Century Communities Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Century Communities Bundle

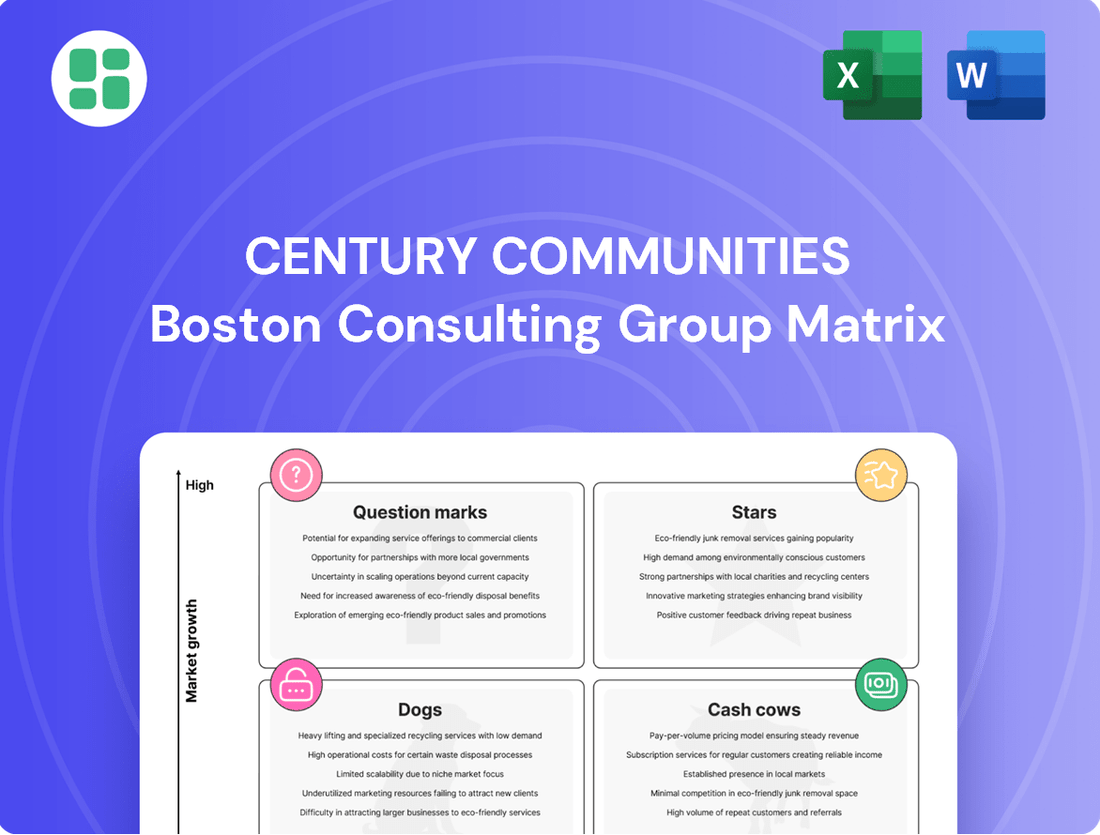

Century Communities' BCG Matrix offers a crucial snapshot of their product portfolio's market share and growth potential. Understanding whether their offerings are Stars, Cash Cows, Dogs, or Question Marks is vital for strategic resource allocation. Purchase the full BCG Matrix for a comprehensive breakdown, enabling you to identify high-performing assets and areas ripe for investment or divestment.

Stars

Century Complete is positioned as a strong contender in the BCG matrix, specifically within the question mark category, due to its focus on the affordable housing segment. This market has demonstrated resilient demand, even when the overall housing sector faces headwinds. Century Communities' strategic expansion of this brand, targeting first-time buyers and value-conscious consumers, fuels its high growth potential.

The brand's success is further bolstered by its land-light approach and a focus on spec builds, which significantly improve its ability to scale and capture market share in this expanding sector. For instance, in 2024, Century Communities reported a notable increase in closings for their Century Complete brand, reflecting the consistent demand for affordable homes.

Century Communities is aggressively pursuing expansion in the booming Sun Belt region, a strategic move driven by significant population influx and job growth. This focus on high-demand metropolitan areas, evidenced by their 2024 acquisitions of Anglia Homes in Houston and Landmark Homes in Nashville, positions them to capitalize on sustained housing demand. These markets are key drivers for their growth.

Century Communities stands out as a leader in online home sales, a segment experiencing significant growth as buyers prioritize convenience. Their digital-first strategy allows them to connect with more customers and simplify the buying journey, giving them a distinct advantage in this expanding market. This approach is particularly effective in attracting digitally-inclined buyers.

First-Time Homebuyer Segment Focus

Despite ongoing affordability hurdles, the first-time homebuyer demographic, especially those eyeing entry-level residences, constitutes a substantial and enduring demand source. Century Communities' deliberate focus on delivering appealing, well-built homes at accessible price points directly addresses this group's needs, enabling the company to secure considerable market share within this vital and consistently replenished buyer segment.

In 2024, this segment remains critical. For instance, data from the National Association of Realtors indicated that first-time buyers accounted for approximately 30% of all home sales in early 2024, highlighting the persistent demand. Century Communities' strategy to offer homes in the $300,000 to $450,000 range, often featuring smaller footprints and efficient designs, directly appeals to this price-sensitive demographic.

- Market Share Capture: Century Communities' affordable offerings allow them to capture a significant portion of the first-time homebuyer market.

- Demand Persistence: This segment represents a large, continuously replenishing pool of potential buyers.

- Strategic Alignment: The company's product development aligns perfectly with the needs and financial capabilities of first-time buyers.

- 2024 Relevance: First-time buyers remained a key driver of the housing market in 2024, making this a crucial strategic focus.

Development of Energy-Efficient and Sustainable Homes

As consumer preferences increasingly lean towards eco-friendly living, the demand for homes featuring energy-efficient technologies and sustainable construction methods is on the rise. This trend presents a significant growth opportunity for builders who can integrate these elements into their offerings.

While Century Communities may not explicitly categorize "energy-efficient and sustainable homes" as a distinct brand within its portfolio, its overarching commitment to quality construction suggests a capacity to incorporate these desirable features. This strategic alignment with evolving consumer values could position Century Communities to capture a growing segment of the market, potentially translating into substantial future market share.

- Growing Demand: In 2024, the market for green building materials and technologies saw continued expansion, with consumer surveys indicating a strong preference for homes with lower utility costs and reduced environmental impact.

- Market Potential: The global green building market is projected to reach significant valuations by 2030, driven by government incentives and increasing environmental awareness.

- Competitive Advantage: Builders incorporating features like high-efficiency insulation, solar panels, and water-saving fixtures are differentiating themselves and attracting environmentally conscious buyers.

- Future Growth: Investments in sustainable building practices are expected to yield long-term benefits, including enhanced brand reputation and a stronger competitive position in the evolving housing market.

Century Communities' focus on the affordable housing segment, particularly through its Century Complete brand, positions it strongly in the Stars category of the BCG matrix. This segment benefits from consistent demand from first-time homebuyers, a demographic that remained a significant portion of the market in 2024, accounting for around 30% of sales according to the National Association of Realtors. The company's land-light strategy and spec build approach allow for efficient scaling and market share capture in this high-growth area.

| Brand/Segment | BCG Category | Key Strengths | 2024 Market Relevance |

|---|---|---|---|

| Century Complete (Affordable Housing) | Stars | High demand from first-time buyers, land-light model, spec builds, strategic Sun Belt expansion. | First-time buyers ~30% of sales; strong closings in 2024. |

| Energy-Efficient/Sustainable Homes | Potential Stars/Question Marks | Growing consumer preference, potential for differentiation, aligns with evolving values. | Increased demand for lower utility costs; green building market expansion. |

What is included in the product

This BCG Matrix analysis provides strategic insights into Century Communities' business units, guiding decisions on investment, holding, or divestment.

A clear BCG Matrix visualizes Century Communities' portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Century Communities' core single-family detached homes are its cash cows. This is where the company makes most of its money and delivers the most homes. In 2024, they delivered a record 11,007 homes, showing the strength and maturity of this product line.

Century Communities' integrated mortgage and insurance services, including Inspire Home Loans, Parkway Title, IHL Home Insurance Agency, and IHL Escrow, function as significant cash cows. These in-house operations generate consistent ancillary revenue and bolster profit margins by capitalizing on existing home sales with minimal incremental marketing costs.

This strategic integration creates a reliable cash flow stream. The mortgage origination market is also anticipated to see a rise in profitability in 2025, further supporting the cash cow status of these services.

Established communities in stable markets are Century Communities' cash cows. These areas, where the company has a long history and a solid reputation, generate steady sales and profits. For instance, in 2024, Century Communities reported a strong performance in its more mature markets, contributing significantly to overall revenue.

These stable markets require less capital for new land purchases or marketing campaigns compared to rapidly expanding areas. This allows Century Communities to efficiently extract cash flow to fund other business initiatives. The company's focus on these established regions leverages existing infrastructure and strong brand recognition, ensuring continued financial stability.

Land-Light Operating Strategy

Century Communities' land-light strategy positions its homebuilding operations as a cash cow. By controlling a significant majority of its lots, typically between 55% and 58% projected for 2024-2025, the company avoids tying up excessive capital in land ownership.

This focus on controlling rather than owning land significantly reduces financial risk and boosts cash flow. Lower land inventory carrying costs and optimized land utilization directly contribute to the operational efficiency that defines a cash cow.

- Land Control vs. Ownership: Century Communities aims to control 55-58% of its lots in 2024-2025, minimizing capital outlay.

- Reduced Financial Risk: Less land inventory means lower carrying costs and reduced exposure to land value fluctuations.

- Enhanced Cash Flow: The strategy frees up capital, enabling greater operational flexibility and cash generation.

- Operational Efficiency: Optimized land utilization contributes to a strong cash flow generation profile.

Efficient Supply Chain and Cost Management

Century Communities' efficient supply chain and cost management are key drivers of its cash cow status. The company has shown a remarkable ability to control direct construction costs and boost gross margins, even when facing economic headwinds and increasing material prices. This operational efficiency translates into consistent profitability and robust cash flow from its ongoing projects.

This disciplined approach to cost control, coupled with effective leverage of fixed costs, ensures strong and reliable cash generation from established operations. For instance, in the first quarter of 2024, Century Communities reported a gross margin of 22.8%, a testament to their cost management strategies in a fluctuating market. This consistent profitability significantly bolsters the company's overall financial stability.

- Strong Gross Margins: Achieved 22.8% gross margin in Q1 2024, demonstrating effective cost control.

- Operational Efficiency: Ability to manage direct construction costs despite rising material prices.

- Consistent Profitability: Disciplined cost control and fixed cost leverage lead to reliable profits.

- Robust Cash Generation: Existing operations consistently produce strong cash flow, contributing to financial health.

Century Communities' core single-family detached homes represent a significant cash cow, underscored by their record delivery of 11,007 homes in 2024. This segment consistently generates the highest revenue and profit, benefiting from established market presence and mature product lines. The company's integrated financial services, including Inspire Home Loans and Parkway Title, also function as crucial cash cows, providing consistent ancillary revenue and enhancing profit margins on existing sales. These services are poised for increased profitability in 2025, further solidifying their cash cow status.

| Business Segment | BCG Matrix Category | 2024 Performance Indicator | Rationale |

|---|---|---|---|

| Single-Family Detached Homes | Cash Cow | 11,007 Homes Delivered (Record) | High market share, mature product, consistent revenue generation. |

| Integrated Financial Services (Mortgage, Title, Insurance) | Cash Cow | Ancillary Revenue & Margin Enhancement | Leverages existing sales, low incremental cost, anticipated 2025 profitability increase. |

| Established Communities | Cash Cow | Strong Performance in Mature Markets | Steady sales, reduced capital needs for expansion, brand recognition. |

Preview = Final Product

Century Communities BCG Matrix

The preview of the Century Communities BCG Matrix you see is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, is ready for your strategic planning and decision-making needs. You can confidently expect the same high-quality, professionally formatted report to be delivered to you, enabling immediate application to your business development.

Dogs

Underperforming legacy community developments, particularly those in stagnant or declining local housing markets, often fall into the question mark category. These older projects might have designs that no longer appeal to today's buyers, leading to slow sales and a drain on resources. For instance, if a development built in the early 2000s is in an area with minimal population growth, its homes might not command the same interest as newer builds in more dynamic regions.

Even with a wide national presence, Century Communities might encounter specific local markets where housing demand is sluggish or there's too much inventory. In these areas, if the company's market share is small and future growth looks unlikely, their operations could just cover costs or even lose money, essentially becoming a drain on resources.

For instance, if a particular metropolitan area saw a 5% year-over-year decline in new housing starts in 2024, and Century Communities held less than a 2% market share there, those specific operations would likely fit the description of a cash trap, requiring careful management to avoid further losses.

Century Communities might categorize experimental or highly specialized home designs as niche product lines with low adoption rates. These could include avant-garde architectural styles or unique amenity packages that haven't captured widespread buyer interest. Such offerings typically represent a small fraction of sales and may demand significant resources for development and marketing without yielding proportional returns.

Inefficient Land Holdings in Non-Strategic Areas

Inefficient land holdings in non-strategic areas represent a drag on Century Communities' resources. These might be parcels in stagnant markets where the company has little presence and no active development plans. Such assets tie up capital and incur carrying costs, hindering potential investments in more promising ventures.

For instance, if Century Communities owns undeveloped land in a region experiencing population decline or economic stagnation, it falls into this category. In 2024, the housing market saw varied performance across regions; areas with declining job growth or out-migration would be prime examples of non-strategic locations for land holdings.

- Stagnant Markets: Land in areas with low demand and limited growth potential.

- Minimal Market Share: Holdings in regions where Century Communities has a negligible presence.

- Capital Tie-up: Assets that prevent investment in higher-return development opportunities.

- Carrying Costs: Ongoing expenses like property taxes and maintenance on unproductive land.

Highly Incentivized Older Inventory

Highly incentivized older inventory, often representing homes from previous phases or model homes, can become a drag on a company's performance. In a slowing market, these properties may require substantial price reductions or attractive incentive packages to attract buyers. For instance, if a builder like Century Communities has a significant amount of unsold inventory from earlier developments, they might offer features like paid closing costs or discounted interest rates. In 2024, the housing market saw varying levels of demand across different regions, making the management of older inventory particularly crucial.

While these incentives can help move stagnant stock, they often come at the cost of reduced profit margins. If these homes consistently need deep discounts due to factors like low demand, outdated designs, or unfavorable locations, they transform into less desirable assets. This situation can impact overall profitability and tie up valuable capital that could be reinvested in more promising projects. For example, a builder offering a 3% incentive on a home might see their profit margin shrink considerably, especially if the initial sale price was already tight.

- Stagnant Inventory Homes that are difficult to sell without significant price cuts or incentives.

- Reduced Profitability Lower profit margins due to the cost of incentives and discounts.

- Capital Tie-up Funds are locked in less desirable assets instead of being used for growth.

- Market Sensitivity Performance is highly dependent on market conditions and buyer demand.

Dogs in Century Communities' portfolio represent projects or land holdings that are not performing well and require significant resources without generating substantial returns. These are often legacy communities in declining areas or specialized products with low demand, tying up capital and hindering growth. For instance, in 2024, areas with high interest rates and limited job growth could have such underperforming assets.

These assets are characterized by low market share, stagnant demand, and high carrying costs, essentially acting as cash traps. Managing these requires strategic decisions to minimize losses and reallocate capital to more promising ventures.

For example, a development in a region experiencing a 2% year-over-year population decrease in 2024, where Century Communities has a market share below 3%, would likely be classified as a Dog.

These underperforming assets can include unsold inventory from older phases or model homes that need deep discounts, impacting profit margins and tying up capital.

| Category | Characteristics | Impact on Century Communities |

| Underperforming Communities | Stagnant local markets, outdated designs, slow sales. | Drain on resources, low ROI, capital tie-up. |

| Inefficient Land Holdings | Non-strategic locations, low demand, minimal presence. | Carrying costs, prevents investment in growth areas. |

| Niche Product Lines | Low adoption rates, experimental designs, high development costs. | Limited sales volume, requires significant marketing investment. |

| Highly Incentivized Inventory | Older homes, model homes requiring price cuts. | Reduced profit margins, capital locked in slow-moving assets. |

Question Marks

Century Communities' expansion into new states and over 40 new markets positions them as a 'Question Mark' in these emerging territories. These areas offer substantial growth opportunities but currently represent a small market share for the company. Significant investment in land acquisition, community development, and brand awareness is crucial for establishing a stronger presence.

Emerging active adult communities represent a strategic focus for Century Communities, aligning with the robust growth of the 55+ housing sector. This segment, showing considerable potential, requires significant capital outlay to establish a foothold and cater to the diverse and evolving needs of this demographic.

These developing communities, especially in markets where Century Communities is newer to the 55+ segment, are positioned as question marks. The company's commitment to this area is underscored by the increasing demand, with the 55+ population projected to grow substantially in the coming years, presenting both opportunities and challenges for market penetration and brand building.

Investing in next-generation smart home tech and sustainable materials positions Century Communities for potential high future demand and market disruption. These innovations, while currently representing a small market share, require significant R&D and marketing to drive widespread adoption.

For instance, the global smart home market was valued at approximately $107.5 billion in 2023 and is projected to reach $250 billion by 2028, showcasing substantial growth potential. Century Communities' pilot programs in this area, even if currently a minor segment of their overall business, could capture a significant portion of this expanding market.

The company's strategic allocation of resources towards these forward-thinking technologies aligns with a Stars or Question Marks quadrant in the BCG matrix, depending on their current market penetration and growth trajectory. This investment is crucial for future competitive advantage.

Expansion into Multi-Family Rental Properties (Century Living, LLC)

Century Living, LLC, Century Communities' venture into multi-family rental properties, is positioned as a Question Mark in the BCG Matrix. This segment, primarily operating in Colorado, faces a high-growth rental market but currently commands a smaller market share relative to the company's established single-family homebuilding operations.

The strategic challenge for Century Living lies in its need for substantial capital investment to expand its footprint and capture a larger portion of the burgeoning rental market. This investment is crucial for scaling operations and competing effectively against established multi-family developers.

- High Market Growth Potential: The multi-family rental sector continues to show robust demand, driven by demographic shifts and affordability concerns in housing.

- Low Current Market Share: Despite market growth, Century Living's share within the broader multi-family rental landscape is still developing.

- Significant Capital Requirements: Scaling multi-family projects necessitates considerable upfront investment in land acquisition, construction, and development.

- Strategic Focus Needed: The company must decide whether to significantly invest in Century Living to turn it into a Star or divest if it doesn't align with long-term strategic goals.

New Product Lines Targeting Shifting Demographics (e.g., Gen Z Homebuyers)

The first-time homebuyer market is indeed changing, with Gen Z exhibiting distinct behaviors like co-buying and a strong need for down payment assistance. Century Communities' strategic move to create new product lines or community concepts that cater to these evolving preferences, even if currently holding a low market share, positions them as potential Stars in the BCG matrix. This focus on a growing demographic with unique needs suggests significant future growth potential if these new offerings resonate.

For instance, in 2024, Gen Z is projected to become a larger segment of the homebuying market. Data from the National Association of Realtors (NAR) indicated that in 2023, 17% of recent buyers were Gen Z. Century Communities' investment in understanding and serving this group, potentially through innovative financing options or community designs that encourage shared ownership, could capture a substantial portion of this expanding market.

- Gen Z Homebuyers: A growing demographic with unique purchasing behaviors.

- Co-buying and Assistance: Key trends influencing Gen Z's entry into homeownership.

- Century Communities' Strategy: Developing new product lines to meet these evolving needs.

- BCG Matrix Placement: Potential Star due to low current market share but high future growth prospects.

Century Communities' expansion into new geographic territories and its focus on emerging segments like active adult communities and catering to Gen Z first-time homebuyers position these efforts as Question Marks in the BCG Matrix. These areas exhibit high growth potential but currently represent a smaller market share for the company, necessitating significant investment in land, development, and brand building to capture future market opportunities.

The company's strategic investments in smart home technology and sustainable building materials also fall into the Question Mark category. While these innovations have the potential to drive future demand and market disruption, their current market penetration is low, requiring substantial research and development alongside marketing efforts to achieve widespread adoption and competitive advantage.

| Business Area | Market Growth | Market Share (Century) | BCG Quadrant | Strategic Consideration |

|---|---|---|---|---|

| New Geographic Markets | High | Low | Question Mark | Requires investment for market penetration |

| Active Adult Communities | High | Developing | Question Mark | Capital intensive, target demographic growth |

| Gen Z Homebuyers | High | Low | Question Mark | Needs tailored product and financing |

| Smart Home Tech | High | Low | Question Mark | R&D and marketing for adoption |

| Century Living (Multi-family) | High | Low | Question Mark | Significant capital for scaling |

BCG Matrix Data Sources

Our Century Communities BCG Matrix draws from a robust blend of financial disclosures, market research reports, and internal performance data to provide a comprehensive view of our business units.