Breville Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Breville Bundle

Breville's competitive landscape is shaped by powerful forces, from the intense rivalry among existing players to the significant bargaining power of their discerning customers. Understanding these dynamics is crucial for any strategic decision.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Breville’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Breville's reliance on a limited number of suppliers for specialized components, such as proprietary heating elements or advanced control boards, significantly amplifies supplier bargaining power. If these critical parts are highly customized or only available from a handful of manufacturers, these suppliers can dictate terms, potentially increasing costs for Breville. For instance, in 2024, the global semiconductor shortage, though easing from its peak, continued to impact the availability and pricing of electronic components essential for Breville's smart appliances, demonstrating the leverage held by chip manufacturers.

Breville faces moderate switching costs when changing suppliers for its kitchen appliances. These costs can involve redesigning components to fit new parts, retooling assembly lines, and the time-consuming process of qualifying new vendors to ensure quality and reliability. For instance, a change in a critical heating element supplier might necessitate extensive testing and adjustments to the appliance's internal workings.

The financial impact of these switching costs can be significant, potentially running into hundreds of thousands of dollars for major component changes. This investment in adaptation means that Breville's existing suppliers, particularly those providing unique or highly integrated components, hold a degree of bargaining power, as the cost and disruption of switching can outweigh the benefits of finding a cheaper alternative.

The significance of Breville's business to its suppliers is a key factor in assessing their bargaining power. If Breville accounts for a large percentage of a supplier's total sales, that supplier is likely to be more accommodating with pricing and terms to maintain the relationship. For instance, if a component supplier derives over 25% of its annual revenue from Breville, it would have less leverage to dictate unfavorable contract conditions.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a significant consideration for Breville. If a key supplier were to start manufacturing their own small appliances, they could directly compete with Breville. This is particularly relevant if the supplier has developed unique or proprietary components that are critical to Breville's product differentiation. For example, a supplier of advanced heating elements or specialized motor technology might possess the manufacturing expertise and intellectual property to enter the market themselves.

While less common for suppliers of highly standardized components, the risk escalates if a supplier has substantial manufacturing capabilities or established brand recognition. Such suppliers could leverage these assets to launch their own appliance lines, potentially undercutting Breville or offering a more integrated solution to consumers.

- Supplier Capability: Assess if suppliers possess the necessary manufacturing infrastructure and technical know-how to produce finished appliances.

- Component Criticality: Evaluate how essential a supplier's component is to Breville's product performance and market appeal.

- Brand Recognition: Consider if suppliers have any existing consumer brand awareness that could be leveraged in a forward integration scenario.

- Market Dynamics: Analyze the overall profitability and growth potential of the small appliance market, which might incentivize suppliers to integrate forward.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts Breville's bargaining power with its suppliers. If Breville can easily source similar components or materials from alternative providers, its dependence on any single supplier diminishes. This flexibility directly weakens the supplier's ability to dictate terms or raise prices.

For instance, if Breville relies on a specific type of heating element, and numerous manufacturers produce comparable elements using different technologies or materials, Breville can switch suppliers with minimal disruption. This competitive landscape among input providers keeps prices in check and ensures a more favorable supply chain for Breville.

Consider the electronics components market. In 2024, the global market for electronic components was valued at over $2 trillion, with a vast array of manufacturers offering standardized parts. This high degree of interchangeability for many components means Breville has considerable leverage.

- High Availability of Substitutes: Many of Breville's components, such as standard screws, plastic casings, and basic electronic chips, have numerous suppliers globally, reducing dependence.

- Technological Advancements: Innovations in materials science and manufacturing processes continually introduce new, viable alternatives for existing components, further increasing substitutability.

- Cost-Effectiveness of Switches: The cost and effort required for Breville to switch to a substitute input are generally low for many commodity-like parts, reinforcing its bargaining power.

Breville's bargaining power with suppliers is generally moderate, influenced by the specificity of components and the number of alternative providers. The company's reliance on specialized, proprietary parts, like advanced heating elements, can empower those suppliers, especially if switching costs are high. However, for more standardized components, Breville benefits from a competitive supplier landscape, with many manufacturers offering interchangeable parts, as seen in the vast electronics market.

What is included in the product

Breville's Five Forces Analysis dissects the competitive intensity and profitability potential within the premium kitchen appliance market, examining threats from new entrants, buyer and supplier power, and the impact of substitutes.

Instantly visualize competitive pressures with a dynamic spider chart, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

Customer price sensitivity for Breville hinges on the perceived value of its premium small appliances. While brand loyalty and innovation can mitigate this, economic pressures or aggressive competitor pricing can amplify it. For example, in 2024, the average consumer spending on small kitchen appliances saw a slight dip, indicating a growing awareness of price points, even for established brands.

The availability of substitute products significantly impacts Breville's bargaining power of customers. In the small kitchen appliance market, numerous brands offer similar items, meaning consumers can easily switch if they find a better deal or a product that meets their needs elsewhere. For instance, in 2024, the global small kitchen appliance market saw intense competition, with brands like Cuisinart, KitchenAid, and Ninja offering a wide array of blenders, toasters, and coffee makers that directly compete with Breville’s offerings.

Breville faces a varied landscape regarding customer bargaining power, largely influenced by customer type. For individual consumers, their power is typically minimal because demand is spread across millions of people, making it difficult for any single buyer to negotiate better terms.

However, the situation changes dramatically when considering large retail partners. Major electronics retailers or large department store chains, particularly those operating in key global markets, represent significant purchasing volume. For instance, in 2024, large retailers like Best Buy or Williams Sonoma can place substantial orders, giving them considerable leverage to negotiate pricing, payment terms, and even product specifications, directly impacting Breville's margins.

Switching Costs for Customers

For Breville, switching costs for customers are generally quite low in the small appliance market. This means a consumer can easily opt for a different brand like Cuisinart or KitchenAid for their next coffee maker or toaster without much hassle or expense.

However, Breville's focus on premium products and innovative features can create a form of soft switching cost through brand loyalty. Customers who appreciate Breville's design, performance, and user experience might be less inclined to switch, even if competitors offer similar functionalities at a slightly lower price point.

- Low Direct Switching Costs: For most small kitchen appliances, the monetary and effort-based costs to switch brands are minimal.

- Brand Loyalty as a Soft Cost: Breville cultivates loyalty through product quality and innovation, making customers hesitant to switch despite low direct costs.

- Impact on Bargaining Power: While direct switching costs are low, strong brand loyalty can somewhat mitigate the customers' bargaining power.

Information Availability to Customers

Customers today have unprecedented access to information, significantly shifting the bargaining power. The internet, through product reviews, comparison websites, and social media, allows consumers to easily research product features, pricing, and quality across various brands. This transparency empowers informed decision-making, making it harder for companies to command premium prices based on information asymmetry.

In 2024, the proliferation of AI-powered shopping assistants and detailed online product specifications further amplifies this trend. For instance, a study in late 2023 indicated that over 80% of consumers conduct online research before making a significant purchase. This readily available data allows customers to pinpoint the best value, directly impacting a company's pricing flexibility and profit margins.

- Information Accessibility: Consumers can effortlessly compare prices and features from multiple vendors online.

- Consumer Reviews: User-generated content provides candid feedback on product performance and reliability.

- Price Transparency: Online platforms often display real-time pricing, making it difficult for businesses to maintain price discrepancies.

- Informed Purchasing: Customers are better equipped to identify the best deals and quality, increasing their leverage.

Breville's customers possess considerable bargaining power, largely due to the availability of numerous substitutes in the competitive small appliance market. For example, in 2024, brands like Ninja and Cuisinart offer comparable products, allowing consumers to easily switch if Breville's pricing or features are not perceived as optimal. This ease of substitution, coupled with increasing price sensitivity observed in 2024 consumer spending trends, amplifies customer leverage.

While individual consumers have limited power, large retail partners represent a significant force. In 2024, major retailers can negotiate favorable terms due to their substantial order volumes, directly influencing Breville's pricing and profit margins. Despite Breville's efforts to build brand loyalty through premium products, the low direct switching costs for most small appliances mean customers can readily choose alternatives.

The transparency afforded by online information further empowers customers. In 2024, readily available product comparisons and reviews allow consumers to make highly informed decisions, reducing Breville's ability to maintain premium pricing based on information asymmetry alone. This trend is underscored by research indicating over 80% of consumers conduct online research before major purchases.

| Factor | Impact on Breville | 2024 Data/Trend |

|---|---|---|

| Availability of Substitutes | High customer bargaining power | Intense competition from Ninja, Cuisinart, KitchenAid |

| Price Sensitivity | Increased customer leverage | Slight dip in average consumer spending on small appliances |

| Switching Costs | Low direct costs, but brand loyalty offers some mitigation | Customers can easily switch, but premium product focus builds loyalty |

| Information Availability | Empowers informed decisions, reduces price discretion | Over 80% of consumers research online; AI shopping assistants proliferate |

What You See Is What You Get

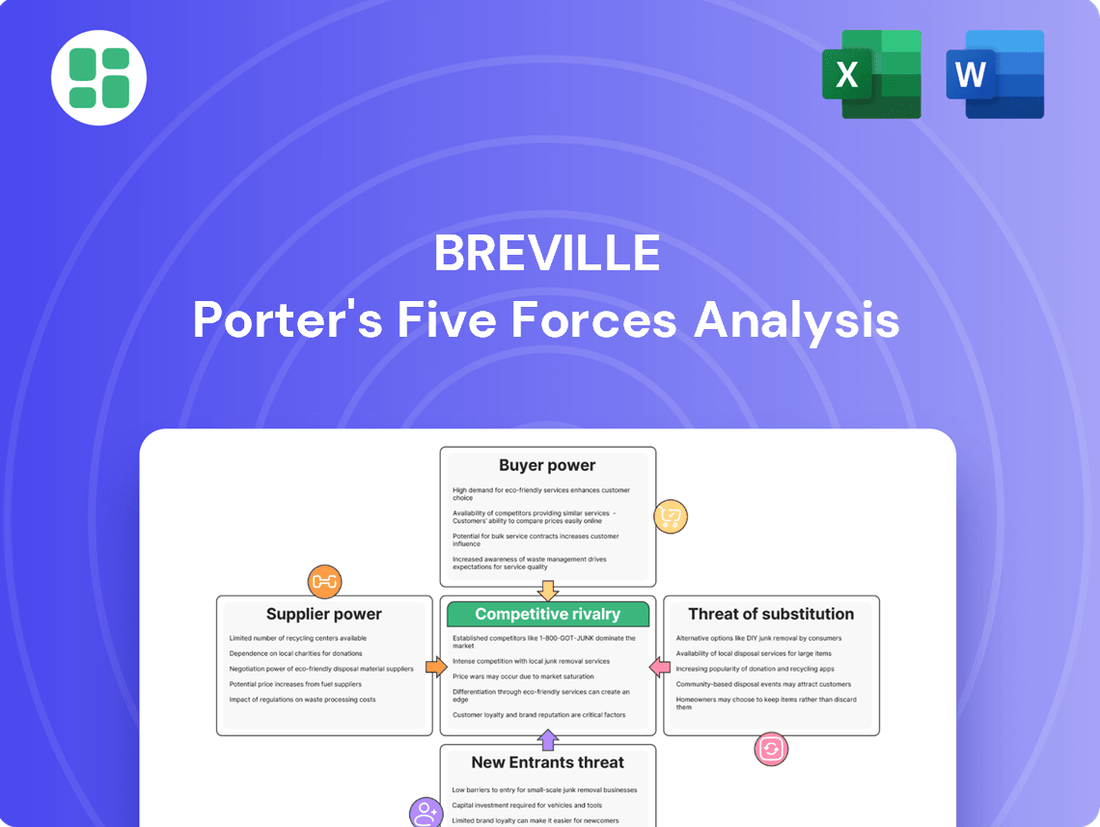

Breville Porter's Five Forces Analysis

This preview showcases the complete Breville Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape for Breville. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate access to this professionally formatted strategic tool.

Rivalry Among Competitors

Breville operates in a market teeming with competitors, ranging from global giants to focused specialists. This diverse field includes companies like KitchenAid, Cuisinart, and DeLonghi, alongside numerous smaller brands catering to specific culinary niches. The sheer volume and variety of players mean Breville must constantly innovate and differentiate to maintain its market position.

The small domestic appliances market is indeed experiencing growth, but understanding the pace is crucial. For instance, the global market was valued at approximately $230 billion in 2023 and is expected to reach over $330 billion by 2030, showing a compound annual growth rate of around 5.4%. While this indicates expansion, a slowing growth rate in specific segments or regions can certainly amplify competitive rivalry as companies vie more intensely for market share.

Breville stands out by offering highly differentiated products, particularly in the premium small kitchen appliance market, with a strong emphasis on design and innovative features. This distinctiveness fosters significant brand loyalty among consumers who appreciate the quality and performance Breville delivers. For instance, their Oracle Touch espresso machine, a flagship product, commands a premium price point and enjoys robust demand, illustrating how product uniqueness can insulate them from intense price wars.

Exit Barriers

Exit barriers in the small appliance market can be substantial, making it difficult for companies to simply walk away. Think about the significant investments needed for manufacturing plants and specialized equipment. These aren't easily repurposed or sold off, forcing firms to continue operating even when profitability wanes.

For instance, a company heavily invested in a proprietary, high-volume production line for blenders might find it prohibitively expensive to shut down or retool for a different product. This sunk cost pressure encourages continued competition, even if margins are thin.

Furthermore, long-term supply contracts with component manufacturers or distribution agreements can also lock companies into the market. Breaking these contracts often incurs penalties, adding another layer of difficulty to exiting. In 2024, the global small appliance market, valued at over $100 billion, still sees companies grappling with these legacy commitments.

- High Capital Investment: Significant upfront costs for specialized machinery and manufacturing facilities create a substantial hurdle for exiting.

- Specialized Assets: Assets like custom tooling for specific appliance models have limited resale value, increasing exit costs.

- Long-Term Contracts: Commitments with suppliers and distributors often carry penalties for early termination, discouraging departure.

- Employee Severance: The cost of laying off a trained workforce can be a considerable financial burden for companies considering an exit.

Marketing and Innovation Intensity

Breville's competitive rivalry is amplified by a high intensity in marketing and innovation. Competitors are pouring resources into advertising and developing new products to capture market share. This means Breville must continually invest to stay ahead.

Breville itself is a prime example, consistently allocating significant funds to research and development alongside marketing efforts. This strategy has led to the introduction of popular new products, such as the InFizz series and the Oracle Jet, which help maintain their brand presence and appeal.

- Marketing Investment: Companies in the premium small kitchen appliance sector often spend upwards of 10-15% of revenue on marketing and advertising to build brand awareness and loyalty.

- R&D Spending: Breville's commitment to innovation is evident in its product pipeline, with significant investment in developing features that differentiate them from competitors. For example, the Oracle Jet, launched in 2023, represented a significant leap in espresso machine technology.

- Product Launches: The frequency and impact of new product introductions by rivals directly influence Breville's need to innovate. A competitor launching a highly successful new appliance can quickly shift consumer preferences.

Breville faces a highly competitive landscape with numerous players, from large conglomerates to niche specialists, driving the need for continuous innovation and differentiation. The market, valued at over $100 billion in 2024 for small appliances globally, sees companies like KitchenAid and DeLonghi as significant rivals, intensifying the pressure to capture market share through unique product offerings and strong brand building.

SSubstitutes Threaten

The threat of substitutes for Breville's premium coffee machines is significant, particularly concerning the price-performance trade-off. While Breville offers high-quality, feature-rich machines, simpler alternatives like Nespresso pod machines or even high-end drip coffee makers can fulfill the basic need for a hot beverage at a considerably lower upfront cost. For instance, a Breville Barista Express might cost upwards of $700, whereas a Nespresso VertuoPlus can be found for around $200, offering convenience but a different sensory experience.

Customer propensity to substitute for Breville appliances is influenced by factors like cost, convenience, and evolving lifestyle trends. For instance, the growing popularity of home cooking, particularly evident in the strong performance of the meal kit delivery market which saw significant growth in 2024, could potentially decrease the likelihood of consumers substituting away from high-quality kitchen appliances like those offered by Breville.

Technological advancements are constantly creating new ways to fulfill the same needs, posing a significant threat to companies like Breville. For example, the rise of sophisticated food delivery services and meal kit subscriptions, which saw substantial growth in 2024, directly challenges the market for high-end food preparation appliances. These services offer convenience and variety, reducing the perceived necessity for consumers to invest in specialized kitchen equipment.

Cost of Switching to a Substitute

The cost of switching from a Breville appliance to a competitor's product is typically quite low for consumers. This means that if another brand offers a significantly better price or a more appealing feature set, customers can easily make the change. For instance, in the competitive small kitchen appliance market, a customer might switch from a Breville toaster oven to a similar model from a rival brand if the price difference is substantial, perhaps saving $30-$50.

This low switching cost is a significant factor when considering the threat of substitutes. Breville operates in a market where brand loyalty can be challenged by price sensitivity and the availability of comparable alternatives. In 2024, the average consumer spent approximately $150 on kitchen appliances, making a switch to save 10-20% a financially attractive proposition.

- Low Financial Switching Costs: Customers can often switch to substitute appliances with minimal financial penalty, as new products are readily available at comparable price points.

- Minimal Psychological Switching Costs: The emotional attachment or perceived complexity of switching to a different brand of small appliance is generally low, facilitating easier customer movement.

- Impact of Value Proposition: A substitute offering a superior combination of price, features, or performance can readily attract Breville's customers due to these low switching barriers.

- Market Dynamics: In 2024, the small appliance sector saw numerous new entrants and aggressive pricing strategies, further intensifying the threat posed by substitutes with low switching costs.

Availability and Accessibility of Substitutes

The threat of substitutes for Breville products is significant due to the wide availability and accessibility of alternatives. Customers can easily find a plethora of options, ranging from basic manual kitchen tools to more affordable appliances from competing brands. This broad spectrum of choices means consumers aren't locked into Breville, impacting pricing power.

For instance, while Breville offers premium, feature-rich coffee machines, the market is flooded with alternatives. In 2024, the global coffee machine market was valued at approximately $25 billion, with a substantial portion representing entry-level and mid-tier segments that directly compete with Breville's offerings, albeit at lower price points.

- Broad Price Range: Competitors offer manual coffee grinders starting under $20, contrasting with Breville's electric models often exceeding $100.

- Functional Equivalents: Basic drip coffee makers, widely available for under $50, can fulfill the core need of brewing coffee, even if lacking Breville's advanced features.

- Brand Proliferation: Numerous brands, such as Cuisinart, DeLonghi, and Nespresso, provide a diverse range of coffee makers and other kitchen appliances, diluting brand loyalty.

- DIY and Manual Options: French presses and pour-over coffee makers represent low-cost, manual substitutes that require no electricity and are readily available in most retail outlets.

The threat of substitutes for Breville's premium kitchen appliances is a key consideration. While Breville focuses on high-end, feature-rich products, consumers can often find functional alternatives at lower price points. For example, in 2024, the average household expenditure on small kitchen appliances was around $150, making more affordable options attractive.

These substitutes range from manual kitchen tools to mid-tier electric appliances, effectively meeting basic needs without the premium price tag. The global coffee machine market, valued at approximately $25 billion in 2024, includes a significant segment of lower-cost machines that directly compete with Breville's higher-priced offerings.

Customer switching costs are generally low, meaning a better value proposition from a competitor can easily sway consumers. This is amplified by the proliferation of brands offering comparable functionality, such as Cuisinart and DeLonghi in the coffee maker space, further intensifying the substitute threat.

| Appliance Category | Breville Example | Typical Substitute | Approximate Price Range (Breville) | Approximate Price Range (Substitute) |

|---|---|---|---|---|

| Espresso Machines | Barista Express | Nespresso VertuoPlus | $700+ | $200+ |

| Toaster Ovens | Smart Oven Air Fryer Pro | Cuisinart TOA-60 Convection Toaster Oven | $300+ | $100+ |

| Juicers | Juice Fountain Cold XL | Hamilton Beach Big Mouth Juicer | $200+ | $80+ |

Entrants Threaten

Entering the small appliance market demands substantial capital. Think about the costs for research and development, building or acquiring manufacturing plants, and establishing robust marketing and distribution channels. For instance, launching a new line of smart kitchen appliances in 2024 could easily require tens of millions of dollars in initial investment.

Established companies like Breville already enjoy significant advantages due to economies of scale. They can produce more units at a lower cost per unit and negotiate better prices with suppliers. This cost advantage makes it incredibly challenging for newcomers to compete on price, as they lack the same production volume and purchasing power.

Established brands like Breville, Sage, and Baratza have cultivated significant customer loyalty. For instance, Breville reported a 9.3% increase in revenue for fiscal year 2023, reaching AUD 1.5 billion, a testament to its strong market position and customer trust. This brand equity makes it challenging for newcomers to gain traction without considerable investment in marketing and product development to differentiate themselves.

Newcomers often struggle to gain access to crucial distribution channels. For instance, securing shelf space in major supermarkets or obtaining prominent placement on popular e-commerce platforms can be incredibly difficult for emerging brands.

Established companies, like those in the consumer electronics sector, have cultivated deep, long-standing relationships with key retailers. These existing partnerships mean new entrants face an uphill battle to get their products in front of consumers, as prime retail real estate is already occupied.

In 2024, the dominance of established online marketplaces continues to be a significant hurdle. For example, Amazon's seller program, while accessible, often favors brands with a proven sales history and significant marketing budgets, making it harder for startups to compete for visibility.

Proprietary Technology and Patents

Breville's strength in proprietary technology and patents can act as a barrier to new entrants. For instance, their patented Auto-Dosing system in the Oracle Touch espresso machine offers a unique user experience that is difficult to replicate. While the small appliance market generally has lower technological barriers than sectors like semiconductors, Breville's consistent investment in R&D, with reported R&D expenses of approximately AUD 100 million in fiscal year 2023, helps maintain this advantage.

The threat of new entrants is somewhat mitigated by Breville's established reputation for quality and innovative design, which requires significant upfront investment and brand building. Competitors entering the market may struggle to match Breville's product performance and consumer trust, which is crucial in a market where features and reliability are highly valued. For example, Breville's market share in premium coffee machines has remained robust, indicating customer loyalty built on technological differentiation.

- Proprietary Technology: Breville holds numerous patents for features like their Smart Grinding Technology and precise temperature control systems.

- High R&D Investment: The company's commitment to innovation, evidenced by consistent R&D spending, creates a moving target for potential entrants.

- Brand Loyalty: Breville's strong brand equity, built on years of delivering high-quality, innovative products, makes it harder for new players to gain traction.

Government Policy and Regulations

Government policy and regulations present a significant barrier to entry for new companies. Navigating complex approval processes, meeting stringent safety standards, and complying with environmental regulations can be costly and time-consuming. For instance, in 2024, the automotive industry faced evolving emissions standards in many major markets, requiring substantial R&D investment for new entrants to meet compliance.

Changes in trade policies, such as the introduction of tariffs or quotas, can dramatically alter the cost structure for new businesses, especially those relying on imported components or exporting finished goods. In 2024, ongoing trade disputes and shifting geopolitical alliances led to increased uncertainty in global supply chains, impacting import/export costs for many sectors.

- Regulatory Hurdles: New entrants must invest heavily in compliance, potentially delaying market entry.

- Safety and Environmental Standards: Meeting these can require significant capital expenditure on product design and manufacturing processes.

- Trade Policy Shifts: Tariffs and import/export restrictions can increase operational costs and reduce competitiveness for newcomers.

- Licensing and Permits: Obtaining necessary licenses can be a lengthy and bureaucratic process, acting as a deterrent.

The threat of new entrants into the small appliance market, particularly for premium brands like Breville, is generally considered moderate to low. Significant capital investment is required for research, development, manufacturing, and marketing, often running into tens of millions of dollars for a new product line in 2024. Furthermore, established players benefit from economies of scale, brand loyalty, and strong distribution networks, making it difficult for newcomers to compete effectively on price or reach consumers.

Breville's proprietary technology, such as its patented Auto-Dosing system, and substantial R&D investment, approximately AUD 100 million in fiscal year 2023, create a technological moat. This, combined with strong brand equity and customer trust, as evidenced by a 9.3% revenue increase to AUD 1.5 billion in fiscal year 2023, presents a considerable challenge for new entrants aiming to capture market share.

Access to distribution channels and securing shelf space in major retailers or prominent online platforms remains a hurdle for new brands in 2024. Existing relationships between established manufacturers and retailers, coupled with online marketplaces favoring brands with proven sales histories and marketing budgets, further solidify the position of incumbents.

Regulatory compliance, including safety and environmental standards, along with potential shifts in trade policies and tariffs, adds complexity and cost for new entrants. Navigating these bureaucratic processes and potential cost increases can deter new businesses from entering the market.

| Barrier Type | Description | Impact on New Entrants | Example Data/Fact |

|---|---|---|---|

| Capital Requirements | High initial investment for R&D, manufacturing, and marketing. | Significant financial barrier. | Launching a new smart appliance line in 2024 could cost tens of millions. |

| Economies of Scale | Lower per-unit costs for established, high-volume producers. | Disadvantage for new entrants on pricing. | Breville's scale allows better supplier negotiations. |

| Brand Loyalty & Equity | Established trust and preference for known brands. | Difficult for newcomers to gain market share. | Breville's FY23 revenue of AUD 1.5 billion shows strong customer trust. |

| Distribution Access | Securing shelf space and online visibility. | Challenging for emerging brands. | Prime retail space is occupied by established players. |

| Proprietary Technology | Patented features and ongoing R&D investment. | Creates a competitive advantage and differentiation. | Breville's FY23 R&D spend was approx. AUD 100 million. |

| Government Regulations | Compliance with safety, environmental, and trade policies. | Increases costs and time to market. | Evolving emissions standards in 2024 impact automotive R&D. |

Porter's Five Forces Analysis Data Sources

Our Breville Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Breville's annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from competitor financial filings and trade publications to provide a comprehensive view of the competitive landscape.