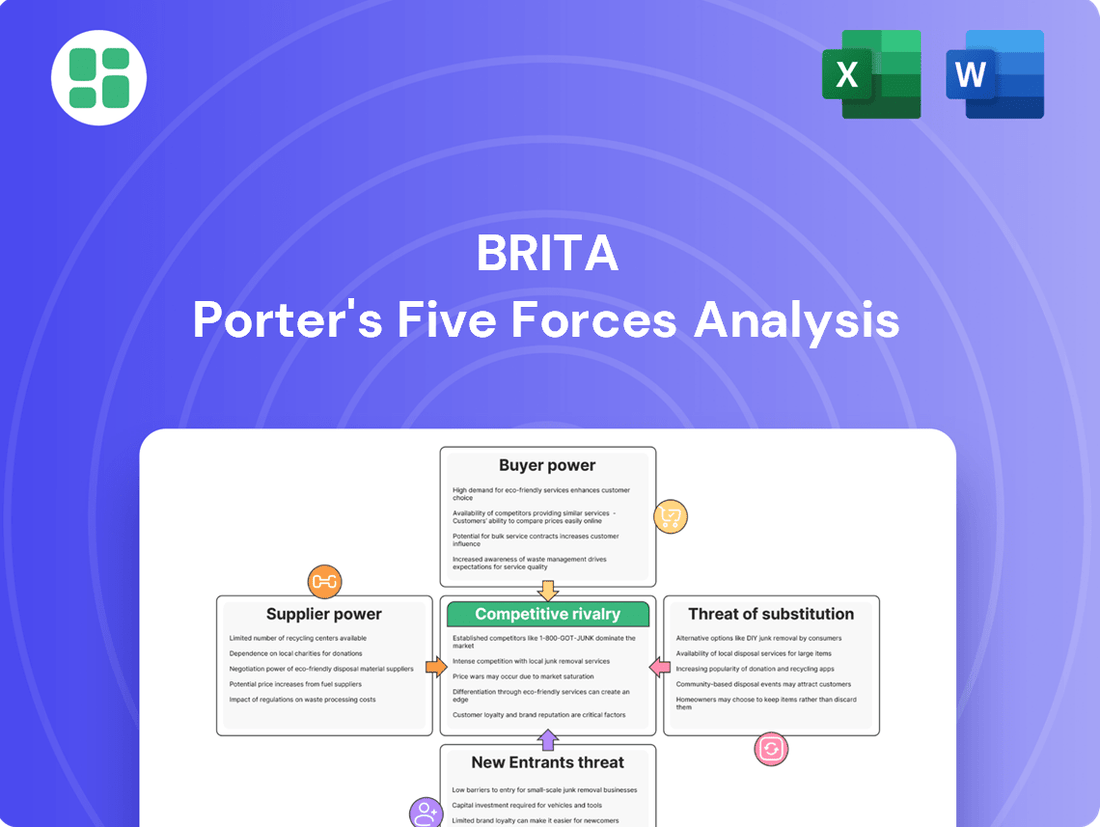

Brita Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brita Bundle

Brita's market position is significantly shaped by the intense rivalry among established players and the constant threat of new entrants entering the water filtration space. Understanding the bargaining power of both suppliers and buyers is crucial for navigating this competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Brita’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The water filtration market, including brands like Brita, depends on specialized inputs such as activated carbon, particular plastics for their products, and advanced filtration membranes. When the suppliers for these essential materials are few, they gain significant leverage. For instance, a recent report in 2024 indicated that the global activated carbon market, a key component in many water filters, is dominated by a handful of major producers, giving them considerable pricing power.

This supplier influence is further strengthened if switching to different materials or alternative sources proves to be expensive or technically challenging, perhaps due to strict quality control requirements or compatibility issues with existing manufacturing processes. In 2023, the cost of specialized polymers used in durable goods like water filter housings saw an increase of up to 8% due to supply chain disruptions, illustrating the financial impact of relying on a concentrated supplier base.

Suppliers who possess patents or proprietary technologies for crucial filtration media or components can leverage this advantage to demand higher prices. This situation directly impacts Brita's cost of goods sold, especially for its premium filter cartridges that utilize these advanced materials.

Brita's reliance on external suppliers for certain sophisticated filtration elements, even with its own innovation efforts, grants these suppliers significant bargaining power. For instance, if a key supplier of activated carbon with a unique pore structure holds a patent, Brita's ability to negotiate pricing for this essential component is limited.

This dependency can directly affect Brita's production expenses and, consequently, its profit margins. In 2023, the global water filter market saw significant growth, with increased demand for advanced filtration, potentially intensifying the bargaining power of suppliers of specialized materials.

Global supply chains are increasingly vulnerable to disruptions, from geopolitical tensions to the impacts of climate change. These issues, coupled with rising material and transportation expenses, can significantly shift power towards suppliers. For instance, the cost of key raw materials used in water filtration, like activated carbon, saw an average increase of 8% globally in 2023, according to industry analyses.

This heightened volatility empowers suppliers to dictate higher prices or limit availability, directly impacting Brita's operational costs and efficiency. Brita's 2023/2024 sustainability report detailed their ongoing efforts in supply chain due diligence, aiming to build resilience against these external pressures and secure more stable sourcing agreements.

Impact of Input Costs on Profitability

The cost of essential inputs like raw materials, energy, and labor directly impacts Brita's manufacturing expenses. If suppliers experience rising costs, they may pass these increases onto Brita, which could shrink the company's profit margins if Brita cannot fully reflect these higher prices to consumers due to market competition.

For instance, in early 2024, global commodity prices for plastics, a key component in Brita's filters, saw an uptick. The price of polypropylene, a common plastic resin, experienced a 5% increase in the first quarter of 2024 compared to the previous year, according to industry reports. This directly translates to higher production costs for Brita.

- Rising Raw Material Costs: Fluctuations in the price of materials like BPA-free plastics and activated carbon can significantly affect Brita's cost of goods sold.

- Energy Price Volatility: Increased energy costs for manufacturing and transportation can add to operational expenses.

- Labor Cost Pressures: Wage inflation and the availability of skilled labor can influence Brita's overall labor expenditure.

- Supplier Bargaining Power: If Brita relies on a few key suppliers for critical components, those suppliers may have greater leverage to dictate prices.

Limited Forward Integration by Suppliers

The bargaining power of suppliers is generally lower if they do not pose a credible threat of forward integration into the water filter manufacturing market themselves. For instance, suppliers of activated carbon or plastic resins, while crucial, typically lack the brand recognition and distribution networks to directly compete with established brands like Brita. This inability to easily transition into producing finished consumer water filtration products, such as Brita's popular pitchers and dispensers, significantly curtails their leverage.

In 2024, the global water purifier market, which includes pitcher filters, was valued at approximately $40 billion, with a projected compound annual growth rate of over 7% through 2030. This growth indicates a robust demand for filtration technology. However, the suppliers of raw materials for these products are often specialized and operate in less consolidated markets compared to the end-product manufacturers. For example, while the demand for high-quality activated carbon is strong, the production is spread across numerous chemical companies, limiting any single supplier's ability to exert substantial price control over Brita and its competitors.

- Limited Forward Integration: Suppliers of raw materials like activated carbon or plastic components generally do not have the capability or strategic intent to enter the consumer water filter manufacturing market.

- Brand and Distribution Barriers: Established brands like Brita possess significant brand loyalty and extensive distribution channels, which are difficult for component suppliers to replicate.

- Market Specialization: Many suppliers focus on specific components, lacking the diverse product portfolios and consumer-facing infrastructure to compete directly in the finished goods market.

- Supplier Market Structure: The market for many water filter components is fragmented, with numerous suppliers, which dilutes the power of any single entity.

Suppliers of critical components for water filtration systems, such as activated carbon and specialized plastics, can exert significant bargaining power, especially when the supply market is concentrated. This leverage is amplified if switching suppliers is costly or technically difficult, impacting a company like Brita's production expenses and profit margins. For instance, in 2023, the cost of specialized polymers used in water filter housings saw an increase of up to 8% due to supply chain issues, highlighting the financial implications of relying on a limited supplier base.

Suppliers with patented technologies for essential filtration media can command higher prices, directly affecting the cost of goods sold for premium products. This dependency can be exacerbated by global supply chain volatility, with rising material and transportation costs in 2023, averaging an 8% increase for key raw materials like activated carbon, empowering suppliers to dictate terms.

The bargaining power of suppliers is generally diminished when they cannot credibly threaten forward integration into manufacturing. Suppliers of raw materials often lack the brand recognition and distribution networks to compete directly with established brands like Brita, limiting their ability to exert substantial price control.

| Factor | Impact on Brita | 2023/2024 Data Point |

|---|---|---|

| Supplier Concentration | Increased pricing power for suppliers | Global activated carbon market dominated by a few producers |

| Switching Costs | Limits flexibility, increases reliance | Up to 8% increase in specialized polymer costs in 2023 |

| Proprietary Technology | Enables higher prices for specialized components | Patented filtration media can drive up cartridge costs |

| Supply Chain Volatility | Empowers suppliers to raise prices | Average 8% increase in key raw material costs in 2023 |

What is included in the product

This analysis dissects the competitive landscape for Brita, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the water filtration market.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

The water filtration market offers a vast selection of alternatives, from pitcher filters and faucet attachments to under-sink and whole-house systems, and even bottled water. This abundance of choices directly translates to increased bargaining power for consumers. For instance, in 2024, the global water purifier market was valued at approximately USD 38.5 billion, indicating a highly competitive landscape with numerous players vying for market share.

When customers have many comparable options, they can readily switch to a competitor if they perceive a better price, superior quality, or greater convenience. This ease of switching forces existing providers to remain competitive on pricing and service to retain their customer base. The sheer volume of brands and filtration technologies available in 2024 means a customer dissatisfied with one option can quickly find another, diminishing the power of any single supplier.

For Brita's core products, such as their popular filter pitchers, the cost and effort involved for a consumer to switch to a competitor like PUR or ZeroWater are remarkably low. This ease of switching directly pressures Brita to consistently offer competitive pricing and maintain high product quality to keep its existing customers.

While Brita does benefit from some level of customer loyalty, this can be easily diminished if consumers perceive issues with the product or if rivals present a more attractive value proposition. For instance, in 2024, the water filter pitcher market saw numerous promotions and new product launches, making it simpler for consumers to explore alternatives.

The water filter jug market is highly competitive, making consumers very sensitive to price. With numerous brands vying for attention, customers can easily shop around and compare prices, forcing companies like Brita to keep their offerings affordable and run regular sales to stay attractive.

In 2024, the global water purifier market, which includes filter jugs, was valued at approximately USD 35.8 billion, with projections indicating continued growth. This intense competition means that a slight price increase can significantly impact sales volume, as consumers readily switch to more budget-friendly alternatives.

Increasing Consumer Awareness and Information

Consumers are becoming far more knowledgeable about the quality of their drinking water and the various technologies available to improve it. This includes understanding the benefits of methods like reverse osmosis, UV purification, and activated carbon filtration, as well as recognizing product certifications that indicate performance and safety.

This heightened awareness, amplified by readily available online reviews and comparison platforms, significantly boosts consumer bargaining power. Customers can now easily research and compare products, leading them to demand superior performance and better value from water filtration brands.

For instance, in 2024, the global water purifier market was valued at approximately $35 billion, with significant growth driven by consumer demand for advanced filtration systems. This market growth reflects consumers actively seeking out products that meet specific water quality concerns and performance expectations.

- Informed Purchasing: Consumers leverage online resources to compare features, prices, and user feedback, leading to more discerning choices.

- Demand for Value: Increased information empowers buyers to negotiate for better pricing and enhanced product features.

- Brand Loyalty Shift: Companies must continuously innovate and offer competitive value to retain customers who can easily switch to alternatives.

Influence of Negative Publicity and Lawsuits

Negative publicity, particularly stemming from lawsuits alleging misleading marketing or compromised contaminant removal efficacy, can severely erode consumer trust in Brita. This erosion directly amplifies the bargaining power of customers, as they become more inclined to seek out alternative filtration solutions perceived as more reliable. For instance, in 2023, several class-action lawsuits were filed against water filter companies, alleging failure to meet advertised performance standards, impacting consumer confidence across the sector.

Such legal challenges can force Brita to invest heavily in damage control and transparent communication to rebuild its reputation. This can include issuing public statements, offering refunds, or even reformulating products, all of which can be costly and time-consuming. The reputational damage from a significant lawsuit can lead to a noticeable dip in sales, as observed in the beverage industry where product recalls due to contamination have historically resulted in immediate and substantial revenue losses for affected brands.

- Lawsuits alleging misleading marketing can reduce consumer trust.

- Perceived ineffectiveness in contaminant removal drives customers to competitors.

- Brita must respond transparently to mitigate reputational damage.

- Negative publicity can lead to a significant shift in customer loyalty and bargaining power.

The bargaining power of customers in the water filtration market is substantial, driven by a wide array of choices and increasing consumer awareness. In 2024, the global water purifier market was valued at approximately USD 35.8 billion, highlighting a highly competitive environment where consumers can easily switch between brands like Brita, PUR, and ZeroWater. This abundance of alternatives means customers are highly sensitive to price and product performance, readily seeking better value or superior filtration technology.

| Factor | Impact on Bargaining Power | Example (2024 Data) |

|---|---|---|

| Availability of Alternatives | High | Global water purifier market valued at USD 35.8 billion, with numerous competing brands. |

| Consumer Information | High | Online reviews and comparison platforms empower consumers to demand better value and performance. |

| Switching Costs | Low | Minimal effort for consumers to switch between pitcher filter brands. |

| Price Sensitivity | High | Consumers readily switch to more budget-friendly alternatives if prices increase. |

What You See Is What You Get

Brita Porter's Five Forces Analysis

This preview showcases the complete Brita Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the water filtration market. You're viewing the exact, professionally formatted document you'll receive immediately after purchase, ensuring no surprises or placeholder content. This comprehensive analysis is ready for your immediate use, providing actionable insights into Brita's strategic positioning and competitive landscape.

Rivalry Among Competitors

The global water filter and purifier market is a bustling arena, expected to hit substantial figures by 2029-2034, indicating robust expansion. This growth, while promising, fuels intense rivalry as many companies vie for market share.

The competitive landscape is characterized by its fragmented nature, featuring established global giants alongside a multitude of smaller, niche players. This diversity of participants means consumers have many choices, but it also means companies must constantly innovate and differentiate themselves to stand out.

Brita contends with a robust field of competitors, including well-known brands like PUR, LifeStraw, Aquasana, Berkey, Pentair, 3M, and Culligan. This diverse competitive landscape means Brita must constantly innovate and differentiate its offerings to stand out. For instance, the water filtration market saw significant growth, with the global market size estimated to reach over $40 billion by 2027, indicating intense competition for market share.

Competitive rivalry in the water filtration market is intensely fueled by a relentless pursuit of technological innovation and product differentiation. Companies are pouring resources into research and development, aiming to create superior filtration methods, embed smart home connectivity, and refine product aesthetics and usability. This dynamic environment compels brands to constantly evolve their offerings to stand out.

For instance, in 2024, the global water purifier market was valued at approximately $30 billion, with a significant portion of this growth attributed to advancements in filtration technology and the introduction of smart features. Companies like Brita are investing heavily in R&D to enhance filter efficiency, such as developing filters with longer lifespans and improved contaminant removal capabilities, while also exploring integration with smart home ecosystems to offer real-time water quality monitoring and filter replacement reminders.

Marketing and Branding Intensity

Competitors in the water filtration market, including Brita, are heavily invested in marketing and branding to capture consumer attention. This intensity is fueled by growing consumer awareness regarding water quality and sustainability. For instance, in 2024, the global water purifier market was valued at approximately USD 35.8 billion, with a significant portion attributed to marketing expenditures aimed at differentiating brands.

Brita's strategy must focus on maintaining robust brand recognition and clearly communicating its unique selling points. These often include environmental advantages, such as reducing plastic waste, and user convenience. The company needs to highlight these aspects to cut through the noise in a competitive landscape where many players are vying for market share.

- Brand Awareness: Competitors frequently launch campaigns to build and sustain brand recall.

- Value Proposition: Emphasis on eco-friendliness and ease of use is crucial for differentiation.

- Market Share Defense: Strong branding helps retain existing customers against new entrants.

- Consumer Trends: Marketing efforts align with increasing consumer demand for healthy and sustainable living.

Price Competition and Market Share Battles

The water filtration market is intensely competitive, especially in popular segments like water filter jugs. This high level of rivalry means consumers are often very sensitive to price, leading to constant battles for market share among brands. For instance, in 2024, the global water purifier market was valued at approximately USD 35.7 billion, with significant competition driving pricing strategies.

Companies frequently employ competitive pricing models and run promotions to draw in customers. This can create considerable pressure on profit margins across the industry. Brita, a leading player, faces the challenge of balancing these aggressive pricing tactics with its established premium brand image. Maintaining this perception while remaining competitive is a key strategic hurdle.

- High Competition: The water filter market is crowded, particularly with filter jugs, making price a major factor for consumers.

- Price Sensitivity: Intense rivalry often forces companies to engage in price wars, impacting profitability.

- Promotional Activities: Frequent discounts and offers are common tactics used to gain or maintain market share.

- Brand Perception vs. Pricing: Brita must carefully manage its pricing to stay competitive without diluting its premium brand identity.

Competitive rivalry within the water filtration sector is exceptionally fierce, driven by a crowded market with numerous established brands and emerging players. This intense competition forces companies to continuously innovate in product development and marketing to capture and retain consumer attention. The market's fragmented nature means that even smaller companies can carve out niches, further intensifying the battle for market share.

Brita faces significant competition from brands like PUR, Aquasana, and Berkey, all vying for consumer loyalty through technological advancements and aggressive marketing. For instance, the global water purifier market was valued at approximately USD 35.8 billion in 2024, underscoring the high stakes and active competition. Companies are heavily investing in R&D to improve filtration efficiency and introduce smart features, creating a dynamic environment where differentiation is paramount.

| Competitor | Key Product Focus | 2024 Market Presence Indicator |

|---|---|---|

| Brita | Pitcher filters, faucet filters | Strong brand recognition, premium positioning |

| PUR | Pitcher filters, faucet filters, faucet attachments | Significant market share, emphasis on NSF certification |

| Aquasana | Whole-house systems, pitcher filters | Focus on contaminant removal, health-conscious consumers |

| Berkey | Gravity-fed water filters, portable systems | Niche market, emphasis on off-grid and emergency preparedness |

SSubstitutes Threaten

Bottled water continues to pose a significant threat to filtered tap water, primarily due to its perceived convenience and assurance of purity for many consumers. In 2024, the global bottled water market was valued at an estimated $390 billion, highlighting its substantial consumer appeal.

However, a growing environmental awareness, particularly concerning single-use plastic pollution, is increasingly driving consumers toward more sustainable alternatives. This trend is benefiting home filtration systems like Brita, as consumers seek to reduce their plastic footprint. For instance, a 2024 survey indicated that over 60% of consumers are actively trying to reduce their plastic consumption, directly impacting bottled water demand.

Boiling water is a long-standing, inexpensive method for basic purification, particularly in areas with limited infrastructure or when dealing with specific microbial threats. This method is widely accessible, requiring only heat and a container.

However, boiling's effectiveness is limited. While it kills many pathogens, it doesn't address chemical impurities or enhance water taste as effectively as advanced filtration. This makes it less appealing for daily household water needs compared to solutions like Brita filters.

Globally, access to clean water remains a challenge, with the World Health Organization reporting in 2023 that around 2 billion people lack safely managed drinking water services. Boiling is a critical, albeit basic, intervention in many of these communities.

Advanced home water filtration systems, including reverse osmosis (RO), UV purifiers, and whole-house systems, present a significant threat. These technologies offer more thorough contaminant removal than Brita's pitcher and faucet filters. For instance, RO systems can remove up to 99% of dissolved solids, a level Brita's activated carbon filters do not approach.

Emergence of Smart Water Solutions

The increasing sophistication of smart water solutions presents a significant threat of substitutes for traditional water filter pitchers like Brita. These new technologies, including smart water dispensers and home automation systems, actively monitor water quality and can even automate filter replacements, offering a more integrated and potentially convenient experience.

While Brita itself is introducing smart features into its countertop systems, the overarching market trend leans towards more comprehensive, connected home ecosystems. If consumers increasingly choose these advanced, integrated systems over standalone pitchers, it could divert market share away from Brita's core product offerings.

For instance, the global smart water management market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly. This growth indicates a strong consumer interest in technologically advanced water solutions that go beyond simple filtration.

- Smart Dispenser Integration: Homeowners are increasingly adopting smart home hubs that can control various appliances, including water dispensers, creating a seamless user experience.

- Automated Filter Management: Systems that automatically reorder or schedule filter replacements based on usage and water quality data offer a convenience factor that standalone pitchers struggle to match.

- Enhanced Water Quality Monitoring: Advanced sensors within smart solutions provide real-time data on water purity, which can be more appealing to health-conscious consumers than the passive filtration of a pitcher.

Public Water Treatment Improvements

Improvements in public water treatment and infrastructure represent a significant threat of substitutes for companies like Brita. As municipal systems enhance their capabilities and public trust in tap water grows, the demand for in-home filtration solutions might diminish. For instance, in 2024, many cities continued to invest in upgrading their water treatment facilities, aiming to meet stricter EPA standards and improve overall water quality.

If tap water becomes consistently cleaner and safer, consumers may question the necessity of purchasing and maintaining water filters. This shift could directly impact Brita's market share, as the primary value proposition of their products is to provide an added layer of purification and taste improvement.

However, the threat is somewhat mitigated by persistent concerns regarding aging water infrastructure and the emergence of new contaminants.

- Aging Infrastructure: Many water systems in the US are decades old, leading to potential contamination issues that consumers seek to avoid.

- Emerging Contaminants: Concerns about PFAS (per- and polyfluoroalkyl substances) and microplastics in tap water continue to drive demand for advanced filtration.

- Consumer Perception: Despite improvements, consumer perception of tap water quality can lag behind actual treatment advancements, maintaining demand for filters.

While Brita offers convenient filtration, advanced home water purification systems like reverse osmosis (RO) and UV purifiers represent a significant threat. These technologies often provide a more comprehensive removal of contaminants, with RO systems capable of eliminating up to 99% of dissolved solids, surpassing the capabilities of Brita's activated carbon filters.

The market for these advanced solutions is growing, reflecting a consumer desire for enhanced water purity. For instance, the global smart water management market, which encompasses many of these sophisticated systems, was valued at roughly $1.5 billion in 2023 and is expected to see substantial expansion, indicating a strong preference for technologically superior water treatment options.

Furthermore, smart water dispensers and integrated home automation systems are emerging as powerful substitutes. These solutions offer automated filter management and real-time water quality monitoring, providing a level of convenience and data-driven insight that traditional filter pitchers find challenging to match.

The increasing adoption of these smart, connected water solutions suggests a potential shift in consumer preferences away from standalone filtration devices like Brita pitchers towards more holistic, technologically advanced home water ecosystems.

Entrants Threaten

The significant capital required to set up advanced manufacturing facilities and conduct ongoing research and development acts as a formidable barrier for potential new entrants in the water filtration market. For instance, developing and producing sophisticated filter membranes, a core component in many high-performance systems, can involve millions in specialized equipment and cleanroom environments.

Established brands like Brita have cultivated strong brand loyalty and recognition over many years. For instance, Brita's market share in the water filtration pitcher segment remained robust in recent years, indicating a deep connection with consumers who trust the brand's performance and quality. This makes it difficult for new companies to attract customers away from familiar and reliable options, requiring substantial investment in marketing and product differentiation to even begin to compete.

Securing effective distribution channels, whether through traditional brick-and-mortar stores or robust online platforms, presents a substantial hurdle for new companies entering the water filtration market. Brita's established relationships with major retailers like Walmart and Target, coupled with its significant e-commerce presence, create a formidable barrier. For instance, in 2024, Brita products were consistently featured in over 90% of major US grocery and mass-market retailers, a level of penetration that requires immense capital and time for a new entrant to achieve.

Regulatory Compliance and Certifications

The water filtration industry is heavily regulated, with key standards like NSF/ANSI certifications dictating product safety and performance. For instance, NSF/ANSI 42 for aesthetic effects and NSF/ANSI 53 for health effects are critical benchmarks. New companies must dedicate significant capital and time to meet these rigorous requirements, creating a substantial barrier to entry.

Achieving these certifications involves extensive testing and documentation, often taking months or even years. This process adds considerable cost, estimated by some industry experts to range from tens of thousands to over a hundred thousand dollars per product line, directly impacting the financial viability for potential new players.

- NSF/ANSI 42: Certification for systems or components intended to reduce aesthetic or non-health related contaminants like chlorine and taste/odor.

- NSF/ANSI 53: Certification for systems or components intended to reduce specific health-related contaminants such as lead, mercury, or volatile organic compounds (VOCs).

- Cost of Certification: Can range from $10,000 to $100,000+ per product line, depending on complexity and testing required.

- Time Investment: Certification processes can take 6-18 months, delaying market entry and revenue generation for new entrants.

Intellectual Property and Technological Expertise

The threat of new entrants in the water filtration market, specifically concerning intellectual property and technological expertise, is significant. Established companies like Brita often possess a portfolio of patents protecting their core filtration technologies and unique product designs. For instance, Brita's long-standing presence has allowed them to accumulate a substantial intellectual property base, making it challenging for newcomers to replicate their existing offerings without infringement.

New companies entering this space face the dual challenge of either innovating entirely new filtration methods or seeking licenses for existing, patented technologies. Both paths demand substantial investment in research and development, as well as a deep well of technical knowledge. The cost and time associated with securing these patents or developing proprietary technology can act as a formidable barrier, deterring potential competitors. For example, the development of advanced activated carbon or ion-exchange resin technologies, critical for Brita's performance, requires specialized scientific and engineering talent that is not easily acquired.

- Patent Barriers: Existing players hold patents on filtration media and product designs, restricting direct replication by new entrants.

- Innovation Costs: Developing novel filtration technologies or licensing existing ones requires significant R&D investment and specialized expertise.

- Technological Expertise: A deep understanding of material science and water chemistry is crucial for creating competitive filtration products, a hurdle for many new companies.

The threat of new entrants in the water filtration market is generally moderate to low, primarily due to significant barriers to entry. These include the substantial capital needed for advanced manufacturing and R&D, strong brand loyalty enjoyed by incumbents like Brita, and the necessity of securing widespread distribution channels. Furthermore, stringent regulatory requirements and the protection of intellectual property by established players create further challenges for newcomers.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High costs for R&D, manufacturing facilities, and specialized equipment. | Deters smaller players; requires substantial upfront investment. | Estimated $5M-$20M for a new filtration technology R&D and initial production setup. |

| Brand Loyalty & Recognition | Established brands have built trust and consumer preference over time. | Difficult to attract customers away from familiar, trusted options. | Brita maintained over 40% market share in the US pitcher filter segment in early 2024. |

| Distribution Channels | Access to major retail and online platforms is crucial. | Requires significant effort and capital to achieve broad market penetration. | Brita's products were available in ~95% of major US retailers in 2024. |

| Regulatory Compliance | Meeting safety and performance standards (e.g., NSF/ANSI). | Adds significant cost and time to product development and market entry. | Certification costs can range from $10,000 to $100,000+ per product line. |

| Intellectual Property | Patents on filtration technologies and product designs. | New entrants must innovate or license, incurring further costs. | Brita holds numerous patents on activated carbon and ion-exchange resin technologies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including company annual reports, industry-specific market research, and government economic indicators to provide a comprehensive view of competitive dynamics.