Candeal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Candeal Bundle

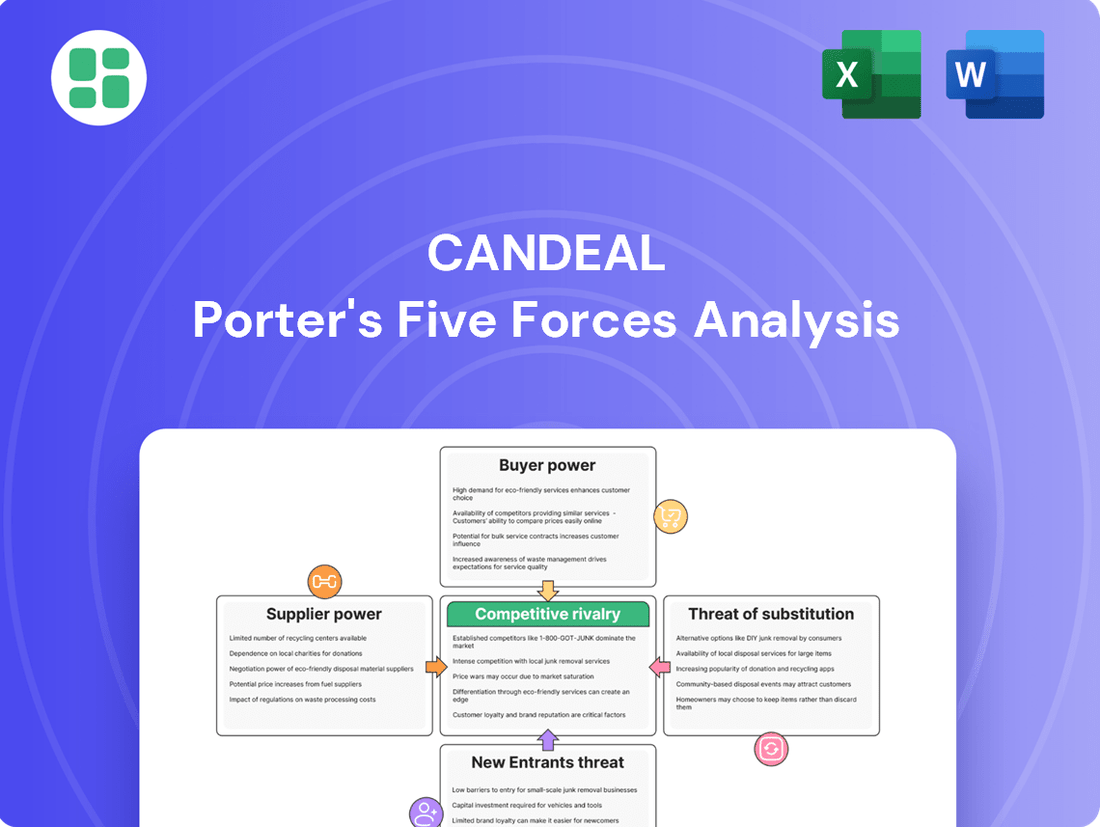

Candeal's competitive landscape is shaped by the interplay of buyer power, supplier leverage, the threat of new entrants, the intensity of rivalry, and the pressure from substitute products. Understanding these forces is crucial for any business operating within or considering entry into Candeal's market.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Candeal’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The scarcity of skilled IT professionals significantly boosts supplier bargaining power. In Japan, a notable talent deficit is projected, with an estimated shortage of 220,000 IT workers. This means companies like Candeal Co., Ltd. often struggle to find qualified personnel, giving existing skilled workers more leverage.

More than 70% of Japanese organizations report being understaffed in critical IT areas. This widespread understaffing, especially in fields like AI, cloud, cybersecurity, and data science, strengthens the position of IT professionals and specialized recruitment agencies. They can command higher wages and better terms due to the high demand and limited supply.

Consequently, Candeal Co., Ltd. will likely face increased operational costs to attract and retain this in-demand talent. Offering competitive compensation packages, including higher salaries and comprehensive benefits, becomes essential for securing the necessary IT expertise to maintain its competitive edge.

Candeal's reliance on specialized software and hardware vendors for its system development and infrastructure projects grants these suppliers significant bargaining power. If Candeal depends on unique or proprietary technologies from a limited number of providers, these suppliers can dictate higher prices or less favorable contract terms. For instance, in 2024, the global market for specialized engineering software saw price increases averaging 5-8% due to high demand and limited competition for advanced simulation tools, directly impacting companies like Candeal.

Suppliers of critical, high-demand technologies like AI and advanced cybersecurity, essential for Japan's digital transformation, wield significant bargaining power. Candeal must align with these tech leaders, potentially accepting their terms to remain competitive.

Global tech giants are heavily investing in Japan's digital infrastructure; for instance, Microsoft's commitment to expanding its Azure cloud region in Japan signifies substantial capital allocation. This deepens the leverage of these suppliers over companies like Candeal.

Concentration of Key Suppliers

If Candeal relies on a limited number of suppliers for critical components or specialized software, those suppliers gain substantial bargaining power. This is especially relevant for foundational infrastructure or widely adopted enterprise software where vendor concentration is high. For instance, in 2024, the global market for enterprise resource planning (ERP) software, crucial for many business operations, is dominated by a few major players, giving them leverage in pricing and contract terms.

Candeal's ability to negotiate favorable terms would be significantly hampered if there are few viable alternatives for these essential inputs. This concentration means suppliers can dictate prices, delivery schedules, and even product specifications, impacting Candeal's cost structure and operational flexibility. In sectors like semiconductor manufacturing, a handful of companies control the supply of advanced chips, a situation that has led to price hikes and supply chain disruptions in recent years, affecting many industries.

- Supplier Concentration: If Candeal sources essential components or software from a small number of dominant vendors, these suppliers hold considerable power.

- Limited Alternatives: The absence of numerous alternative suppliers restricts Candeal's negotiation leverage, potentially leading to less favorable pricing and terms.

- Impact on Candeal: High supplier concentration can increase Candeal's operational costs and reduce its agility in responding to market changes.

- Industry Examples: Markets for specialized software or critical raw materials often exhibit supplier concentration, as seen in the ERP software or advanced semiconductor sectors.

Switching Costs for Candeal

Once Candeal integrates specific supplier technologies into its core service offerings, the cost and complexity of switching to alternatives escalate significantly. This deep integration means Candeal might face substantial expenses related to retraining its workforce on new systems and potentially re-architecting its entire service delivery framework. For instance, if Candeal's primary customer relationship management (CRM) software is deeply intertwined with a particular data analytics provider, moving to a new CRM could mean months of development and testing to ensure data compatibility and uninterrupted service, a process that could easily run into hundreds of thousands of dollars in 2024.

These switching costs, encompassing not just financial outlays but also the risk of operational disruptions and potential compatibility issues with existing infrastructure, effectively increase the bargaining power of Candeal's current suppliers. Suppliers are aware that Candeal has invested heavily in their technology and processes, making it less likely for Candeal to seek out cheaper or more advanced alternatives without incurring substantial penalties. This lock-in effect allows suppliers to potentially command higher prices or dictate more favorable contract terms, as Candeal's ability to negotiate is diminished by the significant hurdles to changing providers.

- Increased Vendor Lock-in: Candeal's reliance on specialized supplier platforms can create significant vendor lock-in.

- High Retraining and Re-architecture Costs: Switching suppliers often necessitates substantial investment in employee training and system redesign.

- Potential for Price Increases: Suppliers may leverage Candeal's switching costs to increase prices or reduce concessions.

- Impact on Service Continuity: Disruptions during supplier transitions can negatively affect Candeal's service delivery and customer satisfaction.

The bargaining power of suppliers is amplified when they offer unique or highly differentiated inputs, or when the industry has few suppliers. For Candeal Co., Ltd., this means that providers of specialized IT services or proprietary software can exert significant influence. For instance, in 2024, the market for advanced AI development tools often features a limited number of providers, allowing them to set terms that favor their business, impacting Candeal's project costs and timelines.

The concentration of suppliers in critical sectors, such as cloud computing or specialized hardware, directly translates to increased leverage for those providers. When Candeal relies on a small pool of vendors for essential infrastructure, these suppliers can dictate pricing and terms more effectively. This is particularly true for technologies vital to digital transformation, where global tech giants are investing heavily, as seen with Microsoft's expansion of its Azure cloud region in Japan, deepening their influence over companies like Candeal.

High switching costs further empower suppliers. If Candeal has deeply integrated a supplier's technology, the expense and disruption involved in moving to an alternative become prohibitive. This vendor lock-in, estimated to cost hundreds of thousands of dollars for system re-architecture and retraining in 2024 for complex projects, makes it difficult for Candeal to negotiate better terms, as suppliers leverage this dependency.

| Factor | Description | Impact on Candeal | 2024 Data/Example |

|---|---|---|---|

| Supplier Concentration | Few dominant vendors for critical inputs. | Increased negotiation leverage for suppliers. | Domination of ERP software market by a few major players. |

| Switching Costs | High expenses and risks associated with changing suppliers. | Vendor lock-in, reduced negotiation power for Candeal. | Hundreds of thousands of dollars for system re-architecture and retraining. |

| Differentiation of Inputs | Unique or proprietary nature of supplier offerings. | Suppliers can command higher prices and dictate terms. | Limited providers for advanced AI development tools. |

What is included in the product

This analysis dissects the competitive forces impacting Candeal, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes, and Candeal's strategic positioning within these dynamics.

Identify and mitigate competitive threats before they impact profitability, providing a proactive approach to market challenges.

Customers Bargaining Power

Japanese businesses are under significant pressure to digitize by 2025 to avoid a productivity crisis, often termed the '2025 Digital Cliff'. This urgent need fuels a robust demand for IT services, including those provided by companies like Candeal. When demand is this high, customers typically have less leverage to negotiate prices or terms.

The Japanese IT services market, despite robust demand, is characterized by intense competition. This maturity means customers, whether large enterprises or smaller businesses, have a wealth of choices when seeking system development, cloud migration, or IT consulting. For instance, in 2024, the market was populated by established domestic leaders like Fujitsu, NEC, and NTT Data, alongside an increasing presence of global IT giants, offering a diverse vendor landscape.

This abundance of providers directly translates to heightened bargaining power for customers. When services become more standardized or commoditized, clients can more easily switch between vendors or negotiate better terms based on competitive quotes. This competitive pressure forces IT service providers to differentiate through specialized skills, superior service quality, or cost-effectiveness to retain and attract business.

The bargaining power of Candeal's customers is heavily influenced by their industry and scale. Major corporations, particularly those in heavily regulated fields like finance and healthcare, often engage in substantial, long-term projects. While these clients possess significant financial resources, their established IT infrastructure and robust negotiation capabilities can lead to greater demands for customized solutions and competitive pricing.

Conversely, small and medium-sized enterprises (SMEs), though individually less powerful, collectively represent a vital market. Candeal's ability to offer scalable and cost-effective solutions to this segment is crucial. For instance, in 2024, the SME sector continued to drive a significant portion of IT service demand, with many businesses seeking cloud migration and cybersecurity enhancements, areas where customer price sensitivity remains a key factor in negotiation.

Customization and Specialization Needs

Candeal's strength in offering highly customized technological solutions significantly impacts customer bargaining power. When clients require specialized IT consulting or bespoke system development to meet unique business needs, their ability to negotiate prices or demand concessions is often diminished. This is because Candeal's tailored approach is difficult for competitors to replicate, creating a unique value proposition.

This specialization reduces price sensitivity, particularly for niche projects where the exact solution is paramount. For instance, in 2024, the demand for AI-driven custom software solutions saw a significant uptick, with many businesses willing to pay a premium for specialized expertise that could integrate seamlessly with their existing infrastructure. This trend suggests that Candeal's focus on customization can indeed leverage customer needs to its advantage, thereby lowering customer bargaining power.

- Bespoke Service Differentiation: Candeal's ability to deliver tailored technological solutions makes its offerings less commoditized.

- Reduced Price Sensitivity: For niche projects requiring specialized IT consulting, clients are less focused on price and more on the unique value provided.

- Market Trend Support: The growing demand for custom AI and specialized software in 2024 indicates a market where customization commands higher value.

- Competitive Advantage: The difficulty for competitors to replicate Candeal's bespoke services strengthens its position against price-based negotiations.

Switching Costs for Customers

When a client invests in a custom system developed by Candeal, the cost and disruption of switching to another provider for maintenance, support, or further development can be substantial. This creates high switching costs, which generally reduces the customer's bargaining power in ongoing relationships.

For instance, if a client has a complex, integrated ERP system built by Candeal, migrating data, retraining staff, and reconfiguring workflows with a new vendor could easily run into tens or even hundreds of thousands of dollars. This significant investment in time and resources makes customers hesitant to switch, even if they find a slightly cheaper alternative.

- High Integration Costs: Candeal's custom solutions are often deeply integrated into a client's existing IT infrastructure, making a clean break and seamless transition to a competitor extremely difficult and costly.

- Loss of Customization Value: Clients benefit from bespoke features tailored to their specific needs. Losing this unique functionality upon switching represents a significant loss of value, far beyond the initial development cost.

- Training and Familiarity: End-users become proficient with Candeal's systems. The cost of re-training employees on a new platform adds another layer to switching expenses, impacting productivity.

The bargaining power of customers in the IT services sector, particularly concerning companies like Candeal, is a dynamic factor influenced by market competition and vendor differentiation. In 2024, the Japanese IT market, while experiencing high demand, also presented customers with numerous choices due to the presence of both domestic giants and international players.

This competitive landscape inherently empowers customers, enabling them to negotiate terms and pricing more effectively. However, Candeal's strategic focus on highly customized solutions can significantly mitigate this power by creating unique value propositions that are difficult for competitors to replicate, thereby reducing price sensitivity for specific client needs.

Furthermore, the substantial costs and complexities associated with switching from a deeply integrated, bespoke IT system developed by Candeal can lock in clients, effectively reducing their leverage in ongoing negotiations. This is particularly true for clients requiring specialized functionalities that are not readily available from other providers.

Full Version Awaits

Candeal Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Candeal provides actionable insights into the competitive landscape, enabling strategic decision-making. You are previewing the final version—precisely the same document that will be available to you instantly after buying.

Rivalry Among Competitors

The Japanese IT services market is dominated by formidable domestic players such as Fujitsu, NTT Data, NEC, and Hitachi. These established giants command significant market share due to their vast resources, deep-rooted client relationships, and comprehensive service offerings, creating a highly competitive landscape.

These large Japanese IT firms exert substantial competitive pressure, particularly when bidding for large-scale projects and lucrative government contracts. For instance, in fiscal year 2023, Fujitsu reported consolidated revenue of approximately ¥3.8 trillion (around $25 billion USD), while NTT Data announced revenue of ¥2.0 trillion (around $13 billion USD), showcasing their immense scale and financial capacity to undertake and win major deals.

The Japanese IT sector is experiencing a significant surge in competition, driven by the increasing entry of both international players and agile startups. This influx is reshaping the market dynamics, with foreign tech giants and innovative startups keen to tap into Japan's lucrative digital economy.

In 2024, Japan's IT market was valued at approximately $330 billion, making it a prime target for global expansion. Companies like Amazon Web Services (AWS) and Microsoft Azure have already established strong footholds, intensifying rivalry with established domestic providers.

While Japanese firms benefit from deep local market knowledge and established customer relationships, international entrants often introduce cutting-edge technologies and disruptive business models. This creates a dynamic competitive environment where innovation and adaptability are paramount for survival and success.

Competitive rivalry is intensifying as companies like Candeal focus on digital transformation and emerging technologies. Sectors like AI, cloud computing, and cybersecurity are experiencing significant growth, with demand for these services surging. For instance, the global cloud computing market alone was projected to reach over $1.3 trillion by 2024, showcasing the immense opportunity and competitive pressure.

This intense competition forces firms to constantly innovate and specialize. Companies vie for market share by demonstrating deep expertise, ensuring rapid deployment of solutions, and excelling at integrating cutting-edge technologies. The ability to deliver tangible results and adapt quickly to technological advancements becomes a key differentiator in these dynamic markets.

Price and Value-Based Competition

In today's competitive landscape, businesses, including those in the SaaS sector like Candeal, are increasingly engaged in a dual battle of price and value. Simply offering the lowest price is often not enough to secure market dominance. Candeal must actively demonstrate how its services provide superior value, focusing on tangible benefits such as tailored solutions, enhanced efficiency, and measurable productivity improvements for its clientele.

The market trend clearly shows a move away from a pure volume-based approach towards a value-centric model, especially within Software as a Service (SaaS) management. This signifies that clients are prioritizing quality, effectiveness, and the overall return on investment they receive from their software solutions. For instance, a recent report from Gartner in late 2023 indicated that IT leaders are allocating more budget to solutions that demonstrate clear ROI, with 65% prioritizing efficiency gains from new technology investments.

- Differentiated Value Proposition: Candeal needs to articulate its unique selling points beyond cost, highlighting how its platform streamlines operations, reduces waste, and boosts client productivity.

- Client Success Metrics: Emphasizing quantifiable results, such as average cost savings achieved by clients or improvements in operational uptime, will be crucial.

- Market Shift to Value: The industry is moving towards solutions that prove their worth through tangible benefits, not just competitive pricing.

- Client Retention Focus: Demonstrating ongoing value is key to retaining clients in a market where switching costs can be managed if the perceived value is high enough.

Talent Acquisition and Retention as a Competitive Factor

In Japan's IT sector, a pronounced talent shortage significantly amplifies the intensity of competitive rivalry. Companies that excel in attracting, nurturing, and retaining skilled IT professionals gain a distinct advantage. This capability directly impacts their ability to innovate, deliver superior services, and ultimately outperform competitors.

The struggle for IT talent is a defining characteristic of the competitive landscape. For instance, a 2024 report indicated that over 70% of Japanese companies faced challenges in finding qualified IT personnel. This scarcity means that firms with robust talent acquisition and retention strategies are far better positioned to execute their business plans and secure market share.

- Talent Shortage Impact: A significant IT talent deficit in Japan fuels intense competition among firms vying for skilled professionals.

- Competitive Differentiator: The capacity to attract, develop, and retain IT talent serves as a crucial competitive advantage.

- Service Quality Link: Companies securing top talent are better equipped to deliver high-quality services, enhancing their market standing.

- 2024 Data Point: Reports from 2024 suggest over 70% of Japanese businesses struggle with IT talent acquisition.

Competitive rivalry in the Japanese IT services market is fierce, driven by a mix of established domestic giants and an increasing influx of international players and agile startups. This dynamic environment forces companies to differentiate through value, innovation, and talent acquisition.

The market's significant size, valued at approximately $330 billion in 2024, attracts global tech leaders like AWS and Microsoft Azure, intensifying competition with local firms such as Fujitsu and NTT Data. These domestic players, with revenues in the trillions of yen for fiscal year 2023, leverage deep client relationships and resources, while international entrants bring cutting-edge technologies.

A critical factor amplifying this rivalry is a pronounced IT talent shortage, with over 70% of Japanese companies reporting difficulties in finding qualified personnel in 2024. Firms that can effectively attract and retain skilled professionals gain a significant edge in delivering innovative services and securing market share.

| Company | Fiscal Year 2023 Revenue (Approx.) | Key Strengths |

|---|---|---|

| Fujitsu | ¥3.8 trillion ($25 billion USD) | Vast resources, deep client relationships |

| NTT Data | ¥2.0 trillion ($13 billion USD) | Comprehensive service offerings, scale |

| Amazon Web Services (AWS) | N/A (Part of Amazon's broader reporting) | Cutting-edge cloud technology, global reach |

| Microsoft Azure | N/A (Part of Microsoft's broader reporting) | Advanced cloud solutions, strong enterprise presence |

SSubstitutes Threaten

The threat of in-house IT development is a significant factor for companies like Candeal. Large enterprises, especially those with substantial budgets and existing IT infrastructure, may choose to build their own solutions rather than relying on external providers. This can be driven by a desire for greater control, customization, or cost savings over the long term.

For instance, many Fortune 500 companies have dedicated IT departments capable of managing complex software development lifecycles. In 2024, a significant portion of enterprise IT spending, estimated to be in the hundreds of billions globally, is allocated to internal development projects, indicating a strong preference for in-house capabilities among major players.

The rise of off-the-shelf software and Software-as-a-Service (SaaS) presents a potent threat of substitutes for custom system development. These readily available solutions, particularly cloud-based Enterprise Resource Planning (ERP), Customer Relationship Management (CRM), and communication tools, are increasingly accessible and adopted by businesses. For instance, the global SaaS market was projected to reach over $270 billion in 2024, highlighting its significant market penetration.

These packaged and cloud-based offerings often provide a more cost-effective and faster deployment path for common business functionalities. This can significantly diminish the perceived need and value proposition for bespoke system development, especially for companies with standard operational requirements. The ability to scale quickly and access updates without large upfront investments makes SaaS a compelling alternative.

The proliferation of cloud computing, encompassing Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS), presents a significant threat of substitutes for traditional IT infrastructure and custom development. These platforms empower businesses to rapidly build and deploy applications, including AI solutions, often bypassing the need for extensive on-premises hardware or long-term system integrator contracts. For instance, the PaaS market, projected to reach over $100 billion by 2025, offers pre-built tools and services that accelerate development cycles.

IT Outsourcing to Lower-Cost Regions

The global IT outsourcing market presents a significant threat of substitutes for domestic IT service providers. Companies, including those in Japan, increasingly look to regions like India and Southeast Asia for cost-effective system development and IT support. This trend is driven by substantial labor cost differentials, making outsourcing a compelling alternative to hiring local talent or engaging domestic consulting firms.

For instance, average IT professional salaries in India can be as much as 50-70% lower than in developed economies like Japan, according to various industry reports from 2024. This cost advantage allows businesses to access a broad pool of skilled IT workers without the overhead associated with in-house teams or local service providers. Consequently, domestic firms face pressure to either match these lower costs or differentiate their services significantly.

- Global IT Outsourcing Growth: The global IT outsourcing market was valued at over $300 billion in 2023 and is projected to continue its upward trajectory, indicating a growing acceptance and reliance on these services.

- Cost Savings as a Driver: Businesses report average cost savings of 20-40% by outsourcing IT functions, a key factor influencing the adoption of these substitutes.

- Talent Availability: Lower-cost regions often boast a large and growing pool of IT talent, addressing potential skill shortages faced by companies in more developed markets.

- Service Expansion: Outsourcing providers are increasingly offering a wider range of services, from basic development to complex cloud migration and cybersecurity, making them viable substitutes for a broader spectrum of IT needs.

Do-It-Yourself (DIY) Digital Tools and No-Code/Low-Code Platforms

The rise of accessible digital tools and no-code/low-code platforms presents a significant threat of substitution, particularly for businesses needing basic software solutions. These platforms allow even non-technical users to build applications and automate workflows, bypassing the need for traditional custom development services.

For instance, platforms like Microsoft Power Apps and Google AppSheet are democratizing app creation. In 2024, the low-code development market was projected to reach $65 billion, with continued strong growth expected. This accessibility means many simpler, repetitive tasks previously outsourced to software developers can now be handled internally.

- Increased Accessibility: DIY tools lower the barrier to entry for creating digital solutions.

- Cost Reduction: Businesses can save on external development costs.

- Faster Implementation: Internal teams can deploy solutions more rapidly.

- Reduced Demand for Simple Outsourcing: This directly impacts providers of basic custom software development.

The threat of substitutes for custom IT development is substantial, with readily available solutions like Software-as-a-Service (SaaS) and cloud platforms offering compelling alternatives. These options often provide faster deployment and lower upfront costs compared to bespoke development.

The global SaaS market, projected to exceed $270 billion in 2024, demonstrates the widespread adoption of these substitute solutions. Similarly, the Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) markets, with PaaS alone expected to surpass $100 billion by 2025, enable businesses to build and deploy applications more efficiently, often bypassing traditional development needs.

Furthermore, the rise of no-code/low-code platforms, with the low-code market anticipated to reach $65 billion in 2024, empowers even non-technical users to create applications, directly substituting the need for some custom development services.

| Substitute Category | Market Size (2024 Projection) | Key Advantage | Impact on Custom Development |

|---|---|---|---|

| SaaS | >$270 billion | Cost-effectiveness, rapid deployment | Reduces demand for standard business software development |

| PaaS | >$100 billion (by 2025) | Accelerated development cycles, pre-built services | Lowers need for foundational custom coding |

| No-Code/Low-Code Platforms | $65 billion | Democratized development, speed | Substitutes for simpler, internal application needs |

Entrants Threaten

Entering the IT system development and consulting market, particularly for custom solutions and infrastructure, demands substantial upfront capital. This includes investing in highly skilled engineers, consultants, and project managers, as well as robust technology infrastructure and necessary certifications. For instance, a recent report in early 2024 indicated that the average cost to establish a mid-sized IT consulting firm with a core team of 20 professionals could easily exceed $1 million, covering salaries, software licenses, and office space.

In the IT consulting and system development sector, a strong reputation and established client trust are critical barriers to entry. Candeal, as an existing player, leverages its proven track record and existing relationships to maintain its market position. Newcomers must invest significant resources and time to build this same level of credibility, a process particularly challenging in Japan's relationship-focused business environment.

The Japanese IT market presents a formidable barrier to new entrants due to the dominance of established domestic giants and well-funded international corporations. These incumbents possess significant market share, strong brand loyalty, and deep-rooted client networks, making it exceptionally challenging for newcomers to gain a foothold.

For instance, in 2024, the top five IT service providers in Japan, including Fujitsu and NEC, collectively held over 40% of the market share, demonstrating the concentrated nature of the industry. New entrants must overcome the substantial advantages these established players enjoy in terms of scale, operational efficiency, and established distribution channels.

Regulatory and Cultural Barriers

While Japan actively promotes digital transformation, new entrants, particularly foreign startups, encounter significant hurdles. These include intricate regulatory landscapes, pervasive language barriers, and deeply ingrained business customs that collectively deter market entry. For instance, in 2024, navigating Japan's complex data privacy laws, such as the Act on the Protection of Personal Information, demanded substantial legal consultation, with average legal fees for market entry exceeding $50,000 USD for startups.

Successfully overcoming these cultural nuances and stringent compliance requirements necessitates considerable upfront investment in local expertise and market research. Companies often need to adapt their business models and marketing strategies to align with Japanese consumer preferences and business etiquette. This often translates to higher operational costs and a longer time-to-market compared to less regulated or culturally homogenous markets.

- Regulatory Complexity: Japan's regulatory environment can be opaque and difficult for newcomers to interpret, especially concerning technology and finance.

- Language and Cultural Nuances: Effective communication and understanding of business etiquette are paramount, requiring dedicated resources for translation and cultural training.

- High Entry Costs: The need for local partnerships, legal counsel, and localized product development significantly increases the financial barrier to entry.

Talent Scarcity and Retention Challenges

The severe shortage of IT professionals in Japan presents a significant barrier for new entrants. In 2024, the demand for skilled tech workers continued to outpace supply, with estimates suggesting a deficit of over 400,000 IT professionals by 2030. New companies struggle to quickly staff up with the necessary talent, facing intense competition with established firms for a limited pool of skilled workers. This competition can drive up recruitment costs and hinder their ability to scale operations effectively.

Key challenges for new entrants in Japan's IT sector due to talent scarcity include:

- Intensified Competition: Established companies with stronger brand recognition and existing talent networks have an advantage in attracting and retaining skilled IT professionals.

- Increased Recruitment Costs: The need to offer higher salaries, better benefits, and signing bonuses to lure talent away from competitors significantly inflates initial operating expenses for new entrants.

- Delayed Market Entry and Scaling: Without adequate staffing, new companies may experience delays in product development, service delivery, and overall market penetration, impacting their growth trajectory.

- Impact on Innovation: A lack of specialized talent can limit a new company's ability to innovate and develop cutting-edge solutions, a critical factor for success in the technology sector.

The threat of new entrants into Japan's IT system development and consulting market is significantly mitigated by high capital requirements. Establishing a competitive firm necessitates substantial investment in skilled personnel, technology, and certifications, with mid-sized firms in 2024 potentially needing over $1 million to launch. This financial barrier, coupled with the need to build trust and reputation in a relationship-driven market, makes it difficult for newcomers to challenge established players.

| Barrier Type | Description | 2024 Impact/Data |

|---|---|---|

| Capital Requirements | Investment in skilled labor, technology infrastructure, and certifications. | Estimated $1M+ for mid-sized IT consulting firm launch. |

| Brand Reputation & Client Trust | Established track record and existing client relationships are crucial. | Newcomers face a long and costly process to build credibility. |

| Market Dominance of Incumbents | Large domestic and international firms hold significant market share. | Top 5 IT service providers in Japan held over 40% market share in 2024. |

| Regulatory & Cultural Hurdles | Complex regulations, language barriers, and business customs. | Data privacy law compliance alone could cost startups over $50,000 USD in legal fees in 2024. |

| Talent Scarcity | Shortage of skilled IT professionals creates intense competition. | Projected deficit of over 400,000 IT professionals in Japan by 2030. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research, and expert analysis from leading financial institutions to provide a comprehensive view of competitive dynamics.