Carvana PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carvana Bundle

Carvana operates in a dynamic environment shaped by political shifts, economic fluctuations, and evolving social attitudes. Understanding these external forces is crucial for navigating the used car market. Our PESTLE analysis delves deep into these factors, providing actionable intelligence to inform your strategy.

Gain a competitive edge by grasping how technological advancements and environmental regulations impact Carvana's business model. This comprehensive PESTLE analysis offers a clear roadmap to identify opportunities and mitigate risks in this rapidly changing industry. Download the full version now for strategic clarity.

Political factors

Government policies concerning online vehicle sales, especially across state lines, are a major factor for Carvana. These regulations, along with consumer protection laws, directly shape how Carvana operates and grows. For instance, differing state rules for vehicle titles and registrations can make compliance tricky for a company that sells entirely online.

Navigating these varied state-specific requirements is crucial. Carvana's operational model relies heavily on efficiently handling these processes nationwide. Failure to comply can lead to issues, as seen in past settlements where companies had to address state-specific laws to avoid penalties and customer dissatisfaction.

Potential new tariffs on imported vehicles and parts, such as those discussed for 2025, could reshape the automotive landscape. For instance, a 10% tariff on imported auto parts could add hundreds of dollars to the cost of a new vehicle.

Higher new car prices resulting from these tariffs might naturally steer more consumers toward the used car market. This shift could significantly boost demand for Carvana's inventory, as it provides a more accessible alternative to expensive new vehicles.

To effectively navigate this evolving market, Carvana would need to implement agile inventory management and dynamic pricing strategies. This proactive approach would allow them to capitalize on increased demand and maintain a competitive edge amidst changing economic conditions.

Government economic stimulus and interest rate policies significantly influence consumer spending power, directly impacting demand for large purchases like vehicles. For instance, during periods of economic expansion and lower interest rates, consumers tend to have more disposable income and confidence, which can boost Carvana's sales. Conversely, tightening monetary policy or economic slowdowns can reduce consumer spending and dampen the used car market.

In 2024, the Federal Reserve's approach to interest rates, aimed at managing inflation, will be a key determinant of consumer borrowing costs for car purchases. If rates remain elevated, it could continue to pressure demand for vehicles, affecting Carvana's revenue streams. Conversely, any indication of rate cuts could signal a potential rebound in consumer confidence and spending on big-ticket items.

Vehicle Safety and Emissions Standards

Government-mandated vehicle safety and emissions standards significantly shape the automotive market, influencing both the types of vehicles manufacturers produce and what consumers ultimately buy. For Carvana, these regulations directly impact its inventory acquisition and reconditioning processes.

Stricter environmental regulations, for example, are pushing a faster adoption of electric vehicles (EVs). This trend is already evident, with Carvana actively increasing its focus on acquiring and selling EV inventory to align with market demand and regulatory pressures. As of early 2024, the US Environmental Protection Agency (EPA) proposed stricter emissions standards for model years 2027-2032, aiming for a significant reduction in greenhouse gas emissions from passenger vehicles, which will further accelerate this shift.

- Regulatory Impact: Stricter emissions standards can increase the cost of traditional internal combustion engine (ICE) vehicles, potentially making used EVs more attractive.

- Inventory Shift: Carvana's proactive increase in EV inventory, reported as a growing segment in their 2023 filings, positions them to capitalize on this trend.

- Consumer Preference: Evolving consumer preferences, driven by environmental awareness and government incentives for EVs, directly influence Carvana's sales mix.

Political Stability and Consumer Confidence

Political stability is a cornerstone for consumer confidence, directly impacting big-ticket purchases like vehicles. When the political landscape is uncertain, consumers tend to hold back on spending, which can significantly slow down used car sales volumes for companies like Carvana. Conversely, a predictable and stable political environment typically boosts consumer sentiment, creating a more favorable market for automotive retailers.

For instance, during periods of heightened political tension or upcoming elections, consumer confidence indexes often see a dip. The Conference Board Consumer Confidence Index, a key indicator, can reflect these shifts. A sustained downturn in this index, often linked to political instability, can translate into fewer online car purchases as consumers prioritize essential spending.

- Consumer confidence directly correlates with demand for durable goods like automobiles.

- Political uncertainty can lead to a contraction in consumer spending, impacting Carvana's sales volume.

- A stable political climate generally supports higher consumer confidence and a healthier automotive retail market.

Government regulations on online sales and vehicle titling vary significantly by state, creating compliance complexities for Carvana's nationwide operations. For example, differing state-specific rules for vehicle registration can add administrative burdens and potential delays. Past settlements with states highlight the importance of adhering to these localized legal frameworks to avoid penalties.

Potential tariffs on imported auto parts, such as the 10% tariff discussed for 2025, could increase new car prices. This might drive more consumers towards the used car market, benefiting Carvana. For instance, a 10% tariff could add hundreds of dollars to new vehicle costs, making Carvana's offerings more competitive.

Federal Reserve interest rate policies directly impact consumer purchasing power for vehicles. In 2024, the Fed's stance on inflation control will influence borrowing costs; higher rates can dampen demand, as seen when rates remained elevated, potentially affecting Carvana's sales. Conversely, rate cuts could stimulate spending.

Stricter emissions standards, like those proposed by the EPA for 2027-2032, accelerate the shift to electric vehicles. Carvana's increased focus on EV inventory, a growing segment in their 2023 filings, positions them to meet this regulatory-driven market change. This trend makes used EVs more attractive as ICE vehicles may become more expensive.

What is included in the product

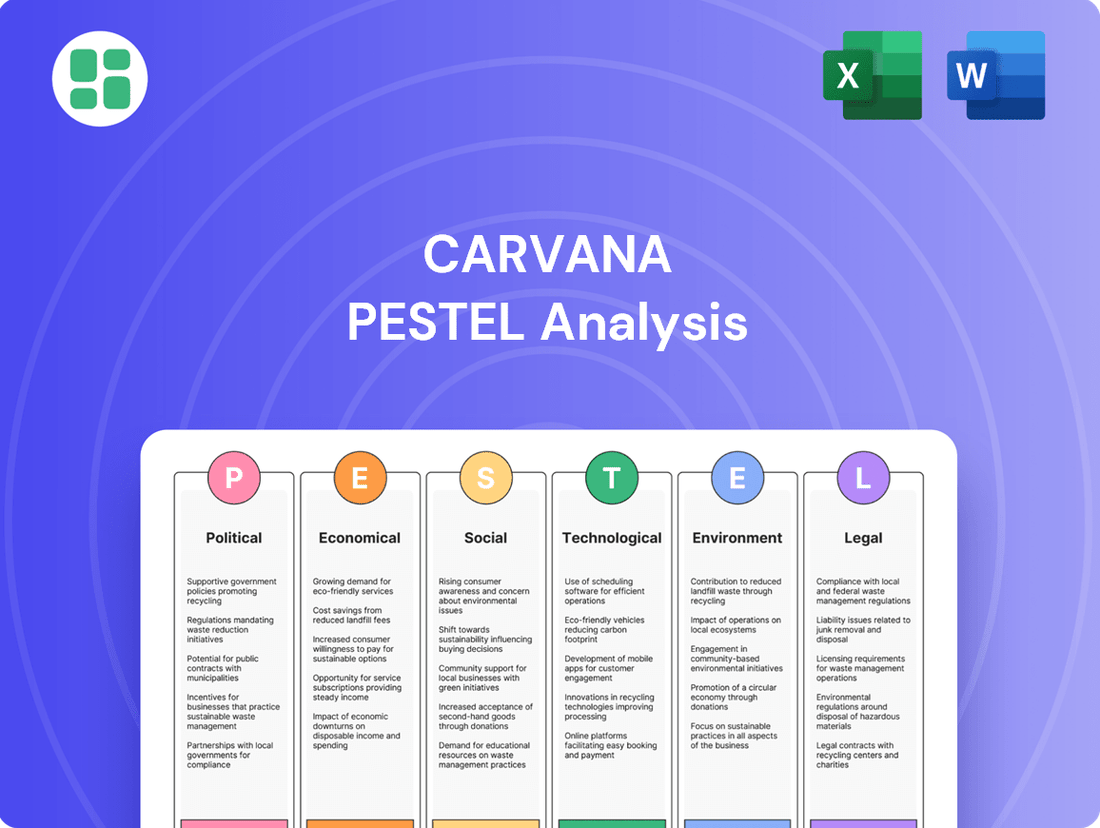

This Carvana PESTLE analysis provides a comprehensive examination of how external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—impact the company’s operations and strategic direction.

It offers actionable insights for stakeholders to navigate market complexities and capitalize on emerging opportunities.

A PESTLE analysis for Carvana can serve as a pain point reliever by highlighting external factors that influence operational challenges, such as regulatory hurdles or economic downturns, allowing for proactive strategy development.

Economic factors

Interest rate fluctuations significantly affect Carvana's business model. As of mid-2024, the Federal Reserve's benchmark interest rate remained elevated, impacting the cost of capital for Carvana's own financing operations and the affordability of auto loans for its customers. For instance, a 1% increase in auto loan interest rates can add hundreds of dollars to the total cost of a vehicle, potentially dampening consumer demand for used cars, a core market for Carvana.

Higher interest rates directly translate to increased borrowing costs for consumers seeking auto loans, a crucial element for a substantial portion of Carvana's customer base. This can lead to reduced purchasing power, forcing buyers to seek cheaper vehicles or delay their purchases altogether. Consequently, Carvana may experience lower sales volumes and a potential decrease in its financing arm's profitability, as seen in periods of aggressive rate hikes by central banks.

Inflationary pressures have a direct impact on the used car market, often driving up prices and making vehicles less affordable for many consumers. This trend can affect demand for Carvana's offerings, particularly among budget-conscious buyers.

Despite Carvana's reported strong financial performance, including a significant increase in Gross Profit per Unit (GPU) to $5,046 in Q1 2024, sustained high inflation could still pose a challenge to affordability and overall market demand.

Consumer disposable income is a key driver for Carvana, as it directly impacts the demand for used vehicles, especially those with higher price tags. When consumers have more money left after essential expenses, they are more likely to consider a car purchase or upgrade.

However, economic headwinds can quickly change this. For instance, if inflation remains elevated in 2024 and 2025, or if interest rates stay high, consumers might find their disposable income squeezed. This could lead them to postpone buying a car or seek out cheaper options, directly affecting Carvana's sales volume and average transaction prices.

Availability of Credit and Lending Standards

Carvana's reliance on customer financing makes it sensitive to credit availability and lending standards. When financial institutions tighten their lending practices, it can become harder for Carvana's customers to secure auto loans, directly affecting sales volume. For instance, in early 2024, many lenders showed increased caution due to economic uncertainties, potentially impacting Carvana's customer base.

The company's strategic focus on increasing its financing penetration rate has been a key driver of growth. This strategy means a larger portion of Carvana's revenue is tied to the financing component of its sales. As of the first quarter of 2024, Carvana reported a significant increase in its financing penetration rate, which contributed to a higher average transaction value per vehicle sold, underscoring the importance of accessible credit for its business model.

- Financing Dependence: Carvana's model is built on providing financing, making it vulnerable to shifts in credit markets.

- Impact of Lending Standards: Stricter lending criteria can reduce the pool of eligible buyers, hindering sales.

- Financing Penetration Growth: The company has actively increased its financing penetration, boosting average transaction values.

- Economic Sensitivity: Economic downturns or rising interest rates can lead lenders to tighten standards, directly affecting Carvana.

Overall Economic Growth and Recession Risks

The used car market, including Carvana's operations, is intrinsically tied to the overall economic health. A strong economy typically translates to increased consumer confidence and spending power, which directly benefits sales volumes and pricing for used vehicles. For instance, in 2023, the U.S. used car price index saw fluctuations, but overall demand remained a key indicator of economic sentiment.

Conversely, the risk of a recession poses a significant threat to Carvana. Economic downturns often lead to reduced disposable income, higher unemployment, and a general pullback in discretionary spending, such as vehicle purchases. This can result in lower demand, downward pressure on prices, and a negative impact on Carvana's revenue and profitability. The Federal Reserve's outlook for 2024 and 2025 continues to monitor inflation and interest rate impacts on consumer spending, which are critical for the automotive sector.

- Economic Sensitivity: Carvana's performance is highly correlated with consumer spending and economic stability.

- Recession Impact: A recession could decrease demand, lower used car prices, and hurt Carvana's financial results.

- 2024-2025 Outlook: Analysts are closely watching economic indicators for potential shifts in consumer purchasing power for used vehicles.

Economic factors significantly shape Carvana's operational landscape, particularly concerning interest rates and inflation. Elevated interest rates, as seen through mid-2024, directly increase borrowing costs for consumers, potentially reducing demand for used vehicles and impacting Carvana's financing arm. Inflationary pressures can drive up used car prices, affecting affordability and consumer purchasing power, even as Carvana reported strong Gross Profit per Unit (GPU) of $5,046 in Q1 2024.

Consumer disposable income is a critical determinant of Carvana's sales volume. Economic headwinds, such as persistent inflation or high interest rates through 2024-2025, could squeeze this income, leading consumers to delay purchases or opt for cheaper alternatives. This sensitivity is amplified by Carvana's reliance on customer financing; tighter lending standards, observed in early 2024 due to economic uncertainty, can limit the pool of eligible buyers.

The overall economic health is a fundamental driver for Carvana, with a strong economy generally boosting consumer confidence and spending on vehicles. Conversely, the risk of a recession presents a substantial threat, potentially leading to decreased disposable income, higher unemployment, and a reduction in discretionary spending, which would negatively impact Carvana's sales and profitability. The Federal Reserve's ongoing monitoring of inflation and interest rates in 2024-2025 remains crucial for the automotive sector's outlook.

| Economic Factor | Impact on Carvana | Data Point/Trend (2024-2025 Focus) |

| Interest Rates | Increases borrowing costs for customers, potentially dampening demand and affecting Carvana's financing revenue. | Federal Reserve benchmark rate remained elevated through mid-2024. |

| Inflation | Drives up used car prices, impacting affordability and consumer purchasing power. | Inflationary pressures continued to influence the used car market in early 2024. |

| Disposable Income | Directly correlates with demand for vehicles; squeezed income can lead to delayed purchases. | Economic headwinds in 2024-2025 could reduce consumer spending power. |

| Credit Availability | Tighter lending standards reduce the pool of eligible buyers, impacting sales volume. | Lenders showed increased caution in early 2024 due to economic uncertainties. |

Preview Before You Purchase

Carvana PESTLE Analysis

The preview you see here is the exact Carvana PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises in the PESTLE analysis.

The content and structure shown in the preview is the same Carvana PESTLE analysis document you’ll download after payment.

Sociological factors

Consumer comfort with online purchasing, even for significant purchases like vehicles, has surged. This shift, amplified by recent global events, saw online retail sales in the US reach an estimated $1.1 trillion in 2024, a notable increase from previous years.

Carvana's business model is built precisely on this evolving preference. Their end-to-end online platform allows customers to complete the entire car buying process—from browsing inventory and securing financing to arranging home delivery—all from their digital devices, aligning perfectly with the demand for seamless, at-home transactions.

Demographic shifts are significantly reshaping how people think about car ownership. For instance, the growing preference for urban living among younger generations, like Millennials and Gen Z, has led some to question the necessity of personal vehicle ownership, favoring ride-sharing services. However, data from 2023 indicates that despite urban trends, the overall demand for personal transportation remains robust. Carvana's online-first, home-delivery model directly addresses the convenience factor that appeals across a wide age spectrum, including these younger demographics who are accustomed to digital transactions.

Carvana’s success hinges on building consumer trust for significant online purchases. Their commitment to detailed vehicle descriptions, thorough reconditioning processes, and straightforward return policies directly tackles the inherent skepticism of buying a car without a physical inspection. This focus on transparency is vital, especially as online used car sales continue to grow, with industry reports in late 2024 indicating a steady increase in consumer comfort with digital automotive retail.

Increasing Environmental Consciousness

Consumers are increasingly concerned about their environmental impact, which is shifting demand towards vehicles that are kinder to the planet, like electric and more fuel-efficient cars. This trend directly affects the automotive market, influencing purchasing decisions and manufacturer strategies.

Carvana has actively adapted to this growing environmental consciousness. The company has expanded its selection of electric vehicles (EVs) and hybrid models within its online inventory. Furthermore, Carvana is simplifying the process for customers to claim federal tax credits available for qualifying EV purchases, making greener transportation more accessible and appealing.

- Growing EV Market Share: In 2023, electric vehicle sales in the U.S. surpassed 1.2 million units, representing over 7.6% of the total new vehicle market, a significant jump from previous years.

- Consumer Preference Shift: Surveys consistently show a rising percentage of consumers considering EVs for their next vehicle purchase, driven by environmental concerns and lower running costs.

- Carvana's EV Inventory Growth: Carvana reported a notable increase in its EV and hybrid inventory throughout 2023 and early 2024, aiming to meet this escalating demand.

Influence of Social Media and Reviews

Social media and online reviews are powerful forces shaping Carvana's public image and ability to attract new customers. Positive endorsements and shared experiences can significantly boost brand loyalty and drive sales, acting as a potent form of organic marketing.

Conversely, negative feedback, especially regarding persistent issues like title processing delays, can rapidly gain traction online, eroding consumer trust and potentially deterring prospective buyers. For instance, in early 2024, discussions around delivery timelines and vehicle condition continued to be prominent on platforms like Reddit and X (formerly Twitter), directly influencing sentiment.

- Brand Perception: Online sentiment analysis of Carvana's social media mentions in Q1 2024 indicated a mixed reception, with approximately 65% positive or neutral sentiment, but a notable 35% negative, often tied to operational concerns.

- Customer Acquisition: A significant portion of Carvana's customer base reports discovering the company through social media recommendations or online reviews, highlighting the direct link between digital presence and growth.

- Reputation Management: The speed at which negative reviews can spread on platforms like Trustpilot and the Better Business Bureau necessitates proactive reputation management strategies to address customer concerns promptly and publicly.

The increasing comfort with online transactions, even for major purchases like vehicles, is a significant sociological driver for Carvana. This trend, accelerated by digital adoption, saw US online retail sales approach $1.1 trillion in 2024, underscoring a fundamental shift in consumer behavior towards digital channels for convenience and accessibility.

Demographic shifts, particularly among younger generations like Gen Z and Millennials, are influencing car ownership models. While urban living might favor ride-sharing, the demand for personal transportation remains strong, and Carvana's digital-first, home-delivery approach appeals to these demographics' preference for seamless, technology-driven experiences.

Consumer concerns about environmental impact are also shaping purchasing decisions, with a growing interest in electric and fuel-efficient vehicles. Carvana has responded by expanding its EV and hybrid inventory and facilitating access to federal tax credits for these greener options, aligning with evolving societal values.

Social media and online reviews wield considerable influence on Carvana's brand perception and customer acquisition. While positive feedback drives growth, negative reviews, especially concerning operational issues like title processing, can quickly damage trust, as evidenced by ongoing discussions in early 2024 on platforms like Reddit and X.

| Sociological Factor | Description | Impact on Carvana | Supporting Data (2023-2024) |

|---|---|---|---|

| Online Purchasing Comfort | Increased consumer willingness to buy high-value items online. | Directly supports Carvana's core business model. | US online retail sales estimated at $1.1 trillion in 2024. |

| Demographic Shifts | Changing preferences in transportation and ownership, especially among younger generations. | Appeals to digital-native consumers seeking convenience. | Robust demand for personal transport persists despite urban trends. |

| Environmental Consciousness | Growing preference for sustainable and fuel-efficient vehicles. | Drives demand for Carvana's expanding EV/hybrid inventory. | EV sales surpassed 1.2 million units in the U.S. in 2023 (7.6% market share). |

| Social Media Influence | The power of online reviews and social sentiment in shaping brand perception. | Affects customer acquisition and requires active reputation management. | Q1 2024 sentiment analysis showed ~35% negative mentions, often tied to operational concerns. |

Technological factors

Carvana's e-commerce platform is central to its operations, facilitating everything from car browsing and financing to the final purchase. Continuous upgrades to its user interface and mobile capabilities are crucial for staying ahead in the competitive online car market.

In 2024, Carvana continued to invest in its digital infrastructure, aiming to enhance customer experience through AI-driven personalization and streamlined transaction processes. These technological advancements are designed to make buying a car as simple as possible for consumers.

Carvana's strategic advantage is significantly bolstered by its application of AI and data analytics. These technologies are crucial for optimizing inventory management, ensuring they have the right cars at the right time, and for dynamic vehicle pricing, allowing them to stay competitive. In 2023, Carvana reported a substantial improvement in its cost of sales per unit, partly attributed to these efficiencies, demonstrating the tangible impact of their data-driven operations.

Technological advancements in logistics are transforming Carvana's operations. By leveraging sophisticated route optimization software, Carvana can significantly cut down on delivery times and fuel costs, directly impacting its bottom line. For instance, in 2023, the company continued to refine its logistics network, aiming to reduce per-unit delivery expenses.

The efficiency gains from these technologies extend to Carvana's vehicle reconditioning processes. Advanced diagnostic tools and streamlined workflows in their reconditioning centers reduce the time vehicles spend in preparation, allowing them to reach customers faster. This technological integration is key to maintaining Carvana's competitive edge in a rapidly evolving market.

Furthermore, the expansion of Carvana's 'megasites' is a testament to their commitment to technological integration in physical infrastructure. These sites utilize advanced inventory management systems and automated processes to handle larger volumes of vehicles, further enhancing operational efficiency and customer delivery speed.

Vehicle Inspection and Reconditioning Technology

Carvana's commitment to technological advancement is evident in its investment in proprietary systems like CARLI (Carvana Automotive Reconditioning and Logistics Interface). This technology is designed to create a more efficient and standardized process for inspecting and reconditioning vehicles. By leveraging AI and advanced analytics, CARLI aims to identify potential issues with greater accuracy and speed, ultimately contributing to higher quality standards for the vehicles Carvana sells.

The operational benefits of CARLI are significant. For instance, by streamlining the inspection and reconditioning workflow, Carvana can reduce the time a vehicle spends in its reconditioning facilities. This reduction in turnaround time directly impacts operational costs by improving throughput and asset utilization. In 2023, Carvana continued to refine its reconditioning processes, with a focus on enhancing the customer experience through improved vehicle readiness and availability.

- Proprietary Technology: Carvana utilizes CARLI for vehicle inspection and reconditioning.

- Efficiency Gains: CARLI aims to reduce operational costs and improve vehicle turnaround times.

- Quality Assurance: The technology enhances the standardization and quality of reconditioned vehicles.

- Customer Value: Improved processes bolster Carvana's value proposition for used car buyers.

Integration of Emerging Vehicle Technologies (EVs, Autonomous)

The accelerating adoption of electric vehicles (EVs) and the ongoing development of autonomous driving technologies present both opportunities and challenges for Carvana. As more consumers shift towards EVs, Carvana must adapt its inventory sourcing to include a wider range of electric models, potentially requiring new relationships with EV manufacturers and fleet operators. Furthermore, the unique reconditioning and inspection requirements for EVs and autonomous vehicles necessitate investments in specialized equipment and technician training to ensure quality and safety.

By 2024, projections indicate a significant increase in EV market share globally, with some estimates suggesting EVs could represent over 20% of new car sales in major markets. This trend directly impacts Carvana's ability to source and sell these vehicles effectively. The company's platform and operational processes need to be agile enough to accommodate the growing demand for and the specific needs of these advanced vehicles to maintain its competitive edge and ensure long-term growth.

- EV Market Growth: Global EV sales are projected to continue their upward trajectory, creating a larger pool of used EVs for Carvana to source.

- Reconditioning Complexity: Advanced vehicle technologies require specialized knowledge and equipment for effective reconditioning, potentially increasing operational costs.

- Platform Adaptation: Carvana's online platform must evolve to effectively showcase and market the features and benefits of EVs and autonomous vehicles.

- Consumer Demand Shift: Catering to the growing consumer interest in sustainable and technologically advanced vehicles is crucial for future market relevance.

Carvana's technological backbone is its e-commerce platform, continuously enhanced for user experience and mobile accessibility. In 2024, investments focused on AI for personalization and streamlined transactions, aiming to simplify car buying.

AI and data analytics are key to Carvana's efficiency, optimizing inventory and pricing. This focus contributed to improved cost of sales per unit in 2023, demonstrating tangible operational benefits.

Logistics technology, including route optimization, cuts delivery times and costs, with ongoing network refinements in 2023 to reduce per-unit expenses.

Advanced diagnostics and workflows in reconditioning centers speed up vehicle preparation, ensuring faster delivery and maintaining a competitive edge.

The integration of proprietary technology like CARLI streamlines vehicle inspection and reconditioning, reducing turnaround times and enhancing quality assurance.

The growing EV market presents an opportunity, requiring Carvana to adapt its sourcing and reconditioning processes for electric and autonomous vehicles, a trend projected to see significant global market share gains by 2024.

| Technology Area | Key Application | Impact/Benefit |

|---|---|---|

| E-commerce Platform | User Interface, Mobile Capabilities, AI Personalization | Enhanced customer experience, streamlined transactions |

| Data Analytics & AI | Inventory Management, Dynamic Pricing | Improved efficiency, cost optimization (e.g., cost of sales per unit in 2023) |

| Logistics | Route Optimization Software | Reduced delivery times and fuel costs |

| Reconditioning | Advanced Diagnostics, CARLI System | Faster vehicle preparation, improved quality and throughput |

| Emerging Technologies | EVs, Autonomous Driving | Adaptation required for sourcing, reconditioning, and platform features |

Legal factors

Carvana operates under a complex web of consumer protection laws at both the state and federal levels, impacting everything from how vehicles are advertised to how customer service is handled. These regulations are designed to ensure fair practices in the automotive sales industry. For instance, the Federal Trade Commission's Used Car Rule mandates that dealers prominently display a Buyers Guide on used vehicles, detailing warranty information and key vehicle condition points.

Compliance with these rules, especially regarding the accuracy of vehicle condition descriptions and transparency in sales processes, is paramount for Carvana. Failure to adhere can lead to significant legal challenges, regulatory fines, and damage to consumer trust. In 2023, the Consumer Financial Protection Bureau (CFPB) reported a notable increase in complaints related to auto loan servicing and sales practices, underscoring the heightened scrutiny on companies in this sector.

Carvana's operations across numerous states mean navigating a patchwork of dealership licensing and vehicle titling regulations. These laws differ significantly from one jurisdiction to another, creating compliance challenges. For instance, in 2023, Carvana faced scrutiny and faced settlements related to title and registration delays in several states, underscoring the critical need for meticulous adherence to each state's specific legal framework.

Carvana, as an online retailer, operates under a complex web of data privacy and security regulations. Compliance with laws like the California Consumer Privacy Act (CCPA) and its upcoming amendments, alongside similar state-level legislation enacted through 2024 and anticipated in 2025, is paramount. Failure to adequately protect customer data can lead to significant fines; for instance, under CCPA, statutory damages for data breaches can range from $100 to $750 per incident, or actual damages, whichever is greater. This necessitates robust cybersecurity measures and transparent data handling practices.

Advertising and Marketing Standards

Carvana must adhere to stringent advertising and marketing standards, governed by federal and state laws that strictly prohibit deceptive or misleading claims. This means their representations of vehicle condition, pricing, and financing terms must be completely accurate to steer clear of regulatory penalties and customer dissatisfaction. For instance, the Federal Trade Commission (FTC) actively monitors advertising for compliance. In 2024, the FTC continued its focus on truth in advertising, particularly in sectors with high consumer interaction like automotive sales.

Failure to maintain transparency can lead to significant repercussions. In 2023, several companies faced FTC enforcement actions for unsubstantiated claims, resulting in substantial fines and mandated changes to their marketing practices. Carvana's commitment to accurate disclosures is therefore not just good business, but a legal necessity. They must ensure all promotional materials clearly and truthfully reflect the actual state of their vehicles and the financial obligations involved in purchasing them.

Key areas of scrutiny for Carvana include:

- Accurate Vehicle Descriptions: Ensuring all advertised features, mileage, and any reported damage or reconditioning are precisely stated.

- Transparent Pricing: Clearly outlining all costs, including taxes, fees, and any potential additional charges, without hidden elements.

- Honest Financing Terms: Presenting interest rates, loan terms, and payment schedules in a straightforward manner, avoiding bait-and-switch tactics.

- Compliance with Consumer Protection Laws: Staying updated on regulations like the Truth in Lending Act (TILA) and state-specific consumer protection statutes.

Warranty and Return Policy Requirements

Laws dictating vehicle warranties and return policies for used car sales differ significantly by state, directly influencing Carvana's customer satisfaction and operational expenses. For instance, "lemon laws" in states like California offer robust consumer protections, potentially increasing return rates and associated costs for a company like Carvana. Adhering to these diverse legal landscapes is crucial for managing customer expectations and minimizing legal liabilities.

Carvana's commitment to transparency and compliance with these varying state regulations is paramount. In 2024, understanding and implementing state-specific return policies, such as the 7-day return window common in many jurisdictions, directly impacts their ability to manage inventory and customer relationships effectively. Failure to comply can lead to penalties and damage brand reputation.

- State-Specific Regulations: Laws vary on the length of implied warranties and mandatory return periods for used vehicles.

- Consumer Protection Laws: "Lemon laws" and disclosure requirements protect buyers, impacting Carvana's return and warranty claim processes.

- Operational Costs: Compliance with diverse state return policies can increase logistical and administrative overhead for Carvana.

- Customer Trust: Clear and fair warranty and return policies are essential for building and maintaining customer confidence in the online car buying model.

Carvana navigates a complex legal environment, facing stringent consumer protection laws that govern advertising, sales, and financing. Adherence to regulations like the Federal Trade Commission's Used Car Rule and the Truth in Lending Act is critical for maintaining consumer trust and avoiding penalties. In 2023, the Consumer Financial Protection Bureau highlighted increased complaints in auto lending, signaling heightened regulatory focus on the sector.

State-specific licensing and titling laws present significant compliance challenges, as demonstrated by Carvana's settlements in 2023 related to title and registration delays in multiple states. Furthermore, data privacy laws such as the California Consumer Privacy Act (CCPA) require robust cybersecurity measures, with potential statutory damages for breaches reaching up to $750 per incident as of 2024.

The company must also contend with varying state "lemon laws" and return policies, impacting operational costs and customer satisfaction. For instance, California's consumer protections can influence return rates. By 2024, compliance with diverse state return policies, often including a 7-day window, directly affects Carvana's inventory management and customer relations.

| Legal Factor | Impact on Carvana | 2023-2025 Data/Trends |

|---|---|---|

| Consumer Protection Laws | Ensures fair advertising, sales, and financing practices; avoids fines and reputational damage. | CFPB reported increased auto loan complaints in 2023; FTC continues focus on truth in advertising. |

| State Licensing & Titling | Requires adherence to diverse state-specific regulations for vehicle registration and ownership transfer. | Carvana faced settlements in 2023 for title/registration delays in several states. |

| Data Privacy & Security | Mandates protection of customer data under laws like CCPA; potential for significant fines in case of breaches. | CCPA statutory damages up to $750 per incident; ongoing evolution of state privacy laws through 2024-2025. |

| Warranties & Return Policies | Governs vehicle condition disclosures, warranty offerings, and customer return rights, varying by state. | State "lemon laws" and common 7-day return windows impact operational costs and customer trust. |

Environmental factors

Stricter vehicle emissions standards, like those being phased in by the EPA for model year 2027, directly impact the desirability and marketability of used cars. Carvana must ensure its inventory includes a growing proportion of vehicles compliant with these evolving regulations, such as those meeting California's Advanced Clean Cars II standards, which many other states are adopting.

This means Carvana's sourcing and remarketing strategies need to favor newer, lower-emission vehicles, potentially impacting the availability and pricing of older models. For instance, as more stringent fuel economy and emissions targets are introduced, the resale value of less efficient vehicles may decline, requiring Carvana to adjust its valuation models accordingly.

Carvana's vast logistics network and reconditioning centers naturally carry an environmental footprint. As of early 2024, the company continues to navigate the increasing scrutiny on corporate environmental impact.

Implementing more sustainable practices in vehicle transportation, like optimizing delivery routes and exploring lower-emission vehicle options, is crucial. Furthermore, reducing energy consumption at its facilities and improving waste management are key areas where Carvana can enhance its environmental stewardship.

These efforts not only address growing environmental concerns but also offer a significant opportunity to bolster brand image and appeal to an increasingly eco-conscious consumer base. For instance, many competitors in the automotive retail space are actively reporting on their Scope 1, 2, and 3 emissions, setting targets for reduction, and investing in renewable energy sources for their operations.

The surge in electric vehicle (EV) adoption is a significant environmental factor impacting Carvana. As of early 2024, EV sales continue to climb, with projections indicating a substantial portion of new vehicle sales will be electric by 2030. This trend means Carvana will see a growing number of used EVs entering its inventory.

Adapting to this shift requires investment in specialized inspection and reconditioning processes for EVs, including battery health assessments. Furthermore, developing the necessary charging infrastructure at its facilities is crucial to efficiently handle and prepare these vehicles for sale, potentially contributing to a greener used car market.

Waste Management and Recycling Practices

Carvana's used vehicle reconditioning process inherently produces waste, such as discarded parts and automotive fluids. Effectively managing and recycling these materials is crucial for adhering to environmental regulations and showcasing a commitment to sustainability. For instance, in 2023, the automotive industry globally saw a significant increase in recycling rates for end-of-life vehicles, with many regions aiming for over 95% material recovery.

Carvana's approach to waste management directly impacts its operational costs and brand reputation. Implementing robust recycling programs can reduce disposal fees and potentially generate revenue from salvaged materials.

- Environmental Compliance: Adhering to local and national waste disposal laws is paramount.

- Resource Recovery: Recycling old parts and fluids can reduce the need for new raw materials.

- Corporate Social Responsibility: Demonstrating strong environmental stewardship enhances brand image.

- Operational Efficiency: Optimized waste management can lead to cost savings.

Carbon Footprint of Delivery and Vending Machines

Carvana's environmental impact is significantly influenced by its delivery model and the energy demands of its car vending machines. Optimizing delivery routes is crucial for reducing fuel consumption, a key component of its carbon footprint. For instance, by consolidating deliveries and utilizing more fuel-efficient vehicles, Carvana can make strides in this area. The energy required to power its large, automated vending machines also presents an environmental consideration.

Exploring renewable energy sources for its facilities, such as solar panels on its vending machine locations, is a viable strategy to mitigate this impact. While specific 2024 or 2025 data on Carvana's direct emissions from deliveries and vending machines isn't publicly detailed, the broader automotive logistics sector is increasingly focused on sustainability. Industry trends show a growing investment in electric vehicle fleets for deliveries and energy-efficient building designs.

Key considerations include:

- Fuel Consumption: The environmental cost associated with transporting vehicles to customers and between hubs.

- Energy Use: The electricity demand of the automated vending machines, including lighting, climate control, and mechanical systems.

- Route Optimization: Implementing advanced logistics software to minimize mileage and reduce emissions from delivery trucks.

- Renewable Energy Integration: Assessing the feasibility of powering facilities with solar or other green energy sources.

Stricter emissions standards, like those impacting model year 2027 vehicles, necessitate Carvana's inventory alignment with regulations such as California's Advanced Clean Cars II. This trend favors newer, lower-emission vehicles, potentially affecting the availability and pricing of older models, requiring adjustments to valuation models.

The increasing adoption of electric vehicles (EVs) means Carvana must invest in specialized EV inspection, reconditioning, and charging infrastructure. As of early 2024, EV sales continue to rise, projecting a significant market share by 2030.

Carvana's operations, including logistics and reconditioning, have an environmental footprint. The company is navigating increased scrutiny on corporate environmental impact, focusing on optimizing delivery routes and reducing energy consumption at its facilities to enhance sustainability and brand image.

Waste management in reconditioning is critical; effective recycling can reduce disposal fees and improve brand reputation, aligning with the automotive industry's global push for higher material recovery rates, aiming for over 95% in many regions as of 2023.

PESTLE Analysis Data Sources

Our Carvana PESTLE Analysis is informed by a comprehensive review of industry-specific market research, automotive sector reports, and government regulatory updates. We also incorporate economic data from reputable financial institutions and technological trend analyses.