Britax Childcare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Britax Childcare Bundle

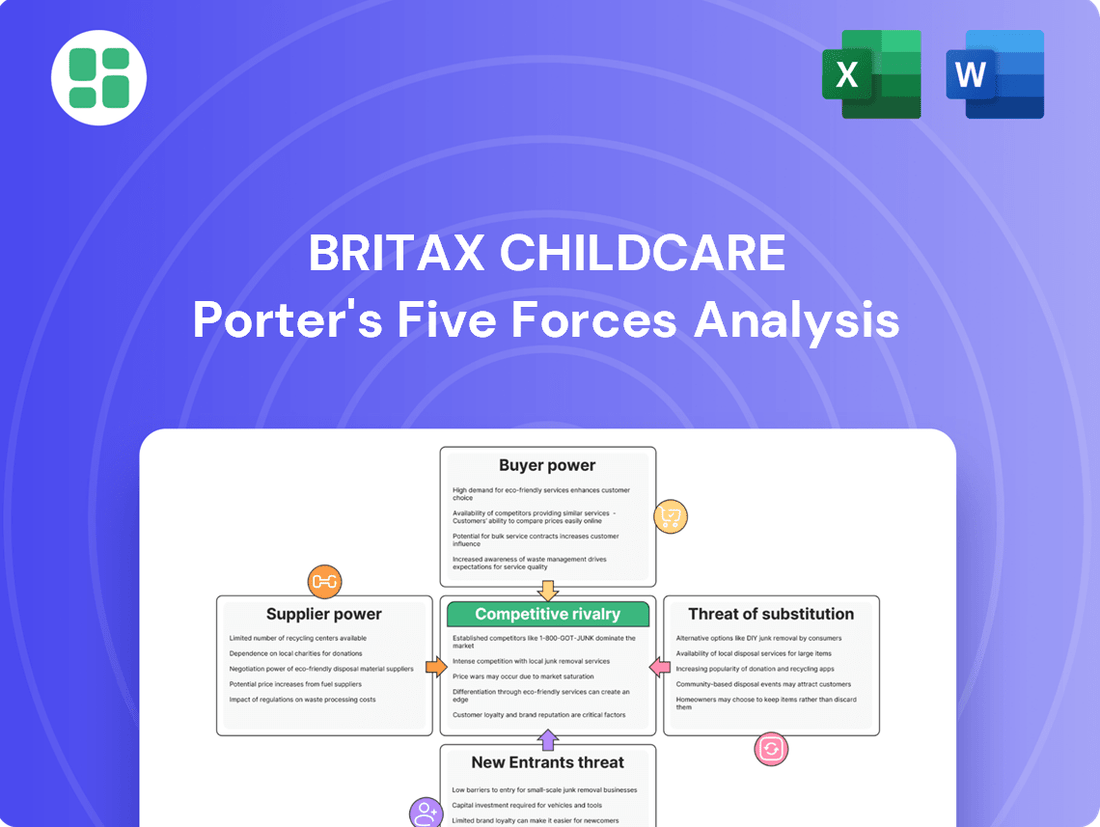

Britax Childcare faces a dynamic competitive landscape, with moderate buyer power and significant threat from substitutes like rental services. Understanding these forces is crucial for strategic positioning.

The full report reveals the real forces shaping Britax Childcare’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Britax Childcare sources essential materials such as plastics, fabrics, metals, and electronic components from a diverse supplier base. The concentration of suppliers for critical, often patented, safety mechanisms significantly influences their bargaining power.

For instance, if a limited number of suppliers provide advanced impact absorption materials or proprietary harness systems, Britax faces heightened supplier leverage. In contrast, the availability of multiple sources for more commoditized materials like standard fabrics or metals dilutes supplier influence.

Britax faces significant switching costs when sourcing specialized components or custom-designed parts for its car seats and strollers. Re-engineering, re-tooling, and obtaining new certifications to meet rigorous safety regulations can add substantial expense and time, strengthening the bargaining power of existing suppliers who offer these unique or integrated solutions. For instance, the development and testing of a new impact-absorbing foam technology could take over a year and cost hundreds of thousands of dollars to implement with a new supplier.

Suppliers offering unique, patented safety technologies or specialized, high-performance materials, such as advanced impact-absorbing foams, wield significant bargaining power. Britax Childcare's emphasis on safety, innovation, and quality implies a potential dependence on these differentiated inputs, especially if alternative sources are scarce.

Threat of Forward Integration by Suppliers

If a key supplier were to realistically enter the child safety product market themselves, they would gain substantial bargaining power over Britax. This scenario, while a theoretical threat, is generally less probable for highly specialized component manufacturers. The significant regulatory hurdles, substantial brand building efforts, and established distribution networks necessary to compete in the finished goods market present considerable barriers to entry.

The threat of forward integration by suppliers for a company like Britax Childcare is a nuanced consideration. While a supplier entering the market directly would undoubtedly increase their leverage, the practicalities are often challenging. For instance, a manufacturer of advanced airbag inflators, a critical component in car seats, would face immense challenges in establishing a recognized brand and distribution channel for complete child safety seats, especially given the stringent safety certifications and consumer trust required.

Consider the automotive component industry, a close parallel. While some large Tier 1 suppliers have explored expanding into vehicle assembly, this is a rare occurrence and requires massive capital investment and a complete shift in business model. For Britax, a supplier of, say, specialized impact-absorbing foam would likely find it more profitable to focus on their core competency rather than navigate the complex, capital-intensive process of designing, manufacturing, marketing, and distributing finished car seats.

- Supplier Forward Integration Barrier: High regulatory compliance and brand trust required in the child safety market make direct competition by component suppliers difficult.

- Specialized Component Focus: Suppliers of niche components, such as advanced buckle mechanisms or proprietary fabric technologies, are less likely to integrate forward due to the complexity and cost of entering the finished product market.

- Industry Capital Requirements: The child safety product industry demands significant investment in research and development, safety testing, and marketing, posing a substantial hurdle for component manufacturers looking to transition.

Importance of Britax to Suppliers

For large, diversified material suppliers, Britax might represent a smaller portion of their overall revenue, giving them less incentive to concede on pricing or terms. This dynamic means Britax may have less leverage in negotiating favorable deals with these major players.

Conversely, for smaller, niche component suppliers specializing in child safety technology, Britax could be a significant customer. In such cases, the supplier's bargaining power is reduced because Britax represents a substantial portion of their business, making them more willing to meet Britax's demands.

- Supplier Concentration: The number of suppliers for key components and raw materials significantly impacts their bargaining power.

- Importance of Britax to Suppliers: If Britax is a minor client for a supplier, the supplier has more power. If Britax is a major client, the supplier's power is diminished.

- Switching Costs for Britax: The ease or difficulty Britax faces in switching to alternative suppliers influences supplier leverage. High switching costs empower suppliers.

- Supplier Differentiation: Unique or highly specialized components provided by suppliers can increase their bargaining power.

The bargaining power of suppliers for Britax Childcare is influenced by several factors, including supplier concentration, the uniqueness of their offerings, and Britax's own switching costs. For instance, in 2024, the global market for advanced polymer compounds used in impact-resistant car seat shells saw consolidation, with key suppliers like SABIC and Covestro holding significant market share, potentially increasing their leverage over manufacturers like Britax.

Britax's reliance on specialized, often patented, safety components, such as advanced buckle systems or proprietary fabric technologies, grants these suppliers considerable power. The high costs and lengthy timelines associated with re-qualifying and integrating new suppliers for these critical elements, potentially running into hundreds of thousands of dollars and over a year for new safety certifications, reinforce this dynamic.

Conversely, for more commoditized materials like standard textiles or metals, where multiple suppliers exist, Britax faces less supplier pressure. However, the overall threat from suppliers is moderated by the substantial barriers to entry in the finished child safety product market, including rigorous safety regulations and the need for strong brand trust, making forward integration by suppliers a less probable scenario.

| Factor | Impact on Britax | Example (2024 Scenario) |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Few suppliers for advanced impact-absorbing foams. |

| Switching Costs | High switching costs empower suppliers. | Re-tooling and re-certification for proprietary harness systems. |

| Supplier Differentiation | Unique offerings increase supplier power. | Patented safety mechanisms or specialized materials. |

| Importance of Britax to Supplier | Britax as a minor client increases supplier power. | Large material suppliers where Britax is a small customer. |

What is included in the product

This analysis delves into the competitive forces impacting Britax Childcare, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the child safety product market.

Effortlessly identify and mitigate competitive threats with a visually intuitive breakdown of each Porter's Five Forces, making strategic planning a breeze.

Customers Bargaining Power

Customers for child car seats and strollers, while heavily prioritizing safety, also exhibit significant price sensitivity. This is particularly true in a market flooded with numerous brands and models, making it easier for consumers to shop around.

The widespread availability of online comparison tools and customer reviews further amplifies price transparency. This empowers buyers to readily identify the most competitive pricing and available discounts, directly impacting Britax's pricing power.

For instance, in 2024, the average price for a convertible car seat in the US ranged from $200 to $400, with many consumers actively seeking deals. This indicates a clear willingness to compare options based on price alongside safety features.

The child safety market is brimming with options. Consumers can easily find alternatives from brands like Graco, Chicco, and UPPAbaby, offering a variety of features and price points. This abundance of choice means customers aren't tied to Britax and can readily switch if they find better value elsewhere, directly impacting Britax's pricing power.

The digital age has dramatically shifted the balance of power towards consumers, particularly in the childcare sector where safety and quality are paramount. With the proliferation of e-commerce platforms and readily available online reviews, customers now possess unprecedented access to detailed product information. This includes everything from safety ratings and comparative analyses to unfiltered peer feedback, allowing them to make highly informed purchasing decisions.

This wealth of readily accessible data empowers customers to exert significant pressure on manufacturers like Britax Childcare regarding both pricing and product features. For instance, a 2024 survey indicated that over 75% of parents research child safety products extensively online before buying, often comparing multiple brands based on independent safety tests and user reviews. This transparency forces companies to be more competitive and responsive to consumer demands.

Concentration of Customers

Britax Childcare's customer base is diverse, with distribution occurring globally through numerous retailers and online platforms. This includes major hypermarkets, specialized baby stores, and prominent e-commerce sites.

The concentration of customers, particularly large retail chains and dominant online marketplaces, significantly impacts Britax. These entities wield considerable bargaining power due to their substantial purchasing volumes and their direct control over reaching the end consumer.

- Retailer Influence: Large retailers like Walmart or Target, which represent a significant portion of Britax's sales, can negotiate favorable terms due to the sheer volume of products they purchase.

- E-commerce Dominance: Platforms such as Amazon, where a vast number of consumers shop for baby products, can also leverage their market position to influence pricing and product availability.

- Fragmented Smaller Buyers: While individual consumers have minimal power, the collective purchasing power of smaller, independent retailers, though less impactful individually, can still contribute to market dynamics.

Switching Costs for Customers

For individual consumers, the effort to switch between car seat or stroller brands is generally minimal. It mostly involves time spent researching alternatives rather than incurring significant financial penalties or facing complex setup procedures.

This low barrier to switching directly impacts Britax's bargaining power. Customers can easily explore and move to competitor offerings if Britax's pricing, product features, or perceived quality don't align with their desires. For instance, in 2024, the average consumer spent approximately 3-5 hours researching a major purchase like a car seat, with a significant portion of that time dedicated to comparing features and prices across brands.

- Low Financial Switching Costs: Customers don't face substantial fees or lost investments when changing car seat or stroller brands.

- Information Accessibility: Online reviews, comparison sites, and readily available product information make it easy for consumers to evaluate alternatives.

- Impact on Britax: Britax must remain competitive in price, innovation, and quality to retain customers who can easily switch to rivals.

Britax faces significant customer bargaining power due to high price sensitivity and the ease with which consumers can switch brands. The abundance of choices in the child safety market, coupled with readily available online information and reviews, empowers buyers to compare prices and features extensively. This dynamic forces Britax to maintain competitive pricing and product innovation to retain its customer base.

For example, in 2024, the average price for a convertible car seat in the US was between $200 and $400, with consumers actively seeking discounts. This highlights a clear tendency to prioritize value, making switching between brands with minimal financial or procedural barriers a common consumer behavior.

The concentration of purchasing power among large retailers and dominant e-commerce platforms like Amazon further amplifies customer bargaining power. These entities can negotiate favorable terms with Britax due to their substantial sales volumes and direct access to the end consumer, influencing pricing and product availability.

| Factor | Impact on Britax | 2024 Data/Trend |

|---|---|---|

| Price Sensitivity | High | Average convertible car seat price: $200-$400; consumers seek deals. |

| Availability of Alternatives | High | Numerous brands (Graco, Chicco, UPPAbaby) offer comparable products. |

| Switching Costs | Low | Minimal financial penalty or complex procedures for consumers to change brands. |

| Information Accessibility | High | Over 75% of parents research extensively online; comparison tools and reviews are prevalent. |

| Retailer Concentration | Moderate to High | Large retailers (Walmart, Target) and e-commerce platforms (Amazon) wield significant influence. |

Preview Before You Purchase

Britax Childcare Porter's Five Forces Analysis

This preview showcases the complete Britax Childcare Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

The child car seat and stroller market is exceptionally crowded. Major global brands such as Maxi-Cosi, Chicco, Graco, Cybex, and Nuna are constantly battling for consumer attention and market share, alongside a multitude of smaller, niche manufacturers. This sheer volume and variety of competitors significantly heats up the rivalry within the industry.

The global baby car seat market is expected to grow at a compound annual growth rate (CAGR) of 4.9% to 7.4% between 2024 and 2029, with the stroller market projected to see a CAGR of 4.2% to 6.01% from 2025 to 2034. This signifies a moderate pace of expansion for the industry.

While this growth is encouraging, it may not be substantial enough to allow all existing players to thrive without intense competition for market share. Companies will likely need to differentiate themselves and capture a larger portion of this expanding, but not explosively growing, market.

Britax Childcare positions itself through a strong emphasis on safety, innovation, and superior quality, setting its products apart in the market. This focus on core values acts as a significant differentiator for the brand.

The competitive landscape is characterized by substantial investments in research and development by rivals. Companies are actively introducing novel features, integrating smart technologies like sensors and app connectivity, and refining ergonomic designs. This continuous product innovation fuels intense competition, where success often hinges on advanced features and a strong perception of safety.

Exit Barriers

Britax Childcare faces substantial exit barriers due to the immense capital required for its specialized manufacturing facilities and rigorous safety testing protocols. Companies like Britax invest heavily in advanced production lines and research and development to meet stringent global safety standards, such as those set by the National Highway Traffic Safety Administration (NHTSA) in the US or the European Union's ECE R44/04 and R129 regulations. These sunk costs make it economically unfeasible for many to simply shut down operations when market conditions become unfavorable.

The significant investment in specialized R&D, particularly in areas like impact absorption materials and ergonomic design, further entrenches companies within the child safety product sector. For example, developing innovative features that comply with evolving safety mandates, such as extended rear-facing capabilities or improved side-impact protection, requires ongoing financial commitment. This commitment discourages exiting the market, even if profitability dips, as the specialized knowledge and infrastructure are not easily transferable.

Regulatory compliance acts as another formidable exit barrier. Child car seats and related products are subject to constant updates and stringent certification processes worldwide. Companies must maintain compliance with evolving standards, which necessitates continuous investment in product redesign and testing. Failure to do so can result in product recalls or market bans, making it difficult to divest from the industry without incurring significant losses.

- High Capital Investment: Manufacturing child safety products requires significant upfront investment in specialized machinery and facilities, often exceeding tens of millions of dollars for a single production line.

- Specialized R&D Costs: Companies like Britax allocate substantial resources to research and development, with annual R&D spending potentially reaching millions to ensure compliance with evolving safety standards and innovate product features.

- Regulatory Compliance Burden: Adhering to global safety regulations, such as those from NHTSA or European agencies, involves ongoing costs for testing, certification, and product modifications, representing a continuous financial commitment.

- Sunk Costs Impact: The substantial sunk costs associated with specialized assets and intellectual property make it economically challenging for companies to exit the market, potentially leading to prolonged periods of intense competition even in less profitable times.

Brand Identity and Loyalty

Britax has cultivated a robust brand identity centered on safety and quality, fostering significant customer loyalty. This strong reputation, built over years of consistent product performance, acts as a considerable barrier to new entrants. For instance, Britax has consistently been a top-rated brand in independent safety tests, a key driver of consumer trust.

However, the competitive landscape is intense, with other established brands like Graco and Chicco also commanding strong market presence and customer allegiance. These competitors frequently invest heavily in marketing campaigns and product innovation, directly challenging Britax's customer retention. The market in 2024 saw significant promotional activity from major players, indicating the ongoing need for Britax to reinforce its brand messaging and loyalty programs.

- Brand Equity: Britax's long history in the childcare sector has allowed it to build substantial brand equity, translating into higher customer retention rates compared to less established brands.

- Competitive Marketing: Competitors like Graco and Chicco are actively engaged in aggressive marketing and promotional activities, often highlighting their own safety features and competitive pricing, which can sway consumer choices.

- Innovation Investment: Continuous investment in research and development to introduce new safety technologies and user-friendly designs is crucial for Britax to maintain its competitive edge and brand perception.

- Customer Loyalty Programs: Implementing effective customer loyalty programs and engaging post-purchase support can further solidify Britax's relationship with its customer base, mitigating the impact of competitor marketing efforts.

The competitive rivalry in the child car seat and stroller market is fierce, with numerous global and niche brands vying for market share. This intense competition is fueled by continuous product innovation, with companies heavily investing in R&D to introduce advanced safety features and smart technologies. Britax Childcare, while benefiting from strong brand loyalty built on safety and quality, faces constant challenges from well-established competitors like Graco and Chicco, who actively engage in aggressive marketing and promotional activities.

The market's projected growth, with the baby car seat segment expected to grow between 4.9% and 7.4% CAGR from 2024-2029, indicates a healthy expansion, but not one that easily absorbs all players without significant competition for consumers. This necessitates continuous differentiation and strategic marketing to capture a larger portion of the available market.

Companies like Britax must navigate a landscape where competitors are not only innovating but also actively promoting their offerings, often emphasizing competitive pricing and unique safety attributes. The need for Britax to reinforce its brand messaging and loyalty programs is paramount in this dynamic environment.

The high capital investment required for specialized manufacturing, coupled with significant R&D and regulatory compliance costs, creates substantial exit barriers. These factors contribute to prolonged periods of intense competition, even if profitability fluctuates, as companies are largely committed to the sector.

| Competitor | Estimated Market Share (2024) | Key Differentiators | Recent Innovations |

|---|---|---|---|

| Britax Childcare | ~5-7% (Global estimate) | Safety focus, premium quality, established brand | Continued emphasis on advanced harness systems and impact absorption |

| Graco | ~10-15% (Global estimate) | Value pricing, wide product range, widespread availability | Integration of lighter materials, enhanced ease-of-use features |

| Chicco | ~7-10% (Global estimate) | Stylish design, European influence, focus on infant travel systems | Development of modular travel systems, sustainable material options |

| Maxi-Cosi | ~6-9% (Global estimate) | Premium design, safety innovation, travel system compatibility | Advanced side-impact protection, user-friendly installation systems |

SSubstitutes Threaten

While direct safety substitutes for car seats are limited by stringent regulations, indirect alternatives like public transport or ride-sharing services, especially those not equipped with specialized child seats, can emerge as substitutes. This is particularly true if Britax's offerings are viewed as prohibitively expensive by consumers. For instance, in 2024, the average cost of a premium Britax car seat could range from $300 to $500, making public transit a more budget-friendly option for some families, despite the inherent safety trade-offs.

The threat of substitutes for Britax Childcare products, particularly car seats, is relatively low due to significant switching costs. For car seats, regulatory mandates in most developed nations make true substitutes virtually non-existent for safe and legal transportation of children.

For other products like strollers, switching to non-traditional substitutes such as baby carriers or opting for cheaper, less regulated alternatives carries perceived costs related to safety and convenience. In 2023, the global baby care market, which includes car seats and strollers, was valued at over $100 billion, indicating a substantial investment by consumers in specialized products.

Britax Childcare's emphasis on safety, innovation, and quality is designed to build a strong perceived value, making parents less likely to switch to cheaper alternatives. This strategy aims to differentiate their offerings and justify a premium price point.

However, economic pressures can significantly impact this. For instance, during periods of high inflation or recession, parents might be more inclined to consider budget-friendly options or even pre-owned car seats, despite potential compromises on perceived safety or advanced features. This was evident in 2023, where consumer spending on non-essential goods saw a slowdown in many markets.

Availability of Indirect Substitutes

For strollers, the availability of indirect substitutes like baby carriers and wraps can significantly impact demand. These alternatives are particularly relevant for short distances or specific environments where the close contact and enhanced portability they offer are advantageous. For instance, a parent might opt for a baby wrap for a quick trip to the grocery store or a walk in a crowded park, thereby reducing the need for a stroller in those instances.

These substitutes, while not a perfect replacement for all stroller functions, can chip away at the market share for certain types of strollers. The market for baby carriers and wraps has seen steady growth, with global sales reaching an estimated USD 1.5 billion in 2023, indicating a notable consumer preference for these alternatives.

- Baby carriers and wraps offer portability and close physical contact, serving as alternatives for short trips.

- This can reduce demand for specific stroller types, impacting market share.

- The global baby carrier and wrap market was valued at approximately USD 1.5 billion in 2023.

Regulatory Environment and Safety Standards

The threat of substitutes for Britax Childcare is significantly lowered by stringent regulatory environments and safety standards governing child car seats and strollers. These regulations, which are regularly updated and rigorously enforced worldwide, effectively eliminate low-quality or unregulated alternatives from the market.

For instance, in the United States, the National Highway Traffic Safety Administration (NHTSA) sets Federal Motor Vehicle Safety Standards (FMVSS) for car seats. In 2024, NHTSA continued its commitment to child passenger safety, emphasizing proper installation and adherence to these standards, which inherently makes non-compliant products an unacceptable substitute.

- Global Harmonization Efforts: Organizations like the United Nations Economic Commission for Europe (UNECE) work towards harmonizing safety standards globally, further reducing the appeal of non-certified products.

- Mandatory Certification: Many jurisdictions require specific certifications, such as ECE R44/04 or R129 (i-Size) in Europe, making it difficult for unsubstantiated products to compete.

- Consumer Awareness: Increased consumer awareness, driven by safety campaigns and media coverage of recalls, reinforces the demand for certified, high-quality products, diminishing the threat of substitutes.

The threat of substitutes for Britax Childcare is generally low, especially for car seats, due to strict safety regulations and high switching costs associated with ensuring child safety. While budget constraints might push some consumers towards cheaper or used options, the perceived risk often deters them from non-certified alternatives.

For strollers, however, indirect substitutes like baby carriers and wraps present a more tangible threat, particularly for parents seeking convenience for shorter outings. The global baby carrier and wrap market's valuation of approximately USD 1.5 billion in 2023 highlights a growing consumer adoption of these alternatives.

The premium pricing of Britax products, with car seats ranging from $300 to $500 in 2024, can make public transport or ride-sharing services appear more appealing to budget-conscious families, despite the inherent safety trade-offs for children.

| Product Category | Primary Substitute | Estimated 2023 Market Value (USD) | Key Differentiator |

|---|---|---|---|

| Car Seats | Public Transport/Ride-Sharing (unfitted) | N/A (Indirect) | Cost Savings vs. Safety Compliance |

| Strollers | Baby Carriers/Wraps | 1.5 Billion | Portability/Close Contact vs. Full Coverage |

Entrants Threaten

The child car seat and stroller market demands significant upfront capital. Companies need to invest heavily in research and development, sophisticated design, rigorous safety testing, and establishing robust manufacturing capabilities. For instance, developing a new car seat model can cost millions of dollars, encompassing advanced crash-testing simulations and materials science.

These high capital requirements act as a formidable barrier for potential new entrants. Building brand recognition and securing necessary certifications, like those from NHTSA in the US or ECE R44 in Europe, also adds to the substantial initial investment, deterring smaller players from entering the competitive landscape.

The child safety product industry faces significant regulatory hurdles, acting as a strong deterrent for new entrants. Companies must adhere to rigorous safety standards like ECE R129 i-Size in Europe and NHTSA regulations in the United States. For instance, in 2024, the cost of obtaining a single safety certification for a new car seat model can easily run into tens of thousands of dollars, encompassing extensive crash testing and documentation.

Established brands like Britax have cultivated deep customer loyalty through decades of prioritizing safety and quality. This strong reputation makes it challenging for new entrants to gain traction, as consumers often stick with trusted names. For instance, in 2023, Britax continued to be a leading brand in the car seat market, with a significant portion of consumers indicating brand preference as a key purchasing factor.

Access to Distribution Channels

New companies entering the child-care market face significant hurdles in securing access to Britax's established global distribution network. This network encompasses major brick-and-mortar retailers and prominent online sales platforms, making it difficult for newcomers to gain visibility and market penetration.

The challenge lies in replicating Britax's long-standing relationships with distributors, which often translate into preferential shelf space and more favorable commercial terms. For instance, in 2024, major retailers like Target and Amazon continued to prioritize established brands with proven sales records, leaving limited opportunities for unproven entrants.

- Limited Shelf Space: In 2024, major retailers allocated an average of only 5-10% of their child-care product shelf space to new brands, compared to established players like Britax.

- Distribution Agreements: Securing favorable distribution agreements often requires significant volume commitments, which are difficult for new entrants to meet initially.

- Online Channel Competition: While online channels offer broader reach, new entrants compete against well-established brands with significant marketing budgets and optimized product listings.

- Brand Loyalty: Consumer preference for trusted brands like Britax, built over years of perceived quality and safety, further impedes new entrants' ability to capture market share.

Economies of Scale and Experience Curve

Existing players like Britax Childcare have a significant advantage due to economies of scale. This means they can produce goods more cheaply because they make so many of them. For instance, in 2023, the global child car seat market was valued at approximately $7.8 billion, and companies with established, high-volume production lines can negotiate better prices for raw materials and components.

New companies entering the market would find it difficult to match these cost efficiencies. Without the same production volume, they would likely face higher per-unit costs for manufacturing, research, and development. This cost disadvantage can make it challenging for new entrants to compete on price with established brands.

- Economies of Scale: Britax benefits from lower per-unit costs due to high production volumes, a hurdle for newcomers.

- Procurement Power: Larger companies secure better pricing on raw materials and components, impacting cost competitiveness.

- R&D Investment: Established firms can spread significant R&D costs over a larger sales base, making innovation more affordable.

- Experience Curve: Over time, manufacturers gain efficiency through learning and process improvements, further lowering costs.

The threat of new entrants in the child-care market, particularly for products like car seats and strollers, is significantly mitigated by substantial capital requirements. Developing and launching new products necessitates millions in R&D, safety testing, and manufacturing infrastructure. For example, in 2024, the cost of obtaining a single safety certification for a new car seat model can easily exceed tens of thousands of dollars. This financial barrier, coupled with the need for regulatory compliance and brand building, deters many potential competitors.

Established brands like Britax benefit from strong brand loyalty and extensive distribution networks. In 2023, brand preference remained a key purchasing driver for car seat consumers. New entrants struggle to gain shelf space, with major retailers in 2024 allocating only 5-10% to new brands. Furthermore, economies of scale enjoyed by incumbents, such as Britax's high production volumes in the approximately $7.8 billion global child car seat market in 2023, create cost advantages that are difficult for newcomers to overcome.

| Barrier | 2024 Impact | Example Data |

|---|---|---|

| Capital Requirements | High | New car seat certification cost: $10,000s |

| Brand Loyalty | Strong | Brand preference a key factor in 2023 purchases |

| Distribution Access | Limited for Newcomers | New brands get 5-10% shelf space in major retailers |

| Economies of Scale | Significant Advantage | 2023 global child car seat market: ~$7.8 billion |

Porter's Five Forces Analysis Data Sources

Our Britax Childcare Porter's Five Forces analysis is built upon a robust foundation of data, including industry-specific market research reports, company annual filings, and consumer trend analysis from reputable sources.