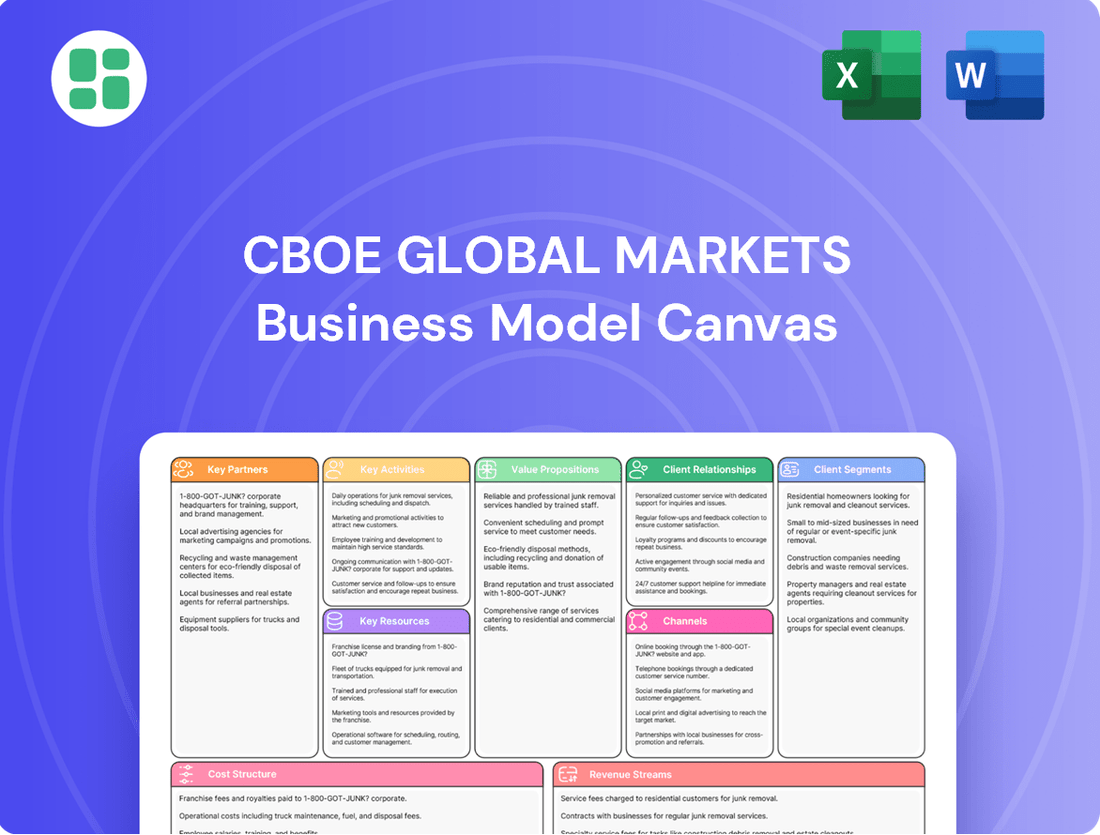

CBOE Global Markets Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CBOE Global Markets Bundle

Unlock the strategic blueprint behind CBOE Global Markets’s innovative business model. This comprehensive Business Model Canvas details how they connect buyers and sellers, manage complex data streams, and generate revenue through diverse offerings. Discover the core components that drive their success.

Ready to dissect CBOE Global Markets's operational genius? Our full Business Model Canvas provides an in-depth look at their customer relationships, revenue streams, and key resources, offering invaluable insights for anyone studying market leaders. Download it now to accelerate your strategic understanding.

Partnerships

Cboe Global Markets strategically partners with leading technology providers to bolster its trading platforms, data dissemination, and analytical capabilities. These collaborations are vital for delivering advanced infrastructure and efficient services to a worldwide clientele, facilitating high-frequency trading and comprehensive data solutions.

In 2024, Cboe continued to invest in technology, with a significant portion of its operating expenses dedicated to technology and data. For instance, their ongoing commitment to cloud migration and platform modernization, often undertaken with key tech partners, aims to enhance scalability and reduce latency. This focus ensures they remain at the forefront of technological innovation in the exchange space.

CBOE Global Markets actively partners with prominent retail brokerage platforms, including Robinhood. This collaboration is designed to broaden access to CBOE's unique product offerings, such as its index options. For example, in Q1 2024, Robinhood reported a significant increase in options trading activity among its user base, highlighting the impact of such partnerships.

Cboe's partnerships with clearinghouses, such as the Depository Trust and Clearing Corporation (DTCC), are vital for the smooth functioning of its markets. These relationships ensure that trades executed on Cboe's platforms are cleared and settled securely and efficiently across all asset classes. In 2023, the DTCC processed trillions of dollars in transactions, highlighting the sheer volume and importance of these clearing services for market stability.

Engagement with Index Providers and Issuers

Cboe Global Markets actively collaborates with major index providers and exchange-traded fund (ETF) issuers. This strategic engagement is crucial for the creation and listing of innovative financial products, including derivatives-based ETFs and unique index options like the S&P 500 (SPX) and the Cboe Volatility Index (VIX).

These partnerships allow Cboe to tap into its strengths in product development and market access, effectively responding to the growing investor appetite for diverse and complex investment strategies. For instance, in 2023, Cboe saw significant growth in its options business, with average daily volume across its U.S. equities options exchanges increasing by 15% compared to 2022, reflecting strong demand for these sophisticated products.

- Index Provider Collaborations: Partnering with entities like S&P Dow Jones Indices and MSCI to list options and futures on their benchmarks.

- ETF Issuer Relationships: Working with ETF providers to list their products and develop new, innovative ETF structures.

- Product Innovation: Jointly creating tradable products that meet evolving investor needs for hedging, speculation, and diversification.

- Revenue Generation: These partnerships directly contribute to Cboe's revenue through listing fees, trading volumes, and data licensing.

Cooperation with Regulatory Bodies and Industry Associations

Cboe Global Markets actively engages with regulatory bodies like the SEC and international counterparts, alongside industry associations such as SIFMA and FIA. This collaboration ensures adherence to evolving regulations and promotes fair, transparent markets. For instance, Cboe's participation in discussions around consolidated tape initiatives in 2024 highlights its commitment to improving data accessibility and market structure.

These partnerships are vital for Cboe's operational legitimacy and influence. By contributing to policy discussions on market access and data dissemination, Cboe helps shape the future of financial markets. In 2023, Cboe reported that its regulatory and compliance costs amounted to $115 million, underscoring the significant resources dedicated to these crucial relationships.

- Regulatory Engagement: Cboe works with bodies like the SEC to navigate and influence market regulation.

- Industry Advocacy: Partnerships with associations like SIFMA and FIA allow Cboe to advocate for favorable market structures.

- Market Structure Improvement: Discussions on consolidated tapes and market access are key areas of cooperation.

- Operational Legitimacy: These relationships are fundamental to Cboe's standing and ability to operate globally.

Cboe's key partnerships extend to technology infrastructure providers, enabling robust trading platforms and data services. These collaborations are essential for maintaining high performance and global reach, as seen in Cboe's continued investment in cloud migration and platform modernization throughout 2024.

Strategic alliances with retail brokers like Robinhood are crucial for expanding access to Cboe's product suite, particularly index options. This has demonstrably driven trading activity, with Robinhood reporting increased options volume in early 2024.

Collaborations with clearinghouses, such as the DTCC, are fundamental for secure and efficient trade settlement. The sheer volume processed by these entities, with DTCC handling trillions in 2023, underscores their critical role in market stability.

Partnerships with index providers and ETF issuers facilitate the creation and listing of innovative financial products, including options on benchmarks like the S&P 500 and VIX. This product development strategy fueled a 15% increase in Cboe's U.S. equity options average daily volume in 2023.

| Partner Type | Example Partners | Strategic Importance | 2023/2024 Impact |

|---|---|---|---|

| Technology Providers | Various | Platform enhancement, scalability, latency reduction | Continued investment in cloud migration and modernization |

| Retail Brokers | Robinhood | Product access expansion, increased trading volume | Significant increase in options trading activity reported |

| Clearinghouses | DTCC | Trade settlement security and efficiency | DTCC processed trillions in transactions, ensuring market stability |

| Index/ETF Providers | S&P Dow Jones Indices, MSCI | New product creation, revenue generation | 15% growth in U.S. equity options ADV |

What is included in the product

A detailed exploration of CBOE Global Markets' Business Model Canvas, outlining its core customer segments, value propositions, and revenue streams within the financial exchange industry.

This canvas reflects CBOE's operational strategy, focusing on its role as a technology-driven marketplace for derivatives and equities, serving diverse financial participants.

Provides a structured framework to identify and address operational inefficiencies, streamlining complex financial market processes.

Activities

Cboe Global Markets' primary function revolves around operating a sophisticated global network of exchanges. These platforms are designed to handle trading across a diverse range of financial instruments, including options, futures, U.S. and European equities, and foreign exchange. This intricate operation is the backbone of their business, ensuring smooth transactions for a worldwide client base.

The company actively manages the complex infrastructure that supports these exchanges. This includes the critical tasks of maintaining order books, fostering market liquidity, and guaranteeing a stable and dependable trading environment. In 2023, Cboe reported total revenue of $4.2 billion, underscoring the scale and significance of these operational activities.

Cboe Global Markets actively develops and lists a diverse range of tradable products. This includes its highly successful proprietary options and futures on benchmarks like the S&P 500 Index (SPX) and the Cboe Volatility Index (VIX). For instance, in 2023, Cboe saw significant growth in its options volume, exceeding 10 billion contracts traded across its U.S. equities and index options markets.

The process involves rigorous market research to pinpoint unmet needs and then designing innovative financial instruments to meet them. This is followed by a crucial phase of securing regulatory approvals to ensure compliance and market integrity. This continuous innovation is vital for attracting new market participants and capital, thereby maintaining Cboe's competitive advantage in the fast-paced financial landscape.

Furthermore, Cboe is expanding its offerings in Exchange Traded Funds (ETFs), recognizing their growing importance in investor portfolios. This strategic expansion into ETFs, alongside its core options and futures business, diversifies its product suite and appeals to a broader range of investors and asset managers.

Cboe Global Markets is a key player in providing market data and analytics through its Cboe Data Vantage offering. This involves gathering, processing, and distributing real-time and historical trading information. Clients leverage these services and analytical tools, including indices, to guide their investment strategies.

This data and analytics segment is a significant driver of non-transactional revenue for Cboe. For instance, in 2023, Cboe reported that its Information Services segment, which includes market data, saw revenue grow by 14% year-over-year. This growth underscores the increasing demand for detailed market insights.

By offering these comprehensive solutions, Cboe enhances its overall value proposition to a diverse client base. This data-driven approach empowers investors, financial professionals, and strategists with the necessary intelligence to navigate complex markets and make more informed decisions.

Maintaining and Enhancing Trading Technology

Cboe Global Markets consistently invests in its sophisticated trading technology and infrastructure. This commitment ensures high performance, minimal latency, and strong security across its worldwide exchanges.

The company actively manages upgrades and maintenance, including strategic cloud migrations. This is crucial for handling growing trading volumes and data demands, a trend evident in their Q1 2024 results where total trading volumes increased by 20% year-over-year.

- Technological Investment: Cboe's ongoing investment in technology underpins its operational efficiency.

- Performance & Security: Focus remains on low latency and robust security for global operations.

- Cloud Migration: Strategic moves to the cloud support scalability and data management needs.

- Volume Handling: Upgrades are essential to manage increasing trading volumes, which saw a significant rise in early 2024.

Ensuring Regulatory Compliance and Market Integrity

Cboe Global Markets operates within a stringent regulatory environment, making compliance a core activity. In 2024, the company continued its robust investment in systems and personnel to meet evolving global financial regulations, ensuring fair and orderly markets.

Key to this is their proactive approach to market integrity. This involves sophisticated surveillance systems to detect and deter manipulative trading practices, alongside comprehensive risk management frameworks designed to safeguard market stability. For instance, Cboe's technology infrastructure is continuously updated to handle increasing data volumes and complex trading strategies, a crucial aspect of maintaining integrity.

- Surveillance: Employing advanced technology to monitor trading activity for potential rule violations.

- Risk Management: Implementing rigorous controls to mitigate operational and market risks.

- Transparent Reporting: Providing accurate and timely data to regulatory bodies as required by law.

- Adherence to Rules: Ensuring all operations align with the directives of financial authorities worldwide.

Cboe Global Markets' key activities center on operating and enhancing its global exchange network, facilitating trading across diverse financial instruments like options, futures, and equities. This involves continuous investment in technology to ensure low latency, high performance, and robust security across its platforms. The company also actively develops and lists innovative financial products, such as proprietary options and futures, to meet market demand and maintain a competitive edge.

A significant portion of Cboe's business involves providing valuable market data and analytics services, leveraging its trading information to offer insights to clients. This segment, which includes offerings like Cboe Data Vantage, is a crucial non-transactional revenue driver. In 2023, Cboe's Information Services segment experienced substantial growth, highlighting the increasing reliance on detailed market intelligence for investment decisions.

Furthermore, Cboe prioritizes regulatory compliance and market integrity through advanced surveillance systems and comprehensive risk management frameworks. These efforts are essential for maintaining fair and orderly markets and ensuring adherence to global financial regulations. The company's commitment to technological upgrades, including cloud migration, supports its ability to handle escalating trading volumes and data demands, as evidenced by a 20% year-over-year increase in total trading volumes observed in early 2024.

| Key Activity | Description | 2023 Data/Impact |

|---|---|---|

| Exchange Operations | Operating global trading platforms for various financial instruments. | Total Revenue: $4.2 billion |

| Product Development | Creating and listing new financial products, including proprietary options and futures. | Options Volume: Over 10 billion contracts traded |

| Market Data & Analytics | Providing real-time and historical trading data and analytical tools. | Information Services Revenue Growth: 14% year-over-year |

| Technology & Infrastructure | Investing in high-performance, secure trading technology and cloud migration. | Q1 2024 Trading Volumes: 20% increase year-over-year |

| Compliance & Risk Management | Ensuring regulatory adherence and market integrity through surveillance and risk controls. | Continuous investment in systems and personnel for evolving regulations |

Full Version Awaits

Business Model Canvas

The preview of the CBOE Global Markets Business Model Canvas you are currently viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, ensuring there are no surprises. You can be confident that you are seeing a genuine snapshot of the complete, ready-to-use Business Model Canvas that will be yours to download and utilize immediately after completing your transaction.

Resources

Cboe Global Markets operates highly advanced proprietary trading technology and platforms, encompassing its electronic exchanges for options, equities, and foreign exchange. These sophisticated systems are engineered for exceptional throughput, minimal latency, and unwavering reliability, all essential for seamless global trading. For instance, Cboe's equities trading platform in the U.S. consistently handles billions of messages daily, demonstrating its capacity.

The company's commitment to innovation is evident in its continuous investment in these technological assets. This ongoing development ensures Cboe maintains a significant competitive edge in the fast-paced financial markets, supporting its role as a leading global exchange operator. In 2024, Cboe continued to enhance its matching engine technology, aiming for even lower latency to attract and retain high-frequency trading participants.

Cboe's proprietary indices, like the Cboe Volatility Index (VIX) and S&P 500 Index (SPX) options, are crucial key resources. These unique offerings create a significant competitive advantage, attracting investors looking for sophisticated risk management and trading solutions.

The intellectual property underpinning these indices represents a highly valuable asset for Cboe. In 2023, Cboe reported that its proprietary index products generated substantial revenue, highlighting their importance to the company's financial performance and market position.

Operating globally means Cboe needs licenses from many financial watchdogs. Think of authorities in North America, Europe, and the Asia Pacific region. These aren't just nice-to-haves; they're essential for Cboe to run legally and be a trusted place for trading.

Getting and keeping these approvals is a big job. It's a complicated, always-on process. In 2024, Cboe continues to navigate these complex regulatory landscapes to ensure its marketplaces remain compliant and robust.

Highly Skilled Human Capital

Cboe Global Markets' competitive edge is significantly bolstered by its highly skilled human capital. This includes specialized talent like software engineers who build and maintain sophisticated trading platforms, market strategists who develop innovative products, and regulatory experts who ensure compliance. Their collective expertise is the engine driving Cboe's growth and operational efficiency.

The company's commitment to attracting and retaining top talent is paramount. For instance, as of Q1 2024, Cboe continued to invest in its workforce through training and development programs aimed at enhancing skills in areas like AI and data analytics, crucial for staying ahead in the rapidly evolving financial technology landscape.

- Software Engineers: Critical for developing and managing Cboe's advanced trading technology and data solutions.

- Market Strategists: Drive product innovation and identify new opportunities in global markets.

- Sales and Client Relationship Professionals: Essential for engaging with a diverse customer base, including institutional investors and retail traders.

- Regulatory and Compliance Experts: Navigate complex global regulations, ensuring Cboe's operations are secure and compliant.

Extensive Global Network Connectivity

Cboe Global Markets leverages an extensive global network infrastructure, linking its exchanges, data centers, and market participants worldwide. This robust connectivity is fundamental to its international operations, enabling seamless order routing and rapid data dissemination across continents. In 2024, Cboe continued to invest in its network to support its expanding product offerings and global client base.

This powerful network ensures reliable access to Cboe's diverse markets, facilitating efficient cross-market operations. The company's commitment to network performance is crucial for maintaining its competitive edge in providing trading solutions to a global audience. Cboe's network underpins its ability to serve participants in over 100 countries.

- Global Reach: Connects trading venues and data centers across North America, Europe, and Asia.

- Low Latency: Facilitates high-speed order execution and data delivery for market participants.

- Reliability: Ensures consistent and dependable access to Cboe's diverse product suite.

- Scalability: Supports the growing volume and complexity of global financial transactions.

Cboe's key resources include its proprietary trading technology, which powers its global exchanges and ensures high-speed, reliable transactions. The company also relies on its valuable intellectual property, particularly its well-known indices like the VIX, which attract significant trading volume. Furthermore, Cboe's global network infrastructure is essential for connecting markets and participants worldwide, enabling efficient data dissemination and order execution.

Value Propositions

Cboe Global Markets offers market participants unparalleled access to deep and diverse liquidity across a wide spectrum of asset classes. This includes its position as the largest options exchange in the U.S., a significant footprint in European equities, and a growing presence in global foreign exchange (FX) markets.

This extensive reach facilitates efficient price discovery and execution for a multitude of trading strategies, making Cboe a crucial venue for global investors. For instance, in 2023, Cboe's U.S. equities exchanges saw average daily notional value traded exceed $100 billion.

The sheer breadth and depth of liquidity available on Cboe's platforms are a primary draw for international investors seeking robust trading opportunities. This deep liquidity pool supports complex strategies and ensures that even large orders can be executed with minimal market impact.

Cboe Data Vantage provides investors with a wealth of actionable market data, analytics, and indices. This empowers users with critical insights for informed decision-making, offering real-time pricing, historical data, and specialized analytical tools to optimize their workflows.

In 2023, Cboe's data and access solutions segment saw significant growth, with revenue reaching $776 million, a 12% increase year-over-year. This highlights the strong demand for high-quality data services among financial professionals and firms seeking a competitive edge.

Cboe's reputation for product innovation is a cornerstone of its value proposition, especially evident in its creation of proprietary index options such as the VIX and SPX. These instruments are critical for investors seeking to manage portfolio volatility and articulate specific market outlooks. In 2023, Cboe's options volume reached a record 11.8 billion contracts, underscoring the demand for these sophisticated risk management tools.

The company actively pursues the development of new financial products, including derivatives-based Exchange Traded Funds (ETFs). This forward-thinking approach caters to the ever-changing needs of the market for advanced investment and hedging strategies. For instance, Cboe's offerings provide accessible pathways for investors to engage with complex financial instruments, thereby broadening market participation.

This dedication to innovation allows Cboe to deliver distinctive solutions tailored to intricate financial requirements. By consistently introducing novel products, Cboe empowers market participants with enhanced capabilities for managing risk and pursuing investment opportunities, thereby solidifying its position as a leader in the financial exchange landscape.

Trusted and Reliable Trading Infrastructure

Cboe Global Markets provides a trading infrastructure that market participants consistently rely on. This robust system is designed for high uptime and exceptional performance, ensuring traders can access markets without interruption, even during periods of intense activity. In 2023, Cboe reported a 99.99% uptime across its major trading platforms, a testament to its reliability.

The dependability of Cboe's infrastructure is paramount for its customers. They need assurance that their orders will be processed accurately and efficiently, especially when market conditions are volatile. This unwavering reliability underpins Cboe's commitment to fostering trusted and stable markets for everyone involved.

Cboe's dedication to building trusted markets is a foundational element of its business strategy. This focus on security and consistent performance directly supports the value proposition for its diverse customer base.

- High Uptime: Cboe's platforms consistently achieve near-perfect uptime, crucial for uninterrupted trading.

- Robust Performance: The infrastructure is built to handle high volumes and maintain execution quality.

- Market Trust: Reliability is central to Cboe's mission of creating dependable trading environments.

- Secure Operations: Advanced security measures protect against disruptions and ensure data integrity.

Enhanced Global Market Accessibility and Efficiency

Cboe is significantly broadening access to its diverse markets, notably through its move towards 24x5 trading in U.S. equities. This expansion, coupled with enhanced data distribution efforts in key regions like Asia Pacific and Europe, directly addresses the needs of international investors.

This enhanced accessibility empowers global clients to respond swiftly to worldwide developments and manage their risk profiles more dynamically. For instance, by providing more continuous access, Cboe allows investors to react to overnight news impacting U.S. markets without waiting for traditional opening hours.

The strategic push for greater operational efficiency alongside this increased accessibility creates a more streamlined and cost-effective trading environment. These improvements ultimately benefit a broad spectrum of global participants, from individual traders to large institutional asset managers.

- Global Reach: Cboe's expansion into 24x5 U.S. equity trading and enhanced APAC/Europe data distribution signifies a commitment to global market participation.

- Real-time Reactivity: International investors can now react to global events impacting U.S. markets outside traditional trading hours, improving risk management.

- Efficiency Gains: Increased accessibility and operational streamlining translate to a more efficient and potentially cost-effective trading experience for all clients.

- Broad Client Benefit: These initiatives cater to a wide array of global clients, enhancing their ability to participate and manage risk in interconnected financial markets.

Cboe Global Markets offers deep and diverse liquidity across asset classes, making it a vital venue for global investors. In 2023, its U.S. equities exchanges facilitated over $100 billion in average daily notional value traded, showcasing the depth of its market.

The company provides actionable market data, analytics, and indices through Cboe Data Vantage, empowering informed decision-making with tools like real-time pricing and historical data. This segment saw robust growth in 2023, with revenue reaching $776 million, a 12% year-over-year increase.

Cboe's innovation is evident in proprietary index options like the VIX and SPX, crucial for volatility management. In 2023, Cboe's options volume hit a record 11.8 billion contracts, highlighting demand for these sophisticated risk management tools.

Cboe ensures reliable trading infrastructure with high uptime and exceptional performance, crucial for market participants. In 2023, its major platforms reported 99.99% uptime, underscoring its dependability.

Customer Relationships

Cboe Global Markets cultivates deep ties with its institutional clientele through specialized support units and dedicated account managers. These teams deliver customized services and solutions, ensuring major financial players receive bespoke attention, technical aid, and strategic guidance.

This high-touch engagement model is crucial for retaining valuable institutional clients and nurturing enduring collaborations. For instance, in 2024, Cboe reported a significant portion of its revenue derived from its institutional services, underscoring the importance of these relationships.

Cboe Global Markets offers a robust suite of educational resources and investor tools designed for a broad audience, from novice retail investors to seasoned professionals. This commitment to education is crucial for fostering a deeper understanding of complex financial instruments such as options and futures, thereby enhancing user engagement and promoting informed decision-making.

In 2024, Cboe continued to expand its library of webinars, market insights, and educational content, providing accessible pathways for participants to navigate evolving market landscapes. These resources are vital for empowering investors, enabling them to build confidence and participate more responsibly in trading activities.

Cboe Global Markets enhances customer relationships through comprehensive self-service platforms and online resources. Its investor relations portal offers easy access to financial reports and company updates, while Cboe DataShop provides sophisticated market data solutions. This digital approach empowers clients, allowing for independent research and immediate access to critical information.

Community Engagement and Industry Collaboration

Cboe actively cultivates its community by hosting numerous industry events and conferences. These gatherings, which include collaborations with retail brokers and technology providers, are crucial for direct feedback and understanding market needs.

In 2024, Cboe continued its tradition of engaging with thousands of market participants through its diverse event calendar. For instance, the Cboe Risk Management Conference in May 2024 drew over 500 attendees, fostering discussions on critical market dynamics.

- Industry Events: Cboe hosted over 20 major industry events in 2024, facilitating direct engagement with over 10,000 participants.

- Collaborative Initiatives: Partnerships with 50+ technology firms and 100+ retail brokers were strengthened through joint webinars and product development sessions.

- Feedback Mechanisms: Direct feedback from these interactions informed the development of three new product enhancements launched in late 2024.

- Ecosystem Support: Cboe’s commitment to the broader financial ecosystem was demonstrated through sponsorships and active participation in 15 industry-wide working groups.

Tailored Solutions for High-Volume Traders

Cboe Global Markets offers highly tailored solutions for market makers and high-frequency trading firms, recognizing their critical role in providing liquidity. These specialized services include dedicated network cores and customized access points, designed to optimize trading speed and reliability. For instance, in 2024, Cboe continued to invest in its low-latency infrastructure, a key differentiator for these high-volume participants.

These bespoke offerings are crucial for liquidity providers who demand the utmost performance and predictability in their operations. By segmenting its customer base and providing these specialized services, Cboe ensures it effectively caters to the unique and demanding requirements of these vital market participants, thereby enhancing overall market quality.

- Dedicated Network Cores: Providing direct, low-latency connections for ultra-fast trading.

- Specialized Access Services: Customized connectivity options to suit specific trading strategies.

- Performance Optimization: Ensuring superior execution speeds and determinism for liquidity providers.

- Market Maker Support: Tailored programs and services to facilitate efficient market-making activities.

Cboe Global Markets fosters strong customer relationships through a multi-faceted approach, combining personalized institutional support with broad educational outreach. This strategy ensures both high-value clients and a wider investor base feel engaged and informed. In 2024, Cboe’s investment in these relationships was evident in its continued expansion of digital resources and event participation, directly impacting client retention and market understanding.

Channels

Cboe's proprietary electronic trading platforms, including Cboe Options Exchange and Cboe EDGX Equities Exchange, are the primary conduits for its services. These platforms enable direct market access for executing trades across diverse asset classes, forming the bedrock of Cboe's market facilitation. In 2023, Cboe reported record trading volumes across its equities and options markets, underscoring the critical role of these platforms.

Cboe Global Markets provides direct Application Programming Interface (API) connectivity, a key component of its Customer Relationships and Key Activities. This service is specifically designed for institutional clients, market makers, and data vendors, facilitating deep integration with their existing trading and data systems.

This direct API access is vital for participants who require automated trading capabilities, real-time market data streams, and streamlined order management. In 2024, Cboe continued to enhance its API offerings, supporting the high-frequency and technologically advanced nature of modern financial markets.

The efficiency gained through API connectivity directly impacts Cboe's value proposition by enabling faster execution and more sophisticated algorithmic strategies for its clients. This robust infrastructure is a cornerstone of Cboe's appeal to sophisticated market participants.

Cboe Global Markets relies heavily on its vast broker-dealer networks to connect with a wide array of investors, both institutional and retail. These intermediaries are essential in distributing Cboe's diverse product offerings, acting as vital conduits to market participants.

By partnering with these extensive networks, Cboe significantly enhances its market reach and accessibility. For instance, in 2024, Cboe continued to foster relationships with thousands of registered broker-dealers globally, facilitating access to its equity, options, and futures markets.

Global Sales and Client Engagement Teams

Cboe Global Markets leverages dedicated global sales and client engagement teams strategically positioned in North America, Europe, and Asia Pacific. These professionals are instrumental in building and nurturing client relationships, facilitating the onboarding of new participants, and delivering continuous support alongside valuable market intelligence.

This localized approach ensures Cboe can effectively understand and cater to the distinct needs of clients in different regions. For instance, in 2023, Cboe reported a significant increase in client engagement across its European markets, driven by new product offerings and enhanced support services.

- Global Reach: Teams operate across key financial hubs in North America, Europe, and Asia Pacific.

- Client Lifecycle Management: Focus on relationship cultivation, onboarding, and ongoing support.

- Market Insight Delivery: Providing clients with relevant and timely market intelligence.

- Regional Expertise: Tailoring services to meet specific local client requirements.

Cboe Data Vantage Products and Services

Cboe Data Vantage, encompassing products like Cboe Global Cloud and Cboe DataShop, acts as a primary channel for disseminating crucial market data, advanced analytics, and benchmark indices. This strategic distribution ensures clients can readily access and leverage Cboe's extensive market intelligence.

These platforms offer adaptable and convenient methods for customers to engage with Cboe's rich data offerings, facilitating a broad market reach and optimizing the monetization of their information assets.

- Cboe Global Cloud: A cloud-native platform offering real-time and historical market data, analytics, and index solutions with flexible delivery options.

- Cboe DataShop: A comprehensive portal for accessing and downloading historical market data, catering to in-depth research and backtesting needs.

- Market Data Distribution: Cboe's commitment to providing diverse and accessible channels for its valuable market intelligence, driving revenue and client engagement.

Cboe's proprietary electronic trading platforms, including Cboe Options Exchange and Cboe EDGX Equities Exchange, are the primary conduits for its services. These platforms enable direct market access for executing trades across diverse asset classes, forming the bedrock of Cboe's market facilitation. In 2023, Cboe reported record trading volumes across its equities and options markets, underscoring the critical role of these platforms.

Cboe Global Markets provides direct Application Programming Interface (API) connectivity, a key component of its Customer Relationships and Key Activities. This service is specifically designed for institutional clients, market makers, and data vendors, facilitating deep integration with their existing trading and data systems. In 2024, Cboe continued to enhance its API offerings, supporting the high-frequency and technologically advanced nature of modern financial markets.

Cboe Global Markets relies heavily on its vast broker-dealer networks to connect with a wide array of investors, both institutional and retail. These intermediaries are essential in distributing Cboe's diverse product offerings, acting as vital conduits to market participants. By partnering with these extensive networks, Cboe significantly enhances its market reach and accessibility, facilitating access to its equity, options, and futures markets.

Cboe Global Markets leverages dedicated global sales and client engagement teams strategically positioned in North America, Europe, and Asia Pacific. These professionals are instrumental in building and nurturing client relationships, facilitating the onboarding of new participants, and delivering continuous support alongside valuable market intelligence, ensuring Cboe can effectively understand and cater to the distinct needs of clients in different regions.

Cboe Data Vantage, encompassing products like Cboe Global Cloud and Cboe DataShop, acts as a primary channel for disseminating crucial market data, advanced analytics, and benchmark indices. These platforms offer adaptable and convenient methods for customers to engage with Cboe's rich data offerings, facilitating a broad market reach and optimizing the monetization of their information assets.

Customer Segments

Institutional investors, including major hedge funds, mutual funds, pension funds, and asset managers, are a cornerstone for Cboe Global Markets. These entities leverage Cboe's platforms for sophisticated trading, risk management, and accessing diverse asset classes, driving significant trading volume and requiring deep liquidity pools.

In 2024, Cboe continued to see strong engagement from these sophisticated market participants. For instance, Cboe's U.S. equities exchanges, which include venues heavily utilized by institutional order flow, consistently ranked among the top for market share, often exceeding 15% of total U.S. equity volume throughout the year, reflecting their crucial role in the ecosystem.

Retail brokers and individual investors represent a burgeoning and vital customer base for Cboe, especially in the options and Exchange Traded Products (ETPs) markets. In 2024, retail participation in options trading continued to surge, with platforms reporting significant increases in volume from this demographic.

Cboe is strategically focused on improving accessibility and providing educational resources tailored to this segment. This commitment is crucial as individual investors increasingly engage with complex financial instruments, driving a notable portion of market activity and liquidity.

Market makers and proprietary trading firms are cornerstone clients for Cboe Global Markets, drawn by its robust technological infrastructure and competitive pricing. These entities are vital for ensuring Cboe's markets, encompassing options, equities, and FX, remain liquid and orderly. In 2023, Cboe's average daily volume across its equities and options markets reached approximately 11.5 million and 40.4 million contracts, respectively, highlighting the significant activity generated by these participants.

Corporates and Exchange-Traded Product (ETP) Issuers

Cboe Global Markets offers listing services for corporates and Exchange-Traded Product (ETP) issuers on its diverse global exchange network. This includes facilitating the listing of equities, exchange-traded funds (ETFs), and other innovative financial products. In 2024, Cboe continued to attract new listings, aiming to solidify its position as a leading venue for capital raising and product innovation.

Cboe's strategy focuses on delivering a superior global listing experience, which is crucial for attracting issuers seeking broad market access and efficient trading. The company's commitment to expanding its role in capital markets is demonstrated by its efforts to onboard a wider array of ETPs and corporate listings, thereby enhancing its product ecosystem.

- Global Listing Venue: Cboe provides a platform for listing equities and ETPs across its international exchanges.

- Product Expansion: The company actively works to attract new listings, including a growing number of ETFs.

- Capital Markets Role: Cboe aims to enhance its significance in the broader capital markets through these listing services.

- Issuer Focus: Efforts are directed towards offering a premier listing experience for corporate and ETP issuers.

Financial Data Vendors and Analytics Firms

Financial Data Vendors and Analytics Firms are key clients who license Cboe's extensive market data and analytical tools. These companies, such as Bloomberg and Refinitiv, integrate Cboe's real-time and historical data into their own platforms to offer sophisticated analytics and insights to their diverse customer bases.

Cboe's Data Vantage product is specifically designed to cater to these entities, providing them with the raw data and derived insights necessary to build their proprietary offerings. This symbiotic relationship allows Cboe to significantly broaden its footprint within the global financial information landscape.

- Data Licensing Revenue: Cboe reported significant revenue from data and access solutions, a segment heavily reliant on serving data vendors. In 2023, Cboe's Data and Access Solutions segment generated approximately $687 million in revenue, showcasing the substantial value these customers derive from Cboe's data.

- Partnership Ecosystem: By supplying data to these vendors, Cboe indirectly reaches a much wider audience of financial professionals, including asset managers, hedge funds, and retail investors, who subscribe to the vendors' services.

- Product Development Synergy: Cboe's continuous investment in data quality and new product development, like enhanced analytics, directly benefits these vendor partners, fostering innovation across the financial technology sector.

Cboe Global Markets serves a diverse clientele, ranging from large institutional investors and active market makers to individual retail traders and corporations seeking listings. Each segment leverages Cboe's platforms for different needs, from high-frequency trading and liquidity provision to capital raising and investment access.

Cost Structure

Cboe Global Markets dedicates a substantial portion of its budget to its sophisticated technology infrastructure. This encompasses the ongoing development, maintenance, and enhancement of its trading platforms, global data centers, and robust network connectivity, ensuring seamless and high-speed operations for its diverse clientele.

Expenses in this category include significant outlays for essential hardware, crucial software licenses, and increasingly, cloud services. Furthermore, substantial investments are made in advanced cybersecurity measures to safeguard operations against threats, ensuring the resilience and optimal performance of Cboe's critical systems. For instance, in 2023, Cboe reported technology and equipment expenses of $615 million, reflecting the continuous need to invest in and maintain its cutting-edge technological backbone.

Personnel expenses are a significant driver of Cboe Global Markets' cost structure. In 2024, employee compensation, including salaries, bonuses, and equity awards, forms the largest portion of these costs. This reflects the need to attract and retain highly skilled professionals in technology, trading operations, sales, and regulatory compliance within the competitive financial services landscape.

Beyond direct compensation, Cboe's investment in its workforce includes substantial spending on employee benefits, such as health insurance, retirement plans, and other welfare programs. Furthermore, ongoing training and development initiatives are crucial to ensure employees remain proficient with evolving market technologies and regulatory frameworks, contributing to the overall personnel expense burden.

CBOE Global Markets faces significant expenses for regulatory compliance and legal counsel. Operating as a regulated entity across various global markets necessitates adherence to a complex web of financial laws, data privacy mandates, and market oversight standards. These costs are crucial for maintaining operational integrity and trust.

In 2024, the financial services industry, including exchanges like CBOE, continued to see substantial investments in compliance technology and personnel. While specific figures for CBOE's regulatory and legal fees aren't publicly itemized in a way that isolates this exact category from broader operating expenses, it's a well-established fact that such costs represent a material portion of overhead for any major financial infrastructure provider. For instance, industry-wide spending on financial compliance is projected to remain in the tens of billions of dollars annually, reflecting the ongoing need for robust legal and regulatory frameworks.

Market Data Acquisition and Distribution Costs

Cboe Global Markets incurs significant costs in acquiring, processing, and distributing market data. These expenses are crucial for their Cboe Data Vantage offerings, ensuring the timely and accurate delivery of information to clients.

In 2023, Cboe reported total operating expenses of $1.23 billion. A substantial portion of this is allocated to the infrastructure and technology required for robust data acquisition and distribution networks.

- Data Licensing Fees: Costs associated with obtaining data feeds from various exchanges and data providers.

- Technology Infrastructure: Expenses for servers, networks, and data centers to process and disseminate information efficiently.

- Data Processing and Storage: Costs for cleaning, normalizing, and storing vast amounts of real-time and historical market data.

- Compliance and Security: Investments in systems to ensure data integrity and protect against cyber threats.

Marketing and Business Development

Cboe Global Markets invests significantly in marketing and business development to drive revenue and enhance its brand. These efforts are crucial for introducing new products and expanding into new geographic markets.

In 2024, Cboe continued its strategic outreach through various channels. This includes digital advertising campaigns, participation in key industry conferences, and hosting client-focused events to foster relationships and educate the market on its offerings.

- Marketing Investments: Cboe allocated resources to promote its diverse range of trading solutions, data products, and technology services.

- Business Development Initiatives: The company actively pursued partnerships and strategic alliances to broaden its market reach and customer base.

- Global Expansion: Cboe focused on strengthening its presence in existing international markets and exploring opportunities for entry into new regions.

- Client Engagement: Investments were made in client events and educational programs to support product adoption and build stronger client relationships.

Cboe Global Markets' cost structure is heavily influenced by its ongoing investment in technology, personnel, and data. These are the core pillars supporting its operations and service offerings.

In 2023, Cboe reported total operating expenses of $1.23 billion. A significant portion of this is dedicated to maintaining and upgrading its technological infrastructure, which is vital for high-speed trading and data dissemination.

Personnel costs, encompassing salaries, benefits, and training for a skilled workforce, represent another substantial expense. Furthermore, expenses related to data acquisition, licensing, and distribution are critical for providing market data services.

| Cost Category | Description | 2023 Expense (Approximate) |

| Technology & Equipment | Platform development, data centers, network, cybersecurity | $615 million |

| Personnel Expenses | Salaries, bonuses, benefits, training | Significant portion of total operating expenses |

| Data Acquisition & Distribution | Licensing, processing, storage, distribution infrastructure | Substantial allocation within total operating expenses |

Revenue Streams

Cboe Global Markets generates its primary revenue from transaction and clearing fees levied on trades executed across its various exchanges, including options, futures, U.S. and European equities, and global FX markets. These fees are directly tied to trading volumes, meaning higher activity translates to greater revenue for Cboe. For instance, in the first quarter of 2024, Cboe reported that its transaction fees, a significant portion of its revenue, contributed substantially to its overall financial performance, driven by robust trading volumes in its key product lines.

Cboe Global Markets significantly monetizes its extensive market data through subscription services like Cboe Data Vantage. These offerings provide clients with crucial real-time and historical data, alongside sophisticated analytical tools and unique proprietary indices, forming a key non-transactional revenue driver.

This recurring revenue model is a cornerstone of Cboe's financial strategy, demonstrating robust growth potential. In 2024, Cboe reported that its Data and Access Solutions segment, which includes these subscriptions, saw a substantial increase, reflecting the increasing demand for high-quality market intelligence.

Cboe Global Markets generates revenue from access and capacity fees, charging market participants for the ability to connect to its various exchanges and trading systems. These fees are crucial for maintaining the high-speed, reliable infrastructure that high-volume traders depend on, ensuring consistent connectivity.

In 2024, Cboe's commitment to robust connectivity is reflected in its ongoing investments. For instance, the company has been expanding its data center footprint and enhancing network capabilities to support increasing trading volumes and the demand for low-latency access, which directly translates into revenue from these essential services.

Listing Fees

Cboe Global Markets generates revenue through listing fees, which are charges applied to companies and Exchange Traded Product (ETP) issuers for the privilege of having their securities traded on Cboe's various exchanges. This is a core component of their business model, directly tying their success to the vibrancy of the listed securities market.

As Cboe continues to strategically grow its global listings business, with a particular emphasis on attracting more Exchange Traded Funds (ETFs), these listing fees are poised for expansion. This growth is anticipated to further diversify Cboe's income streams, making it less reliant on any single revenue source.

- Listing Fees: Cboe charges companies and ETP issuers for listing their securities.

- ETF Growth: Expansion in global ETF listings is expected to boost this revenue.

- Diversified Income: Listing fees contribute to Cboe's varied revenue sources.

Proprietary Index Licensing Fees

Cboe Global Markets generates significant revenue by licensing its proprietary indices, like the widely recognized VIX and SPX, to various financial entities. These agreements are crucial for third-party product issuers, such as ETF providers and futures exchanges, as well as data vendors who integrate these benchmarks into their offerings. This licensing model provides a consistent and predictable income stream, underscoring the market's reliance on Cboe's intellectual property.

In 2024, the demand for Cboe's benchmark indices continued to be robust. For instance, Cboe's proprietary index licensing segment is a key contributor to its overall financial performance. These fees are directly tied to the usage and popularity of indices that have become integral to investment strategies and financial product development globally.

- Proprietary Index Licensing Fees: Cboe licenses its well-known indices, including the VIX and SPX, to financial institutions worldwide.

- Recurring Revenue: These licensing agreements create a stable, recurring revenue stream for Cboe, reflecting the high value and broad acceptance of its intellectual property.

- Market Adoption: The widespread use of Cboe's indices in investment products and data services highlights their critical role in the financial industry.

Cboe Global Markets diversifies its revenue through a multi-faceted approach beyond transaction fees. This includes selling access to its vast market data, charging for exchange listings, and licensing its popular proprietary indices. These revenue streams are crucial for its financial stability and growth.

| Revenue Stream | Description | 2024 Data/Impact |

|---|---|---|

| Transaction & Clearing Fees | Fees on trades across options, futures, equities, FX. | Significant contributor, driven by high trading volumes in Q1 2024. |

| Market Data Subscriptions | Sales of real-time/historical data, analytics, proprietary indices. | Data & Access Solutions segment saw substantial growth in 2024. |

| Access & Capacity Fees | Charges for connecting to Cboe's exchanges and trading systems. | Essential for maintaining low-latency infrastructure, supported by data center expansion in 2024. |

| Listing Fees | Fees for companies and ETP issuers to list securities. | Poised for expansion with strategic growth in global ETF listings. |

| Proprietary Index Licensing | Licensing of indices like VIX and SPX to third parties. | Robust demand in 2024, a key contributor to financial performance. |

Business Model Canvas Data Sources

The CBOE Global Markets Business Model Canvas is meticulously constructed using a blend of proprietary financial data, comprehensive market research reports, and internal strategic planning documents. These diverse sources ensure that each component of the canvas is grounded in factual analysis and forward-looking insights.