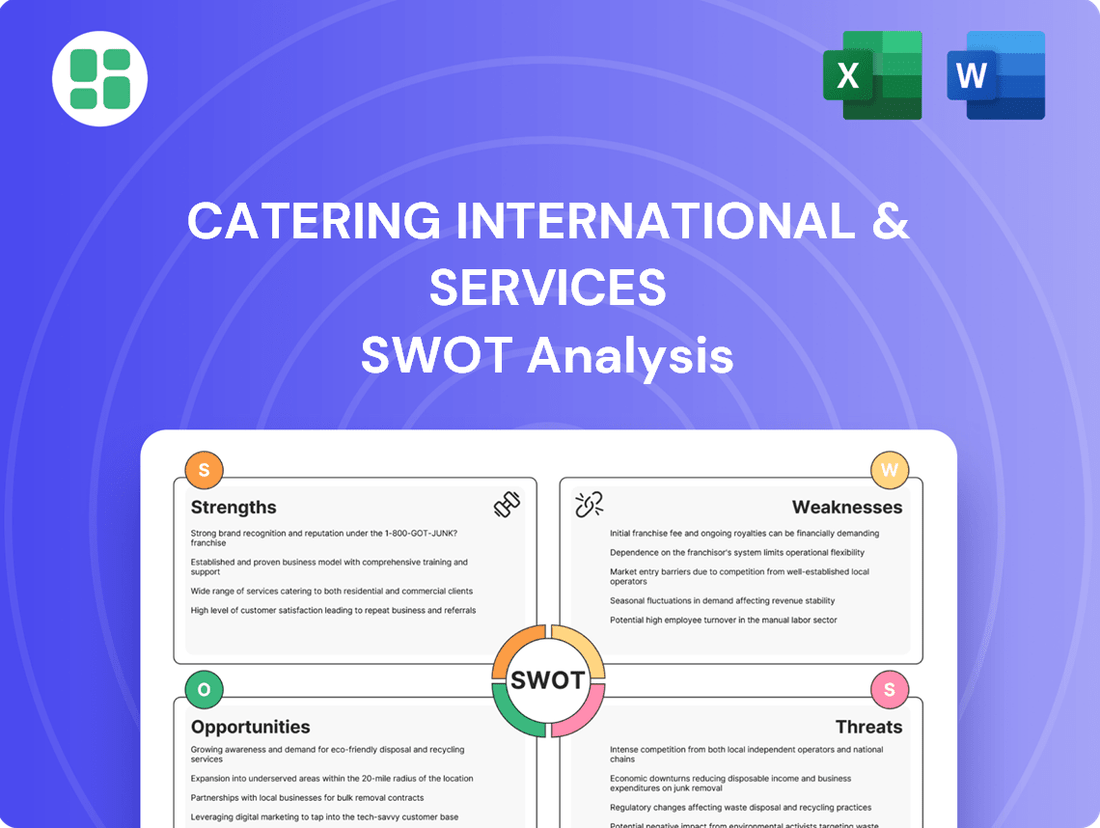

What is included in the product

Delivers a strategic overview of Catering International & Services’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable framework to identify and address potential operational disruptions and market vulnerabilities.

Weaknesses

Catering International & Services (CIS) faces a significant weakness due to its heavy reliance on sectors known for their volatility, such as oil and gas, mining, and defense. These industries are highly susceptible to fluctuations in commodity prices and geopolitical instability, directly affecting client spending on remote projects.

This inherent volatility can lead to unpredictable impacts on CIS's revenue streams, with potential for contract delays, reductions, or outright cancellations. For instance, a sharp downturn in oil prices, as seen periodically in 2023 and early 2024, can significantly curtail exploration and production activities, thereby reducing demand for catering and support services.

Catering International & Services faces considerable exposure to geopolitical and operational risks, especially when operating in challenging and remote environments. Regions with geopolitical instability, such as parts of Africa and Eurasia, pose significant security and logistical hurdles. For instance, in 2024, several African nations experienced heightened political tensions, impacting supply chains and personnel safety for companies with operations there.

These risks can directly lead to operational disruptions, as seen in instances where political unrest forced temporary shutdowns of service facilities. Furthermore, the necessity for enhanced security measures in these areas drives up operational costs. In 2023, companies operating in high-risk zones reported an average increase of 15% in security-related expenditures compared to more stable regions, directly affecting profitability.

Managing these multifaceted risks demands substantial resource allocation and unwavering vigilance. This includes investing in robust risk assessment frameworks, contingency planning, and maintaining strong relationships with local stakeholders to navigate potential challenges effectively. The ongoing volatility in certain markets means continuous adaptation is crucial for maintaining service continuity and protecting personnel and assets.

Catering International & Services (CIS) faces significant challenges from currency fluctuations, impacting its financial results. In 2024, the company reported a negative currency effect of €20.7 million, a continuation of the €32.9 million negative impact experienced in 2023. This volatility directly affects reported revenues and profitability, even when the core business operations perform well in constant currency terms.

High Operational Costs in Remote Areas

Providing comprehensive services in isolated and challenging locations inherently involves higher operational costs. This is due to complex logistics, transportation, infrastructure development, and the need to maintain specialized personnel. For instance, in 2024, the global logistics sector experienced a 7% increase in operating costs, driven by fuel price volatility and labor shortages, impacting companies like Catering International & Services (CIS) operating in remote regions.

While these elevated costs act as a barrier to entry for potential competitors, they also necessitate meticulous cost management for CIS to ensure profitability. This is particularly relevant given the inflationary pressures observed throughout 2024 and projected into 2025, which could further squeeze margins if not effectively controlled.

- Logistical Complexity: Increased expenses associated with transporting goods and personnel to remote sites.

- Infrastructure Demands: Costs for setting up and maintaining necessary facilities in areas lacking existing infrastructure.

- Specialized Workforce: Higher compensation and support costs for personnel willing to work in challenging environments.

- Supply Chain Vulnerability: Greater susceptibility to disruptions and price fluctuations in remote supply chains.

Potential for Intense Competition in Specific Segments

While Catering International & Services (CIS) excels in remote site management, its core catering and facility management services can encounter robust competition. Larger, more diversified contract catering firms and even agile local providers in less remote regions can leverage economies of scale or specialized local knowledge. For instance, in areas where CIS operates but which are not strictly remote, these competitors might offer more competitive pricing structures or unique service packages. This can put pressure on CIS's profit margins and potentially erode market share in these more accessible markets.

This competitive pressure is particularly relevant as the contract catering market continues to evolve. In 2024, the global contract catering market was valued at approximately $250 billion, with significant growth driven by demand for specialized services. CIS's niche in remote locations offers a clear advantage, but its ability to compete in more mainstream segments will depend on its cost-efficiency and service differentiation. For example, while CIS might have secured contracts in challenging environments, a competitor like Compass Group, with its vast global reach and diverse service portfolio, could potentially undercut CIS on price for standard catering services in non-remote industrial parks or corporate campuses.

- Intense Competition: CIS faces competition from large, generalized contract caterers and local providers in non-remote areas.

- Pricing Pressure: Competitors may offer lower prices due to economies of scale or local market efficiencies.

- Market Share Erosion: Accessible regions could see market share shifts if competitors present more attractive service models or pricing.

Catering International & Services (CIS) is susceptible to significant financial impacts from currency fluctuations. The company reported a negative currency effect of €20.7 million in 2024, following a €32.9 million negative impact in 2023. This volatility directly affects reported revenues and profitability, even when core operations perform well in constant currency terms.

Full Version Awaits

Catering International & Services SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear snapshot of Catering International & Services' strategic position. The full, detailed analysis awaits your purchase.

Opportunities

Catering International & Services (CIS) can capitalize on the increasing demand for remote site services in emerging markets and frontier regions. Growth in new resource discoveries and infrastructure development projects in these areas presents a significant opportunity for expansion.

Leveraging its established global presence and proven expertise, CIS is well-positioned to strategically diversify its geographical footprint. This expansion can tap into markets experiencing rapid development and a growing need for specialized support services.

Catering International & Services (CIS) has a significant opportunity to diversify into the rapidly expanding renewable energy and infrastructure sectors. These industries are experiencing substantial global investment, presenting a prime area for CIS to apply its established expertise in remote site development and comprehensive service provision.

The global renewable energy market is projected to reach over $1.9 trillion by 2030, with infrastructure spending also seeing robust growth. CIS can capitalize on this by offering its camp construction, catering, and facility management services to companies developing wind farms, solar parks, and large-scale transportation or utility projects in often remote locations.

This strategic pivot would not only tap into new revenue streams but also decrease CIS's dependence on the more volatile oil and gas and mining industries. Aligning with the global push for sustainability, this diversification positions CIS favorably for long-term growth and enhanced market relevance.

Catering International & Services can significantly boost its operational efficiency and customer service by investing further in advanced technologies. For instance, implementing AI for demand forecasting can optimize inventory management, potentially reducing waste by an estimated 5-10% in the 2024-2025 fiscal year, based on industry trends. Smart kitchen technologies can streamline food preparation, leading to faster service times and improved consistency.

Digital platforms for operational management offer real-time insights into service delivery, enabling quicker responses to client needs and better resource allocation. Innovation in virtual reality training for staff can improve onboarding efficiency and skill development, while advanced air treatment systems can enhance the ambiance and perceived quality of service, a key differentiator in the competitive catering market.

Strategic Acquisitions and Partnerships

Catering International & Services (CIS) has clearly stated its ambition to pursue strategic acquisitions, aiming to enhance its existing service portfolio and expand its global footprint. This proactive approach signals a commitment to inorganic growth as a key driver for future success.

By engaging in mergers or forming strategic alliances, CIS can unlock new revenue streams and gain entry into previously untapped markets. Such collaborations also offer the potential to integrate specialized technologies or acquire complementary service expertise, thereby accelerating market penetration and fortifying its competitive standing.

- Acquisition Focus: CIS actively seeks opportunities to acquire businesses that align with its strategic goals for service expansion and geographical reach.

- Market Access: Partnerships and mergers can provide immediate access to new customer segments and geographic regions, bypassing lengthy organic market entry processes.

- Capability Enhancement: The company can leverage acquisitions to integrate advanced technologies or specialized skills, thereby improving its service delivery and innovation capacity.

- Competitive Edge: By strategically combining resources and capabilities, CIS aims to solidify its market position and gain a significant advantage over competitors.

Increasing Demand for ESG-Compliant and Sustainable Solutions

As clients across various sectors increasingly focus on Environmental, Social, and Governance (ESG) factors, Catering International & Services' (CIS) dedication to sustainable development, local employment, and ethical operations positions it favorably. This growing client preference for sustainability offers a prime opportunity for CIS to attract new business by highlighting its strong ESG performance.

By actively promoting its ESG credentials, CIS can differentiate itself in the market and appeal to companies that prioritize aligning their supply chains with their own sustainability goals. This can lead to increased revenue streams and a stronger, more reputable brand image in the competitive catering and services industry.

For instance, a growing number of corporate clients are setting ambitious ESG targets. In 2024, a significant percentage of Fortune 500 companies reported on their ESG performance, and this trend is expected to accelerate through 2025. CIS's ability to demonstrate tangible progress in these areas, such as reducing food waste or increasing local sourcing, directly addresses this demand.

- Growing Market Share: The global sustainable food market is projected to reach over $200 billion by 2027, indicating substantial growth potential for companies like CIS that prioritize ESG.

- Client Acquisition: Companies with strong ESG ratings are increasingly favored by investors and consumers, creating a competitive advantage for CIS in securing new contracts.

- Brand Enhancement: Emphasizing sustainable practices can boost CIS's brand reputation, attracting not only clients but also top talent committed to corporate responsibility.

Catering International & Services (CIS) can leverage the increasing global investment in renewable energy and infrastructure projects. These sectors, particularly in remote locations, require extensive support services that align with CIS's core competencies. The company can also capitalize on its established global presence to expand into emerging markets with developing resource and infrastructure sectors, thereby diversifying its revenue streams away from more volatile industries.

Strategic acquisitions and partnerships offer a direct path to enhance CIS's service portfolio and broaden its geographical reach. By integrating new technologies and specialized skills through inorganic growth, CIS can accelerate its market penetration and strengthen its competitive position. Furthermore, CIS's commitment to Environmental, Social, and Governance (ESG) principles aligns with growing client demand for sustainable operations, presenting an opportunity to attract new business and enhance its brand reputation.

Threats

Geopolitical instability poses a significant threat to Catering International & Services (CIS). Operating in politically sensitive regions, such as parts of the Middle East and Africa where CIS has a presence, exposes the company to risks like armed conflicts and civil unrest. For instance, the ongoing conflicts in regions where CIS operates can lead to supply chain disruptions, impacting their ability to procure necessary goods and services, a challenge that has been amplified globally in 2024 due to various regional tensions.

Such instabilities can also directly endanger CIS personnel, necessitating increased security measures and potentially leading to higher operational costs. Furthermore, abrupt changes in government policies or the outbreak of hostilities can result in sudden contract terminations or operational suspensions. This was evident in 2024, where several multinational companies operating in conflict zones faced significant project delays and cancellations, directly impacting their revenue streams and requiring substantial contingency planning.

A significant portion of Catering International & Services (CIS) revenue is tied to the oil and gas and mining sectors. For instance, in 2023, these sectors represented a substantial percentage of CIS's client base, highlighting a direct dependency.

When commodity prices, such as oil and metals, experience sustained downturns, it directly impacts the operational budgets of CIS's key clients. This can lead to scaled-back exploration and project development, thereby reducing the need for essential support services like catering, which CIS provides.

This inherent link to commodity market cycles exposes CIS to considerable risk. A prolonged slump in oil prices, for example, could directly translate into a decrease in demand for CIS's services, impacting revenue streams.

The global catering and remote site services market, a sector where Catering International & Services (CIS) operates, is experiencing heightened competition. This isn't just from other niche players but also from larger, more diversified service companies entering the space. For instance, the broader global facilities management market, which often overlaps with remote site services, was valued at approximately $1.1 trillion in 2023 and is projected to grow, attracting more diverse competitors.

This intensified competition directly translates into significant pricing pressures for CIS. To win and retain contracts, especially in less specialized or more accessible operational areas, CIS may be compelled to reduce its profit margins. Reports from industry analysts in late 2024 indicated that companies in this sector are increasingly bidding on tighter margins, with some contract awards reflecting a 5-10% reduction in expected profitability compared to previous years, directly impacting CIS's ability to maintain its current pricing structures.

Regulatory Changes and Compliance Burden

Catering International & Services (CIS) operates in a global environment, making it susceptible to a patchwork of evolving international and local regulations. These can range from labor laws and environmental standards to stringent health and safety protocols. For instance, in 2024, the European Union continued to implement new directives concerning food safety and waste management, requiring significant operational adjustments for companies like CIS operating within its member states.

The burden of compliance can be substantial, demanding continuous monitoring and adaptation of business practices. Failure to adhere to these regulations can lead to hefty fines and legal challenges, impacting profitability and reputation. A 2025 report highlighted that the average cost of regulatory compliance for multinational service companies increased by 7% year-over-year, driven by new data privacy laws and stricter environmental mandates.

- Increased Compliance Costs: CIS faces escalating expenses to ensure adherence to diverse international and local regulatory frameworks.

- Operational Disruptions: Regulatory shifts necessitate costly and time-consuming changes to existing operational procedures and supply chains.

- Potential Penalties: Non-compliance can result in significant financial penalties and legal repercussions, impacting financial performance.

- Reputational Risk: Regulatory breaches can damage CIS's brand image and customer trust in the highly competitive catering services market.

Global Economic Downturns and Reduced Investment

A significant global economic downturn poses a substantial threat to Catering International & Services (CIS). A broad recession or slowdown could curtail capital expenditure across key sectors like energy, mining, and construction. This reduction in spending directly translates to fewer new projects requiring remote site services, impacting CIS's order intake and overall growth trajectory in its primary operational areas.

For instance, projections for global GDP growth in 2024 and 2025, while varied, indicate potential headwinds. The IMF, in its April 2024 World Economic Outlook, projected global growth at 3.2% for 2024, a slight slowdown from 2023, with risks tilted to the downside. A more severe contraction could see this figure significantly lower, directly affecting the demand for CIS's services.

- Reduced Project Pipeline: A global economic contraction typically shrinks the pipeline of new infrastructure and resource extraction projects, CIS's core markets.

- Lower Client Budgets: Companies facing economic pressure are likely to reduce their spending on support services, including catering and remote site management.

- Increased Competition for Fewer Projects: As opportunities diminish, competition for available contracts intensifies, potentially driving down margins for CIS.

The increasing complexity and stringency of global regulations present a significant hurdle for Catering International & Services (CIS). Navigating diverse legal landscapes, from labor laws to environmental mandates, requires constant vigilance and investment. For example, new data privacy regulations implemented in 2024 across several key markets have necessitated system overhauls, adding to operational costs.

The inherent volatility of commodity prices, particularly oil and gas, directly impacts CIS's revenue streams. A substantial portion of their business is tied to these sectors, meaning downturns in resource extraction projects lead to reduced demand for their services. In 2024, the fluctuating price of crude oil, often dipping below $75 per barrel at times, directly correlated with project deferrals in the energy sector, a key client base for CIS.

Intensifying competition within the remote site services market is another major threat. Larger, diversified companies are increasingly entering this niche, leading to pricing pressures and the potential erosion of profit margins for CIS. Industry analysis from late 2024 indicated that contract bids in some regions saw margins shrink by as much as 5-10% compared to previous years.

Geopolitical instability, particularly in regions where CIS operates, poses risks of supply chain disruption and operational halts. Ongoing conflicts in areas like the Middle East in 2024 have led to increased security costs and project delays for multinational corporations, directly affecting the demand for support services.

| Threat Category | Specific Risk | Impact on CIS | 2024/2025 Relevance |

| Regulatory Environment | Evolving International & Local Laws | Increased compliance costs, potential penalties, operational adjustments | New data privacy laws, stricter environmental standards driving up costs by an estimated 7% year-over-year in 2025 for multinational service firms. |

| Market Dependence | Commodity Price Volatility (Oil & Gas, Mining) | Reduced demand for services due to client budget cuts, project cancellations | Oil prices fluctuating, with some periods in 2024 seeing benchmarks below $75/barrel, leading to project deferrals in key CIS markets. |

| Competitive Landscape | Increased Competition & Pricing Pressure | Erosion of profit margins, difficulty in securing new contracts at favorable terms | Industry reports in late 2024 showed contract bids with 5-10% lower expected profitability compared to prior years. |

| Geopolitical Factors | Regional Instability & Conflict | Supply chain disruptions, personnel safety concerns, potential operational suspensions | Ongoing conflicts in 2024 amplified global supply chain vulnerabilities, impacting procurement for companies in sensitive regions. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Catering International & Services' official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic overview.