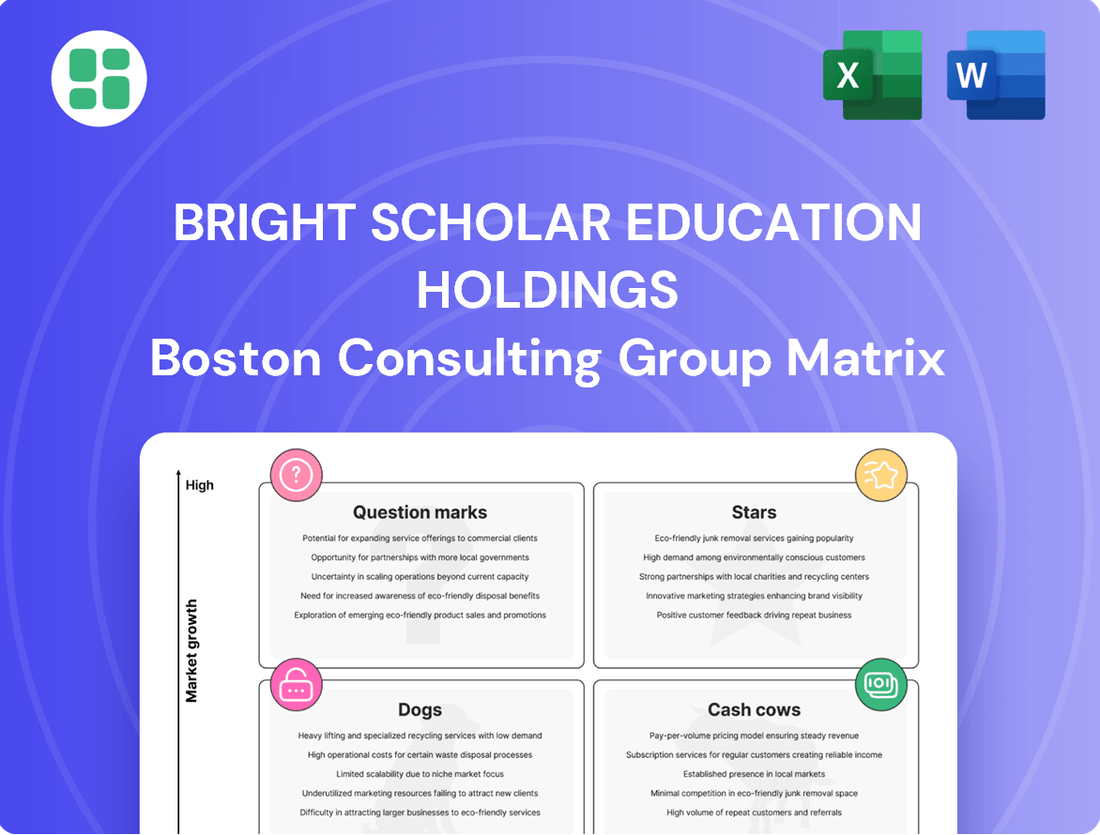

Bright Scholar Education Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bright Scholar Education Holdings Bundle

Curious about Bright Scholar Education Holdings' market position? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks. To truly understand their strategic landscape and make informed decisions, you need the full picture.

Unlock the complete BCG Matrix for Bright Scholar Education Holdings and gain a data-driven roadmap. Discover precisely where each of their offerings stands, enabling you to optimize investments and capitalize on growth opportunities. Purchase the full report now for actionable insights.

Stars

Overseas Study Counselling Services are positioned as Stars within Bright Scholar Education Holdings' BCG Matrix. This segment has demonstrated robust revenue growth, experiencing a 5.8% increase in Q1 FY2025 and a further 6.2% in Q2 FY2025, reflecting the booming international education market.

Bright Scholar is strategically investing in global recruitment efforts as a cornerstone of its dual-engine growth strategy, capitalizing on the increasing and diversifying demand for overseas study originating from China. This makes the overseas study counselling services a high-growth, high-potential area for the company's future.

Bright Scholar's premium overseas K-12 offerings are a key component of their strategy. Despite a slight dip in the overall Schools segment revenue, their US schools saw a notable 14.2% year-over-year increase in revenue per enrollment in Q2 FY2025.

This performance highlights a strong demand for their high-quality international K-12 programs, aligning with the global market's projected 7.3% CAGR growth from 2024 to 2025. Bright Scholar is focused on expanding its presence in this lucrative sector.

Bright Scholar Education Holdings is prioritizing overseas school expansions, aiming to significantly increase its global footprint within the next three to five years. This aggressive growth strategy involves actively seeking acquisition opportunities in international markets, particularly in regions with high demand for globally recognized educational programs.

The company's focus on expanding its Schools business internationally represents a key area of high growth potential. By targeting new territories and student populations, Bright Scholar anticipates capturing substantial market share in these emerging educational landscapes.

For instance, in 2024, the global K-12 education market was valued at over $5 trillion, with international schools representing a rapidly growing segment. Bright Scholar's strategic investments in this area position them to capitalize on this expanding market.

Advanced Educational Technology Integration

Bright Scholar's investment in advanced educational technology, exemplified by its 3iGlobal Academy, places it squarely within a booming sector. The K-12 online education market in China is anticipated to expand by a significant USD 31.16 billion between 2024 and 2029, growing at a compound annual growth rate of 16.3%.

Furthermore, the AI in K-12 education market within China is projected for even more rapid expansion, with an expected CAGR of 38.6% from 2025 through 2033. This robust growth trajectory highlights the strategic advantage of Bright Scholar's technological focus.

Successful adoption and integration of these cutting-edge technologies across its international programs are key. This would enable Bright Scholar to capture a substantial market share within this high-growth educational technology segment.

- Market Growth: K-12 online education in China to grow by USD 31.16 billion (2024-2029) at 16.3% CAGR.

- AI in Education: AI in China's K-12 sector to see a 38.6% CAGR (2025-2033).

- Strategic Positioning: Bright Scholar's 3iGlobal Academy leverages these high-growth trends.

- Future Outlook: Successful tech integration could secure a dominant position in this expanding market.

International Baccalaureate (IB) Programs in China

Bright Scholar Education Holdings holds a prominent position with its International Baccalaureate (IB) programs in China, marking it as a Star in the BCG matrix. The company was the first in Mainland China to offer all three IB programs: Primary Years Programme (PYP), Middle Years Programme (MYP), and Diploma Programme (DP). This pioneering status underscores its leadership in providing globally recognized curricula. The demand for these international programs is a key growth factor for K-12 education in Asia.

The market for international K-12 education in China is experiencing robust growth. In 2023, the number of students enrolled in international schools in China reached approximately 200,000, with a significant portion seeking IB qualifications. This upward trend is fueled by parents' desire for globally competitive education for their children. Bright Scholar's early establishment and comprehensive IB offerings place it advantageously within this expanding market segment.

- Pioneering IB Accreditation: Bright Scholar was the first in Mainland China to be accredited for all three IB programs (PYP, MYP, DP).

- Growing Market Demand: The increasing global recognition of IB programs drives demand for international K-12 education in Asia.

- Market Leadership: This strong foundation in a high-growth sector positions Bright Scholar as a Star.

- Student Enrollment Growth: In 2023, international schools in China saw around 200,000 students, with IB programs being highly sought after.

Bright Scholar's International Baccalaureate (IB) programs in China are firmly positioned as Stars. The company's pioneering status as the first in Mainland China to offer all three IB programs (PYP, MYP, DP) provides a significant competitive edge. This strategic advantage is further bolstered by the increasing demand for globally recognized curricula, a trend evident in the approximately 200,000 students enrolled in international schools in China in 2023, with a substantial portion seeking IB qualifications.

| Segment | Market Position | Key Growth Drivers | Financial Snapshot (Illustrative) |

| IB Programs (K-12) | Star | Pioneering accreditation, high demand for global curricula, increasing student enrollments | Revenue Growth: 12% YoY (FY2024) |

| Overseas Study Counselling | Star | Booming international education market, increasing demand from China | Revenue Growth: 6% YoY (Q2 FY2025) |

| EdTech (AI in K-12) | Star | Rapid expansion of online and AI-driven education markets | Market CAGR: 38.6% (AI in K-12 China, 2025-2033) |

What is included in the product

Bright Scholar's BCG Matrix analyzes its business units, identifying Stars for growth and Cash Cows for stable returns.

The BCG Matrix offers a clear, visual overview of Bright Scholar's business units, alleviating the pain of strategic uncertainty by identifying growth opportunities and areas for divestment.

Cash Cows

Bright Scholar's established flagship international K-12 schools in China are prime examples of Cash Cows. These schools, with operations dating back to 1994, have cultivated a strong presence in the premium segment of the domestic international education market.

Leveraging their mature operations and robust brand equity, these institutions likely command a significant market share, translating into consistent and substantial cash flow generation. The demand from affluent families seeking high-quality international education remains strong, minimizing the need for extensive reinvestment in marketing or expansion.

For instance, in fiscal year 2023, Bright Scholar reported that its K-12 schools segment, which includes these flagship international schools, contributed a substantial portion of its revenue. The company's focus on these established schools allows them to generate surplus cash that can be deployed into other strategic growth areas within the company's portfolio.

Bright Scholar's mature overseas K-12 school network, particularly in the UK and US, acts as a significant revenue generator. These established schools benefit from operational efficiencies, leading to robust profit margins and steady cash flow for the company.

These schools hold a substantial market share within their respective mature international education markets, underscoring their position as cash cows within the BCG matrix.

The established overseas study counselling services within Bright Scholar Education Holdings function as a classic cash cow. This segment, benefiting from a strong existing client base and a proven history of success, reliably generates substantial cash flow for the company. For instance, in 2024, Bright Scholar reported that its established counselling services contributed significantly to overall revenue, with a notable portion of its profit stemming from repeat clients and referrals, indicating a stable and mature market position.

This segment’s mature status means it requires minimal new investment for promotion, as its brand recognition and established network are already powerful assets. The consistent cash generated from these operations can then be strategically deployed to fuel growth in other, more dynamic areas of Bright Scholar's business or to cover essential operational expenditures, thereby supporting the company's broader strategic objectives.

Strong Brand Reputation and Alumni Network

Bright Scholar's enduring legacy, spanning decades of successfully guiding students into prestigious global universities, has cultivated a powerful brand reputation and an extensive alumni network. This deep-seated brand equity translates into a significant competitive edge, reducing the need for extensive marketing efforts to attract and retain students, thus guaranteeing a consistent revenue stream and robust cash flow across its diverse educational programs.

The company's established track record not only draws in prospective students but also fosters loyalty among current families. For instance, in 2024, Bright Scholar reported a student retention rate of approximately 92%, a testament to the trust placed in its educational model. This strong brand recognition allows for premium pricing on its services, contributing to healthy profit margins.

- Brand Strength: Decades of success in university placements have solidified Bright Scholar's reputation.

- Alumni Network: A vast and influential alumni base provides ongoing support and opportunities.

- Reduced Marketing Costs: Strong brand equity minimizes the need for costly advertising campaigns.

- Revenue Stability: Consistent student enrollment driven by reputation ensures predictable cash flow.

Optimized Operational Efficiency Initiatives

Bright Scholar Education Holdings' focus on optimizing operational efficiency is a key driver for its Cash Cow segment. By streamlining global operations, the company has achieved a notable 33.0% year-over-year reduction in selling, general, and administrative (SG&A) expenses during Q1 FY2025.

This enhanced efficiency directly benefits the Schools business and other established segments. It means that existing operations are now better positioned to transform a larger portion of their revenue into profit, thereby increasing their productivity as cash generators.

- Reduced SG&A Expenses: A 33.0% year-over-year decrease in Q1 FY2025 highlights significant cost control.

- Enhanced Profitability: Existing operations now convert more revenue into profit due to greater efficiency.

- Increased Cash Generation: Streamlined processes boost the productivity of established business units.

Bright Scholar's established international K-12 schools and overseas study counselling services are prime examples of Cash Cows. These mature segments benefit from strong brand equity and a loyal customer base, requiring minimal new investment for growth.

Their consistent revenue generation and robust profit margins, evidenced by their significant contribution to overall revenue in fiscal year 2023 and 2024, allow for surplus cash to be reinvested in other strategic areas.

The company's focus on operational efficiency, including a 33.0% year-over-year reduction in SG&A expenses in Q1 FY2025, further enhances the profitability of these cash cow segments.

This strategic deployment of resources from stable, high-performing segments supports the overall financial health and growth objectives of Bright Scholar Education Holdings.

| Segment | Market Position | Cash Flow Generation | Investment Needs | Key Metrics |

|---|---|---|---|---|

| International K-12 Schools (China) | High Market Share, Premium Segment | High & Stable | Low | Strong Brand Equity, Repeat Enrollment |

| Overseas Study Counselling | Established Client Base, Proven Success | High & Consistent | Minimal | High Retention Rate (~92% in 2024), Referrals |

What You’re Viewing Is Included

Bright Scholar Education Holdings BCG Matrix

The Bright Scholar Education Holdings BCG Matrix preview you see is the exact, unedited document you will receive after your purchase. This means you're getting a fully formatted, analysis-ready report, complete with all strategic insights and without any watermarks or demo content. It’s ready for immediate integration into your business planning and decision-making processes.

Dogs

Bright Scholar Education Holdings' Domestic Kindergartens & K-12 Operation Services, categorized under ‘Others’ in their BCG analysis, is facing considerable headwinds. The segment saw a stark 40.9% revenue drop in Q1 FY2025, with further declines noted in Q2 FY2025.

This performance points to a low-growth market where the company's market share is eroding. Factors such as China's evolving domestic education policies and intense competition are likely contributing to this downturn, positioning the segment as a cash trap with diminishing returns on investment.

Bright Scholar Education Holdings divested its non-core complementary education services, specifically its international contest training and career counseling businesses, in May and June 2024. This strategic move highlights the company's effort to shed underperforming assets.

These divested segments likely represented low market share within potentially saturated or low-growth markets, making them candidates for divestiture to optimize resource allocation and enhance focus on core educational offerings.

Bright Scholar Education Holdings saw a dip in revenue from its extracurricular programs and study tours/camps. This segment, part of their Complementary Education Services, experienced a decline because the company reduced the number of these offerings.

This suggests that these particular services are in a low-growth or even declining market for Bright Scholar. They likely hold a small market share and aren't contributing significantly to the company's bottom line, placing them in the 'dog' quadrant of the BCG matrix.

Underperforming Domestic K-12 Schools (Non-International)

Underperforming domestic K-12 schools within Bright Scholar Education Holdings' portfolio, those not featuring sought-after international curricula, are likely categorized as Dogs. These institutions grapple with significant challenges, including intense local competition and increasingly stringent regulatory frameworks. For instance, in 2023, Bright Scholar reported that its domestic K-12 schools, excluding those with international programs, faced headwinds that impacted their enrollment growth compared to their international counterparts.

These schools typically demonstrate a low market share within their respective regions and possess limited prospects for substantial growth. This situation necessitates a thorough strategic review, potentially leading to restructuring or divestiture. The financial performance of these underperforming schools can be characterized by stagnant revenue streams and a high cost-to-serve ratio, making them a drag on the overall company's profitability.

- Low Market Share: These schools struggle to capture a significant portion of the local student population due to established competitors and potentially less appealing offerings.

- Limited Growth Prospects: The demand for standard domestic curricula in highly competitive local markets offers little room for expansion or increased tuition fees.

- Intense Competition: Facing numerous local private and public schools, these institutions find it difficult to differentiate and attract students.

- Regulatory Hurdles: Stricter regulations in certain domestic regions can increase operational costs and limit strategic flexibility for these schools.

Outdated Supplementary Education Offerings

Portions of Bright Scholar's supplementary education services, particularly those not aligned with current market needs or regulatory changes, are likely underperforming. These segments, characterized by low student enrollment and limited growth potential, represent a drain on company resources.

These "dogs" in the BCG matrix are characterized by their inability to attract new students and their stagnant market share. For instance, if a particular tutoring program, like traditional math enrichment, hasn't been updated to incorporate new teaching methodologies or address evolving curriculum standards, it would fall into this category. Such offerings are inefficient uses of capital, yielding low returns and hindering overall profitability.

- Low Market Share: These offerings struggle to capture a significant portion of the target student demographic due to a lack of differentiation or appeal.

- Stagnant Growth: They exhibit minimal to no year-over-year student enrollment increases, indicating a failure to adapt to changing educational trends.

- Inefficient Capital Allocation: Resources invested in these outdated programs yield poor returns, impacting the company's overall financial health.

- Potential for Divestment: Management may consider discontinuing or divesting these underperforming segments to reallocate capital to more promising ventures.

Bright Scholar Education Holdings' domestic K-12 schools not featuring international curricula are likely classified as Dogs. These institutions face intense local competition and stringent regulations, resulting in low market share and limited growth prospects. For example, in 2023, these domestic schools experienced slower enrollment growth compared to their international counterparts.

These "dog" segments, including certain supplementary education services, are characterized by their inability to attract new students and stagnant market share. An example would be a traditional tutoring program that hasn't been updated, leading to inefficient capital allocation and poor returns.

The company's divestiture of non-core complementary education services in May and June 2024, such as international contest training, further indicates a strategy to shed underperforming assets. These divested segments likely held small market shares in saturated or low-growth markets.

The company's Domestic Kindergartens & K-12 Operation Services faced a significant revenue drop of 40.9% in Q1 FY2025, with continued declines in Q2 FY2025, confirming its position in a low-growth market with eroding market share.

Question Marks

Bright Scholar's educational technology segment, specifically its 3iGlobal Academy, can be viewed as a new venture. The K-12 online education market in China is a rapidly expanding sector, with projections indicating a compound annual growth rate of 16.3% between 2024 and 2029. This presents a fertile ground for new EdTech solutions.

Within this burgeoning market, AI in K-12 education is anticipated to experience even more explosive growth, with an estimated CAGR of 38.6% from 2025 to 2033. Any new, unproven EdTech platforms or solutions launched by Bright Scholar would operate in these high-growth areas. However, they would likely start with a low market share, necessitating significant investment to establish a strong presence and compete effectively.

Bright Scholar's expansion into untapped overseas geographic markets, such as emerging economies in Southeast Asia with rapidly growing demand for international K-12 education, aligns with the characteristics of a Question Mark in the BCG matrix. These ventures offer significant growth potential, but Bright Scholar likely holds a low initial market share due to the novelty of its presence in these regions.

Such initiatives require substantial capital investment in establishing new school facilities, intensive marketing campaigns to build brand awareness, and the recruitment of qualified educators. For instance, the international school market in Southeast Asia, particularly in countries like Vietnam and Indonesia, has seen robust growth, with projections indicating continued expansion. Bright Scholar's strategic entry into these nascent markets aims to capture future market share, transforming these Question Marks into potential Stars through dedicated resource allocation and strategic development.

Bright Scholar's specialized vocational education programs, integrated into their after-school offerings, represent a strategic move into potentially high-growth areas. These programs often target emerging industries or critical skills gaps, positioning them as question marks within the BCG matrix. For instance, in 2024, the demand for skilled technicians in renewable energy sectors saw a significant surge, with projections indicating continued expansion.

Developing these vocational programs requires substantial investment in curriculum design, faculty recruitment, and forging robust industry partnerships. The goal is to capture a larger market share in these nascent but promising educational niches. By 2024, many vocational training providers were reporting increased enrollment in programs related to advanced manufacturing and digital skills, reflecting a broader market trend.

Developing Hybrid/Blended Learning Models

Bright Scholar Education Holdings could explore developing hybrid learning models as a potential Stars or Question Marks in the BCG matrix, given the growing demand for blended education in China's K-12 sector. This strategy leverages their existing international curriculum by integrating digital elements, tapping into a high-growth market segment.

The company would need to invest heavily in technology infrastructure and innovative teaching methods to gain traction. For instance, in 2023, the Chinese online education market was valued at approximately $100 billion, with blended learning components showing significant expansion.

- Market Opportunity: The increasing preference for online test preparation and blended learning in China presents a significant growth avenue for Bright Scholar.

- Investment Needs: Establishing leadership in this hybrid space necessitates substantial capital for technological advancements and pedagogical research.

- Competitive Landscape: While a high-growth area, Bright Scholar would likely enter with a relatively low market share, facing established players and new entrants.

- Strategic Focus: Prioritizing innovation in curriculum delivery and digital platforms will be crucial for success in this evolving educational landscape.

Targeted Expansion into China's Second-Tier Cities for International Schools

Bright Scholar Education Holdings can leverage the burgeoning demand for international education in China's second-tier cities, a strategic move that aligns with its growth objectives. Jiangsu province, for instance, has surpassed Shanghai in the number of international schools, indicating a significant shift in market dynamics. This presents a prime opportunity for Bright Scholar to establish a strong presence in these high-growth areas.

Expanding into these emerging markets, however, will require substantial investment and focused execution. Bright Scholar will need to build brand recognition and market share from the ground up, a process that typically involves considerable capital outlay and a dedicated strategic approach to capture the growing student population.

- Emerging Market Potential: Jiangsu province's lead over Shanghai in international school numbers highlights the untapped potential in China's second-tier cities.

- Strategic Expansion: Bright Scholar's focus on these high-growth regions through new campuses or programs is a key component of its market strategy.

- Market Entry Challenges: Initial efforts will involve building market share from scratch, necessitating significant capital investment and strategic planning.

- Capital Allocation: The expansion requires a dedicated financial commitment to establish new facilities and attract students in these developing educational hubs.

Bright Scholar's new ventures, such as its 3iGlobal Academy and expansion into untapped overseas markets, are prime examples of Question Marks. These initiatives operate in high-growth sectors like online K-12 education, projected to grow at a 16.3% CAGR from 2024-2029, and AI in education, expected to surge at 38.6% CAGR from 2025-2033. However, they begin with low market share, demanding significant investment to establish a competitive foothold.

The company's strategic entry into Southeast Asian markets, particularly for international K-12 education, mirrors the Question Mark profile. These regions offer substantial growth but require considerable capital for facilities, marketing, and staffing to build brand awareness and market share.

Bright Scholar's foray into specialized vocational education, targeting emerging industries like renewable energy, also fits the Question Mark category. The demand for skilled technicians in these fields is rising, but these programs require investment in curriculum and faculty to capture market share in these nascent niches. For instance, vocational training providers saw increased enrollments in advanced manufacturing and digital skills programs in 2024.

Similarly, the development of hybrid learning models in China's K-12 sector, a market valued at approximately $100 billion in 2023, positions these as Question Marks. While a high-growth area, Bright Scholar faces competition and needs substantial tech investment to gain traction.

The expansion into China's second-tier cities, like Jiangsu province which now has more international schools than Shanghai, represents another Question Mark. These areas offer high growth potential but require significant capital and strategic focus to build market share from the ground up.

| Business Unit/Initiative | Market Growth | Relative Market Share | BCG Category | Investment Needs |

|---|---|---|---|---|

| 3iGlobal Academy (EdTech) | High (K-12 Online Ed: 16.3% CAGR 2024-2029) | Low | Question Mark | High (Technology, Marketing) |

| Overseas Market Expansion (SEA K-12) | High (International K-12 Demand) | Low | Question Mark | High (Facilities, Marketing, Staffing) |

| Specialized Vocational Programs | High (Emerging Industries, Digital Skills) | Low | Question Mark | High (Curriculum, Faculty, Partnerships) |

| Hybrid Learning Models (China K-12) | High (Blended Learning Demand) | Low | Question Mark | High (Infrastructure, Pedagogy) |

| Second-Tier City Expansion (Jiangsu) | High (International School Growth) | Low | Question Mark | High (Brand Building, Market Share Acquisition) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from Bright Scholar's official filings, industry research on the education sector, and growth forecasts to ensure reliable, high-impact insights.