Carrefour Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Carrefour Bundle

Carrefour's marketing brilliance lies in its expertly balanced 4Ps. From its diverse product offerings catering to every need to its strategic pricing that attracts a broad customer base, Carrefour truly understands its market. Discover how their extensive distribution network and impactful promotional campaigns create a seamless customer journey.

Ready to unlock the secrets behind Carrefour's retail dominance? Get the complete, in-depth 4Ps Marketing Mix Analysis, packed with actionable insights and real-world examples. Elevate your own marketing strategy by learning from one of the best.

Product

Carrefour's diverse portfolio is a cornerstone of its strategy, offering a vast selection of both food and non-food items. This broad range, from fresh groceries and packaged goods to electronics and apparel, positions Carrefour as a comprehensive destination for everyday needs.

In 2023, Carrefour continued to refine its product assortment. For instance, its private label penetration reached 33.6% in France, demonstrating a commitment to offering value and quality across its diverse categories.

The company actively manages this extensive product mix, adapting to shifts in consumer behavior. This includes a growing focus on organic and local products, reflecting a response to increasing demand for healthier and more sustainable options among its shoppers.

Carrefour places a strong emphasis on its private label brands, a core element of its product strategy. These brands are designed to deliver good quality at more attractive prices compared to national brands, directly appealing to shoppers seeking value. This focus is a significant differentiator in a competitive retail landscape.

The company views its private labels as a crucial engine for growth. Carrefour has set an ambitious target to achieve a 40% share of its food sales from own-brand products by 2026. This strategic push aims to bolster profitability and customer loyalty by offering exclusive, value-driven options.

Carrefour's commitment to a 'food transition for all' is a cornerstone of its marketing strategy, focusing on healthier, local, and sustainable offerings. This is evident in their 'Act For Food' program, which drives improvements in nutritional quality, product origin, seasonality, and overall sustainability. For instance, in 2023, Carrefour continued its efforts to reduce sugar, saturated fats, and salt in its private label products, a key element of promoting healthier eating.

The company actively champions organic and plant-based foods, exceeding sales targets in these growing segments. By the end of 2023, Carrefour reported a significant increase in sales for its organic product lines, demonstrating strong consumer adoption of these more sustainable choices. This focus aligns with broader market trends and consumer demand for environmentally conscious and health-promoting food options.

Financial and Complementary Services

Carrefour extends its value proposition beyond groceries by offering a suite of financial and complementary services. These include consumer credit options, various insurance products, and robust loyalty programs designed to deepen customer relationships and encourage repeat business. For instance, Carrefour's loyalty program, often integrated with payment solutions, aims to capture a larger share of customer spending.

These financial services act as a significant revenue enhancer and a powerful tool for customer retention. By providing convenient credit and insurance, Carrefour makes its core retail offerings more accessible and appealing, fostering a stickier customer base. This strategy directly supports the Product element of the marketing mix by adding tangible value beyond the physical goods sold.

Furthermore, Carrefour diversifies its service portfolio with offerings like photo printing and ticket booking. These services capitalize on existing customer traffic and brand trust, creating additional touchpoints and revenue streams. For example, in 2023, Carrefour continued to invest in its digital platforms, which often host these ancillary services, aiming to capture a larger share of the growing digital services market.

- Loyalty Programs: Carrefour's loyalty schemes, such as the Carrefour loyalty card, are central to driving repeat purchases and collecting valuable customer data for personalized offers.

- Financial Services: The company provides consumer credit and insurance solutions, often through partnerships, to facilitate purchases and offer peace of mind to its customers.

- Ancillary Services: Photo printing and ticket booking are examples of complementary services that leverage Carrefour's physical store footprint and customer loyalty to generate additional revenue.

- Digital Integration: Many of these services are increasingly integrated into Carrefour's digital ecosystem, enhancing convenience and accessibility for online and app users.

Omnichannel Experience

Carrefour is deeply committed to providing a cohesive omnichannel experience, seamlessly blending its extensive network of physical stores with a sophisticated e-commerce presence. This integration ensures customers can access Carrefour’s vast product assortment whether they are browsing online or visiting a brick-and-mortar location, offering unparalleled flexibility in how and when they shop.

The company's strategic focus on digital transformation underpins this omnichannel push. Significant investments are being channeled into enhancing the digital infrastructure to create a truly frictionless customer journey. This includes improving website functionality, mobile app capabilities, and the integration of in-store and online inventory management systems.

This strategy is yielding tangible results, with Carrefour reporting continued growth in its digital channels. For instance, in the first half of 2024, Carrefour’s online sales saw a notable increase, demonstrating the effectiveness of its omnichannel approach in meeting evolving consumer demands. The company aims to further solidify its position as a leader in integrated retail by continuously refining its digital offerings and in-store experiences.

- Seamless Integration: Carrefour’s strategy connects physical stores with online platforms for unified shopping.

- Digital Investment: Significant capital is allocated to digital transformation for an enhanced customer journey.

- Customer Flexibility: Shoppers can buy anytime, anywhere, with integrated online and in-store availability.

- Growth in Digital Channels: First-half 2024 results show strong performance in e-commerce sales, validating the omnichannel model.

Carrefour's product strategy centers on a vast, diverse assortment, encompassing both essential groceries and a wide array of non-food items. This comprehensive offering aims to satisfy a broad spectrum of consumer needs. The company's commitment to its private label brands is a key differentiator, with a strategic goal to increase their share of food sales significantly.

Carrefour actively promotes healthier, more sustainable options, aligning with evolving consumer preferences. Their 'Act For Food' program underscores this, focusing on nutritional improvements and product origin. This strategic product development is crucial for maintaining competitiveness and customer loyalty in the dynamic retail sector.

| Product Category | Key Initiatives/Data Points | Impact/Target |

|---|---|---|

| Private Labels | 33.6% penetration in France (2023). Target: 40% of food sales by 2026. | Enhance profitability and customer loyalty with value-driven options. |

| Health & Sustainability | Focus on organic and plant-based foods. Reduction of sugar, salt, and saturated fats in private labels (2023). | Meet growing consumer demand for healthier and eco-conscious products. |

| Assortment Breadth | Offers fresh groceries, packaged goods, electronics, apparel, and more. | Positioned as a one-stop shop for diverse consumer needs. |

What is included in the product

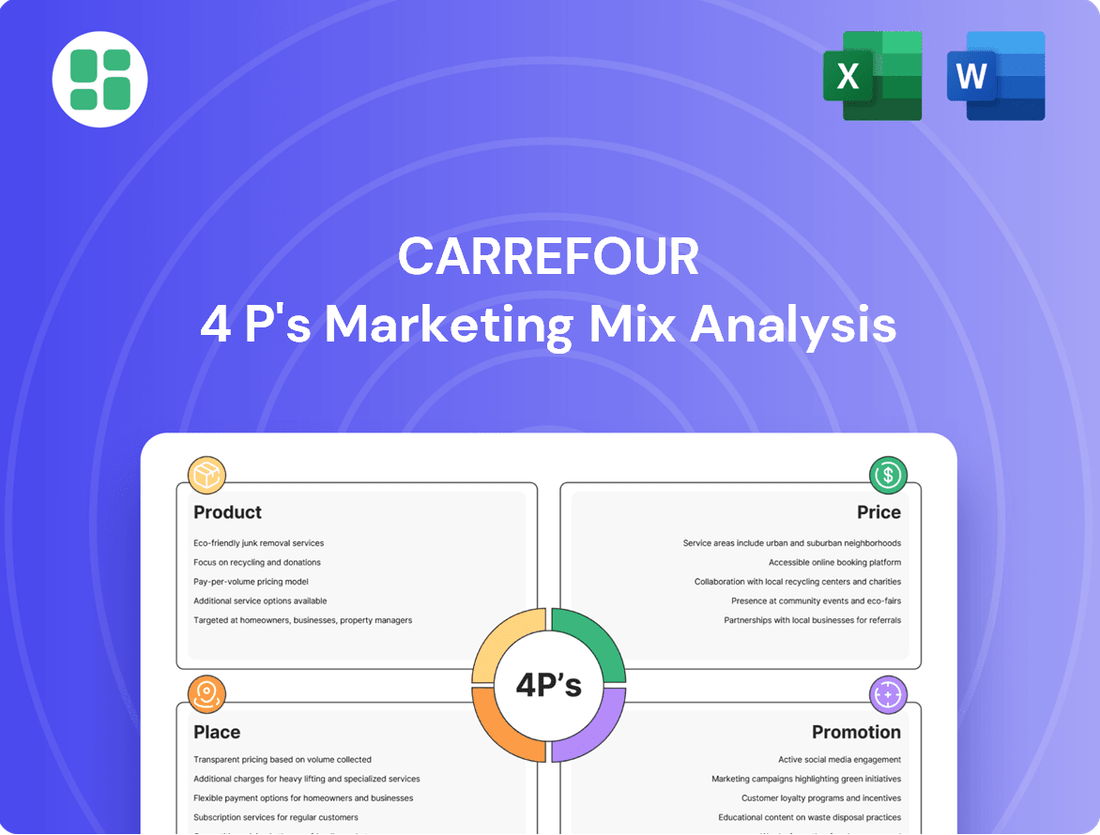

This analysis offers a comprehensive examination of Carrefour's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Carrefour's market positioning, providing a solid foundation for competitive benchmarking and strategic planning.

Simplifies complex Carrefour 4Ps analysis into actionable insights, relieving the pain of information overload for busy decision-makers.

Provides a clear, concise overview of Carrefour's marketing strategy, easing the burden of understanding their competitive positioning.

Place

Carrefour's extensive multiformat store network is a cornerstone of its strategy, encompassing hypermarkets, supermarkets, convenience stores, and cash-and-carry formats. This diverse physical presence allows Carrefour to effectively reach a broad customer base across various geographies and shopping preferences. For instance, in 2023, Carrefour continued to leverage its hypermarket strength while also focusing on the expansion of its more agile formats.

This multi-format approach is crucial for maximizing market penetration and adapting to evolving consumer behaviors. By offering different store sizes and service levels, Carrefour can better serve both suburban families seeking one-stop shopping and urban dwellers needing quick purchases. The company's commitment to this strategy is evident in its ongoing store openings, with a particular emphasis on convenience formats and its Brazilian discounter, Atacadão.

As of the first half of 2024, Carrefour reported a significant number of store openings, with a strong focus on convenience and hard discount formats, demonstrating a clear direction in optimizing its store network. This expansion aims to capture market share in diverse segments, reinforcing its position as a leading global retailer by offering accessibility and tailored shopping experiences.

Carrefour boasts a robust global footprint, operating in over 30 countries and holding leading positions in key markets such as France, Spain, and Brazil. This extensive reach allows for significant economies of scale and diverse revenue streams. In 2023, Carrefour reported approximately 13,500 stores worldwide, underscoring its substantial physical presence.

The company emphasizes local adaptation, with stores tailoring their offerings to regional consumer preferences and supporting local suppliers. This approach, evident in their strong performance in diverse geographies, helps build customer loyalty and a competitive edge. For instance, Carrefour's commitment to local sourcing is a significant driver of its product assortment in markets like France.

Carrefour is aggressively expanding its e-commerce and digital presence, a key element of its marketing mix. The company has set ambitious goals, targeting a substantial increase in its e-commerce Gross Merchandise Volume (GMV) by 2026, demonstrating a clear commitment to online growth. This strategic push involves enhancing user experience through intuitive websites and mobile applications, offering convenient services like home delivery and click-and-collect options.

The retailer's vision is to become a seamless omnichannel operator, effectively bridging its physical stores with its digital platforms. This integration aims to provide customers with unparalleled convenience and broader accessibility, ensuring Carrefour is available wherever and however they choose to shop. For instance, in 2023, Carrefour reported a significant acceleration in its digital sales, with its e-commerce GMV growing by over 20% year-on-year, underscoring the success of these investments.

Efficient Supply Chain and Logistics

Carrefour places a strong emphasis on an efficient supply chain to guarantee product availability and minimize waste. This commitment is evident in their strategic use of technology to streamline operations from sourcing to the customer. Their focus on optimized logistics directly impacts their ability to offer competitive prices and a diverse product selection.

Leveraging artificial intelligence (AI) is a key component of Carrefour's logistics strategy. They are employing AI to enhance demand forecasting, optimize supplier orders, and improve inventory management across their extensive network of physical stores, distribution centers, and online platforms. For instance, in 2024, Carrefour reported a significant reduction in stockouts for key product categories due to these AI-driven inventory improvements.

- AI-powered demand prediction helps anticipate customer needs, reducing overstocking and waste.

- Optimized inventory management across all channels ensures products are available where and when customers want them.

- Streamlined logistics contribute to cost savings, enabling competitive pricing strategies.

- Reduced waste through better inventory control aligns with sustainability goals and improves profitability.

Strategic Partnerships for Distribution

Carrefour actively cultivates strategic partnerships to broaden its distribution network and amplify market penetration. These collaborations are crucial for expanding its reach, particularly in the rapidly growing quick commerce sector.

Notable alliances include those with Uber Eats and Bringo, which significantly bolster Carrefour's capabilities in express delivery and home delivery services, underscoring its commitment to convenience and market leadership in this area. By leveraging these platforms, Carrefour ensures faster fulfillment and wider accessibility for its customers.

These strategic alliances also serve a dual purpose: they provide a stronger negotiating stance against supplier pricing power and fortify Carrefour's overall market position. This proactive approach to partnerships allows Carrefour to adapt to evolving consumer demands and competitive pressures.

For instance, Carrefour's partnership with Uber Eats in France saw an expansion of delivery zones and product availability in 2024, aiming to capture a larger share of the on-demand grocery market. Similarly, Bringo, a subsidiary of Carrefour, continued its expansion across various European markets in early 2025, focusing on hyper-local delivery solutions.

- Distribution Enhancement: Partnerships with platforms like Uber Eats and Bringo expand Carrefour's delivery reach and speed.

- Quick Commerce Focus: These alliances are vital for strengthening its presence in the fast-growing quick commerce segment.

- Market Power: Collaborations help counterbalance supplier pricing power and solidify Carrefour's competitive standing.

- Customer Convenience: The focus remains on improving customer access and satisfaction through efficient, on-demand services.

Carrefour's "Place" strategy centers on its extensive and diversified physical store network, coupled with a rapidly expanding digital presence. This omnichannel approach ensures accessibility and caters to varied consumer shopping habits across more than 30 countries where it operates. By optimizing its store formats, from large hypermarkets to smaller convenience stores, Carrefour aims for broad market penetration and customer convenience.

The company's commitment to an integrated online and offline experience is evident in its ongoing investments in e-commerce capabilities and strategic partnerships for faster delivery. This multi-channel strategy is designed to meet evolving customer demands for seamless shopping journeys.

As of early 2025, Carrefour continues to refine its store portfolio, with a notable emphasis on convenience and hard discount formats, reflecting a strategic shift to capture market share in diverse segments. This dynamic approach to "Place" ensures Carrefour remains a dominant player in the global retail landscape.

| Aspect | Description | 2023/2024/2025 Data |

|---|---|---|

| Store Formats | Multiformat presence (hypermarkets, supermarkets, convenience, cash-and-carry) | Approx. 13,500 stores worldwide (2023); continued expansion of convenience and hard discount formats (2024/2025) |

| Geographic Reach | Operations in over 30 countries | Leading positions in France, Spain, Brazil; focus on local adaptation |

| Digital Presence | E-commerce and omnichannel development | Targeting significant GMV increase by 2026; over 20% year-on-year e-commerce GMV growth (2023) |

| Strategic Partnerships | Collaborations for delivery and market expansion | Partnerships with Uber Eats and Bringo; expansion of delivery zones (2024/2025) |

Same Document Delivered

Carrefour 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Carrefour 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

Carrefour leverages integrated advertising campaigns across TV, online video, and digital channels to create a cohesive brand message. This multi-channel approach ensures broad reach and consistent communication of its value proposition to a diverse customer base.

The 'Act For Food' relaunch exemplifies this strategy, focusing on taste, price, and sustainability. This campaign, deployed internationally in key markets like France and Spain, aims to build emotional connections and highlight Carrefour's corporate responsibility initiatives, reinforcing brand loyalty.

In 2024, Carrefour's marketing investments are expected to reflect this integrated approach. For instance, digital ad spending across Europe, a significant market for Carrefour, saw a notable increase in 2023, projected to continue growing in 2024, supporting these comprehensive campaigns.

Carrefour frequently leverages sales and discounts as a core element of its marketing strategy, aiming to attract a broad customer base. In 2024, the company continued its practice of offering significant price reductions on a wide array of goods, both in its hypermarkets and online. These promotions are designed to stimulate immediate sales and increase overall transaction volume.

Carrefour's loyalty program, the Carrefour Club Card, is a cornerstone of its customer retention strategy. By offering exclusive benefits and discounts, the program actively encourages repeat business and deepens customer engagement. As of early 2024, Carrefour reported a significant portion of its sales were driven by loyalty program members, highlighting its effectiveness.

Further enhancing customer relationships, Carrefour is increasingly employing data analytics and artificial intelligence. This allows for hyper-personalized recommendations and targeted offers, tailored to individual purchasing habits. For instance, in 2024, personalized promotions through the app led to a measurable increase in basket size for targeted customer segments.

Digital Marketing and Retail Media

Carrefour is making a significant push into digital marketing, dedicating a larger share of its advertising spend to online platforms. This strategic shift is designed to boost its online presence and reach customers where they are increasingly spending their time. By focusing on digital channels, Carrefour aims to create more dynamic and personalized customer interactions.

The company is also positioning itself as a leader in retail media, a growing sector that leverages customer data for targeted advertising. Through initiatives like Carrefour Links and collaborations with ad tech companies, Carrefour seeks to monetize its vast customer data. This allows for highly specific promotions and improved customer engagement across digital touchpoints.

- Digital Investment: Carrefour is channeling a substantial portion of its marketing budget into digital channels to enhance online visibility and engagement.

- Retail Media Leadership: The company is actively developing its retail media capabilities, aiming to monetize customer data through platforms like Carrefour Links.

- Targeted Promotions: By leveraging digital marketing and retail media, Carrefour can deliver more precise and effective promotions to its customer base.

- Customer Engagement: These digital strategies are key to fostering deeper connections and improving the overall customer experience online.

Public Relations and Sustainability Communication

Carrefour leverages public relations to highlight its dedication to sustainability and corporate social responsibility, a key element of its marketing mix. The company's 'Act For Food' program and comprehensive climate plan are central to this communication strategy, showcasing tangible actions taken to lessen environmental impact and ensure ethical sourcing practices.

These efforts are designed to cultivate a positive brand image and resonate with an increasingly conscious consumer base. For instance, Carrefour's commitment to reducing food waste saw a 13% decrease in food waste in its French stores between 2019 and 2022, a fact often communicated through PR channels.

Carrefour's sustainability communications focus on several key areas:

- Environmental Impact Reduction: Initiatives like reducing plastic packaging and investing in renewable energy sources are regularly featured. Carrefour aims to have 100% of its private label packaging be recyclable, reusable, or compostable by 2025.

- Ethical Sourcing: The company emphasizes fair trade practices and partnerships with local producers, strengthening community ties and ensuring product integrity.

- Social Responsibility: Programs supporting local economies and employee well-being are communicated to demonstrate a holistic approach to corporate citizenship.

Carrefour's promotional strategy is multifaceted, encompassing aggressive sales, a robust loyalty program, and increasingly personalized digital offers. These tactics are designed to drive immediate sales, foster repeat business, and build deeper customer relationships through data-driven insights.

The company's digital marketing and retail media initiatives, including platforms like Carrefour Links, are central to its promotional efforts in 2024. This focus allows for highly targeted promotions, enhancing customer engagement and the overall effectiveness of marketing spend.

Carrefour's commitment to sustainability, communicated through public relations and initiatives like 'Act For Food', also serves as a promotional tool, appealing to a growing segment of environmentally conscious consumers.

| Promotion Tactic | Description | 2024 Focus/Data Point |

|---|---|---|

| Sales & Discounts | Attracting broad customer base with price reductions. | Continued significant price reductions across hypermarkets and online. |

| Loyalty Program (Club Card) | Encouraging repeat business and customer engagement. | Significant portion of sales driven by loyalty members (early 2024). |

| Personalized Offers | Leveraging data analytics and AI for tailored promotions. | Personalized app promotions led to measurable increase in basket size (2024). |

| Digital Marketing & Retail Media | Boosting online presence and monetizing customer data. | Increased digital ad spending in Europe (2023, projected for 2024); development of Carrefour Links. |

| Public Relations (Sustainability) | Highlighting corporate social responsibility and environmental impact. | 'Act For Food' program; 13% reduction in food waste in French stores (2019-2022). |

Price

Carrefour employs a competitive pricing strategy, frequently emphasizing low prices daily to draw in budget-conscious consumers. This approach is crucial for staying profitable in the highly competitive retail landscape.

The company actively monitors market trends and competitor pricing, making strategic adjustments to ensure its offerings provide perceived value. For instance, in early 2024, Carrefour continued its focus on price competitiveness across its European markets, particularly in France and Spain, where inflation pressures remained a concern for shoppers.

Carrefour actively utilizes dynamic and promotional pricing strategies to attract and retain customers. For instance, in 2024, the company continued its focus on permanent price reductions for its private label goods, a key element in its value proposition. This approach aims to provide consistent affordability, especially as consumers navigate economic pressures.

Beyond everyday value, Carrefour implements significant discount campaigns across thousands of products. These promotions are designed to offer substantial savings, directly addressing consumer concerns about rising living costs. For example, during key sales periods in late 2024, customers saw discounts of up to 50% on selected categories.

The integration of electronic shelf labels in Carrefour's physical stores is a crucial enabler for its dynamic pricing. This technology allows for rapid and frequent price adjustments, ensuring that promotions and competitive pricing can be implemented swiftly and efficiently across their store network, enhancing agility in response to market changes.

Carrefour's pricing strategy heavily emphasizes value for money, particularly through its extensive range of private label brands. These own-brand products are strategically priced below national brands, offering a compelling alternative for budget-conscious shoppers. For instance, by mid-2024, Carrefour's private label sales represented a significant portion of its overall revenue, demonstrating the success of this approach in attracting and retaining customers.

Strategic Investments

Carrefour has significantly boosted its price competitiveness, notably in 2024, by making substantial investments. This strategic move aims to counter inflation and meet evolving consumer expectations, leading to improved customer satisfaction and a stronger market position in key regions.

These price initiatives have demonstrably benefited Carrefour, with reports indicating positive traction in customer loyalty and market share gains throughout 2024. The company is committed to continuing this strategy, with further price investments planned for 2025 to solidify and expand upon these gains.

- 2024 Price Investments: Carrefour allocated significant capital to price reductions and promotions, enhancing its value proposition.

- Customer Impact: Studies in late 2024 showed a notable increase in customer satisfaction scores linked to Carrefour's pricing strategies.

- Market Share Gains: The company observed a positive trend in market share, particularly in France and Spain, during the latter half of 2024.

- 2025 Outlook: Carrefour has signaled its intention to maintain or increase its investment in pricing for 2025 to sustain competitive momentum.

Consideration of External Factors

Carrefour's pricing strategy is deeply intertwined with external economic forces. The company actively monitors market demand, competitor pricing, and prevailing economic conditions, particularly inflation, to set competitive prices. For instance, in early 2024, Carrefour continued its efforts to mitigate the impact of rising inflation on consumers.

The company has demonstrated a proactive approach to managing price increases, notably by challenging suppliers over what they deem unacceptable hikes. This stance is aimed at safeguarding consumer purchasing power, a key element in maintaining customer loyalty and market share. In 2023, Carrefour reported a significant number of negotiations with suppliers regarding price adjustments.

These external considerations directly influence Carrefour's pricing decisions, ensuring that their offerings remain attractive and accessible. The company's commitment to affordability is a core tenet of its market positioning.

- Market Demand: Carrefour analyzes consumer purchasing trends to align prices with what the market will bear.

- Competitor Pricing: Continuous monitoring of rival pricing strategies ensures Carrefour remains competitive.

- Economic Conditions: Inflationary pressures and overall economic health are critical inputs for Carrefour's pricing models.

- Supplier Negotiations: Carrefour actively engages with suppliers to negotiate fair prices, impacting their cost of goods sold and consumer prices.

Carrefour's pricing strategy centers on delivering consistent value, a cornerstone of its 2024 initiatives. The company has made substantial investments to maintain price competitiveness, particularly in response to inflation, which saw significant impact on consumer spending throughout the year.

This focus on affordability is evident in its private label offerings and extensive promotional campaigns. By mid-2024, private label sales constituted a significant portion of Carrefour's revenue, underscoring the success of its value-driven approach. These efforts have demonstrably boosted customer satisfaction and market share, with further price investments planned for 2025 to sustain this momentum.

| Metric | 2024 (Actual/Projected) | 2025 (Projected) |

|---|---|---|

| Price Investment | Significant capital allocation | Maintain or increase investment |

| Private Label Share of Revenue | Significant portion (mid-2024) | Expected continued growth |

| Customer Satisfaction Scores | Notable increase (late 2024) | Targeting sustained improvement |

| Market Share (France & Spain) | Positive trend (late 2024) | Targeting continued gains |

4P's Marketing Mix Analysis Data Sources

Our Carrefour 4P's analysis leverages a robust blend of official company disclosures, including annual reports and investor presentations, alongside extensive market research from industry-specific databases and competitor benchmarking. This ensures a comprehensive view of their product offerings, pricing strategies, distribution networks, and promotional activities.