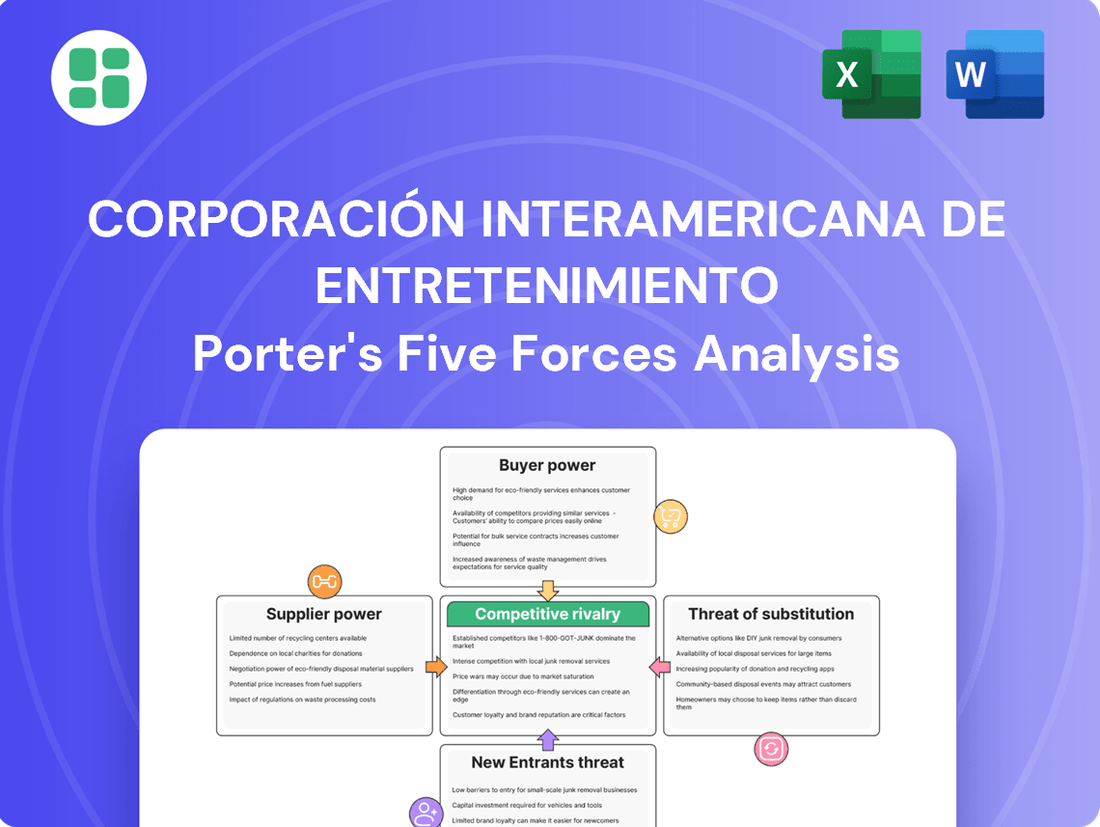

Corporación Interamericana de Entretenimiento Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corporación Interamericana de Entretenimiento Bundle

Corporación Interamericana de Entretenimiento (CIE) navigates a dynamic entertainment landscape where buyer power can be significant, and the threat of new entrants is a constant consideration. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Corporación Interamericana de Entretenimiento’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of unique and highly demanded artists is a significant factor for Corporación Interamericana de Entretenimiento (CIE). These performers are the core of live entertainment, and their exclusivity allows them to negotiate higher fees and better contract terms, directly affecting CIE's expenses and profit margins. For instance, in 2024, major international tours often saw artists demanding substantial percentages of ticket sales, sometimes exceeding 50%, especially for artists with a proven track record of selling out venues.

Venue operators, particularly those managing large or distinctive event spaces, wield significant influence. This is because finding suitable alternatives for major concerts and events can be challenging, especially in desirable urban centers or for high-demand dates. In 2024, rental costs for prime venues in major cities saw an average increase of 7% compared to the previous year, reflecting this scarcity.

Corporación Interamericana de Entretenimiento's (CIE) success in staging large-scale events directly depends on securing access to these venues. This reliance can translate into elevated rental fees and more rigid scheduling arrangements. For example, a key venue in Mexico City that CIE frequently utilizes experienced a 10% price hike for peak season bookings in 2024, impacting CIE's operational costs.

Specialized providers for sound, lighting, staging, and special effects hold significant influence. Their unique technical skills and proprietary equipment make them essential for high-quality events, and finding suitable replacements can be costly and time-consuming for Corporación Interamericana de Entretenimiento (CIE).

In 2024, the live entertainment and events sector continued to rely heavily on these specialized technical services. For instance, major concert tours and large-scale festivals often require bespoke staging and advanced lighting systems, where the expertise of a few key providers becomes paramount, directly impacting CIE's operational costs and flexibility.

Supplier Power 4

Ticketing platform providers, like Ticketmaster, hold significant sway due to their extensive distribution and advanced technology. CIE's reliance on these platforms, while offering broad reach, can lead to substantial service fees and diminished control over ticketing operations and customer data, directly affecting revenue.

The bargaining power of these ticketing platforms is evident in their ability to dictate terms and pricing. For instance, in 2024, major ticketing platforms continued to command significant percentages of ticket sales, impacting the net revenue for event organizers like CIE.

- High Service Fees: Platforms often charge a percentage of the ticket price, which can be a considerable cost for CIE.

- Control over Data: Limited access to customer data restricts CIE's ability to conduct direct marketing and build customer loyalty.

- Technological Dependence: CIE's operations are tied to the platform's infrastructure, making them vulnerable to any disruptions or changes in service.

- Limited Negotiation Leverage: Due to the consolidated nature of the ticketing market, CIE may have less power to negotiate favorable terms.

Supplier Power 5

Marketing and advertising agencies, especially those with deep expertise in the Latin American entertainment sector, wield significant influence. Their capacity to effectively promote events is crucial for CIE's success in driving attendance and securing sponsorships. Agencies possessing proven track records or specialized knowledge can therefore negotiate higher fees for their services.

The bargaining power of these specialized marketing agencies is amplified when they possess unique insights into consumer behavior within the target markets. For instance, agencies that can demonstrate a clear ROI through data-driven campaigns for similar entertainment events in regions like Mexico or Colombia can command stronger pricing power. In 2024, many of these agencies reported increased demand for their services, leading to an upward trend in their fee structures.

- Specialized Expertise: Agencies with proven success in promoting entertainment events in Latin America.

- Market Knowledge: Deep understanding of local consumer preferences and media consumption habits.

- Performance Metrics: Demonstrated ability to drive ticket sales and secure sponsorships through effective campaigns.

- Negotiating Leverage: The power to charge premium rates based on specialized skills and market insights.

Suppliers of unique talent, like highly sought-after artists, possess considerable bargaining power over Corporación Interamericana de Entretenimiento (CIE). Their drawing power allows them to command higher fees and favorable contract terms. For example, in 2024, top-tier artists often secured over 50% of ticket revenue for their performances.

Venue operators, especially for prime locations, also exert significant influence due to limited availability. This scarcity drives up rental costs for CIE. In 2024, rental fees for key venues in major Latin American cities saw an average increase of 7% year-over-year.

Specialized technical service providers, such as those for advanced sound and lighting, are critical for event quality. Their unique equipment and expertise make them difficult to replace, increasing their leverage. In 2024, the demand for these specialized services remained high, impacting CIE's operational costs.

Ticketing platforms, like Ticketmaster, hold substantial power due to their extensive reach and technology. Their high service fees and control over customer data can impact CIE's net revenue and marketing efforts. In 2024, these platforms continued to charge significant percentages of ticket sales.

What is included in the product

This analysis unpacks the competitive forces impacting Corporación Interamericana de Entretenimiento, detailing buyer and supplier power, threat of new entrants and substitutes, and the intensity of rivalry within the entertainment sector.

Instantly visualize the competitive landscape of the entertainment industry, pinpointing key pressures on Corporación Interamericana de Entretenimiento.

Gain a clear understanding of threats and opportunities, enabling proactive strategies to mitigate risks and capitalize on market dynamics.

Customers Bargaining Power

Individual event attendees, while numerous, generally have low bargaining power for highly anticipated or unique events. For instance, in 2024, tickets for major sporting events or concerts often sold out quickly, indicating inelastic demand where consumers are willing to pay higher prices.

However, this power shifts when entertainment options are abundant or events are less popular. In such scenarios, customers become more price-sensitive, readily comparing prices and opting for cheaper alternatives or demanding discounts, thereby increasing their leverage.

Corporate sponsors and advertisers hold considerable sway due to their substantial budgets and precise audience targeting needs, allowing them to negotiate favorable terms for sponsorship packages. For Corporación Interamericana de Entretenimiento (CIE), this translates to a direct impact on revenue generated from event marketing and sponsorships, as these powerful clients dictate terms based on their marketing objectives and financial commitments.

Amusement park visitors, a broad audience, generally possess moderate bargaining power. Their decisions hinge on elements like ticket costs, the array of attractions, and the overall park atmosphere. For Corporación Interamericana de Entretenimiento (CIE), this means a constant need to deliver compelling value to draw and keep patrons.

Customer Power 4

Customers seeking venue rentals for events like conventions or corporate gatherings often wield significant bargaining power, particularly in cities with numerous comparable options. This is evident for venues such as CIE's Citibanamex Center, where clients meticulously compare facilities, services, and pricing. For instance, in 2024, the average occupancy rate for convention centers in major metropolitan areas can fluctuate, influencing a venue's willingness to negotiate terms to secure bookings.

The ability for customers to switch to alternative venues easily, coupled with the potential for large-scale bookings, amplifies their leverage. Clients might demand customized packages or discounts, pushing CIE to remain competitive. The strategic importance of securing anchor tenants or large annual events can further empower these customers in negotiations.

- Customer Price Sensitivity: Event organizers often operate with strict budgets, making price a critical factor in venue selection.

- Availability of Substitutes: The presence of multiple convention centers and event spaces in key markets directly impacts customer bargaining power.

- Switching Costs: While not always high, the effort and potential disruption involved in changing venues can influence negotiation dynamics.

- Information Availability: Customers can readily access information on pricing and amenities from various venues, enabling informed comparisons.

Customer Power 5

The bargaining power of customers for Corporación Interamericana de Entretenimiento (CIE) is significantly influenced by the proliferation of digital entertainment options. Consumers now have an ever-expanding array of accessible and often more affordable choices, from streaming services to online gaming, directly competing with live events for leisure time and disposable income. This shift can make customers more discerning about the value proposition of attending a live event, potentially increasing their leverage in demanding better pricing or enhanced experiences.

In 2024, the global digital entertainment market continued its robust growth, with streaming services alone accounting for a substantial portion of consumer spending on entertainment. For instance, the Video-on-Demand (VOD) market was projected to reach hundreds of billions of dollars globally, demonstrating the sheer scale of these alternatives. This provides customers with a clear benchmark for entertainment costs, intensifying pressure on live event organizers like CIE to justify their ticket prices.

- Increased Competition: Digital platforms offer a vast and varied entertainment landscape, directly challenging the exclusivity of live events.

- Price Sensitivity: Customers can easily compare the cost of live events with digital alternatives, leading to heightened price sensitivity.

- Shifting Expectations: The convenience and personalization of digital entertainment can influence customer expectations for live event experiences.

- Reduced Switching Costs: For many entertainment choices, switching between providers or options is seamless, empowering customers to readily shift their spending.

The bargaining power of customers for Corporación Interamericana de Entretenimiento (CIE) is a multifaceted force, significantly shaped by the availability of substitutes and the price sensitivity of various customer segments. While individual attendees for high-demand events in 2024 showed limited power due to sold-out shows, those seeking venue rentals or attending less popular events found their leverage increased by abundant alternatives and the ease of price comparison. Corporate sponsors, with their substantial budgets, also wield considerable influence, dictating terms based on their marketing needs and financial commitments, directly impacting CIE's sponsorship revenue streams.

| Customer Segment | Bargaining Power Factors | Impact on CIE (2024 Context) |

|---|---|---|

| Individual Event Attendees | Low for popular events (inelastic demand); High for less popular events (price sensitivity, substitutes) | Ticket pricing and demand management are key. Quick sell-outs for major events in 2024 indicated strong customer desire despite price. |

| Corporate Sponsors | High (large budgets, specific targeting needs) | Negotiate favorable terms for sponsorship packages, directly affecting marketing revenue. |

| Venue Rental Clients | High (numerous comparable options, potential for large bookings) | Demand customized packages/discounts; CIE must remain competitive to secure bookings, especially for venues like Citibanamex Center. |

| Amusement Park Visitors | Moderate (dependent on ticket cost, attractions, atmosphere) | Requires continuous value delivery to attract and retain visitors. |

What You See Is What You Get

Corporación Interamericana de Entretenimiento Porter's Five Forces Analysis

This preview showcases the complete Corporación Interamericana de Entretenimiento Porter's Five Forces Analysis, reflecting the exact document you will receive immediately after purchase. The analysis meticulously details the competitive landscape, covering the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the entertainment industry. You're getting the full, professionally formatted report, ready for your immediate use without any placeholders or surprises.

Rivalry Among Competitors

Corporación Interamericana de Entretenimiento (CIE) operates in a Latin American live entertainment market marked by significant competitive rivalry. This landscape features a mix of dominant large-scale promoters and a multitude of smaller, regional players vying for market share.

Global powerhouse Live Nation, for instance, has strengthened its position by increasing its stake in OCESA, a significant former CIE asset. This strategic move intensifies competition for securing top-tier musical acts and desirable event locations across the region, driving up talent acquisition costs.

Corporación Interamericana de Entretenimiento (CIE) operates in a highly competitive landscape, facing intense rivalry from other integrated entertainment companies. These competitors, much like CIE, are involved in venue operations, event promotion, and managing a broad spectrum of entertainment experiences. For instance, in 2024, the live entertainment sector saw significant competition not only in music concerts but also in theatrical productions, major sporting events, and family-oriented shows, all vying for consumer attention and spending.

This broad scope of competition means CIE must constantly innovate and differentiate its offerings to stand out. The pressure to secure top talent, create unique experiences, and manage operational costs effectively is a constant challenge. Companies that can successfully blend diverse entertainment formats, from high-profile concerts to engaging family attractions, tend to capture a larger market share, as evidenced by the increasing diversification strategies observed across the industry in early 2024.

The entertainment sector's fragmented landscape means Corporación Interamericana de Entretenimiento (CIE) faces rivalry from niche promoters. These specialized entities, often focusing on specific music genres, local cultural festivals, or smaller-scale productions, collectively carve out a substantial portion of regional market share, even if they don't directly vie for the same global headliners.

For example, in 2024, the Latin American live entertainment market, where CIE is a major player, saw numerous independent festivals and local concerts thrive. While specific market share data for these smaller promoters is often not publicly disclosed, industry reports from 2023 indicated a growing trend of localized event popularity, suggesting these smaller players are increasingly capturing consumer spending on entertainment experiences.

Competitive Rivalry 4

Corporación Interamericana de Entretenimiento (CIE) faces intense competitive rivalry not just from direct entertainment providers but also from a broad spectrum of leisure activities vying for consumer discretionary spending. This includes cinemas, professional sports leagues, and cultural institutions, all competing for limited consumer leisure budgets.

To capture consumer attention and spending, CIE must differentiate its offerings and create compelling event experiences that stand out. This requires robust marketing strategies and a constant focus on delivering high-quality entertainment to attract and retain audiences.

- Broad Competition: CIE competes with numerous leisure options, from movie theaters to live sports and cultural events, all seeking a share of consumer entertainment budgets.

- Discretionary Spending Battle: The primary challenge is capturing disposable income that could be allocated to dining, travel, or other non-entertainment activities.

- Marketing Imperative: Effective marketing is crucial for CIE to highlight its unique value propositions and draw consumers away from alternative leisure pursuits.

Competitive Rivalry 5

While digital platforms and online content providers are often seen as substitutes, they also intensify competitive rivalry for Corporación Interamericana de Entretenimiento (CIE) by directly competing for consumer attention and entertainment spending. The burgeoning popularity of streaming video services and online gaming across Latin America means CIE faces a vast and growing array of digital alternatives for consumer leisure time and disposable income.

This digital competition is significant. For instance, the digital advertising market in Latin America was projected to reach over $15 billion in 2024, indicating a substantial portion of entertainment budgets being allocated to online channels. Companies like Netflix, Amazon Prime Video, and various gaming platforms are constantly innovating and expanding their content libraries, directly challenging CIE's traditional live entertainment offerings.

- Digital Entertainment Growth: Latin America's digital entertainment sector is experiencing rapid expansion, with streaming subscriptions and online gaming revenue showing consistent year-over-year increases.

- Consumer Attention Fragmentation: The proliferation of digital content providers fragments consumer attention, making it harder for live entertainment events to capture and retain audiences.

- Budget Allocation Shifts: Entertainment budgets are increasingly being diverted towards subscription-based digital services and in-game purchases, impacting the affordability and perceived value of live event tickets.

- Competition for Talent and Sponsorships: Digital platforms also compete with CIE for talent and sponsorship dollars, further intensifying the competitive landscape.

The competitive rivalry within the live entertainment sector, where Corporación Interamericana de Entretenimiento (CIE) operates, is exceptionally strong. This intensity stems from a diverse range of competitors, from global giants to localized niche promoters, all vying for consumer attention and spending. The pressure to secure premier talent and desirable venues is a constant factor, directly impacting operational costs and event success.

In 2024, the Latin American entertainment market saw significant competition not only in music concerts but also in other live events like sports and theater, all competing for a share of consumer leisure time and budgets. This broad competition necessitates continuous innovation and differentiation for CIE to maintain its market position.

The rise of digital entertainment further exacerbates this rivalry. Streaming services and online gaming platforms are increasingly capturing consumer attention and a portion of entertainment spending, presenting a formidable challenge to traditional live events. This trend means CIE must not only compete with other live entertainment providers but also with the vast digital content ecosystem.

| Competitor Type | Key Activities | Impact on CIE |

| Global Promoters (e.g., Live Nation) | Securing top-tier talent, large-scale event production | Increased talent acquisition costs, competition for prime venues |

| Integrated Entertainment Companies | Venue operations, event promotion across multiple genres | Direct competition for audience share and event types |

| Niche/Local Promoters | Specialized genre events, local festivals | Fragmented market share, competition for localized audiences |

| Digital Entertainment Platforms (e.g., Netflix, gaming) | Content streaming, online gaming, digital advertising | Diversion of consumer attention and spending, competition for sponsorship |

SSubstitutes Threaten

The most significant threat of substitutes for Corporación Interamerican de Entretenimiento (CIE) stems from the burgeoning in-home digital entertainment sector. Services like Netflix, Spotify, and a growing array of online gaming platforms offer consumers a vast and constantly updated library of content, often at a significantly lower price point than CIE's live events.

These digital alternatives provide unparalleled convenience and accessibility, allowing individuals to consume entertainment whenever and wherever they choose. For instance, global subscription video on demand (SVOD) revenues were projected to reach over $100 billion in 2024, highlighting the immense scale and appeal of these substitute offerings.

Alternative leisure activities, such as dining out, travel, and shopping, constantly vie for consumer discretionary income and free time. For instance, in 2024, consumer spending on experiences like travel and dining saw a notable increase, reflecting a desire for diverse entertainment options beyond large-scale live events.

These substitutes provide varied experiences that can satisfy entertainment needs, often at different price points and with greater flexibility than attending a major event. Local community events, in particular, offer accessible and often lower-cost alternatives, drawing away potential attendees from larger entertainment venues.

The rise of sophisticated virtual events, such as online concerts and festivals, poses a significant threat of substitution for traditional live entertainment. Post-pandemic, these digital alternatives offer unparalleled accessibility and convenience, often at a lower price point compared to in-person experiences.

While virtual events may not fully replicate the immersive atmosphere of live performances, their growing appeal, particularly among younger demographics, could siphon off demand. For instance, the global virtual events market was projected to reach $200 billion by 2025, indicating a substantial shift in consumer preferences.

4

The threat of substitutes for Corporación Interamericana de Entretenimiento (CIE) is significant, particularly from sports broadcasting and esports. These alternatives offer convenience and often lower costs, directly competing with CIE's live event promotions like the Formula 1 Mexican Grand Prix. For instance, in 2024, the global esports market was projected to generate over $1.5 billion in revenue, demonstrating its growing appeal and accessibility as a form of entertainment that can be enjoyed from home.

The ease of access and lower price points associated with watching sports on television or engaging with esports can certainly detract from the allure of attending live events in person. This shift in consumer preference is further amplified by the increasing quality and immersive nature of digital viewing experiences. In 2023, the average price for a Formula 1 Grand Prix ticket could range from $200 to over $1000, making the at-home viewing option considerably more economical for many.

- Sports Broadcasting: Offers a convenient and often more affordable way to consume sporting events, directly impacting attendance at live events.

- Esports: A rapidly growing digital entertainment sector that competes for consumer attention and leisure time, particularly among younger demographics.

- Accessibility and Cost: The primary drivers for substitute appeal, allowing consumers to enjoy events from home without travel or premium ticket expenses.

- Digital Immersion: Advancements in broadcast technology and streaming services enhance the at-home viewing experience, narrowing the gap with live events.

5

The rise of user-generated content platforms like YouTube and TikTok presents a significant threat of substitutes for traditional entertainment providers. These platforms offer a vast and constantly updated library of content created by individuals, often for free. In 2024, platforms like TikTok continued to see explosive growth, with an estimated 1.5 billion monthly active users globally, demonstrating their ability to capture significant consumer attention and time.

While not direct replacements for high-production value events or films, these platforms provide an accessible and diverse alternative that can divert audience engagement. For instance, the average user spent over 90 minutes per day on TikTok in 2024, a stark indicator of how much leisure time is being allocated to these substitute forms of entertainment.

- User-Generated Content: Platforms like YouTube and TikTok offer free, diverse entertainment created by individuals.

- Audience Attention: These platforms capture significant consumer time, diverting it from traditional entertainment.

- Global Reach: TikTok boasted approximately 1.5 billion monthly active users globally in 2024.

- Time Spent: The average TikTok user spent over 90 minutes daily on the platform in 2024.

The threat of substitutes for Corporación Interamericana de Entretenimiento (CIE) is multifaceted, with digital entertainment and alternative leisure activities posing significant challenges. The convenience and cost-effectiveness of streaming services and user-generated content platforms, alongside the allure of other experiential spending, directly compete for consumer attention and disposable income.

These substitutes offer diverse options, from the vast libraries of SVOD services, projected to exceed $100 billion in revenue in 2024, to the engaging, often free content on platforms like TikTok, which had 1.5 billion monthly active users globally in 2024. Even local events and virtual alternatives are carving out market share, highlighting the broad spectrum of competition CIE faces.

The appeal of these substitutes is amplified by their accessibility and lower price points, with average ticket prices for events like the Formula 1 Mexican Grand Prix potentially ranging from $200 to over $1000 in 2023, making at-home viewing a more economical choice for many consumers.

| Substitute Category | Key Characteristics | 2024 Data/Projections | Impact on CIE |

|---|---|---|---|

| Digital Entertainment (SVOD, Gaming) | Convenience, vast content, lower cost | SVOD revenue > $100 billion | Diverts audience from live events |

| User-Generated Content (YouTube, TikTok) | Free, diverse, highly engaging | TikTok users: 1.5 billion monthly; Avg. daily use: >90 mins | Captures significant leisure time |

| Sports Broadcasting & Esports | Accessibility, affordability, growing market | Esports market revenue > $1.5 billion | Direct competition for sports fans |

| Alternative Leisure Activities | Variety, flexibility, discretionary spending | Increased spending on travel/dining | Competes for consumer time and money |

| Virtual Events | Accessibility, convenience, lower cost | Virtual events market projected to reach $200 billion by 2025 | Offers an alternative to in-person experiences |

Entrants Threaten

The threat of new entrants for Corporación Interamericana de Entretenimiento (CIE) is generally moderate to low, primarily due to substantial barriers. The significant capital required for establishing large-scale event promotion and venue operations, which includes securing premium talent and managing intricate logistics, acts as a formidable deterrent. For instance, the cost of securing headline performers for major festivals or concerts can run into millions of dollars, a sum many new players cannot readily access.

CIE's existing, well-established infrastructure, such as its ownership and operation of key venues like the Citibanamex Center in Mexico City, presents another significant hurdle. Replicating this kind of established physical presence, coupled with integrated ticketing systems and operational expertise, would demand considerable investment and time, making it difficult for newcomers to compete effectively on a similar scale.

The threat of new entrants for Corporación Interamericana de Entretenimiento (CIE) is moderate. Established relationships with artists, their management, and global agencies create significant network barriers, making it difficult for newcomers to secure popular acts. CIE's long-standing presence and reputation in the Latin American market further solidify its advantage in booking and promoting major events, requiring substantial investment and market penetration for any new player to compete effectively.

The threat of new entrants for Corporación Interamericana de Entretenimiento (CIE) is moderate, largely due to significant economies of scale and scope. CIE's established infrastructure in marketing, ticketing, and venue management creates a substantial cost advantage that new players would struggle to match. For instance, in 2024, large-scale entertainment venues often require upfront investments in the tens or even hundreds of millions of dollars, a barrier that deters many smaller competitors.

CIE's diversified portfolio, spanning concerts, sports, and festivals, allows it to spread operational costs and negotiate better terms with suppliers and artists. This ability to leverage its size across various entertainment segments enhances its efficiency and bargaining power, making it harder for newcomers to achieve comparable cost efficiencies. In 2023, the global live entertainment market was valued at over $100 billion, with major players like CIE capturing a significant share through optimized operations.

4

The entertainment sector, particularly for a company like Corporación Interamericana de Entretenimiento (CIE), faces a moderate threat from new entrants. Brand recognition and consumer trust are paramount; CIE has cultivated a strong reputation in Latin America over many years, making it difficult for newcomers to rapidly build credibility and attract substantial audiences. For instance, in 2024, the cost of launching a major entertainment venue or event comparable to CIE's established operations, including marketing and securing prime locations, can easily run into tens of millions of dollars.

New entrants must overcome significant capital requirements and established distribution channels.

- High Capital Investment: Building new venues or acquiring rights for major events requires substantial upfront funding, often in the hundreds of millions of dollars for large-scale projects.

- Brand Loyalty: CIE's long-standing presence fosters deep customer loyalty, a difficult asset for new players to replicate quickly.

- Regulatory Hurdles: Obtaining necessary permits and licenses for entertainment operations can be a complex and time-consuming process, acting as a barrier.

- Economies of Scale: CIE benefits from existing infrastructure and operational efficiencies that new entrants would struggle to match initially.

5

The threat of new entrants for Corporación Interamericana de Entretenimiento (CIE) is moderately low, primarily due to significant regulatory and licensing complexities across its operating regions. For instance, obtaining the necessary permits to operate large venues, promote major events, and manage ticketing systems in countries like Mexico and Brazil involves navigating intricate legal frameworks and administrative processes. These hurdles require substantial investment in legal counsel and compliance, acting as a considerable deterrent to smaller, less-resourced potential competitors.

Furthermore, establishing a brand reputation and securing key partnerships with artists, sponsors, and local authorities takes considerable time and effort. CIE’s established track record and existing relationships provide a competitive advantage that new players would struggle to replicate quickly. The capital expenditure required for building or acquiring modern entertainment facilities also presents a substantial barrier, making it difficult for new entrants to compete on scale and quality.

- Regulatory Complexity: Navigating diverse and stringent licensing requirements across Latin American markets deters new entrants.

- Capital Intensity: Significant upfront investment is needed for venue development and operational infrastructure.

- Brand & Relationships: CIE's established reputation and existing industry connections create a high barrier to entry.

- Operational Expertise: Managing complex event logistics and ticketing systems requires specialized knowledge.

The threat of new entrants for Corporación Interamericana de Entretenimiento (CIE) remains moderate, largely due to the substantial capital investment required to establish a competitive presence. Building or acquiring large-scale entertainment venues, securing top-tier talent, and developing robust marketing campaigns demand significant financial resources, often in the tens to hundreds of millions of dollars, as seen in major global market developments in 2024.

CIE's established infrastructure, including its ownership of key venues and integrated ticketing systems, along with its strong brand recognition and existing relationships with artists and sponsors, creates considerable barriers. These factors, combined with the complexity of navigating regulatory environments in Latin America, make it challenging for new players to achieve comparable economies of scale and scope, especially given the global live entertainment market's valuation exceeding $100 billion in 2023.

| Barrier Type | Description | Impact on New Entrants | Example (2024 Data) |

|---|---|---|---|

| Capital Requirements | High upfront costs for venues, talent, and marketing. | Deters smaller, less-funded competitors. | Major concert venue construction can exceed $50 million. |

| Brand & Relationships | Established reputation and industry connections. | Difficult for newcomers to gain trust and secure top acts. | CIE's long-standing partnerships with major artists. |

| Economies of Scale | Operational efficiencies from existing infrastructure. | New entrants struggle to match cost advantages. | Bulk purchasing power for event supplies and artist fees. |

| Regulatory Hurdles | Complex licensing and permit processes. | Increases time and cost for market entry. | Navigating varied permit requirements in Mexico and Brazil. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Corporación Interamericana de Entretenimiento leverages data from annual reports, investor presentations, and industry-specific market research reports to understand competitive dynamics.

We also incorporate information from regulatory filings, news archives, and financial databases to provide a comprehensive view of the entertainment industry landscape.