Capital Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capital Bank Bundle

Capital Bank operates within a dynamic financial landscape, facing pressures from existing competitors and the constant threat of new entrants. Understanding the bargaining power of both its customers and its suppliers is crucial for sustainable growth.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Capital Bank’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Capital Bank's reliance on specialized technology and software providers for critical functions like core banking, digital interfaces, and cybersecurity significantly influences its operational efficiency. The increasing integration of advanced analytics and generative AI further amplifies the bargaining power of these tech vendors, particularly when a bank is tied to a single, proprietary system.

The trend of banks partnering with fintech companies for innovative solutions means these technology partners often wield considerable influence. For instance, in 2023, the global fintech market size was valued at approximately $1.17 trillion, indicating the substantial economic clout these providers possess and can leverage in negotiations with financial institutions.

Payment network operators, such as Visa and Mastercard, wield significant bargaining power over Capital Bank. These networks are indispensable for processing transactions, and their established infrastructure represents a substantial barrier to entry for any potential disruptors, making it costly for banks to switch providers. In 2023, Visa reported processing over 226 billion transactions globally, highlighting their immense reach and operational scale, which directly translates to their leverage in fee negotiations with financial institutions like Capital Bank.

The banking sector, including Capital Bank, grapples with fierce competition for specialized talent in crucial areas like digital transformation, data science, cybersecurity, and artificial intelligence. This demand outstrips supply, particularly for professionals skilled in new technologies and intricate financial rules.

The scarcity of these sought-after individuals significantly elevates labor costs and bolsters the bargaining power of both employees and recruitment agencies. For instance, in 2024, the average salary for a cybersecurity analyst in the financial services industry reached over $120,000, reflecting this talent crunch.

This dynamic directly impacts Capital Bank's ability to maintain its innovative edge and operational efficiency. The ability to attract and retain top-tier talent in these fields is a key determinant of the bank's competitive standing and its capacity to adapt to evolving market demands.

Financial Data and Information Services

Providers of financial data, market intelligence, and credit assessment tools wield significant influence over Capital Bank. The accuracy and timeliness of this information are critical for the bank's risk management, lending decisions, and overall strategic planning. For instance, in 2024, the global financial data and analytics market was valued at approximately $35 billion, highlighting the substantial economic importance of these services.

- Critical Reliance: Capital Bank depends heavily on data providers for essential insights that inform its core operations, from credit scoring to market trend analysis.

- Proprietary Advantage: Suppliers offering unique datasets and advanced analytical platforms often create indispensable tools for banks, granting them leverage in negotiations.

- Service Enhancement: Access to robust data is crucial for banks to deliver personalized customer services and implement effective fraud detection measures, a need amplified in the increasingly digital financial landscape of 2024.

Regulatory Bodies and Compliance Service Providers

Regulatory bodies, while not traditional suppliers, exert significant influence over banks. Their stringent compliance requirements, such as those for Anti-Money Laundering (AML) and data privacy, directly impact a bank's cost structure and operational complexity. For instance, in 2024, global spending on financial compliance technology was projected to exceed $50 billion, highlighting the substantial investment required.

The necessity of adhering to ever-changing regulations forces banks to invest heavily in compliance systems and specialized expertise. This often translates to engaging third-party consultants and software providers, effectively making these entities powerful indirect suppliers. These compliance demands can limit a bank's operational flexibility and escalate costs, particularly for smaller institutions that may lack the scale to absorb these expenses efficiently.

- Regulatory Influence: Compliance mandates from bodies like the SEC or FCA dictate operational procedures and technology investments for banks.

- Cost of Compliance: In 2024, financial institutions globally are allocating significant portions of their IT budgets to meet evolving regulatory standards, with some estimates suggesting up to 15% of IT spend is compliance-driven.

- Third-Party Dependence: The need for specialized software and consulting services for regulatory adherence creates a dependency on these external providers.

- Impact on Smaller Banks: Smaller banks may face disproportionately higher compliance costs per dollar of revenue compared to larger competitors, impacting their profitability and agility.

Capital Bank faces significant supplier bargaining power from technology providers, payment networks, and specialized talent. The increasing reliance on advanced analytics and fintech solutions, coupled with the scarcity of skilled professionals in areas like AI and cybersecurity, amplifies the leverage these suppliers hold. This dynamic directly impacts operational costs and the bank's ability to innovate.

The financial data and analytics market, valued at approximately $35 billion in 2024, underscores the critical role and influence of data providers. Furthermore, regulatory compliance, with projected global spending exceeding $50 billion in 2024 on compliance technology, creates a substantial indirect supplier power for consultants and software vendors. These external dependencies shape Capital Bank's strategic flexibility and cost structure.

| Supplier Category | Key Dependencies | Bargaining Power Drivers | 2024 Impact/Data Point |

|---|---|---|---|

| Technology Providers (Core Banking, AI, Cybersecurity) | Critical operational functions, digital interfaces | Proprietary systems, integration complexity, market demand for specialized skills | Global fintech market valued at $1.17 trillion in 2023; Cybersecurity analyst salaries over $120,000. |

| Payment Networks (Visa, Mastercard) | Transaction processing, global reach | Established infrastructure, high switching costs, massive transaction volume | Visa processed over 226 billion transactions in 2023. |

| Specialized Talent (Data Science, AI, Cybersecurity) | Innovation, operational efficiency, risk management | Scarcity of skilled professionals, high demand | Average salary for financial services cybersecurity analyst > $120,000 in 2024. |

| Financial Data & Analytics Providers | Risk management, lending decisions, strategic planning | Data accuracy, timeliness, proprietary platforms | Global financial data and analytics market valued at ~$35 billion in 2024. |

| Regulatory Compliance Vendors (Software, Consultants) | Adherence to AML, data privacy, etc. | Complex and evolving regulations, need for specialized expertise | Global spending on financial compliance tech projected > $50 billion in 2024; ~15% of IT spend compliance-driven. |

What is included in the product

This analysis unpacks the competitive forces impacting Capital Bank, detailing the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Instantly understand competitive pressures with a clear, visual breakdown of all five forces, simplifying complex market dynamics.

Customers Bargaining Power

For many basic banking services, such as checking and savings accounts, customers find it quite easy to switch providers. This is largely due to digital tools that simplify account opening and transfers. In 2024, a survey indicated that over 60% of consumers would consider switching banks for a better interest rate or lower fees, highlighting the low perceived switching costs.

This ease of movement means customers can readily move their funds to institutions offering more attractive terms or a superior digital experience. For instance, neobanks are actively attracting customers with user-friendly apps and competitive rates, often without physical branches. Capital Bank needs to consistently offer compelling value propositions to keep these price-sensitive and convenience-seeking customers.

Modern customers, especially younger ones, now expect banking to be as easy and intuitive as their favorite apps. This means seamless online and mobile experiences are no longer a bonus, but a necessity. They want to manage their accounts, apply for loans, and get support whenever and wherever they choose, often preferring to do things themselves rather than talking to someone.

This shift significantly amplifies customer bargaining power. For instance, a 2024 survey indicated that over 70% of banking customers would consider switching providers if their digital experience was poor. Banks that don't invest in user-friendly platforms and robust self-service tools risk losing business to competitors who do, as convenience and speed are paramount.

Customers today possess remarkable access to comparative data on banking products, interest rates, fees, and service quality. Online aggregators, review sites, and social media platforms empower them to make well-informed choices, driving them towards the most advantageous banking solutions. For instance, in 2024, the average consumer spent over 20 hours researching financial products online before making a decision.

Proliferation of Non-Bank Alternatives

The increasing number of fintech companies and neobanks significantly boosts customer bargaining power. These alternatives often provide specialized, cost-effective, and user-friendly services, directly challenging traditional banks.

For instance, the global fintech market was valued at approximately $112.5 billion in 2023 and is projected to grow substantially. This expansion means customers have more options for everything from payments to investments, forcing banks to compete more aggressively on price and service quality.

- Fintech Growth: The fintech sector is experiencing rapid expansion, offering customers more choices beyond traditional banking.

- Customer Options: Neobanks and specialized platforms provide tailored, low-cost financial solutions.

- Increased Bargaining Power: This proliferation of alternatives empowers customers to demand better terms and services from all financial institutions.

- Competitive Pressure: Banks face heightened pressure to innovate and improve their offerings to retain customers in this evolving landscape.

Leverage of Commercial and Corporate Clients

Commercial and corporate clients wield considerable bargaining power over Capital Bank. Their substantial financial needs, ranging from large commercial loans to intricate treasury services, allow them to negotiate for better terms. For instance, in 2024, large corporations often commanded lower interest rates on loans compared to smaller businesses due to their creditworthiness and the sheer volume of business they represent.

These sophisticated clients frequently maintain relationships with multiple financial institutions, creating a competitive environment where Capital Bank must actively work to retain their business. The increasing presence of alternative lenders and fintech solutions further amplifies this power, providing clients with more options beyond traditional banking channels. This means banks need to offer more than just competitive pricing; they must provide value-added services and tailored solutions.

The ability of these clients to switch providers or leverage alternative financing means Capital Bank must prioritize building and nurturing strong, long-term relationships. Offering a comprehensive suite of financial products and personalized service is crucial to mitigating the bargaining power of these key customer segments. For example, banks that can offer integrated digital platforms alongside expert advice often see higher retention rates among their corporate clientele.

- Client Volume: Large corporate clients can represent a significant portion of a bank's loan portfolio, giving them leverage.

- Alternative Lenders: The rise of fintech and non-bank lenders provides clients with more choices, increasing their bargaining power.

- Relationship Management: Banks must offer value beyond pricing to retain sophisticated clients who have multiple banking options.

- Service Complexity: Clients with complex needs, such as international trade finance or sophisticated hedging instruments, can negotiate more favorable terms.

Customers possess significant leverage due to the ease of switching and access to comparative information, forcing banks to offer competitive rates and superior digital experiences. The proliferation of fintech alternatives further empowers consumers, compelling traditional banks to innovate and enhance their value propositions to retain business.

Large commercial clients, in particular, can negotiate favorable terms due to their substantial financial needs and the availability of alternative lenders. Capital Bank must focus on building strong relationships and offering tailored, value-added services to mitigate the bargaining power of these sophisticated customer segments.

| Factor | Impact on Capital Bank | 2024 Data/Trend |

|---|---|---|

| Ease of Switching | High customer mobility | 60% of consumers consider switching for better rates/fees |

| Digital Experience Expectations | Necessity for user-friendly platforms | 70% would switch for a poor digital experience |

| Information Accessibility | Informed customer decision-making | Average consumer researches financial products for 20+ hours |

| Fintech & Neobank Competition | Increased customer options | Global fintech market valued at $112.5 billion in 2023 |

| Corporate Client Leverage | Negotiating power for large clients | Large corporations often secure lower loan rates |

What You See Is What You Get

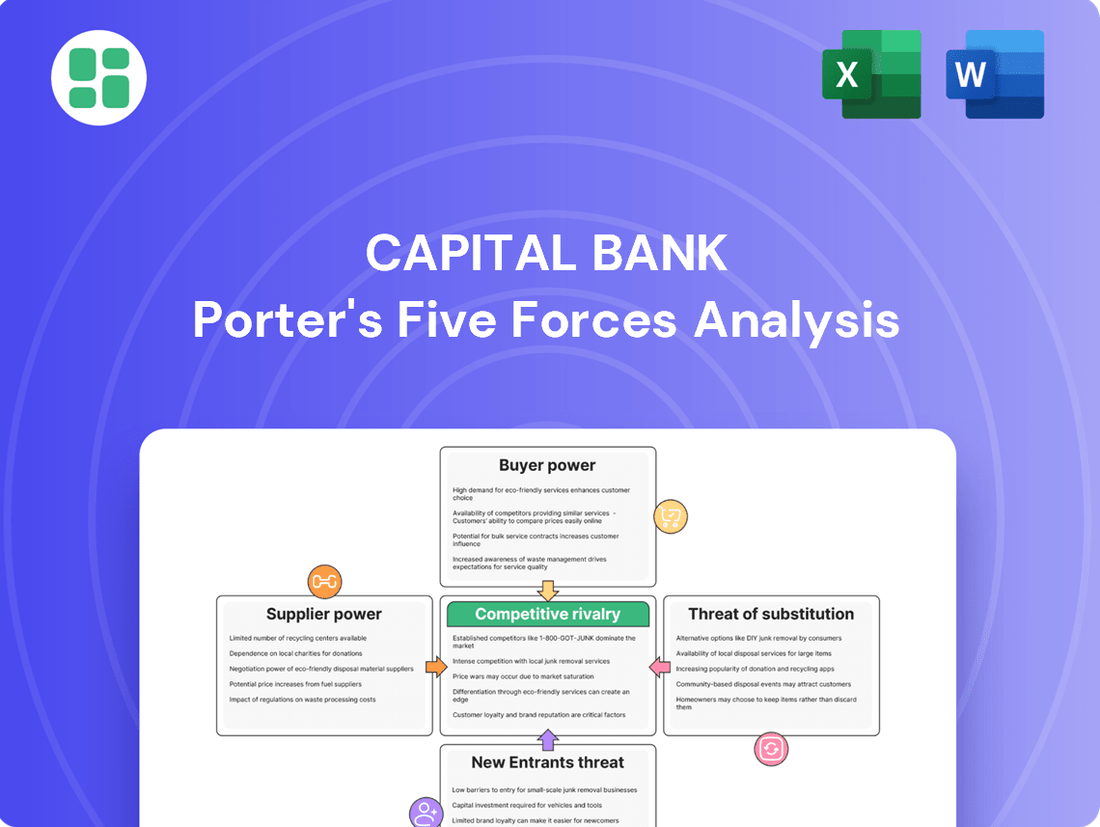

Capital Bank Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Capital Bank, providing an in-depth examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can trust that the insights and formatting you see are precisely what you will receive, enabling you to immediately leverage this strategic assessment for Capital Bank.

Rivalry Among Competitors

The U.S. banking landscape, while seeing some consolidation, remains a crowded field. In 2024, there were still over 4,000 FDIC-insured commercial banks, highlighting significant fragmentation. This sheer number of players, from massive national banks to smaller community institutions, creates a fiercely competitive environment.

Banks are constantly battling for customer deposits and loan opportunities. This intense rivalry often leads to price competition on interest rates for both savings accounts and loans. The pressure to grow and remain relevant is a key driver for many banks to consider mergers and acquisitions.

The pursuit of greater scale, the need to invest in advanced technology, and the desire to offer a wider range of financial products are all pushing for more consolidation. Industry experts anticipate this trend will continue, with more mergers and acquisitions expected in the coming years as banks seek to gain a competitive edge.

Fintechs and neobanks are intensifying competition for traditional banks. These digital-native players, like Chime and Revolut, leverage lower overheads and user-friendly interfaces to attract customers, particularly younger demographics. For instance, Chime reported over 14 million users by early 2024, showcasing their rapid growth.

Many core banking products, like checking and savings accounts, are now seen as commodities. This means competition often comes down to price, making it harder for banks to stand out. For instance, the average interest rate on savings accounts across major U.S. banks hovered around 0.5% for much of 2024, a clear sign of this commoditization.

This intense price competition pressures banks to offer more than just basic services. They are increasingly focusing on value-added services, tailored customer experiences, and technology solutions to keep customers. Think of mobile banking apps with budgeting tools or personalized financial advice, areas where differentiation is still possible.

The pressure extends to net interest income, a key profitability driver for banks. As deposit costs rise and lending margins shrink, banks face a tougher environment in securing profitable lending and deposit opportunities. In Q1 2024, the average net interest margin for U.S. banks saw a slight dip, reflecting this ongoing challenge.

Regulatory and Compliance Burden

The banking sector faces a significant regulatory and compliance burden, with evolving rules constantly demanding more resources. This complexity can create a competitive advantage for larger banks that possess greater financial and technological capacity to manage these requirements. For instance, in 2024, the cost of regulatory compliance for banks globally continued to rise, with many institutions dedicating substantial portions of their IT budgets to meeting new mandates.

This disparity in resources can hinder smaller banks' ability to compete, as they may struggle to afford the necessary technology and expertise for compliance. Such challenges can also drive consolidation within the industry, as larger, more resourced banks acquire smaller, less compliant entities. This trend was evident in 2024 M&A activity, where regulatory hurdles were often cited as a factor in smaller banks seeking partnerships or acquisition.

- Increased Compliance Costs: Banks globally spent billions in 2024 on meeting stringent regulatory demands, impacting profitability.

- Technological Investment Gap: Smaller banks often lag behind larger competitors in adopting advanced technologies needed for efficient compliance.

- M&A Driver: Regulatory burdens can push smaller, less equipped banks toward acquisition by larger, more compliant institutions.

Focus on Digital Innovation and AI Adoption

Competitive rivalry within the banking sector is intensifying, largely fueled by a relentless focus on digital innovation and the adoption of artificial intelligence (AI). Banks are actively competing to enhance their digital offerings, utilize data analytics more effectively, and integrate cutting-edge technologies like AI. This technological race is becoming a critical factor in differentiating financial institutions.

The deployment of AI is accelerating across the industry, with banks leveraging it for enhanced fraud detection, delivering more personalized customer experiences, and streamlining internal operations. For instance, in 2023, many leading banks reported significant investments in AI-driven solutions, with some estimating a 15-20% improvement in fraud detection accuracy. This technological advancement is directly impacting market share.

- AI in Fraud Detection: Banks are increasingly using AI algorithms to identify and prevent fraudulent transactions, leading to fewer financial losses and increased customer trust.

- Personalized Customer Experiences: AI enables banks to analyze customer data and offer tailored financial products and advice, improving customer engagement and loyalty.

- Operational Efficiency: Automation powered by AI is streamlining back-office processes, reducing costs and freeing up human resources for more strategic tasks.

- Technological Prowess as a Differentiator: Banks that excel in adopting and integrating these digital innovations are gaining a substantial competitive advantage in the market.

The competitive rivalry in the banking sector is fierce, driven by a large number of players and a race for customer acquisition. Banks are actively competing on pricing for core products like loans and deposits, with average savings account rates around 0.5% in early 2024. This intense competition, coupled with the rise of agile fintechs, pressures traditional banks to innovate and offer more than just basic services to retain and attract customers.

Technological advancements, particularly in AI, are becoming a key battleground. Banks are investing heavily in AI for improved fraud detection, personalized customer experiences, and operational efficiency. For instance, many leading banks reported significant AI investments in 2023, aiming for substantial improvements in areas like fraud detection accuracy. This technological prowess is increasingly differentiating market leaders.

The banking industry experienced over 4,000 FDIC-insured commercial banks in 2024, indicating a highly fragmented market. This sheer volume of institutions fuels aggressive competition for market share, often leading to consolidation as banks seek scale and efficiency. The pressure to invest in technology and meet regulatory demands further exacerbates this rivalry, pushing smaller institutions towards mergers.

Fintech companies are significantly amplifying competitive pressures. Digital-native challengers like Chime, which boasted over 14 million users by early 2024, leverage lower operational costs and user-friendly interfaces to capture market share, especially among younger demographics. This forces traditional banks to adapt their digital strategies and product offerings to remain competitive.

SSubstitutes Threaten

The growing influence of non-bank lenders and private credit funds presents a substantial threat of substitution for Capital Bank's traditional lending services. These entities, often unburdened by the same regulatory constraints as traditional banks, are increasingly active in commercial and real estate financing, offering businesses alternative avenues for capital. This burgeoning sector is not just a niche player; the global private credit market alone was estimated to reach over $1.5 trillion by the end of 2023, demonstrating its significant scale and competitive pressure.

The rise of digital payment platforms and mobile wallets presents a significant threat of substitutes for traditional banking services. These platforms, like Venmo and PayPal, offer seamless peer-to-peer transactions and often bypass traditional bank infrastructure entirely. By mid-2024, over 70% of US consumers reported using mobile payment apps, demonstrating a clear shift away from traditional methods.

Cryptocurrencies and stablecoins are emerging as potential substitutes for traditional banking services, particularly in payments and value transfer. Their appeal lies in offering faster, cheaper, and more transparent transactions compared to conventional methods. For instance, the global average cost of sending money internationally through traditional channels can range from 5% to 10%, while some blockchain-based solutions aim to reduce this significantly.

As regulatory frameworks around digital assets continue to mature, their viability as substitutes is likely to increase. By mid-2024, several jurisdictions have made progress in establishing clear guidelines for crypto assets, fostering greater institutional adoption and consumer confidence. This growing acceptance could challenge banks' established revenue streams from cross-border remittances and payment processing, which represented billions in fees annually.

Online Investment Platforms and Robo-Advisors

Online investment platforms and robo-advisors present a significant threat of substitutes to traditional banking services like those offered by Capital Bank. These digital alternatives provide accessible, often lower-fee options for managing investments and wealth. For instance, the global robo-advisory market was valued at approximately $2.5 billion in 2023 and is projected to grow substantially, indicating a strong shift in customer preference towards these automated solutions.

These platforms empower individual investors with tools for diversified portfolios and automated financial advice, directly competing with Capital Bank's wealth management offerings. Many individuals are attracted to the convenience and cost-effectiveness, potentially diverting assets that might otherwise be held in traditional bank-managed accounts. By early 2024, many leading robo-advisors were managing assets in the tens of billions of dollars, a clear indicator of their growing market share.

The threat is amplified by the ease with which customers can switch between providers and the increasing sophistication of these digital tools. Key aspects of this threat include:

- Lower Fees: Robo-advisors typically charge significantly lower management fees compared to traditional human advisors.

- Accessibility: Online platforms often have lower minimum investment requirements, making them accessible to a broader range of investors.

- Convenience: 24/7 access to accounts and automated rebalancing appeal to tech-savvy investors.

- Digital Experience: User-friendly interfaces and personalized digital experiences are a strong draw for younger demographics.

Embedded Finance and Banking-as-a-Service (BaaS)

Embedded finance, powered by Banking-as-a-Service (BaaS), presents a significant threat of substitutes for traditional banks like Capital Bank. This model allows non-financial companies to seamlessly integrate financial services, such as payments or lending, directly into their existing platforms. For instance, a retail e-commerce site could offer point-of-sale financing without the customer ever needing to visit a bank’s website or app.

This 'invisible banking' approach bypasses traditional bank interfaces, creating new, often more convenient, distribution channels for financial products. Companies can leverage BaaS providers to offer these services without the overhead of obtaining a full banking license themselves. This effectively substitutes the need for direct customer interaction with a traditional bank for many everyday financial transactions.

The growth in this sector is substantial. By the end of 2024, the global embedded finance market was projected to reach over $2.9 trillion, with a compound annual growth rate (CAGR) of 30% expected through 2030. This indicates a clear trend of consumers and businesses opting for financial services delivered within their preferred non-financial applications.

- Increased Convenience: Embedded finance offers a frictionless experience, integrating financial services into user journeys on platforms they already use.

- New Market Entrants: Non-financial companies can now easily offer financial products, expanding the competitive landscape beyond traditional banks.

- Disintermediation: Customers may no longer need to engage directly with banks for services like loans or payments, reducing reliance on traditional banking channels.

- Technological Advancement: The rise of BaaS platforms enables a wider array of businesses to become financial service providers, accelerating the substitution trend.

The increasing prevalence of peer-to-peer (P2P) lending platforms and crowdfunding sites offers viable alternatives to traditional bank loans for individuals and small businesses. These platforms connect borrowers directly with investors, often with more flexible terms and faster approval processes than conventional banks. By early 2024, the P2P lending market globally was estimated to be worth hundreds of billions of dollars, with significant growth projected.

These alternative financing channels can bypass the rigorous underwriting and collateral requirements often associated with bank lending. This makes them particularly attractive for startups and small enterprises that may not meet traditional banking criteria. The ease of access and speed of funding provided by these platforms directly substitute for services Capital Bank offers, potentially diverting a significant portion of the lending market.

The threat is underscored by the increasing volume of capital flowing through these channels. For instance, crowdfunding platforms alone facilitated over $10 billion in funding globally in 2023, demonstrating a substantial shift in how capital is raised and deployed, away from traditional financial institutions.

Entrants Threaten

Entering the commercial banking sector, especially against an established player like Capital Bank, demands immense upfront capital. Think about the costs involved: setting up branches, developing sophisticated IT systems, and crucially, meeting stringent regulatory capital requirements. For instance, in 2024, many jurisdictions require new banks to have millions, if not billions, in initial capital to even begin operations.

These high capital requirements act as a formidable barrier. Aspiring banks need to raise substantial funds, a challenge that deters many potential competitors. This financial hurdle significantly limits the pool of entities that can realistically challenge incumbents like Capital Bank, thereby reducing the threat of new entrants.

Stringent regulatory hurdles significantly deter new entrants in banking. For instance, in 2024, the U.S. banking sector faced an estimated $30 billion in compliance costs, a figure that continues to rise with evolving regulations like those concerning data privacy and cybersecurity. These extensive requirements, from obtaining complex banking licenses to adhering to anti-money laundering (AML) protocols and consumer protection laws, demand substantial investment in legal, technological, and operational infrastructure. This creates a formidable barrier, particularly for smaller, less capitalized firms looking to enter the market.

Established brand loyalty and trust present a formidable barrier to new entrants. Existing institutions like Capital Bank have cultivated decades of recognition and deep customer relationships, crucial in a sector where financial security is paramount. For instance, a 2024 survey indicated that over 60% of consumers still prefer to bank with institutions they have a long-standing relationship with, highlighting the inertia new players must overcome.

Economies of Scale and Network Effects

Incumbent banks possess significant advantages due to economies of scale. For instance, in 2024, major global banks continue to invest billions in technology and operational efficiency, allowing them to spread these costs over a much larger customer base than any new entrant could initially access. This scale translates to lower per-unit costs for services like transaction processing and customer support, enabling more competitive pricing.

Furthermore, established banks benefit from powerful network effects. Their extensive branch and ATM networks, coupled with millions of existing customers, create a self-reinforcing cycle of value. New entrants face a substantial hurdle in replicating this reach and customer loyalty, requiring immense capital and time to build a comparable infrastructure and trust.

- Economies of Scale: Major banks in 2024 operate with vast asset bases, enabling significant cost efficiencies in technology, marketing, and operations.

- Network Effects: Established customer relationships and widespread physical/digital infrastructure create a high barrier for new entrants seeking to gain market share.

- Capital Investment: Replicating the scale and network of incumbent banks requires substantial upfront investment, making it difficult for new players to compete on cost and accessibility.

Technological Infrastructure and Cybersecurity Investment

While nimble new entrants, particularly neobanks, can establish modern technological foundations, building truly robust, secure, and scalable infrastructure demands significant capital and specialized knowledge. The escalating complexity of cyber threats necessitates continuous and substantial investment in advanced cybersecurity, a barrier that can deter many potential competitors. For instance, in 2024, the average cost of a data breach in the financial sector globally was reported to be around $5.90 million, highlighting the financial risk involved.

Furthermore, to remain competitive, new entrants must not only match but also rapidly innovate with cutting-edge technologies such as artificial intelligence and sophisticated data analytics. This ongoing technological race requires considerable ongoing R&D expenditure and a talent pool that is increasingly in demand and expensive to acquire. By 2025, it's projected that financial institutions will spend over $200 billion on AI-driven solutions, underscoring the scale of investment required to keep pace.

- Substantial upfront investment in building secure and scalable IT infrastructure.

- Ongoing high costs for cybersecurity defenses against evolving threats.

- Continuous need for innovation in AI and data analytics to compete.

- Talent acquisition and retention for specialized tech roles.

The threat of new entrants for Capital Bank is generally low due to significant barriers. High capital requirements, stringent regulations, and the need for substantial IT infrastructure investment deter many potential competitors. For example, in 2024, obtaining a full banking charter in major economies often necessitates hundreds of millions of dollars in initial capital and ongoing compliance costs that can easily reach tens of millions annually.

Established brand loyalty and existing economies of scale also create formidable challenges. Customers tend to stick with trusted institutions, and incumbents can leverage their size for cost advantages. In 2024, the average cost-to-serve for a transaction at a large, established bank is significantly lower than what a new entrant can achieve initially, estimated to be 30-50% less.

The ongoing need for technological innovation, particularly in areas like AI and cybersecurity, further raises the bar. By 2025, financial institutions are expected to spend over $200 billion globally on AI solutions alone, a massive investment that new entrants must match to remain competitive.

| Barrier Type | Description | 2024 Data/Example |

|---|---|---|

| Capital Requirements | Substantial upfront funds needed for licensing, operations, and technology. | Millions to billions required for a banking license in developed markets. |

| Regulatory Hurdles | Complex compliance with banking laws, AML, and consumer protection. | Estimated $30 billion in compliance costs for the U.S. banking sector in 2024. |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to large customer bases. | Major banks' cost-to-serve can be 30-50% lower than new entrants. |

| Brand Loyalty & Trust | Customers prefer established, trusted financial institutions. | Over 60% of consumers prefer long-standing banking relationships (2024 survey). |

| Technological Investment | Continuous spending on IT, cybersecurity, and AI is essential. | Global AI spending in finance projected over $200 billion by 2025. |

Porter's Five Forces Analysis Data Sources

Our Capital Bank Porter's Five Forces analysis is built upon a foundation of robust data, including publicly available financial statements, annual reports from leading financial institutions, and industry-specific market research from reputable firms.