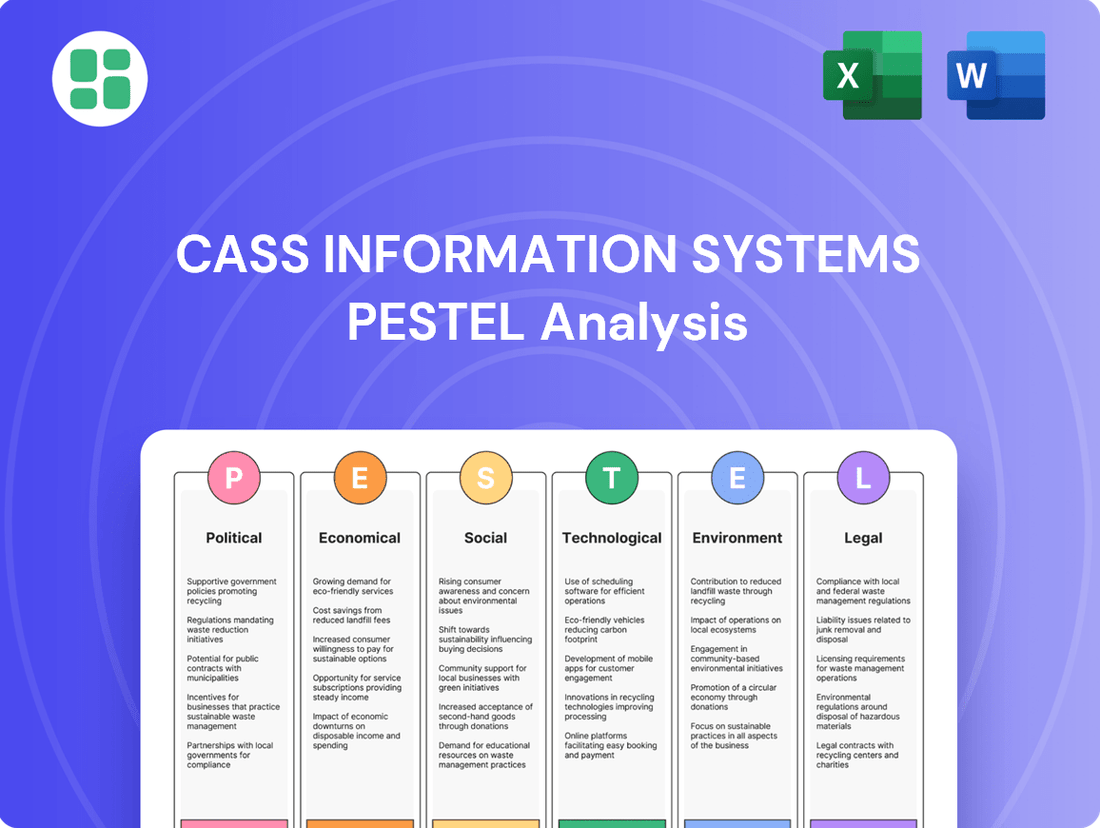

Cass Information Systems PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cass Information Systems Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Cass Information Systems. Our expertly crafted PESTLE analysis provides actionable intelligence to help you anticipate market shifts and refine your strategic planning. Download the full report now for a comprehensive understanding of the external forces shaping Cass Information Systems's future.

Political factors

Changes in government regulations, particularly within the financial services and transportation sectors, present a significant factor for Cass Information Systems. For instance, the Federal Reserve's ongoing scrutiny of payment processing and data security, as seen in its 2024 policy updates, directly affects how Cass operates and manages client information.

New compliance requirements, such as those mandated by the Gramm-Leach-Bliley Act for financial data privacy or evolving Know Your Customer (KYC) protocols, demand continuous adaptation. Cass must invest in system upgrades and process modifications to ensure adherence, impacting operational agility.

The sheer complexity and associated costs of meeting these evolving regulatory landscapes, including potential fines for non-compliance, directly influence Cass Information Systems' operational efficiency and bottom-line profitability. For example, the estimated annual cost for financial institutions to comply with regulations like the Bank Secrecy Act can run into millions, a burden Cass must also navigate.

Global trade policies, including tariffs and trade agreements, significantly influence the transportation and logistics industries, core client sectors for Cass Information Systems. For instance, the ongoing adjustments to international trade relationships, such as those impacting goods moving between the United States and China, can directly alter shipping volumes and associated costs. These shifts can lead to Cass processing fewer transactions or experiencing changes in the demand for its freight audit and payment services as supply chains adapt.

Geopolitical tensions, such as ongoing conflicts in Eastern Europe and the Middle East, continue to create significant ripples across global supply chains and energy markets. This instability directly impacts freight rates, which saw fluctuations throughout 2023 and early 2024, affecting the operational costs for Cass Information Systems' clients. For instance, disruptions to key shipping lanes can lead to increased transit times and surcharges, adding complexity to logistics management.

These geopolitical uncertainties can also influence how businesses manage their expenses. As clients face volatile operating environments, their demand for robust expense management solutions, like those offered by Cass, may increase. This creates an opportunity for Cass to provide tools that help businesses navigate unpredictable cost structures and optimize their spending in challenging economic conditions.

Government Spending and Infrastructure Projects

Government investments in infrastructure, particularly in transportation and energy, can significantly stimulate economic activity. For instance, the U.S. Infrastructure Investment and Jobs Act, enacted in 2021, allocated over $1.2 trillion to improve roads, bridges, public transit, and the energy grid. This increased spending directly benefits Cass Information Systems' clients by boosting freight volumes and the need for efficient payment processing and data management services.

Conversely, shifts in government fiscal policy, such as austerity measures or a reduction in public spending, can dampen economic growth. A slowdown in infrastructure projects or decreased government contracts could translate to lower transaction volumes for Cass's core business. For example, if federal funding for highway construction is cut, trucking companies, a key client segment for Cass, might experience reduced freight demand, impacting their payment needs.

- Increased infrastructure spending, like the $1.2 trillion from the U.S. Infrastructure Investment and Jobs Act, drives higher transaction volumes for Cass's clients.

- Reduced government spending on public works can lead to decreased freight volumes and a subsequent impact on demand for Cass's payment services.

- Government policies affecting energy infrastructure can influence the operational costs and investment decisions of Cass's clients in the energy sector.

Consumer Financial Protection Bureau (CFPB) Oversight

The Consumer Financial Protection Bureau's (CFPB) oversight significantly shapes the operating environment for companies like Cass Information Systems, particularly concerning consumer financial data and digital payment applications. Increased regulatory scrutiny, such as the CFPB's focus on data privacy and security, necessitates robust compliance measures. This can influence how Cass manages customer information and develops its digital payment solutions.

The CFPB's stance, especially regarding enhanced consumer control over financial data, directly impacts fintech companies and their partners. For Cass, this means ensuring their data management systems are not only secure but also transparent, allowing consumers to understand and manage their financial information effectively. This regulatory posture can lead to adjustments in service offerings and operational procedures to maintain compliance.

- CFPB Enforcement Actions: In 2023, the CFPB announced record enforcement actions, including significant penalties for data security and privacy violations, underscoring the importance of compliance for financial service providers.

- Digital Payment Scrutiny: The CFPB continues to examine digital payment platforms for potential unfair or deceptive practices, impacting companies offering such services.

- Data Access Rulemaking: Ongoing CFPB initiatives around data access and portability, potentially impacting how companies like Cass share and utilize consumer financial data, are a key consideration.

Government policies directly influence Cass Information Systems through regulatory frameworks and fiscal decisions. For example, the U.S. Infrastructure Investment and Jobs Act, with over $1.2 trillion allocated to infrastructure, boosts freight volumes, a key driver for Cass's services. Conversely, shifts in government spending or austerity measures can reduce economic activity and, consequently, transaction volumes for Cass.

The actions of regulatory bodies like the Consumer Financial Protection Bureau (CFPB) are also critical. The CFPB's focus on data privacy and security, evidenced by its record enforcement actions in 2023, necessitates robust compliance from Cass. This scrutiny extends to digital payment platforms, requiring companies like Cass to ensure transparency and consumer control over financial data.

Geopolitical factors and global trade policies, such as tariffs and trade agreements, significantly impact Cass's transportation clients. Instability in regions like Eastern Europe and the Middle East can lead to volatile freight rates, affecting operational costs for Cass's clients and potentially altering demand for its services as supply chains adjust.

| Policy Area | Impact on Cass Information Systems | Example/Data Point (2024/2025 Focus) |

|---|---|---|

| Infrastructure Spending | Increases freight volumes and transaction demand. | U.S. Infrastructure Investment and Jobs Act ($1.2T) continues to support transportation sector growth. |

| Financial Regulation (CFPB) | Requires enhanced data security and privacy compliance. | CFPB's 2023 record enforcement actions highlight significant penalties for data violations. |

| Global Trade Policy | Affects shipping volumes and freight costs for clients. | Ongoing adjustments in international trade relationships can lead to supply chain realignments and cost fluctuations. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Cass Information Systems, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and potential challenges and opportunities within these critical areas.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy development.

Economic factors

Rising inflation presents a significant challenge for Cass Information Systems and its clientele by increasing operational expenses. For instance, the US annual inflation rate reached 3.4% in April 2024, impacting everything from fuel costs for transportation services to the price of technology. This directly translates to higher costs for Cass's logistics and payment processing services.

Fluctuating interest rates have a direct and substantial impact on Cass's financial performance, particularly its net interest margin. As of May 2024, the Federal Reserve maintained its benchmark interest rate between 5.25% and 5.50%, a level that has persisted. Changes to this rate directly affect the profitability of Cass's financial intermediation activities, influencing how much they earn on funds held or lent.

Furthermore, shifts in interest rate policy can significantly alter client behavior and demand for financial services. Higher rates, like those currently in place, can make borrowing more expensive, potentially dampening investment and reducing the volume of transactions Cass processes. Conversely, lower rates might stimulate economic activity, increasing demand for Cass's payment and financial management solutions.

The global economic outlook for 2024 and into 2025 presents a mixed picture, with varying GDP growth forecasts across regions. While some economies are projected to expand, concerns about a potential slowdown persist, particularly in major markets. For Cass Information Systems, this translates to a direct impact on their clients' business volumes.

Higher GDP growth generally signals increased industrial activity and consumer spending, which benefits Cass's core client sectors like transportation and energy. Conversely, a weakening economy or outright recession can lead to reduced freight movement and lower overall transaction volumes. For instance, if global GDP growth slows significantly in 2025, Cass could see a tangible decrease in the number of transactions processed, directly affecting their revenue.

Recent projections from institutions like the IMF and World Bank for 2024 and 2025 highlight this sensitivity. For example, a projected global GDP growth of around 3% for 2024, with potential moderation in 2025, means Cass's clients in logistics might experience less demand for shipping services. This directly impacts Cass's transaction-based revenue streams.

Ongoing supply chain disruptions, fueled by geopolitical tensions and unexpected events, continue to elevate logistics expenses for businesses. This persistent volatility directly increases the demand for Cass Information Systems' freight audit and payment solutions, as companies seek to manage and mitigate these rising costs.

However, this very volatility presents a double-edged sword. Strained client finances due to unpredictable expenses could potentially hinder their investment in new management systems or impact their payment timeliness, a critical factor for Cass's operational efficiency and revenue flow.

For instance, the average cost of shipping a 40-foot container from Asia to Europe saw significant fluctuations throughout 2024, with some routes experiencing increases of over 50% compared to pre-pandemic levels, directly impacting the need for robust freight management.

Industry Consolidation and M&A Activity

Industry consolidation is a significant trend impacting Cass Information Systems. Mergers and acquisitions (M&A) in the logistics and fintech spaces can reshape the competitive environment. For instance, the global M&A market saw robust activity in 2023, with deal values reaching trillions, and projections for 2024 and 2025 indicate continued strategic consolidation as companies seek scale and technological advantages.

These shifts present dual possibilities for Cass. Competitors might consolidate, potentially creating larger entities with greater market power, which could challenge Cass's existing client relationships or service offerings. Conversely, Cass could leverage this environment by pursuing its own strategic acquisitions to bolster its fintech capabilities or expand its geographical footprint, aiming to enhance its competitive standing.

- Logistics M&A: Increased consolidation among trucking and freight companies could lead to fewer, larger clients for Cass, altering payment volumes and service needs.

- Fintech Integration: Strategic acquisitions by fintech players in payments and financial management could introduce new competitive pressures or partnership opportunities.

- Cass's Strategic Options: Cass may consider acquiring smaller fintech firms to integrate advanced payment technologies or expand its data analytics services.

- Client Consolidation: If Cass's key clients merge, it could result in a concentrated client base, requiring adaptation in service delivery and relationship management.

Demand for Real-time Payments and Cost Savings

Businesses are increasingly prioritizing real-time payment capabilities and seeking ways to cut costs, which directly fuels the demand for sophisticated payment and expense management tools. Cass Information Systems is well-positioned to capitalize on this shift as companies look to optimize their financial operations.

The drive for faster transactions and reduced expenses is evident in market trends. For instance, the global real-time payments market was projected to reach over $30 billion by 2025, indicating significant growth and adoption. This surge means businesses are actively searching for solutions that can enhance their cash flow management and lower overall transaction expenditures.

- Enhanced Cash Flow: Real-time payments allow businesses to access funds immediately, improving liquidity and working capital.

- Reduced Transaction Costs: Companies are actively looking for payment methods that minimize fees and processing expenses.

- Immediate Spending Insights: Advanced solutions provide instant visibility into expenditures, enabling better financial control and decision-making.

Economic factors significantly shape Cass Information Systems' operating environment, with inflation and interest rates being key concerns. The US inflation rate was 3.4% in April 2024, impacting operational costs, while the Federal Reserve kept its benchmark rate between 5.25% and 5.50% as of May 2024, affecting net interest margins and client borrowing behavior.

The global economic outlook for 2024-2025 indicates varied GDP growth, directly influencing Cass's clients' business volumes. For example, a projected global GDP growth of around 3% for 2024, with potential moderation in 2025, suggests varying demand for logistics services, impacting Cass's transaction-based revenue.

Supply chain disruptions and industry consolidation also present challenges and opportunities. Increased shipping costs, with some container routes seeing over 50% increases in 2024 compared to pre-pandemic levels, drive demand for Cass's solutions, while M&A activity in logistics and fintech reshapes the competitive landscape.

Businesses' increasing demand for real-time payments and cost reduction strategies, with the global real-time payments market projected to exceed $30 billion by 2025, positions Cass to benefit from companies seeking to optimize financial operations and enhance cash flow.

| Economic Factor | Data Point (2024/2025) | Impact on Cass |

|---|---|---|

| US Inflation Rate | 3.4% (April 2024) | Increases operational costs for Cass and its clients. |

| Federal Reserve Benchmark Rate | 5.25%-5.50% (May 2024) | Affects net interest margins and client borrowing costs. |

| Global GDP Growth Projection | ~3% for 2024 (IMF/World Bank) | Influences client transaction volumes and demand for logistics services. |

| Container Shipping Costs (Asia-Europe) | Up over 50% vs. pre-pandemic (selected routes, 2024) | Drives demand for freight audit and payment solutions. |

| Real-Time Payments Market Growth | Projected >$30 billion by 2025 | Indicates growing demand for efficient payment and expense management tools. |

Same Document Delivered

Cass Information Systems PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Cass Information Systems provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into Cass Information Systems' strategic landscape.

Sociological factors

Societal trends are increasingly favoring digital interactions for all aspects of business, including financial management. This digital transformation is a significant tailwind for Cass Information Systems, as businesses worldwide are adopting new technologies. For instance, a 2024 report indicated that over 75% of small and medium-sized businesses in the US are actively investing in digital solutions for their operations, a trend directly benefiting providers like Cass.

The widespread adoption of mobile applications and cloud-based platforms for payments and expense tracking further fuels this shift. As of early 2025, mobile payment transaction volumes are projected to exceed $10 trillion globally, demonstrating a clear societal preference for digital convenience. This growing reliance on digital infrastructure means businesses are actively seeking integrated solutions for managing their financial workflows, which aligns perfectly with Cass's service offerings.

Businesses and stakeholders are increasingly demanding a clearer view into financial operations and how money flows through supply chains, along with practical insights derived from that data. This trend is driven by a desire for accountability and a need to make smarter business decisions. For instance, a 2024 survey by PwC found that 75% of companies reported increased pressure from investors for ESG (Environmental, Social, and Governance) transparency, which often includes financial data.

Cass Information Systems is well-positioned to meet this demand with its robust data analytics and reporting capabilities. These tools empower clients to not only see where their money is going but also to uncover opportunities for cost savings and enhance overall operational efficiency. In 2023, Cass reported that its clients utilizing their data analytics solutions saw an average reduction of 8% in freight spend through better visibility and control.

The modern workforce is increasingly embracing remote and hybrid models, demanding greater flexibility and efficiency in how tasks are managed. This shift, coupled with a persistent focus on optimizing operational costs, directly fuels the demand for sophisticated, automated expense management solutions. Companies are actively seeking ways to reduce manual intervention and minimize errors, making Cass's streamlined offerings particularly attractive for enhancing financial and administrative operations.

In 2024, studies indicated that over 30% of the US workforce was working remotely at least part-time, a trend that continued to influence technology adoption. This necessitates platforms that can seamlessly integrate with distributed teams and provide real-time visibility into spending, directly aligning with Cass Information Systems' value proposition of simplifying complex financial processes.

Customer Expectations for Seamless Experiences

Customers, whether they are businesses or individual consumers, are increasingly demanding payment processes that are not only easy to use but also highly secure and convenient. This trend is a significant sociological factor influencing how companies like Cass Information Systems operate.

To stay competitive, Cass must continuously invest in improving its user interfaces and the ease with which its systems can be integrated with other business platforms. Meeting these elevated customer expectations means ensuring that Cass's offerings are intuitive, efficient, and provide a frictionless experience from start to finish.

- Digital Payment Growth: Global digital payment transaction volume is projected to reach over $10 trillion by 2025, underscoring the demand for seamless digital experiences.

- User Experience Focus: Studies show that over 80% of consumers are willing to pay more for a better customer experience, highlighting the importance of intuitive platforms.

- Integration Demands: Businesses expect payment solutions to integrate smoothly with their existing ERP and accounting software, with over 70% prioritizing this capability.

- Security Assurance: Despite the demand for convenience, data security remains paramount, with nearly 90% of consumers citing security as a critical factor in their payment choices.

ESG Reporting and Corporate Responsibility

Societal expectations are increasingly pushing companies toward greater transparency and accountability in their operations, particularly concerning environmental, social, and governance (ESG) factors. This trend is directly impacting how businesses approach their supply chains and overall corporate responsibility.

Investors are now scrutinizing companies' ESG performance more than ever, making it a critical factor in investment decisions. For instance, a significant portion of global assets under management, estimated to be over $35 trillion by some reports in early 2024, is now linked to ESG mandates, highlighting the financial imperative for companies to adapt.

Cass Information Systems can play a vital role in helping clients navigate these evolving demands. By offering solutions to track and report on expenses associated with sustainable practices, such as those for green logistics or waste reduction programs, Cass empowers businesses to demonstrate their commitment to corporate responsibility and meet investor expectations.

- Growing investor demand for ESG data: Over 70% of institutional investors consider ESG factors in their investment decisions as of 2024.

- Supply chain scrutiny: Consumers and regulators are increasingly focused on the social and environmental impact of company supply chains.

- Financial benefits of ESG: Companies with strong ESG profiles often experience lower cost of capital and enhanced brand reputation.

- Cass's role in ESG reporting: Facilitating tracking of expenses for eco-friendly logistics and waste management aligns with client sustainability goals.

Societal expectations for seamless digital transactions continue to grow, with global mobile payment transaction volumes projected to surpass $10 trillion by early 2025, a trend that Cass Information Systems is well-positioned to capitalize on. Businesses are increasingly prioritizing integrated financial management tools that offer enhanced visibility and control over their spending, especially with a significant portion of the workforce operating remotely, necessitating efficient, automated expense management solutions.

The demand for transparency in financial operations, particularly concerning ESG factors, is a major societal driver, with over 70% of institutional investors considering ESG data in their decisions as of 2024. Cass can support clients in meeting these demands by facilitating the tracking of expenses related to sustainable practices, thus aiding in ESG reporting and enhancing corporate responsibility. This focus on transparency and sustainability directly aligns with the evolving values of consumers and stakeholders.

Technological factors

The rapid evolution of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping how payment processing and data analytics operate. These technologies offer Cass Information Systems significant opportunities to innovate.

Cass can harness AI for improved fraud detection, predictive analytics to identify cost-saving opportunities, and automated invoice processing, leading to greater client efficiency. For instance, by mid-2024, AI in financial services was projected to reduce operational costs by up to 25%.

Furthermore, AI-driven insights can lead to more accurate accruals and better forecasting, directly enhancing the value proposition Cass offers to its diverse client base.

Blockchain and distributed ledger technology (DLT) present significant opportunities for Cass Information Systems to bolster transparency, security, and efficiency, particularly within supply chain finance and cross-border payment processing. These advancements could lead to more robust and immutable transaction records.

While still in a developmental phase, the integration of blockchain by Cass could enhance its service portfolio, offering clients more secure and verifiable transaction histories. For instance, the global DLT market was valued at approximately $9.8 billion in 2023 and is projected to reach over $150 billion by 2030, indicating substantial growth and potential for adoption.

As a financial technology firm, Cass Information Systems is inherently exposed to escalating cybersecurity threats. The protection of sensitive client financial data is paramount, necessitating substantial and ongoing investment in advanced security technologies. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the critical need for robust defenses like encryption and sophisticated fraud detection systems, which Cass actively employs to safeguard its operations and client information.

Cloud Computing and Scalability

The increasing adoption of cloud computing is a significant technological factor for Cass Information Systems. This allows Cass to provide payment and information management solutions that are not only scalable and flexible but also highly resilient. The ability to scale up or down based on demand is crucial in the dynamic financial services sector.

Cloud-based platforms are instrumental in accelerating the deployment of new features and enhancing data accessibility for Cass. This agility is vital for staying competitive. For instance, in 2024, many financial technology companies reported significant improvements in deployment times after migrating to cloud infrastructure, with some seeing reductions of up to 40%.

Furthermore, cloud solutions enable Cass to efficiently manage increasing transaction volumes, directly supporting business growth and operational efficiency. The global cloud computing market size was valued at approximately $610 billion in 2023 and is projected to grow significantly, indicating a strong trend towards cloud adoption across industries, including financial services.

- Scalability: Cloud infrastructure allows Cass to easily adjust resources to meet fluctuating transaction volumes.

- Agility: Faster deployment of new payment features and services is enabled by cloud platforms.

- Resilience: Cloud solutions enhance the robustness and availability of Cass's information management systems.

- Cost Efficiency: Moving to the cloud can optimize IT spending by shifting from capital expenditure to operational expenditure.

Real-time Payments Infrastructure Development

The global shift towards real-time payment infrastructure presents a significant technological factor for Cass Information Systems. As more countries implement instant payment regulations, Cass needs to ensure its systems can handle faster transaction processing. This includes reducing current processing times to meet the increasing customer demand for immediate payments and reconciliation, a trend accelerated by digital transformation initiatives worldwide. For instance, the U.S. Faster Payments Council is actively working to improve payment speeds, with many financial institutions aiming for near-instantaneous capabilities by 2025.

Adapting to this evolving landscape offers Cass opportunities to enhance its service offerings and competitive edge. By investing in and developing robust real-time payment capabilities, Cass can streamline operations for its clients, improving cash flow management and reducing operational friction. This modernization is crucial as businesses increasingly expect seamless and rapid financial transactions, directly impacting efficiency and customer satisfaction.

Key considerations for Cass in this technological shift include:

- System Modernization: Upgrading existing platforms to support instant transaction processing and real-time data flow.

- Security and Compliance: Ensuring that faster payment systems maintain high levels of security and adhere to evolving regulatory requirements.

- Integration Capabilities: Developing seamless integration with various payment networks and client systems to facilitate end-to-end real-time transactions.

- Scalability: Building infrastructure that can handle a significant increase in transaction volume as real-time payments become more prevalent.

The integration of AI and machine learning is transforming payment processing, offering Cass Information Systems enhanced fraud detection and operational efficiencies. By mid-2024, AI in financial services was projected to cut operational costs by up to 25%, a benefit Cass can leverage.

Blockchain technology offers Cass opportunities to improve transaction security and transparency, particularly in supply chain finance. The global DLT market, valued at $9.8 billion in 2023, is expected to exceed $150 billion by 2030, highlighting significant growth potential.

Cloud computing provides Cass with scalable, resilient, and agile platforms, crucial for managing fluctuating transaction volumes and accelerating new feature deployment. Financial tech firms in 2024 saw deployment time reductions of up to 40% after cloud migration.

The global shift to real-time payments necessitates Cass's system modernization to support instant transaction processing and compliance. By 2025, many financial institutions aim for near-instantaneous payment capabilities.

Legal factors

New and evolving financial services regulations, such as the EU's Payment Services Directive 3 (PSD3), Digital Operational Resilience Act (DORA), and Markets in Crypto-assets Regulation (MiCA), are reshaping the landscape for companies like Cass Information Systems. These directives impose significant compliance burdens, requiring substantial investment in technology and processes to meet new standards for payment security, operational resilience, and digital asset handling.

The implementation of DORA, for instance, mandates robust ICT risk management frameworks, aiming to enhance the digital operational resilience of the financial sector. This means Cass must ensure its systems are protected against a wide range of ICT disruptions and threats. Similarly, PSD3 is expected to further harmonize payment services across the EU, potentially increasing competition and requiring adjustments to existing business models.

MiCA, on the other hand, provides a regulatory framework for crypto-assets, offering legal certainty but also imposing licensing and conduct requirements for service providers. For Cass, navigating these complex and often overlapping regulations necessitates a proactive and adaptable approach to maintain compliance and capitalize on emerging opportunities within the evolving financial technology space.

Cass Information Systems must navigate a complex web of global data privacy laws, such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These regulations mandate stringent protocols for handling sensitive financial and business information, impacting everything from data collection to its ultimate disposal.

Failure to adhere to these evolving legal landscapes can result in significant financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher. For instance, in 2023, several large corporations faced substantial fines for data breaches and non-compliance, underscoring the critical need for robust data governance at Cass.

Compliance directly influences Cass's operational strategies, requiring investments in secure data storage, anonymization techniques, and transparent data usage policies. This ensures client trust and avoids reputational damage, which is crucial in the financial services sector where data security is paramount.

Fintech firms, including those Cass Information Systems partners with or competes against, face heightened scrutiny over Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. This means Cass must invest in robust systems for monitoring transactions and verifying customer identities to prevent financial crime. Failure to comply can result in significant fines; for instance, in 2023, global AML fines reached an estimated $5.7 billion, underscoring the financial risks involved.

Bank-Fintech Partnership Scrutiny

Regulatory bodies are intensifying their oversight of collaborations between established banks and fintech innovators. For Cass Information Systems, whose operations are deeply embedded in the financial services sector, these partnerships are crucial for growth and service development. For instance, the U.S. banking sector saw fintech investments reach an estimated $150 billion in 2024, highlighting the significance of these alliances.

Any shifts in regulatory frameworks or new compliance demands for these bank-fintech ventures could directly influence Cass's operational strategies and future expansion plans. The U.S. Consumer Financial Protection Bureau (CFPB) has been particularly active, issuing guidance on data privacy and security in digital financial services throughout 2024 and early 2025.

- Increased Regulatory Scrutiny: Regulators are focusing on data security, consumer protection, and anti-money laundering (AML) compliance in bank-fintech partnerships.

- Impact on Cass's Model: Stricter regulations could necessitate increased compliance costs or limit the scope of services Cass can offer through its partnerships.

- Strategic Adaptation: Cass must remain agile, adapting its partnership strategies to evolving legal and compliance landscapes to ensure continued growth and market access.

Industry-Specific Regulations (Transportation, Energy, Telecom)

Cass Information Systems navigates a complex web of industry-specific regulations that directly impact its core services. For instance, in the transportation sector, evolving rules around freight auditing and fuel surcharge calculations, such as those influenced by the Federal Motor Carrier Safety Administration (FMCSA) and its ongoing efforts to enhance safety and transparency, necessitate continuous adaptation in Cass's invoice processing. The energy industry's regulatory environment, including fluctuating energy pricing mechanisms and environmental compliance standards, also shapes how Cass audits utility bills and manages energy spend for its clients.

Furthermore, the telecommunications industry's dynamic regulatory landscape, encompassing changes in billing practices, data privacy laws (like potential updates to state-level data breach notification requirements), and network infrastructure compliance, directly affects the accuracy and validity of telecom invoices that Cass audits. These sector-specific mandates, often subject to frequent revision by bodies like the Federal Communications Commission (FCC) or state public utility commissions, require Cass to maintain robust compliance frameworks to ensure its clients' adherence and to accurately reflect these changes in their financial operations. For example, the FCC's 2024 initiatives around network modernization and broadband deployment could introduce new billing complexities for telecom providers, impacting Cass’s audit scope.

The financial implications of these regulations are substantial. Non-compliance can lead to significant fines and penalties, directly impacting client costs and Cass's reputation. For example, a shift in a state's sales tax treatment of specific transportation services could retroactively alter the accuracy of past audits, requiring remediation. Similarly, changes in energy reporting requirements could necessitate adjustments to how Cass validates utility expenses, potentially uncovering previously unbilled charges or overpayments for clients. The 2025 outlook suggests continued regulatory scrutiny across these sectors, underscoring the critical need for Cass to remain agile.

- Transportation: Evolving FMCSA regulations on driver hours and vehicle maintenance can influence the types of charges audited on carrier invoices.

- Energy: Changes in state-level renewable energy credit (REC) reporting or carbon pricing mechanisms directly affect utility bill audits.

- Telecommunications: Updates to data roaming regulations or universal service fund contributions can alter the structure of telecom invoices processed by Cass.

- Compliance Costs: Adapting to new regulatory requirements often involves investment in updated software and training, impacting operational expenses for Cass and its clients.

Legal factors significantly shape Cass Information Systems' operational landscape, demanding constant vigilance and adaptation to a dynamic regulatory environment. The increasing focus on data privacy, as evidenced by the ongoing enforcement of GDPR and CCPA, necessitates robust data governance frameworks, with potential fines for breaches reaching substantial percentages of global revenue.

The financial services sector, where Cass operates, faces heightened scrutiny regarding Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, with global AML fines estimated to have reached $5.7 billion in 2023 alone. This mandates significant investment in transaction monitoring and identity verification systems.

Furthermore, industry-specific regulations, such as those impacting freight auditing in transportation or energy pricing in utilities, require Cass to continuously update its audit processes. For example, the Federal Communications Commission's (FCC) 2024 initiatives on network modernization could introduce new complexities in telecom invoice auditing.

Navigating these legal complexities, including new EU directives like PSD3 and DORA, requires substantial investment in technology and processes to ensure compliance and maintain client trust.

Environmental factors

The increasing emphasis on Environmental, Social, and Governance (ESG) reporting is a significant environmental factor affecting Cass Information Systems. Investors, regulators, and the public are all demanding greater transparency regarding corporate sustainability practices. This trend directly influences Cass's clientele, who are increasingly being asked to provide detailed environmental data about their operations.

For Cass, this translates into a growing need for sophisticated data analytics to support client sustainability initiatives. For instance, clients are likely to request more granular reporting on the carbon footprint of their supply chains, particularly concerning transportation emissions. A 2024 report indicated that over 70% of institutional investors consider ESG factors in their investment decisions, highlighting the market's shift.

Stricter carbon emissions regulations, like the EU's Carbon Border Adjustment Mechanism (CBAM) which began its transitional phase in October 2023, are directly impacting transportation costs for businesses. These regulations aim to level the playing field for goods imported into the EU based on their embedded carbon footprint, potentially increasing expenses for logistics providers and their clients.

This evolving regulatory landscape presents a significant opportunity for Cass Information Systems. By offering robust data analytics and insights, Cass can empower its logistics clients to navigate these changes effectively. This includes helping them optimize shipping routes to minimize emissions, identify and partner with carriers committed to greener practices, and accurately track their overall environmental impact.

Environmental directives concerning waste reduction and energy efficiency directly influence Cass Information Systems, as clients in these sectors need robust data to manage costs and comply with regulations. For instance, the European Union's Circular Economy Action Plan, updated in 2023, sets ambitious targets for waste reduction and recycling, prompting businesses to seek better analytics for tracking waste-related expenses. This means Cass can expect increased demand for services that highlight cost savings through improved waste management and energy efficiency.

As of early 2024, many nations are strengthening their energy efficiency standards for commercial buildings, a key area for Cass's clients. The U.S. Department of Energy, for example, continues to promote initiatives like the Better Buildings Challenge, encouraging significant energy reductions. These evolving requirements mean Cass must be prepared to offer sophisticated reporting that helps clients demonstrate compliance and identify opportunities for further savings in their energy consumption, directly impacting the data they will require from Cass.

Climate Change Impact on Supply Chains

Climate change presents significant physical risks to global supply chains. Extreme weather events, like the severe flooding in parts of Germany in July 2021 which caused billions in damages, or the widespread droughts impacting agricultural yields in 2023, directly disrupt transportation networks and logistics operations. These disruptions can lead to delays, increased costs, and reduced availability of goods.

For Cass Information Systems, this translates into a heightened need for resilient payment and information management solutions. As supply chains face increasing volatility due to climate-related events, Cass's ability to offer adaptable systems that can manage fluctuating payment flows and provide real-time visibility becomes paramount for clients navigating these challenges. The company's role in streamlining transactions and providing critical data insights becomes even more valuable in an unpredictable environment.

- Supply Chain Disruptions: Extreme weather events, such as hurricanes and floods, directly impact transportation infrastructure, causing delays and increased costs for businesses.

- Increased Operational Costs: Climate-related disruptions can lead to higher insurance premiums, rerouting expenses, and the need for more robust inventory management.

- Demand for Resilience: Companies are increasingly seeking financial and information management partners like Cass that can offer flexible solutions to mitigate the impact of supply chain volatility.

- Data Visibility: Enhanced data analytics and reporting are crucial for clients to understand and manage the financial implications of climate-induced supply chain disruptions.

Demand for Circular Economy Solutions

The global shift towards a circular economy, driven by both societal expectations and increasing regulations, is fundamentally reshaping how businesses operate. This focus on resource efficiency and minimizing waste directly impacts Cass Information Systems' client base. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and further strengthened with proposals in 2023 and 2024, aims to boost sustainable production and consumption.

Cass may find opportunities to adapt its financial management services to cater to clients actively pursuing circular economy strategies. This could involve developing specialized solutions for tracking expenses associated with reverse logistics, managing the costs of material reuse and refurbishment, or facilitating payments for services that support product longevity and repair. The growing emphasis on Extended Producer Responsibility (EPR) schemes across various regions, which hold producers accountable for their products throughout their lifecycle, further necessitates robust financial tracking for these circular initiatives.

Key areas where Cass could offer support include:

- Expense management for reverse logistics: Tracking costs associated with product returns, repair, and refurbishment.

- Supply chain finance for circular models: Facilitating payments and financing for businesses involved in material recovery and remanufacturing.

- Sustainability reporting integration: Providing data and analytics to help clients report on their circular economy performance and associated financial impacts.

- Waste reduction cost tracking: Enabling clients to monitor and manage expenditures related to waste diversion and recycling programs.

Environmental factors are increasingly shaping business operations, pushing companies like Cass Information Systems' clients towards greater sustainability. The growing demand for ESG reporting, exemplified by over 70% of institutional investors considering ESG in 2024, necessitates advanced data analytics for tracking environmental impacts, particularly in transportation emissions.

Stricter regulations, such as the EU's Carbon Border Adjustment Mechanism, are directly affecting logistics costs, creating opportunities for Cass to offer solutions that optimize routes and promote greener carrier partnerships. Furthermore, evolving energy efficiency standards for commercial buildings, supported by initiatives like the U.S. Department of Energy's Better Buildings Challenge, require Cass to provide sophisticated reporting to help clients demonstrate compliance and identify savings.

Climate change's physical risks, evidenced by billions in damages from events like the July 2021 German floods, underscore the need for Cass's resilient payment and information management solutions to navigate supply chain volatility and ensure data visibility.

The global pivot to a circular economy, supported by EU action plans and Extended Producer Responsibility schemes, presents opportunities for Cass to adapt its services. This includes expense management for reverse logistics and facilitating payments for material reuse, aligning with the growing emphasis on product longevity and waste reduction.

PESTLE Analysis Data Sources

Our PESTLE analysis for Cass Information Systems is meticulously constructed using a blend of public government data, reputable financial news outlets, and industry-specific market research reports. This comprehensive approach ensures that each element of the analysis is grounded in factual and timely information.