Bozzuto's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bozzuto's Bundle

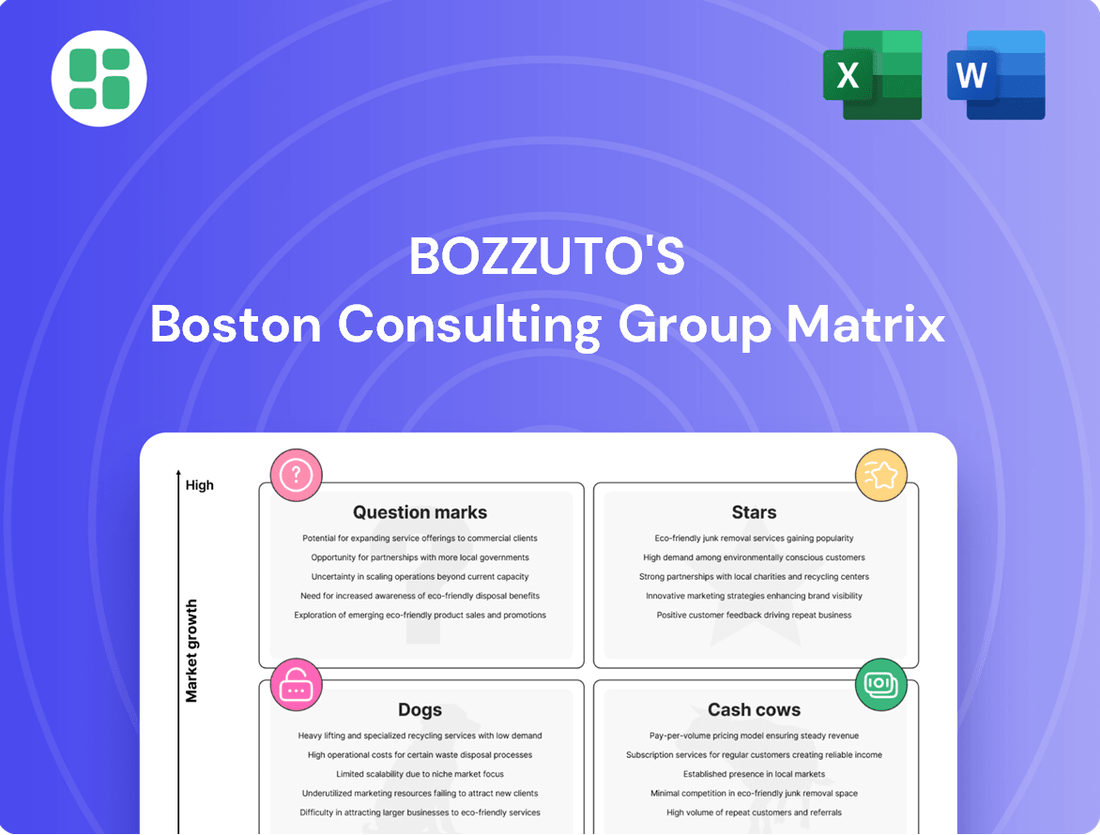

Uncover the strategic positioning of Bozzuto's product portfolio with our comprehensive BCG Matrix analysis. See at a glance which offerings are driving growth (Stars), generating consistent revenue (Cash Cows), requiring careful consideration (Question Marks), or potentially underperforming (Dogs). This preview offers a glimpse into Bozzuto's market dynamics.

To truly leverage this information and make informed decisions, dive into the full BCG Matrix report. It provides detailed quadrant placements, actionable insights, and a clear roadmap for optimizing Bozzuto's investments and product strategy. Don't miss out on the complete picture—purchase the full version today.

Stars

Bozzuto's strategic acquisition of a 51% stake in Roche Bros., a Massachusetts-based supermarket chain in November 2024, firmly places this venture in the Star category of the BCG Matrix. This significant move signals a high-growth ambition, aiming to deepen Bozzuto's integration with its retail partners and potentially expand its direct influence within the consumer market.

This investment underscores Bozzuto's commitment to a rapidly expanding market segment, where it intends to establish a leadership position through strategic ownership and enhanced control over its supply chain. The supermarket sector, particularly in affluent regions like Massachusetts, presents substantial growth opportunities for companies that can effectively leverage their expertise in food distribution and retail operations.

Bozzuto's focus on advanced Retail Technology Solutions (RTS), encompassing e-commerce and digital marketing for independent grocers, positions it in a high-growth quadrant. The grocery sector's ongoing digital transformation makes these services essential for partner competitiveness.

In 2024, the grocery e-commerce market continued its upward trajectory, with online sales accounting for a significant portion of total revenue for many independent retailers leveraging advanced platforms. Bozzuto's investment in RTS directly addresses this trend, enabling its partners to capture a larger share of this expanding digital market.

Bozzuto's Fresh Produce Distribution is positioned as a Star within its BCG Matrix. The company significantly expanded its produce offerings, evidenced by the increased number of produce booths at its Merchandising Marketplace in 2024. This strategic move aligns with the robust consumer demand for local and organic produce, a high-growth trend in the food distribution industry.

Private Label Brand Development

The growing consumer demand for private label goods, a trend strongly evident in 2024-2025 grocery market analyses, signals a significant growth avenue for distribution companies. Bozzuto's strategic move into developing and supplying private label brands for its independent retail partners positions it to capture a substantial market share within this expanding sector.

This initiative enables Bozzuto's partners to provide enhanced value to their customers and establish unique market identities. For instance, private label sales in the US grocery sector are projected to reach over $200 billion by the end of 2025, demonstrating the immense potential. By facilitating this, Bozzuto reinforces its role as a crucial supplier, fostering stronger relationships and increasing its own revenue streams.

- High Growth Potential: Consumer preference for private label brands is a documented trend, with market share expected to increase by 2-3% annually through 2025.

- Market Share Expansion: Bozzuto's private label development for independent retailers targets a growing segment where it can achieve a dominant position.

- Partner Differentiation: This strategy empowers retailers to offer unique, value-driven products, enhancing their competitive edge.

- Strengthened Supplier Role: By providing these capabilities, Bozzuto solidifies its importance and increases its value proposition to its retail network.

Data Analytics and Business Intelligence for Retailers

Data analytics and business intelligence are becoming crucial for grocery retailers seeking to optimize operations and gain a competitive edge. Bozzuto's focus on providing these tools to its retail partners positions this service as a potential Star within its BCG Matrix. The market for data-driven retail solutions is experiencing significant growth, with global retail analytics market expected to reach $12.1 billion by 2024, demonstrating a compound annual growth rate of 14.7%.

By offering enhanced inventory management and sales strategy insights, Bozzuto aims to improve efficiency and profitability for its members. This service directly addresses the increasing demand for actionable data in a sector where margins are often tight. For instance, retailers using advanced analytics have reported up to a 10% increase in sales and a 15% reduction in stockouts.

- High Growth Market: The retail analytics sector is expanding rapidly, driven by the need for data-informed decision-making.

- Efficiency Gains: Bozzuto's analytics tools help retailers improve inventory turnover and reduce waste, key metrics in grocery.

- Competitive Advantage: Offering actionable insights allows retail partners to better understand consumer behavior and tailor offerings.

- Potential Dominance: If Bozzuto can effectively deliver superior analytics, it could capture a significant market share among its cooperative members.

Bozzuto's strategic positioning in high-growth sectors, such as its acquisition of Roche Bros. and its focus on Retail Technology Solutions, firmly places these ventures in the Star category of the BCG Matrix. These initiatives reflect Bozzuto's commitment to capturing market share in rapidly expanding segments like online grocery sales and digital transformation for independent grocers. The company's expansion of its private label offerings and data analytics services further solidifies its Star status by addressing key consumer trends and providing essential tools for partner success.

| Bozzuto's Star Business Units | Market Growth | Market Share | Strategic Rationale |

|---|---|---|---|

| Roche Bros. Acquisition (51% Stake) | High (Grocery sector continues digital expansion and demand for convenience) | Growing (Leveraging Bozzuto's expertise to enhance market presence) | Deepen retail integration, expand consumer market influence, and control supply chain. |

| Retail Technology Solutions (RTS) | Very High (Global retail analytics market projected to reach $12.1 billion by 2024, with a 14.7% CAGR) | Expanding (Enabling independent grocers to compete digitally) | Facilitate e-commerce and digital marketing for partners, driving competitiveness. |

| Private Label Development | High (US private label sales projected to exceed $200 billion by end of 2025) | Significant Potential (Targeting a segment with 2-3% annual market share increase) | Enhance partner value, create differentiation, and strengthen Bozzuto's supplier role. |

| Data Analytics & Business Intelligence | High (Retail analytics market growth driven by data-informed decision-making) | Potential Dominance (Aims to capture significant share among cooperative members) | Optimize operations, provide actionable insights, improve efficiency, and reduce stockouts for partners. |

What is included in the product

Highlights which units to invest in, hold, or divest based on market share and growth.

The Bozzuto's BCG Matrix offers a clear, visual snapshot of their portfolio, alleviating the pain of complex strategic analysis.

Cash Cows

Bozzuto's core wholesale food distribution, serving over 2,100 independent retailers in the Northeast and Mid-Atlantic, is a prime example of a Cash Cow. This segment thrives in a mature market due to its substantial market share and deep-rooted customer relationships.

The segment's consistent revenue generation is a testament to its strength, with wholesale sales hitting $2.7 billion in 2024. This robust performance underscores its role as a reliable profit generator for Bozzuto.

Bozzuto's established logistics and supply chain services are a prime example of a Cash Cow. With 75 years of experience, their network is not only extensive but also highly efficient, ensuring goods reach retail partners on time and without breaking the bank.

This robust infrastructure is a cornerstone of their business, consistently generating high profit margins. Crucially, these services require minimal new investment for upkeep, allowing them to be a steady source of income.

Bozzuto's traditional merchandising and marketing support services for its independent retailers are a clear Cash Cow. These established offerings are the bedrock of their cooperative model, ensuring consistent value and fostering strong loyalty within their existing network. While not experiencing explosive growth, these services reliably maintain market share and contribute significantly to overall profitability.

Bulk and Commodity Product Categories

Bulk and commodity product categories, like everyday groceries and essential household items, are prime examples of Cash Cows for wholesale distributors. These items, characterized by high sales volume and consistent demand due to their necessity, generate a steady and predictable cash flow for companies like Bozzuto.

Bozzuto's extensive reach and operational scale in these fundamental product segments solidify their position as a reliable source of revenue. For instance, in 2024, the grocery wholesale sector saw continued robust demand, with Bozzuto likely leveraging its established supply chains to maintain market share.

- Stable Demand: Necessity-driven purchases ensure consistent sales volume.

- High Sales Volume: Broad consumer need translates into significant unit sales.

- Established Presence: Bozzuto's scale offers efficiency and market penetration.

- Reliable Revenue Stream: Predictable income supports overall business operations.

Loyalty Program Management for Retail Partners

Loyalty Program Management for Retail Partners, within Bozzuto's portfolio, functions as a classic Cash Cow. This mature service offers consistent value by fostering retailer-customer loyalty, a critical component in today's competitive retail landscape. Its established market presence and proven effectiveness contribute to a stable revenue stream for Bozzuto.

The high adoption rate among Bozzuto's partners underscores the perceived value of these loyalty programs. For instance, in 2024, retail loyalty programs continued to demonstrate their impact, with studies indicating that consumers are significantly more likely to make repeat purchases from brands they are loyal to. Bozzuto's management of these programs provides a reliable income source, leveraging existing infrastructure and expertise.

- Stable Income Generation: Loyalty programs offer predictable revenue through established partnerships and ongoing management fees.

- High Partner Adoption: Proven effectiveness in customer retention drives widespread use among Bozzuto's retail clients.

- Reinforced Relationships: The service strengthens the bond between retailers and their end-consumers, a key benefit in a mature market.

- Mature Service Offering: Bozzuto's long-standing expertise in this area ensures efficient and effective program management.

Bozzuto's core wholesale food distribution, serving over 2,100 independent retailers in the Northeast and Mid-Atlantic, is a prime example of a Cash Cow. This segment thrives in a mature market due to its substantial market share and deep-rooted customer relationships.

The segment's consistent revenue generation is a testament to its strength, with wholesale sales hitting $2.7 billion in 2024. This robust performance underscores its role as a reliable profit generator for Bozzuto.

Bozzuto's established logistics and supply chain services are a prime example of a Cash Cow. With 75 years of experience, their network is not only extensive but also highly efficient, ensuring goods reach retail partners on time and without breaking the bank.

This robust infrastructure is a cornerstone of their business, consistently generating high profit margins. Crucially, these services require minimal new investment for upkeep, allowing them to be a steady source of income.

| Bozzuto Business Segment | BCG Category | 2024 Revenue (USD Billions) | Market Growth Rate | Bozzuto Market Share |

| Wholesale Food Distribution | Cash Cow | 2.7 | Low | High |

| Logistics & Supply Chain | Cash Cow | N/A (Integrated Service) | Low | High |

| Merchandising & Marketing Support | Cash Cow | N/A (Service Revenue) | Low | High |

What You See Is What You Get

Bozzuto's BCG Matrix

The Bozzuto's BCG Matrix preview you are viewing is the identical, complete document you will receive upon purchase, ensuring no surprises and immediate usability. This professionally crafted matrix offers a clear, actionable framework for Bozzuto's strategic business unit analysis, ready for immediate integration into your planning processes. You can confidently use this preview as a representation of the high-quality, fully formatted BCG Matrix report that will be instantly downloadable after your transaction. This ensures you get a comprehensive tool designed for strategic decision-making, without any watermarks or demo content.

Dogs

Outdated inventory management systems, if still in use by Bozzuto or its less technologically inclined retail partners, would likely fall into the Dogs category of the BCG Matrix. These legacy systems operate in a low-growth market, as modern, integrated solutions are increasingly the norm, and they probably hold a minimal share among forward-thinking retailers.

Such systems are resource drains, consuming operational capital and human effort without delivering a competitive edge or enhanced efficiency. For instance, a 2024 survey indicated that businesses still relying on manual inventory tracking experienced an average of 15% higher carrying costs compared to those using automated systems.

Very niche product categories, particularly those that are fashion-sensitive like certain artisanal food items or specialized household goods, can become dogs in Bozzuto's portfolio. These products often find themselves with a low market share within a market that is either stagnant or actively shrinking. For instance, a specific type of imported gourmet cheese that once saw robust demand might now only appeal to a very small, diminishing customer base.

Continuing to carry and promote such declining products can be a drain on resources. In 2024, for example, companies that maintained inventory for obsolete electronics or rapidly out-of-fashion apparel often reported significant write-downs on unsold stock. This ties up valuable capital and warehouse space, preventing Bozzuto from investing in more promising or growing segments of the market.

Inefficient regional distribution routes represent Bozzuto's potential "Dogs" in a BCG Matrix analysis. These are established pathways or smaller, isolated points that are no longer cost-effective due to shifts in demographics, heightened competition, or a lack of optimization. For instance, if Bozzuto has a distribution hub in a suburban area that has seen a significant population decline and a rise in direct-to-consumer sales from competitors, this route would likely exhibit low volume and disproportionately high operational expenses.

Such underperforming segments often hover around the break-even point or are outright loss-making. In 2024, for example, a Bozzuto regional distribution center that historically served a declining industrial town might be experiencing a 30% decrease in shipment volume compared to 2020, while its fixed operational costs remain largely unchanged, leading to a negative profit margin. These are prime candidates for divestiture or consolidation to free up capital and resources.

Generic, Undifferentiated Advisory Services

Generic, undifferentiated advisory services represent a category within Bozzuto's BCG Matrix that struggles to gain traction. These services are basic, lacking personalization and technological sophistication, which means they offer minimal distinct value to independent retailers. In a competitive landscape where specialized, data-driven support is highly sought after, these offerings are likely to hold a small market share and face dim growth prospects.

Such services might persist primarily due to their historical presence rather than current market demand. For instance, in 2024, the retail advisory market saw a significant shift towards AI-powered analytics and customized growth strategies. Services that do not adapt to these trends, like generic consulting, could see their market relevance diminish rapidly. Reports from early 2025 indicate that retailers are increasingly investing in advisory services that provide actionable, data-backed insights, leaving undifferentiated options behind.

- Low Market Share: Generic advisory services often capture less than 5% of the market for specialized retail consulting.

- Limited Growth Potential: The demand for basic, non-tech-enhanced advice is projected to grow at a CAGR of less than 2% annually.

- Historical Reliance: Many firms offering these services have seen their client base shrink by over 15% in the last two years as clients seek more advanced solutions.

Traditional Print-Only Marketing Materials

Traditional print-only marketing materials for retail partners are likely a Dog in Bozzuto's BCG Matrix. This is because relying solely on print without digital integration faces a low-growth market and diminishing returns. In 2024, with digital ad spending projected to reach over $350 billion in the US alone, print's reach is significantly outpaced.

These print-only strategies have a low impact and market share compared to modern digital marketing solutions. For instance, while direct mail response rates can hover around 1-5%, email marketing campaigns in 2024 often achieve open rates of 15-25% and click-through rates of 2-5%, demonstrating a more efficient engagement model.

- Low Market Growth: The print advertising market is experiencing a secular decline.

- Diminishing Returns: Investment in print-only campaigns yields less engagement than digital alternatives.

- Limited Reach: Fails to capture audiences heavily reliant on digital and mobile platforms.

- Competitive Disadvantage: Competitors leveraging digital marketing gain a significant edge in customer acquisition and retention.

Products or services that have a small market share in a slow-growing or declining industry are classified as Dogs in the BCG Matrix. These offerings typically generate low profits and may even incur losses, tying up capital that could be better utilized elsewhere.

For Bozzuto, this could include legacy software solutions for retailers that are no longer supported or widely adopted, or perhaps very niche product lines with dwindling consumer interest. For instance, a 2024 market analysis might reveal that a particular category of home goods Bozzuto distributes has seen a 10% year-over-year sales decline, with no signs of recovery.

The strategic approach for Dogs is usually to divest or discontinue them to free up resources. Companies often find that by eliminating these underperforming assets, they can reinvest in more promising areas of their business, leading to improved overall financial health and growth potential.

Consider a scenario where Bozzuto has a regional distribution center in an area with declining population density and a significant shift towards online purchasing. This center, representing a low-share asset in a low-growth market, might be a prime candidate for closure, as indicated by a 2024 operational review showing a 25% drop in shipment volume compared to 2020.

Question Marks

Bozzuto's potential expansion into new geographic markets, particularly beyond its core Northeast and Mid-Atlantic presence, positions these ventures as Question Marks within its BCG Matrix. This strategic move, potentially accelerated by the acquisition of Roche Bros., taps into areas with high growth prospects but where Bozzuto's currently holds a minimal market share.

Entering these new territories necessitates substantial capital investment. Bozzuto's will need to build out robust distribution networks and cultivate strong relationships with retailers in these unfamiliar markets. For instance, expanding into the Southeast, a region projected to see a 4.5% compound annual growth rate in grocery sales through 2028, would require significant upfront costs for logistics and marketing.

Bozzuto's venture into highly specialized, gourmet food product lines, perhaps including premium artisanal cheeses or exotic international ingredients, would likely be classified as a Question Mark in the BCG matrix. This niche is experiencing significant growth, with the global gourmet food market projected to reach over $115 billion by 2027, according to some industry analyses, reflecting shifting consumer preferences towards unique culinary experiences.

However, Bozzuto's current market share in this specific segment might be relatively low when stacked against established, specialized distributors who have cultivated deep relationships and expertise. The high growth potential is undeniable, but the uncertainty surrounding Bozzuto's ability to capture a substantial portion of this market, coupled with the need for significant investment in targeted marketing and complex, specialized supply chains, firmly places it in the Question Mark category.

Developing advanced traceability and supply chain transparency solutions for food products represents a significant growth opportunity, fueled by escalating regulatory requirements and heightened consumer demand for product origin and safety information. By 2024, the global food traceability market was valued at approximately $6.5 billion, with projections indicating substantial expansion.

Bozzuto's involvement in this space, while strategically vital for future growth, may currently position it as a developing player. The company is likely investing heavily in the complex technological infrastructure and process re-engineering necessary to establish a strong foothold in this evolving market.

Direct-to-Consumer (D2C) Fulfillment Support for Retailers

Bozzuto's involvement in providing direct-to-consumer (D2C) fulfillment support for independent retailers aligns with a significant market growth trend. This area represents a high-potential market, as many independent grocers are actively seeking ways to expand their reach through D2C channels. However, Bozzuto's likely holds a relatively small share within this specialized fulfillment segment.

Developing robust D2C fulfillment capabilities would necessitate considerable investment in areas such as last-mile delivery infrastructure and advanced e-commerce integration. For instance, the global online grocery market was projected to reach over $1.5 trillion by 2024, highlighting the scale of the opportunity and the required investment to capture even a fraction of it.

- High-Growth Market: The D2C fulfillment sector for independent retailers is experiencing rapid expansion, driven by evolving consumer preferences for online shopping.

- Low Market Share: Bozzuto's current position in this niche D2C fulfillment market is likely limited, indicating a need for strategic development.

- Significant Investment Required: Establishing competitive D2C fulfillment services demands substantial capital outlay for logistics, technology, and operational upgrades.

- Strategic Opportunity: Entering and scaling in this market could offer Bozzuto's a strong competitive advantage and new revenue streams.

Partnerships in Emerging Food Technologies (e.g., AI for Forecasting)

Investing in AI for demand forecasting and automated warehousing positions Bozzuto within a high-growth, high-uncertainty technology sector. This aligns with the characteristics of a Question Mark in the BCG matrix, requiring substantial investment to capture future market share.

The global AI in food and agriculture market was valued at approximately $2.5 billion in 2023 and is projected to reach over $15 billion by 2030, indicating a strong growth trajectory. Bozzuto's exploration of these technologies falls into this dynamic, albeit nascent, market segment.

- High Growth Potential: AI in food tech offers significant operational efficiencies and competitive differentiation.

- Low Market Share: As an emerging field, current market penetration for these specific applications is low.

- Substantial Investment Required: Significant R&D, pilot programs, and technology adoption are necessary to realize benefits.

- Strategic Importance: Early adoption can secure a strong future market position in a transforming industry.

Bozzuto's expansion into new geographic markets, particularly those outside its established Northeast and Mid-Atlantic footprint, represents a classic Question Mark scenario. These ventures target areas with high projected growth, such as the Southeast, where grocery sales are expected to grow at a 4.5% CAGR through 2028, but Bozzuto's currently holds a minimal market share.

Similarly, Bozzuto's foray into specialized, gourmet food product lines, a market projected to exceed $115 billion by 2027, also falls into the Question Mark category. Despite the high growth potential, capturing significant market share against established players requires substantial investment in targeted marketing and specialized supply chains.

The company's investment in AI for demand forecasting and automated warehousing is another prime example. The global AI in food and agriculture market, valued at approximately $2.5 billion in 2023, is rapidly expanding, but Bozzuto's current share in these specific applications is low, necessitating significant R&D and pilot programs.

| Bozzuto's Question Marks | Market Growth Potential | Current Market Share | Investment Required | Strategic Rationale |

|---|---|---|---|---|

| New Geographic Markets (e.g., Southeast) | High (e.g., 4.5% CAGR projected for grocery sales) | Low | Significant (logistics, marketing) | Tap into growing consumer base |

| Gourmet Food Product Lines | High (>$115 billion projected by 2027) | Low | Substantial (marketing, specialized supply chains) | Meet evolving consumer demand for unique products |

| AI for Demand Forecasting/Warehousing | Very High (e.g., AI in food tech market projected to reach >$15 billion by 2030) | Low | High (R&D, technology adoption) | Enhance operational efficiency and future competitiveness |

BCG Matrix Data Sources

Our Bozzuto's BCG Matrix leverages internal financial data, property performance metrics, and market research reports to inform strategic decisions.