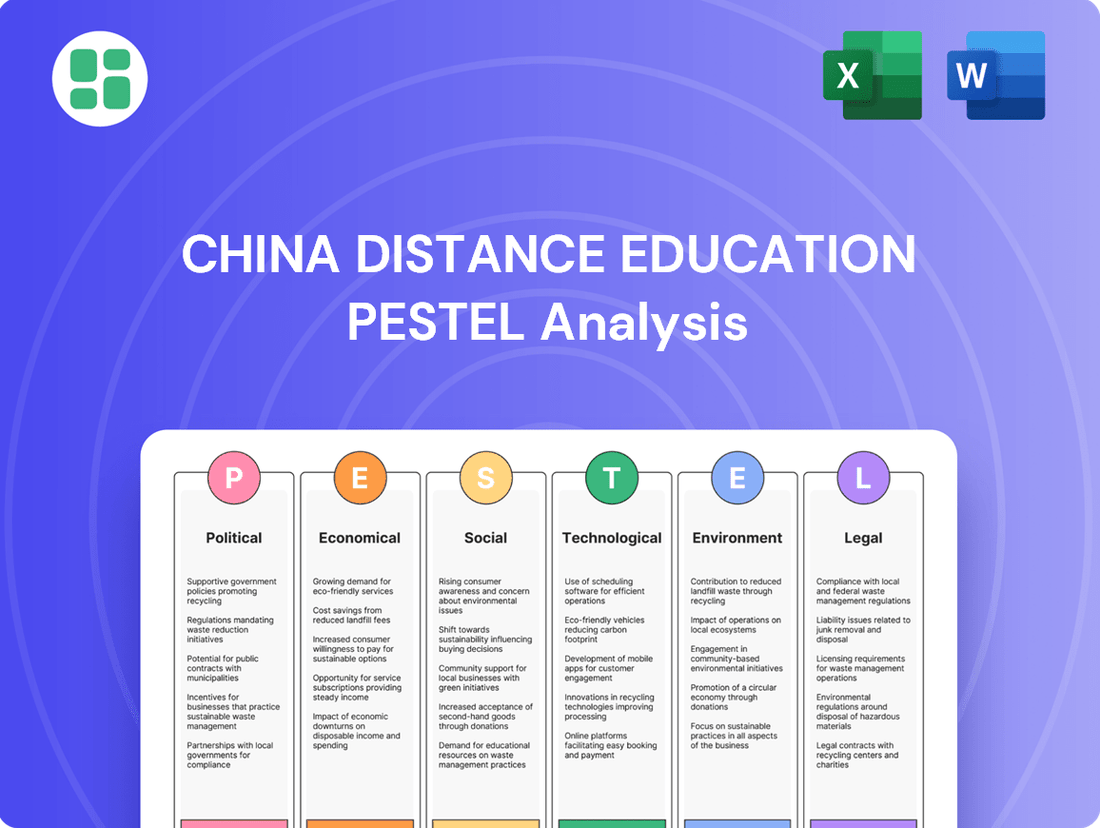

China Distance Education PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Distance Education Bundle

Uncover the intricate web of political, economic, social, technological, legal, and environmental factors shaping China Distance Education's trajectory. Our comprehensive PESTLE analysis provides the critical intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full report now to gain a strategic advantage.

Political factors

The Chinese government is heavily invested in digital education, recognizing its importance for national progress. The 'Smart Education of China' initiative and the 'Education Powerhouse Plan (2024–2035)' underscore this commitment by pushing for AI and digital tech integration, building extensive digital learning resources and platforms.

This robust policy support creates a fertile ground for companies like China Distance Education Holdings Limited. In 2024, China's digital education market was estimated to be worth over $300 billion, with projections indicating continued strong growth driven by these government-led advancements.

China's government is heavily prioritizing vocational and professional training to fuel its evolving economy and tackle skill gaps. This strategic push is underscored by legislation such as the revised Vocational Education Law, which took effect on May 1, 2020, significantly boosting the standing of vocational education and attracting more investment.

This governmental focus directly benefits companies like China Distance Education Holdings Limited, whose curriculum in areas like accounting, healthcare, and engineering certifications aligns perfectly with national development goals. For instance, in 2023, China aimed to enroll over 10 million students in vocational colleges, signaling a substantial market for specialized online learning platforms.

China's online education sector is experiencing increased regulatory oversight, impacting content quality, data protection, and foreign capital. While vocational training welcomes foreign investment, general online tutoring has been significantly curtailed by policies such as the 'Double Reduction' initiative, which aims to ease student burdens.

Companies in this space must diligently adhere to intricate and frequently updated compliance mandates to maintain legal standing and secure governmental endorsements. This evolving landscape necessitates constant adaptation to ensure sustained operations and market presence.

Digital Literacy and Skills Development Initiatives

China's government is actively pushing for widespread digital literacy and skills development, aiming to significantly boost the nation's digital economy by 2025. This commitment is evident in plans that prioritize nurturing digital talent across all levels of education.

Key to this strategy is the integration of Artificial Intelligence (AI) education into the curriculum for primary and secondary students. Furthermore, higher education institutions are being encouraged to strengthen their digital-related academic programs, creating a more robust pipeline of skilled professionals.

These government-led initiatives directly expand the addressable market and amplify the demand for digital education services. For instance, China's Ministry of Education reported that in 2023, over 2.5 million students were enrolled in computer science and related fields at universities, a number expected to grow with these new mandates.

- National Digital Literacy Target: Government plans aim to significantly enhance national digital literacy and skills by 2025.

- AI Education Mandate: AI education is being mandated for primary and secondary school students.

- Higher Education Focus: Strengthening digital-related academic programs in universities is a key priority.

- Market Impact: These policies are projected to increase the demand and addressable market for digital education services.

Regional Disparities and Resource Allocation

Government policies are actively addressing regional disparities in education, aiming to bridge urban-rural divides and optimize resource distribution. This involves significant investment in modernizing infrastructure and facilities in less developed areas to ensure fairer access to quality learning experiences. For instance, China's 14th Five-Year Plan (2021-2025) emphasizes balanced regional development, including educational equity.

These initiatives create substantial opportunities for distance education providers to extend their reach into previously underserved regions. The government's commitment to improving digital connectivity, a key enabler for online learning, further supports this expansion. By 2023, China had achieved a broadband penetration rate of over 60% in rural areas, a figure expected to continue growing.

- Bridging the Gap: Government funding for rural education infrastructure, including digital learning tools, aims to equalize educational opportunities.

- Connectivity Boost: Continued investment in rural broadband networks supports the expansion of online education services into remote areas.

- Market Expansion: Distance learning platforms can leverage these policy shifts to tap into new student demographics in underdeveloped provinces.

- Resource Optimization: Policies encouraging the sharing of educational resources digitally help overcome geographical limitations in teacher and material availability.

Government policy in China strongly favors digital education, with initiatives like the 'Education Powerhouse Plan (2024–2035)' driving AI and digital tech integration. This robust support is reflected in the market, which was valued at over $300 billion in 2024, with continued growth anticipated.

The government's emphasis on vocational training, bolstered by legislation like the revised Vocational Education Law, directly benefits companies offering relevant certifications, aligning with national development goals and a 2023 target of over 10 million vocational college enrollments.

While the government promotes digital literacy and AI education for all students, aiming to boost the digital economy by 2025, it also imposes stricter regulations on online tutoring, necessitating careful compliance from education providers.

Policies aimed at reducing regional educational disparities, such as investments in rural digital infrastructure, open new avenues for distance learning providers to expand their reach. By 2023, rural broadband penetration exceeded 60%, facilitating this digital expansion.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting China's distance education sector across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for stakeholders to navigate the evolving landscape and capitalize on emerging opportunities.

A PESTLE analysis of China's distance education sector provides a clear roadmap to navigate regulatory hurdles and capitalize on technological advancements, alleviating concerns about market entry and growth.

Economic factors

The e-learning market in China is on a significant upward trajectory, with projections indicating it will reach a substantial USD 1,44,848.4 Million by 2033. This growth is fueled by an impressive compound annual growth rate (CAGR) of 11.04% from 2025 to 2033. Factors such as wider internet access, rapid technological innovation, and a growing preference for adaptable learning methods are key drivers behind this expansion.

For companies like China Distance Education Holdings Limited, this burgeoning market presents a highly favorable environment. The increasing demand for online educational content and services directly translates into expanded opportunities for the company to offer its diverse range of courses and learning solutions to a larger audience.

China is channeling substantial public and private capital into its education technology (EdTech) sector, especially in AI-driven learning and vocational skills development. The government's '14th Five-Year Plan' underscores this commitment, earmarking billions of yuan specifically for integrating AI into educational platforms. This focus is creating a fertile ground for EdTech firms, fueling innovation and enabling them to scale their operations effectively.

China's economic landscape is increasingly prioritizing specialized skills, with a notable surge in demand for professional certifications. This is largely driven by an evolving job market that requires expertise in sectors like advanced manufacturing, artificial intelligence, and green energy. For instance, the demand for AI specialists in China saw a significant increase, with job postings growing by over 50% in 2023 compared to the previous year, according to recruitment platforms.

This economic push for upskilling is also reflected in educational attainment. Master's degrees and advanced vocational qualifications are rapidly becoming the new standard for career progression, highlighting a widening skills gap. This trend directly benefits companies like China Distance Education Holdings Limited, whose core business revolves around preparing individuals for crucial professional certification exams.

Impact of Declining Birth Rates on Enrollment

China's declining birth rate presents a significant challenge for higher education enrollment, particularly affecting regional institutions. While the overall education market continues to expand, the shrinking pool of high school graduates is a direct consequence of this demographic trend. This could lead to increased competition for students and potentially strain smaller or less established universities.

The demographic shift is expected to drive consolidation within the higher education sector. As fewer students graduate high school, institutions may find it harder to maintain enrollment numbers, prompting mergers or closures. This environment could also accelerate the adoption of flexible online learning models, as individuals increasingly seek professional development and upskilling opportunities rather than traditional, full-time degree programs.

- Shrinking Graduate Pool: China's birth rate has fallen significantly, with the National Bureau of Statistics reporting 9.02 million births in 2023, a decrease from 9.56 million in 2022. This directly impacts the number of students entering the higher education pipeline.

- Regional Impact: Universities in less populated or economically developing regions are likely to feel the enrollment crunch more acutely than those in major metropolitan areas.

- Shift in Learning Preferences: A growing demand for lifelong learning and reskilling, fueled by economic changes and technological advancements, may see a greater proportion of learners opting for online or part-time programs over traditional campus-based degrees.

Digital Economy Growth and Employment Trends

China's digital economy is booming, making up almost 45% of its GDP in 2024. This rapid growth is a major driver for new jobs and a significant shift in the skills employers are looking for. Industries across the board are increasingly prioritizing digital literacy and specialized tech expertise, directly impacting the demand for accessible and effective online learning solutions.

This economic transformation creates a clear demand for a workforce equipped with enhanced digital capabilities. Consequently, the need for online education and training services, such as those offered by China Distance Education Holdings Limited, is on the rise. The company is well-positioned to meet this growing need by providing the specialized skills development required in this evolving digital landscape.

- Digital Economy's GDP Share: Reached nearly 45% of China's GDP in 2024.

- Job Creation: The digital economy is a significant source of new employment opportunities.

- Skills Demand: There's a growing requirement for digital literacy and specialized tech skills across industries.

- Education Demand: This trend fuels increased demand for online education and training services.

China's economic focus on specialized skills, particularly in advanced manufacturing and AI, directly boosts demand for vocational training and certifications. This is evidenced by a more than 50% increase in AI specialist job postings in 2023. The government's 14th Five-Year Plan further supports this by allocating billions to AI in education, creating a fertile ground for EdTech firms.

The burgeoning digital economy, representing nearly 45% of China's GDP in 2024, necessitates a digitally literate workforce. This economic shift fuels the demand for online learning solutions that provide specialized tech expertise, positioning companies like China Distance Education favorably.

| Economic Factor | 2023 Data/Trend | Impact on Distance Education |

|---|---|---|

| Demand for Specialized Skills | 50%+ increase in AI job postings (2023) | Increased demand for certification and vocational training |

| Government Investment in EdTech | Billions allocated to AI in education (14th Five-Year Plan) | Supports innovation and scaling for EdTech providers |

| Digital Economy Growth | 45% of GDP in 2024 | Drives demand for digital literacy and tech skills training |

Full Version Awaits

China Distance Education PESTLE Analysis

The preview you see here is the exact, fully formatted China Distance Education PESTLE Analysis document you will receive after purchase. This comprehensive analysis covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the sector. You can be confident that what you're previewing is the final, ready-to-use report.

Sociological factors

China's internet penetration reached an impressive 77.5% by the end of 2023, meaning over 1.09 billion people were online. This massive digital footprint, bolstered by widespread 5G and broadband availability, directly fuels the growth of distance education.

This extensive connectivity makes online learning platforms incredibly accessible to a vast segment of the Chinese population. It's no longer a niche offering; it's a mainstream channel for acquiring new skills and knowledge, significantly impacting educational accessibility and demand.

Historically, vocational education in China was often viewed as a secondary option compared to traditional academic pathways. However, significant government initiatives, including the 2019 Vocational Education Law revisions, are actively working to elevate its prestige, aiming to place it on an equal footing with general higher education. This shift is crucial for meeting the evolving demands of China's industrial and technological sectors.

The growing accessibility and perceived quality of online learning platforms are further transforming societal views on distance education. As more individuals recognize the flexibility and targeted skill development offered by online courses, the stigma associated with non-traditional learning is diminishing. By mid-2024, over 300 million Chinese citizens had participated in some form of online learning, highlighting its increasing acceptance for professional advancement.

The demand for flexible and accessible learning is a major societal shift in China, driven by individuals needing to upskill or reskill while managing busy lives. Online education platforms are perfectly positioned to meet this need, offering self-paced courses and convenient test preparation. By mid-2024, over 70% of Chinese internet users reported engaging with online learning resources, highlighting the widespread adoption of these flexible educational models.

Demographic Shifts and Lifelong Learning

China's demographic landscape is undergoing a significant transformation, with an aging population and declining birth rates becoming prominent features. This shift underscores the growing necessity for lifelong learning and continuous upskilling among the current workforce. As the traditional student demographic contracts, there's an increasing societal demand for adult education and professional development programs aimed at sustaining a competitive labor market, presenting a direct advantage for entities like China Distance Education Holdings Limited.

The implications of these demographic trends are substantial for the education sector. For instance, by the end of 2023, China's population aged 60 and above reached 296.97 million, accounting for 21.1% of the total population. This growing segment of older adults requires accessible and relevant learning opportunities to remain engaged and productive. Simultaneously, the declining birth rate means fewer young people entering the workforce, necessitating a focus on enhancing the skills of existing employees to fill critical roles and drive economic growth.

- Aging Population: China's elderly population is expanding rapidly, creating a demand for reskilling and upskilling programs tailored to mature learners.

- Declining Birth Rate: With fewer young entrants, companies must invest in the continuous development of their current workforce to maintain productivity and innovation.

- Lifelong Learning Emphasis: The demographic shift necessitates a societal embrace of lifelong learning to adapt to evolving job market demands and technological advancements.

- Adult Education Growth: The shrinking traditional student pool fuels the expansion of adult and vocational education, directly benefiting distance learning providers.

Parental and Student Focus on Skill Enhancement

Chinese parents and students are increasingly prioritizing practical skills and certifications over traditional degrees. This shift is fueled by a highly competitive job market, with many seeking vocational training and online courses that offer direct career pathways. For instance, data from 2024 indicates a significant uptick in enrollment for online professional development courses focused on digital marketing and artificial intelligence, reflecting this demand.

This emphasis on skill enhancement directly impacts the distance education sector, driving demand for specialized programs. The desire for tangible career outcomes means that online platforms offering demonstrable skill acquisition and recognized certifications are particularly attractive. A 2024 survey revealed that over 60% of Chinese students consider job prospects as the primary factor when choosing an online course.

- Rising demand for vocational online courses: Parents and students are actively seeking out distance learning programs that impart job-ready skills.

- Focus on professional certifications: The value placed on certifications that enhance employability is growing, influencing course selection.

- Impact of competitive job market: The intense competition for desirable jobs is a key driver behind the shift towards skill-based learning.

- Growth in specialized online training: Online education providers are responding by offering more niche courses in high-demand fields.

China's societal focus is shifting towards lifelong learning, driven by an aging population and a declining birth rate. This demographic trend, with the elderly population reaching 296.97 million by the end of 2023, necessitates continuous upskilling for the existing workforce to maintain economic competitiveness.

Furthermore, there's a growing emphasis on practical skills and certifications over traditional degrees, a trend evident in over 60% of Chinese students prioritizing job prospects when selecting online courses in 2024. This demand for vocational training and job-ready skills directly benefits distance education providers offering specialized, career-oriented programs.

| Sociological Factor | Description | 2023/2024 Data Point |

|---|---|---|

| Lifelong Learning Emphasis | Societal acceptance and pursuit of continuous education for career and personal development. | Growing demand driven by demographic shifts. |

| Vocational Skill Prioritization | Increasing preference for practical skills and certifications that lead to direct employment. | Over 60% of students consider job prospects when choosing online courses (2024). |

| Aging Population Impact | Need for accessible reskilling and upskilling opportunities for older demographics. | China's elderly population was 21.1% of the total in 2023. |

| Declining Birth Rate Impact | Necessity for enhanced workforce skills due to fewer young entrants. | Focus on upskilling current employees for critical roles. |

Technological factors

Artificial Intelligence and immersive technologies like AR and VR are revolutionizing China's distance education. The government’s push for AI education, aiming to boost digital literacy, is evident. For instance, by 2023, over 300 universities in China had established AI-related majors, reflecting this commitment.

E-learning platforms are actively integrating AI to offer personalized learning experiences and AI-powered homework assistance. This tech infusion is designed to significantly improve the quality and effectiveness of online educational content and its delivery.

China's commitment to building a national data infrastructure is a significant technological driver for distance education. By 2029, the main structure of this infrastructure is slated for completion, aiming to create a robust backbone for digital services.

Enhancements to internet connectivity, including the upgrade of 5G networks to the more advanced 5G-A standard, are crucial. This expansion of 5G base stations and the development of computing power networks directly support the delivery of high-quality online education, ensuring greater reliability and accessibility for students across the nation.

Cloud computing is a major driver for China's distance education sector, offering scalable infrastructure for content delivery and data management. This technology underpins the efficient operation of online learning platforms, a critical factor in meeting the growing demand for accessible education. By July 2025, the adoption of cloud solutions is expected to further streamline operations and enhance user experience.

The development of robust data management systems is essential for China Distance Education. Efforts to activate data elements are crucial for leveraging the vast amounts of information generated by online learners. This allows for personalized learning experiences and more effective platform development, with significant advancements anticipated by the close of 2024.

Development of National Smart Education Platforms

China's commitment to digital learning is evident in its ongoing development of national smart education platforms. A prime example is the 'Smart Education of China' platform, which acts as a vast digital library for educational content. This initiative aims to standardize and centralize digital education delivery nationwide.

These platforms are not static; they are continuously upgraded with artificial intelligence capabilities to enhance user experience and learning outcomes. This evolution positions them as a potential ecosystem for other educational technology providers to integrate with.

- AI Integration: Platforms are increasingly incorporating AI for personalized learning paths and automated assessment.

- Resource Expansion: The 'Smart Education of China' platform already hosts a significant volume of resources spanning K-12, vocational, and higher education.

- Government Investment: Significant state funding is allocated to the construction and maintenance of these national digital education infrastructure projects.

Cybersecurity and Data Security Technologies

The escalating reliance on digital platforms in China's education sector, particularly for distance learning, amplifies the critical need for robust cybersecurity and data protection. As of 2024, the digital transformation in education means that protecting sensitive student and institutional data from breaches is paramount. Companies are increasingly allocating significant resources to safeguard their operations.

China's commitment to data privacy, underscored by regulations like the Personal Information Protection Law (PIPL), necessitates that online education providers implement advanced security measures. This includes investing in technologies such as end-to-end encryption, multi-factor authentication, and regular security audits to ensure compliance and maintain user trust. The market for cybersecurity solutions in China is projected to grow substantially, reflecting this demand.

- Investment in advanced encryption technologies is crucial for protecting student data.

- Multi-factor authentication significantly reduces unauthorized access risks.

- Regular security audits are essential for compliance with China's PIPL.

- The Chinese cybersecurity market is experiencing rapid growth, with a significant portion dedicated to data protection solutions.

Technological advancements are fundamentally reshaping China's distance education landscape. The integration of Artificial Intelligence (AI) and immersive technologies like Augmented Reality (AR) and Virtual Reality (VR) is creating more engaging and personalized learning experiences. By 2023, over 300 Chinese universities had introduced AI-related majors, underscoring the nation's focus on digital literacy.

E-learning platforms are leveraging AI for personalized learning paths and automated homework assistance, aiming to boost educational effectiveness. Furthermore, the ongoing development of China's national data infrastructure, with its main structure expected by 2029, will provide a robust foundation for digital education services. Enhancements in 5G connectivity, including the rollout of 5G-A, are crucial for delivering high-quality online content reliably.

Cloud computing is a vital enabler, offering scalable infrastructure for content delivery and data management, which is critical for meeting the rising demand for accessible education. By July 2025, cloud adoption is expected to further optimize operations and user experience in the sector. Robust data management systems are also essential for leveraging learner data to personalize educational offerings and improve platform development, with significant progress anticipated by the end of 2024.

The 'Smart Education of China' platform exemplifies the government's commitment to digital learning, serving as a centralized repository for educational content across various levels. Continuous AI-powered upgrades to these platforms are enhancing user experience and learning outcomes, positioning them as potential integration hubs for other EdTech providers. Cybersecurity and data protection are paramount, with significant investments being made to safeguard sensitive student information against breaches, especially given the escalating reliance on digital platforms.

| Technology | Key Application in Distance Education | Impact/Trend |

|---|---|---|

| Artificial Intelligence (AI) | Personalized learning paths, automated assessment, AI-powered homework assistance | Enhanced learning effectiveness and engagement; over 300 universities offered AI majors by 2023 |

| Immersive Technologies (AR/VR) | Interactive learning environments, virtual labs, simulations | Deeper understanding and practical skill development |

| 5G Connectivity | High-quality streaming of video content, real-time interaction, VR/AR experiences | Improved accessibility and reliability of online learning; expansion to 5G-A standard |

| Cloud Computing | Scalable content delivery, data storage, platform management | Efficient operations and enhanced user experience; expected further streamlining by July 2025 |

| Data Management Systems | Personalized learning insights, platform optimization, data-driven decision making | Improved learner outcomes and platform development; advancements by end of 2024 |

| Cybersecurity | Data protection, end-to-end encryption, multi-factor authentication | Safeguarding sensitive student data, compliance with PIPL; growing cybersecurity market |

Legal factors

China's legal landscape for data protection is robust and rapidly advancing. Key legislation like the Personal Information Protection Law (PIPL), Data Security Law (DSL), and Cybersecurity Law (CSL) are in effect, with the Network Data Security Management Regulations coming into force on January 1, 2025. These laws mandate stringent protocols for how online education providers handle personal data, from collection to storage and cross-border transfer.

Compliance with these regulations is critical for online education platforms operating in China. Failure to adhere to the strict requirements on data collection, processing, storage, and security can lead to significant penalties. For instance, PIPL can impose fines of up to 50 million yuan or 5% of the previous year's annual turnover for violations.

China's government exercises stringent control over online education content, ensuring it adheres to national curriculum guidelines and ideological directives. This oversight is crucial for maintaining educational quality and national unity. For instance, the Ministry of Education regularly updates guidelines for online courses, impacting content creation and delivery for all providers.

Operating an online education platform in China necessitates obtaining specific licenses or completing registration procedures with relevant education authorities. Failure to comply can lead to significant penalties or operational shutdowns. As of late 2024, reports indicate thousands of online education providers have undergone compliance reviews, with a notable percentage facing corrective actions due to regulatory gaps.

China's Vocational Education Law, revamped in 2022, significantly elevates the standing of vocational training and actively promotes its growth, including welcoming foreign investment. This legal foundation offers a secure and encouraging environment for businesses specializing in professional and vocational instruction, a notable advantage compared to more stringent regulations affecting other areas of education.

Cross-Border Data Transfer Regulations

China's regulations on cross-border data transfers, particularly the Cybersecurity Law and the Personal Information Protection Law (PIPL), impose significant compliance burdens on education providers. These laws mandate security assessments and often require government approval before personal data can be moved outside of China. For instance, PIPL, effective November 1, 2021, outlines strict conditions for data transfers, including obtaining consent or meeting specific government-approved standards.

Navigating these rules is crucial for online education platforms serving international students or utilizing global cloud services. While recent updates in 2024 have introduced some optimizations and potential exemptions for certain data transfer scenarios, the core requirements remain. For example, the Cyberspace Administration of China (CAC) has been actively issuing guidelines and conducting reviews, impacting how companies like TAL Education Group or New Oriental might handle data for their overseas operations or international student admissions.

- PIPL Compliance: Requires explicit consent or other legal bases for transferring personal data abroad.

- Security Assessments: Mandatory for critical information infrastructure operators and data processors handling significant volumes of personal data.

- Government Approval: May be necessary depending on the type and volume of data transferred, and the nature of the business.

- Evolving Landscape: Regulations are subject to ongoing refinement, necessitating continuous monitoring by affected businesses.

Intellectual Property Protection

Intellectual property protection is paramount for China's distance education sector, especially with its increasing reliance on digital content. The rise of generative AI has intensified intellectual property rights claims, with a notable uptick in related litigation in 2024. This trend underscores the critical need for robust IP strategies to safeguard course materials and educational resources from unauthorized use and infringement.

The Chinese government has been actively strengthening its IP framework. For instance, amendments to the Copyright Law, effective from June 1, 2021, introduced enhanced penalties for infringement, aiming to deter piracy. As of early 2025, reports indicate continued focus on enforcing these regulations within the digital education space.

- Increased IP Litigation: Generative AI has led to a surge in intellectual property disputes within the online education landscape.

- Legal Framework Enhancements: China's amended Copyright Law (effective 2021) provides stronger deterrents against infringement.

- Enforcement Focus: Regulatory bodies are prioritizing IP enforcement in the digital education sector as of early 2025.

- Protection of Digital Assets: Robust IP strategies are essential for distance education providers to protect their valuable course content.

China's legal framework for online education is comprehensive, covering data protection, content regulation, and operational licensing. The Personal Information Protection Law (PIPL) and Data Security Law (DSL), effective since 2021 and 2021 respectively, impose strict rules on handling student data, with potential fines up to 5% of annual turnover for violations. The Ministry of Education also maintains oversight on curriculum content, ensuring alignment with national guidelines. As of late 2024, thousands of online education providers underwent compliance reviews, with many facing corrective actions for regulatory oversights.

The Vocational Education Law, significantly updated in 2022, actively promotes vocational training and welcomes foreign investment, creating a more favorable legal environment for specialized educational services. This contrasts with stricter regulations in other educational sub-sectors. Navigating cross-border data transfer regulations, such as those outlined in PIPL, remains a key legal challenge for platforms serving international students or using global cloud infrastructure, requiring careful adherence to security assessments and potential government approvals.

Intellectual property rights are increasingly critical, with a notable rise in IP litigation in 2024, partly due to generative AI. China's amended Copyright Law, effective since June 2021, offers stronger penalties for infringement, a crucial deterrent for digital content providers. As of early 2025, enforcement efforts are intensifying within the digital education sector, making robust IP strategies essential for protecting course materials.

| Legal Area | Key Legislation/Regulation | Effective Date | Potential Impact/Requirement |

|---|---|---|---|

| Data Protection | Personal Information Protection Law (PIPL) | November 1, 2021 | Strict rules on data collection, storage, and cross-border transfer; fines up to 5% of annual turnover. |

| Data Security | Data Security Law (DSL) | September 1, 2021 | Mandates data security measures and reporting obligations. |

| Content Oversight | Ministry of Education Guidelines | Ongoing updates | Ensures alignment with national curriculum and ideological directives. |

| Operational Licensing | Relevant Education Authority Requirements | Varies | Specific licenses or registration needed to operate; non-compliance can lead to shutdowns. |

| Vocational Education | Vocational Education Law | 2022 | Elevates vocational training status and encourages foreign investment. |

| Intellectual Property | Amended Copyright Law | June 1, 2021 | Enhanced penalties for infringement, crucial for digital content protection. |

Environmental factors

China's commitment to green development is accelerating digitalization across all sectors, including education. This shift to online platforms significantly cuts down on physical resource consumption, such as paper, and reduces the carbon emissions associated with commuting and maintaining large physical campuses. By 2023, China's digital economy had already reached an estimated 50.6 trillion yuan, demonstrating the scale of this transformation and its potential environmental benefits.

While China Distance Education's online model inherently reduces the physical footprint associated with traditional schooling, its reliance on data centers and digital infrastructure presents a significant environmental consideration. These facilities are substantial energy consumers, directly impacting the sector's carbon footprint.

As China aggressively pursues its carbon neutrality goals, aiming for peak emissions before 2030 and neutrality by 2060, the energy efficiency and carbon emissions of data centers supporting online education become increasingly scrutinized. Reports in 2024 highlighted the growing energy demands of China's digital economy, underscoring the need for sustainable practices within the education technology sector.

China's government is strongly pushing for ecological civilization and green, low-carbon development. A key objective is to enhance environmental governance and foster a robust green economy. For instance, by the end of 2023, China had achieved over 45% non-fossil fuel share in its primary energy consumption, a significant step towards its carbon neutrality goals.

While this environmental focus might not directly alter online education course material, it creates a policy landscape that nudges all industries, including digital services, to acknowledge and adopt sustainable operational practices. This means online education providers are increasingly expected to consider their digital footprint and incorporate eco-friendly approaches where feasible.

E-waste Management from Digital Devices

The surge in online education, driven by widespread adoption, inherently increases the demand for digital devices like computers, tablets, and smartphones among students and educators. This growing reliance on hardware directly contributes to the escalating issue of electronic waste (e-waste) throughout the device lifecycle, from manufacturing to disposal.

Companies operating within the online education sector must acknowledge and address the environmental consequences stemming from this amplified device consumption. For instance, China's e-waste generation reached approximately 7.3 million tons in 2021, highlighting the scale of the challenge.

- Increased Device Lifecycles: The push for sustainable practices encourages longer device usage and repairability.

- Recycling Initiatives: Robust e-waste recycling programs are crucial for managing discarded electronics.

- Circular Economy Models: Implementing circular economy principles in device production and disposal can reduce environmental impact.

- Consumer Awareness: Educating users on responsible device disposal is vital for mitigating e-waste.

Potential for Environmental Education Integration

Online education platforms in China, including those like China Distance Education Holdings Limited, are well-positioned to weave environmental education into their course structures, particularly in specialized areas such as engineering and healthcare. This integration directly supports China's national environmental objectives and cultivates a workforce with a heightened awareness of sustainability, potentially leading to the development of novel educational programs.

By incorporating modules on sustainable practices, emerging green technologies, or environmental compliance pertinent to various professions, online learning providers can actively contribute to China's vision of an ecological civilization. Such initiatives not only enhance the appeal and relevance of their educational content but also underscore a commitment to corporate social responsibility, aligning with the nation's pressing environmental priorities.

The demand for such specialized environmental training is growing. For instance, China's investment in renewable energy is significant, with the country leading global installations. In 2023, China added a record 216.9 GW of renewable energy capacity, primarily solar and wind power, highlighting a clear need for professionals skilled in these green technologies.

- Growing Demand: China's push for ecological civilization and its massive investments in green energy create a substantial market for environmental education.

- Curriculum Enhancement: Integrating sustainability into engineering and healthcare courses can attract students and professionals seeking to align their careers with national goals.

- Workforce Development: Educated professionals in environmental fields are crucial for achieving China's carbon neutrality targets by 2060.

- New Revenue Streams: Developing specialized environmental courses can open new avenues for revenue for distance education providers.

China's environmental focus is driving a digital transformation in education, reducing paper usage and commute emissions. However, the energy demands of data centers supporting online learning are a growing concern, particularly as the nation strives for carbon neutrality by 2060. Increased hardware reliance for online learning also exacerbates the e-waste challenge, with China generating millions of tons annually.

The push for ecological civilization presents opportunities for distance education providers to integrate environmental topics into their curricula, catering to a growing demand for green skills. For example, China's significant investments in renewable energy in 2023, adding over 216 GW of capacity, underscore the need for professionals trained in these emerging technologies.

| Environmental Factor | Impact on China Distance Education | Relevant Data/Trend (2023-2025) |

| Green Development Policies | Encourages digital learning, reduces physical resource use. | China's non-fossil fuel energy consumption share exceeded 45% by end of 2023. |

| Data Center Energy Consumption | Contributes to carbon footprint of online platforms. | Digital economy's energy demands are increasing, requiring focus on data center efficiency. |

| E-waste Generation | Increased device usage for online learning leads to more electronic waste. | China's e-waste generation is a significant environmental issue, necessitating recycling solutions. |

| Demand for Green Skills | Opportunity to develop courses on sustainability and green technologies. | Record 216.9 GW of renewable energy capacity added in China in 2023, driving demand for related expertise. |

PESTLE Analysis Data Sources

Our China Distance Education PESTLE Analysis is built on a comprehensive review of official government policies, educational statistics from the Ministry of Education, and reports from leading market research firms. We also incorporate data from international organizations and academic studies to ensure a well-rounded perspective.