BWX SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BWX Bundle

BWX possesses notable strengths in its brand portfolio and market penetration, yet faces significant challenges from intense competition and evolving consumer preferences. Our comprehensive SWOT analysis dives deep into these dynamics, uncovering the critical opportunities and threats shaping its future.

Want the full story behind BWX's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

BWX Limited boasts a strong portfolio of natural and organic beauty brands, including Sukin and Andalou Naturals, which have garnered significant consumer recognition within the rapidly expanding natural beauty market. This strategic focus on plant-based and eco-conscious products aligns perfectly with increasing consumer demand for sustainable and ethically produced goods. The company's historical vertical integration, encompassing development, manufacturing, and marketing, historically offered a distinct advantage in maintaining stringent product quality and supply chain control.

BWX's dedication to sustainability and ethical production is a significant strength, aligning perfectly with the growing demand for eco-conscious products. This focus on avoiding synthetic chemicals, ensuring no animal testing, and utilizing safe, natural ingredients sets its brands apart in a crowded marketplace.

This commitment is increasingly influencing consumer purchasing decisions worldwide, with a notable rise in consumers actively seeking out brands that demonstrate strong ethical and environmental credentials. For instance, reports from 2024 indicate that over 60% of consumers are willing to pay more for sustainable products, a trend that directly benefits BWX's brand positioning.

BWX Limited previously boasted an extensive global distribution network, spanning Australia, New Zealand, Asia, the Americas, and the EMEA region. This broad reach enabled its brands to tap into a variety of markets and consumer segments.

While recent challenges have impacted this network, the established infrastructure represents a significant potential asset for future market penetration once operational stability is regained. For instance, prior to its difficulties, BWX's international sales accounted for a substantial portion of its revenue, underscoring the importance of its global footprint.

Brand Loyalty in Natural Beauty Segment

Brands such as Sukin have cemented their position as prominent natural skincare choices in Australia, demonstrating considerable brand loyalty within the natural beauty sector. This established trust and recognition are crucial assets, particularly in a crowded marketplace.

This loyalty translates into a stable customer base, providing a solid platform for BWX to leverage during periods of market fluctuation or strategic repositioning. A loyal following often signifies repeat purchases and positive word-of-mouth, which are invaluable for sustainable growth.

- Sukin's Market Standing: Recognized as a leading natural skincare brand in Australia, indicating strong consumer trust.

- Loyalty as a Foundation: A dedicated customer base offers resilience and a springboard for future expansion.

- Competitive Advantage: Brand loyalty in the natural beauty segment differentiates BWX from competitors relying on less established brands.

Agility in Direct-to-Consumer Channels

BWX has demonstrated agility in building direct-to-consumer (DTC) capabilities, notably through platforms like Nourished Life and Flora & Fauna. This strategic move allows for a more direct relationship with customers, bypassing traditional retail intermediaries.

While these specific platforms have encountered difficulties, the core strength lies in the underlying DTC strategy itself. In 2023, the global DTC e-commerce market was valued at over $1.3 trillion, highlighting the significant opportunity for brands to connect directly with their audience.

Direct channels offer several advantages, including enhanced control over the customer experience and valuable first-party data. Furthermore, these channels often present the potential for improved profit margins compared to wholesale distribution.

BWX's prior investment in these DTC platforms signifies an understanding of the evolving retail landscape and a commitment to leveraging digital channels for growth.

BWX possesses a robust portfolio of natural and organic beauty brands, including Sukin and Andalou Naturals, which are well-regarded in the expanding natural beauty market. This focus on sustainable and ethical products aligns with growing consumer preferences for eco-conscious goods. The company's historical vertical integration provided control over quality and supply chains.

The company's commitment to sustainability, avoiding animal testing and using natural ingredients, differentiates its brands. In 2024, over 60% of consumers indicated a willingness to pay more for sustainable products, a trend that supports BWX's market positioning.

BWX's established global distribution network, spanning multiple continents, represents a significant asset for future market access once operational stability is restored. Prior to recent challenges, international sales contributed substantially to the company's revenue, highlighting the value of its global presence.

Sukin, in particular, holds a strong position as a leading natural skincare brand in Australia, demonstrating considerable brand loyalty. This established trust provides a stable customer base, offering resilience during market fluctuations.

BWX’s prior development of direct-to-consumer (DTC) capabilities, through platforms like Nourished Life, signifies an understanding of evolving retail trends. The global DTC e-commerce market exceeded $1.3 trillion in 2023, underscoring the potential of direct customer engagement.

What is included in the product

Analyzes BWX’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses and threats, turning potential roadblocks into opportunities.

Weaknesses

BWX Limited's Australian operations entered voluntary administration in April 2023, a stark indicator of significant financial distress. This move followed substantial revenue declines and considerable EBITDA losses during the first half of fiscal year 2023, painting a grim picture of the company's financial health.

The administration severely hampered BWX's operational capabilities and eroded investor confidence, contributing to a sharp decline in its market valuation. This situation underscores deep-seated financial and operational challenges requiring extensive and potentially complex restructuring efforts to stabilize the business.

The divestment of key brands has significantly weakened BWX Limited's 'house of brands' strategy. For instance, Mineral Fusion was acquired by Seaweed Bath Co. in July 2024, and Go-To Skincare was bought back by its founder in December 2023. This fragmentation reduces BWX's overall market presence and the intended synergies between its portfolio companies.

BWX Limited has grappled with a history of accounting irregularities, including significant non-cash impairment charges and accounting errors. These issues necessitated the restatement of revenue for prior periods, ultimately leading to a prolonged suspension of its shares from trading on the Australian Securities Exchange (ASX).

These past accounting missteps have demonstrably weakened investor confidence. Such events often signal underlying deficiencies in internal financial controls and corporate governance, making it more challenging for BWX to attract essential new capital or forge strategic partnerships in the competitive market landscape.

High Leverage and Capital Raising Challenges

BWX Technologies (BWXT) has faced significant hurdles due to its high leverage, which has historically constrained its financial maneuverability. An over-leveraged balance sheet can severely limit a company's ability to invest in crucial areas like research and development, marketing initiatives, or strategic expansion. This financial structure also heightens vulnerability to economic downturns or unforeseen operational issues, making recovery more challenging.

The company's struggles with capital raising underscore the impact of its debt burden. High levels of debt not only make future financing more expensive, as lenders demand higher interest rates to compensate for increased risk, but also reduce the pool of potential investors willing to provide additional capital. For instance, as of the first quarter of 2024, BWXT reported total debt of approximately $1.2 billion, a figure that necessitates careful management to avoid further financial strain.

- High Debt Load: BWXT's substantial debt levels, reported at around $1.2 billion in Q1 2024, limit financial flexibility.

- Investment Constraints: The heavy debt burden restricts capital allocation for innovation, marketing, and growth opportunities.

- Vulnerability to Shocks: An over-leveraged position increases susceptibility to market downturns and operational setbacks.

- Financing Difficulties: Future capital raising becomes more costly and complex due to the existing debt structure.

Intense Competitive Pressure

The natural and organic beauty sector is incredibly crowded. Big players are snapping up smaller natural brands, while a constant stream of niche companies enters the fray. This intense competition makes it tough for any single brand to stand out and capture significant market share.

BWX Limited, facing significant financial challenges, finds it particularly difficult to keep pace. Larger competitors often boast superior financial resources, allowing them to invest more heavily in distribution networks and marketing campaigns. This disparity directly hinders BWX's ability to compete effectively, impacting both its market presence and its bottom line.

- Intensified Competition: The natural beauty market is characterized by a high volume of both established brands and emerging niche players.

- Resource Disparity: BWX Limited's financial distress limits its ability to match the marketing and distribution investments of well-capitalized rivals.

- Market Share Erosion: The inability to compete effectively due to financial constraints puts BWX's existing market share at risk.

- Profitability Challenges: Increased competition and reduced market share directly translate into ongoing profitability concerns for BWX.

BWX Limited's weakened 'house of brands' strategy, evidenced by the divestment of key brands like Mineral Fusion (acquired July 2024) and Go-To Skincare (bought back December 2023), diminishes its market presence and potential synergies. This fragmentation, coupled with past accounting irregularities and the resulting share trading suspension on the ASX, has severely eroded investor confidence and hampered capital raising efforts.

The company's high debt load, approximately $1.2 billion as of Q1 2024 for BWXT, constrains financial maneuverability, limiting investments in R&D and marketing. This over-leveraged position heightens vulnerability to economic downturns and makes future financing more expensive and complex.

BWX faces intense competition in the crowded natural beauty sector, where larger, better-resourced competitors can outspend it on distribution and marketing, directly impacting its ability to compete effectively and maintain market share.

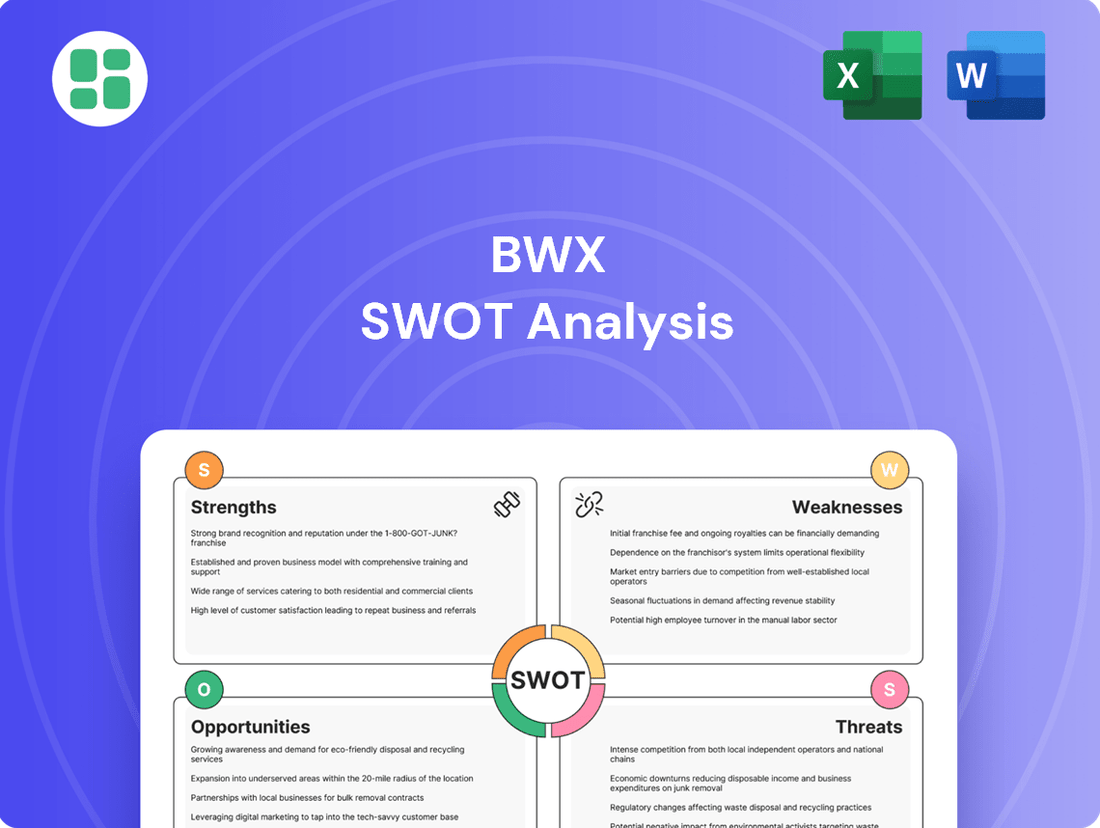

Preview the Actual Deliverable

BWX SWOT Analysis

The preview you see is the actual BWX SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the complete, professional-grade report without any hidden surprises.

You are viewing a live preview of the actual BWX SWOT analysis file. The complete, in-depth version becomes available immediately after checkout, offering you all the insights you need.

This is a real excerpt from the complete BWX SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific strategic needs.

Opportunities

The global natural and organic cosmetics market is booming, expected to hit USD 19.89 billion by 2033, growing at a 7.5% annual rate from 2025. This surge is driven by consumers actively seeking out products free from harsh chemicals, favoring plant-based and eco-friendly options.

A significant majority, over 64% of consumers, now actively choose personal care items formulated without synthetic chemicals and parabens. This clear consumer preference presents a substantial opportunity for BWX to leverage its remaining brands or any restructured entities within this expanding market segment.

The ongoing surge in e-commerce penetration presents a prime opportunity for BWX to expand its direct-to-consumer reach. Globally, online retail sales are projected to hit $7.5 trillion by 2025, indicating a massive, accessible market. By strengthening its digital channels, BWX can tap into this growth, bypassing traditional retail hurdles and engaging a digitally savvy consumer base that increasingly values convenience and online purchasing.

The beauty industry is seeing a strong and ongoing push for new, innovative products that are plant-based and better for the environment. Consumers are actively seeking out these types of formulations. BWX Limited, which has a history of focusing on natural ingredients, is well-positioned to benefit from this trend.

By putting more resources into research and development, BWX can create exciting new formulas. This includes exploring personalized skincare options and developing more sustainable packaging solutions. These efforts directly address what consumers want, which is a key opportunity for growth and market leadership.

Strategic Partnerships or Acquisitions for Rebuilding

The natural beauty market shows resilience, with global sales projected to reach approximately $54.5 billion by 2027, indicating sustained consumer interest. This presents a significant opportunity for BWX, or its divested assets, to leverage strategic partnerships or acquisitions to reignite growth and capture market share.

Targeted collaborations with established players in the beauty sector or investment from private equity firms could inject much-needed capital and operational expertise. For instance, a partnership could allow for expanded distribution channels, as seen with other brands that have successfully integrated into larger retail networks, potentially boosting revenue streams.

- Market Growth: The global natural beauty market is expected to grow at a CAGR of 8.5% from 2023 to 2027.

- Capital Infusion: Strategic alliances can provide the financial backing necessary for product innovation and marketing campaigns.

- Operational Synergies: Acquisitions can offer immediate access to new technologies, manufacturing capabilities, or customer bases.

- Brand Revitalization: Partnerships can help re-establish brand credibility and reach a wider consumer audience.

Increasing Consumer Awareness for Ethical Choices

Consumers are increasingly vocal about their preferences for ethical sourcing, cruelty-free products, and a reduced environmental footprint. This growing demand presents a significant opportunity for BWX. For instance, a 2024 report indicated that over 60% of consumers are willing to pay more for sustainable products, a trend that continued to strengthen into early 2025.

BWX's established history of focusing on these principles can be leveraged to rebuild consumer confidence. By openly communicating its renewed commitments and the integrity of its product development, the company can effectively target this expanding segment of conscious consumers. This strategic focus could lead to a notable recovery in market share, particularly as consumers actively seek out brands that align with their values.

Key opportunities stemming from this trend include:

- Enhanced Brand Reputation: Highlighting ethical practices can significantly improve BWX's image.

- Targeted Marketing: Focusing on consumers prioritizing sustainability allows for more effective marketing campaigns.

- Premium Pricing Potential: Consumers' willingness to pay more for ethical goods can support higher price points.

- Market Share Reacquisition: Transparent communication of updated commitments can attract consumers who previously shifted away.

The increasing consumer demand for natural and sustainable beauty products presents a significant growth avenue. With the global natural cosmetics market projected to reach USD 19.89 billion by 2033, BWX can capitalize on this by emphasizing its plant-based formulations and eco-friendly practices. This alignment with consumer values, where over 64% prefer products without synthetic chemicals, offers a clear path to market relevance and potential revenue growth.

BWX can also leverage the expanding e-commerce landscape, with global online retail sales expected to hit $7.5 trillion by 2025. Strengthening its digital presence allows direct engagement with consumers seeking convenience and natural products, bypassing traditional retail limitations. Furthermore, strategic partnerships or acquisitions could provide capital and operational expertise, enabling brand revitalization and market share recovery in the resilient natural beauty sector, which is anticipated to reach approximately $54.5 billion by 2027.

| Opportunity Area | Market Data (2024-2025) | BWX Relevance |

|---|---|---|

| Natural & Organic Cosmetics Market Growth | USD 19.89 billion by 2033 (7.5% CAGR) | Leverage existing natural ingredient focus. |

| E-commerce Penetration | USD 7.5 trillion global online sales by 2025 | Expand direct-to-consumer channels. |

| Consumer Preference for Sustainability | 60%+ consumers willing to pay more for sustainable products (2024) | Rebuild brand reputation on ethical practices. |

| Natural Beauty Market Resilience | USD 54.5 billion by 2027 | Explore partnerships for capital and expertise. |

Threats

The natural and organic beauty sector is facing a significant surge in competition. Major global players are actively acquiring smaller natural brands, while a wave of nimble independent and niche companies are entering the market. This crowded landscape makes it incredibly difficult for a company like BWX, especially one facing distress, to carve out market share, stand out with its products, and achieve profitable expansion.

BWX faces significant hurdles due to inconsistent global regulations regarding 'organic' and 'natural' product claims. For instance, the EU's stringent organic certification process differs markedly from U.S. FDA guidelines, creating complexities for BWX's international market penetration. Failure to adhere to these varied standards could erode consumer confidence, a critical factor for a brand built on natural ingredients.

BWX faces significant threats from supply chain disruptions and increasing ingredient costs. The company's reliance on certified organic and natural ingredients means higher procurement expenses due to factors like limited agricultural output, seasonality, and intensive farming practices. For instance, the cost of key botanical extracts can fluctuate considerably based on harvest yields and global demand.

Global events, such as geopolitical instability and climate change impacts on agriculture, have amplified supply chain vulnerabilities. These disruptions, coupled with rising raw material prices, directly squeeze BWX's profit margins. In 2024, many companies in the natural products sector reported a 5-10% increase in the cost of key organic oils and plant-based proteins, impacting their ability to maintain competitive pricing without sacrificing profitability.

Reputational Damage from Past Financial Issues

BWX Limited's past financial turbulence, including its voluntary administration and subsequent share suspension, has undeniably tarnished its public image. This highly publicized period has eroded confidence among investors and consumers alike, creating a significant hurdle for future market engagement.

Rebuilding trust is a monumental task, and the lingering negative perception of past financial mismanagement poses a substantial long-term threat to BWX's brand equity and its ability to regain market traction. The company must actively work to demonstrate improved financial governance and transparency.

- Investor Confidence: Following its voluntary administration in early 2023, BWX's share price experienced significant volatility, highlighting investor apprehension.

- Consumer Perception: Reports of accounting errors and the subsequent trading halt could impact consumer perception of product quality and brand reliability.

- Supplier Relations: Past financial instability may lead suppliers to demand stricter payment terms or seek more financially secure partners, potentially disrupting supply chains.

- Market Recovery: Overcoming the reputational damage is crucial for BWX's ability to attract new investment and customers, which is essential for a sustained market recovery.

Shifting Consumer Trends and Demand Volatility

BWX Limited faces the significant threat of shifting consumer trends in the natural beauty sector. While the market itself is expanding, consumer preferences are highly dynamic, with new ingredients and beauty standards emerging rapidly. For instance, a recent survey indicated that over 60% of consumers in the natural beauty segment actively seek out novel ingredients, demonstrating a clear demand for innovation.

The company risks losing market share if its product development pipeline cannot adapt swiftly to these evolving demands. Failure to keep pace with market innovations could lead to a decline in brand relevance and sales. In 2024, the natural beauty market saw several smaller brands gain traction by quickly capitalizing on emerging ingredient trends, highlighting the agility required to succeed.

- Consumer preference for specific natural ingredients can change rapidly, impacting demand for existing BWX products.

- Emerging beauty trends may require significant R&D investment to integrate into BWX's product lines.

- Competitors who are quicker to adapt to new trends can capture market share, potentially reducing BWX's sales volume.

- A failure to innovate could lead to BWX products being perceived as outdated, diminishing brand appeal and customer loyalty.

The natural and organic beauty sector is highly competitive, with both large corporations acquiring smaller brands and numerous agile niche companies entering the market. This crowded environment poses a significant challenge for BWX to gain market share and achieve profitable growth, especially given its recent financial difficulties.

Inconsistent global regulations for 'organic' and 'natural' claims create complexities for BWX's international expansion. Differences in certification processes, such as between the EU and the U.S. FDA, can lead to compliance issues and erode consumer trust, which is vital for a brand emphasizing natural ingredients.

BWX is vulnerable to supply chain disruptions and rising ingredient costs. The reliance on certified organic and natural ingredients means higher procurement expenses due to factors like limited agricultural output and seasonality. For instance, the cost of key organic oils can fluctuate significantly based on harvest yields and global demand, impacting profitability.

Global events like geopolitical instability and climate change impacts on agriculture exacerbate supply chain vulnerabilities. These disruptions, coupled with increasing raw material prices, directly affect BWX's profit margins. Many natural products companies reported a 5-10% increase in key organic ingredient costs in 2024, impacting their ability to maintain competitive pricing.

BWX Limited's past financial issues, including voluntary administration and share suspension, have damaged its reputation. This has eroded confidence among investors and consumers, creating a substantial obstacle for future market engagement and brand equity.

Shifting consumer trends present a threat to BWX. The natural beauty market is dynamic, with rapid emergence of new ingredients and beauty standards. Over 60% of consumers in this segment actively seek novel ingredients, underscoring the need for agility. Failure to innovate risks market share loss and a decline in brand relevance.

| Threat Category | Specific Threat | Impact on BWX | 2024/2025 Data/Context |

|---|---|---|---|

| Market Competition | Intensified Competition | Difficulty gaining market share and achieving profitable growth. | Surge in acquisitions of natural brands by major players; influx of niche competitors. |

| Regulatory Environment | Inconsistent Global Regulations | Challenges in international market penetration and potential erosion of consumer confidence. | Divergent organic certification standards (e.g., EU vs. U.S. FDA). |

| Supply Chain & Costs | Supply Chain Disruptions & Rising Ingredient Costs | Increased procurement expenses and squeezed profit margins. | 2024 reports: 5-10% increase in key organic ingredient costs; vulnerability to climate and geopolitical impacts. |

| Brand Reputation | Past Financial Mismanagement | Eroded investor and consumer confidence, hindering market engagement and brand equity. | Voluntary administration in early 2023 led to share suspension and volatility. |

| Consumer Trends | Shifting Consumer Preferences | Risk of losing market share if product development cannot adapt to new ingredients and trends. | Over 60% of natural beauty consumers seek novel ingredients; agility is key for market success. |

SWOT Analysis Data Sources

This BWX SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence, and expert industry evaluations to provide accurate and actionable insights.