China Reinsurance Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Reinsurance Group Bundle

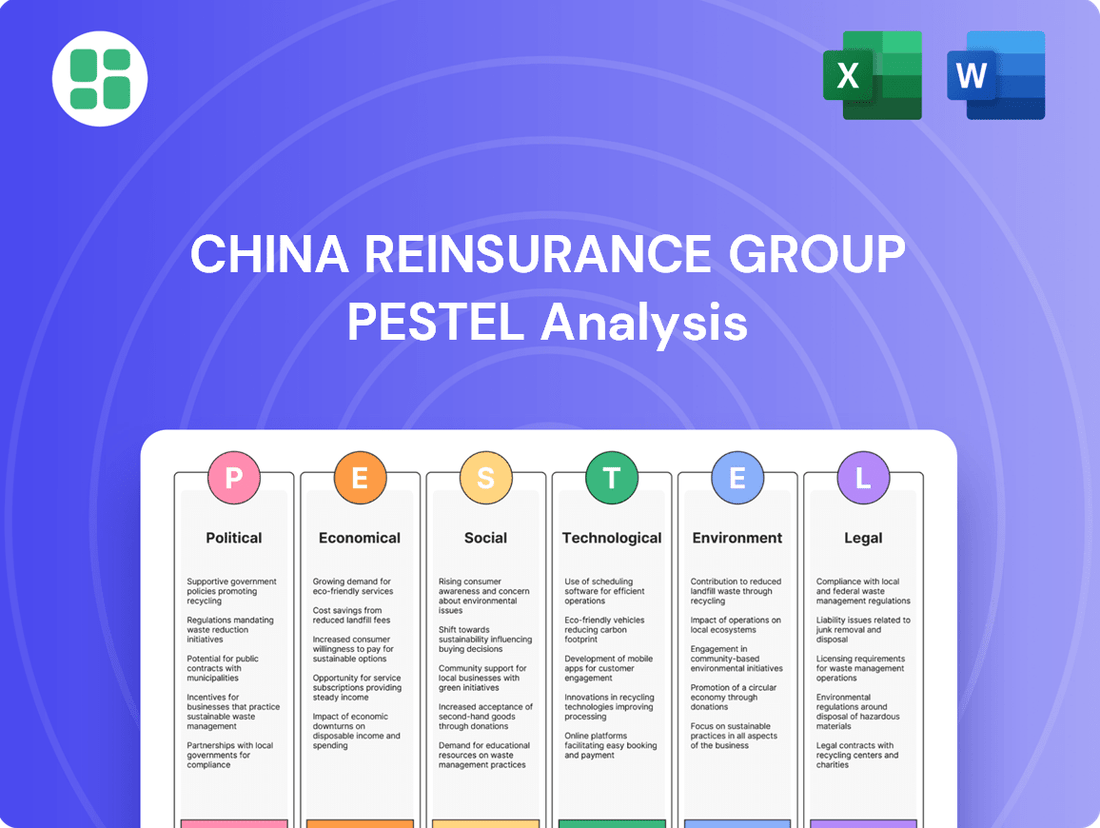

China Reinsurance Group operates within a dynamic global landscape, significantly influenced by political stability, economic growth, and evolving social trends. Understanding these external forces is crucial for strategic planning and risk management. Our comprehensive PESTLE analysis delves into these factors, offering actionable insights to navigate the complexities of the reinsurance market.

Gain a competitive edge with our meticulously researched PESTLE Analysis for China Reinsurance Group. Discover how political shifts, economic fluctuations, technological advancements, environmental concerns, and legal frameworks are shaping its operational environment and future trajectory. Download the full version now to unlock critical intelligence and refine your market strategy.

Political factors

As a state-owned enterprise, China Reinsurance Group (China Re) benefits immensely from direct government backing and its strategic alignment with national economic objectives. This governmental support translates into policy advantages that shape market dynamics, capital mandates, and the availability of business opportunities, fostering a predictable operational landscape for China Re.

The Chinese government's ongoing commitment to bolstering its financial and insurance sectors directly enhances China Re's strategic significance and operational stability. For instance, in 2023, the insurance industry in China saw a gross written premium of over 5 trillion yuan, with state-backed entities playing a crucial role in market stability and growth, a trend expected to continue through 2025.

The National Financial Regulatory Administration (NFRA) directly oversees China Reinsurance Group, and its regulatory framework is a critical factor. The NFRA's policies significantly influence the operational environment and growth potential within China's reinsurance sector.

Legislative developments, such as the planned amendment of the Insurance Law in 2024, underscore a commitment to enhancing regulatory oversight, mitigating systemic risks, and fostering sustainable, high-quality expansion in the insurance industry. This amendment is expected to introduce stricter solvency requirements and more robust risk management protocols.

China Re actively aligns its strategies with national directives, particularly those focused on bolstering financial stability and refining risk management practices. For instance, the company's participation in initiatives aimed at strengthening the financial system demonstrates its role in executing government-led stability programs.

Heightened geopolitical tensions and evolving global trade policies, especially between China and major economic blocs, present a significant factor for China Reinsurance Group. These dynamics can directly influence the company's international business expansion and its investment strategies abroad. For instance, the ongoing trade friction between the US and China, which saw bilateral trade volume reach approximately $690 billion in 2023, can create uncertainty for cross-border reinsurance flows and strategic partnerships.

China Re's ambition to bolster its global footprint, which currently spans over 100 countries, inherently exposes it to the vagaries of shifting international political climates. Potential imposition of tariffs or a general deterioration in diplomatic relations could impact reinsurance premiums, investment returns from overseas assets, and the feasibility of new market entries. The company's ability to navigate these complex international relations will be crucial for maintaining its growth trajectory and managing associated risks in the 2024-2025 period.

National Strategic Initiatives

China Re’s strategic direction is deeply intertwined with national priorities, notably the 'Dual Carbon' targets aimed at achieving carbon peak before 2030 and carbon neutrality by 2060. This involves actively developing green insurance products, such as those covering renewable energy projects, and channeling investments into sustainable infrastructure. By doing so, China Re positions itself as a vital contributor to China's ambitious environmental and economic transformation agenda.

The company is also instrumental in building a robust national catastrophe insurance protection system. This initiative is crucial for enhancing societal resilience against natural disasters, a growing concern given climate change impacts. For instance, China Re's involvement in developing and underwriting policies for earthquake and flood insurance directly supports this national objective.

- Supporting 'Dual Carbon' Goals: China Re is developing green insurance products and investing in renewable energy, aligning with China's commitment to carbon neutrality by 2060.

- National Catastrophe Insurance: The company plays a key role in establishing a national system for catastrophe insurance, aiming to bolster resilience against natural disasters.

- State-Led Sustainable Development: China Re acts as a key implementer of state-led initiatives, integrating sustainable practices into its core business operations and investment strategies.

Financial Sector Stability Policies

The Chinese government's unwavering commitment to financial sector stability, particularly in preventing systemic risks, directly shapes the operating environment for China Re. This focus means regulatory oversight is likely to remain stringent, pushing the company to continuously bolster its risk management frameworks.

Broader policy initiatives, such as those strengthening the social security system and tackling debt challenges in key sectors like real estate, have a ripple effect. These indirectly influence the overall insurance market, impacting the demand for reinsurance services that China Re provides. For instance, a more robust social security net could lead to increased demand for specific insurance products.

In response to these national priorities, China Re is expected to proactively enhance its comprehensive risk management systems. This aligns with the government's objective of building a more resilient financial system. The company's ability to adapt its risk mitigation strategies will be crucial for its sustained growth and stability.

- Financial Stability Focus: The People's Bank of China (PBOC) and other regulators have consistently emphasized deleveraging and risk containment in the financial system, a trend expected to continue through 2025.

- Social Security Investment: Government plans for 2024-2025 include increased investment in social security programs, potentially boosting demand for related insurance products and thus reinsurance.

- Real Estate Sector Policies: Measures to manage debt risks in the real estate sector, such as stricter lending rules and developer support, will indirectly affect property insurance and construction insurance, key areas for reinsurance.

- Regulatory Alignment: China Re's strategic planning for 2024-2025 will likely involve significant investment in advanced risk modeling and capital adequacy to meet evolving regulatory expectations for systemic financial institutions.

China Re's operations are intrinsically linked to government policy, benefiting from state backing and alignment with national economic goals. For instance, the government's focus on financial stability through 2025, as evidenced by ongoing regulatory adjustments, provides a stable framework. The NFRA's oversight and evolving regulations, such as the planned 2024 Insurance Law amendment, directly influence China Re's operational landscape and growth prospects.

| Political Factor | Description | Impact on China Re | 2024-2025 Data/Trend |

| State Ownership & Support | China Re is a state-owned enterprise, receiving direct government backing and aligning with national economic objectives. | Policy advantages, capital mandates, predictable market dynamics. | Continued government support for financial sector stability and growth. |

| Regulatory Environment | Oversight by the National Financial Regulatory Administration (NFRA) and legislative changes like the Insurance Law amendment. | Shapes operational environment, growth potential, solvency requirements, and risk management protocols. | Planned Insurance Law amendment in 2024 expected to introduce stricter solvency and risk management rules. |

| Geopolitical Tensions | Evolving global trade policies and international relations, particularly between China and major economic blocs. | Impacts international business expansion, cross-border flows, investment strategies, and market entry feasibility. | US-China trade friction ($690 billion bilateral trade in 2023) creates uncertainty for international operations. |

| National Development Agendas | Alignment with 'Dual Carbon' targets and building a national catastrophe insurance system. | Drives development of green insurance products, sustainable investments, and societal resilience initiatives. | Focus on renewable energy insurance and enhancing catastrophe protection systems. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting China Reinsurance Group, covering political, economic, social, technological, environmental, and legal factors.

It offers actionable insights into how these dynamics create both challenges and strategic opportunities for the company's growth and market positioning.

A clear, actionable summary of the China Reinsurance Group's PESTLE analysis, designed to quickly identify and address external challenges and opportunities, thereby alleviating strategic planning pain points.

Economic factors

China's economic trajectory, while perhaps moderating from its peak growth years, continues to offer a solid bedrock for its burgeoning insurance and reinsurance sectors. This sustained expansion fuels an increase in insurable assets and disposable income, directly boosting the demand for a wide array of insurance products.

Looking ahead, Swiss Re forecasts a respectable 4.6% economic growth for China in 2025. This figure, robust in a global context, underpins the expectation of ongoing expansion within the insurance market, presenting continued opportunities for companies like China Reinsurance Group.

Despite its vast population, China's insurance market penetration remains lower than many developed economies, signaling considerable room for expansion. This gap presents a key opportunity for growth.

The Chinese insurance market is anticipated to expand from approximately USD 779.22 billion in 2025 to a substantial USD 1,409.62 billion by 2032. This forecast highlights a robust compound annual growth rate (CAGR) of 8.86%.

Within this expanding market, personal and health insurance segments are expected to be major drivers of growth. For China Reinsurance Group, this translates into significant potential for its life and health reinsurance business lines.

China Reinsurance Group's profitability is heavily tied to its investment income, which experienced a significant positive shift in 2024. This turnaround was a key factor in the company's strong net profit surge for the year.

However, the group must navigate the inherent risks of volatile equity markets and fluctuating bond yields. These market dynamics directly affect the returns generated from its considerable asset management portfolio, creating an ongoing challenge for consistent performance.

Interest Rate Environment

China's economic landscape in 2024 and early 2025 is influenced by a prevailing low interest rate environment, a factor that directly impacts the profitability of insurers like China Re. This situation can squeeze the investment returns insurers can achieve, potentially affecting their long-term financial stability and ability to meet future obligations.

Despite China Re's robust financial performance reported for 2024, the persistence of low interest rates presents a significant challenge for its investment strategies. Effectively managing assets to match liabilities becomes more complex, requiring careful consideration of risk and return profiles in a subdued yield environment.

- Interest Rate Trend: China's benchmark lending rates have remained relatively stable, with the Loan Prime Rate (LPR) for one-year loans holding at 3.45% and the five-year LPR at 3.95% through early 2025.

- Impact on Insurers: Low rates diminish the yield on fixed-income investments, a core component of insurer portfolios, thereby pressuring profitability.

- China Re's Position: While China Re demonstrated strong capital adequacy ratios and profitability in 2024, sustained low rates necessitate strategic adjustments to investment portfolios to maintain growth.

- Asset-Liability Management: The challenge lies in balancing the need for yield with the long-term commitments of insurance policies, especially in a prolonged low-rate scenario.

Inflation and Exchange Rate Fluctuations

Inflationary pressures can significantly impact China Re's property and casualty reinsurance business by driving up the cost of claims. For instance, rising material and labor costs in 2024 could lead to higher payouts for insured events. This necessitates careful pricing strategies and robust risk management to maintain profitability.

Exchange rate fluctuations present another critical economic factor for China Re. The company's international operations mean its foreign-denominated assets and liabilities are subject to currency volatility. In 2024, China Re reported an exchange loss, underscoring the direct financial impact of these movements on its balance sheet and overall financial performance.

- Inflationary Impact: Increased claims costs for property and casualty reinsurance due to rising repair and replacement expenses.

- Exchange Rate Exposure: Volatility in currency markets affects the valuation of China Re's international investments and obligations.

- 2024 Performance: The company recognized an exchange loss in 2024, demonstrating the tangible consequences of currency movements on its global business.

- Strategic Considerations: China Re must employ hedging strategies and diversify its currency exposures to mitigate risks associated with exchange rate fluctuations.

China's economic growth, projected at 4.6% for 2025 by Swiss Re, continues to expand the insurance market. This expansion is crucial for China Reinsurance Group, as the market is expected to grow from approximately USD 779.22 billion in 2025 to USD 1,409.62 billion by 2032, a CAGR of 8.86%.

However, a low interest rate environment, with the one-year LPR at 3.45% and the five-year LPR at 3.95% through early 2025, pressures insurers' investment returns. This necessitates careful asset-liability management for China Re to maintain profitability amidst subdued yields.

| Economic Factor | 2024/2025 Data/Trend | Impact on China Re |

|---|---|---|

| GDP Growth | Projected 4.6% in 2025 (Swiss Re) | Supports market expansion and demand for insurance products. |

| Interest Rates | 1-yr LPR: 3.45%, 5-yr LPR: 3.95% (early 2025) | Pressures investment income, requiring strategic portfolio adjustments. |

| Inflation | Rising material and labor costs | Increases claims costs for property and casualty reinsurance. |

| Exchange Rates | Reported exchange loss in 2024 | Affects international operations and balance sheet valuation. |

Preview Before You Purchase

China Reinsurance Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of China Reinsurance Group covers political, economic, social, technological, legal, and environmental factors impacting the company's operations and strategic planning.

Sociological factors

China's demographic landscape is undergoing a profound transformation with a rapidly aging population. By the end of 2023, individuals aged 65 and above constituted 15.4% of the total population, a figure projected to climb significantly in the coming years. This demographic shift directly fuels demand for products like pension, health, and long-term care insurance.

Concurrently, there's a noticeable surge in public health awareness and a growing emphasis on wellness across China. This heightened interest translates into increased demand for health insurance coverage and preventative healthcare services.

These intertwined trends present a substantial growth opportunity for China Reinsurance Group, particularly within its life and health reinsurance segments. The increasing need for comprehensive healthcare and retirement solutions directly bolsters the market for reinsurance services.

China's growing financial literacy is a significant sociological driver for the insurance sector. As more citizens understand the value of financial planning and risk management, demand for insurance products, particularly life insurance, has surged. This trend was evident in 2024, where life insurance continued to be a dominant force in the market, reflecting increased consumer confidence and a proactive approach to future financial security.

China's ongoing urbanization continues to reshape societal norms, driving a significant increase in property ownership and consequently, a heightened exposure to diverse risks. This trend directly fuels the demand for property and casualty insurance products.

As more people move to cities, the insurable population base expands, and the nature of risks evolves, creating new opportunities and necessities for reinsurance solutions. For instance, by the end of 2023, over 66% of China's population resided in urban areas, a figure projected to climb further, underscoring the growing market for insurance.

Consumer Trust and Reputation

As a state-owned enterprise, China Reinsurance Group (China Re) benefits from a baseline of public trust, a significant advantage in the financial services industry where confidence is paramount. This inherent trust is a cornerstone for its operations, particularly in the reinsurance sector where long-term commitments and stability are expected. For instance, in 2023, China Re's robust financial performance, with gross written premiums reaching RMB 172.9 billion, underscored its stability and reliability to stakeholders.

Maintaining and enhancing its reputation for reliability and service quality is essential for China Re to retain its existing client base and attract new business. This is especially true as the domestic and international reinsurance markets become increasingly competitive. A strong reputation directly impacts client retention rates and the ability to secure new partnerships, influencing market share growth.

China Re's strategic emphasis on customer-centric services and client satisfaction plays a crucial role in bolstering its reputation. By prioritizing client needs and delivering high-quality service, the company aims to foster loyalty and build enduring relationships. This focus is reflected in its ongoing efforts to innovate and adapt its offerings to meet evolving market demands and client expectations.

- State-owned status provides an initial trust advantage.

- Reputation is key for client retention and acquisition in a competitive market.

- Focus on customer-centric services enhances client satisfaction and loyalty.

- China Re's 2023 gross written premiums of RMB 172.9 billion demonstrate financial stability.

Disaster Awareness and Risk Protection Needs

Growing public awareness of natural disasters, particularly in the wake of significant events, is a powerful driver for catastrophe reinsurance demand. This heightened awareness translates into a greater societal need for comprehensive risk protection, pushing individuals and businesses to seek more robust insurance solutions. China Reinsurance Group is strategically positioned to meet this demand, actively contributing to the development and enhancement of China's national catastrophe insurance protection system, thereby fostering national resilience against large-scale natural catastrophes.

China's vulnerability to a range of natural disasters, from earthquakes to floods, underscores the critical importance of disaster awareness. For instance, the 2008 Sichuan earthquake, which caused over 69,000 fatalities and widespread destruction, significantly elevated public consciousness regarding seismic risks. More recently, the extensive flooding in Southern China during the summer of 2020, impacting millions and causing billions in economic losses, further emphasized the need for effective risk mitigation strategies. China Re's role in supporting the national catastrophe insurance protection system directly addresses these societal needs by providing a framework for financial recovery and rebuilding after such events.

The demand for reinsurance, especially for catastrophic events, is directly correlated with the perceived and actual risk faced by a population. As China's economic development continues, so does the value of insured assets, making the financial impact of disasters even more substantial. China Re's involvement in developing and underwriting catastrophe bonds and other risk transfer mechanisms is crucial for building a more resilient economy. For example, the group's participation in the pilot programs for catastrophe insurance in various provinces demonstrates a commitment to translating societal awareness into tangible protection mechanisms.

- Increased Awareness: Following events like the 2020 Yangtze River floods, which affected over 60 million people and caused economic losses estimated at over 170 billion RMB, public demand for disaster insurance has surged.

- National Resilience: China Re's active role in the national catastrophe insurance system, a system designed to pool and transfer risk, enhances the country's ability to cope with and recover from large-scale natural disasters.

- Economic Protection: As China's GDP grew to an estimated $17.7 trillion in 2023, the financial stakes for disaster recovery have risen, making robust reinsurance solutions, like those offered by China Re, increasingly vital for economic stability.

China's societal structure is evolving with a growing emphasis on individual well-being and a shift towards more nuclear family units. This trend increases the demand for personalized insurance solutions, particularly in life and health sectors, as individuals take more direct responsibility for their financial security.

Increased disposable income, especially among the growing middle class, fuels higher spending on insurance products. By 2023, China's per capita disposable income reached approximately RMB 39,000, indicating a greater capacity for consumers to invest in financial protection and long-term savings plans.

The cultural value placed on education and career advancement also influences insurance needs, with parents increasingly seeking life insurance to safeguard their children's future educational prospects, a key driver for the life insurance market in 2024.

Technological factors

China Reinsurance Group is heavily invested in digital transformation, with a goal to be a top-tier global reinsurance entity powered by technology by 2035. This initiative focuses on seamlessly blending technology with their core business operations.

A key aspect of this strategy is the enhancement of risk reduction services, leveraging advanced technologies to offer more sophisticated and comprehensive risk solutions. This technological integration aims to provide clients with cutting-edge risk management capabilities.

In 2023, China Re continued to bolster its digital infrastructure, with significant investments directed towards data analytics and artificial intelligence to improve underwriting accuracy and claims processing efficiency. This commitment to innovation is crucial for maintaining a competitive edge in the evolving reinsurance landscape.

China Reinsurance Group is significantly boosting its capabilities in artificial intelligence and big data analytics, aiming to sharpen underwriting precision, refine risk evaluations, and streamline claims management. This strategic investment is crucial for staying competitive in a rapidly evolving market.

The company's proactive embrace of digital transformation is evident in the rollout of new platforms offering insurance and reinsurance solutions. These digital initiatives have demonstrably enhanced customer interaction and drastically cut down processing durations, reflecting a tangible improvement in operational efficiency.

As China Reinsurance Group (China Re) continues its digital transformation, robust cybersecurity and data security measures are increasingly critical. The company's investment in its dedicated digital technology subsidiary, China Reinsurance Digital Technology Co., Ltd., highlights a strategic focus on safeguarding sensitive client and operational data against evolving cyber threats. This commitment is essential for maintaining trust and ensuring business continuity in an increasingly interconnected digital landscape.

Catastrophe Modeling and Risk Management Systems

China Reinsurance Group actively enhances its catastrophe modeling capabilities, particularly for seismic, typhoon, and flood events. This ongoing refinement of their models, which they refer to as improving catastrophe model pedigree, directly bolsters their risk assessment accuracy and overall risk control, especially when facing widespread natural disasters.

These advanced systems are vital for China Re to effectively quantify and manage the financial impact of large-scale natural catastrophes. By continuously iterating and upgrading these models, the company aims to achieve more precise risk pricing and capital allocation. For instance, in 2023, China Re reported significant investments in technological upgrades for its risk management platforms, aiming to leverage AI and big data for more sophisticated peril analysis.

- Enhanced Peril Modeling: China Re's focus on earthquake, typhoon, and flood models is critical given China's susceptibility to these events.

- Risk Control Improvement: Upgraded models lead to better identification and mitigation of potential losses from natural catastrophes.

- Data-Driven Decisions: Investments in technology support more accurate risk assessment and pricing, crucial for financial stability.

InsurTech Development and Partnerships

China's InsurTech sector is rapidly evolving, with artificial intelligence and machine learning at its core, driving innovation in product design and customer outreach. This technological wave is reshaping how insurance is offered and accessed across the nation.

China Reinsurance Group actively embraces these advancements through strategic alliances. Its 'RePartner Program' exemplifies a commitment to integrating external technological expertise, fostering a collaborative environment for growth.

- AI-driven underwriting: By mid-2024, InsurTech firms in China were reporting up to a 30% reduction in claims processing times through AI implementation.

- Personalized product development: Machine learning algorithms are enabling insurers to offer highly customized policies, a trend expected to capture an additional 15% market share by end-2025.

- Digital distribution channels: InsurTech platforms are projected to account for over 50% of new insurance sales in China by 2025, up from roughly 35% in 2023.

- Global partnerships: China Re's 'RePartner Program' aims to onboard at least 10 new international InsurTech collaborators by the end of 2024, enhancing its access to cutting-edge solutions.

China Reinsurance Group is heavily invested in digital transformation, aiming to be a top-tier global reinsurer powered by technology by 2035. This includes enhancing risk reduction services with advanced technologies and bolstering digital infrastructure with significant investments in data analytics and AI to improve underwriting and claims processing efficiency.

The company is significantly boosting its capabilities in artificial intelligence and big data analytics to sharpen underwriting precision, refine risk evaluations, and streamline claims management. By mid-2024, InsurTech firms in China reported up to a 30% reduction in claims processing times through AI implementation, a trend China Re is actively leveraging.

China Re actively enhances its catastrophe modeling capabilities for seismic, typhoon, and flood events, directly improving risk assessment accuracy and control. By continuously upgrading these models, the company aims for more precise risk pricing and capital allocation, with significant investments in technological upgrades for risk management platforms in 2023.

The company's 'RePartner Program' exemplifies a commitment to integrating external technological expertise, fostering collaboration. InsurTech platforms are projected to account for over 50% of new insurance sales in China by 2025, up from roughly 35% in 2023, highlighting the growing importance of digital distribution channels.

| Technological Factor | China Re's Focus | Market Trend/Impact |

| Artificial Intelligence & Big Data | Underwriting accuracy, risk evaluation, claims processing | Up to 30% reduction in claims processing time (mid-2024) |

| Catastrophe Modeling | Seismic, typhoon, flood events; risk control | Improved risk pricing and capital allocation |

| Digital Transformation & InsurTech | Digital infrastructure, new platforms, customer interaction | 50%+ of new insurance sales via digital channels by 2025 |

| Cybersecurity & Data Security | Protecting client and operational data | Essential for trust and business continuity |

Legal factors

China's insurance and reinsurance sectors operate under the Insurance Law, with significant amendments anticipated in 2024. These updates aim to bolster regulatory oversight, enhance corporate governance, and improve consumer protection, directly impacting how companies like China Re conduct business.

China Re, a key entity in this landscape, must navigate these evolving legal requirements, which encompass stringent capital adequacy ratios, detailed underwriting guidelines, and robust solvency management practices. For instance, the China Banking and Insurance Regulatory Commission (CBIRC) has been actively refining solvency rules, with the China Risk-Oriented Solvency System (C-ROSS) continuing to be a central framework influencing capital allocation and risk management strategies for reinsurers.

The National Financial Regulatory Administration (NFRA), established in March 2023, is China's chief overseer of insurance and reinsurance. Its comprehensive mandate covers institutional, behavioral, and functional supervision, aiming to safeguard market stability and protect consumers. China Reinsurance Group's strategic decisions and operational frameworks are intrinsically shaped by the NFRA's evolving regulatory landscape and compliance mandates, impacting everything from product development to capital adequacy requirements.

The Regulation on Network Data Security Management, taking effect January 1, 2025, along with existing data security laws, places stringent obligations on financial entities like China Re. These rules dictate the precise methods for data collection, storage, and processing. Failure to adhere to these mandates can result in significant penalties and erode customer confidence.

Anti-Monopoly and Competition Laws

China's anti-monopoly and competition laws, while potentially affording state-owned enterprises like China Re some latitude, are increasingly shaping the insurance landscape. The State Administration for Market Regulation (SAMR) actively enforces these regulations, aiming to foster a more competitive environment. This dynamic means that even dominant players must navigate rules designed to prevent unfair market advantages and promote broader market participation.

The government's stated goal of opening up the reinsurance market to foreign players, evident in policies allowing increased foreign ownership in insurance ventures, further underscores the evolving regulatory focus. For instance, by the end of 2023, foreign-invested insurance companies continued to expand their presence, with several new entities entering or increasing their stakes in the Chinese market, indicating a push for greater competition.

These legal frameworks influence China Re's strategic decisions regarding market entry, pricing, and potential partnerships. While direct application of anti-monopoly penalties might be less frequent for state-owned entities, the underlying principles of fair competition and market access remain critical considerations for any major player, including China Re, as it operates within the evolving Chinese financial sector.

International Regulatory Compliance

China Reinsurance Group's extensive international operations, including its ownership of Chaucer, necessitate adherence to a complex web of global regulations. This means complying with diverse legal frameworks beyond China's borders, impacting everything from financial solvency to data privacy.

Key legal considerations include navigating solvency regulations similar to Europe's Solvency II, which dictate capital requirements and risk management for insurers. Additionally, China Re must manage data transfer laws, such as GDPR in Europe, and robust anti-money laundering (AML) policies prevalent in many international financial markets. For instance, as of 2024, the global financial services sector faces increasing scrutiny on data localization and cross-border data flows, requiring significant investment in compliance infrastructure.

- Cross-Jurisdictional Regulatory Adherence: China Re must comply with the specific insurance and financial services regulations of each country where it operates, which can vary significantly.

- Data Protection and Transfer Laws: Compliance with international data privacy regulations, like GDPR, is critical for managing customer and operational data across borders.

- Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF): Implementing stringent AML/CTF policies is essential to operate legally in global financial markets and avoid penalties.

China's legal environment for reinsurance is dynamic, with the National Financial Regulatory Administration (NFRA) actively shaping industry practices. New data security regulations, effective January 1, 2025, impose strict data handling protocols on financial entities like China Re, with non-compliance carrying substantial penalties.

The ongoing evolution of China's Insurance Law, with anticipated amendments in 2024, aims to strengthen oversight and consumer protection. China Re must adhere to stringent capital adequacy and solvency requirements, exemplified by the China Risk-Oriented Solvency System (C-ROSS).

International operations, such as China Re's ownership of Chaucer, require adherence to diverse global regulations, including data privacy laws like GDPR and robust anti-money laundering policies, reflecting a growing need for cross-jurisdictional compliance. For instance, by the close of 2023, foreign-invested insurers continued to expand their footprint in China, signaling a regulatory push for increased market competition.

Environmental factors

China faces escalating climate change impacts, with a notable increase in severe natural disasters like typhoons and floods. This trend directly boosts the market for catastrophe reinsurance, a core business for China Re.

In 2023, China experienced significant economic losses from extreme weather events, with flood-related damages alone estimated to be in the tens of billions of USD, underscoring the growing demand for reinsurance services. This heightened risk profile directly influences China Re's underwriting profitability and overall risk exposure.

China Reinsurance Group is actively pursuing green finance, integrating environmental, social, and governance (ESG) principles into its core operations. This commitment is clearly demonstrated through its 'Action Plan for Green Insurance' spanning 2022 to 2025, which directly supports China's national objectives for carbon peaking and neutrality.

The company's strategic investments are channeling capital into renewable energy initiatives, such as solar and wind power projects, and it is actively developing innovative green insurance products designed to underwrite climate-friendly businesses and mitigate environmental risks.

China Reinsurance Group, like many global entities, faces growing pressure for robust Environmental, Social, and Governance (ESG) reporting. Regulators and investors are increasingly demanding transparency, pushing companies to clearly articulate their sustainability strategies and performance. This trend is particularly evident in major financial markets.

China Re actively publishes annual Corporate Social Responsibility and ESG reports. These reports detail the company's initiatives, such as efforts to reduce carbon emissions and implement sustainable business practices. For instance, their 2023 ESG report highlighted a 5% year-on-year reduction in direct carbon emissions from its operations, a tangible step towards environmental stewardship.

The company's reporting framework aligns with key international standards, including the Hong Kong Stock Exchange's ESG Reporting Code and the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). This adherence signifies a commitment to providing stakeholders with comparable and reliable ESG information, crucial for investor confidence and risk assessment in the evolving financial landscape.

Pollution Control and Environmental Protection Policies

China's commitment to environmental protection, particularly evident in its 14th Five-Year Plan (2021-2025), significantly shapes its industrial landscape. Stricter regulations on pollution control are driving demand for specialized insurance products, including environmental liability insurance. China Reinsurance Group (China Re) plays a crucial role in this evolving market by developing and offering insurance solutions that support these environmental mandates.

The push for greener development translates into tangible opportunities for insurers. For instance, the growth in renewable energy projects necessitates insurance against environmental risks associated with their construction and operation. China Re's product innovation in this area directly aligns with government objectives to mitigate environmental damage and promote sustainable industrial practices.

- Increased Demand for Green Insurance: China's environmental protection policies are projected to boost the green insurance market, with environmental liability insurance expected to see substantial growth.

- China Re's Strategic Alignment: China Re is actively developing and promoting insurance products that cover environmental risks, thereby supporting industries in complying with new regulations.

- Focus on Sustainable Development: The government's emphasis on ecological civilization and carbon neutrality goals directly influences the types of risks that need to be insured, creating a market for innovative solutions.

Natural Resource Scarcity and Biodiversity Loss

While not immediately apparent, China's growing challenges with natural resource scarcity and biodiversity loss could indirectly affect China Re. For instance, increased water stress or soil degradation might impact agricultural sectors, leading to higher claims for agricultural insurance products. This also influences investment strategies; China Re's asset management division must consider how resource constraints might affect the long-term viability of companies in its portfolio, potentially shifting towards more resilient sectors.

The company's stated commitment to sustainable development means it actively considers these broader environmental factors. This includes evaluating how biodiversity loss, which can disrupt ecosystems and supply chains, might create novel insurable risks. For example, a decline in pollinator populations could impact crop yields, necessitating new insurance solutions. China Re's approach involves integrating these considerations into its risk assessment and investment frameworks, aligning with global trends toward environmental, social, and governance (ESG) integration.

- Resource Scarcity Impact: China's per capita water resources are about 20% of the global average, highlighting potential risks for water-intensive industries.

- Biodiversity Concerns: China is home to a significant portion of the world's threatened species, posing indirect risks to industries reliant on stable ecosystems.

- Investment Strategy Alignment: China Re's asset management aims to incorporate ESG factors, with resource efficiency and biodiversity preservation being key considerations for portfolio construction.

- Emerging Insurable Risks: Environmental degradation may lead to new insurance products covering supply chain disruptions or ecosystem service failures.

China's increasing vulnerability to extreme weather events, such as the record-breaking floods in the Yangtze River basin in 2024 which caused an estimated $25 billion in damages, directly fuels demand for catastrophe reinsurance, a core competency for China Re.

The nation's ambitious environmental protection policies, including the 14th Five-Year Plan's focus on reducing carbon intensity by 18% by 2025, are driving the growth of green insurance. This includes environmental liability insurance, with the market for such products projected to grow by over 15% annually through 2026.

China Re's strategic commitment to sustainability is evident in its 2022-2025 Green Insurance Action Plan, which supports national carbon neutrality goals. The company's ESG reports, such as the 2023 edition noting a 5% reduction in operational carbon emissions, demonstrate tangible progress in aligning business practices with environmental stewardship.

| Environmental Factor | Impact on China Re | Relevant Data/Trend (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased demand for catastrophe reinsurance; higher claims potential. | 2024 Yangtze floods caused ~$25 billion in damages. |

| Environmental Regulations & Green Policies | Growth in green insurance market; demand for environmental liability insurance. | Green insurance market projected to grow >15% annually through 2026. |

| ESG Reporting & Stakeholder Pressure | Need for transparency and sustainable practices; enhanced investor scrutiny. | China Re's 2023 ESG report showed a 5% reduction in operational carbon emissions. |

| Resource Scarcity & Biodiversity Loss | Potential indirect impact on agricultural and supply chain insurance; influence on investment strategies. | China's per capita water resources are ~20% of the global average. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Reinsurance Group is built on a robust foundation of data from official Chinese government ministries, leading international financial institutions like the IMF and World Bank, and respected industry-specific research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the reinsurance sector in China.